What is Aster's path to breakthrough with逆势 development in both token price and reputation? Aster's 2026 core strategy

TechFlow Selected TechFlow Selected

What is Aster's path to breakthrough with逆势 development in both token price and reputation? Aster's 2026 core strategy

Aster is achieving sustainable and steady growth in on-chain finance by rebuilding the on-chain transaction ecosystem.

Author: TechFlow

Introduction

The market is gloomy, but a rare few projects are thriving—Aster being one of them.

According to CoinGecko data from November 19, $ASTER surged over 7.7% in the past 24 hours, up 18.4% over seven days, and 32.1% over 14 days.

As one of this year’s most successful TGE projects, after witnessing Aster’s TGE-week surge exceeding 2800%, the market has become increasingly focused on its future trajectory.

After all, having seen too many cases where TGE marks the peak, sustained user engagement, trading activity, and revenue post-TGE are what truly demonstrate resilience against market and community scrutiny.

Meanwhile, with 2025 expected to be a breakout year for Perp DEXs, Aster's battle for differentiation becomes even more compelling amid fierce competition from peers like Hyperliquid, Lighter, and EdgeX.

So, what is Aster’s core competitive strategy?

From launching Rocket Launch to offer early access to high-quality assets, to introducing a privacy-focused Layer 1, and empowering the $ASTER token through staking, buybacks, burns, and fee discounts—on November 10, 2025, Leonard, founder of Aster, delivered a clear answer during a direct community-facing AMA:

The market doesn’t need another repetitive and boring Perp DEX, but true trading freedom—integrating security, trust, privacy, efficiency, cost, liquidity, and discovery and capture of yield opportunities.

Aster is rebuilding an on-chain trading ecosystem, aiming for long-term stability and sustainable growth in on-chain finance.

An AMA aimed at clarifying Aster’s future—what did the founder say?

Summarizing this one-hour AMA, you can easily grasp the following key points:

-

Aster is building a privacy-focused Layer 1: The team is working full speed to complete internal testing and prepare the testnet technically by early 2026.

-

Ongoing empowerment of the $ASTER token: Aster has already introduced concrete use cases such as fee discounts, airdrops, and VIP tiers for $ASTER, and continues enhancing token value via buyback and burn programs. With the launch of Layer 1, $ASTER will unlock further utility in validation, staking, governance, and more.

-

Expanded trading assets: Beyond continuously adding support for cryptocurrencies, Aster will extend to gold, stocks, and commodities.

-

Optimized liquidity incentives: Continuously attract and reward market makers, supporting both professional large-pair market makers and those providing liquidity for long-tail markets.

-

Exploration into degen direction: Launching and operating Rocket Launch to empower users with early-stage value capture.

-

Global partnership network development: Enriching the trading ecosystem for a broader user experience.

Each initiative may appear independent, yet together they create synergy, building a truly attractive trading environment for all participants—traders, institutions, token holders, and market makers alike.

Reaching new heights after TGE

The massive success of TGE acted like a traffic tsunami, bringing waves of users, trading volume, and community discussions to Aster.

Now that TGE has concluded successfully, how can Aster effectively retain users? As a trading platform, Aster has its own secret formula.

In founder Leonard’s vision, this is a dual-track strategy: horizontally expanding yield opportunities while vertically deepening user experience.

To retain users, first ensure they trade comfortably—through a series of experience optimizations. Aster is purpose-built for traders, aiming to create a trading ecosystem combining CEX-level smoothness with DEX-level trustworthiness. For traders, especially professional traders and institutional users, Aster offers several advantages:

On one hand, under its decentralized architecture, Aster can list assets faster and expand trading pairs more flexibly. Maintaining permissionless openness, Aster supports not only cryptocurrencies but also U.S. stocks and gold, with plans to add more U.S. equities and commodities, offering diverse on-chain trading options.

On the other hand, Aster continues refining liquidity management. Its market maker program incentivizes LPs to fill thinner markets. While optimizing depth for major coins, Aster will increasingly focus on long-tail assets, planning higher rebate rewards for small-cap market makers to improve depth and execution quality—ensuring smooth, low-slippage trading regardless of asset type.

