Analyzing the Underlying Logic of the "Gold Price Surge"

TechFlow Selected TechFlow Selected

Analyzing the Underlying Logic of the "Gold Price Surge"

Seize the historic opportunity.

Author: Nathan Ma, Co-founder of DMZ Finance

When gold prices broke $4,000 per ounce in 2025, many were stunned to realize that this supposedly "conservative" asset was undergoing an astonishing surge.

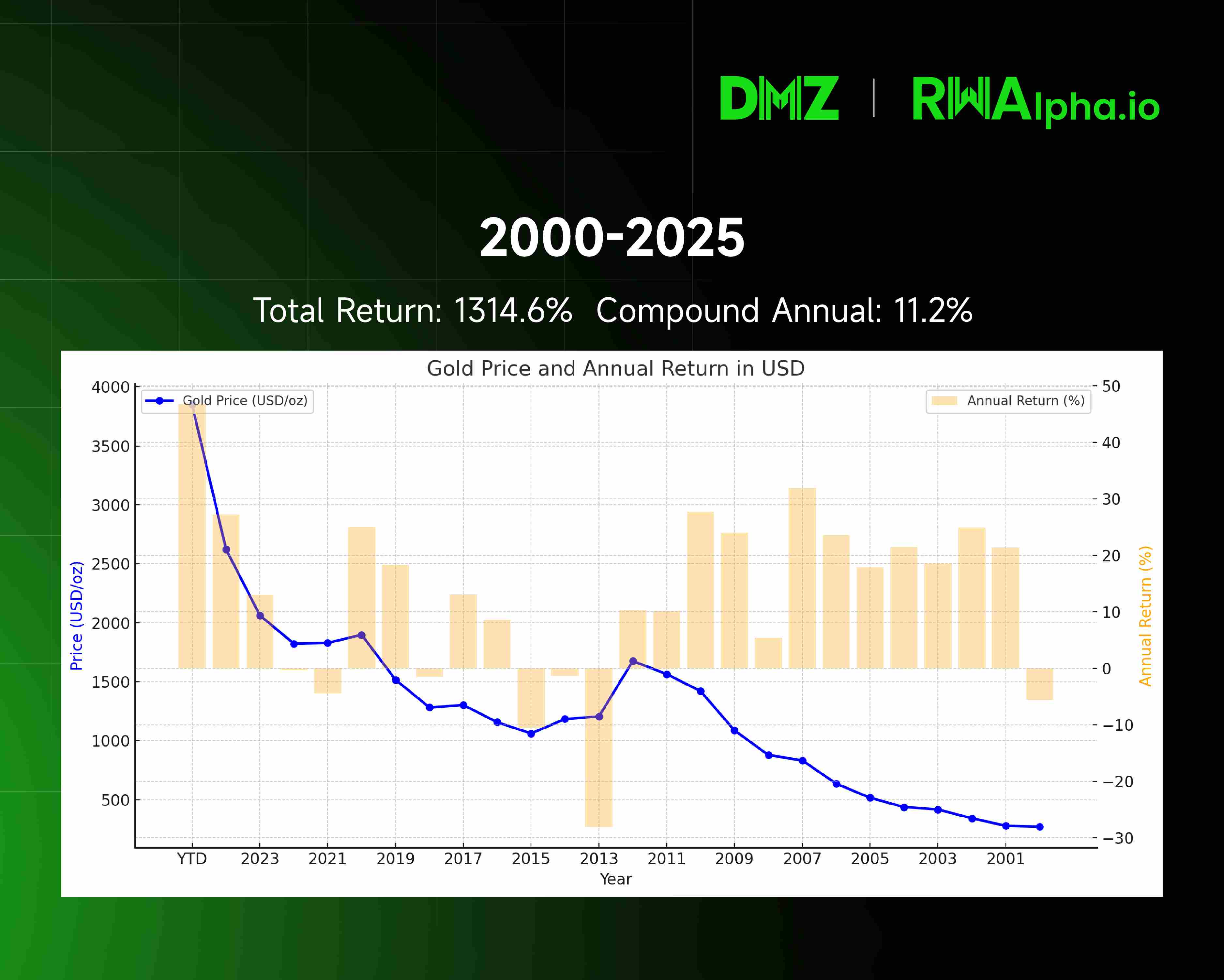

Gold price trend and annual returns from 2001 to 2025. Historical data clearly shows gold's upward trajectory.

