Is Bitcoin divorcing "cryptocurrency"?

TechFlow Selected TechFlow Selected

Is Bitcoin divorcing "cryptocurrency"?

Money can be anything we agree it is, but suddenly, it isn't anymore.

By Thejaswini M A

Translated by Block unicorn

You should know I often talk about this—the philosophical underpinnings, its history, and the complex agreements humans have made to assign value to a piece of paper or numbers on a screen. And every time we dive deep, we end up with the same frustrating conclusion: its definition keeps shifting beneath our feet.

For most of human history, people used all sorts of things as money: salt, shells, livestock, precious metals, and pieces of paper promising something. What makes something "money," versus just a "valuable item," has never had a clear answer. We usually recognize it when we see it—unless we don't.

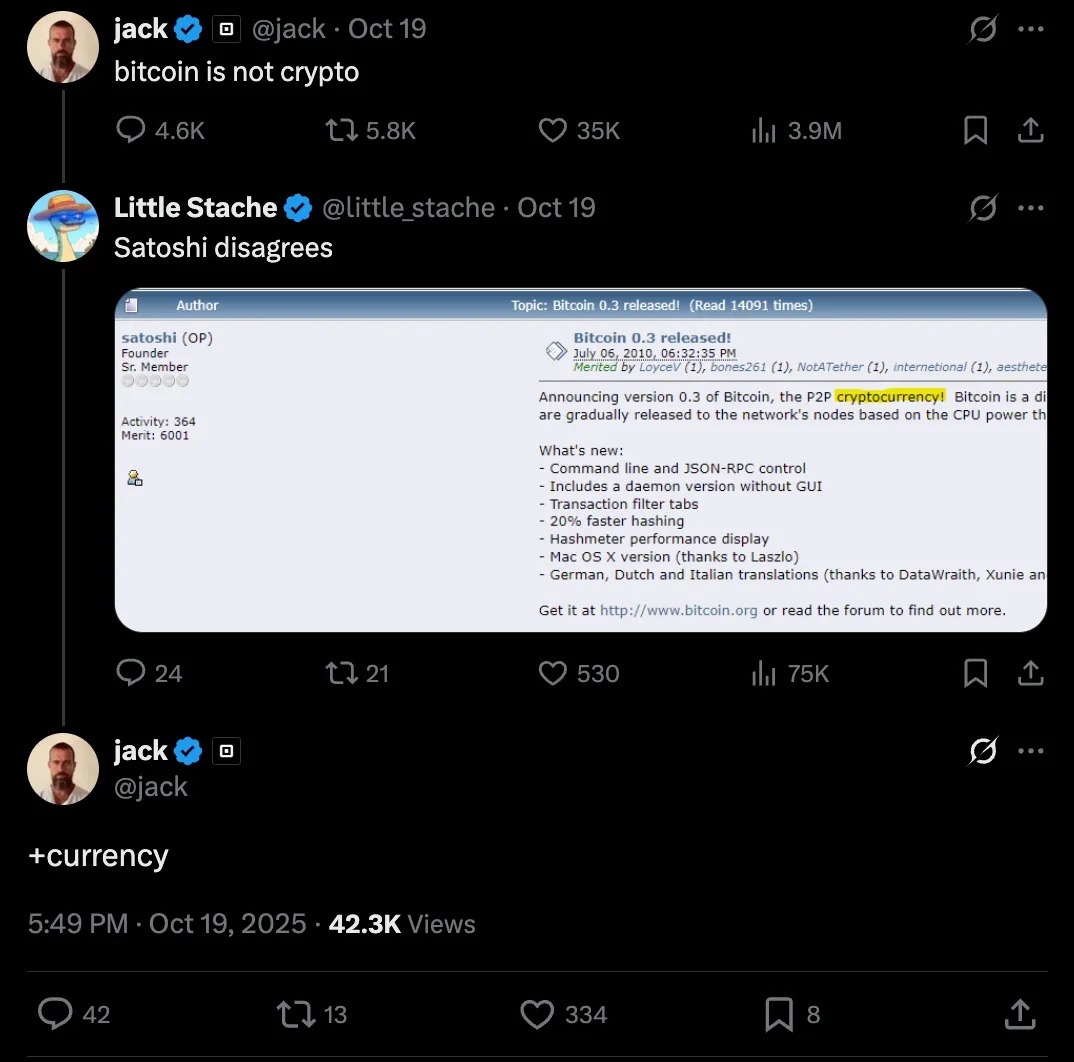

When Jack Dorsey tweets that "Bitcoin is not crypto," it touches a raw nerve in an old debate. Because if Bitcoin isn’t crypto, then what is it? And if crypto isn’t Bitcoin, what is it? More importantly: why does it matter?

