Bitcoin leads the downturn as $100,000 level proves difficult to hold, risk-off storm intensifies across the board

TechFlow Selected TechFlow Selected

Bitcoin leads the downturn as $100,000 level proves difficult to hold, risk-off storm intensifies across the board

Risk turmoil sweeps global assets, U.S. stocks plunge in tandem.

Author: ChandlerZ, Foresight News

As expectations for a Fed rate cut rapidly cool amid uncertainty over economic data releases, global risk assets are facing a new wave of sell-offs. U.S. tech stocks and the cryptocurrency market have declined simultaneously, with the Nasdaq index plunging over 2% in a single day. Starting from the early hours of November 13, Bitcoin fell from around $102,000 to a low of $98,000. ETH dropped from $3,400 to $3,150 before rebounding to hover around $3,250. SOL fell to $141. Affected by the broader market downturn, altcoins also experienced widespread declines.

According to SoSoValue data, the PayFi sector dropped 3.74% over 24 hours, but Telcoin (TEL) continued to rise, gaining another 13.09%; the CeFi sector fell 3.75%, with Binance Coin (BNB) down 3.58%; the Layer1 sector dropped 4.22%, with Solana (SOL) falling 5.76%; the Layer2 sector declined 4.37%, though Starknet (STRK) rose counter-trend by 8.08%; the DeFi sector fell 4.47%, with Jupiter (JUP) down 8.27%; the Meme sector dropped 4.70%, although Mog Coin (MOG) surged intraday by 6.16%.

Data from Coinglass shows that total liquidations across the entire crypto market reached $755 million in the past 24 hours, including $601 million in long positions and $154 million in short positions. Among them, Bitcoin liquidations amounted to $273 million, while Ethereum liquidations reached $229 million. According to Alternative.me, the Fear & Greed Index for cryptocurrencies today rose to 16 (yesterday's index was 15, indicating "extreme fear"), showing the market remains in an "extreme fear" state.

Fed Officials Turn Hawkish En Masse

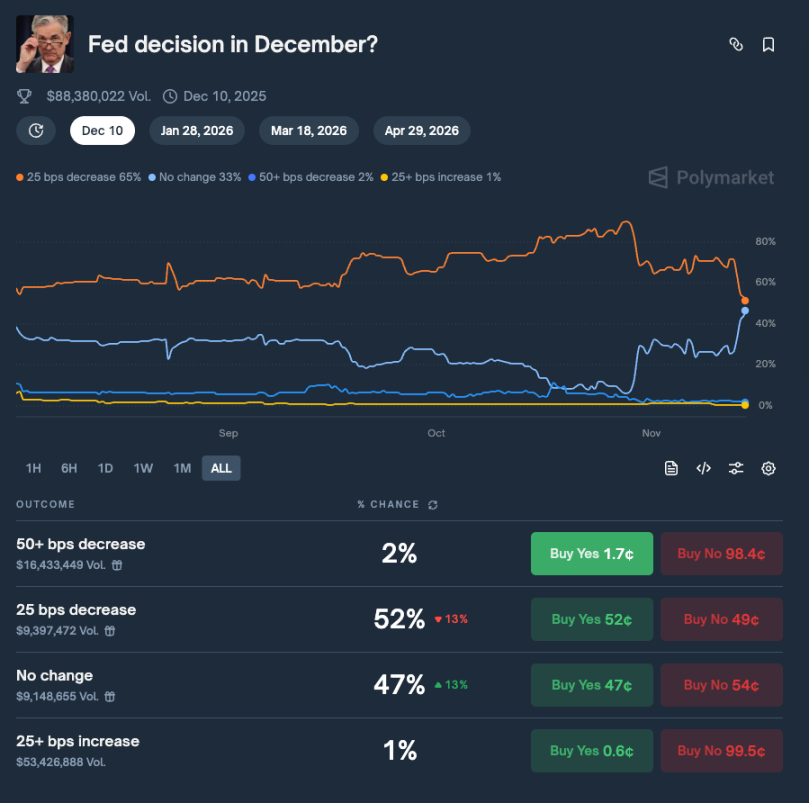

Federal Reserve officials have collectively adopted a hawkish tone, with the core driver of market volatility stemming from a reassessment of interest rate trajectories. Over the past week, multiple Fed officials have made cautious remarks, rapidly cooling market expectations for a December rate cut. Data from Polymarket shows that the probability of a 25-basis-point rate cut by the Fed in December is now at 52%, while the probability of "no change" has risen to 47%. The trading volume on this prediction market has exceeded $88 million.