Privacy features are a key differentiator setting Aster apart from other Perp DEX platforms. Many users, particularly institutional traders, do not want their strategies and positions fully exposed on-chain. Features like Hidden Orders and hidden order systems meet this need, helping attract more institutional capital.

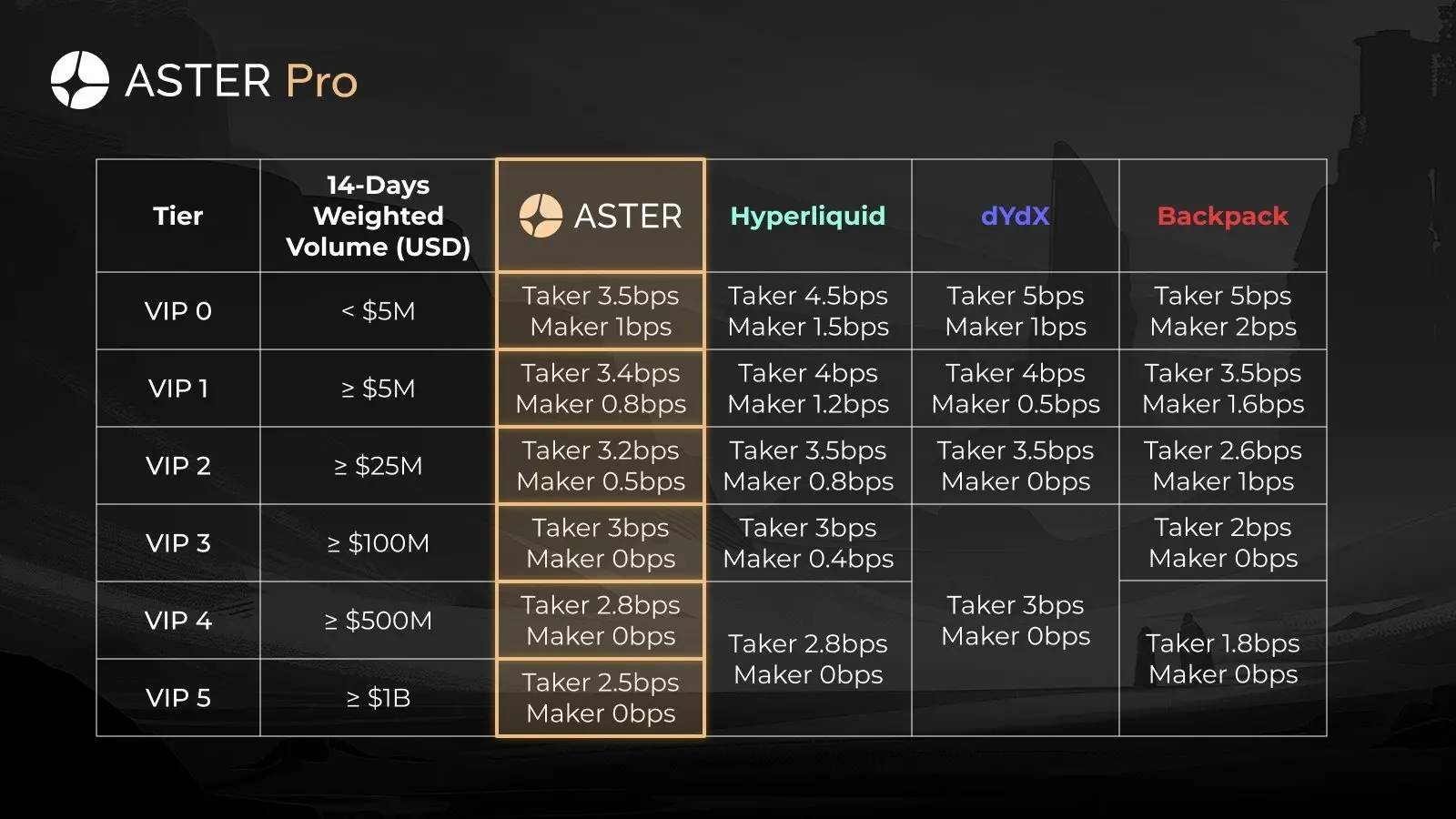

Additionally, extreme leverage of up to 1001x and favorable fee structures bring significant cost advantages for large institutions or high-leverage traders.

