Which offers a better opportunity: prediction markets or memes, with $100 at stake?

TechFlow Selected TechFlow Selected

Which offers a better opportunity: prediction markets or memes, with $100 at stake?

Prediction market analysis wins, Memecoin survives by luck.

Author: Baheet

Translation: TechFlow

In a recent post, I posed a question: With only $100 in starting capital, which offers traders more opportunity—trading Memecoins (via the Pumpfun platform) or prediction markets?

Original tweet link: Click here

To me, it's like comparing a game of chess to playing a casino slot machine: both can yield substantial returns, but one rewards strategy while the other thrives on chaos and luck.

We'll now dive deeper into an analysis based on feasibility, risk, return, advantages, and the impact of capital.

Market Mechanisms

Prediction Markets

Prediction markets are structured forecasting tools; top platforms such as @Kalshi and @Polymarket allow users to trade based on the outcomes of specific, verifiable events—such as election results, economic data releases, or particular price movements.

The price of a contract on a prediction market reflects the market’s perceived probability of an event occurring. For example, a contract trading at $0.80 implies an 80% chance of a "yes" outcome.

Moreover, these markets are praised for their “wisdom of the crowd” effect, where collective participant knowledge converges to produce remarkably accurate forecasts—a feature unreplicable in the Memecoin space.

Prediction market contracts derive value from verifiable real-world events. This foundation provides a degree of legitimacy and is a core distinction from Memecoins.

Memecoin Trading on Pumpfun

The Pumpfun platform allows users to quickly create and trade new tokens via bonding curves, with prices rising rapidly as more buyers enter. This low barrier attracts a flood of untested new meme projects.

A typical Memecoin lifecycle follows a predictable yet chaotic pattern. After reaching a certain market cap, the token is often deployed to a decentralized exchange (like @Raydium), usually experiencing an initial "pump" phase.

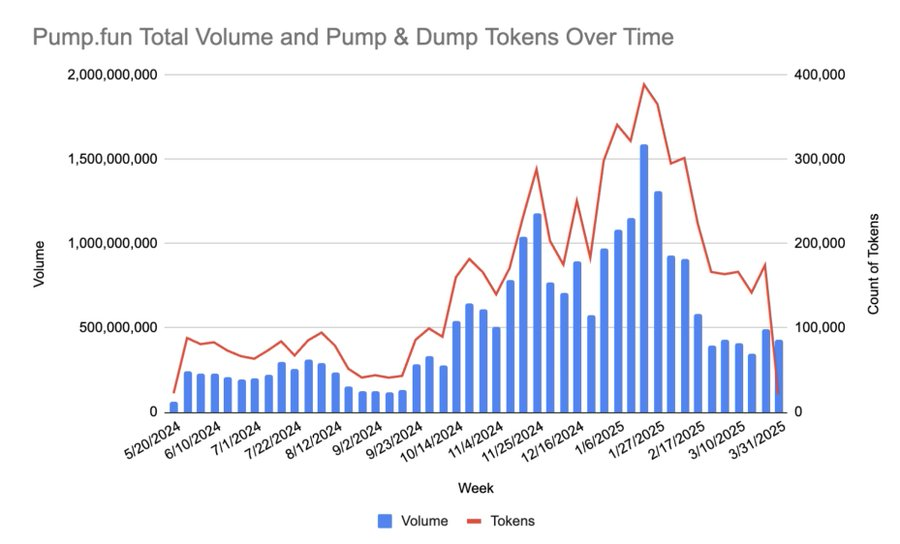

In fact, data from May 2025 shows that the majority of tokens fail shortly after launch.

A report from @Solidus_Labs found that 98.6% of the seven million tokens launched on Pumpfun were classified as "rug pulls" or manipulative schemes.

Accessibility

Both markets are highly accessible to small capital with almost no entry barriers.

On Polymarket, as little as $10 allows participation—for instance, betting on elections or cryptocurrency price events.

With $50–$100, you could even diversify across 5–10 events and optimize bet sizing through better strategy.

Pumpfun is even cheaper to enter: creating a Memecoin costs about 0.02 SOL (around $3–$4 at current prices), and purchases can be made using just spare change in your Solana wallet.

Initial trading typically occurs at lower market caps—around $4,000—so $50–$100 can secure a significant early position.

Besides network fees, there are no formal minimums, making it ideal for "reckless trading."

Risk, Return, and Reality

Prediction markets are known for quantifiable risk; risks are clear and tied directly to event outcomes. While a trader might lose their entire investment on a single contract, the odds and event criteria are transparent from the start.

Potential returns through well-researched predictions can be very high. While not as flashy as Memecoin gains, these returns are generally more sustainable and based on informed decisions.

