The $2 billion "game of probability": Is the prediction market approaching its "singularity" moment?

TechFlow Selected TechFlow Selected

The $2 billion "game of probability": Is the prediction market approaching its "singularity" moment?

Bitget Wallet Research will delve into the underlying logic and core value of prediction markets in this article, and provide an initial assessment of the key challenges they face and their development direction.

Author: Bitget Wallet Research

From casual banter about "whether Zelenskyy wears a suit" to global focal points like the U.S. election and Nobel Prize outcomes, prediction markets periodically flare into public attention. However, since Q3 2025, a real storm appears to be brewing:

-

In early September, industry giant Polymarket received regulatory approval from the U.S. CFTC, allowing its return to the U.S. market after three years;

-

In early October, NYSE parent ICE announced plans to invest up to $2 billion in Polymarket;

-

In mid-October, weekly trading volume in prediction markets hit a record high of $2 billion.

A convergence of massive capital inflows, regulatory greenlights, and market euphoria has been accompanied by rumors of a potential Polymarket token launch—where is this surge coming from? Is it merely another fleeting hype cycle, or the "value singularity" of an emerging financial sector? In this article, Bitget Wallet Research will deeply analyze the underlying logic and core value of prediction markets, and offer preliminary insights into their critical challenges and future direction.

1. From "Dispersed Knowledge" to "Duopoly": The Evolution of Prediction Markets

Prediction markets are not an invention of the crypto world; their theoretical foundation dates back as far as 1945. Economist Hayek famously argued that fragmented, localized "dispersed knowledge" can be effectively aggregated through market price mechanisms—a concept widely regarded as the intellectual cornerstone of prediction markets.

In 1988, the University of Iowa launched the first academic prediction platform—the Iowa Electronic Markets (IEM)—allowing users to trade futures contracts on real-world events such as presidential elections. Over the following decades, extensive research consistently confirmed that well-designed prediction markets often outperform traditional opinion polls in accuracy.

However, with the emergence of blockchain technology, this niche tool found fertile ground for large-scale adoption. Blockchain’s transparency, decentralization, and global accessibility provide an almost ideal infrastructure for prediction markets: smart contracts enable automated settlement, breaking down traditional financial barriers and enabling global participation, thereby vastly expanding the breadth and depth of information aggregation. As a result, prediction markets have gradually evolved from niche gambling tools into a powerful on-chain financial sector, becoming increasingly intertwined with the "crypto market."

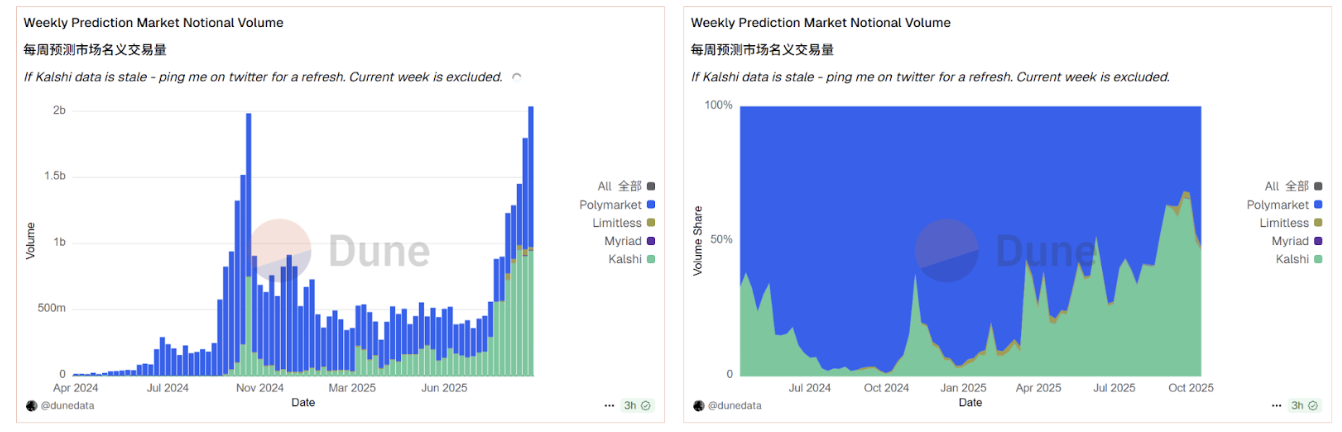

Data source: Dune

Data from Dune vividly illustrates this trend. On-chain data shows that today's crypto-based prediction markets are highly monopolized, dominated by a "duopoly": Polymarket and Kalshi now control over 95% of the market share. Fueled by both capital and favorable regulatory developments, the entire sector is being revitalized. In mid-October, weekly trading volume surpassed $2 billion, exceeding the previous peak before the 2024 U.S. election. During this explosive growth, Polymarket has temporarily gained a slight edge over Kalshi due to key regulatory breakthroughs and anticipated token launches, further solidifying its leading position.

