2025 Top 10 Cryptocurrency Payment Cards and Noebanks

TechFlow Selected TechFlow Selected

2025 Top 10 Cryptocurrency Payment Cards and Noebanks

It is certain that with the expansion of stablecoins and cryptocurrencies, crypto payments are no longer a dream.

Author: Pink Brains

Compiled by: TechFlow

Crypto cards have evolved from simple cashback tools into full-featured neobank services. Today’s best crypto cards let you earn yield, borrow against your assets, and spend directly from DeFi without relying on centralized intermediaries. However, user experiences vary significantly across different crypto cards.

Below is a 2025 comparison of top crypto cards and neobanks based on custody models, availability, reward mechanisms, and real-world usability.

1. EtherFi Card

EtherFi's Cash Card is redefining the standard for crypto cards. Instead of selling your ETH (Ethereum), it allows you to borrow stablecoins against your ETH for spending—meaning your assets continue earning yield while being used. The card is fully non-custodial, integrates directly with your DeFi wallet, and supports Apple Pay and Google Pay.

EtherFi Cash Card offers tiered levels based on user loyalty:

-

Core Tier: Designed for everyday users. Includes 1 free physical card and 3 virtual cards, with an annual fee of 0.01 ETH and a daily spending limit of $20,000.

-

Luxe Tier: For users needing more cards and higher limits. Offers 2 free physical cards and 10 virtual cards, with an annual fee of 0.1 ETH and a daily spending limit of $150,000.

-

Pinnacle Tier: Targeted at crypto industry professionals, includes one free conference pass per year. Provides 5 free physical cards and unlimited virtual cards, with an annual fee of 1 ETH and a daily spending limit of $1 million.

-

VIP Tier: Invite-only, offering most benefits similar to Pinnacle, plus exclusive investment opportunities via Ether.fi Ventures.

Within just four months of launch, EtherFi Cash has processed over 1 million transactions totaling $82.6 million, with an average transaction value of $82.60.

Pros:

-

Borrow against ETH for spending without selling your assets

-

Up to 3% cashback (promotional rates up to 20% occasionally)

-

Foreign exchange fees around 1%, low travel costs

-

Integrated UltraYield stablecoin yield vault for earnings

-

Non-custodial model, directly connected to your DeFi wallet

Cons:

-

Limited regional availability (still partially rolling out in the U.S.)

-

Borrowing carries liquidation risk—if collateral value drops, positions may be forcibly closed

-

Cashback promotions are temporary or tier-dependent

-

No traditional banking protections such as FDIC insurance

2. Payy Card

Payy is a newer combination of crypto card and wallet focused on privacy and stablecoin spending. It offers a self-custodied Visa card allowing users to spend USDC via its unique zk-powered "Payy Network," designed to obscure links between on-chain identities, wallets, and card transactions. More interestingly, the physical card lights up when used—yes, really! The team also says they’re developing a points/rewards program and broader fiat on-ramps.

Pros:

-

Privacy-first: Zero-knowledge system ensures your transactions and wallet balances aren't publicly traceable.

-

Non-custodial: Users retain full control of funds within Payy Wallet.

-

Unique physical card experience: The glowing card adds a "cool factor" distinct from most crypto cards.

-

Low fee structure: According to official documentation, many actions incur no transaction or deposit fees.

Cons:

-

Limited rewards/cashback: Reward mechanism isn’t yet clear; users must wait for the upcoming "points program" to gain more benefits.

-

Still early-stage: Fiat on-ramps, global availability, and full card benefits are gradually rolling out.

-

Limited functionality: Compared to full neobanks, lacks lending, yield-earning, or comprehensive banking features.

-

Typical issues with non-traditional cards: Regulatory/licensing risks exist, and standard banking protections may not apply.

3. Gnosis Pay

Gnosis Pay, also known as Gnosis Card, is one of the fewtruly self-custodied crypto cards available. Rather than storing funds with a provider, the card connects directly to a Gnosis Safe wallet on the Gnosis Chain, acting merely as a Visa interface for cryptocurrency.

Users can spend stablecoins like USDC or EURc directly, without converting to fiat first, and most purchases incur no foreign exchange fees. Cashback ranges from 1% to 5%, paid in $GNO, depending on asset holdings and loyalty tier.