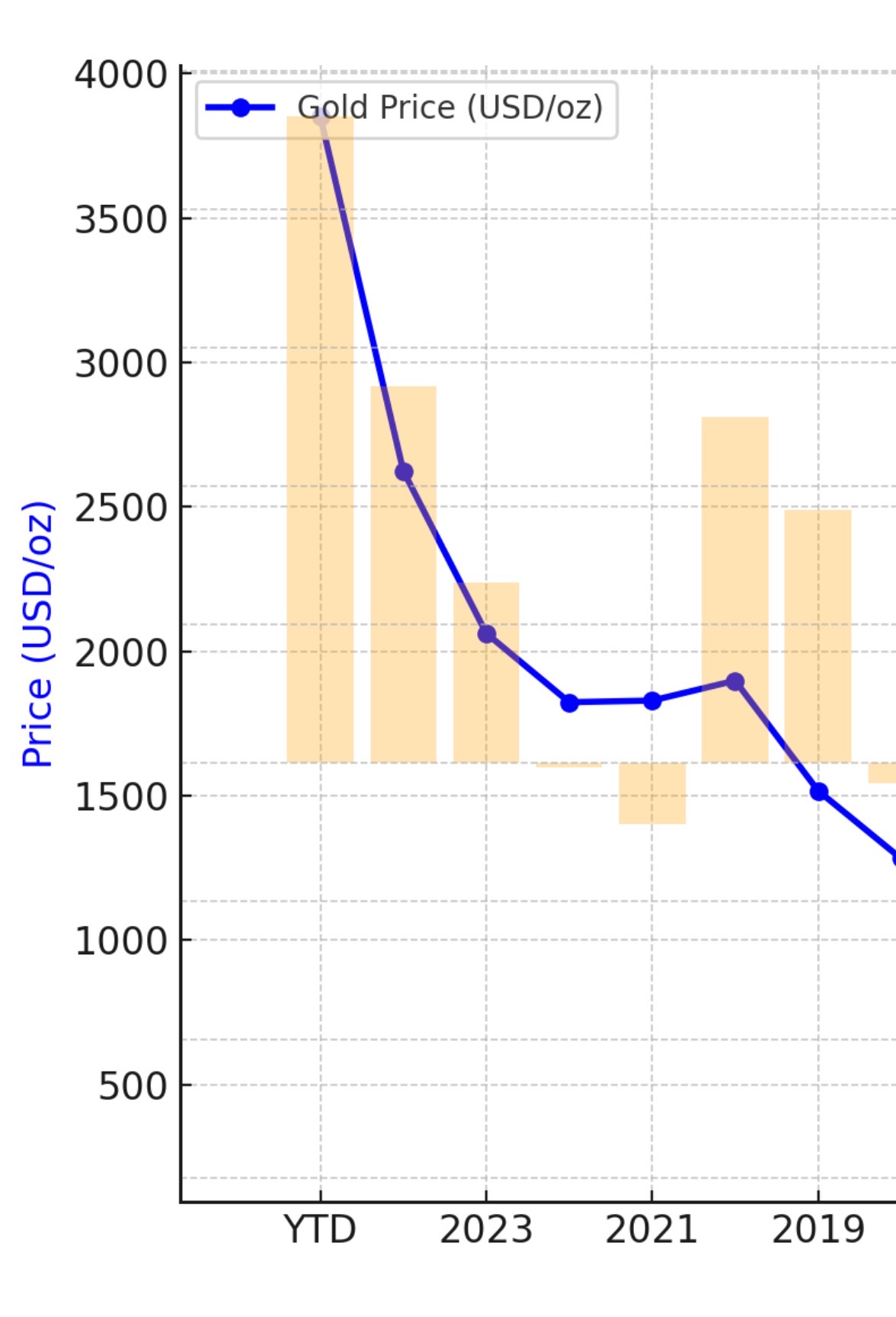

Accelerating gold price rise from 2019 to 2025

Focusing on data since 2019, it’s clear that gold rose from $1,500 in 2019 to $4,000 in 2025, achieving a compound annual growth rate exceeding 18%, far outpacing most traditional asset classes.

This rally is no accident, but the inevitable result of four core factors acting in concert.

1. 2019 – Institutional Reform: Basel III Redefines Gold’s Value

The turning point in gold’s fate began with an international banking regulation document known as “Basel III.”

This regulatory framework, introduced after the 2008 financial crisis, was fully implemented around 2019 across major global economies. Its core objective was clear: ensure banks hold sufficient high-quality capital to withstand risks. Under this new system, gold’s status underwent a fundamental change.

Under previous regulations, gold was classified as a “Tier 3 asset”—holding gold carried a high capital cost for banks. This millennia-old metal had become a burden within the modern financial system.

However, Basel III made a revolutionary decision: officially setting the risk weight of physical gold to zero. This means that in bank risk assessments, gold now stands alongside cash and top-tier sovereign debt.

This change directly reduced the cost of holding gold for banks, prompting them to include gold in their high-quality liquid asset portfolios. Gold returned to the center of the financial system, laying the institutional foundation for its subsequent price rise.

2. 2022 – Russia-Ukraine War: The De-Dollarization Wave Triggered by $300 Billion Frozen

If Basel III paved the way for gold’s rise in 2019, the Russia-Ukraine war in 2022 directly ignited the engine.

The freezing of approximately $300 billion of Russia’s foreign exchange reserves showed the world another form of credit collapse—even sovereign-backed bonds and deposits can vanish overnight in the face of political risk.

This event prompted central banks worldwide to reassess the safety of reserve assets. According to IMF data, the dollar’s share in global foreign exchange reserves has declined from 72% in 2000 to 58% in 2025, reaching a near thirty-year low. Meanwhile, over 20% of central banks stated in 2024 that they plan to continue increasing gold holdings over the next two years.