The simplest explanation is tribalism. Hardliners draw lines, factions form. This tedious argument repels normal people because everyone involved seems slightly unhinged.

But I think something else is happening—something more significant than tribal warfare. I believe the market is slowly and painfully realizing that Bitcoin and crypto were never the same thing, even though they’ve coexisted in the same space for fifteen years. And the process of separating them isn’t a breakup—it’s specialization.

This distinction matters because specialization isn’t about conflict; it’s about function. The heart and lungs don’t compete—they serve different purposes. If you tried to make the heart also handle respiration, you wouldn’t get a more efficient organism—you’d get a corpse.

The divergence between Bitcoin and crypto isn’t driven by hostility, but by fundamentally different design goals. One aims to be money; the other tries to be everything else. And their success lies precisely in no longer trying to be each other.

It sounds like a war. But wars are fought to win—this is merely about differentiation.

Dorsey's tweet was just the spark

Why am I revisiting this topic?

Look, when Jack Dorsey tweets "Bitcoin is not crypto," you have to pause and ask: what’s really going on here? He’s the co-founder of Twitter and Square (now Block), and his advocacy for Bitcoin borders on fanaticism—he once called the Bitcoin whitepaper “poetry.” He’s a true Bitcoin maximalist: he believes Bitcoin is the only meaningful digital asset, and everything else is noise at best, fraud at worst.

So when Dorsey says this, it feels momentous—like an announcement of separation. Maximalists cheer. Crypto developers scoff. Everyone picks a side.

Meanwhile, the Czech Republic just added Bitcoin to its national balance sheet. Not enough to shift the landscape. But this follows closely after the U.S. established a strategic Bitcoin reserve in March, prompting 45 states to introduce their own reserve bills—with Arizona, New Hampshire, and Texas already passing theirs. Luxembourg’s sovereign wealth fund has fully shifted into Bitcoin investments.

They surveyed the entire digital asset universe—and chose one thing. Why?

For years, Bitcoin and "crypto" have been lumped together. Journalists write about the "crypto market," covering everything from Bitcoin to Dogecoin to whatever token launched this morning. Regulators speak of "digital assets" and group them all under one umbrella. Asset managers allocate "crypto assets" in portfolios. Insiders track "Bitcoin dominance"—measuring Bitcoin’s share of total crypto market cap—as if all cryptos are competing for the same slice of pie.

But this framework is starting to crack—not due to ideology or tribalism, but because of how institutions actually treat these assets, how markets price them, and how people use them.

When Fidelity publishes research on Bitcoin, it doesn’t call it a "crypto asset"—it calls it a "monetary asset." BlackRock describes it as "digital gold" and a "non-sovereign store of value." This isn’t just marketing spin; it’s a fundamental categorization that separates Bitcoin from everything else. They’re not comparing Bitcoin to Ethereum like Coke vs. Pepsi—they’re treating Bitcoin as its own asset class.

And this happened well before Dorsey ever tweeted. Hardcore Bitcoin holders mentally separated Bitcoin from crypto years ago. They just didn’t issue a press release about it.

What Bitcoin wants

Bitcoin is designed around a few very clear priorities: security, predictability, decentralization, and monetary credibility. These traits make it hard to change. Bitcoin’s development culture is notoriously conservative—any upgrade takes years of discussion. The system is built to resist modification.

You could call that a bug. Many do. They point out that Bitcoin’s ten-minute block time is laughably slow compared to newer blockchains. They note that Bitcoin can’t run smart contracts, dApps, or the advanced programmable features that Ethereum supports. These criticisms are all valid.

But viewed differently: Bitcoin isn’t trying to do everything. It’s focused on doing one thing extremely well—being a credible, predictable, censorship-resistant money.

Predictability is especially crucial. Bitcoin’s supply cap of 21 million is hardcoded. Changing it would require massive coordination and likely a hard fork. For many, that 21 million cap *is* Bitcoin—it’s what distinguishes it from fiat and other cryptos. So it stays unchanged—unchanged for 16 years now. The same monetary policy, repeated cycle after cycle, with no surprises.

