Delphi Digital Research Report: Who Issues Stablecoins Doesn't Matter—Controlling Distribution Rights Holds the Future

TechFlow Selected TechFlow Selected

Delphi Digital Research Report: Who Issues Stablecoins Doesn't Matter—Controlling Distribution Rights Holds the Future

Distribution rights are the moat.

Author: Simon

Translation: TechFlow

Tether and Circle's Moats Are Shrinking: Distribution Power Over Network Effects

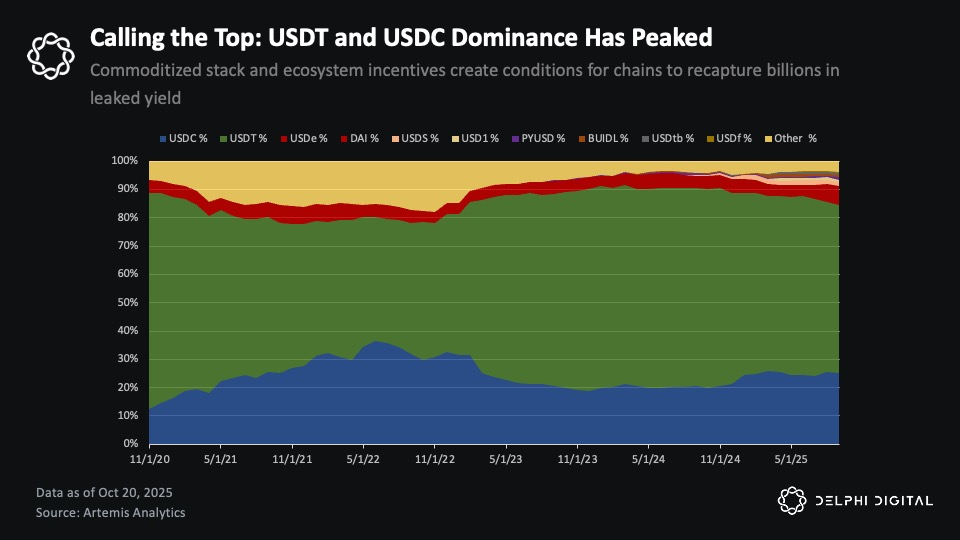

According to Delphi’s full report, “Apps and Chains, Not Issuers,” Tether and Circle have reached a relative peak in their dominance of the stablecoin market, despite continued growth in overall stablecoin supply. The total market cap of stablecoins is expected to surpass $1 trillion by 2027, but this growth will no longer be primarily driven by existing giants as in the previous cycle. Instead, an increasing share of the market will flow toward ecosystem-native stablecoins and white-label issuance strategies, as blockchains and applications gradually internalize yields and distribution power.

Currently, Tether and Circle account for approximately 85% of circulating stablecoin supply, totaling around $265 billion.

Background data: Tether is reportedly valued at $500 billion and is seeking $20 billion in financing, with a circulating supply of $185 billion. Circle, meanwhile, is valued at approximately $35 billion, with a circulating supply of $80 billion.

The network effects that once solidified their dominance are weakening, driven by three key forces:

