Behind the recent stablecoin de-pegging: the industry has not learned from history

TechFlow Selected TechFlow Selected

Behind the recent stablecoin de-pegging: the industry has not learned from history

Stablecoins are not stable; they only appear stable before collapsing, and the collapse can happen within just a few hours.

Author: YQ

Translation: AididiaoJP, Foresight News

The first two weeks of November 2025 saw a stablecoin meltdown that exposed fundamental flaws in decentralized finance—a reality scholars have long warned about. The collapse of Stream Finance's xUSD and the subsequent chain reaction that brought down Elixir’s deUSD and numerous other synthetic stablecoins was far from an isolated case of poor management. These events revealed deep structural problems within the DeFi ecosystem regarding risk management, transparency, and trust.

What I observed during the Stream Finance collapse was not a sophisticated exploitation of smart contract vulnerabilities, nor a traditional oracle manipulation attack. Instead, it revealed a more disturbing truth: beneath the glossy rhetoric of "decentralization," basic financial transparency has been lost. When an external fund manager can lose $93 million without effective oversight, triggering a cross-protocol ripple effect of up to $285 million; when the entire "stablecoin" ecosystem loses 40% to 50% of its total value locked within a week despite maintaining pegs on the surface—we must acknowledge a fundamental fact about the current state of DeFi: this industry has learned nothing.

More precisely, the current incentive structure rewards those who ignore historical lessons and punishes cautious, conservative actors—shifting losses onto the broader market when inevitable collapses occur. A well-known adage in finance rings particularly true and harsh here: if you don’t know where the returns come from, then you are the source of the returns. When certain protocols promise 18% annual returns through opaque strategies while mature lending markets offer only 3% to 5%, the nature of those high yields is likely the depositors’ own principal.

Mechanics and Risk Transmission of Stream Finance

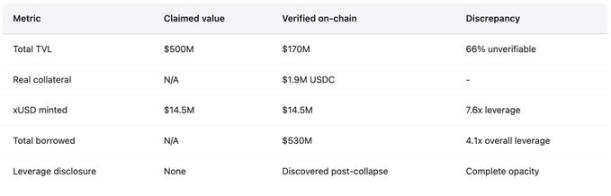

Stream Finance positioned itself as a yield optimization protocol, offering users up to 18% annualized returns on USDC deposits via its interest-bearing stablecoin xUSD. It touted complex-sounding strategies such as “delta-neutral trading” and “hedged market making,” but its actual operations remained vague. By comparison, Aave offers around 4.8% APY on USDC deposits, and Compound slightly above 3%. Basic financial literacy suggests caution toward returns multiples higher than market averages—yet users still deposited hundreds of millions into the protocol. Before the crash, 1 xUSD traded as high as 1.23 USDC, reflecting compounding interest. At its peak, xUSD claimed $382 million in assets under management, but DeFiLlama data showed its peak TVL was only $200 million—meaning over 60% of its purported assets existed in unverifiable off-chain positions.

After the collapse, Yearn Finance developer Schlagonia uncovered its real mechanism: a systemic fraud disguised as financial innovation. Stream employed a recursive borrowing model to create synthetic assets with no underlying value support through the following process:

-

Users deposit USDC.

-

Stream swaps USDC for USDT via CowSwap.

-

Uses these USDT to mint deUSD on Elixir (choosing Elixir due to its high yield incentives).

-

Transfers these deUSD across chains to networks like Avalanche and deposits them into lending markets to borrow more USDC, completing one cycle.

At this point, the strategy, though already complex and reliant on cross-chain operations, could still be seen as a form of collateralized lending. But Stream did not stop there. Rather than using borrowed USDC solely to expand the collateral loop, it used its StreamVault contract to mint additional xUSD—causing the supply of xUSD to vastly exceed the actual value of its collateral. With only $1.9 million in verifiable USDC backing, Stream minted up to $14.5 million in xUSD, inflating its synthetic asset supply 7.6 times relative to its reserves. This is equivalent to a fractional reserve banking system with no reserves, no regulation, and no lender of last resort.

