Who will be the biggest winner in the x402 trillion赛道?

TechFlow Selected TechFlow Selected

Who will be the biggest winner in the x402 trillion赛道?

The party controlling the traffic entry points and user interfaces (as well as assets / public chains) will gain the most value in the x402 ecosystem.

Author: Yash

Translation: AididiaoJP, Foresight News

x402 is having its moment, with a16z calling it a $30 trillion market.

As someone who has followed x402 since its early days, I’ve started wondering: if this market is truly that large, who will emerge as the biggest winners?

This article won’t explain what x402 is, but instead takes a practical look at its value accrual and adoption.

The core value of x402 is turning every API call into a payment transaction. Simply put, any button click can become a micropayment.

x402 isn't a technical innovation—it can be fully implemented via blockchain transactions. All limitations of blockchain transactions, such as gas fees and wallets, apply equally to x402.

But as a payment standard, it's extremely powerful because it’s compatible with HTTPS, enabling payments across the entire internet.

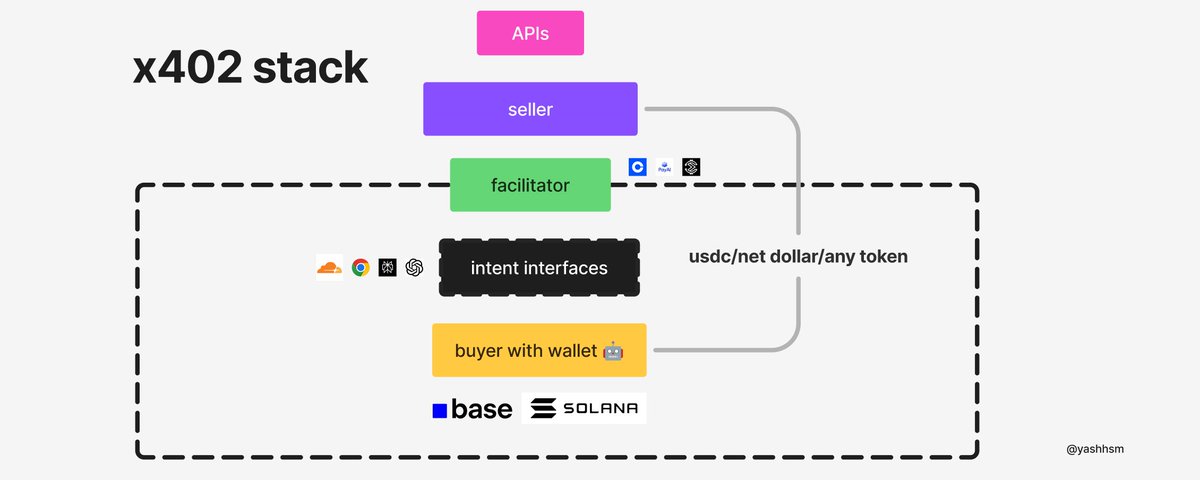

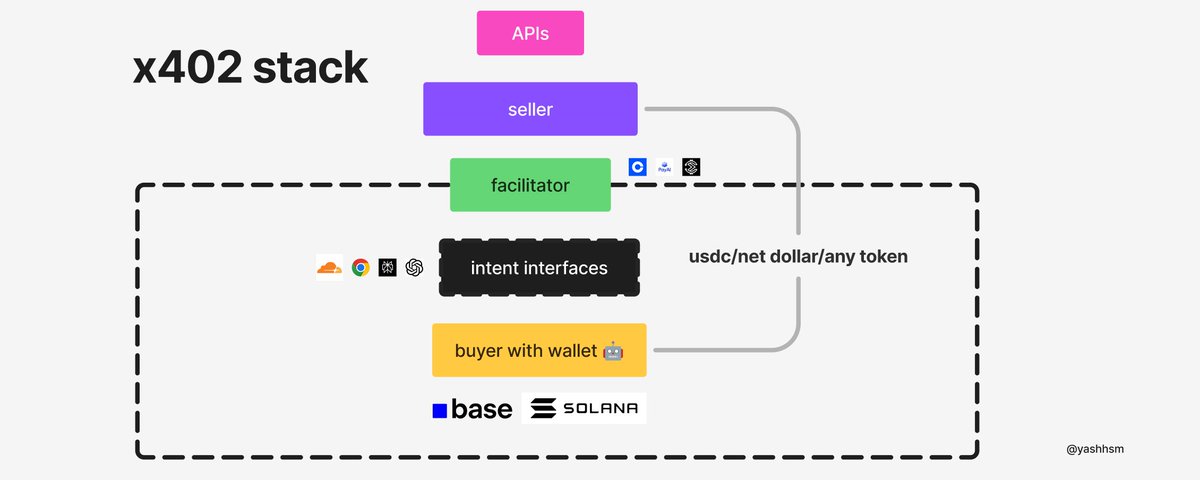

Like all payment systems, x402 has four main stakeholders:

-

API sellers (supply side)

-

API buyers (demand side)

-

Intermediaries

-

Underlying chains and tokens

1. Sellers (Supply Side)

Mainly two types:

-

First-party / second-party sellers (e.g., @switchboardxyz selling their own priced data)

-

Third-party sellers (e.g., reselling @heliuslabs’ RPC services via proxy APIs)

For first-party sellers, once demand is sufficient, they have strong incentives to support x402, which helps them access new markets.