Now look at almost every other cryptocurrency. Ethereum has undergone massive changes. It moved from Proof-of-Work (PoW) to Proof-of-Stake (PoS). It plans to make ETH deflationary via ERC-1559. These are interesting technical decisions—but they run counter to predictability. Every change reminds us that the rules could change again.

Sure, I’ll tell you these changes improve the system. But you might ask: better for what? If you’re building a neutral, long-term store of value, changing the rules isn’t an advantage—it’s a liability. But if you’re building an application platform for developers that needs rapid iteration, then changing rules is great. You should keep changing, shipping fast, experimenting boldly.

The point is: different goals.

What crypto wants

The broader crypto ecosystem—everything beyond Bitcoin—looks less like a monetary system and more like a tech sector. It values speed, programmability, and innovation. New Layer 2 scaling solutions emerge every few months. There’s DeFi—lending protocols, derivatives, liquidity mining. Decentralized physical infrastructure. Games. NFTs. And whatever comes next.

The pace is frantic, cycles are short, ambitions are vast.

Crypto operates much like Silicon Valley. Venture capital floods in. Founders raise funds, launch products, pivot when stuck, relaunch. Some succeed wildly—most fail. There are hype cycles and crashes, new narratives every quarter. After DeFi summer came NFT mania, followed by the Layer 2 boom, and now whatever is unfolding today.

A monetary system doesn’t work like this. You don’t want the money supply fluctuating with market trends. You don’t want foundation members voting on whether to change issuance schedules. You don’t want your unit of account constantly iterating.

So crypto and Bitcoin play different roles. Crypto aims to become a technology industry; Bitcoin aims to become money. These aren’t competing visions—they’re different functions within the same economic system.

Why this looks like a breakup

From the outside, this split appears deeply adversarial. Bitcoin maximalists dismiss other cryptos as scams or distractions. They’ll tell you every non-Bitcoin crypto is either a security, a clunky centralized database, or a solution to a problem that doesn’t exist. Meanwhile, crypto developers see Bitcoin as rigid and outdated. They highlight Bitcoin’s limited functionality and accuse maximalists of being stuck in 2009.

The markets treat them differently too. Bitcoin has its own cycles, trajectory, and institutional buyers. When MicroStrategy (sorry, "Strategy") spends billions buying Bitcoin, they don’t casually diversify into some Ethereum. When El Salvador adopted Bitcoin as legal tender, they didn’t include the top ten cryptos by market cap.

Regulators are increasingly distinguishing these tokens. Bitcoin is typically treated as a commodity. Most other tokens sit in a gray zone—whether they’re securities depends on how they were issued and who controls them. This leads to different regulatory frameworks, compliance requirements, and risk profiles.

So yes, it looks like a breakup. Different treatment, different communities, different use cases.

But what if this separation isn’t hostile? What if they’re just doing different things?

Asymmetric dependence

Crypto needs Bitcoin far more than Bitcoin needs crypto.

Bitcoin lends legitimacy to the entire field. It’s the entry point for institutional investors, the reference asset for new users, and the benchmark against which all digital assets are measured. When people talk about "blockchain technology," they mean the kind pioneered by Bitcoin. Regulators start with Bitcoin when crafting digital asset policies, then examine differences in other assets.

Bitcoin also sets the liquidity cycle. Bull markets usually begin with Bitcoin. Capital flows into Bitcoin first, then spills into riskier crypto assets. This pattern has repeated across multiple cycles. Without Bitcoin’s liquidity and market awareness, the structural fragility of the broader crypto market would be far more apparent.

Bitcoin acts as crypto’s reserve asset. Even as ecosystems diverge, Bitcoin remains dominant for large-scale settlement, long-term storage, and cross-border value transfer. It’s the closest thing we have to digital gold.

The reverse isn’t true. Bitcoin doesn’t need innovations from the crypto world. It doesn’t need smart contracts, DeFi, NFTs, or anything else. Bitcoin can sit quietly, slowly processing transactions, maintaining its monetary policy, staying exactly what it is. That’s the point.

This creates an interesting dynamic. Crypto orbits around Bitcoin. Bitcoin is the sun. The planets can spin wildly, experiment, collide—but the center of gravity remains fixed.

The real problems

If Bitcoin wants to be money, it faces a problem: people simply won’t spend it.

