Detached, vulnerabilities, regulation, volatility— are stablecoins really "stable"?

TechFlow Selected TechFlow Selected

Detached, vulnerabilities, regulation, volatility— are stablecoins really "stable"?

It is important to pay attention to the correlation between returns and collateral, as this is often the root of problems.

Author: ✧Panterafi

Translation: TechFlow

There has been extensive discussion about stablecoins, but comparatively little exploration of their risks—an issue I believe deserves deeper attention. This is the result of months of reflection, finally organized and ready to share.

Summary

-

Past and future discussions on stablecoins

-

Main categories of stablecoins

-

Comparative analysis of risk indicators

-

Development status of the Solana ecosystem

Past and Future Discussions on Stablecoins

Here, I revisit key industry discussions and perspectives on stablecoin development—most of which revolve around various paths for decentralized finance (DeFi) to achieve global adoption through stablecoins.

"On-chain FX is key to mass adoption" —— @haonan

On-chain foreign exchange (FX) can enhance the efficiency of global trade settlements. It enables cross-border payments, remittances, and conversions into local stablecoins or fiat currencies without being hindered by regulatory barriers. On-chain FX has the potential to replace today’s slow systems with instant, low-cost currency conversion.

To achieve widespread adoption, on-chain FX requires deep automated market maker (AMM) pools capable of handling volumes such as $11 billion over 30 days. Managing slippage becomes a challenge, and scalable infrastructure and payment systems must be developed. The stablecoin ecosystem must also prioritize strong security in foreign exchange swaps.

"Agent-based payments improve user experience for microtransactions online" —— @hazeflow_xyz

x402 is an open-source internet-native payment protocol developed by Coinbase. It leverages HTTP 402 status code ("Payment Required") to enable instant micropayments using stablecoins like USDC, significantly improving the user experience for small online transactions.

Multiple Advantages of x402

-

Autonomous Operation: AI agents can independently pay for services, data, computing, or tools in real time without human intervention, enabling machine-to-machine economic activity.

-

Instant Settlement: Transactions are confirmed and completed within seconds, with no concerns about refunds or processing fees—ideal for high-frequency micropayment scenarios.

-

Seamless Integration: Agents can attach stablecoin payments to any web request with minimal setup, eliminating traditional payment obstacles such as API keys or intermediaries.

-

Compliance and Security: Built-in verification and settlement features ensure regulatory compliance while leveraging stablecoins to maintain price stability amid volatile crypto markets.

-

Scalability of AI Ecosystems: Supports agent marketplaces where agents autonomously trade resources, fostering growth in stablecoin infrastructure—backed by players like Coinbase or PayAI.

Traditional financial institutions like Deutsche Bank, and auditing firms such as Deloitte and EY, have faced serious allegations due to improper audits or money laundering. Additionally, many politicians have been convicted of embezzlement.

Blockchain-based stablecoin systems offer significant advantages in reducing corruption, illegal transactions, and money laundering. Blockchain enables financial regulators to trace fund flows, and auditors gain clearer visibility into corporate operations. This transparency could even give rise to new job roles such as wallet trackers or data analysts (e.g., platforms like DUNE). Through more precise transaction flow analysis and data insights, new economic models and concepts may emerge.

To me, blockchain is not merely a practical revolution from a business perspective—it is a social transformation that restores trust by empowering the public to monitor governments and elites. The transparency and controllability of blockchain will provide greater visibility to the public, promoting fairness and the restoration of trust.

"Stablecoin infrastructure will become invisible" —— @SuhailKakar

SuhailKakar emphasizes that blockchain stablecoins will gradually fade from public view. For average consumers, as long as the payment system works well, they don't care about the underlying technology. He illustrates this with Telegram, originally a messaging app that later integrated the TON network, giving users wallets and payment capabilities without them realizing it involved cryptocurrency or blockchain.

This is exactly what companies like Circle, Tether, Coinbase, and Stripe are striving to achieve: building a payment infrastructure so seamless that merchants can accept crypto payments without knowing anything about crypto. Merchants simply receive USD, while the infrastructure handles all blockchain-related operations, and customers enjoy frictionless checkout experiences.

SuhailKakar believes crypto's greatest success will come the day people stop talking about crypto. When it becomes the "invisible infrastructure" supporting the experiences users truly value, it will have fulfilled its purpose.

"Explosive Growth of Yield-Bearing Stablecoin Protocols" —— @Jacek_Czarnecki

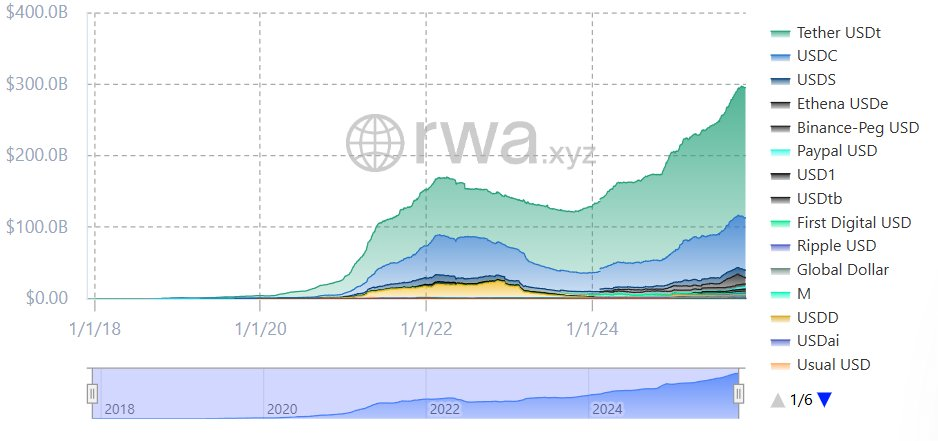

The total market capitalization of yield-bearing stablecoin protocols surged 13-fold in just two years—from $666 million in August 2023 to $8.98 billion in May 2025, peaking at $10.8 billion in February 2025.

Currently, yield-bearing stablecoins account for 3.7% of the overall stablecoin market (valued at $300 billion). Over 100 such stablecoins exist, led by Ethena’s sUSDe and Sky’s sUSDS/sDAI, which together hold 57% of the market share (approximately $5.13 billion). Since mid-2023, these protocols have collectively distributed nearly $600 million in yields.