-

Distribution power supersedes network effects

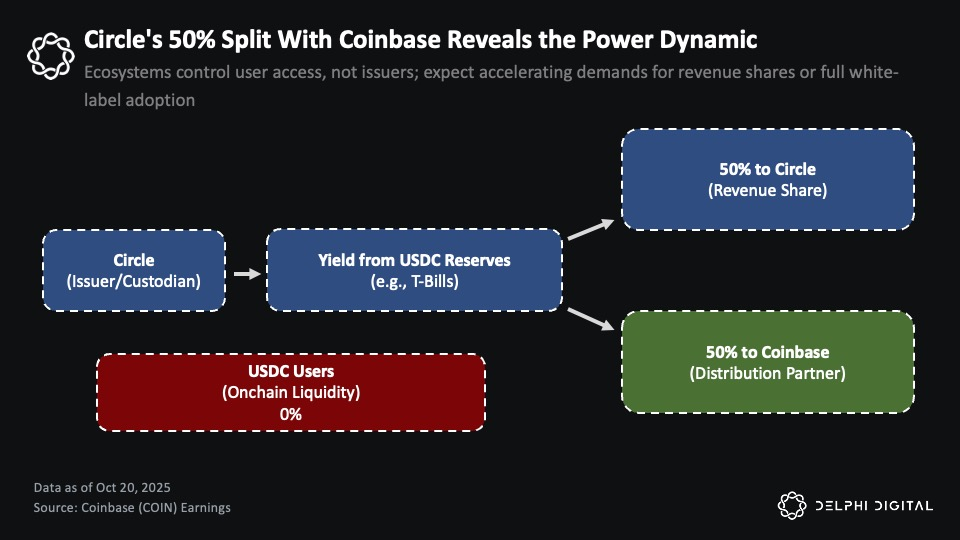

This is clearly demonstrated by Circle’s partnership with Coinbase. Coinbase receives 50% of the residual yield from Circle’s USDC reserves and captures all yield generated by USDC held on its platform. In 2024, Circle’s reserve income was approximately $1.7 billion, of which about $908 million went to Coinbase. This shows that distribution partners can capture the majority of stablecoin economics, prompting players with strong distribution capabilities to launch their own stablecoins rather than continue creating value for issuers.

-

Cross-chain infrastructure makes stablecoins more interchangeable

Advancements in cross-chain technology have nearly eliminated the cost of swapping between stablecoins. Standard bridge upgrades on major L2s, universal message passing protocols like LayerZero and Chainlink, and the widespread adoption of smart routing aggregators have made intra- and cross-chain stablecoin swaps efficient and user-friendly. Users can now rapidly switch stablecoins based on liquidity needs, significantly reducing the importance of which specific stablecoin is used.

-

Regulatory clarity lowers entry barriers

Legislation such as the GENIUS Act creates a unified framework for U.S.-based stablecoins, reducing risks for infrastructure providers holding stablecoins. Combined with an increasing number of white-label issuers lowering fixed issuance costs and the appeal of Treasury yields driving monetization of floating capital, the stablecoin stack is becoming commoditized and more interchangeable.

This commoditization undermines the structural advantages of incumbent giants. Any platform with strong distribution power can now internalize stablecoin economics without sharing yields externally. Leading players include fintech wallets, centralized exchanges, and increasingly, DeFi protocols.

DeFi is where this trend is most evident and impactful.

From Leakage to Revenue: DeFi’s Stablecoin Strategy

This shift is already emerging within the on-chain economy. Certain chains and apps—outperforming Circle and Tether in product-market fit (PMF), user stickiness, and distribution power—are adopting white-label stablecoin solutions, leveraging their existing user bases to capture yields that historically flowed to giants. For on-chain investors who long overlooked stablecoins, this dynamic presents real opportunities.

Hyperliquid: The First Major "Defection"