2. "Event Derivatives": Beyond Gambling—Why Wall Street Is Betting

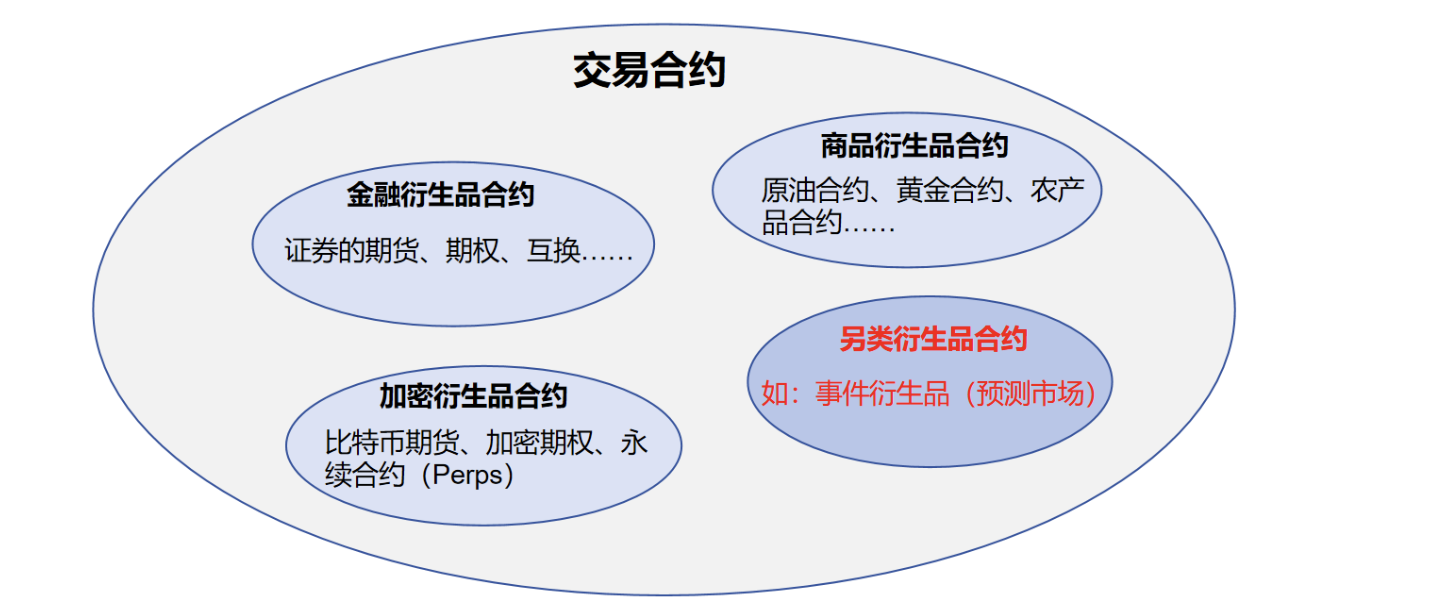

To understand why ICE is making a major investment in Polymarket, we must look beyond the "gambling" label and recognize its essence as a financial instrument. At its core, a prediction market is an alternative type of trading contract—an "event derivative."

This differs fundamentally from familiar "price derivatives" like futures and options. While the latter trade on the future prices of assets (e.g., oil, stocks), event derivatives trade on the future outcomes of specific "events" (e.g., elections, weather). Therefore, their contract prices do not reflect asset valuations but rather the market’s collective consensus on the "probability of an event occurring."

