Why does Bitcoin rise when the U.S. government reopens?

TechFlow Selected TechFlow Selected

Why does Bitcoin rise when the U.S. government reopens?

Was the U.S. government shutdown the culprit behind the global financial market decline?

Author: EeeVee

The U.S. government shutdown has officially entered its record-breaking 36th day.

Over the past two days, global financial markets have plunged. Nasdaq, Bitcoin, tech stocks, the Nikkei index—even safe-haven assets like U.S. Treasuries and gold—have all been hit.

Market panic is spreading, while politicians in Washington remain locked in budget disputes. Is there a connection between the U.S. government shutdown and the global market downturn? The answer is beginning to emerge.

This is not an ordinary market correction, but a liquidity crisis triggered by the government shutdown. With fiscal spending frozen, hundreds of billions of dollars are trapped in the Treasury’s accounts and unable to flow into the market, effectively cutting off the financial system's blood circulation.

The Real Culprit: The Treasury's "Black Hole"

The Treasury General Account (TGA) can be understood as the U.S. government’s central checking account at the Federal Reserve. All federal revenues—whether from taxes or bond issuance—are deposited into this account.

All government expenditures—from civil servant salaries to defense spending—are also disbursed from this account.

Under normal circumstances, the TGA acts as a financial transit hub, maintaining dynamic balance. The Treasury collects money and quickly spends it, injecting funds into the private financial system, increasing bank reserves, and providing market liquidity.

The government shutdown has broken this cycle. The Treasury continues to collect revenue through taxes and bond sales, causing the TGA balance to grow steadily. However, due to Congress failing to approve the budget, most government agencies have shut down, preventing the Treasury from making planned expenditures. The TGA has become a financial black hole—money flows in but nothing flows out.

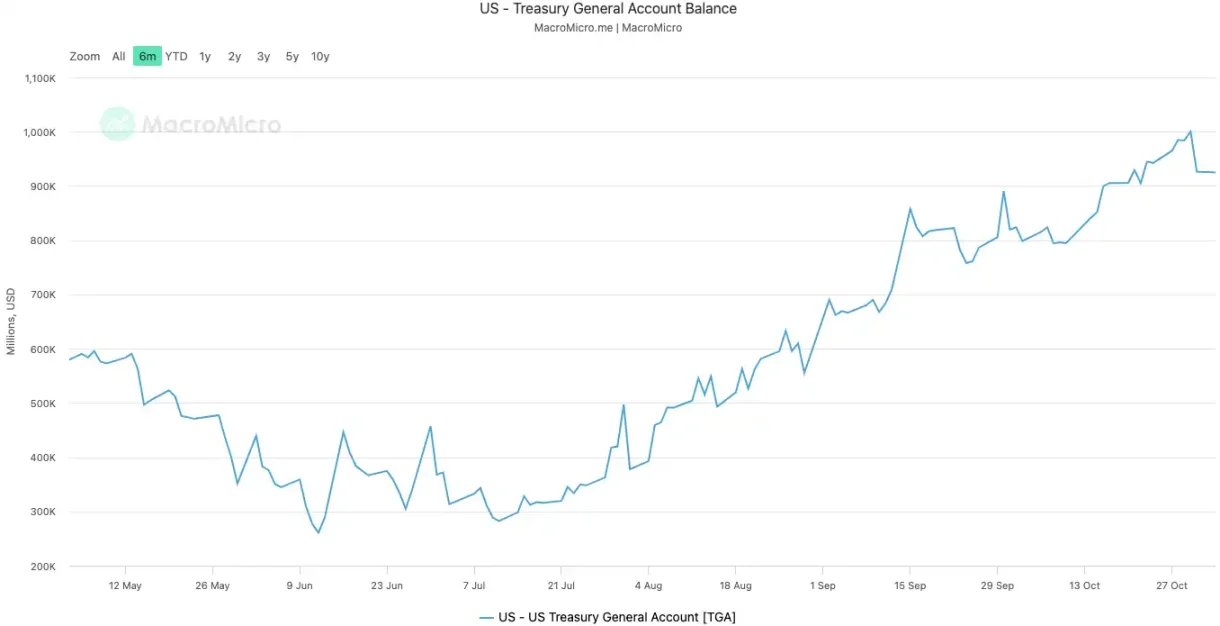

Since the shutdown began on October 10, 2025, the TGA balance has ballooned from approximately $800 billion to over $1 trillion by October 30. In just 20 days, more than $200 billion has been drained from the market and locked away in the Federal Reserve's vaults.