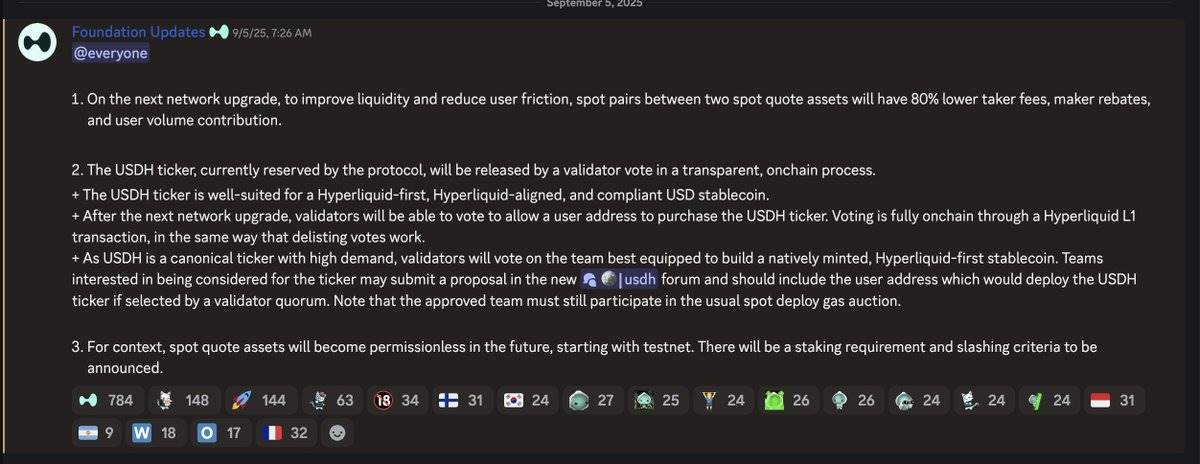

In DeFi, this trend first emerged with Hyperliquid. At one point, about $5.5 billion in USDC reserves were sitting idle under its USDH proposal, meaning up to $220 million in annual revenue could flow to Circle and Coinbase instead of being retained internally.

In an upcoming validator vote, Hyperliquid announced plans to launch a natively minted, Hyperliquid-centric stablecoin—a pivotal moment in the redistribution of stablecoin economic power.

For Circle, maintaining USDC as a primary trading pair on Hyperliquid has been highly profitable. They directly benefit from Hyperliquid’s explosive growth while contributing little in return. For Hyperliquid, this represents significant value leakage to a third party that contributed minimally—contradicting its “community-first, ecosystem-aligned” ethos.

Hyperliquid’s USDH selection process attracted bids from nearly all major white-label stablecoin providers, becoming one of the first large-scale competitive cases for application-layer stablecoin economics.

In the competitive USDH bidding process, major white-label issuers including Native Markets, Paxos, Frax, Agora, MakerDAO (Sky), Curve Finance, and Ethena Labs submitted proposals. This highlighted the immense value of distribution power in stablecoin economics.

In the end, Native Markets won with a proposal better aligned with Hyperliquid’s ecosystem incentives.

Native’s model is issuer-neutral and regulated, with its stablecoin backed by off-chain reserves managed by BlackRock and on-chain infrastructure provided by Superstate. Crucially, 50% of reserve yields will flow directly into Hyperliquid’s aid fund, while the remaining 50% will be reinvested to expand USDH liquidity.

Although USDH won’t replace USDC in the short term, this decision reflects a broader power shift: in DeFi, moats and leverage are shifting toward applications and ecosystems with sticky user bases and strong distribution power—not traditional issuers like Circle and Tether.

The Rise of White-Label Stablecoins: A New Chapter via SaaS Model

In recent months, this trend has accelerated as more ecosystems adopt the white-label stablecoin model. Ethena Labs’ “Stablecoin-as-a-Service” solution sits at the heart of this transformation, with on-chain players like Sui, MegaETH, and Jupiter either integrating or announcing plans to issue their own stablecoins using Ethena’s infrastructure.

Ethena’s model stands out because it returns yields directly to holders. With USDe, for example, yields come from basis trades. Though yields have compressed to about 5.5% as supply exceeds $12.5 billion, this still exceeds the ~4% yield on Treasuries and far outperforms the zero yield of holding USDT or USDC on-chain.

However, as other issuers enter the market and pass through Treasury yields directly, Ethena’s comparative advantage is weakening. Treasury-backed stablecoins offer comparable yields with lower execution risk, making them more attractive today. But if future rate cuts widen basis trade spreads, Ethena’s yield-generating model could regain appeal.

You might wonder how this model aligns with the GENIUS Act, which technically prohibits stablecoin issuers from paying yields directly to holders. Yet, the reality may not be so strict. The GENIUS Act does not explicitly ban third-party platforms or intermediaries from distributing rewards to stablecoin holders, even if funded by the issuer. This gray area remains undefined, but many believe the loophole persists.

Regardless of how regulatory frameworks evolve, DeFi has long operated permissionlessly at the edge of regulation—and likely will continue to do so. Underlying economic realities matter more than legal nuances.