The circular dependency with Elixir made the entire structure even more precarious. In expanding the xUSD supply, Stream deposited $10 million in USDT into Elixir, thereby increasing the deUSD supply. Elixir then swapped this USDT into USDC and deposited it into Morpho’s lending markets. By early November, Morpho had over $70 million in USDC supplied and over $65 million borrowed, with Elixir and Stream as major participants. Stream held approximately 90% of the total deUSD supply (around $75 million), while Elixir’s reserves were largely composed of loans provided back to Stream through private Morpho vaults. These two stablecoins effectively collateralized each other—one fails, both fall. This “financial recycling” inevitably leads to systemic fragility.

Industry analyst CBB publicly flagged the issue as early as October 28: “xUSD has about $170 million in on-chain assets backing it, yet it has borrowed around $530 million from lending protocols. That’s 4.1x leverage built on many illiquid positions. This isn’t yield farming—it’s gambler’s ruin.” Schlagonia also warned the Stream team 172 days before the collapse, stating that just five minutes of checking their positions would show the crash was inevitable. These warnings were public, specific, and accurate—but were ignored by yield-chasing users, fee-hungry curators, and the various protocols propping up the structure.

When Stream announced on November 4 that an external fund manager had lost about $93 million in fund assets, the platform immediately paused all withdrawals. With no effective redemption mechanism, panic spread instantly. Holders rushed to dump xUSD on thin secondary markets. Within hours, xUSD plummeted 77% to about $0.23. The stablecoin that once promised stability and high returns erased three-quarters of its value in a single trading day.

Specific Data on Risk Transmission

According to a report by DeFi research firm Yields and More (YAM), direct debt exposure related to Stream reached $285 million across the ecosystem. Key parties involved include:

-

TelosC: faces $123.64 million in loan risk due to accepting Stream assets as collateral (the largest single exposure).

-

Elixir Network: lent $68 million through private Morpho vaults (65% of deUSD reserves).

-

MEV Capital: $25.42 million exposure, with ~$650k becoming bad debt (due to oracles freezing xUSD price at $1.26 while market price dropped to $0.23).

-

Others: Varlamore ($19.17M), Re7 Labs (one vault $14.65M, another $12.75M), and smaller exposures held by Enclabs, Mithras, TiD, and Invariant Group.

-

Euler: faces approximately $137 million in bad debt.

-

Over $160 million in funds frozen across various protocols.

Researchers noted this list is incomplete and warned “there are likely more stablecoins or vaults affected,” as the full extent of risk transmission remains unclear weeks after the collapse.

Elixir’s deUSD, whose reserves were 65% concentrated in loans to Stream via private Morpho vaults, crashed 98% from $1.00 to $0.015 within 48 hours—the fastest major stablecoin failure since Terra’s UST collapse in 2022. Elixir redeemed about 80% (excluding Stream itself) of deUSD holders at 1:1 for USDC, protecting most community users. However, this came at great cost—the losses were shifted to protocols like Euler, Morpho, and Compound. Subsequently, Elixir announced it would fully shut down all stablecoin products, acknowledging that market trust had been irreparably destroyed.

Broad market reactions reflected systemic loss of confidence. According to Stablewatch, interest-bearing stablecoins collectively lost 40% to 50% of their total value locked within a week of the Stream collapse—even though most maintained their dollar pegs. This means roughly $1 billion flowed out of protocols that neither failed nor experienced technical issues. Users could not distinguish between sound projects and fraudulent ones, so they fled all similar products. DeFi’s total value locked dropped by about $20 billion in early November. The market was pricing in generalized contagion risk—not just the failure of a single protocol.

October 2025: A $60 Million Triggered Cascade Liquidation

Less than a month before the Stream Finance collapse, the crypto market experienced another catastrophic drop. On-chain forensic analysis shows this was not a typical market downturn, but a precision attack exploiting known vulnerabilities at institutional scale. From October 10 to 11, 2025, a coordinated $60 million sell-off triggered oracle failures, leading to cascading mass liquidations across the DeFi ecosystem. This was not due to over-leveraged positions becoming insolvent, but rather a replay—at an institutional level—of design flaws in oracle systems, repeating attack patterns documented and disclosed multiple times since February 2020.