Beyond trading experience, traders care about “gaining something”—aligning perfectly with Aster’s core philosophy: Trade & Earn.

Stable yield is a key module for Aster, designed to enhance capital efficiency—especially for institutional users. By integrating lending, perps, and yield pools, it aims to boost capital returns while maintaining controlled risk. Aster will also expand DeFi partnerships to unlock more yield scenarios.

USDF is central to Aster’s stable yield module. Within Aster’s trading system, USDF serves triple roles—as trading collateral, liquidity asset, and passive income source. As a delta-neutral yield-bearing stablecoin, USDF generates returns by deploying underlying assets into low-risk DeFi protocols.

Post-TGE, Aster launched multiple incentive initiatives, including ongoing Stage 3 and Stage 4 events, and a $10 million prize pool Double Harvest trading competition, rewarding real trading activity to attract users and drive ecosystem growth.

Another significant move post-TGE was the launch of Rocket Launch—the core vehicle for Aster’s “providing liquidity support” value proposition. Rocket Launch offers high-potential projects a launchpad with strong liquidity and long-term value. Projects can set up reward pools to reach wider audiences, while users gain access to degen culture and early opportunities. Since launch, five projects have gone live, distributing over $3 million in rewards.

Since TGE, this growth logic has proven effective through concrete metrics:

According to official Aster data, user count exceeds 4.6 million; per Dune analytics, 24-hour open interest stands at $2.329 billion, weekly trading volume surpasses $25.6 billion, capturing over 20% market share among Perp DEXs.

While these figures have declined due to bearish market conditions, they still strongly demonstrate Aster’s firm foothold in the Perp DEX space, establishing itself as a top-tier player.

By continuing its dual-path strategy of expanding yield horizontally and deepening experience vertically, and advancing its Layer 1 roadmap, Aster’s trading ecosystem now holds far greater potential.

Aster Layer 1: Upgrading the narrative from Perp DEX to trading infrastructure

During Leonard’s AMA session, the most anticipated topic was Aster Layer 1.

Building a Layer 1 means building infrastructure—Aster Layer 1 aims to create a blockchain re-architected specifically for trading.

Why rebuild an entire chain? At the heart lies Aster’s original mission: achieving a truly decentralized trading environment on-chain, while delivering a CEX-like user experience.

On one hand, Aster believes trading ecosystems must be built on decentralization, as verifiability and self-custody offered by blockchains lay a robust foundation of trust.

On the other hand, the essence of trading lies in order book matching. Aster requires infrastructure capable of near-centralized matching performance. However, existing public chains typically run matching either within smart contracts or off-chain systems, using blockchains merely as data recorders—resulting in significant limitations.

Moreover, from a pure performance standpoint, Leonard believes no current blockchain can outperform centralized matching engines and databases. Therefore, while striving for CEX-comparable experience, Aster Layer 1 must identify a key differentiator—and privacy is Aster’s answer.

In many cases, traders don’t want their strategies fully transparent on-chain, which could expose them to front-running and other risks. Strategy privacy is increasingly critical. The targeted attacks on renowned trader James Wynn on Hyperliquid illustrate this well, and rising interest in Zcash further confirms market demand. Offering on-chain privacy fills a current market gap and enables more users and strategies to operate securely on-chain.

Given all this,Aster Layer 1 has begun taking shape:

-

Designed for trading: Aster Layer 1 embeds order book logic directly into the blockchain’s core, writing the entire matching process—including order placement, execution, cancellation—into consensus and execution layers. This ensures resource allocation and performance optimization are centered around trading, delivering CEX-like experience.

-

Deepened privacy and security: Privacy remains a core differentiator. Aster Layer 1 extends this strength, safeguarding trading strategies and user privacy.

-

Verifiable and self-custodial: Breaking free from the black box of centralized trading, participants can define and verify trading rules themselves.