The Stablecoin "Tax": A Widespread Value Drain Across Major Chains

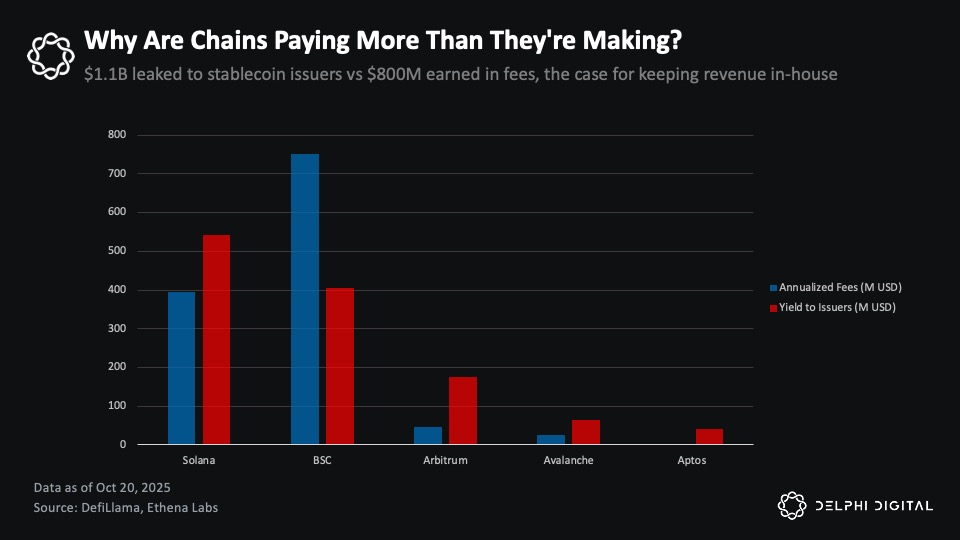

Over $30 billion in idle USDC and USDT sits on chains like Solana, BSC, Arbitrum, Avalanche, and Aptos, generating about $1.1 billion annually in yield for Circle and Tether (assuming a 4% reserve yield). This exceeds these chains’ total transaction fee revenue by roughly 40%. This imbalance highlights stablecoins as the largest under-monetized segment across L1s, L2s, and applications.

On Solana, BSC, Arbitrum, Avalanche, and Aptos, about $1.1 billion in annual yield flows to Circle and Tether, while total transaction fee revenue across these ecosystems amounts to only $800 million.

In other words, these ecosystems lose hundreds of millions annually due to stablecoin revenue leakage. If even a fraction of these earnings could be recaptured, it would fundamentally reshape their economic models, establishing a more stable, counter-cyclical revenue base beyond transaction fees alone.

Why haven’t these chains reclaimed this revenue? The answer: they absolutely can!

In fact, these chains have multiple pathways to recapture this value:

-

Negotiate revenue-sharing agreements directly with Circle or Tether, similar to Coinbase’s partnership model;

-

Follow Hyperliquid’s lead by launching competitive tenders via white-label stablecoin providers;

-

Partner with “Stablecoin-as-a-Service” platforms like Ethena to launch native ecosystem stablecoins.

Each approach involves trade-offs:

-

Partnering with incumbent stablecoin giants preserves familiarity, liquidity, and trust in USDC or USDT—assets tested through multiple market stress cycles;

-

Launching a native stablecoin offers greater control and higher revenue capture, but faces bootstrapping challenges and less battle-tested infrastructure.

Whichever path is chosen, the necessary infrastructure already exists—different chains will pursue strategies based on their priorities.

Redefining On-Chain Economics: Stablecoins as Revenue Engines

Stablecoins have the potential to become the largest revenue source for certain chains and applications. Currently, when a blockchain’s economy relies solely on transaction fees, its growth faces structural limits. Revenue increases only when users pay more—this misalignment suppresses user activity and hinders sustainable, low-cost ecosystem development.

MegaETH’s strategy clearly illustrates the current shift. By partnering with Ethena Labs, it launched USDm, a white-label stablecoin backed by USDtb—primarily supported by BUIDL, BlackRock’s on-chain short-term Treasury product. By internalizing USDm’s yield, MegaETH can run its sequencer at cost and redirect earnings toward “community-oriented projects.”

Jupiter, Solana’s leading decentralized exchange aggregator, is undergoing a similar strategic shift with its stablecoin JupUSD. Deeply integrated across its product suite—including collateral for Jupiter Perps (planned replacement of $750 million in stablecoins within JLP) and liquidity pools in Jupiter Lend—the protocol now reinvests stablecoin yields internally rather than sending 100% to external issuers. These earnings can fund user rewards, token buybacks, or new incentives—offering far greater ecosystem value than external payouts.