The rapid growth of yield-bearing stablecoins shows they are not just payment tools, but also emerging as a new option for users seeking stable returns.

Drivers Behind New Stablecoin Inflows: Two Key Factors

-

Innovation in Core Mechanisms: Recent growth in stablecoins is largely driven by breakthroughs in core concepts. For example, Ethena’s USDe uses a delta-neutral hedging mechanism, while Curve’s crvUSD introduces soft liquidation mechanisms. These technological innovations helped the market recover from the Luna collapse and contributed to the stablecoin market reaching a $300 billion valuation.

-

Government Regulation as Catalyst: Recognition by governments of certain crypto assets as financial instruments has opened doors for innovation. Examples include the U.S. GENIUS Act passed in July 2025 (requiring 1:1 reserves, AML/KYC compliance, and banning uncollateralized algorithmic stablecoins), Europe’s MiCA regulations, and frameworks in the UK and Asia. These regulatory advances have boosted institutional adoption and market confidence, laying the foundation for further stablecoin development.

"New Yield Models and White-Label Distribution"——@hazeflow

In low-interest-rate environments, new reward models can be introduced, possibly involving government incentives to encourage stablecoin usage. In high-interest environments, decentralized stablecoins gain an advantage by offering yield or incentives via reserve assets. Simply holding a stablecoin can generate annual returns sufficient to offset inflation. These yields can be transformed into cashback or other utility benefits through partnerships with enterprises.

Stable infrastructure providers and corporations (like Apple or Microsoft) can achieve mutual benefit. Enterprises can unlock new revenue streams, while stablecoins can leverage massive user bases to drive global expansion.

The U.S. is fertile ground for stablecoin development, with evolving regulatory frameworks and a sizable market. However, economically weaker countries, whose local currencies are less stable, are more inclined to adopt stablecoins as alternatives.

Next, let’s dive into the specific characteristics of different stablecoin types to better understand their risk profiles and yield mechanisms. I’ve created visualizations to help you fully grasp which mechanisms are more robust and how they differ in generating returns.

Stablecoins are a cornerstone of DeFi, but concentrating all idle funds into a single protocol is not optimal. While diversification is important, the range for sustainable yield generation is limited, so careful selection of suitable stablecoin types is essential.

Stablecoin Categories

Collateralized stablecoins (over-collateralized with cryptocurrencies or real-world assets)

Yield Mechanism

Users borrow stablecoins by over-collateralizing assets (e.g., ETH, BTC), where the collateral value exceeds the issued stablecoin, generating yield. Sources include:

-

Borrowing fees

-

Interest from real-world assets (RWA), such as U.S. Treasuries

-

Protocol profits: The over-collateralization acts as a buffer, enhancing system stability.

Examples

-

USDS (issued by Sky): Yield comes from real-world assets and lending.

-

GHO (issued by Aave): Yield derived from borrowing fees.

-

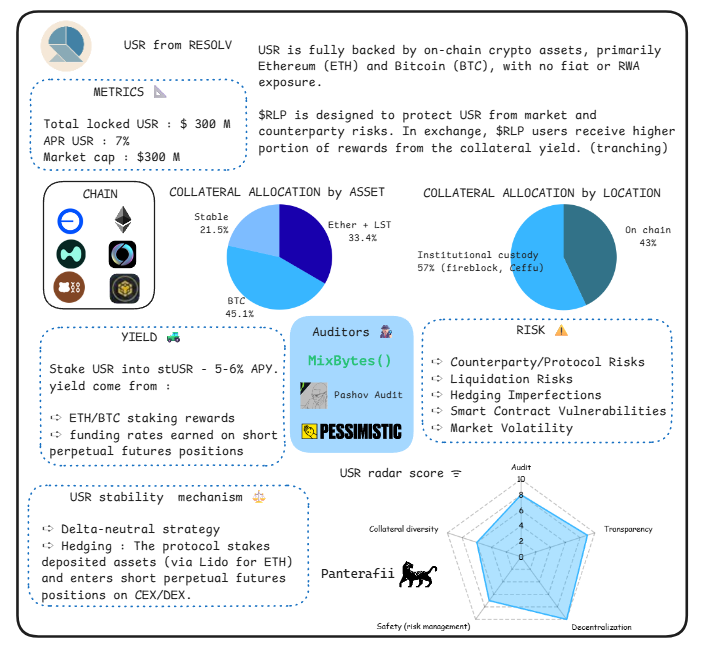

USR (issued by Resolv): Yield from asset tokenization.

-

USDe (issued by Ethena): Yield from staked ETH and futures trading.

-

USD0 (issued by Avalon): Yield from interest on real-world assets.

-

cUSD (issued by Celo): Yield supported by natural resources.

How Yield Is Generated

Interest generated from collateral (such as staking rewards or RWA returns) is typically distributed to holders or stakers via modules (e.g., savings rate modules). This mechanism enhances both user returns and the attractiveness and utility of the stablecoin.

Yield Mechanism

Algorithmically adjusts supply (minting/burning) to maintain stability. Yield sources include:

-

Seigniorage: Fees collected during minting.

-

Incentives: Such as governance token rewards.

Examples

-

USDF (issued by Falcon): Hybrid model providing yield via perpetual futures.

-

USDO (issued by Avalon): Combines algorithmic mechanisms with real-world assets (RWA).

How Yield Is Generated

Dynamic adjustment mechanisms create arbitrage or incentive opportunities, with yields often amplified through DeFi integrations (e.g., staking or liquidity provision), offering user incentives.

