CZ opens position in $ASTER—will he finally defeat Hyperliquid this time?

TechFlow Selected TechFlow Selected

CZ opens position in $ASTER—will he finally defeat Hyperliquid this time?

Zhao Changpeng publicly builds a position in ASTER worth over $1.9 million for the first time since BNB.

Written by: 1912212.eth, Foresight News

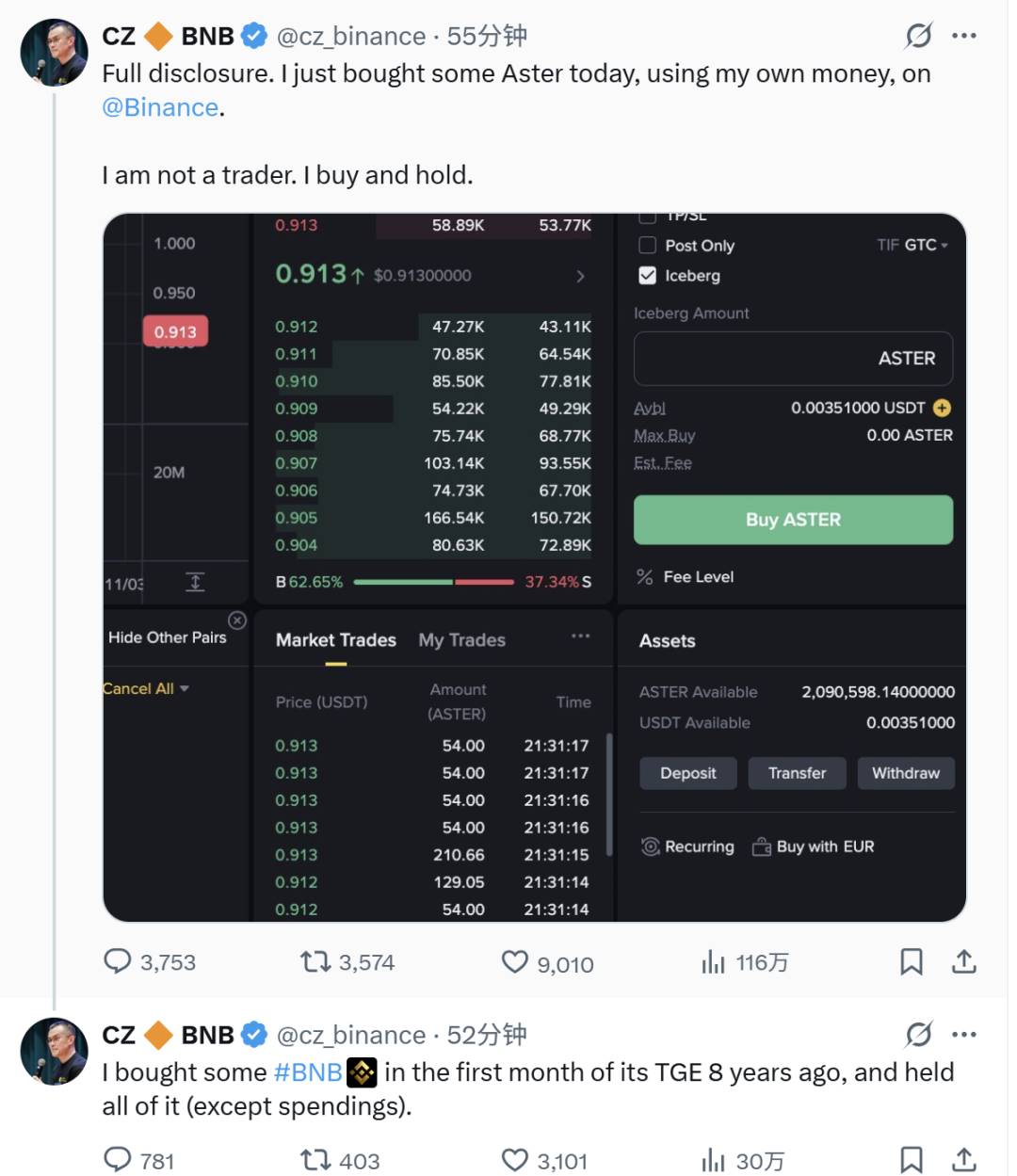

On the evening of November 2, Changpeng Zhao announced he had used his own money to purchase 2.09 million Aster tokens. He then posted a series of cryptic tweets stating, "Eight years ago, I bought some BNB during its TGE's first month and have held it ever since (except for portions used for spending)."

ASTER quickly surged from $0.9 to around $1.25, achieving nearly a 30% gain within one hour.

This was not a casual statement by Changpeng Zhao, but rather his first direct public endorsement—“shilling”—of a specific cryptocurrency in an official capacity. Previously, although he had frequently mentioned the Aster project in posts and praised its innovation, he had never disclosed any personal holdings or purchasing activity. This purchase marks a strong vote of confidence from Zhao in support of Aster.