Interest rate futures and related indicators have revised downward the likelihood of rate cuts, which had previously been well above 50%. This shift directly raises the risk-free rate and compresses valuation premiums for high-risk assets, triggering synchronized selling pressure on yield-sensitive assets. Tech-heavy indices such as the Nasdaq saw sharp declines on the same trading day, leading to reduced risk appetite and increased pressure across risk assets, including cryptocurrencies.

For the crypto market, macro signals merely act as the spark. Since last year, institutional allocations, inflows into spot ETFs, and corporate-level crypto asset investments provided price support during the first half of the year. However, when the rate window closes and sentiment turns defensive, these external pillars tend to exit faster than retail liquidity.

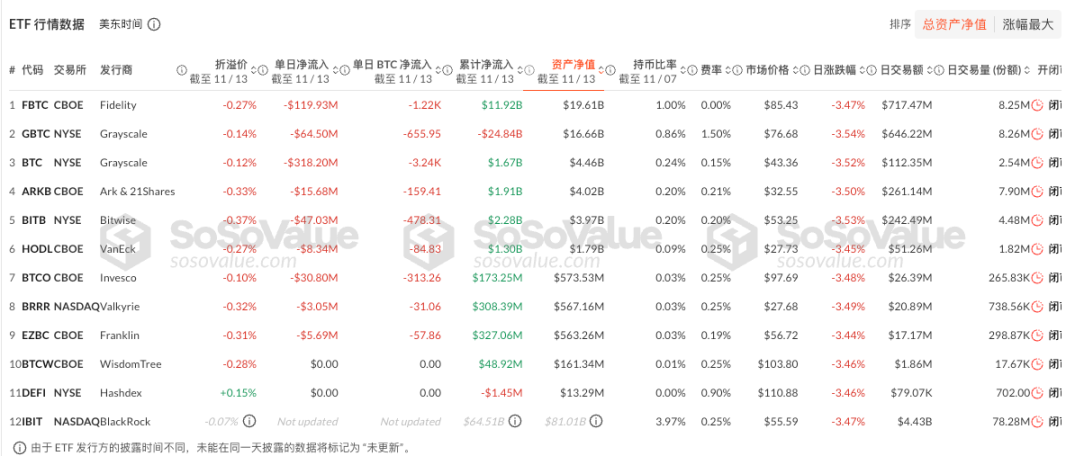

As of November 13, according to SoSoValue data, total net outflows from Bitcoin spot ETFs reached $613 million. The largest single-day net outflow was recorded by Fidelity’s FBTC ETF, which saw $119.9 million in outflows. FBTC’s historical cumulative net inflow currently stands at $11.92 billion.

With weak macro market sentiment, what lies ahead for crypto assets? Analytical firms and industry figures have shared their views.

McKenna: Prices may face downward pressure in the near term

McKenna, partner at Arete Capital, said assuming prices remain below the 50-day moving average, the price has broken above the previous range high of $108,400. Key support levels are now PoC at $96,200, annual opening price and mid-range at $93,300, and worst-case lows between $91,000 and $86,000. In the event of a brief panic-driven plunge, prices could correct by approximately 26%, while filling the lower zone would result in a traditional correction of about 31%. While the final bottom cannot be determined, these support levels represent key buying opportunities for BTC. He expects BTC will not reach a new all-time high this year, but believes BTC will trade above $150,000 in the second half of 2026 and surpass $200,000 by the end of President Trump’s term. Institutional adoption of BTC will not stop, BTC ETFs will continue accumulating, and new capital inflows will arrive in 2026.

Wintermute: BTC trading bias more bearish than stock indices, upside narrative premium gone

Wintermute’s latest report notes that Bitcoin still has a high correlation of 0.8 with the Nasdaq index, but its trading behavior is more bearish compared to equity indices, reacting more strongly to negative sentiment than positive. On days when equities fall, BTC typically drops more than the index; on rising equity days, BTC gains less. This pattern last appeared during the 2022 bear market. Wintermute identifies two main factors behind this phenomenon:

For most of 2025, capital that traditionally flows into the crypto space—including new token launches, infrastructure upgrades, and retail participation—has shifted toward the stock market. Large-cap tech companies have become the focal point for both institutional and retail investors seeking high beta/high growth exposure. While Bitcoin remains correlated during shifts in global risk sentiment, it fails to benefit proportionally when optimism returns. It now behaves more like a "high-beta tail" of macro risk rather than an independent narrative, retaining downside beta but having lost its upside narrative premium.

Liquidity conditions in crypto today differ from previous risk cycles. Stablecoin issuance has plateaued, ETF inflows have slowed, and exchange market depth has yet to recover to early 2024 levels. This fragility amplifies negative reactions during equity pullbacks. As a result, Bitcoin’s downside participation remains higher than its upside participation, exacerbating this performance divergence.