U.S. Government TGA Balance | Source: MicroMacro

Analysts estimate that the government shutdown has removed nearly $700 billion in liquidity from the market within a month—an effect comparable to multiple rounds of Fed rate hikes or accelerated quantitative tightening.

As the TGA siphons off large amounts of bank system reserves, banks’ ability and willingness to lend plummet, causing funding costs across the market to spike.

Assets most sensitive to liquidity are always the first to feel the chill. The cryptocurrency market crashed the day after the shutdown began on October 11, with liquidations approaching $20 billion. This week, tech stocks have wobbled—Nasdaq dropped 1.7% on Tuesday, with Meta and Microsoft plunging after earnings reports.

The global market sell-off is the most visible manifestation of this hidden tightening.

The System Is "Feverish"

The TGA is the cause of the liquidity crisis, while surging overnight borrowing rates are the clearest symptom of the financial system's "fever."

The overnight repo market is where banks lend short-term funds to each other—it forms the capillaries of the entire financial system. Its interest rate is the most accurate indicator of how tight or loose interbank funding conditions are. When liquidity is abundant, banks borrow easily and rates remain stable. But when liquidity dries up, banks scramble for cash and are willing to pay much higher rates to borrow overnight.

Two key indicators clearly show how severe this fever has become:

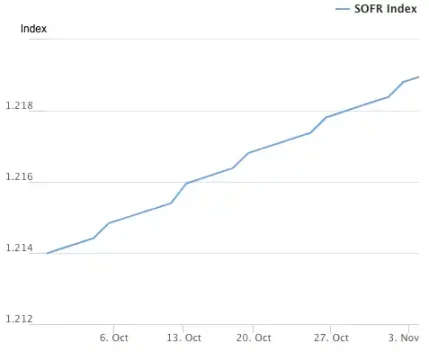

The first is SOFR (Secured Overnight Financing Rate). On October 31, SOFR surged to 4.22%, marking the largest single-day gain in a year.

This not only exceeded the upper bound of the Federal Reserve's target federal funds rate of 4.00%, but was also 32 basis points above the effective federal funds rate—the highest level since the market crisis of March 2020. Actual borrowing costs in the interbank market have spiraled out of control, far surpassing the central bank's policy rate.

Secured Overnight Financing Rate (SOFR) Index | Source: Federal Reserve Bank of New York

The second, even more alarming indicator is the usage volume of the Fed's SRF (Standing Repo Facility). SRF is an emergency liquidity tool provided by the Fed to banks. When banks cannot borrow in the open market, they can pledge high-quality bonds to the Fed in exchange for cash.

On October 31, SRF usage spiked to $50.35 billion, the highest level since the March 2020 pandemic crisis. The banking system is now experiencing a severe dollar shortage, forcing institutions to knock on the Fed's last-resort window.

Standing Repo Facility (SRF) Usage | Source: Federal Reserve Bank of New York

The financial system’s fever is transmitting pressure to vulnerable parts of the real economy, detonating long-simmering debt time bombs. The two most dangerous areas right now are commercial real estate and auto loans.

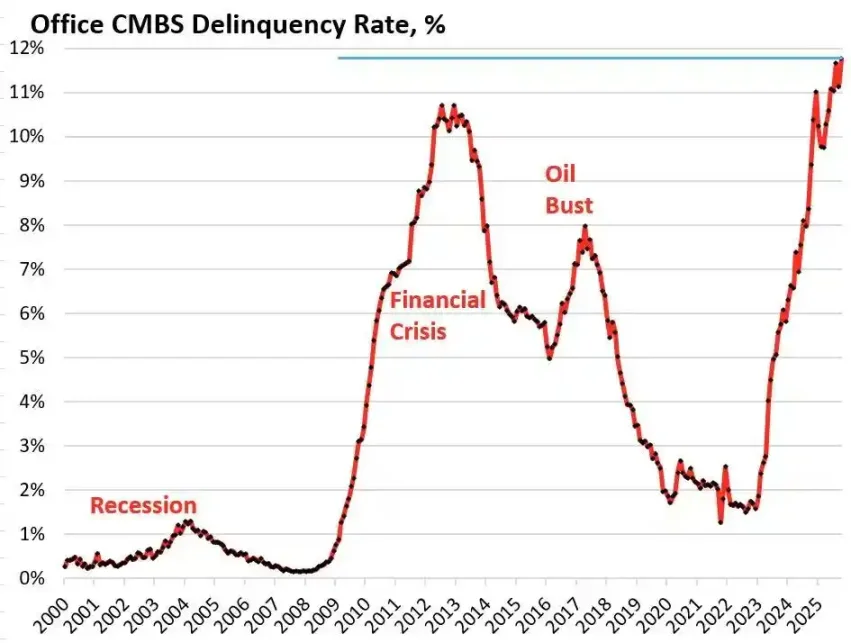

According to research firm Trepp, the delinquency rate for U.S. office CMBS (Commercial Mortgage-Backed Securities) reached 11.8% in October 2025—not only a new historical high, but exceeding the 10.3% peak during the 2008 financial crisis. In just three years, this figure has skyrocketed nearly tenfold from 1.8%.

