Regulation, the highest barrier prediction markets must overcome

TechFlow Selected TechFlow Selected

Regulation, the highest barrier prediction markets must overcome

Kalshi's trading volume surpassing Polymarket proves that compliance is not a constraint, but a core competitive factor.

Author: c4lvin, Four Pillars

Translation: Luffy, Foresight News

TL;DR

-

The development of prediction markets has made compliance a key competitive advantage, exemplified by Kalshi's rapid rise. Polymarket was blocked from the U.S. market due to sanctions from the Commodity Futures Trading Commission (CFTC), while Kalshi, holding an official license, gained market leadership through aggressive marketing and expansion.

-

Fragmented global regulatory environments constrain the growth of prediction markets, with conservative stances in Asian countries being a major obstacle. While signs of regulatory relaxation have emerged under the Trump administration in the United States, countries like South Korea, Singapore, and Thailand either classify prediction markets as illegal gambling or outright block access.

-

Decentralization and demonstrating the social value of prediction markets may be key to overcoming regulatory hurdles in conservative jurisdictions. By leveraging inter-subjective decision protocols such as EigenLayer to reduce manipulation risks, and emphasizing their utility as tools for academic research and economic hedging, prediction markets can clearly differentiate themselves from gambling.

Regulation Reshapes the Prediction Market Landscape

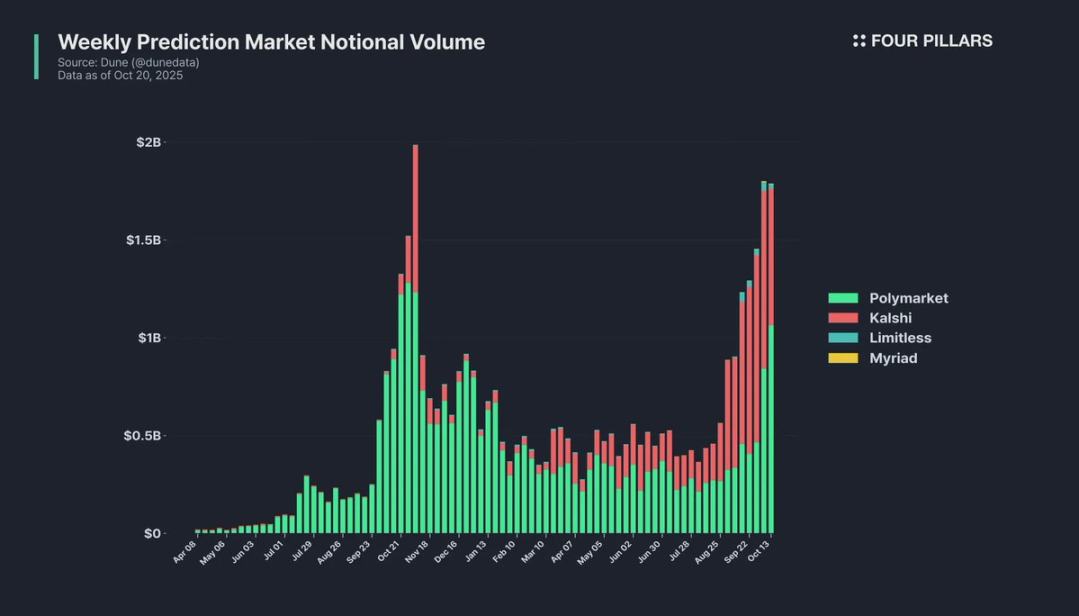

Source: Dune

One of the most notable changes in the prediction market ecosystem this year is Kalshi’s rapid ascent. As of March this year, Kalshi’s trading volume was only about one-tenth that of Polymarket. However, after August, its volume surpassed Polymarket, catapulting it into the market leadership position.

An entire episode of "South Park" focused on people trading on Kalshi

The immediate catalyst behind Kalshi’s growth was its feature in the popular animated series “South Park.” In September this year, an episode satirizing the prediction market industry prominently showcased Kalshi, including scenes of characters using the Kalshi mobile app. Following the episode’s release, Kalshi’s market share surged significantly, confirming that public attention can translate into tangible user growth.

However, the fundamental reason such aggressive marketing was possible lies in Kalshi’s regulatory compliance status. While Polymarket is prohibited from serving U.S. users due to CFTC sanctions, Kalshi, holding a valid license, enjoys exclusive access to the U.S. market. Here, compliance is no longer merely a means of avoiding legal risk—it becomes a strategic asset enabling bold marketing and partnerships.

Kalshi’s case demonstrates that in prediction markets, compliance is not a constraint but a core competitive element. Yet discussions within the community about regulation remain limited. This article aims to analyze the complex regulatory environment surrounding prediction markets and the efforts required to navigate it.