Every Bitcoin holder knows the story of Laszlo’s pizza. It rewires your brain. It makes you afraid to spend Bitcoin—what if it goes up? What if your pizza becomes the next billion-dollar transaction?

This isn’t just an early adopter quirk—it’s basic human nature. When you hold an appreciating asset, you hoard it. You spend the worst-performing assets first and save the best. This is Gresham’s Law: bad money drives out good. If some of your money might double next year and some definitely won’t, you’ll spend the one that won’t appreciate and save the one that might.

So Bitcoin is too successful as a store of value—and thus fails as a medium of exchange. People see it as digital gold because it behaves like gold: scarce, valuable, and absolutely not something you’d use to buy coffee.

Then there’s the unit of account problem. Money should fulfill three functions: store of value, medium of exchange, and unit of account. Bitcoin does well on store of value, poorly on medium of exchange, and worst on unit of account. And the real issue lies in the unit of account.

Nobody prices things in Bitcoin. Salaries are paid in dollars, euros, or rupees. Rent is paid in fiat. Corporate accounting is done in fiat. Even tickets to Bitcoin conferences are usually priced in dollars. You might pay in Bitcoin, but the price is set in fiat first and converted.

Why? Because Bitcoin is too volatile to price directly in. You can’t walk into a café and see a sign saying “Coffee: 0.0001 BTC,” because tomorrow it might be 0.00008 BTC or 0.00015 BTC depending on overnight moves. A currency not used for pricing goods can’t function as a medium of exchange. It becomes an asset—an unnecessary middleman you convert into real money before buying things.

Even when merchants “accept Bitcoin,” the reality tells a different story: Bitcoin is instantly converted into fiat at the time of transaction. The merchant receives dollars or euros—not Bitcoin. So you’re using Bitcoin as an inefficient intermediary—converting your appreciating asset into money you could’ve used directly.

In certain edge cases, this logic holds. If you’re in Turkey, Venezuela, or Argentina, where local inflation outpaces Bitcoin’s volatility, Bitcoin may indeed be the more stable option. But that doesn’t mean Bitcoin is good money—it means fiat is terrible money in those places.

This is why Jack Dorsey’s Cash App announced this week it would support stablecoins—on Solana, not Bitcoin. To Bitcoin maximalists, it’s like a vegan opening a steakhouse. But if you understand the actual purpose of each thing, it makes perfect sense.

Stablecoins are the money people actually spend. Pegged to the dollar, they carry no spending risk. No one worries their USDC will 10x next year, so they can spend it freely. Stablecoins are boring, reliable, and genuinely useful for moving money.

Bitcoin is what people use to store value. It’s scarce, hard to inflate, and independent of any government. But you wouldn’t use your 401(k) to buy coffee—and you probably shouldn’t use your Bitcoin either.

The layered model

Perhaps the digital asset economy isn’t fracturing—but organizing itself into distinct layers, each serving its own purpose:

Layer 1: Bitcoin – The Monetary Base Layer

A non-sovereign store of value, with predictable issuance and global neutrality. It grows slowly and steadily, designed to last decades. Institutions see it as digital gold. People hoard it. That’s normal. That’s what it’s for.

Layer 2: Stablecoins – The Medium of Exchange Layer

Digital versions of fiat money—what people actually use. Fast, cheap, but boring. They don’t appreciate, so you don’t feel guilty spending them. They live on various blockchains—including Bitcoin’s Lightning Network, Ethereum, Solana, Tron—whichever works best for the use case.

Layer 3: Crypto Networks – The Application Layer

Platforms enabling financial markets, decentralized apps, tokenized assets, and whatever comes next. This is where innovation happens. This is the tech industry. It’s fast-moving, venture-backed, sometimes absurd, occasionally brilliant.

This mirrors how traditional economies work. Gold stores value, fiat serves as exchange medium, and financial markets and tech companies build applications on top. No one expects gold to also be a payment rail and smart contract platform. Different things serve different functions.

These aren’t competing investment vehicles.

Bitcoin isn’t breaking up with crypto—it’s embracing its role. Crypto is doing the same. And stablecoins fill the gap neither can address.

Not a breakup—specialization.

And this specialization is the foundation of the future architecture of digital money—Bitcoin providing the base for a complex, diverse, rapidly evolving ecosystem.

The question was never which will win: Bitcoin or crypto. The real question is how they coexist in a system where each plays to its strengths and complements the other.

This structure is already forming. The "breakup narrative" completely misses it.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News