1460% Surge: Reassessing ZEC's Value Foundation

TechFlow Selected TechFlow Selected

1460% Surge: Reassessing ZEC's Value Foundation

Narrative and sentiment can create myths, but fundamentals determine how far those myths can go.

By: Lacie

The Beginning of a Myth, the Foreshadowing of Collapse

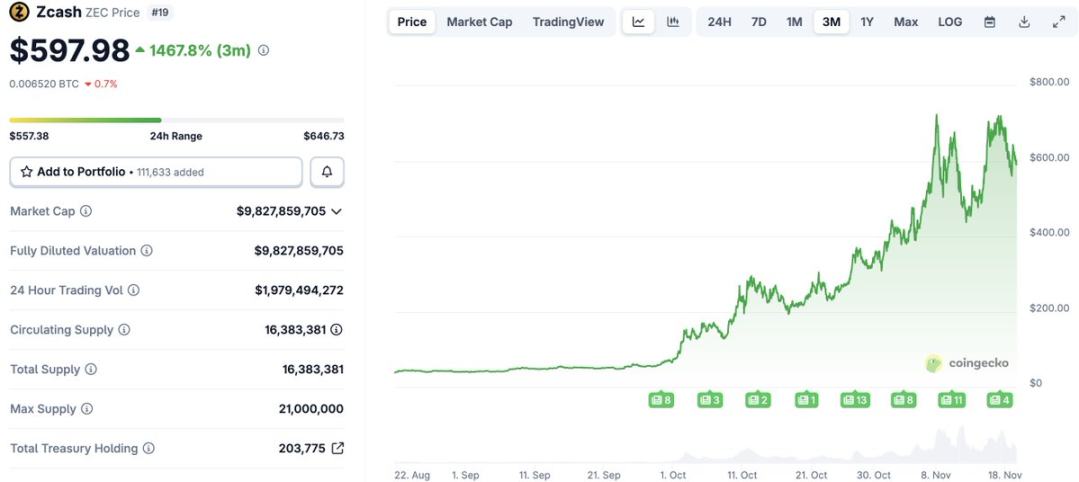

Over the past two months, Zcash ($ZEC) has become the brightest spotlight in the entire crypto market. It surged from $50 at the end of September to a recent high of $730—an increase of 1460%—and its FDV soared to a historical peak of $13B, the highest in eight years.

https://www.coingecko.com/en/coins/zcash

Adding further fuel to the fire, a wave of top-tier influencers publicly endorsed ZEC: figures like @naval, @0xMert_, and @CryptoHayes acted as catalysts, triggering widespread market FOMO and prompting many KOLs, retail investors, and even some funds to reevaluate this old chain. Rarely seen before, both Chinese and English crypto Twitter are now actively discussing ZEC, privacy narratives, and the resurgence of ZK technology—privacy seems to be crowned once again as the protagonist of "the next big trend" in crypto.

Yet beneath this seemingly hot and perfect narrative, some critical fundamental issues have consistently been overlooked: do ZEC’s mining economics, network security, and on-chain activity truly justify an FDV exceeding $10 billion?

ZEC is on the brink of a classic Hardware–Price Scissors event in PoW history

Before assessing the sustainability of any PoW project, mining-side economic incentives often most directly reflect a chain's value capture capability.

Let’s first calculate ZEC’s current breakeven cycle:

1) Z15 Pro: the current dominant mining rig

The most talked-about and sought-after latest flagship ZEC miner in the market right now is the Bitmain Antminer Z15 Pro, with the following hardware specs:

-

Hashrate: 840 KH/s

-

Power consumption: 2780 W, running at around 2560 W in practice

-

Energy efficiency ratio: 0.302 KH/W

Currently, only Z15 Pro futures are available on the official site, with delivery scheduled for April 2026 at a price of $4,999. Those who can’t wait may purchase second-hand units on gray markets such as Xianyu, where the real price is about 50,000 RMB.

https://m.bitmain.com/zh/product/detail?pid=00020251112140439260bFAoSY2F0667

2) ZEC’s hashrate and mining revenue structure: astonishing daily returns

In the past two months, ZEC’s high profitability has rapidly attracted new mining power, causing the global hashrate to grow significantly and difficulty to enter an upward cycle. The chart clearly shows that ZEC’s price (yellow line) began breaking out of consolidation at the end of September, followed by simultaneous increases in hashrate (light purple) and difficulty (dark blue). This movement indicates that miners have already responded to the rising price.