The infrastructure upgrades brought by Aster Layer 1 will powerfully connect various ecosystem modules, triggering a series of cascading effects:

First, foundational improvements in trading experience;

Second, achieving true “verifiable + self-custodial + private” will open doors to institutional adoption and accelerate Aster’s evolution into a “trading infrastructure.” Whether DeFi projects or traditional financial institutions such as brokers, exchanges, banks, and payment providers, all can build directly atop Aster, replicating its successful model of “CEX-level smoothness combined with DEX-level trust”:

Aster provides matching engine + liquidity + risk control; partners provide brand + product + local operations.

Going forward, starting from Asia, Aster will expand into English-speaking markets, continuously growing its global partner network and accelerating ecosystem expansion.

With the launch of Layer 1 and staking functionality, the value cycle of the Aster ecosystem will achieve full closure through the $ASTER token.

All value converges into $ASTER

As the core value carrier of the ecosystem, Aster continuously introduces practical applications for $ASTER, empowering token holders. Current utilities include:

-

Governance: Token holders vote on protocol development, including integration of liquidity sources, fee structures, and treasury management;

-

Fee discounts: Users paying fees with $ASTER receive discounts;

-

VIP tiers: A multi-level VIP system based on trading volume and $ASTER holdings unlocks deeper fee discounts, priority liquidity access, higher leverage limits, and other benefits for higher-tier users;

-

Token airdrops: Holding or staking $ASTER increases multipliers in Aster Spectra, improving eligibility for future airdrops;

-

Event participation: For example, holding a minimum amount of $ASTER is required to join Rocket Launch.

In addition, Aster is negotiating with lending protocols to further expand use cases for the $ASTER token.