The core of this shift: revenue that once passively flowed to stablecoin issuers is now actively reclaimed and retained within apps and blockchains.

Apps vs Blockchains: Valuation Divergence and Rebalancing

As this trend unfolds, both blockchains and applications may generate more stable, durable revenue streams than currently seen. This income will no longer depend on cyclical “internet capital markets” or speculative on-chain behavior. Such a transformation could even help them achieve economic foundations matching their valuations.

Current valuation frameworks largely measure value based on total on-chain economic activity. In this model, on-chain fees equal total user costs, while on-chain revenue refers to the portion distributed to protocols or token holders via burns, treasury inflows, or similar mechanisms. Yet this framework has a clear flaw: it assumes value is naturally captured by the blockchain whenever economic activity occurs, though actual economic gains often flow elsewhere.

This model is beginning to change, led by applications. Take two standout apps this cycle—Pumpfun and Hyperliquid: they allocate nearly 100% of their revenue (not fees) to buy back their native tokens, yet trade at valuation multiples far below mainstream infrastructure layers. These apps generate transparent, real cashflows—not implied yields.

Today, most major public chains trade at revenue multiples in the hundreds or even thousands, while leading applications achieve higher revenues at much lower multiples.

Over the past year, Solana generated about $632 million in fees and $1.3 billion in revenue, with a market cap of ~$105 billion and a fully diluted valuation (FDV) of $118.5 billion. This implies a market cap-to-fee ratio of ~166x and a market cap-to-revenue ratio of ~80x—already among the more conservative valuations for major L1s. Many other public chains have FDV multiples in the thousands.

In contrast, Hyperliquid earned $667 million in revenue with an FDV of $38 billion—just 57x FDV/revenue, or 19x market cap/revenue. Pump.fun generated $724 million in revenue with an FDV multiple of just 5.6x and a market cap multiple of only 2x. These figures show that apps with strong product-market fit and distribution power are achieving substantial revenue at valuation multiples far below infrastructure layers.

This phenomenon clearly reveals an ongoing power shift: app valuations are increasingly based on actual generated revenue and ecosystem reinvestment, while public chains struggle to justify their high valuations. The L1 premium is eroding, and the direction ahead is clear.

If public chains fail to internalize more of the value flowing through their ecosystems, their lofty valuations will remain under pressure. White-labeled stablecoins may represent the first real attempt by chains to reclaim some of this value—transforming passive “monetary plumbing” into active revenue streams, giving L1s a chance to redefine their economic models.

The Coordination Challenge in On-Chain Competition: Why Some Chains Move Faster?

The ecosystem-aligned stablecoin transition is accelerating, but progress varies widely across chains depending on coordination capacity and urgency.

Take Sui: despite having a far less mature and developed ecosystem than Solana, Sui has moved exceptionally fast. It partnered with Ethena to launch sUSDe and USDi—both BUIDL-backed stablecoins, similar to those adopted by Jupiter and MegaETH. This wasn’t a grassroots movement from apps, but a chain-level strategic decision aimed at gaining early advantage in stablecoin economics and shaping user behavior before path dependency sets in. These products are expected to launch in Q4. Though not yet live, Sui has become the first major public chain to proactively implement this strategy.

In contrast, Solana faces a more urgent and painful situation. Currently, about $15 billion in stablecoins reside on Solana, over $10 billion of which is USDC. These generate roughly $500 million annually in interest income for Circle, much of which flows directly to Coinbase via revenue-sharing agreements.

Where does Coinbase use this money? To subsidize Base—one of Solana’s most direct competitors. Liquidity incentives, developer grants, ecosystem investments—all partially funded by stablecoin yields originating on Solana. In effect, Solana isn’t just losing revenue; it’s indirectly funding its biggest rival.

This issue has long drawn attention within the Solana ecosystem. Prominent voices like @0xMert_ from Helius have called for Solana to launch an ecosystem-aligned stablecoin, proposing frameworks such as allocating 50% of yields to SOL buybacks and burns. Leaders from stablecoin issuer Agora have also suggested similar alignment structures. Yet, compared to Sui’s proactive stance, these proposals have received little traction from Solana’s leadership.