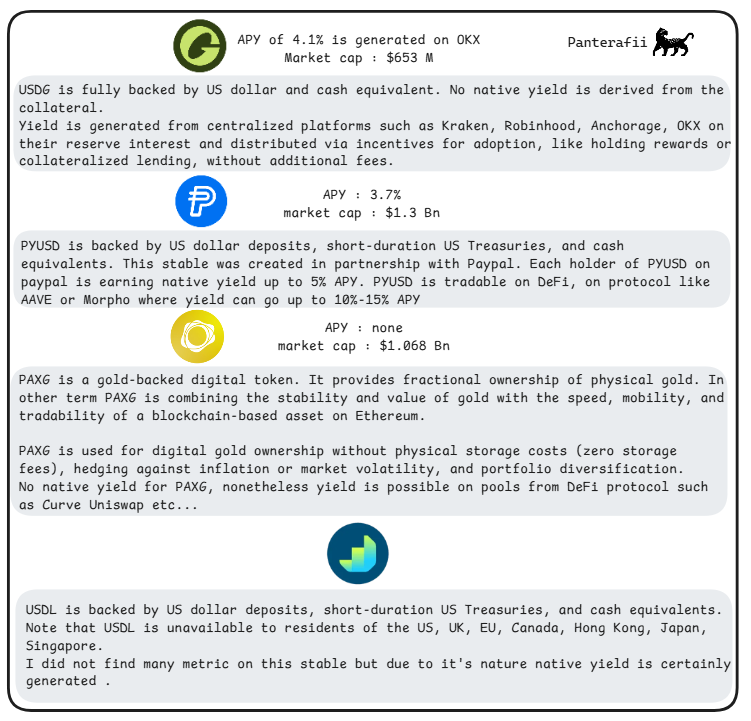

Fiat-backed or centralized stablecoins (for comparison)

Yield Mechanism

Backed 1:1 by fiat or equivalent assets; yield primarily comes from reserve holdings (e.g., Treasuries). Base yield is usually retained for operational purposes rather than distributed to users.

Examples

-

USDC (issued by Circle)

-

USDT (issued by Tether)

How Yield Is Generated

Low-risk interest from reserves is the primary source, but with lower decentralization—more yield is retained for enterprise use rather than directly distributed to users.

Risk Indicators

Depeg Risk

Occurs when a stablecoin fails to maintain its intended $1 peg, typically triggered by extreme market stress, supply-demand imbalances, or sharp declines in underlying collateral value. This risk is inherent to stablecoin models, as they rely on economic incentives, algorithms, or reserves—all of which may fail during crypto market crashes or broader financial turmoil.

Collateralized Stablecoins: Risk of depeg if reserves are insufficient or illiquid.

Algorithmic Stablecoins: Depend on fragile arbitrage mechanisms that may collapse during panic selling.

Key Additional Points

-

Types of Depeg Mechanisms

Depegs can be categorized into two types:

-

Temporary Depeg: Caused by short-term liquidity crunches, often recoverable.

-

Permanent Failure: Such as the “death spiral” seen in under-collateralized systems. Metrics to monitor include:

-

Percentage Deviation from Peg: Track how frequently price deviates beyond ±0.5% within 24 hours.

-

Reserve Transparency: Monitor collateral ratios via on-chain audits.

-

Redemption Speed: Efficiency of redemptions under stress testing.

-

-

Market Contagion Effect

A depegged stablecoin can trigger chain reactions across the DeFi ecosystem, similar to a bank run. Since stablecoins are often used as collateral in lending protocols, losses can be magnified.

-

Risk Mitigation Strategies

-

Regular reserve audits.

-

Maintain over 100% collateralization ratio.

-

Adopt hybrid models combining fiat backing with algorithmic adjustments. However, even well-reserved stablecoins aren’t immune—for example, during periods of high volatility, arbitrageurs may delay intervention due to high gas fees or network congestion.

-

-

Recent Developments

As of 2025, with wider stablecoin adoption, predictive models now treat depeg risk as central, factoring in collateral volatility, issuance volume, and macroeconomic indicators (e.g., interest rate changes affecting Treasury-backed reserves).

-

Case Event: TerraUSD (UST) Depeg

-

In May 2022, UST lost its $1 peg, plummeting close to zero. Due to algorithmic failure and market panic, over $40 billion in ecosystem value collapsed. This event highlighted the fragility of algorithmic stablecoins under extreme market conditions.

Smart Contract Vulnerabilities

Code bugs or exploitable weaknesses in protocols can lead to hacks or fund loss. Longer-running stablecoin protocols generally exhibit stronger resistance, while newer ones face higher smart contract risks due to lack of battle-testing.

Smart contracts form the core framework of stablecoin protocols and may contain coding flaws, logic errors, or exploitable vulnerabilities leading to unauthorized access, theft, or protocol failure. By contrast, mature, thoroughly tested protocols that have undergone extensive audits and real-world validation tend to be more robust; newer protocols with untested code carry higher risks.

Key Additional Points

-

Audit and Testing Practices

The importance of the following measures:

-

Multilateral independent audits (e.g., conducted by Quantstamp or Trail of Bits).

-

Use of formal verification tools.

-

Ongoing bug bounty programs to identify potential issues pre- and post-launch. Relevant metrics include number of audits, time since last major update, and history of past vulnerability incidents.

-

Oracle Dependency

Stablecoin protocols often rely on external data sources (oracles) for collateral pricing—a potential weak point susceptible to manipulation. For instance, attackers can use flash loans to temporarily distort prices, triggering unnecessary liquidations (leading to temporary depegs).

-

Ecosystem-Wide Impact

Smart contract vulnerabilities are not isolated. A hack on one protocol can affect integrated stablecoins, triggering cascading liquidations across interdependent protocols (due to shared collateral or support), ultimately causing a crisis of trust and reduced adoption. For example, SVB default caused temporary depeg of USDC, impacting the entire DeFi ecosystem.

Case Event: Ronin Network Hack

In March 2022, attackers exploited a vulnerability to steal $620 million worth of ETH and USDC from Axie Infinity’s cross-chain bridge.

Regulatory Risk

Stablecoins face increasing government scrutiny regarding anti-money laundering (AML), know-your-customer (KYC) requirements, securities classification, and transparency of fiat backing. This could lead to operational restrictions, asset freezes, or outright bans—especially for stablecoins integrating real-world assets (RWA) or operating internationally. This risk is amplified in jurisdictions with shifting crypto policies, affecting global availability.

Key Additional Points

-

Global Regulatory Differences

-

European Union: Under MiCA (Markets in Crypto-Assets Regulation), issuers must hold reserves in licensed banks and maintain liquidity buffers.