Common risks in prediction markets include misjudging probabilities or encountering insufficient market liquidity. However, if bets are limited to a small portion of one’s portfolio, total ruin is manageable and rare.

For most traders, a diversified prediction market portfolio offers a more structured way to engage in high-risk trading with more predictable outcomes.

Below is a high-quality article from @Predictifybot on how to diversify a prediction market portfolio:

Original tweet link: Click here

Finally, regulatory oversight—such as from the U.S. Commodity Futures Trading Commission (CFTC), which regulates Kalshi—adds a layer of supervision and protection, reducing risks of fraud and manipulation.

On the other hand, the Memecoin ecosystem is rife with scams, manipulation, and extreme price volatility. Projects may "rug pull," with developers withdrawing liquidity, rendering investors' tokens worthless.

Memecoin value is driven by hype and social sentiment rather than any fundamental utility, making it highly vulnerable to social media trends and "insider" trading.

While many hope for massive, life-changing returns, the reality is such success is extremely rare. Most participants either lose money or earn negligible gains.

What Can $100 Do?

Effectively deploying small capital—such as $100—on both prediction markets and Pumpfun requires highly specialized and fundamentally different strategies.

I believe the best approach in prediction markets is identifying mispriced events due to information asymmetry—but this concept is nearly impossible to apply to Pumpfun Memecoins.

Prediction Markets: Exploiting Information Asymmetry

$100 in capital cannot influence prediction markets, so your strategy must emulate that of a shrewd analyst. Your edge comes from uncovering information overlooked by the market collectively.

How it works:

-

Identify information gaps: Market odds are based on the aggregated knowledge of all traders. Low-volume markets may lack enough participants to function efficiently, giving small-capital traders an advantage.

-

Leverage overlooked expertise: If you possess niche knowledge not widely held in the market—such as deep insights into local elections, specific technological developments, obscure legal cases, or sports outcomes—you can exploit this informational edge.

-

Focus on low-liquidity markets: Large, liquid markets are typically more efficient, but small-capital traders can target smaller, less-traded markets where odds may not yet reflect all available information.

As a small-capital trader, your role is that of an information arbitrageur—the goal being to identify market inefficiencies caused by incomplete information.

Pumpfun: Survival of the Fittest

The concept of information asymmetry on Pumpfun is entirely different and far harder to exploit. It involves less rational odds and more insider access.

How it works:

-

Insider information is key: On Pumpfun, information asymmetry usually disadvantages ordinary traders. Memecoin creators have full information and multiple tools to manipulate trading.

-

Social and emotional leverage: The most powerful "information" in this market is the viral potential within crypto communities. Founders control initial marketing pushes, often relying on influencers and social media tactics to generate FOMO.

-

Information asymmetry: There is an edge here—if you're part of Solana meme communities or catch a token early before its surge. But this asymmetry is fleeting: pumps last minutes to hours, and 97% of traders make less than $1,000.

Unlike prediction markets, there are no real probabilities—only crowd-driven FOMO.

The strategy is simple: get lucky or get out! With only $100 allocated to Memecoins, your strategy looks like this:

-

Get in early: DYOR (do your own research) and jump quickly on new tokens, hoping to ride the initial momentum.

-

Use specialized tools: Many traders use bots to monitor listings and market activity of new tokens, gaining a few seconds’ advantage.

-

Manage risk carefully: Watch price charts closely, spot signs of "dev dumping," and be ready to sell instantly.

On Pumpfun, your $100 isn't used to exploit information gaps—it's thrown into a market where information is weaponized by more powerful players. Your success depends less on analysis and more on luck, timing, and avoiding becoming a victim of manipulative scams.

Final Thoughts

Ultimately, choosing between prediction markets and Memecoin trading on Pumpfun comes down to a trader’s risk tolerance.

While both offer the potential for high returns, they achieve this through fundamentally different mechanisms.

Prediction markets—with verifiable outcomes and potential regulatory oversight—offer a more structured, information-based approach to high-risk speculation.

Memecoin trading, by contrast, resembles gambling in a high-stakes, unregulated casino: while massive profits are possible, the risks of losses due to scams and extreme volatility are enormous.

Below is an excellent thread from @tradefoxintern discussing why prediction markets will replace Memecoins:

Original tweet link: Click here

Therefore, for those who prefer a calculated, research-driven approach, prediction markets are the clear choice.

For those seeking huge, lottery-like payouts and willing to navigate through thousands of scams, Pumpfun remains an option.

That’s it!

John Wang: Mark my words, prediction markets will be 10x bigger than Memecoins!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News