This trend is evident globally. The Reserve Bank of India added over 200 tons of gold between 2023 and 2025, raising its gold reserve ratio to 8%; Poland’s central bank purchased about 130 tons during the same period, citing “geopolitical risks” as a key factor; and the Monetary Authority of Singapore announced in 2024 a 15% increase in gold reserves to strengthen financial resilience.

These coordinated moves signal a profound restructuring of global reserve assets. As sovereign credit risks emerge, gold—requiring no counterparty commitments—is becoming the inevitable choice for central banks in a new geopolitical landscape.

3. Three Years of Pandemic – Monetary Expansion: Continuous Erosion of the Dollar’s Purchasing Power

The surge in gold also reflects the erosion of fiat currencies, especially the U.S. dollar.

Theoretically, as a scarce physical asset, gold can serve as a hedge against inflation. When governments issue large amounts of money, reducing purchasing power, gold’s intrinsic scarcity allows it to be priced in more monetary units.

During the three pandemic years, major global central banks implemented unprecedented monetary easing. The Federal Reserve’s balance sheet ballooned from about $4 trillion at the start of 2020 to nearly $9 trillion at its 2022 peak—a surge of over 125%. Meanwhile, U.S. M2 money supply skyrocketed from $15 trillion in 2020 to $21 trillion in 2022, an increase of over 40%, the fastest monetary growth since WWII.

Historically, gold hasn’t always been effective against inflation, but it has played a significant role in specific periods. During the entire 1970s, the U.S. suffered from “stagflation,” with CPI averaging 7.1% annually. Over the same period, gold surged from about $35/ounce in 1970 to a peak of around $670/ounce in 1980—an increase of over 1800%.

In 2021–2023, post-pandemic supply chain disruptions and massive fiscal stimulus drove global inflation higher. U.S. CPI hit a 40-year high of 9.1% in June 2022. Although the Fed’s aggressive rate hikes pressured gold prices, the high-inflation environment still provided strong support.

Data shows that since 2000, the real purchasing power of the dollar has declined by about 40%. This long-term value erosion forces investors seeking preservation to look beyond dollar-based credit.

4. China’s Portfolio Shift – Reserve Restructuring: Strategic Adjustments by Global Central Banks

China’s foreign exchange reserve management strategy is becoming a key variable shaping the gold market.

Compared to the end of 2019, China’s reserve structure shows a clear trend of “reducing debt, increasing gold”: U.S. Treasury holdings dropped from $1.0699 trillion to $0.7307 trillion (as of July 2025), a net reduction of $339.2 billion, or -31.7%; while official gold reserves rose from 1,948 tons to 2,303.5 tons (as of September 2025), a net increase of 355 tons, up +18.2%. Behind this shift lies deep strategic consideration by the central bank.

China’s foreign exchange reserves are vast, but beneath this scale lies a structural transformation—moderately reducing Treasuries while steadily increasing gold.

As of the end of September 2025, gold accounted for only 7.7% of China’s official international reserves, significantly below the global average of around 15%. This suggests ample room for further gold accumulation by the PBOC.

This trend is not unique to China. According to the World Gold Council, central bank gold buying reached a record 1,136 tons in 2022 and has remained strong since. Markets widely expect central banks’ net gold purchases to stay above 1,000 tons annually through 2026—the fifth consecutive year at historic highs. Russia has shifted from a net exporter to a net importer of gold since 2006, continuously building its reserves.

Behind these central bank purchases lies profound strategic logic: as a globally accepted ultimate means of payment, gold enhances the credibility of sovereign currencies and creates favorable conditions for currency internationalization.

5. Outlook: The Logic Behind Gold’s Potential Tenfold Growth Over the Next 10–15 Years

Based on current fundamentals, a tenfold increase in gold over the next 10–15 years is not fantasy. This view rests on the following core arguments:

First, the global de-dollarization process has just begun. Currently, the dollar still accounts for nearly 60% of global reserves, while gold makes up only about 15%. If this balance shifts over the next decade, central bank demand alone could inject trillions of dollars into the gold market.

Second, the continued expansion of global money supply contrasts sharply with gold’s limited growth. Over the past two decades, M2 in major economies has grown nearly fivefold, while annual gold reserve growth remains under 2%. This imbalance will continue to support higher prices long term.

Third, the normalization of geopolitical risks will keep gold’s safe-haven appeal prominent. In the transitional phase where dollar credibility weakens and new reserve currencies remain immature, gold’s value as a neutral reserve asset will be further re-evaluated.

Conclusion: Seizing a Historic Opportunity

Gold’s surge is not driven by a single factor, but by the combined impact of institutional reform, geopolitical shifts, monetary expansion, and reserve restructuring.

Looking ahead, multiple institutions including Goldman Sachs hold optimistic outlooks for gold prices, with Goldman even raising its December 2026 forecast to $4,900/ounce.

“Gold is money; everything else is just credit.” At a time when fiat money faces challenges, gold offers wealth protection tested over millennia. An allocation that lets you sleep soundly is the true strength to endure economic cycles.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News