McKinsey 2025 Global Payments Report: Development Insights Across Multiple Payment Tracks

TechFlow Selected TechFlow Selected

McKinsey 2025 Global Payments Report: Development Insights Across Multiple Payment Tracks

The way money flows is becoming as critical as the amount of money.

Author: Will A Wang

The payments industry in 2025 stands at a turning point. The once-universal pursuit of efficiency has evolved into competition among multiple market systems, each with its own unique philosophy, capabilities, and constraints. Some systems prioritize control and interoperability through centralized infrastructure; others emphasize decentralization, programmability, and private rails. Still others embed payment functionality within platforms, devices, and networks that were traditionally non-financial.

How money flows is becoming as critical as how much money moves. Whether it's wage disbursements in Southeast Asia, inter-corporate settlements in Europe, or retail checkouts in Latin America, the design choices made today are shaping the payments landscape for the next decade—and determining who will lead, who will follow, and who will fall behind.

The global financial system is increasingly influenced by non-financial factors such as tariffs, data governance rules, energy constraints, and national security priorities. The growing fragmentation in payments reflects a broader evolution of the financial system into a regional mosaic defined by divergent standards, timelines, currencies, and trust anchors.

Against this backdrop, payments remain the most valuable segment of financial services, generating $2.5 trillion in revenue from $20 million billion in value flows (a 0.125% take rate), supporting 36 trillion transactions globally.

Thus, integrating stablecoins/tokenized money into the broader global payments map—or from a fintech perspective, determining who will integrate and how to integrate these geopolitically fragmented systems, and how to position oneself according to competitive advantages for the next era of payments—has become a pressing question for all market participants.

The McKinsey Global Payments Report 2025 provides an in-depth analysis of the rise of diverse payment rails, the impact of digital assets, and the transformative power of artificial intelligence, offering a roadmap for success in a rapidly evolving global payments ecosystem. It identifies key elements required to remain competitive amid constant change. Based on McKinsey’s “Global Payments Map,” which covers data from 50 countries and over 20 payment methods accounting for 95% of global GDP, the report is structured in three parts:

-

A foundational forecast of industry growth through 2029, analyzing how economic volatility and policy shifts could lead to significant divergence in margins and revenue structures. Key consideration: Can new revenue streams emerge from integrating multiple payment rails? This is a crucial driver of future payment development.

-

The major forces reshaping the payments landscape, including AI-native operations and monetization of AI agents, emerging models of programmable payment liquidity, and regulated digital currencies. Key consideration: How will these new forces transform existing models?

-

What payment operators should focus on during this transition, centered on agility, architecture, and trust. Key consideration: How can value be captured?