Prediction Market Regulation and Mainstream Platform Strategies

Current Regulatory Framework for Prediction Markets

In the United States, prediction markets are regulated by the CFTC and must comply with the Commodity Exchange Act. The services offered by prediction markets are legally classified as event contracts or binary options—essentially derivatives whose payout depends on whether a specified event occurs, resulting in either a fixed payout or zero.

Current prediction market exchanges must meet multi-dimensional compliance requirements:

-

Compliance with the Commodity Exchange Act: Requires fair governance mechanisms, oversight systems, and anti-fraud measures. All exchanges must submit detailed rulebooks for approval to ensure core principles are implemented.

-

Event type restrictions: Markets involving terrorism, assassinations, war, gambling, or illegal activities are prohibited; contracts related to economic indicators or weather are generally permitted.

-

Regulatory Oversight Committee: Must establish a committee composed of individuals without criminal records, responsible for supervising regulatory procedures, personnel management, and annual reporting.

-

Transaction data storage: Per CFTC rules, all transaction data must be stored in an accessible database for no less than five years.

-

Prevention of market manipulation: The Commodity Exchange Act strictly prohibits non-competitive trading, wash trading, spoofing, and front-running. Platforms must build sophisticated systems to detect and prevent such activities.

Additionally, all prediction market exchanges must establish disciplinary and appeals committees to ensure procedural fairness, and must implement a market outcome determination mechanism specifying how results are confirmed.

Kalshi and Polymarket have adopted different approaches to result resolution:

-

Kalshi uses a centralized model: Its own Results Review Committee makes final determinations.

-

Polymarket uses a decentralized model: It employs a system called UMA Oracle with optimistic adjudication—if no dispute arises during a 2-hour challenge period, the proposed result automatically takes effect; if challenged, UMA token holders vote to resolve it.

Regulatory Gray Areas

Classifying prediction markets as gambling leads to ambiguous regulatory boundaries. The conflict between the Unlawful Internet Gambling Enforcement Act (UIGEA) and CFTC regulation is particularly pronounced: although UIGEA excludes CFTC-regulated activities from its scope, this creates room for regulatory arbitrage, allowing platforms to potentially circumvent state-level gambling laws and taxes.

In October 2025, the Pennsylvania Gaming Control Board warned Congress about conflicts between federal derivative laws and state gambling regulations, highlighting potential risks arising from federal-state regulatory clashes.

The regulatory conflict is even sharper in sports and entertainment-related markets. In January 2025, after Kalshi launched its sports prediction markets, six states—Nevada, New Jersey, Maryland, among others—issued cease-and-desist orders, claiming Kalshi’s services constituted unlicensed gambling violating state laws. Kalshi responded by invoking federal preemption, asserting federal regulatory authority overrides state-level regulation.

Regulatory Challenges Facing Prediction Market Platforms

Polymarket

Source: Cointelegraph

After launching in June 2020, Polymarket experienced rapid growth. However, in January 2022, it received a severe penalty from the CFTC: fined $1.4 million for operating without registration as an exchange and banned from serving U.S. users. For the next two years, Polymarket remained accessible only outside the U.S.

The CFTC ruled that Polymarket’s services constituted swap contracts under the Commodity Exchange Act, which can only be traded on registered designated contract markets (DCMs).

In November 2024, the Federal Bureau of Investigation (FBI) raided CEO Shayne Coplan’s home, suspecting Polymarket continued serving U.S. users. However, in July 2025, the situation reversed when Polymarket acquired QCX LLC, a derivatives exchange holding a CFTC license, thereby obtaining both DCM and Derivatives Clearing Organization (DCO) licenses. In September 2025, Polymarket received a no-action letter from the CFTC regarding “swap data reporting and recordkeeping requirements,” officially re-entering the U.S. market.

Kalshi

Unlike Polymarket, Kalshi chose full regulatory compliance from inception. On November 5, 2020, Kalshi became the first platform in U.S. history solely dedicated to event contract trading to receive CFTC approval for DCM status.

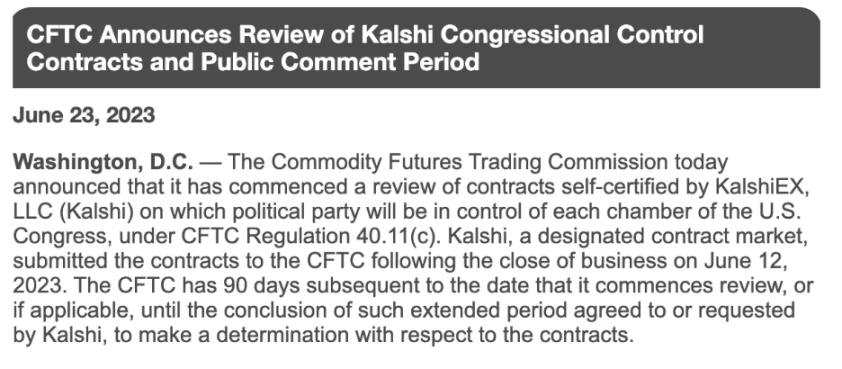

Source: CFTC

However, in June 2023, after Kalshi self-certified and launched markets related to "control of Congress," the CFTC objected, arguing such markets amounted to betting on contests, violated state laws, and were contrary to the public interest. Kalshi filed a lawsuit in federal court in November 2023 and won in September 2024. After the CFTC dropped its appeal, Kalshi fully overcame this regulatory hurdle.