The attack began at 05:43 UTC on October 10, with $60 million worth of USDe dumped into the spot market of a single exchange. In a well-designed oracle system, localized selling pressure would be absorbed by multiple independent price sources using time-weighted average prices (TWAP), minimizing manipulation risks. However, the actual oracle systems updated the values of relevant collateral (wBETH, BNSOL, and USDe) based on manipulated spot prices from the targeted exchange. Mass liquidations were immediately triggered. System infrastructure buckled under the strain—millions of simultaneous liquidation requests exhausted processing capacity. Market makers couldn't quickly submit buy orders due to API data disruptions and backlog in withdrawal requests. Market liquidity evaporated instantly. A vicious feedback loop formed.

Attack Methodology and Historical Precedents

Oracles faithfully reported manipulated prices from a single exchange, while prices on all other markets remained stable. Major exchanges showed USDe dropping to $0.6567 and wBETH to $430, whereas other venues deviated less than 0.3% from normal levels. On-chain decentralized exchange pools were minimally affected. As Ethena founder Guy Young pointed out, throughout the event, “over $9 billion in stablecoin collateral remained available for redemption,” proving the underlying assets were intact. Yet oracles reported manipulated prices, and liquidation systems acted on them—destroying positions based on valuations that didn’t exist in actual markets.

This mirrored the pattern that devastated Compound in November 2020: DAI briefly traded at $1.30 on Coinbase Pro while staying at $1.00 elsewhere, causing $89 million in liquidations. The venue changed, but the vulnerability remained. The attack method was identical to the one that destroyed bZx in February 2020 (stealing $980k via Uniswap oracle manipulation), the same as the October 2020 attack on Harvest Finance (stealing $24 million via Curve price manipulation and triggering a $570 million bank run), and consistent with the multi-exchange manipulation attack that cost Mango Markets $117 million in October 2022.

Data shows 41 oracle manipulation attacks occurred between 2020 and 2022, resulting in $403.2 million in losses. Industry response has been slow and fragmented, with most platforms still relying on oracle designs heavily dependent on spot prices and lacking sufficient redundancy. The amplification effect demonstrates that as market size grows, learning from these incidents becomes more critical. In the 2022 Mango Markets incident, a $5 million manipulation caused $117 million in losses—an amplification factor of 23x. In the October 2025 event, a $60 million manipulation triggered ripple effects with massive amplification. The attack techniques haven’t become more sophisticated—the underlying systems remain fundamentally flawed, just operating at larger scale.

Historical Patterns: Failure Cases from 2020–2025

The collapse of Stream Finance was neither novel nor isolated. The DeFi ecosystem has experienced repeated stablecoin failures, each exposing similar structural vulnerabilities. Yet the industry continues to repeat the same mistakes, each time at greater scale. Documented cases over the past five years show a highly consistent pattern:

-

Unsustainable High Yields: Algorithmic or partially backed stablecoins offer returns far above market rates to attract deposits.

-

Suspicious Yield Sources: High returns typically funded by token emissions or new deposits, not real business revenue.

-

Excessive Leverage and Opacity: Protocols operate with hidden leverage and unclear true collateral ratios.

-

Circular Dependencies: Protocol A’s assets back Protocol B, which in turn backs Protocol A, forming fragile closed loops.

-

Trigger of Collapse: Any shock exposes insolvency, or subsidies become unsustainable, triggering a bank run.

-

Death Spiral: Panic-driven exits, collapsing collateral values, cascading liquidations—entire structures implode within hours or days.

-

Risk Contagion: Failures spread to other protocols that accepted the stablecoin as collateral or were otherwise linked.

Review of key case studies:

May 2022: Terra (UST/LUNA)

-

Loss: ~$45 billion in market cap erased in three days.

-

Mechanism: UST was an algorithmic stablecoin maintained via LUNA mint-burn mechanics. Anchor Protocol offered unsustainable 19.5% yield on UST deposits.

-

Trigger: Large-scale UST redemptions and sell-offs broke the peg, triggering hyperinflation of LUNA and a death spiral.

-

Impact: Led to bankruptcies of Celsius, Three Arrows Capital, Voyager Digital, and others. Founder Do Kwon arrested and facing fraud charges.

June 2021: Iron Finance (IRON/TITAN)

-

Loss: ~$2 billion in TVL reduced to zero within 24 hours.

-

Mechanism: IRON was 75% backed by USDC and 25% by its native volatile token TITAN. Offered up to 1700% APY in yield incentives.