1. Payment Revenues in the New Economic Era

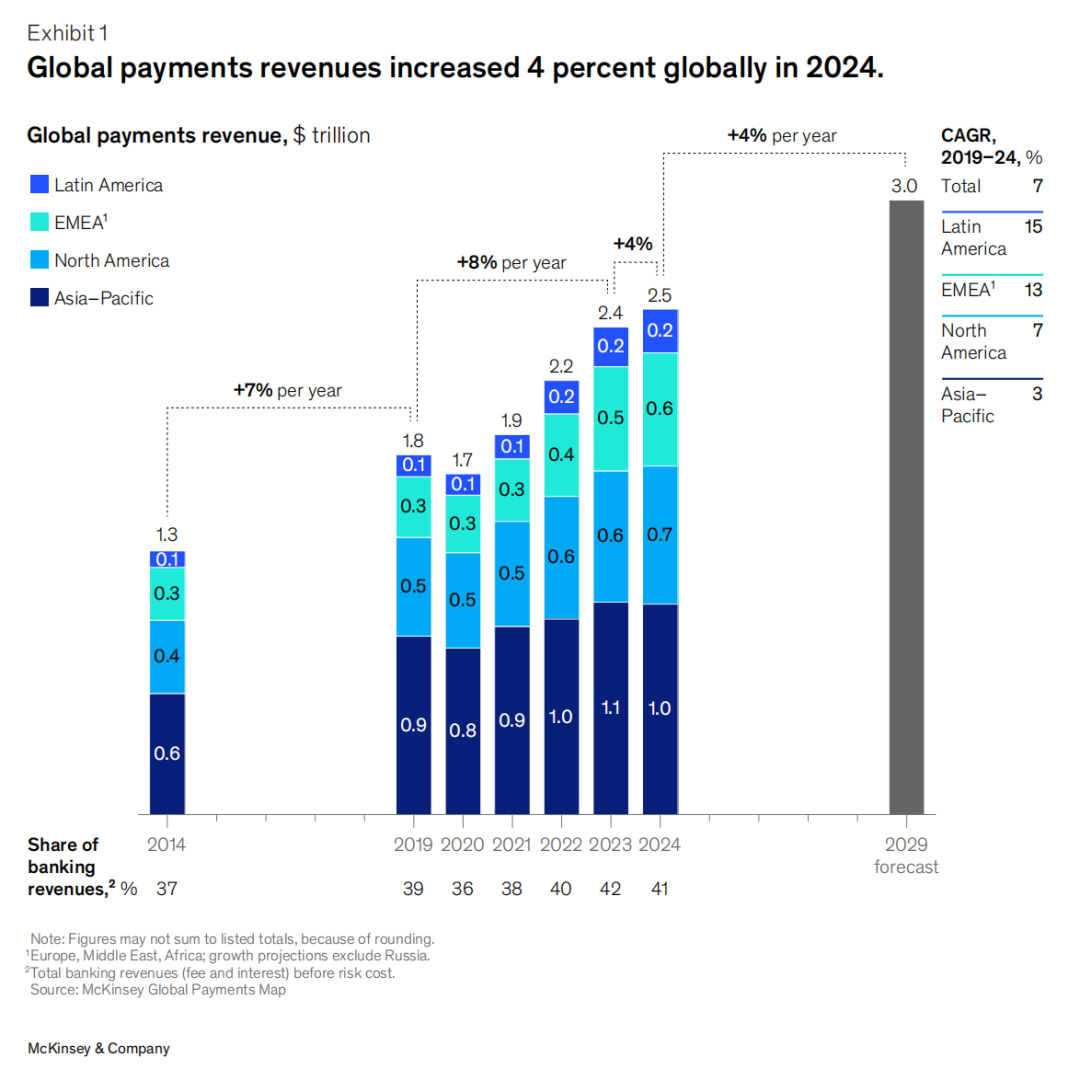

Between 2019 and 2024, global payment revenues grew at an average annual rate of 7%. Driven by rising interest rates, interest income accounted for 46% of total revenue in 2024. However, growth slowed to 4% that year, significantly lower than the 12% recorded in 2023. Contributing factors include peak interest rates, weakening macroeconomic conditions, structural expansion of low-yield payment methods, and ongoing pressure on interchange fees.

Regionally, Latin America grew by 11%, EMEA (Europe, Middle East, Africa) and North America by 8% and 5% respectively, while APAC (Asia-Pacific) declined by 1%. Nevertheless, payments remain the most valuable sub-sector in finance, with an average return on equity of 18.9% in 2024—some institutions exceeding 100%.

However, as interest rates peak and reverse across multiple countries and deposit behaviors shift, net interest income is expected to grow by only about 2% annually through 2029, absent major shocks. Meanwhile, consumers are increasingly favoring low-cost methods like direct account transfers and digital wallets, slowing transaction-based revenue growth. Persistent pricing pressures—especially within card ecosystems—tighter regulation, and the rise of platformized payment experiences are squeezing fee-based models. As a result, we project average annual revenue growth to remain around 4% through 2029, potentially dropping to 3% under global disruptions or rising to 6% if productivity gains accelerate. At a 4% growth rate, the total market size will reach $3.0 trillion by 2029.