In terms of transaction details, according to publicly available records of Zhao’s Binance account, the average purchase price was locked at $0.913, with a total value exceeding $1.9 million. Zhao emphasized that he is not a trader but a long-term holder—a stance consistent with his established investment philosophy: buy and hold, focusing on the long-term value of projects.

Chronologically, this purchase occurred shortly after ASTER's token listing, during a period of market volatility. Zhao’s position-building triggered a sharp increase in trading volume, pushing Aster’s market cap back above $2 billion.

Challenging Hyperliquid?

As early as September, Changpeng Zhao had engaged multiple times with content related to Aster—for example, praising its Hidden Order feature, noting that it went live just 18 days after launch, far faster than over 30 similar projects. He also reshared Aster’s posts highlighting its multi-chain support and low-fee advantages, promoting growth within the BNB Chain ecosystem. However, these were all project-level comments without disclosure of personal investment—until November 2, when he openly revealed his purchase.

Zhao’s decision to build a position in Aster is no impulsive act, but rather a carefully considered strategic move.

Since stepping down from his role as Binance CEO, Zhao has shifted focus toward investments and ecosystem development. His newly founded YZi Labs is the key backer behind Aster, which incubated the Aster DEX focused on next-generation Perp DEX innovation. By purchasing ASTER, Zhao is effectively voting with real capital for his own project, sending a clear signal to the market: Aster is not a short-term speculative play, but a piece of infrastructure with long-term potential.

Aster positions itself as a multi-chain Perp DEX supporting networks like BNB Chain, with its core selling point being Hidden Orders—large trades are only revealed after matching, preventing front-running and sniping. Aster addresses key pain points of traditional DEXs, where competitors like Hyperliquid suffer from manipulatable public order books.

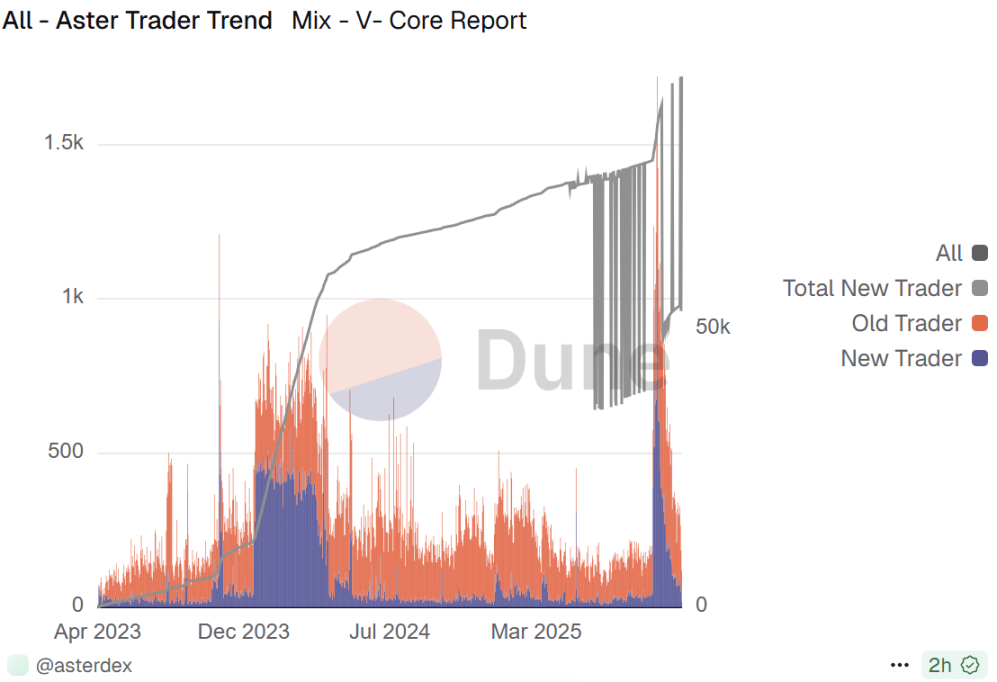

Zhao’s endorsement is essentially a liquidity “redirect” toward BNB Chain–based products—driving more activity onto BNB Chain, stimulating gas fees and DeFi usage. According to the latest data from Dune, Aster currently has over 5.314 million total users, a TVL exceeding $1.256 billion, and a staggering total trading volume reaching $2.9 trillion. From September to October this year, a large influx of new users joined, with daily user growth at times surpassing the bull market levels seen at the beginning of 2024.

The Perp DEX space is fiercely competitive, but Aster stands out through its low fees, tokenized stocks, dark pool trading, and grid strategies. At the time of Zhao’s purchase, rumors were circulating (later debunked) that he had sold $30 million worth of ASTER via fake screenshots—making his actual buying move all the more significant, signaling his determination to challenge Hyperliquid in the perpetual contracts DEX arena.