Pros:

-

Fully self-custodied: Funds remain in your wallet, not on a third-party platform.

-

Up to 5% $GNO cashback: Available to active users and NFT holders.

-

Low or zero foreign exchange fees: Accepted at millions of Visa merchants.

-

Direct stablecoin spending: No need to "withdraw" before spending.

Cons:

-

Requires bridging to Gnosis Chain: Adds setup complexity.

-

Cashback tiers depend on $GNO holdings: Base rewards are limited.

-

Managing a Safe wallet requires technical knowledge.

-

Card availability is limited: Not yet launched in the U.S. market.

4. Bybit Card

The Bybit Card is ideal for active traders and users within the Bybit ecosystem. Through a Visa card, users can spend crypto directly, earn tiered cashback, and seamlessly connect with Bybit Pay. The latest update integrates both services into a unified rewards system, meaning every transaction—whether through wallet or card—helps level up and unlock higher rewards.

Pros:

-

Up to 10% cashback: Available to high-tier users; some limited-time promotions offer up to 20%.

-

10% rebate on select partners: Including Netflix, ChatGPT, Spotify, Amazon Prime, and TradingView.

-

Auto-savings feature: Bybit Card users earn interest on flexible savings, which can be unlocked and spent anytime.

-

$100 monthly free ATM withdrawal allowance.

-

Supports multiple payment methods: Compatible with Apple Pay, Google Pay, and Samsung Pay.

-

No annual fee (in most regions) and competitive foreign exchange rates (~0.5%–1%).

-

Integrated with Bybit Pay: Unified rewards system enables faster tier upgrades.

-

Widely accepted globally, easy setup for existing Bybit users.

Cons:

-

Tiered and conditional cashback: Base rewards are relatively low.

-

0.9% crypto conversion fee, plus spot trading fees.

-

High cashback offers are often temporary or region-specific.

-

Available only to users in Australia and the European Economic Area (EEA).

5. Tria

Tria is a "borderless Web3 neobank" aiming to make spending and saving crypto as seamless as using a modern banking app. Users can deposit over 1,000 tokens, trade and earn yield directly within the app, and use the card in over 150 countries.

Powered by its BestPath engine, Tria automatically handles gas fees and cross-chain routing, eliminating the need for users to bridge or pay gas in different tokens.

In late 2025, Tria raised $12 million to drive global expansion, positioning itself as a strong contender in the self-custodied neobanking space.

Pros:

-

Global availability: Supports over 1,000 crypto assets.

-

Up to 6% cashback: For active users.

-

No-interest spending, simple sign-up process.

-

Gas-free cross-chain experience: Powered by the BestPath engine.

-

Potential airdrops for early users.

Cons:

-

Up to 3% foreign exchange fee on non-USD transactions.

-

Reward tiers and promotions may change over time.

-

Some features still rolling out: e.g., multi-chain credit and advanced reward systems.

-

Card delivery and customer support vary by region.

6. KAST Card

KAST is an elegantly designed lifestyle card supporting cryptocurrencies with deep ties to Solana. Users can deposit stablecoins like USDC or USDT and receive a virtual card within minutes, usable globally via Apple Pay or Google Pay.

Pros:

-

Quick setup: Offers both physical and virtual card options.

-

Multi-chain token support: Includes USDC, USDT, and USDe across multiple blockchain networks.

-

Mobile payment integration: Supports Apple Pay and Google Pay.

-

Global availability: Covers over 150 countries (excluding India and China due to regulatory restrictions).

-

No daily transaction limits: Up to $20,000 daily ATM withdrawals.

-

SOL staking integration: Earn up to 21% APY via KAST validators, no commission, 100% MEV rewards returned.

-

KAST Points Program: Earn points on every transaction for future airdrops and rewards.

Cons:

-

Points are not direct cashback: Their value depends on future airdrops.

Standard KAST Cards:

-

Standard (K Card): Free, enjoy 4% rewards on all 2025 spending, earn KAST points through SOL staking.

-

Premium (X Card): $1,000/year, 8% rewards, double KAST points from SOL staking, comes with a premium metal card.

-

Limited Edition (Founder's Edition): One-time $5,000 payment, 8% rewards, VIP concierge service, double KAST points from SOL staking, no recurring fees.