https://minerstat.com/coin/ZEC

At the time of writing, key parameters of the Zcash network are:

-

Global hashrate: 13.31 GH/s

-

Network difficulty: 118.68M

-

Block reward: 2.5 ZEC/block

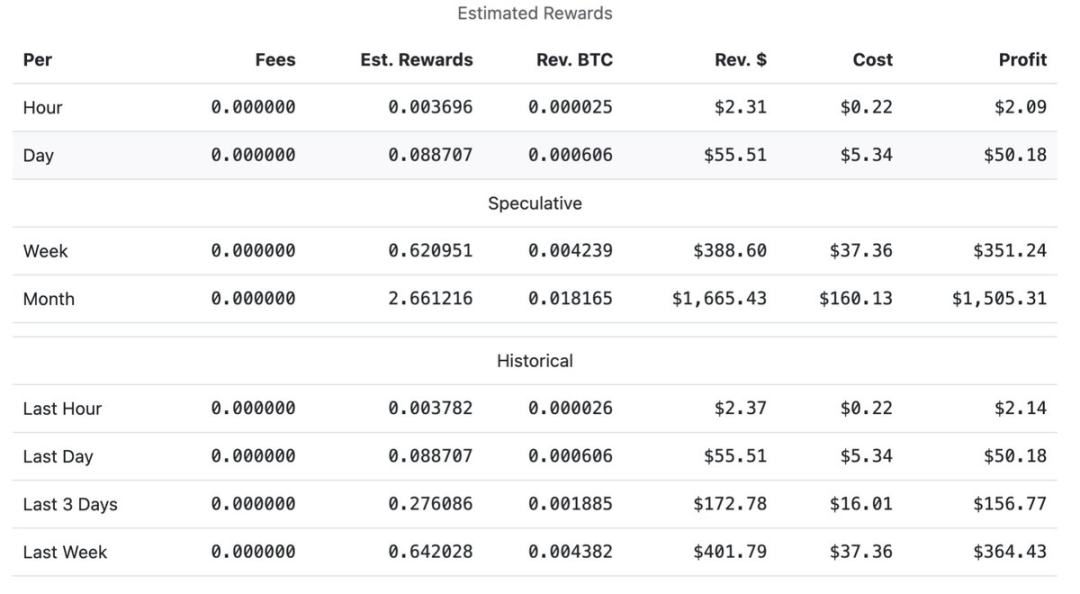

To calculate daily earnings, we input the Z15 Pro’s specifications into a mining profit calculator using standard miner settings:

-

Mining pool fee: 2%

-

Electricity cost: $0.08/kWh

-

Daily electricity cost: $5.34 (2.78 kW × 24 hours × $0.08/kWh)

This yields an astonishing figure: a single Z15 Pro generates over $50 in net profit per day—and such high profits have persisted for at least one week based on historical data.

https://whattomine.com/coins/166-zec-equihash

3) Breakeven period: an exceptionally high ROI

Assuming short-term network stability and constant electricity prices, we calculate the breakeven period using the Z15 Pro’s future price of $4,999.

To reflect actual costs, we apply straight-line depreciation over the miner’s expected 5-year lifespan (1826 days):

-

Daily equipment cost amortization: $2.74

-

Daily net profit after amortization: approximately $47.63

Thus, the static breakeven period for a single Z15 Pro is only about 105 days, translating to an annualized return of nearly 350%.

This figure is extremely rare in PoW history—even abnormal:

-

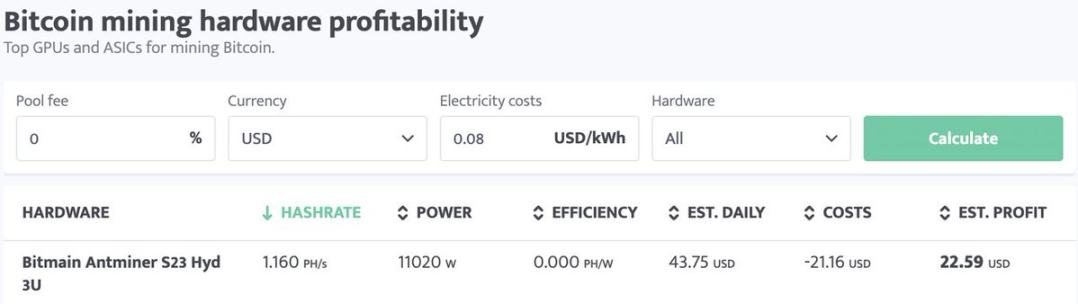

BTC miner breakeven periods during bull cycles typically range from 12–24 months

-

ETH PoW-era miners saw ROIs between 300–600 days

-

Historically, PoW projects with breakeven periods under 120 days (e.g., FIL, XCH, RVN) almost all collapsed within months

Current top-tier BTC miners generate ~$23 per day, with a static breakeven period of about 3.4 years

4) Case review: the recurring Hardware–Price Scissors pattern

Hardware–Price Scissors is a recurring “收割” script in PoW mining history. Miners, caught in peak FOMO and driven by soaring coin prices, order mining rigs at multiples of their original price (with apparent ROI looking unrealistically low—sometimes as short as four months). However, when these miners finally arrive and go online (usually delayed by over three months), driving a massive spike in hashrate, large holders often dump their positions at the top, leaving miners facing a double whammy of “halved coin price + halved mining rewards,” turning their expensive machines into overpriced scrap metal overnight.

-

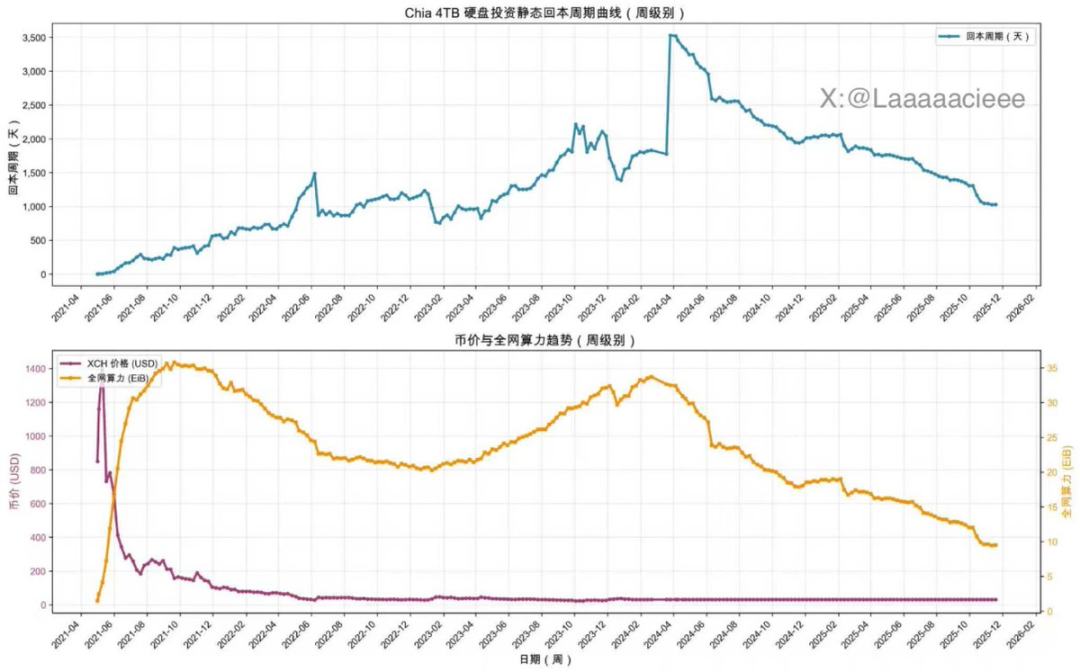

In May 2021, Chia triggered a global hard drive shortage. At the time, XCH’s price surged to $1,600, and early storage investments showed static breakeven periods compressed below 130 days. This extreme profitability instantly triggered a tsunami of global storage-based hashrate. What followed was a brutal scissors effect: despite falling coin prices, previously ordered drives continued coming online, and global hashrate kept growing inertia after price peaked, extending breakeven periods from 30 days to over 3,000 days.