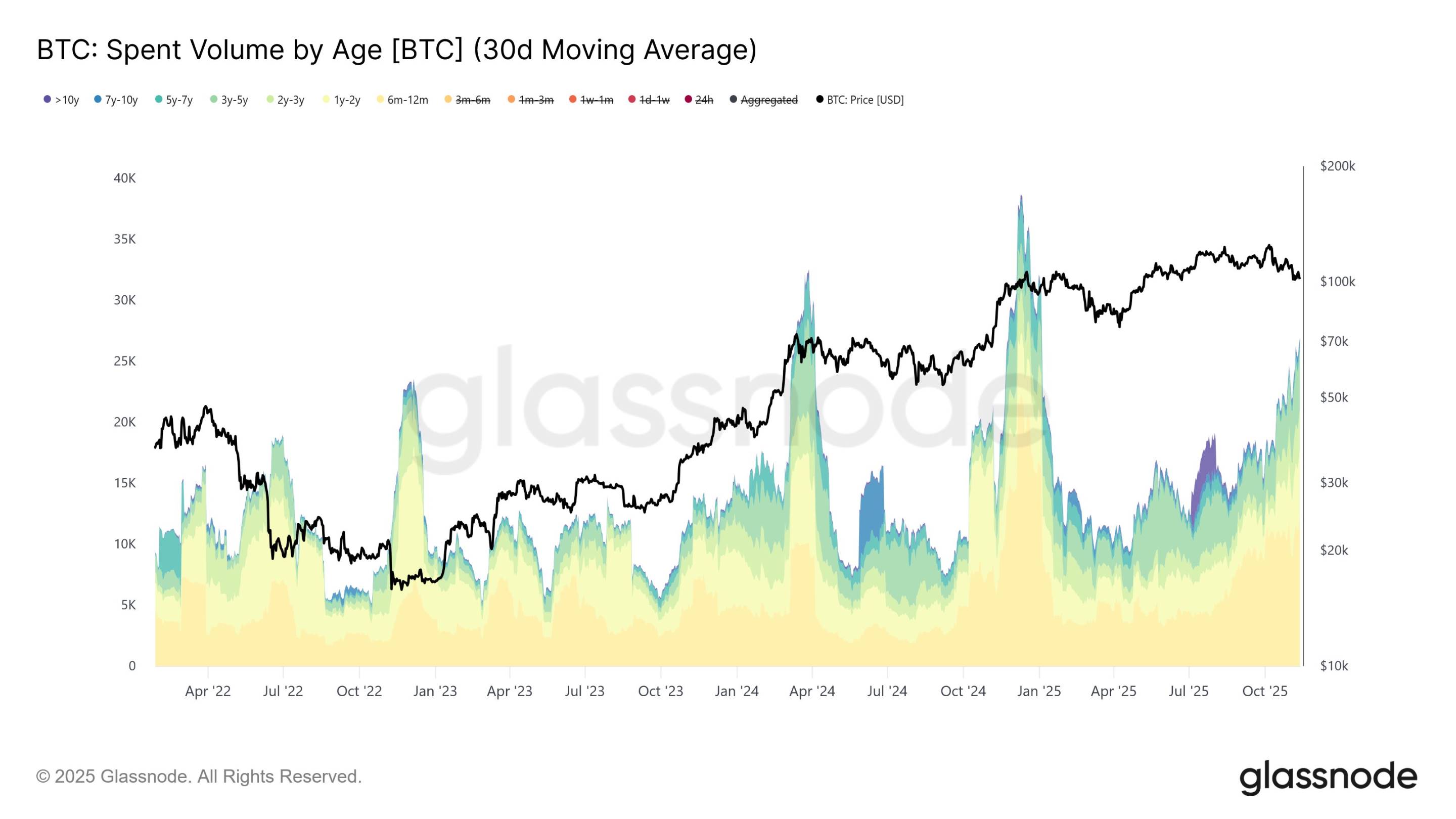

Glassnode: Long-term holders accelerate distribution, supply rapidly declining

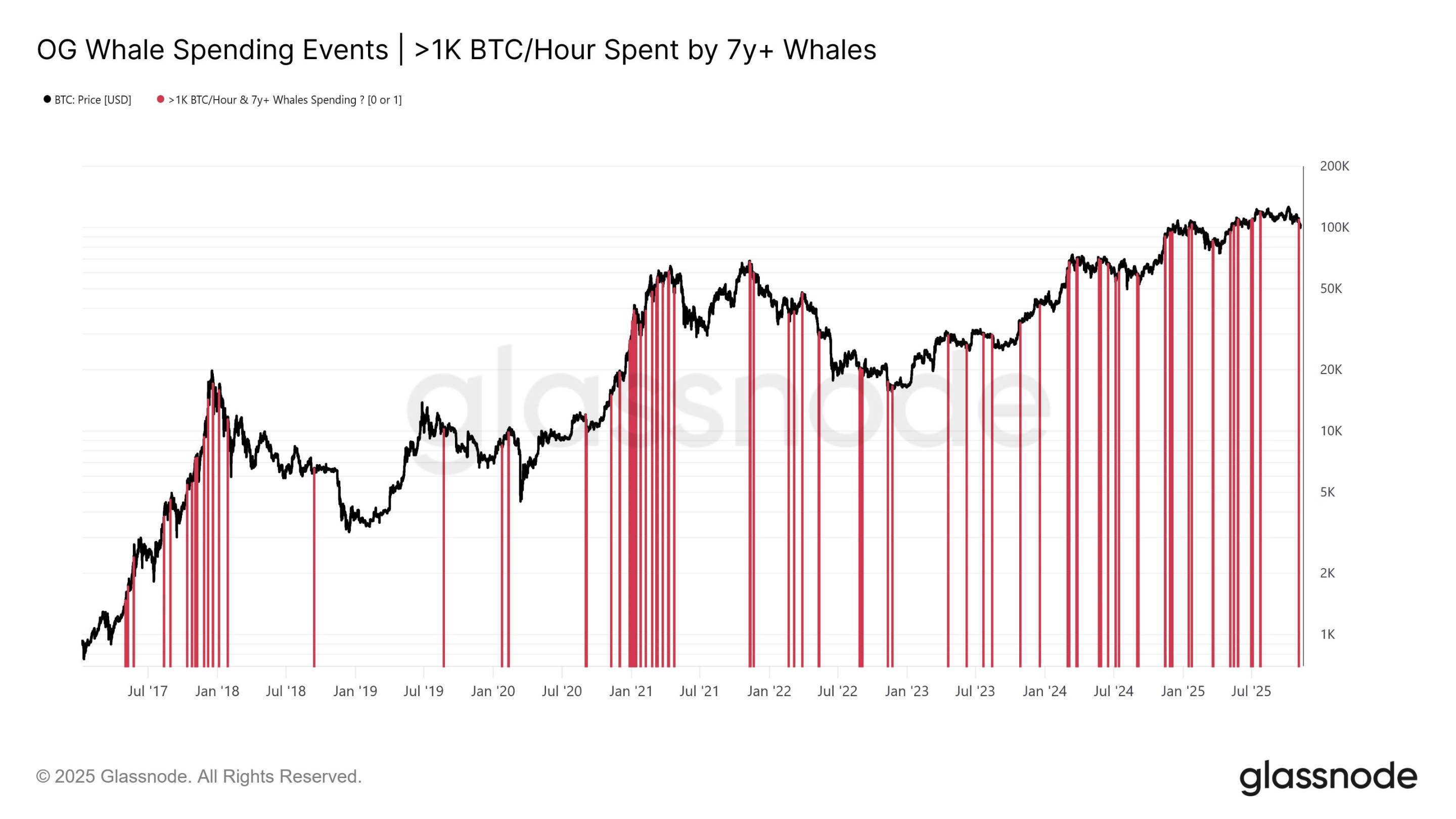

Foresight News – According to Glassnode monitoring, the monthly average spending by long-term Bitcoin holders has significantly increased, rising from a daily average of 12,500 BTC in early July to 26,500 BTC today (30-day moving average). This sustained upward trend reflects growing profit-taking pressure among veteran investors—a typical late-cycle behavior rather than sudden whale exits. Even among whale wallets inactive for over seven years, hourly spending exceeding 1,000 BTC shows a similar trend. Such high-intensity spending events have occurred in every major bull cycle, but the current distinguishing feature is their frequency: transactions exceeding 1,000 BTC are occurring more frequently and evenly spaced, indicating ongoing, distributed distribution rather than sudden "OG dumping." Meanwhile, accelerating distribution by long-term holders is causing supply to decline rapidly, with net position changes turning sharply negative—long-term holders are already taking profits even as they defend the $100,000 level during the bull market.

Yi Lihua: Continue to believe 3,000–3,300 is the best buying opportunity

Yi Lihua, founder of Liquid Capital (formerly LD Capital), said: “Due to declining expectations for a December rate cut, both U.S. stocks and crypto have fallen sharply. But we continue to believe that 3,000 to 3,300 is the best buying opportunity, and our actions align with our words. I remember during the black swan pullback to 2,700, we held on using leveraged borrowing, but the psychological pressure was immense, causing us to deleverage early above 3,000 just for better sleep. This time, we’re buying spot without leverage, adding positions gradually on dips, and now it’s just a matter of patience.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News