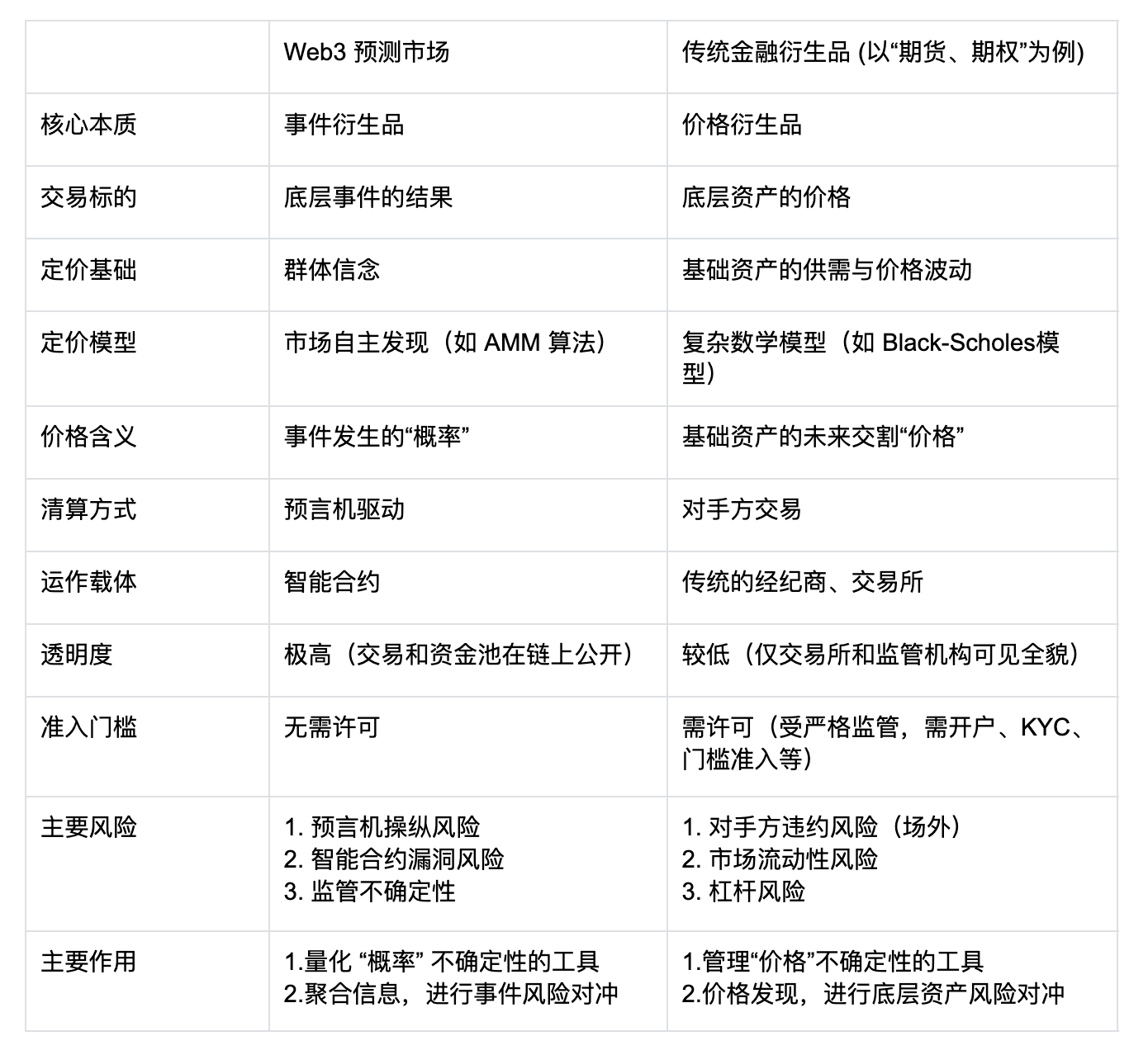

Web3 amplifies these differences. Traditional derivatives rely on complex mathematical models like Black-Scholes for pricing and are cleared through brokers and centralized exchanges. In contrast, on-chain prediction markets use smart contracts for automatic execution, oracle-driven settlement, and transparent on-chain pricing (e.g., AMM algorithms) and liquidity pools. This drastically lowers entry barriers but introduces new risks—such as oracle manipulation and smart contract vulnerabilities—contrasting sharply with traditional finance’s counterparty and leverage risks.

Comparison table: Prediction markets vs. traditional financial derivatives

This unique mechanism is precisely what attracts mainstream financial institutions. It offers three core values unattainable in traditional markets—this is where giants like ICE are truly placing their bets:

First, it acts as an advanced "information aggregator," reshaping the landscape of informational equality. In an era flooded with AI-generated content, misinformation, and filter bubbles, "truth" has become expensive and hard to discern. Prediction markets offer a radical solution: truth is not defined by authorities or media, but priced through a decentralized, economically incentivized market. It responds to growing distrust—especially among younger generations—in traditional information sources, offering a more honest alternative where people can literally "vote with money." More importantly, this mechanism goes beyond mere information aggregation by enabling real-time pricing of "truth," creating a valuable "real-time sentiment indicator" and achieving informational parity across dimensions.