Solana Exclusive Cards (Enhanced SOL Staking Benefits):

-

Solana Standard Card: Free, 4% rewards on all spending, earn KAST points and 3.5%-7% APY through SOL staking.

-

Solana Illuma (Premium Card): $1,000/year, 8% rewards, double KAST points, 7%-14% APY from SOL staking.

-

Solana Gold (Gold Card): $10,000/year, 12% rewards, VIP concierge service, triple KAST points, 14%-21% APY from SOL staking.

-

Solana Solid Gold (Solid Gold Card): Invite-only, mostly same benefits as Solana Gold.

7. MetaMask Card

The MetaMask Card is still in early rollout but stands out due to its fully self-custodied nature. The card connects directly to your MetaMask wallet, allowing users to spend crypto directly from their wallet address while retaining control of private keys throughout the payment process.

Running on the Linea network, supported tokens include USDC, aUSDC, USDT, and WETH. Currently available in select regions including Europe, the UK, and parts of Latin America, with plans for global expansion.

Cardholders can choose between two options:

-

Virtual Card: Digital-only, free to use. Earn 1% USDC crypto cashback on all eligible transactions. Single transaction limit: $10,000; daily limit: $15,000.

-

Metal Card: Premium physical metal card with exclusive perks, such as 3% cashback on the first $10,000 spent annually (1% thereafter), higher spending and ATM withdrawal limits, and exclusive access. Single transaction limit: $20,000; daily limit: $30,000.

Pros:

-

Multi-token support: Six tokens supported globally—USDC, USDT, wETH, EURe, GBPe, and aUSDC. U.S. users can only use USDC and aUSDC.

-

Cashback: 1% on all virtual card purchases; 3% on first $10,000 spent annually (then 1%) with the Metal Card.

-

Free ATM withdrawals: Up to $1,200 monthly; 2% fee applies beyond that.

-

Seamless integration: Deeply integrated with MetaMask app and Linea Layer 2 blockchain.

-

Global usability: Operates via Mastercard network, smooth experience in supported regions.

-

Spending rewards: Spending on Linea earns Linea Boosted Yield (Aave-based yield) and Linea Coinmunity Cashback.

-

Mobile payment integration: Supports Apple Pay and Google Pay.

Cons:

-

Still in pilot phase: Limited regional coverage; users elsewhere must wait in line.

-

Rewards details unclear: Rules inconsistently applied.

-

Wallet management required: Includes gas fees and token conversion steps.

-

Limited fiat functionality: Less convenient for fiat compared to neobank-style crypto cards.

-

Availability: Currently supports Argentina, Brazil, Colombia, Mexico, Europe (excluding Czechia, Estonia, Latvia, Lithuania), and the UK. In the U.S., early testing ended, but new releases remain on a waitlist.

8. Bleap

Bleap is designed for users who want a simple way to spend crypto. Built on the Mastercard network, it offers a flat 2% USDC cashback with no foreign exchange or hidden fees. Users can set up a virtual card in minutes, link it to Apple Pay or Google Pay, and use it across Europe like a regular debit card.

Pros:

-

Simple cashback: Flat 2% USDC cashback on all spending.

-

High-yield DeFi products: Access top DeFi yields—up to 20% APY on digital USD, GBP, and EUR holdings.

-

Free ATM withdrawals: Around $400 free per month.

-

No FX or conversion fees: No extra charges when spending abroad.

-

Fast setup: Easy onboarding and mobile wallet integration.

-

Mobile payment compatible: Supports Apple Pay and Google Pay.

Cons:

-

Europe-only availability.

-

Limited cashback: Modest compared to high-reward cards.

-

No bank-grade deposit protection: Operated via an e-money service provider.

-

Limited features: Few additional functions beyond payments.

-

Extra features (e.g., high-yield vaults): Exist but less appealing to casual spenders.

9. Avici

Avici is building what it calls an "internet-native neobank," aiming to bridge fiat and crypto while ensuring full user control over funds. Users deposit USDC into a smart contract, instantly receive a Visa card, and spend globally.

The card supports Apple Pay and Google Pay, offers virtual and physical card options, and has no hidden or foreign exchange fees. Additionally, Avici provides virtual USD and EUR accounts, making it easier to move money between traditional banking and crypto.