-

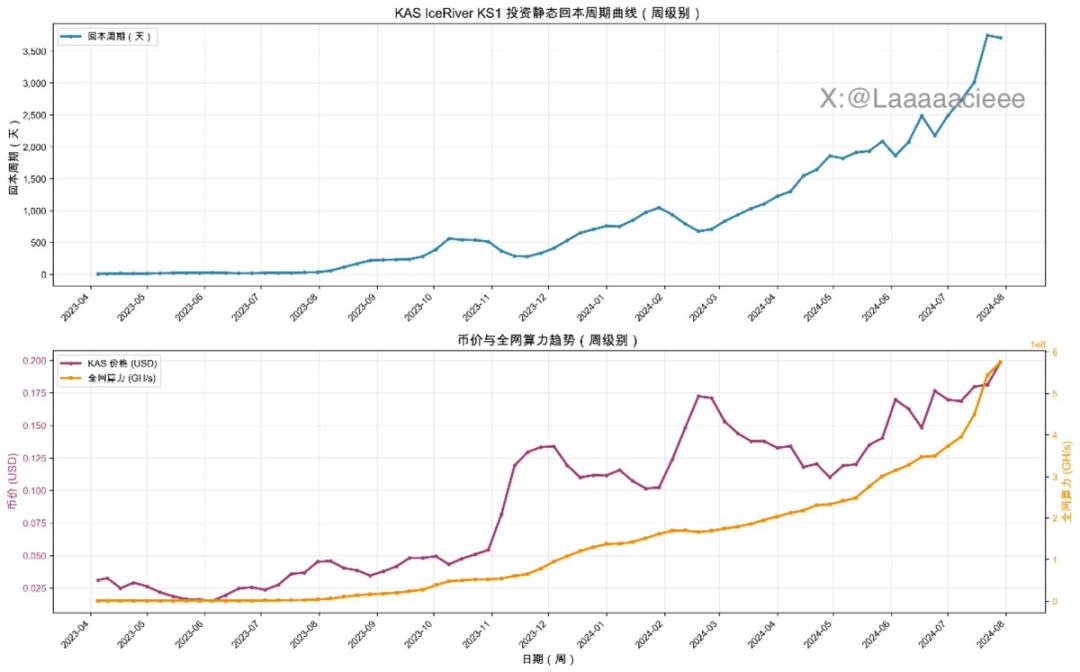

Looking at IceRiver KS1 miner data, in mid-2023, its breakeven period dropped as low as 150 days. Unlike Chia, KAS’s price actually maintained an upward trend. Yet miners still ended up losing money because the growth rate of hashrate far exceeded the pace of price appreciation. Rapid industrial ASIC iteration and mass deployment caused network difficulty to rise exponentially. Despite strong price performance, due to skyrocketing difficulty, the KS1’s breakeven period inevitably ballooned to 3,500 days.

ZEC’s hashrate level is entering a danger zone historically prone to 51% attacks

Beyond mining economics, another decisive risk factor is network security and hashrate scale. For any PoW chain, “global hashrate size + 51% attack cost” directly determines whether its high valuation can be self-consistent.