-

United States: Focuses on classifying certain stablecoins as securities regulated by the SEC.

-

Emerging Markets: May impose capital controls restricting cross-border fund flows. Protocols must comply with local regulations to serve users, increasing development complexity. They must also choose jurisdictions suitable for legal operation—Europe is not always preferred.

-

Compliance Metrics

Metrics to monitor:

-

Issuer licensing status.

-

Frequency of reserve reporting.

-

Association with sanctioned entities. Non-compliance may lead to delisting from exchanges, eroding user trust and base.

-

Geopolitical Factors

-

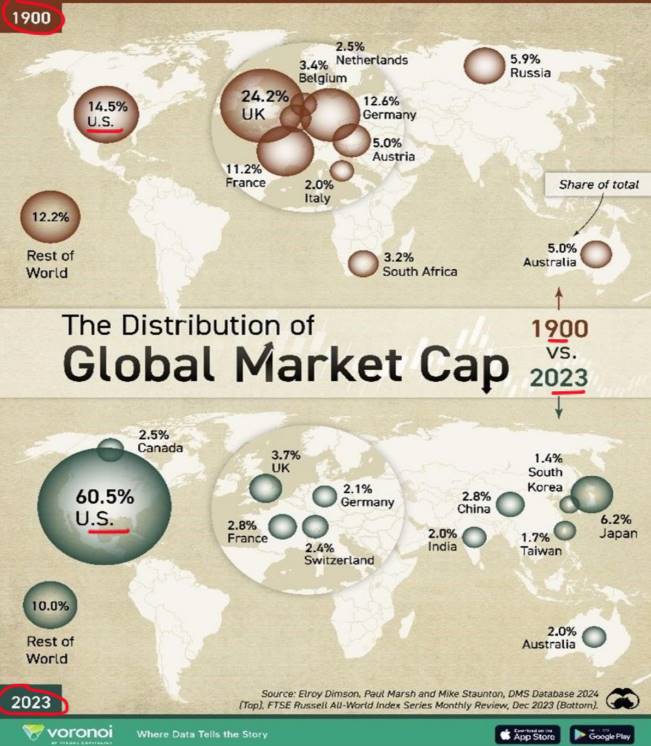

USD-pegged stablecoins face risks from U.S. policy changes, such as tech export controls or expanded sanctions targeting crypto entities.

-

Most stablecoins are pegged to USD assets—but what happens if the U.S. financial system collapses or its financial influence over Asia or the EU weakens?

-

Potential Solution: The Swiss franc, as a relatively strong currency, might offer an alternative. Developing Swiss franc-backed stablecoins could bring advantages in diversification, trust, and FX swapping.

-

Positive Side

Regulation can enhance legitimacy, but overregulation may stifle innovation, pushing users toward unregulated alternatives.

Case Event: Sanctioning of Tornado Cash

In August 2022, the U.S. Office of Foreign Assets Control (OFAC) sanctioned Tornado Cash, blacklisted its addresses, prohibited U.S. persons from interacting with it, and froze $437 million in assets.

Liquidity Risk

Liquidity risk refers to significant price slippage users face when buying or selling stablecoins due to shallow market depth. This is especially severe in low-volume markets, during panic sell-offs, or on low-traffic exchanges. Mature stablecoins with high TVL (total value locked) and deep liquidity pools perform better, benefiting from network effects that reduce slippage risk.

Key Points:

Metrics:

-

Assess liquidity health using on-chain data: TVL (via DefiLlama), 24-hour trading volume to market cap ratio, and slippage rates on major DEXs during volatility peaks.

-

A healthy benchmark is daily trading volume exceeding 5–10% of circulating supply.

Market Depth Issues:

-

In bear markets, redemption demand may exceed minting capacity, draining liquidity reserves.

Cascading Liquidation Risk:

-

Similar to bank runs, large-scale withdrawals can create a self-fulfilling prophecy—where perceived illiquidity turns into actual liquidity crisis.

Improvement Measures:

-

Integration with automated market makers (AMMs) and liquidity incentives (e.g., liquidity mining rewards, Merkl, Turtle) can enhance market resilience.

-

But overreliance on incentives may create "artificial liquidity" that evaporates quickly during crises.

Case Study: FTX Collapse

In November 2022, FTX’s collapse created an $8 billion liquidity gap, halting withdrawals and leading to bankruptcy. The crisis worsened due to massive capital outflows, making it a textbook case of liquidity risk.

Counterparty Risk

Stablecoins often depend on third parties—custodians managing real-world assets (RWAs), oracles providing price data, or cross-chain bridges enabling interoperability. These counterparties can become points of failure due to insolvency, fraud, or operational errors.

Key Additional Points

-

Risks of Custodian and Oracle Failure

-

Custodians: Custodial parties may default, leaving reserve assets unredeemable.

-

Oracles: Oracles like Chainlink may deliver inaccurate data during network failures, leading to incorrect collateral valuations.

-

-

Evaluation Metrics

-

Diversification of custodians.

-

Insurance coverage.

-

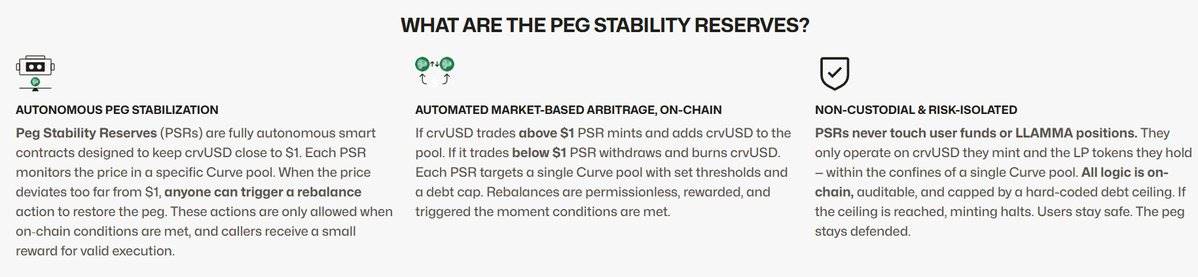

Oracle decentralization. Heavy reliance on centralized APIs increases risk. For example, Curve’s crvUSD stabilizes oracle prices using data from multiple stablecoins to ensure accuracy.