-

Trigger: Large redemptions led to TITAN being dumped, price collapsed, destroying IRON’s collateral base.

-

Lesson: Partial backing combined with reliance on a volatile native token is extremely dangerous under stress.

March 2023: USDC

-

Depeg: Fell to $0.87 due to $3.3 billion in reserves trapped in the collapsed Silicon Valley Bank.

-

Impact: Shook market confidence in “fully reserved” fiat-backed stablecoins. Caused DAI (over 50% of whose collateral was USDC) to depeg, triggering over 3,400 liquidations on Aave totaling $24 million.

-

Lesson: Even the most trusted stablecoins face centralized risks and dependencies from traditional finance.

November 2025: Stream Finance (xUSD)

-

Loss: Direct loss of $93 million, total ecosystem exposure of $285 million.

-

Mechanism: Recursive borrowing created unsupported synthetic assets (leverage up to 7.6x). 70% of funds managed by anonymous external managers via opaque off-chain strategies.

-

Status: xUSD trades between $0.07–$0.14, liquidity dried up, withdrawals frozen, facing multiple lawsuits. Elixir has shut down.

Summary of Common Failure Modes:

-

Unsustainable yields: Terra (19.5%), Iron (1700% APR), Stream (18%).

-

Circular dependencies: UST-LUNA, IRON-TITAN, xUSD-deUSD.

-

Information opacity: Concealed subsidy costs, hidden off-chain operations, questionable reserve assets.

-

Fragile collateral structures: Partial backing or reliance on volatile native tokens, prone to death spirals under stress.

-

Oracle manipulation: Distorted price inputs lead to erroneous liquidations and accumulation of bad debt.

The conclusion is clear: stablecoins are not stable—they only appear stable until they collapse, which can happen within hours.

Oracle Failures and Infrastructure Collapse

From the moment the Stream collapse began, oracle issues became glaringly evident. While the market price of xUSD had already fallen to $0.23, many lending protocols kept their oracle prices hardcoded at $1.00 or higher—to prevent cascading liquidations. This well-intentioned decision created a severe disconnect between protocol behavior and market reality. Such hardcoding is an active policy choice, not a technical failure. Many protocols use manual oracle updates to avoid triggering liquidations during temporary volatility. However, when price drops reflect genuine insolvency, this approach leads to catastrophic outcomes.

Protocol teams face a difficult choice:

-

Use real-time prices: risks market manipulation and cascade liquidations during volatility (as proven costly in the October 2025 event).

-

Use delayed or TWAP prices: fail to reflect actual insolvency promptly, leading to bad debt accumulation (e.g., in the Stream case, oracles showed $1.26 while actual price was $0.23—MEV Capital alone incurred $650k in bad debt).

-

Use manual updates: introduce centralization and human intervention risks, potentially enabling price freezes to conceal insolvency.

All three methods have previously resulted in losses of hundreds of millions—or even billions—of dollars.

Infrastructure Capacity Under Stress

As early as October 2020, when Harvest Finance suffered a $24 million attack followed by a bank run that slashed its TVL from $1 billion to $599 million, the lesson was already clear: oracle systems must account for infrastructure capacity under extreme stress; liquidation mechanisms need rate limits and circuit breakers; exchanges must reserve redundant capacity for traffic ten times normal levels. Yet the October 2025 event proved that, at the institutional level, this lesson remains unheeded. When thousands of accounts face liquidation simultaneously, when tens of billions in positions are unwound within an hour, when order books go blank because all bids are exhausted and overloaded systems cannot accept new orders—the infrastructure fails as completely as the oracles do. Technical solutions exist, but are often not implemented because they reduce efficiency and increase costs (impacting profits) during normal operations.

Core Warnings

If you cannot identify the source of returns, then you are not earning returns—you are paying for someone else’s gains. This principle is not complicated. Yet billions continue to flow into “black box” strategies because people prefer comforting lies over uncomfortable truths. The next Stream Finance may already be operating today.

Stablecoins are not stable.

Decentralized finance is often neither fully decentralized nor secure.

Unexplained yields are not profit—they are asset transfers with a countdown timer.

These are not opinions, but empirically verified, well-documented facts repeatedly proven at enormous cost. The only question is: will we finally act on these known lessons, or would we rather pay another $20 billion tuition to relearn them? History seems to favor the latter.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News