Following the victory, Kalshi aggressively expanded its sports prediction markets: in January 2025, it launched NFL, NHL, NBA, and NCAA-related markets across all 50 U.S. states. During the "March Madness" college basketball tournament alone, trading volume exceeded $500 million. Subsequently, six states—including Nevada and New Jersey—issued cease-and-desist orders again, but Kalshi invoked federal preemption and received support from a New Jersey federal court in May 2025.

Other Platform Cases

Besides Polymarket and Kalshi, several other prediction market exchanges have faced U.S. government regulation:

-

PredictIt: Originated in 2014 as a research project at Victoria University of Wellington, New Zealand. It previously held a CFTC no-action letter but operated under strict limits ($850 maximum per contract, capped at 5,000 traders per contract). In August 2022, the CFTC withdrew the no-action letter and demanded closure. After prolonged litigation, PredictIt won its case in July 2025 and obtained a DCM license in September 2025, becoming a compliant derivatives exchange.

-

Crypto.com: After obtaining a margin derivatives license in September 2025, partnered with Underdog to launch sports prediction markets in 16 states, though facing state-level challenges (including losing a case in Nevada courts).

-

Railbird: An emerging prediction market platform that received a no-action letter in August 2025, permitting operations within a narrow B2B risk hedging scope.

Relaxed Regulatory Climate in U.S. Prediction Markets

Although the U.S. government previously imposed extremely strict standards on prediction market platforms, the regulatory environment underwent a fundamental shift under the Trump administration:

-

Trump himself posted Polymarket odds on Truth Social, signaling personal interest;

-

Donald Trump Jr. serves as a paid advisor to Kalshi and is also a board member and investor in Polymarket, with his firm 1789 Capital investing tens of millions of dollars in Polymarket;

-

On September 29, 2025, SEC Chair Paul Atkins and acting CFTC Chair Caroline Pham announced a "comprehensive coordination plan," expressing intent to cross-jurisdictionally review opportunities for event contracts and close regulatory gaps.

Fragmented Global Regulatory Environment

While prediction markets are gradually becoming legalized in the United States, other regions are moving in the opposite direction. This regulatory fragmentation poses serious challenges for global platforms, with conservative attitudes in Asian markets particularly constraining global expansion.

Attitudes Toward Prediction Markets in Asian Countries

South Korea: Strictly prohibited, classified as illegal gambling

South Korean regulators take an extremely conservative stance toward prediction market platforms: all gambling markets are regulated under the National Sports Promotion Act, with only Sports Toto operated by the Korea Sports Promotion Foundation considered legal. All other gambling websites are illegal, and both users and operators may face penalties.

The legal Sports Toto allows betting only on a very limited set of sporting events, under strict government oversight, with a maximum bet limit of 100,000 KRW (approximately $70 USD).

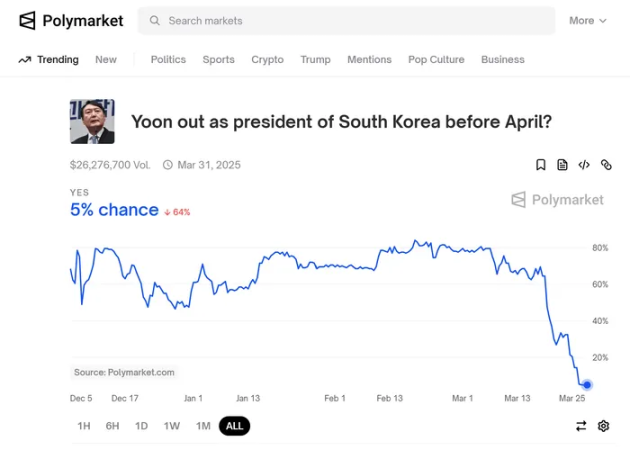

Source: South Korean media "Maeil Business Newspaper"

During the impeachment crisis of former President Yoon Suk-yeol in early 2025, Polymarket saw a surge in contracts related to South Korean political events, drawing widespread public and media attention. South Korean media uniformly labeled Polymarket as an illegal private Toto and emphasized that under current law, South Korean citizens participating in prediction market betting could be prosecuted for gambling offenses.