For example, The New York Times could enable x402 on its site, requiring crawlers to pay for access, thereby creating a new revenue stream.

Or platforms like Airbnb, by supporting x402, could allow AI agents like @perplexity_ai to pay directly in USDC and automatically receive commissions within the same transaction.

Third-party sellers often evolve into "API marketplaces," aggregating various APIs and offering simplified payment methods. Their profit model is arbitrage—e.g., paying a fixed $20 monthly fee and charging users $0.0001 per API call.

In the short term, intermediaries have incentives to build API marketplaces to solve cold-start problems (e.g., @corbits_dev).

For sellers, the immediate opportunity is upgrading existing APIs or websites to support x402, gaining additional revenue and traffic from network effects.

2. Buyers (Demand Side)

API consumers, especially "AI agents." Any user or agent with a wallet can pay for API usage via x402.

This is the hardest part of the chain to bootstrap. Currently, real demand is nearly zero (most transactions are spam).

There are two ways to stimulate demand:

-

Sellers exclusively offer data through x402 (e.g., news sites only allowing paid crawling via x402)

-

Provide enough x402-supported APIs so agents and apps can easily adopt them

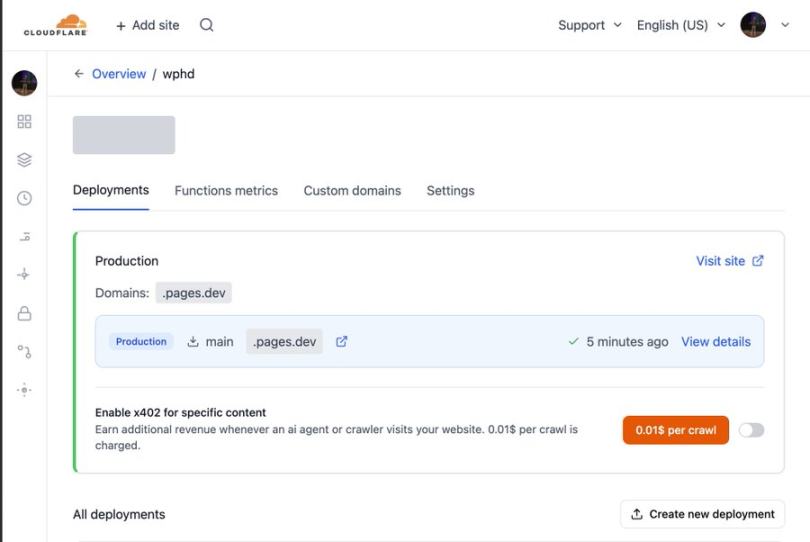

I believe the key catalyst might be @Cloudflare (a member of the x402 Foundation, particularly focused on pay-per-crawl). As the world’s largest edge network/CDN provider, Cloudflare deeply controls the distribution of web traffic—including APIs, content, and services.

All they need is a simple toggle to enable x402 for specific content, allowing developers to earn extra income. (I suspect initially it’ll be exclusive to Coinbase/Base, supporting NET dollar payments.)

I've even sketched out a potential interface design for how Cloudflare could implement this feature.

Agent-based commerce (e.g., ChatGPT, Shopify) will likely become the biggest drivers of x402 demand.

Important note: Many mistakenly believe x402 enables payments without wallets, but x402 is not magic—it still fundamentally relies on wallets and blockchain transactions (including gas fees), though these are abstracted away or batch-processed off-chain via API credits.

3. Intermediaries

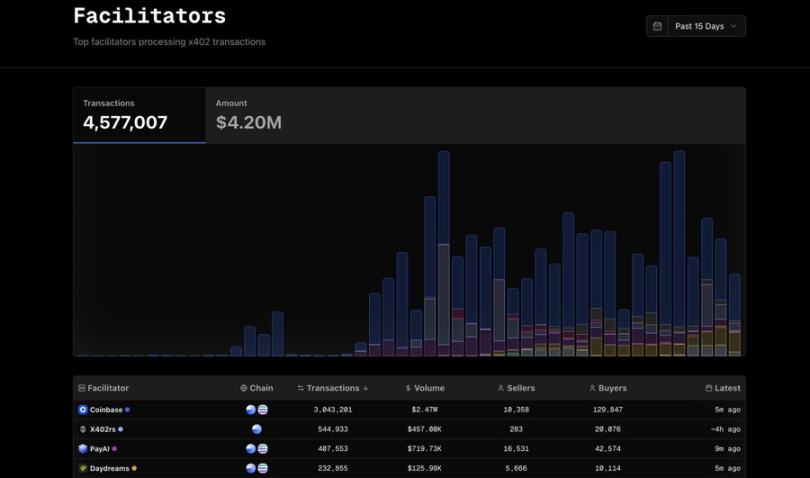

Like Visa and Mastercard, they route payments between API buyers and sellers. They typically charge 0–25 basis points (mostly free now), but this is bound to become a price war since barriers to entry are very low.