-

Managing counterparty risk requires multi-dimensional review—assessing custodial diversification, oracle data reliability, and degree of decentralization—to mitigate potential crises arising from single points of failure.

Interdependence Risk

In asset tokenization scenarios, chain-like dependencies between counterparties can amplify problems. For example, a hack on a linked protocol could freeze stablecoin redemption functions.

Legal Protection Risk

In bankruptcy, holders may be treated as unsecured creditors with minimal recovery. This underscores the importance of diversified reserves. Some stablecoins rely on certain collateral types—even if not directly held by them (typically short-term Treasuries, near-zero default risk). Others may over-rely on ETH-LST, BTC-LST, or SOL-LST, raising concerns about yield volatility.

Case Event: Celsius Network Bankruptcy

In June 2022, Celsius Network went bankrupt due to illiquid investments and counterparty defaults, freezing $4.7 billion in user funds.

Yield Volatility Risk

Stablecoin yields typically come from lending protocols or Treasury investments, but these fluctuate with market conditions, lending demand, and interest rate changes. This volatility reduces predictability for users seeking stable passive income.

Key Additional Points

-

Factors Affecting Yield

-

In low-volatility environments, reduced lending demand leads to lower yields; during bull markets, yields may rise.

-

For RWA-linked stablecoins, external interest rates (e.g., Fed funds rate) significantly impact yield.

-

-

Risk Assessment Metrics

-

Monitor historical yield ranges.

-

Analyze correlation between yield and crypto volatility index (CVIX).

-

Track protocol utilization (lending ratios above 80% often mean higher yield but increased risk).

-

-

Sustainability Concerns

-

High yields may indicate hidden risks, such as excessive leverage.

-

Sustainable yield models favor "Delta-neutral" strategies (e.g., Ethena), minimizing directional risk for more stable returns—part of why they’ve succeeded.

-

-

User Impact

-

Yield volatility may lead to opportunity cost: users miss out on higher-return alternatives.

-

If yields fall below fiat savings rates, users face inflation erosion risk.

-

Case Event: Declining Yields on Aave and Compound

In winter 2022, weak lending demand caused yields on Aave and Compound to drop from over 10% to under 2%.

Specific Risk Analysis

Smart contract vulnerabilities (due to complex lending modules), regulatory risk (scrutiny due to exposure to U.S.-backed securities via RWAs), yield volatility (dynamic savings rates may decline).

Sky Dashboard Metrics

Specific Risk Analysis: Lending mechanism vulnerabilities (over-collateralization may trigger cascading liquidations), yield generation failure (if lending demand drops, yield may fall to zero).

GHO Dashboard Metrics

Specific Risks: Under-collateralization risk (if real-world assets depreciate), liquidation threshold risk (high volatility of underlying ETH/BTC), security module failure (insurance-like buffers may be insufficient).

USR Dashboard Metrics

Specific Risks: Yield generated via auto-compounding staking rewards makes it vulnerable to ETH slashing events or low-yield periods—unlike fully over-collateralized stablecoins.

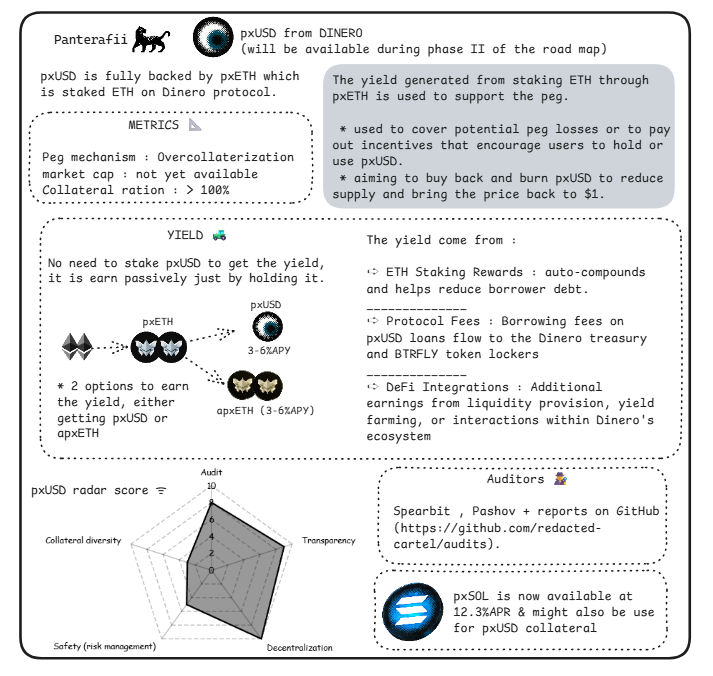

Dinero Dashboard Metrics

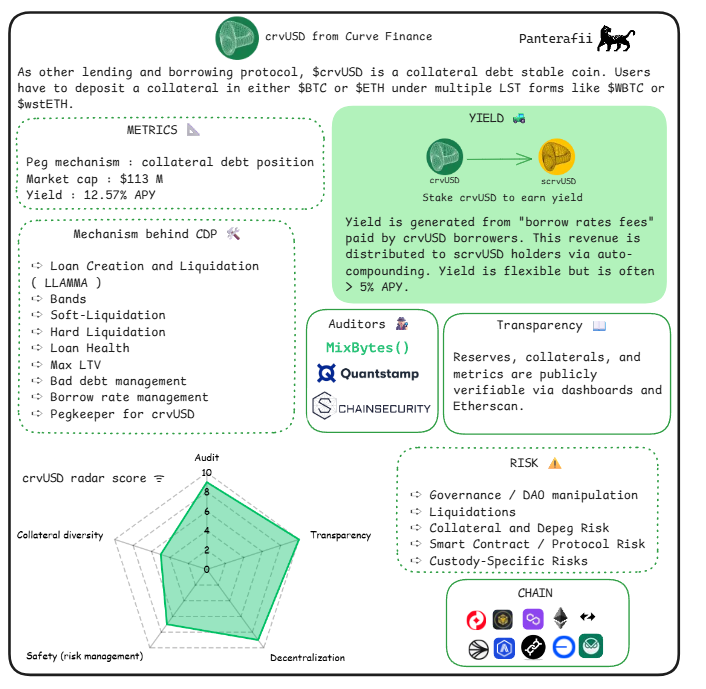

Specific Risks: crvUSD’s CDP model (150–167% health ratio, backed by BTC/ETH LST) focuses on lending, making cascading liquidations during market volatility a primary risk. Yield comes from flexible fees, typically APY over 3.5%.

