Recent Market Analysis: Bitcoin Falls Below Key Support Level, Market on High Alert Preparing for No Rate Cut Scenario

TechFlow Selected TechFlow Selected

Recent Market Analysis: Bitcoin Falls Below Key Support Level, Market on High Alert Preparing for No Rate Cut Scenario

Given the uncertainty surrounding the Federal Reserve's December decision, exercising caution and managing position sizes may be wiser than attempting to predict short-term bottoms.

Meta Description

As Bitcoin and Ethereum prices weaken, the cryptocurrency market continues to slide. Analysts warn that liquidity remains tight and market sentiment is softening ahead of the December rate decision.

Three Key Takeaways

• Expanding declines in Bitcoin and Ethereum amid rising selling pressure and weakening buying momentum indicate deteriorating market confidence and worsening short-term sentiment.

• Market leaders emphasize liquidity stress, shifting rate expectations, and structural pressures rather than panic-driven sell-offs, suggesting the cycle may still be in its mid-phase.

• Given uncertainty surrounding the Fed's December decision, exercising caution and managing position sizes may be wiser than attempting to time a short-term bottom.

Cryptocurrency markets remained under pressure yesterday, with sentiment continuing to turn cautious.

Declines in Bitcoin (BTC) and Ethereum (ETH) deepened as buyers remained hesitant and selling pressure took control. Unlike previous sharp crashes, this downturn resembles a steady, controlled correction—indicating leverage is being reduced gradually rather than aggressively liquidated.

Bitcoin’s recent price action highlights this pattern. After multiple failed attempts to reclaim higher levels earlier this week, momentum weakened further. At the time of writing, Bitcoin was trading between $89,500 and $89,600, marking another drop from last week’s levels. Ethereum followed a nearly identical path, unable to decouple from Bitcoin or find effective support.

The overall market tone has shifted: declines are no longer seen as buying opportunities but instead trigger silence and caution—signaling fragile market confidence.

Last 24 Hours: Data Confirms Weak Momentum

In the past 24 hours, Bitcoin’s price continued to decline.

On the 4-hour chart, the structure shows persistent downward pressure accompanied by increasing sell volume. Brief rebound attempts quickly faded, indicating a lack of buyer conviction. Larger sell orders and rising volume suggest this move may not be driven solely by retail sentiment.

Since November 14, Bitcoin has displayed a clear pattern: lower highs, weakening rebounds, and gradually increasing supply. If this trend persists, traders may shift focus toward deeper structural support zones rather than expecting a rapid recovery.

The decline hasn’t triggered panic, but it has brought weakness. That alone is enough to unsettle investors hoping for a stronger year-end rally.

What Market Leaders Are Saying

Several prominent figures have commented on the current market situation, offering context beyond charts.

Fundstrat’s Tom Lee attributes the current weakness to lingering effects from the October 10 de-leveraging event. He believes market makers’ balance sheets may still be impaired, creating a temporary liquidity shortage akin to quantitative tightening in crypto. However, Lee maintains that the current cycle hasn’t reached its final peak, suggesting true highs could still be one to three years away.

Arthur Hayes takes a more cautious view. He notes that while Bitcoin falls, equities remain elevated—a potential sign of brewing credit stress. His liquidity model shows a weakening dollar. If liquidity tightens further before policymakers intervene, Bitcoin could retest high levels above $80,000. Still, Hayes believes Bitcoin remains positioned for strong long-term gains once liquidity recovers.

Cathie Wood remains optimistic about Bitcoin as an asset class. While acknowledging competition within the ecosystem—especially from stablecoins—she continues to view Bitcoin as a long-term macro asset rather than a speculative cyclical play.

Together, these views suggest the weakness may be structural rather than emotional—driven by liquidity mechanics, not just eroding confidence.

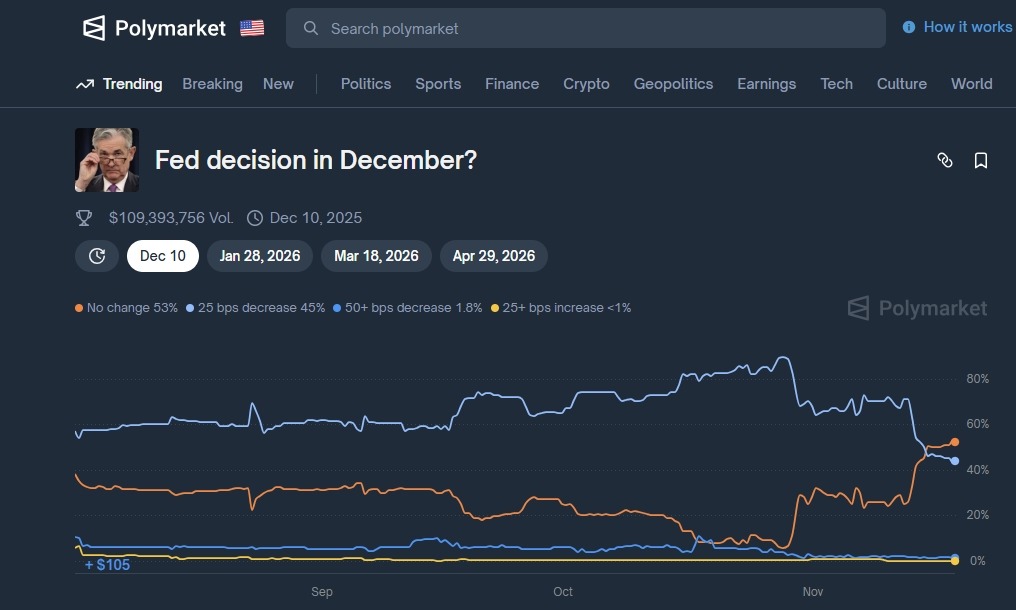

Fed's December Decision Heavily Influences Market Sentiment

Uncertainty around the upcoming Federal Reserve decision has become another pressure point.

The likelihood of no rate cut in December has risen significantly, now becoming the consensus expectation across traditional markets and prediction platforms. Despite recent political turbulence, traders appear focused on data and central bank communication.

This shift is significant for asset classes closely tied to liquidity conditions. Prolonged high rates suppress speculative appetite, reduce leverage, and accelerate risk-off behavior—all of which are now visible in digital asset markets.

Is This the Market Bottom?

It seems too early to declare a market bottom. The current environment lacks typical late-cycle characteristics: forced liquidations, capitulation selling, extreme fear, or severe valuation disconnects. Instead, the market appears to be drifting lower, seeking stability amid ongoing liquidity contraction.

But this doesn’t mean long-term investment strategies are obsolete. It means timing matters—entering positions based on assumptions rather than signals increases risk.

Looking Ahead

For now, caution may be more appropriate than aggressive positioning. Gradual entry, maintaining flexibility, and avoiding leverage could prove wiser over the coming weeks.

The next expansion phase will eventually arrive—but the market may need to endure a winter cycle before regaining momentum. Until then, patience is not weakness.

It’s discipline.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News