Delinquency Rate for U.S. Office CMBS | Source: Wolf Street

Bravern Office Commons in Bellevue, Washington, is a typical case. This office building, once fully leased by Microsoft, was valued at $605 million in 2020. Now, following Microsoft's departure, its value has plummeted 56% to $268 million, and it has already entered default proceedings.

This worst commercial real estate crisis since 2008 is spreading systemic risk throughout the financial system via regional banks, real estate investment trusts (REITs), and pension funds.

On the consumer side, alarm bells are ringing for auto loans. New car prices have soared to an average of over $50,000, with subprime borrowers facing loan rates as high as 18–20%. A wave of defaults is imminent. As of September 2025, subprime auto loan delinquency rates have approached 10%, while overall auto loan delinquency rates have increased by over 50% in the past 15 years.

Under the dual pressures of high interest rates and high inflation, the financial health of America’s lower-income consumers is deteriorating rapidly.

From the TGA’s hidden tightening, to the systemic fever in overnight rates, to the bursting debt bombs in commercial real estate and auto loans—a clear chain of crisis transmission has emerged. A political deadlock in Washington has unexpectedly lit the fuse, detonating deep-seated structural weaknesses already present within the U.S. economy.

What Do Traders Think About the Market Outlook?

Facing this crisis, the market is deeply divided. Traders stand at a crossroads, fiercely debating the future direction.

The bearish camp, represented by Mott Capital Management, believes the market is facing a liquidity shock comparable to late 2018. Bank reserves have fallen to dangerous levels, similar to the conditions when the Fed’s balance sheet reduction triggered turmoil in 2018. As long as the government shutdown persists and the TGA continues draining liquidity, market pain will not end. The only hope lies in the Treasury’s Quarterly Refunding Announcement (QRA) on November 2. If the Treasury decides to lower its target TGA balance, it could release over $150 billion in liquidity back into the market. But if it maintains or raises the target, the market winter will grow longer.

The optimistic camp, led by renowned macro analyst Raoul Pal, presents an intriguing “window of pain” theory. He acknowledges that the market is currently in a painful phase of liquidity contraction, but firmly believes what follows will be a flood of liquidity. Over the next 12 months, the U.S. government must roll over as much as $10 trillion in debt, compelling it to ensure market stability and sufficient liquidity.

31% of U.S. government debt (about $7 trillion) will mature within the next year, plus new issuances, bringing total scale to potentially $10 trillion | Source: Apollo Academy

Once the shutdown ends, the pent-up hundreds of billions in fiscal spending will flood into the market. Quantitative tightening (QT) will technically end—and may even reverse.

In preparation for the 2026 midterm elections, the U.S. government will go to great lengths to stimulate the economy—including rate cuts, loosening bank regulations, passing crypto legislation. Against a backdrop of continued monetary expansion in China and Japan, the world is heading toward another round of liquidity injection. The current pullback is merely a shakeout within a bull market, and the right strategy should be to buy the dip.

Mainstream institutions like Goldman Sachs and Citigroup hold relatively neutral views. They generally expect the government shutdown to end within the next one to two weeks. Once the impasse is resolved, the massive cash pile locked in the TGA will be rapidly released, alleviating market liquidity stress. But the long-term trajectory still hinges on the Treasury’s QRA announcement and the Fed’s subsequent policy moves.

History seems to repeat itself. Whether it was the 2018 balance sheet reduction scare or the September 2019 repo crisis, each ultimately ended with the Fed capitulating and re-injecting liquidity. This time, under the dual pressures of political gridlock and economic risk, policymakers appear to be standing once again at a familiar crossroads.

In the short term, the market’s fate hangs on the decisions of Washington politicians. But in the long run, the global economy appears trapped in an endless cycle of debt, stimulus, and bubbles.

This crisis, accidentally triggered by a government shutdown, may merely be the prelude to the next, larger wave of liquidity frenzy.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News