crvUSD Dashboard Metrics

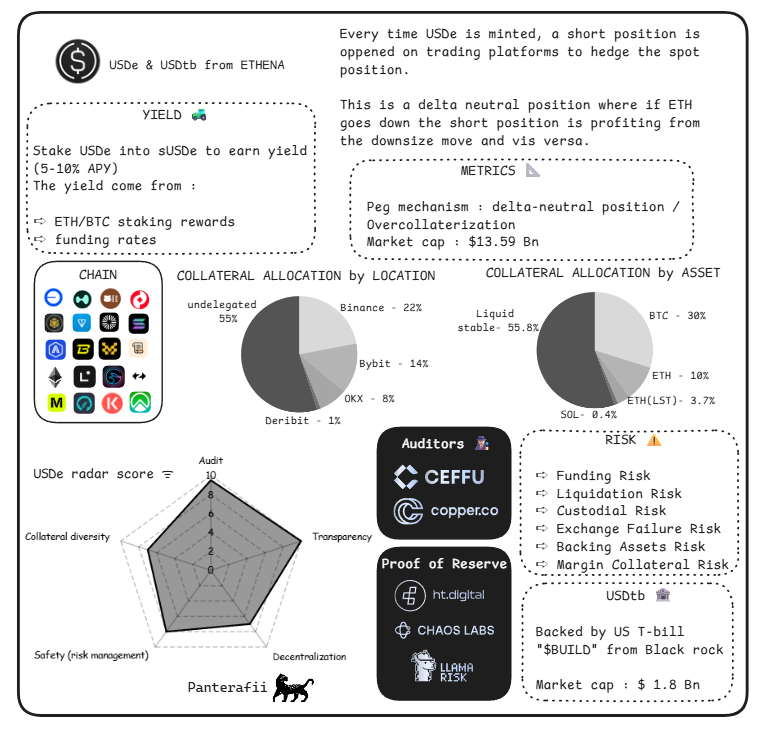

Specific Risks: Market volatility of underlying assets (futures may cause rapid losses), regulatory compliance issues (as a PPI-linked stablecoin), counterparty risk from exchanges.

Falcon Dashboard Metrics

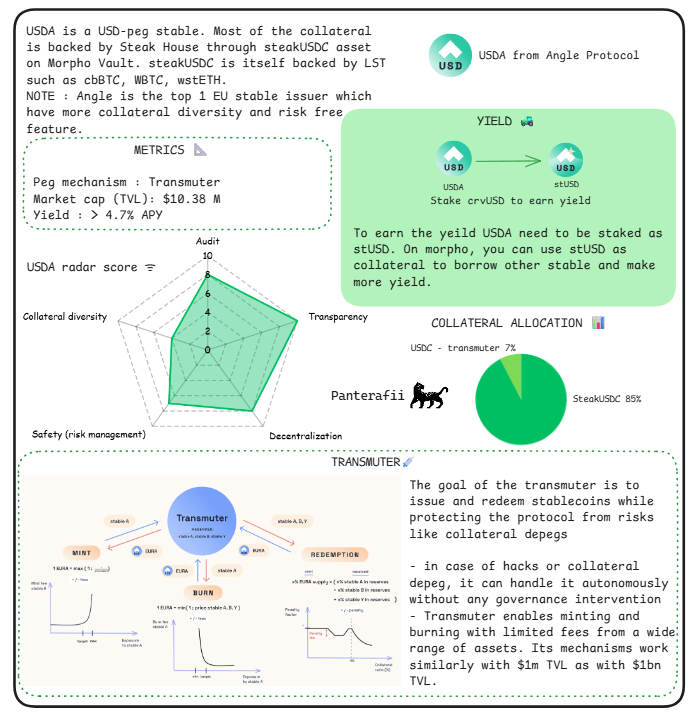

Specific Risks: USDA’s converter aims to prevent depeg by allowing minting/burning at a fixed fee (same for $1M and $1B TVL), but introduces autonomy risks—governance operating without intervention, making it vulnerable to hacks or failure of its 85% steakUSDC-backed collateral.

Angle Analysis Metrics

Specific Risks: csUSD’s three-party market (holders, generators, restakers) uniquely generates yield (from Treasuries/T-bills and LSTs), but balancing shifts pose risks, potentially causing compatibility issues with DeFi protocols.

Coinshift Analysis Metrics

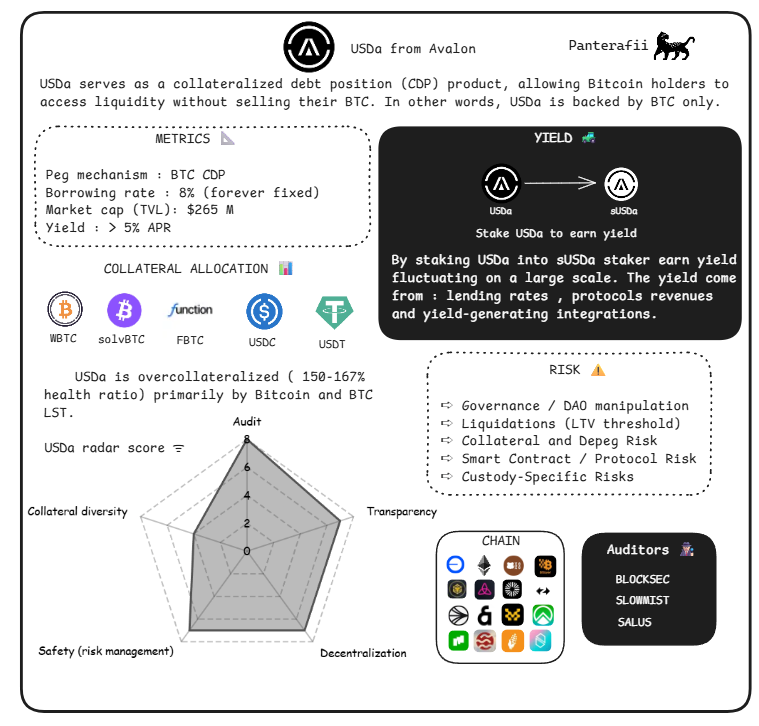

Specific Risks: USDA’s fixed borrowing rate (8%) and BTC-only CDP model (yield from >5% APY) expose it to BTC price volatility, unlike diversified collateral. No mention of over-collateralization buffer mechanisms.