Singapore: Platform blocked, users heavily penalized

Singapore also classifies prediction markets as gambling. In January 2025, the Singaporean government took strong action, completely blocking Polymarket and categorizing it as an unlicensed online gambling operator under the Gambling Control Act. Under this law, users of unlicensed gambling platforms face fines up to 10,000 SGD (approximately $7,200 USD) and up to six months in prison.

Thailand: Blocked due to cryptocurrency usage

In January 2025, Thailand’s Technology Crime Suppression Division announced plans to block Polymarket at a press conference, citing its use of cryptocurrency as a violation of gambling laws.

Clearly, Asian countries maintain highly conservative positions toward prediction markets. Given Asia’s significant share of the cryptocurrency market, this will remain a key constraint on future platform expansion.

Regulatory Cases in Western Countries

France: Polymarket was blocked in November 2024. The French National Gaming Authority ruled that Polymarket provided online gambling services without a French license and explicitly stated, “even when using cryptocurrency, gambling activities remain illegal in France.”

Canada: Prohibited due to a 2017 ban on retail investors trading binary options with maturities under 30 days. In April 2025, the Ontario Securities Commission reached a settlement with Polymarket-affiliated companies, with Polymarket admitting violations in Canada and agreeing to pay a 200,000 CAD (approximately $150,000 USD) fine.

United Kingdom: Relatively open. The Financial Conduct Authority is discussing with Robinhood the possibility of introducing prediction markets to the UK, with Robinhood stating demand for prediction market products is strongest in the UK and Europe.

Conclusion: The Future of Prediction Markets – Breaking Regulatory Barriers Through Decentralization

In summary, the global regulatory environment for prediction markets is highly complex due to regional policy differences and divergent legal interpretations. This fragmentation not only restricts global user expansion for prediction market platforms but also impacts their operational stability.

Although decentralized prediction market protocols attempt to enable borderless trading via blockchain technology, national regulators still prioritize domestic laws and restrict platform operations and user access through measures such as “domain blocking” and “direct sanctions against operators.”

Currently, while platforms like Polymarket and Kalshi have successfully penetrated the U.S. market, the potential of global markets—especially in Asia—cannot be overlooked. Without access to Asian markets, which account for a significant portion of cryptocurrency trading volume, true globalization of prediction markets remains out of reach.

To achieve global expansion, prediction markets must address the root causes of strict regulation and may consider piloting within regulatory sandboxes.

The main reasons prediction markets currently face strict regulation include:

-

Market manipulation risk: Most current prediction markets suffer from this issue—real-time disclosure of voting results may trigger herd behavior, allowing large capital holders to dominate initial trends. Additionally, if outcome determination is controlled by a small group or lacks transparency, manipulation risks become unavoidable.

-

Potential distortion of public opinion: If large injections of capital can manipulate probabilities, prediction markets might distort public sentiment and indirectly influence real-world outcomes—particularly sensitive in political and social events.

-

Blurred line with gambling: Since prediction markets fundamentally involve betting on event probabilities, many regulators classify them directly as gambling.

Notably, aside from the blurred line with gambling, the first two issues can be partially addressed through decentralization. For example, decentralized oracle systems using inter-subjective decision protocols like EigenLayer can greatly enhance transparency and resistance to manipulation. Economic incentives encouraging multiple validators to truthfully report outcomes, combined with penalty mechanisms against malicious actors, can significantly reduce manipulation risks. Although existing governance-based resolution mechanisms like UMA remain subject to fairness concerns, EigenLayer offers more equitable solutions to suspected manipulation through features like “challenge and penalty mechanisms” and “forkable token systems.”

The gambling boundary issue requires long-term strategic handling and cannot be solved by technology alone. It requires demonstrating the social value of prediction markets. For instance, academic prediction markets such as the Iowa Electronic Markets and the Good Judgment Project have already shown higher accuracy than traditional polls in political and economic forecasting. Building on these successes, the core message must be consistently communicated: prediction markets are not mere gambling but information aggregation mechanisms harnessing collective intelligence.

Since the emergence of Chicago grain futures in 1848, derivatives markets have steadily expanded from agricultural commodities to financial assets. In the era of social media, treating personal opinions and forecasts as a new asset class and launching event contracts based on them may represent a natural evolution of markets. As Kalshi co-founder Mansour put it, prediction markets democratize hedging—they offer individual investors and small businesses accessible, low-cost tools for risk mitigation.

The future of prediction markets depends on constructive dialogue and collaboration among regulators, platform operators, and technology developers. What we need is not unconditional prohibition, but balanced regulatory frameworks—ones that embrace innovation while protecting consumers. In the long run, countries that completely ban prediction markets will fall behind those nurturing them under compliant frameworks, showing clear disparities in information efficiency and financial innovation.

We hope prediction markets can shed their label as mere speculative tools and evolve into core infrastructure for managing uncertainty and leveraging collective intelligence in the modern economy.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News