Pros:

-

Direct crypto spending: Use crypto directly at millions of Visa merchants worldwide.

-

No FX markups or hidden fees.

-

Fast setup: Supports Apple Pay and Google Pay.

-

Funds secured: Money locked in your own smart contract, not in a custodial account.

-

Ecosystem expansion: Lending, fiat on-ramps, and privacy tools coming soon.

-

Virtual bank accounts: Offers USD and EUR accounts, enabling fiat deposits automatically converted to stablecoins in your wallet.

Cons:

-

Rewards and cashback mechanisms not yet defined.

-

Some features (e.g., credit lines) still under development.

-

Regional support and delivery times may vary.

-

Smart contract management may be challenging for beginners.

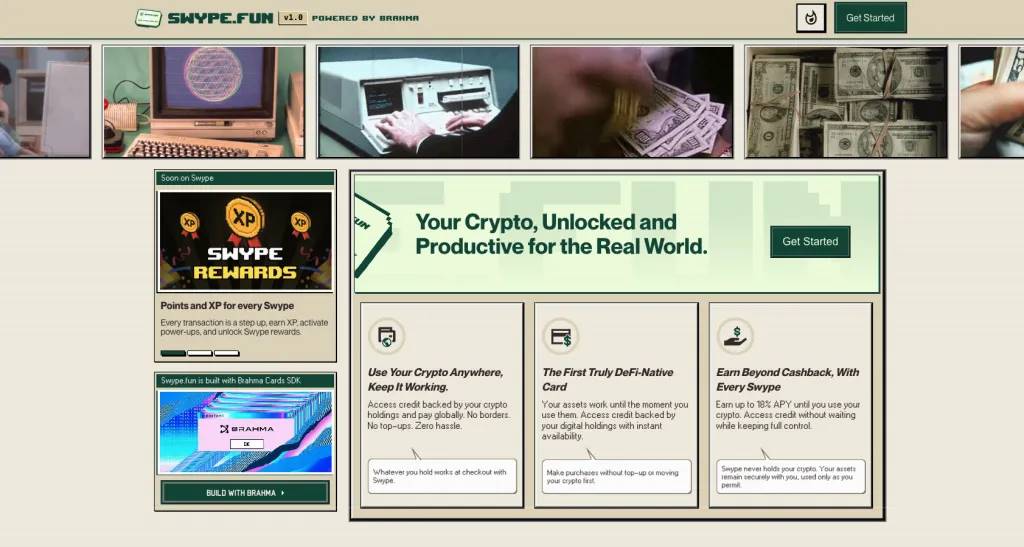

10. Swype by BrahmaFi

Swype is BrahmaFi’s first DeFi-native payment card, designed for everyday crypto users to keep their assets working for them. Without converting or topping up stablecoins, you can spend directly against on-chain collateral. It connects your wallet to lending protocols like Aave or Euler, letting you borrow or spend while keeping your crypto invested. Users can choose "Borrow Mode," where USDC is borrowed for each purchase, or "Spend Mode," using yield-generating stablecoins.

Pros:

-

Can spend without selling crypto—assets stay in DeFi earning yield.

-

Global usability: Runs on Visa network, supports Apple Pay and Google Pay.

-

Built on Ethereum Layer 2: Operates on Base and HyperEVM networks.

-

Advanced automation: Each transaction can trigger auto-yield or dollar-cost averaging logic.

Cons:

-

Fees: ~0.5% execution fee per transaction, plus 1% FX fee for non-USD payments.

-

Borrowing risk: Collateralized borrowing carries liquidation risk.

-

Not beginner-friendly: Requires understanding of DeFi concepts.

-

Gradual rollout: Subject to regional and protocol limitations.

Summary

Crypto payment cards have come a long way from early "top-up-and-go" models. Today, you can spend yield-bearing ETH, borrow against on-chain positions, or earn cashback on coffee without leaving your wallet.

Each option suits different users: EtherFi and BrahmaFi cater to deep DeFi users, Tria sits in the middle, while Bleap prioritizes simplicity. One thing is certain—as stablecoins and crypto expand, crypto payments are no longer a dream but increasingly part of daily life.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News