1) Global hashrate scale: equivalent to a small-to-medium Bitcoin mining farm

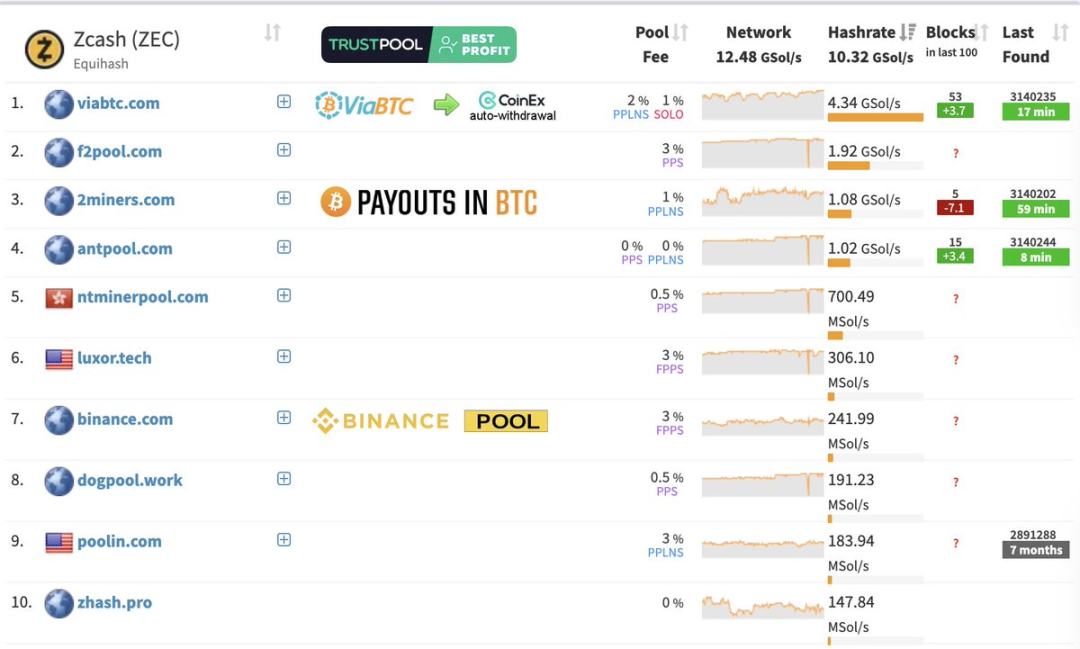

According to the latest network data, ZEC’s total hashrate is approximately 12.48 GSol/s. Given that each Z15 Pro delivers 0.00084 GSol/s, only about 14,857 units would be needed, consuming roughly 40 MW of energy—equivalent to a small-to-medium Bitcoin mining facility.

In terms of overall hashrate scale, Zcash’s security foundation appears extremely weak, placing it squarely within the risk range of smaller PoW chains that have suffered successful 51% attacks.

https://miningpoolstats.stream/zcash

2) Attack cost: theoretically in the millions of dollars

Generally, launching a 51% attack requires controlling more than 50% of the network’s total hashrate simultaneously. If ZEC’s network is currently dominated by around 16,000 Z15 Pro units, an attacker could potentially gain control by renting or purchasing just a few thousand devices.

Rough estimate:

-

Each Z15 Pro futures cost ~$5,000; bulk purchases of 300+ units qualify for at least a 10% discount

-

Controlling ~8,000 units → maximum cost ~$40M, with energy demand around 20 MW

-

If using rentals or second-hand units, actual startup cost could drop to several million dollars

On a public blockchain with an FDV nearing $10 billion, the ability to launch potential chain reorganizations or double-spends with only a few million dollars in mining investment represents a significant structural vulnerability.

3) Comparison with major chains: vast security gap

To provide clearer perspective, let’s compare ZEC with other major operating PoW chains:

More critically, ZEC’s current hashrate not only lags far behind mainstream PoW chains like BTC, LTC, and KAS, but is also lower than ETC, BTG, VTC, and BSV—chains that have all suffered successful 51% attacks—at the times they were attacked. This means ZEC’s network security has effectively entered a vulnerable, attack-prone zone.

On-chain data reveals ZCash’s actual usage remains very limited

Despite the ongoing surge in ZEC narratives, on-chain data offers a more sobering view—the real-world usage significantly deviates from its current billion-dollar FDV.

In terms of transaction volume, active addresses, and ecosystem size, Zcash’s actual network activity is far less vibrant than its price action suggests:

-

Average daily transactions over the past month: only 15,000–18,000 per day, just 1%–2% of major public chains

-

As a privacy chain, the vast majority of transactions remain transparent, with shielded transactions accounting for less than 10%

https://zechub.wiki/dashboard

Repricing as the market cools from frenzy

Narrative, sentiment, celebrity influence, and mining economics traps have collectively propelled a dormant eight-year-old project to the peak of public attention. But beyond the noise, when we return to blockchain’s three core pillars—economic sustainability, network security, and on-chain adoption—ZEC presents a starkly different picture.

This is:

-

A mining scheme targeting miners with a 105-day breakeven and 350% annualized ROI

-

A PoW chain whose hashrate equals only a medium-sized Bitcoin mine, with 51% attack costs as low as millions of dollars, daily transaction volume at just 1%–2% of mainstream chains, and less than 10% actual usage of its privacy features

History has proven countless times: abnormally short breakeven periods (extremely high ROI) are often harbingers of mining crashes and price collapses.

Whether ZEC will be an exception, I cannot say.

But the rules of crypto have never changed: narratives and emotions can create myths, but fundamentals determine how far those myths can go.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News