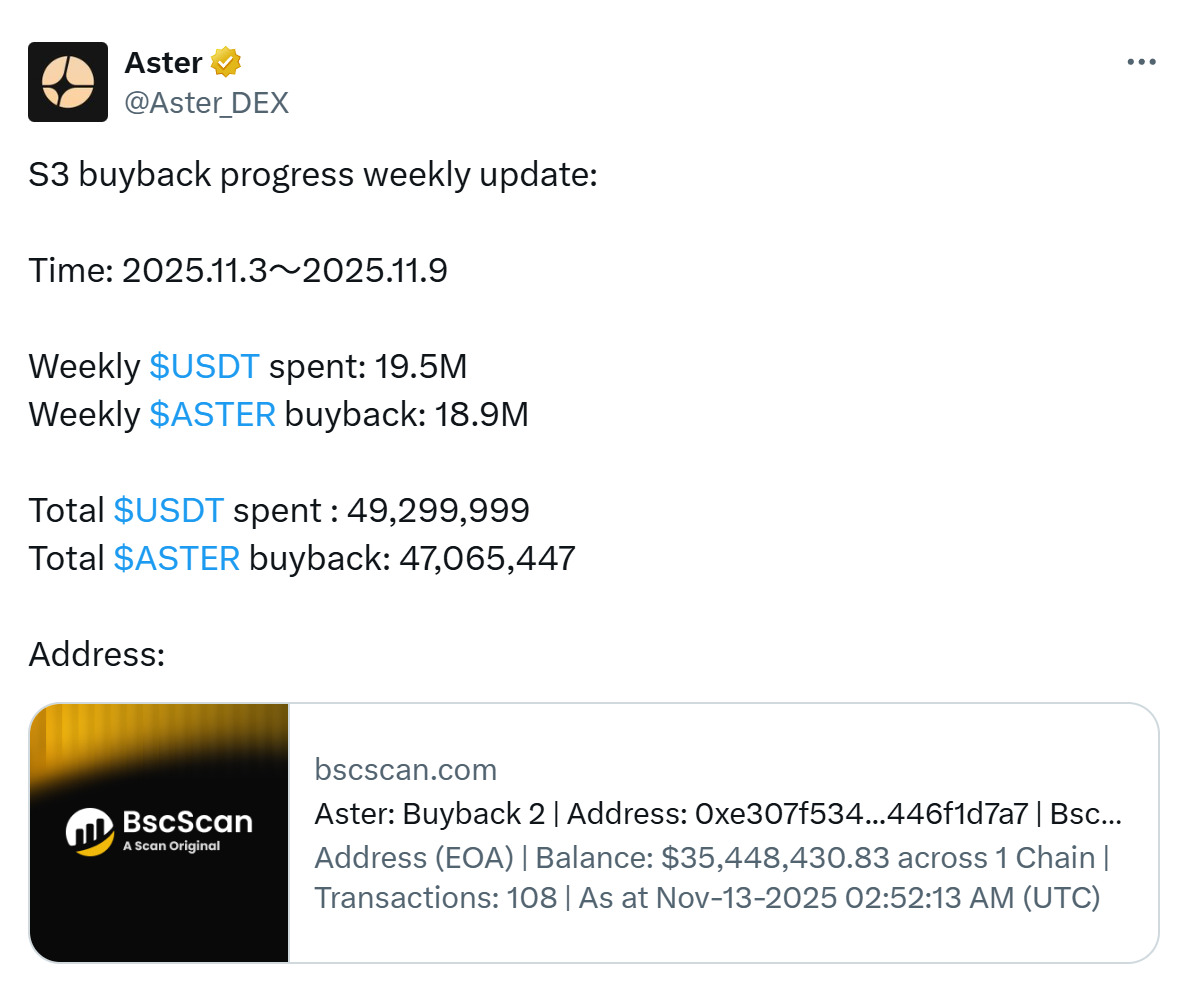

Moreover,Aster has implemented a buyback and burn mechanism to further protect token value:

Previously, Aster announced that 70%–80% of trading fees generated during S3 would be used to repurchase $ASTER. It also stated that of all buyback funds from S2 and S3, 50% would be burned and 50% returned to locked airdrop addresses—to reduce supply and strengthen long-term value.

All operations are executed systematically and are publicly transparent, enhancing community trust.

These measures significantly reduce speculative aspects of $ASTER, transforming holders into long-term ecosystem builders. Meanwhile, the virtuous cycle of “more active trading → higher platform revenue → greater buybacks and burns → stronger holder empowerment” creates a sustainable positive flywheel.

With the official launch of Layer 1, $ASTER will become even more tightly coupled with the entire Aster ecosystem:

On one hand, validator nodes and staking are expected to go live alongside the Aster Layer 1 mainnet. Given the nearly zero-Gas design of Layer 1, validator incentives will be funded by two sources: protocol-level ecosystem incentives and transaction fee sharing. Thanks to Aster’s sustained positive cash flow, the ecosystem can support a stable and sustainable incentive model, giving every trading act added significance in securing the network.

On the other hand, the buyback logic can be directly encoded into smart contracts for automatic execution, making each buyback’s amount, price, and address publicly verifiable—eliminating front-running and information asymmetry—while retaining algorithmic flexibility to adjust parameters across different stages.

Furthermore, with the launch of Aster Layer 1, $ASTER’s governance role will expand. Stakers will participate in on-chain governance votes and decisions on ecological parameters, positioning the token as a central pillar in ecosystem governance.

Conclusion

From building a Perp DEX product to reconstructing trading infrastructure, Aster is undergoing a narrative evolution—an upgrade from application layer to infrastructure layer—signaling its ambition to cultivate an ecosystem where countless trading scenarios can flourish.

When global DeFi platforms, brokers, exchanges, and financial institutions can rapidly build their own derivatives trading platforms atop Aster’s infrastructure, the $ASTER token—as the value carrier of this vast ecosystem—will see its potential grow alongside the expanding ecosystem footprint.

It’s also worth noting that behind this narrative evolution, Aster carries a distinct “Binance-affiliated” identity: YZi Labs is the backer of Aster. Even more notably, on the evening of November 2, CZ announced he personally purchased 2.09 million Aster tokens using his own funds—marking a strong endorsement from CZ and showing that industry influencers are voting with their actions for Aster’s future.

From competing on trading performance to pioneering trading privacy, Aster chose a differentiated path from day one, quickly capturing market share among Perp DEXs. Now, as a new round of Perp DEX competition begins, will Aster once again deliver explosive growth akin to its TGE phase?

With Aster Layer 1 expected to launch by the end of 2025, let us always remain hopeful for the future of on-chain trading.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News