Avalon Analysis Metrics

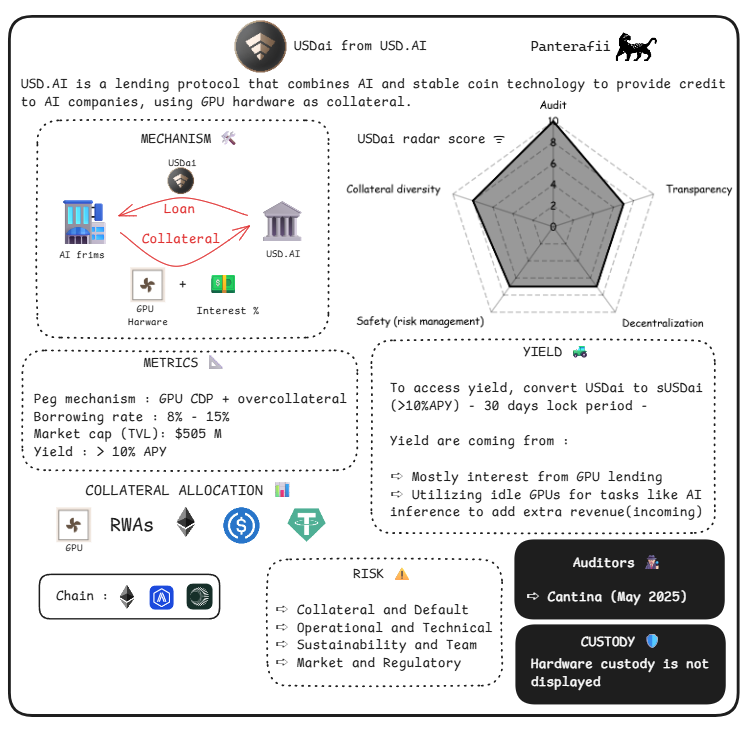

Specific Risks: GPU CDP involves illiquid assets.

USDai Analysis Metrics

Specific Risks: Sharp rate hikes (futures positions may lose value), funding rate volatility (negative rates erode yield), perpetual futures risk (market crash triggers liquidation).

Ethena Analysis Metrics

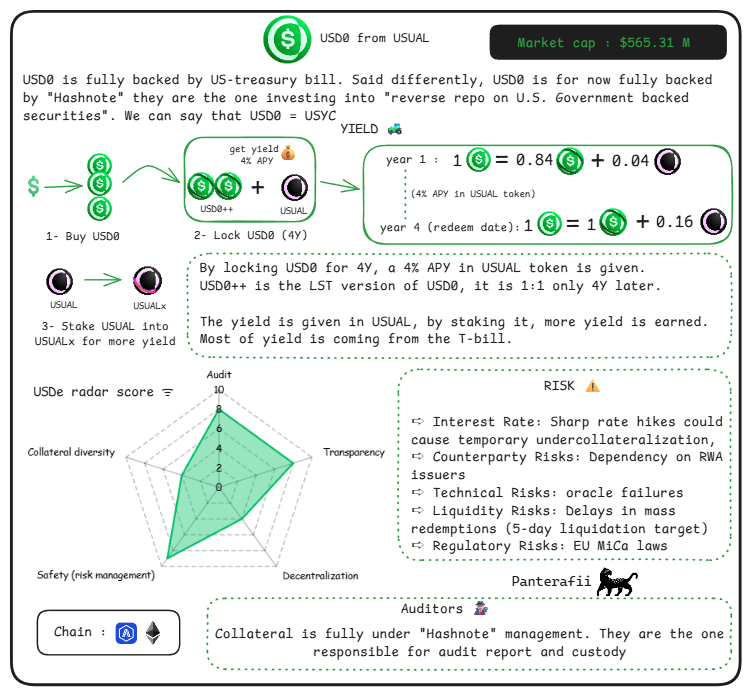

Specific Risks: Custody-specific risks (real-world assets managed by "Hashnote").

Usual Analysis Metrics

Specific Risks: Hybrid mechanisms may exacerbate peg failure risks during economic shifts.

Frax Analysis Metrics

Paxos Transparency Report

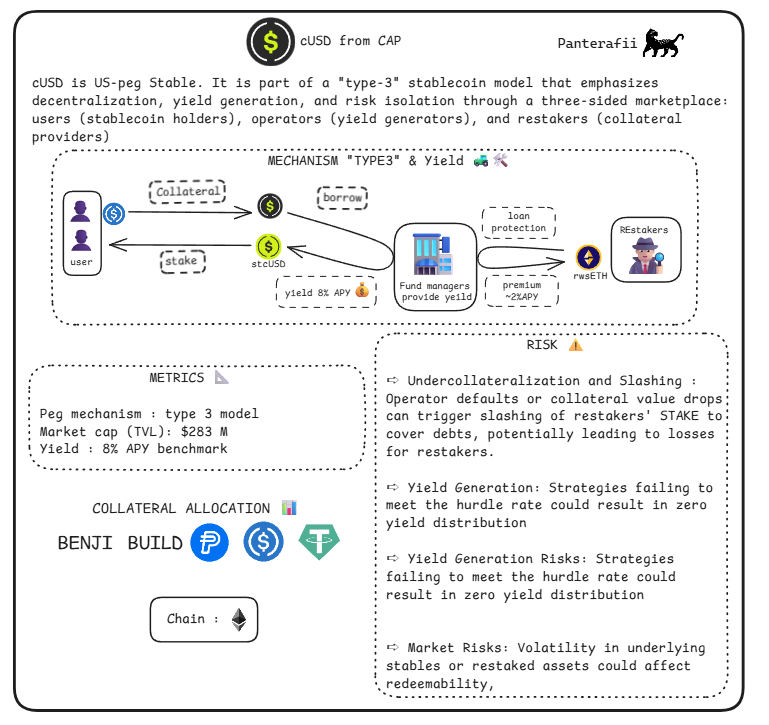

Specific Risks: cUSD emphasizes decentralization, yield generation, and risk isolation via a three-party market (holders, generators, restakers), exposing restakers to unique slashing risks. Its yield (benchmark 8% APY) depends on loan protection mechanism effectiveness—if it fails, risk arises.