Second, it turns "information asymmetry" itself into an asset, opening a new investment frontier. In traditional finance, investment targets are ownership instruments like stocks and bonds. Prediction markets create a completely new tradable asset—"event contracts." This allows investors to directly convert their "beliefs" or "information advantages" about the future into financial instruments. For professional analysts, quant funds, or even AI models, this represents an unprecedented profit dimension. They no longer need to indirectly express views via complex secondary market maneuvers (e.g., long/short positions on related stocks), but can directly "invest" in the event itself. The vast trading potential of this new asset class is a core attraction for exchange operators like ICE.

Third, it enables risk management for "everything," dramatically expanding the boundaries of finance. Traditional financial tools struggle to hedge uncertainties tied to specific "events." For example, how can a shipping company hedge against the geopolitical risk of a canal closure? How can a farmer hedge against climate risk—say, whether rainfall over the next 90 days falls below X millimeters? Prediction markets offer an elegant solution: they allow real-economy participants to transform abstract "event risks" into standardized, tradable contracts for precise hedging. This effectively opens a new "insurance" market for the real economy, providing a novel entry point for finance to empower real-world industries—its potential is far beyond imagination.

3. Hidden Risks Beneath the Boom: Three Core Challenges Facing Prediction Markets

Despite their compelling value proposition, prediction markets face three interlinked practical challenges on their path from "niche" to "mainstream"—challenges that collectively form the ceiling of industry development.

The first challenge: the contradiction between "truth" and the "adjudicator"—the oracle problem. Prediction markets are "outcome-based trading," but who determines the outcome? A decentralized on-chain contract ironically depends on a centralized "adjudicator"—the oracle. If an event is ambiguously defined (e.g., what counts as "wearing a suit") or if the oracle is manipulated or fails, the entire market’s trust foundation collapses instantly.

The second challenge: the contradiction between "breadth" and "depth"—the liquidity drought in long-tail markets. Current prosperity is heavily concentrated around headline events like the U.S. election. Yet the true value of prediction markets lies precisely in serving vertical, niche "long-tail" markets (e.g., agricultural or shipping risks). These markets naturally lack attention, leading to severe liquidity shortages, manipulable prices, and ultimately undermining their core functions of information aggregation and risk hedging.

The third challenge: the contradiction between "market makers" and "informed traders"—the "adverse selection" problem in AMMs. In traditional DeFi, AMM market makers (LPs) bet on volatility and earn trading fees. But in prediction markets, LPs are directly betting against "informed traders." Imagine a market on whether a new drug will be approved—when LPs face off against scientists with insider knowledge—it becomes a losing game of adverse selection. Over time, automated market makers struggle to survive, forcing platforms to rely on costly human market makers, severely limiting scalability.

Looking ahead, breakthroughs in the prediction market industry will inevitably revolve around these three challenges: more decentralized, manipulation-resistant oracle solutions (e.g., multi-party validation, AI-assisted verification) are the foundation of trust; incentivization mechanisms and superior algorithms (e.g., dynamic AMMs) to channel liquidity into long-tail markets are key to unlocking real-world utility; and more sophisticated market maker models (e.g., dynamic fees, asymmetric information insurance pools) will serve as engines for scale.

4. Conclusion: From "Probability Game" to "Financial Infrastructure"

The CFTC’s approval and ICE’s entry send a clear signal: prediction markets are transitioning from a marginalized "crypto toy" to a serious financial instrument. Centered on "aggregating truth" and built on the financial foundation of "event derivatives," they offer modern finance a new dimension of risk management. Admittedly, the journey from "probability game" to "financial infrastructure" is far from smooth. As discussed, the oracle dilemma around adjudication, the liquidity crisis in long-tail markets, and the market makers’ "adverse selection" problem are real challenges the industry must soberly address after the hype fades.

Nevertheless, a new era integrating information, finance, and technology has begun. When top-tier traditional capital starts betting heavily on this space, the impact will extend far beyond a weekly $2 billion trading volume. This may indeed be a true "singularity" moment—one signaling that a new asset class (the right to price "belief" and "the future") is being embraced by the mainstream financial system.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News