While Visa/Mastercard enjoy deep moats, x402 intermediaries have almost none—real network effects accumulate on the underlying blockchains. Large companies like Cloudflare or Google could launch their own intermediary on Solana or Base in a single day, given their control over user interfaces.

Majors like Coinbase may even open-source and offer free intermediary services to promote ecosystem growth, further squeezing margins.

Current major x402 intermediaries include: @CoinbaseDev, @x402rs, and @PayAINetwork.

4. Public Chains and Tokens

As a key initiative of @coinbase, @base (and USDC) naturally take center stage. But other chains like @SolanaFndn (which hosted an x402 hackathon) are also pushing hard.

All stablecoins and public chains will compete fiercely for dominance in x402, as it directly boosts on-chain TVL (via increased stablecoin deposits and transaction volume).

It will be interesting to see how stablecoin chains like @tempo and @arc integrate x402 into enterprise developer toolkits.

In my view, public chains, tokens, and wallets will capture the most value within the x402 ecosystem.

Coinbase and @brian_armstrong have strong reasons to push x402 aggressively—Coinbase controls the full tech stack:

-

Intermediary (CDP)

-

Public chain (Base)

-

Stablecoin (USDC)

-

Wallet (Base app and Coinbase embedded wallet)

They can offer end-to-end solutions directly to enterprise clients (e.g., Cloudflare, Vercel), while keeping the core protocol open source.

Base is currently far ahead, but everything has just begun.

Large players like Stripe are likely to either launch their own x402-like protocol or run x402 payments on their own chain (e.g., @tempo). Also, large-scale micropayments remain uneconomical on chains like @solana or @base.

For example, on Solana, due to base + priority fees, any payment under $0.10 is unprofitable, as payment transactions must compete with speculative ones (like memecoin swaps). I appreciate Tempo’s design, which provides dedicated lanes for payment transactions.

Expect dedicated sidechains/app-chains/Rollups specifically designed to handle x402 payments as adoption grows.

Value Capture via Interfaces and Wallets

Clearly, those controlling traffic gateways and user interfaces—whether platforms/marketplaces, AI chat apps, or AI browsers—will capture the most value.

In the internet space, browsers command the most user attention and are naturally positioned to integrate x402 and control the wallet layer.

Imagine Chrome with a built-in native wallet, where every click could trigger an x402 payment. Any API approved via a secure whitelist could initiate payments instantly when needed.

The browser provider could easily charge a 0.05% transaction fee, and users would willingly pay for convenience.

However, x402’s biggest competitor is Stripe!

For instance, the leading consumer AI app, ChatGPT, announced it will use @Stripe for commerce functionality. Stripe has its own Agent Commerce Protocol (ACP), processing payments over existing card networks using shared payment tokens.

x402 and Dynamic Resource Pricing

x402 excels at handling fixed pricing (e.g., “$0.001 per API call”), but this fails to unlock blockchain’s true potential: creating markets for everything.

I believe x402’s unique strength lies in enabling “resource markets.” These resources could be:

-

Data or results (e.g., prices, news)

-

Compute or inference power

-

Specific actions (e.g., booking flights)

-

Complex workflows (e.g., custom chair manufacturing)

-

Priority services (e.g., time slots or bandwidth reservations)

Historically, market mechanisms solved information coordination problems, with prices naturally reflecting supply and demand.

Now imagine a future where you tell your AI agent, “Custom-build me a chair to these specs for $500.”

The agent autonomously coordinates multiple resources: sourcing wood, hiring carpenters, arranging delivery—fully automated, solving resource coordination seamlessly.

Thanks to large language models and AI agents, we now have machines capable of reasoning and negotiating across entire supply chains. This will drive hyper-financialization, dynamic market formation, and real-time pricing for every resource and action, with AI agents conducting seamless transactions and payments behind the scenes.

While x402 itself doesn’t support dynamic pricing, blockchains like Solana can—through permissionless market creation.

Imagine each Airbnb host having a dynamic market where room prices aren’t set by the host but entirely determined by real-time market demand. That’s the world we’re moving toward.

Outlook for x402

I’m excited about x402 and the infinite possibilities it brings.

But it’s definitely overhyped—99% of x402-related tokens are vaporware if you're thinking about investing.

Despite short-term skepticism, I’m extremely bullish long-term: x402 will inevitably become foundational infrastructure for agent-driven internet and deeply integrated into crypto networks.

x402 reminds me of Solana Blinks, which turned every click into a Solana transaction request—but Blinks never took off.

This time is different—we have giants like @coinbase leading the charge. If successful, we’ll permanently change how the internet handles payments!

Summary

Those who control traffic gateways and user interfaces (along with assets/chains) will capture the most value in the x402 ecosystem. This is why Coinbase is pushing so hard—they control the full end-to-end tech stack.

The SendAI team (especially @_0xaryan) has closely tracked x402 development since May 2025 and actively contributed to the x402-mcp project in collaboration with @vercel (adding @solana support for specific use cases).

Going forward, we plan to integrate the full x402 tech stack into broader infrastructure and applications.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News