x402 V2 Launch: When AI Agents Start Having "Credit Cards," Which Projects Will Be Revalued?

TechFlow Selected TechFlow Selected

x402 V2 Launch: When AI Agents Start Having "Credit Cards," Which Projects Will Be Revalued?

Still waters run deep, rediscovering the subtle threads of the 402 narrative.

By David, TechFlow

The recent crypto market has entered a typical period of dead time, with market sentiment repeatedly swinging between weakness and anxiety.

During this silent phase lacking clear wealth effects, paying attention to localized narrative热点 can be a cost-effective choice—such as infrastructure projects that are still actively building or even quietly iterating.

About one to two months ago, we were among the first to introduce Coinbase's x402 protocol and its associated ERC-8004 standard. At that time, there was roughly a one- to two-week window of opportunity, during which tokens within this narrative saw solid gains.

(Further reading: Google and Visa Are Both Betting on It: What Investment Opportunities Lie in the Underrated x402 Protocol?)

In our earlier analysis, I argued that the core narrative of x402 v1 was solving the "AI owns a wallet" problem—enabling AI agents to make on-chain payments via simple API calls. This was then seen as Base chain’s key move in the AI space.

While the logic was validated, x402 remained constrained by its single-chain environment and limited settlement model, preventing large-scale adoption.

Yesterday, quietly and without much notice, the developers behind x402 released the V2 version.

If V1 was merely an experimental tool enabling AI to “pay,” the update log for V2 reveals far greater ambitions:

Cross-chain compatibility, hybrid crypto and fiat payment rails, and crucially, a credit mechanism enabling “do work first, pay later”. These features don’t look like minor patches—they appear aimed at building a true financial infrastructure for a “machine-based commercial society.”

Fits perfectly into the broader AI narrative.

You might say the crypto market currently lacks profitable momentum, but getting ahead of live protocol updates isn’t a bad idea.

What if you find alpha again?

From Giving AI a Wallet to Enabling AI “Buy Now, Pay Later”

For those who’ve forgotten what x402 is, here’s a one-sentence explanation of the original 402 protocol:

“Revive the dormant HTTP 402 code from early internet protocols, allowing AI to automatically purchase data and services via crypto wallets through API calls—just like humans swiping credit cards.”

While V1 successfully implemented this logic, it proved clunky in practice.

If your AI agent had to sign a transaction and pay gas every time it ran inference or accessed data, such atomic “pay-per-use” transactions would be extremely inefficient and costly.

This made V1 more of a technical demo than viable commercial infrastructure.

The core change in V2 lies precisely in its attempt to normalize AI’s commercial behavior.

After carefully reviewing the V2 documentation, I believe the most significant update is the introduction of a deferred payment mechanism.

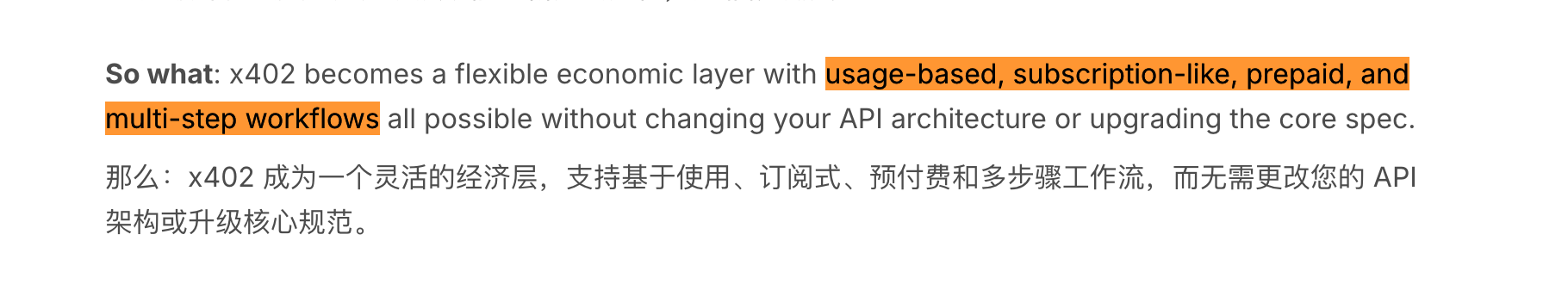

In the official text, it says:

This sounds technical—but translated into financial terms, it means:

Allowing service providers and AIs to establish a “ledger” relationship: AI can use services after verification (e.g., calling compute APIs 1,000 times continuously), with the system recording usage in the background and settling all charges in a single batch at the end.

This may seem like just saving gas fees, but narratively, it implies that AI Agents are now gaining “credit”.

Once “buy now, pay later” is enabled, new speculation and narrative niches emerge—such as assessing an Agent’s default risk, which creates demand for third-party guarantees for newly created Agents.

This is effectively laying the foundation for AgentFi, evolving from mere payment tools into credit and financial systems.

