Barclays: Powell aims to "break the expectation of inevitable rate cuts," but data supports further rate cuts

TechFlow Selected TechFlow Selected

Barclays: Powell aims to "break the expectation of inevitable rate cuts," but data supports further rate cuts

Barclays believes the market's hawkish interpretation of Powell's remarks is a misjudgment.

Author: Dong Jing, Wall Street Insights

The market's "hawkish" interpretation of the latest comments from Federal Reserve Chair Powell may be a misjudgment. Barclays believes that what Powell truly aims to do is correct the market's overconfidence in assuming rate cuts are certain.

Following the October FOMC meeting, the Fed chair stated at a press conference that inflation still faces near-term upward pressure, employment carries downside risks, and the current situation remains challenging. The committee remains deeply divided on whether another rate cut will occur in December—rate cuts are not a given. Markets interpreted these remarks as hawkish, triggering a sell-off in two-year Treasuries, a sharp rise in yields, and a pullback in U.S. equities.

On October 31, according to Fengwind Trading Desk, Barclays presented a clear counterargument in its latest research report, suggesting that the market’s panic might be misplaced. Powell’s true intention is not a shift toward hawkishness, but rather managing overly "certain" market expectations for rate cuts.

Anshul Pradhan and his analyst team at the bank believe this is a communication strategy aimed at dismantling the market assumption that rate cuts are inevitable regardless of incoming data. Recent economic indicators show continued softening in labor demand, while underlying inflation is close to the 2% target—both supporting further rate cuts by the Fed.

Barclays noted in the report that current market pricing is too hawkish, failing to fully reflect the risk of a significant weakening in the labor market and the possibility that the new Fed chair could adopt a more dovish stance.

Not a Hawkish Shift, But Breaking Market "Certainty"

Barclays stated in the report: "We believe the primary motivation is to challenge the market assumption that a December rate cut is certain, rather than signaling a hawkish shift in how the Fed responds to data."

In other words, the Fed wants to reaffirm that its decisions are data-dependent, not driven by market expectations. Powell explicitly stated that the Fed will respond to the slowdown in labor demand—and this slowdown is precisely what is already happening.

The report emphasizes that recent economic data does not support a hawkish stance; instead, it provides justification for further rate cuts.

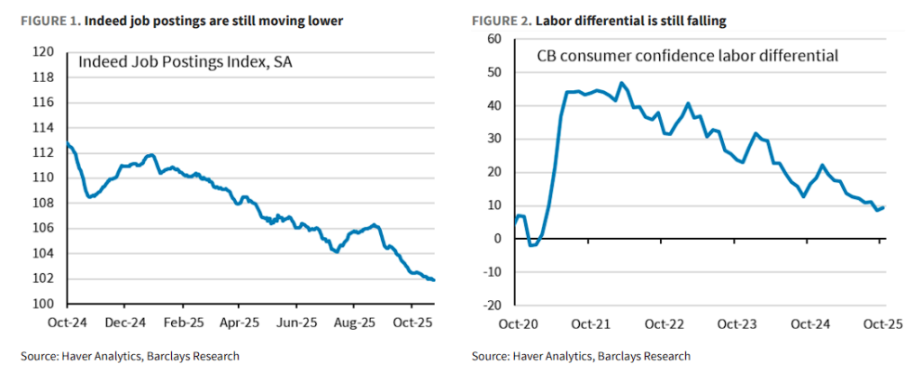

On the labor market front, leading indicators including Indeed job postings and the labor balance measure (jobs plentiful vs. hard to get) both indicate slowing demand.

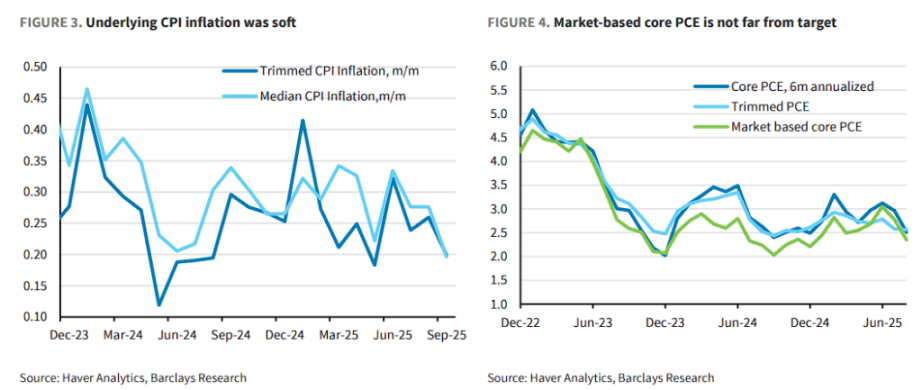

On inflation, Powell also acknowledged recent weakness in data. Core inflation measures have shown downward trends. Barclays analysis suggests that once tariff effects are stripped out, underlying core PCE inflation is already close to the 2% target.

"Overall, if underlying inflation is only a few tenths above target, and unemployment is only a few tenths above the natural rate (NAIRU), then policy should be neutral."

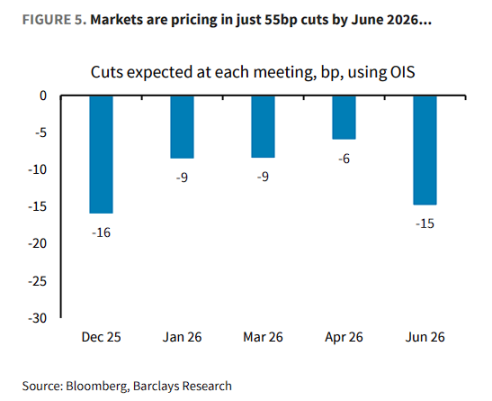

This implies that, under the current data backdrop, restrictive monetary policy is no longer necessary. Barclays observes that markets currently price in only 55 basis points of cumulative rate cuts by June 2026—a view that is "excessively one-sided."

Markets currently expect only 35 basis points of cuts by March 2026, and just 55 basis points by June, bringing rates down to 3.3%. Option-implied distributions show disagreement on the number of cuts by March and June, with the modal expectation being only one rate cut by June.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News