The logic is simple: stablecoins have become commodities, especially under clearer regulatory guidance like the GENIUS Act. As long as a stablecoin remains pegged and liquid, users don’t care whether they hold USDC, JupUSD, or another compliant option. So why default to a stablecoin that funds your competitor?

Solana’s hesitation may stem partly from its desire to maintain “credible neutrality.” This is particularly important as the Solana Foundation seeks institutional recognition on par with Bitcoin and Ethereum. Attracting major issuers like BlackRock—whose endorsement could drive massive capital inflows and position Solana as a commoditized asset in traditional finance—may require Solana to maintain distance from internal ecosystem politics. Even supporting an ecosystem-aligned stablecoin could be seen as favoring certain participants, complicating its path toward this goal.

Additionally, Solana’s scale and complexity make decisions harder. With hundreds of protocols, thousands of developers, and tens of billions in total value locked (TVL), coordinating a transition away from USDC is far more difficult than on younger, less dependent chains like Sui. Yet this complexity itself reflects Solana’s maturity and depth—not a weakness.

But inaction carries a cost—and that cost grows over time.

The impact of path dependency intensifies daily. Every new user defaulting to USDC raises switching costs. Every protocol optimizing liquidity around USDC makes alternatives harder to launch. Technically, existing infrastructure allows this shift overnight—but the real hurdle is coordination.

Currently, Jupiter is leading the charge within Solana via JupUSD, explicitly committing to recycle yields back into the Solana ecosystem and deeply integrating it across its product stack. The question is: will other major Solana apps follow? Will applications like Pump(.)fun adopt similar strategies and internalize stablecoin economics? At what point will Solana need top-down intervention? Or will it allow ecosystem apps to harvest this value independently? While ceding stablecoin economics to apps may not be ideal from a chain perspective, it’s certainly better than leaking funds—or worse, funding competitors.

From a chain-wide or ecosystem-wide view, the key now is collective action: protocols must tilt liquidity toward aligned stablecoins, treasuries must make deliberate allocation decisions, developers must adjust default UX, and users must vote with their capital. The $500 million Solana currently subsidizes to Base each year won’t disappear because of a foundation directive. Only when enough participants decide to stop funding rivals will this capital truly stay within the ecosystem.

Conclusion: A New Direction for Stablecoin Economics

The next wave of stablecoin economics will be determined not by who issues the token, but by who controls distribution and who can coordinate faster.

Circle and Tether built massive businesses by issuing first and capturing liquidity. But as the stablecoin tech stack becomes commoditized, these moats are weakening. Cross-chain infrastructure makes stablecoins interchangeable, regulatory clarity lowers barriers, and white-label services reduce issuance costs. Most importantly, platforms with the strongest distribution, sticky users, and proven monetization models are beginning to internalize yields rather than pay third parties.

This shift is already underway. Hyperliquid is capturing $220 million annually previously flowing to Circle and Coinbase by switching to USDH. Jupiter is deeply integrating JupUSD across its entire product stack. MegaETH uses stablecoin income to run its sequencer at cost. Sui deployed ecosystem-aligned stablecoins with Ethena before path dependency set in. These are just early movers—now every chain losing hundreds of millions annually to leakage has a playbook to follow.

For investors, this shift offers a new lens to evaluate on-chain ecosystems. The question is no longer “How much on-chain activity is here?” but “Can they overcome coordination challenges, monetize floating capital, and capture stablecoin yields at scale?”

When public chains and apps internalize hundreds of millions in annual yield and reinvest it into buybacks, ecosystem incentives, or protocol revenue, market participants can directly price and invest in these yield flows through the platform’s native tokens. Protocols and apps that internalize this income will have stronger economic models, lower user costs, and tighter alignment with their communities. Those that fail to transform will keep paying the “stablecoin tax,” while their valuations continue to compress.

The most compelling investment opportunities are no longer holding equity in Circle or speculating on high-FDV stablecoin issuer tokens, but identifying which chains and apps can successfully complete this transition—turning passive infrastructure into active revenue drivers.

Distribution power is the moat. Those who control the flow of capital—not just those who provide infrastructure—will define the next era of stablecoin economics.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News