Beyond this hidden “credit layer,” V2 also includes two major visible upgrades at the infrastructure level:

-

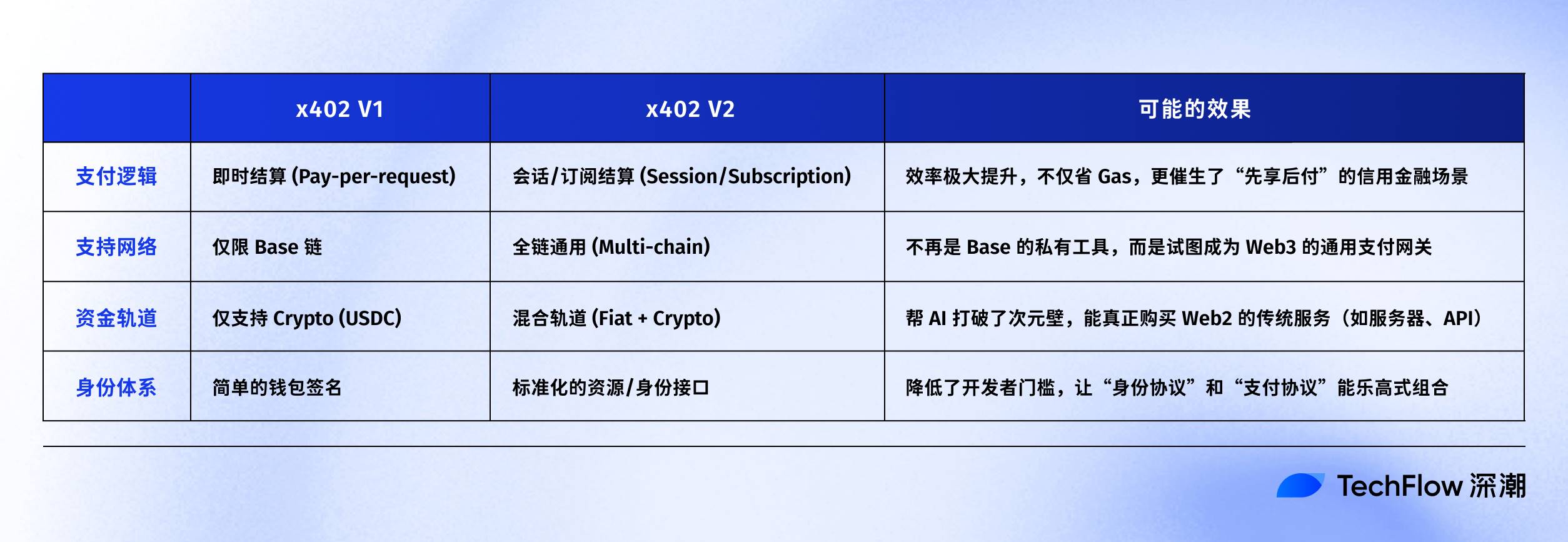

From “Base-first” to “Multi-chain by default”: V1 carried strong overtones of a Base ecosystem experiment. V2 defines a universal HTTP header interaction standard, meaning any chain—Solana, Ethereum mainnet, or L2s—that adopts the standard can integrate. This bridges liquidity across previously isolated “cross-chain islands.”

-

Hybrid Rails: V2 breaks down barriers between fiat and crypto. An Agent can pay in USDC, and through the x402 gateway, traditional cloud providers (AWS, Google Cloud) receive fiat directly. This is a critical step for AI moving from on-chain self-referential activity toward real-world procurement.

To better visualize the scale of this upgrade, I’ve prepared a comparison table outlining key differences between V1 and V2:

In summary, V2 no longer aims to be just a toy on Base—it leans toward becoming a VISA-like network for the AI economy, issuing AI a universally accepted “credit card”:

-

Using “deferred payments” to solve efficiency issues in high-frequency transactions.

-

Using “multi-chain compatibility” to address funding source limitations.

For alpha hunters, I anticipate this may signal revaluation in two upcoming sectors:

-

Who will provide credit ratings and guarantees for these AIs? i.e., the AI credit layer

-

Who can first sell computing power to AI via this streaming payment model? Possibly tied to DePIN payment adoption

Following the Thread: Which Projects Are Positioned at the V2 Frontier?

Once we understand the core upgrade logic of x402 V2, identifying promising projects becomes straightforward.

If x402 V2 is the “Visa settlement network” of the AI economy, then the following three types of protocols form the critical nodes enabling this network to function.

Type 1: AI Credit Bureaus and Performance Verification Layers

V2’s introduction of a “do work first, settle later” subscription model creates a direct challenge:

Why should a service provider trust an anonymous AI Agent to pay up at month-end?

Solving this requires two layers: first, credit scoring—assessing whether the Agent can pay—and second, performance verification—confirming whether the work was done properly. This is exactly where the x402 and ERC-8004 narratives converge, as previously discussed.