Status of Solana Stablecoin Ecosystem

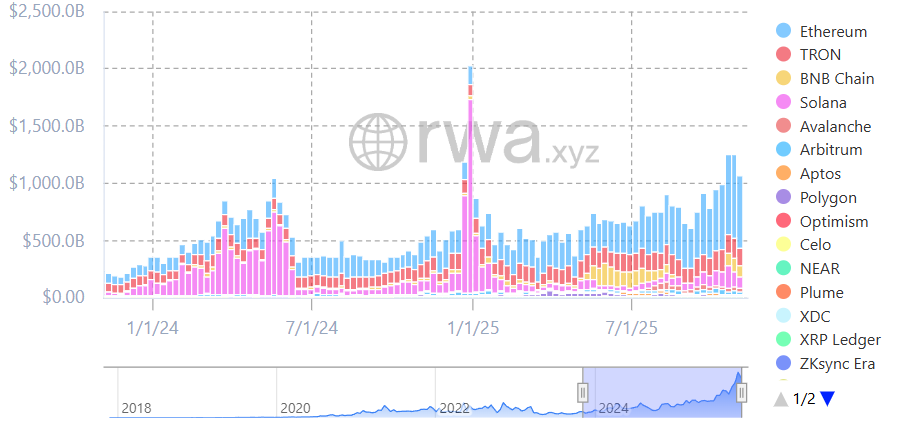

The Solana ecosystem is experiencing rapid growth in stablecoins, with rumors of potential ETF products further fueling expansion.

Figure: Stablecoin transfer volume

Solana ranks in the top five for on-chain stablecoin transfer volume.

Figure: Stablecoin active addresses

Solana ranks in the top three for stablecoin active address networks.

Native stablecoins with innovative algorithmic mechanisms are emerging, including jupUSD by Jupiter, USX by Solstice, and hyUSD by Hylo.

These stablecoins employ clever algorithmic mechanisms to maintain their peg and are worth monitoring.

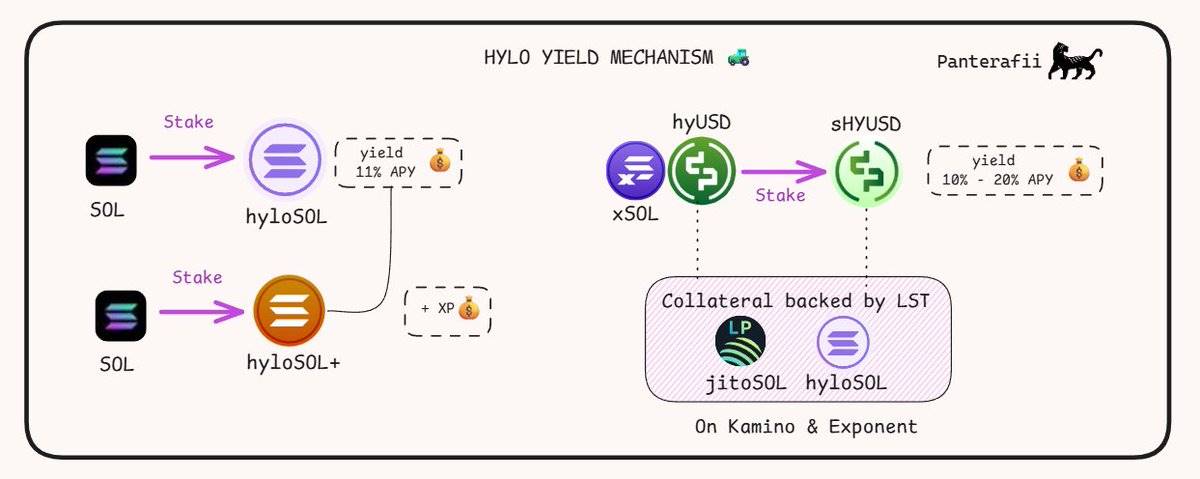

Below is an introduction to Hylo hyUSD’s yield mechanism:

-

hyloSOL: Hylo’s LST (liquid staking token), earning yield from SOL staking rewards.

-

hyloSOL+: A gamified LST that earns only XP points, with actual yield transferred to hyloSOL holders.

-

hyUSD: Hylo’s stablecoin, backed by multiple LSTs and supported by Solana DeFi strategies, but does not generate yield itself.

-

sHYUSD: Staked version of hyUSD, generating yield via LST-based DeFi strategies.

-

xSOL: A buffer asset absorbing volatility and regulating hyUSD’s peg price. It represents a leveraged position on SOL price, generates no yield, but earns XP points.

Conclusion

Sometimes, the relationship between yield and collateral isn’t aligned—exactly what happened during the Terra Luna collapse, when APY remained stable around 20% despite clearly insufficient revenue. Therefore, it’s crucial to monitor the correlation between yield and collateral, as this is often where problems originate.

Regarding the USDai stablecoin, our friend raised an interesting point:

USDai responded, noting delays in GPU loans. Borrowers want USDai, but lenders struggle with shipping collateral. "NVIDIA B200 GPUs were stuck in French customs after leaving Taiwan"—a real-world example.

Hope you enjoyed this article. I firmly believe DeFi will one day become the core engine driving finance. Here, I’ve shared some innovative thoughts on strategies, concepts, and protocols.

Thank you for reading, and have a wonderful day!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News