Over the past several years, whether with Pancake, wallet products, or Alpha-focused initiatives, Binance has rarely led from the start—but often manages to catch up and even overtake competitors. This raises market speculation about whether Aster could eventually claim the top spot in the Perp DEX sector.

Possibly, the real derivatives battle has yet to begin.

Can On-Chain Buybacks Offset November’s Large Token Unlock?

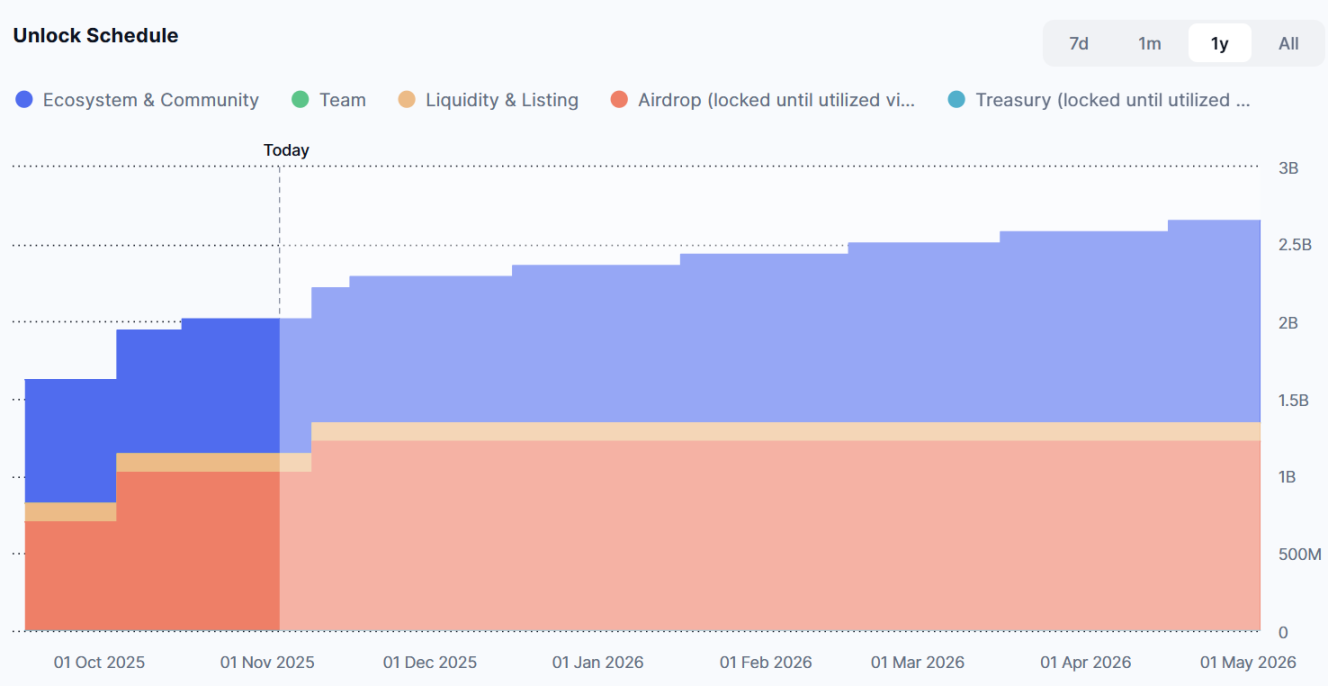

Aster’s tokenomics model features gradual releases, with a total supply of 8 billion tokens. In November, Aster faces two cliff unlocks.

According to Binance App data, approximately 200 million tokens (2.5% of total supply), valued at around $240 million at current prices, will unlock on November 10; another 72.73 million ASTER tokens (0.91% of total supply), worth approximately $87.276 million, will unlock on November 17.

With broader market liquidity tight, S3 sell pressure, and token unlocks looming, investor sentiment remains cautious and观望.

On October 30, Aster announced that its S3 buyback program would be fully transparent and executed 100% on-chain. Daily purchases from the open market will continue until cumulative buybacks reach 70–80% of transaction fees collected during the S3 period. The S3 phase will last 35 days, ending on November 9. Additionally, the S3 airdrop will commence only after all buybacks are completed, using tokens from the buyback address first for distribution; any shortfall will be covered by unlocking tokens from the airdrop allocation pool to ensure full disbursement.

According to the latest data from DefiLlama, Aster’s recent daily fee revenue averages around $1.93 million, implying daily buyback amounts of approximately $1.35 million to $1.54 million.

On October 31, the team announced that 50% of all buyback funds (including those from S2 and S3) will be permanently burned via the public buyback address, reducing supply and reinforcing ASTER’s long-term value. The remaining 50% will be redirected to a locked airdrop address, reducing circulating supply and reserving additional tokens for future distributions to reward genuine Aster users and long-term holders.

Ongoing official buybacks continue to support the token’s price. As market liquidity improves and broader conditions turn favorable—especially if derivative interest rebounds—the negative impact of these unlocks may diminish significantly.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News