Prominent projects aligned with this narrative include:

-

Spectral ($SPEC), @Spectral_Labs

Positioning: On-chain credit scoring and machine intelligence network.

Connection: Spectral’s core product is the MACRO score (similar to an on-chain FICO). In an x402 V2 environment, service providers can set thresholds: only Agents with sufficient credit scores can access “post-paid” mode. This is the prerequisite for the “credit” model to function.

Spectral’s Inferchain initiative aims to solve Agent verification, complementing x402 V2’s settlement needs.

-

Bond Credit, @bondoncredit

Positioning: A credit lending layer specifically designed for AI agents.

Connection: One of the few projects explicitly promoting “Credit for Agents.” When a new Agent wants to use cloud compute via x402 V2 but lacks funds, Bond Credit uses TEE to monitor its historical behavior and offer credit guarantees, enabling providers to safely enable “deferred payments.”

Note: The project is early-stage. Do your own research. But it occupies a highly specialized niche, filling a gap in AI lending.

-

CARV ($CARV), @carv_official

Positioning: Modular data and identity layer.

Connection: Solves the “who am I?” problem. With x402 V2 supporting multi-chain operations, CARV’s ID standard allows Agents to maintain a unified identity across chains.

Official social channels show actual payment scenario testing already underway.

Incidentally, the “performance verification” logic here reaffirms our previous analysis in the article on the ERC-8004 standard.

x402 V2 handles the settlement of “cash flow,” while the ERC-8004 standard verifies the delivery of “service flow.”

Delayed payments only trigger upon confirmation of completed service. The sector logic we outlined previously remains fully applicable amid this x402 V2 update. Re-sharing the diagram below:

(Further reading: As x402 Gets More Competitive,挖掘 New Asset Opportunities in ERC-8004 Early)

Type 2: AI’s “Utilities” and Quality Inspectors

x402 V2’s “session-based settlement” drastically reduces friction in high-frequency payments. This theoretically benefits DePIN projects selling compute power, as well as protocols verifying that “compute isn’t faked.”

Notable established protocols include:

-

Akash Network ($AKT)

Positioning: Decentralized compute marketplace.

Connection: Compute leasing is a classic “pay-per-second/volume” use case. x402 V2 enables AI to make streaming payments in USDC or even via fiat rails, significantly lowering the barrier for AI to procure compute.

Logically, this is more of a passive benefit—less directly connected.

-

Giza ($GIZA), @gizatechxyz

Positioning: Verifiable machine learning (ZKML) and DeFi Agent applications.

Connection: Giza has a dual role. As a technical layer, it acts as a “quality inspector” before settlement. Before paying high inference costs via x402, Giza’s ZKML tech can prove that “the model indeed ran as required.”

As an application, its flagship products (like ARMA) are themselves DeFi Agents operating on payment rails like x402.

Type 3: AI’s “Asset Side” and Execution Layer

The narrative here is: if x402 V2 makes AI payments smoother, then who is creating these Agents? And who is using these tools to generate profits for users?

Back to an old favorite: Virtuals Protocol ($VIRTUAL).

As a leading AI Agent issuance platform, x402 V2 essentially gives Virtuals’ Agents a “cross-chain passport.” Users holding VIRTUAL-based Agents could soon deploy them via the x402 protocol to launch new tokens on Solana or perform arbitrage on Ethereum mainnet.

-

Brahma, @BrahmaFi

Positioning: On-chain execution and strategy orchestration layer.

Connection: Since Brahma’s core business involves automating complex DeFi strategies for users, they can use x402 to uniformly pay gas and execution fees for various Keepers (executors), achieving full automation.

This also enables new DeFAI use cases. A key infrastructure for the transition from DeFi to AgentFi.

Conclusion

Finally, let’s step back and calmly assess the signal sent by the x402 V2 release.

Technically, x402 is a payment protocol. But in the crypto context, it unlocks numerous financial possibilities.

By introducing “deferred payments (credit)” and multi-chain accounts, V2 enables AI to develop balance sheet concepts.

When an Agent is allowed to “serve first, pay later,” it acquires liabilities; when it holds multiple assets across chains, it gains equity.

Once assets and liabilities exist, an AI is no longer just a script—it becomes an independent economic entity, opening up vast new possibilities.

This is the true origin of the AgentFi (Agent Finance) narrative.

For speculation, during this current market downturn, there’s no need to fantasize about how AI might build complex commercial empires in the future. Instead, focus on shifts in foundational narrative logic:

Previously, we invested in AI at the model layer—betting on “who’s smarter.” In the future, we’ll invest at the financial layer—betting on “who’s richer.”

x402 V2 is just the starting gun. Once the market turns, closely watch those projects issuing IDs to AI, providing AI credit, and turning compute into retail commodities.

These are exactly the kinds of projects that sound highly compelling, are hard to disprove, and possess narrative foresight.

Throughout AI’s narrative evolution from tool to economy, these shovel-sellers will collect the first tolls—regardless of bull or bear markets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News