1.1 Global Payment Trends

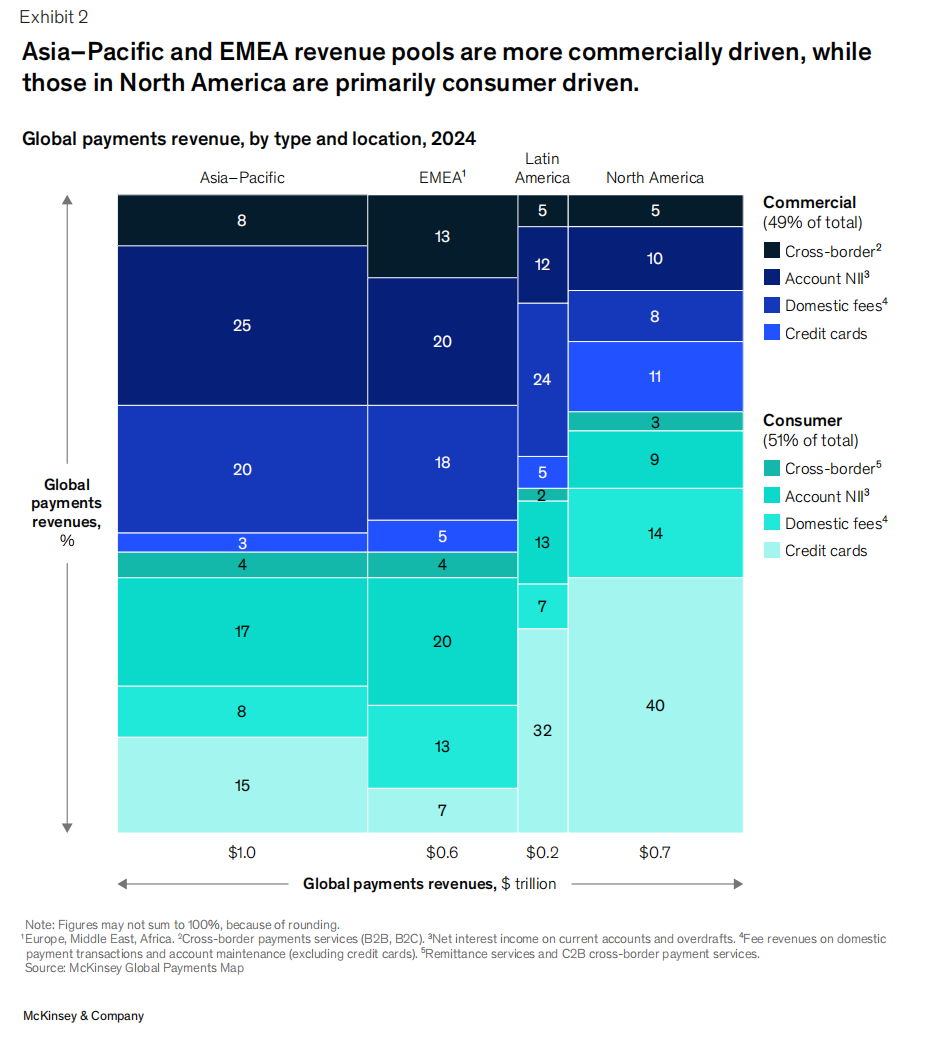

Overall, global payment revenues are nearly equally split between consumer and commercial segments, though regional compositions vary significantly.

-

North America leans toward consumer payments, as credit cards serve both as primary payment tools and borrowing instruments—reflecting a mature consumer credit market and strong loyalty programs.

-

The Asia-Pacific region favors commercial payments, with 25% of revenue coming from net interest income (NII) on business accounts, highlighting deep corporate banking relationships and reliance on deposit interest in fast-growing economies.

-

EMEA exhibits the most diversified structure: 20% of revenue comes from NII on commercial accounts linked to trade and treasury activities, and another 20% from consumer account NII, supported by Europe’s high savings base.

-

Latin America resembles North America, leaning toward consumers, with consumer credit card revenue making up 32% of total revenue, underscoring the importance of revolving credit and installment financing.

1.2 Payment Trends Underlying Revenue Structure

Cash usage continues to decline globally, dropping from 50% of all payments in 2023 to 46%. Account-to-account (A2A) payments are gaining traction, particularly via digital wallets, now accounting for approximately 30% of global point-of-sale (POS) transactions—with markets like India, Brazil, and Nigeria leading the way.

As transaction volume shifts toward lower-yield rails like instant payments, monetization becomes more challenging—especially in markets with strict regulations on interchange and processing fees. We expect new economic and pricing models to gradually emerge in the A2A space, possibly following India’s example, where banks have begun charging payment aggregators for UPI merchant transactions.

In business-to-business (B2B) payments, digitization is widespread but largely confined to low-margin channels like bank transfers and instant payments. To capture value, companies—especially software-centric ones—are investing in value-added services such as invoice automation, reconciliation, and working capital tools. These services are particularly important for SMEs and industries like healthcare that still rely heavily on manual processes.

Finally, new technologies continue to present both opportunities and threats. From tokenized money and central bank digital currencies to AI-driven fraud detection and liquidity management, innovation enhances security, efficiency, and reach. However, adoption remains uneven. Regulatory uncertainty, infrastructure gaps, and inconsistent technical standards mean progress occurs only in isolated pockets.

2. Three Forces Reshaping Global Payments

Three structural forces may fundamentally alter how individuals, businesses, and intermediaries move money:

-

Increasing fragmentation and regionalization of payment systems;

-

Large-scale application of digital assets in payments;

-

The transformative potential of artificial intelligence.

2.1 Fragmentation and Regionalization of the Payments Landscape

The global payments ecosystem is entering an unprecedented phase of complexity, set against a backdrop of highly interconnected goods, services, and people. Over the past 30 years, globalization ensured smooth cross-border money flows. However, geopolitical events have prompted some countries and regions to reduce dependence on global standards and systems. For example, sanctions on Russia excluded it from international card networks, pushing it to rely on Mir cards domestically and co-branded cards with UnionPay for international needs. Some jurisdictions are advancing "payment sovereignty" to reduce reliance on global intermediaries; the European Central Bank, for instance, is actively promoting Europe-centric large-value systems.

At the same time, technological advances are accelerating the growth of localized and regional payment systems. Instant payment infrastructure is particularly pivotal, enabling exceptional user experiences—as seen with Brazil’s Pix, Spain’s Bizum, and India’s UPI. Growing interoperability among domestic instant payment systems offers new pathways for cross-border payments beyond traditional standards. Notable examples include Pix’s internationalization across Latin America and NPCI International’s rapid expansion into the Middle East and Southeast Asia. Meanwhile, the rapid adoption of stablecoins is creating an alternative channel distinct from traditional payment rails.

These geopolitical and technological shifts are reshaping the payments map, resulting in greater regionalization and diversification. A return to the fully globalized payment system of five years ago is unlikely, as the forces driving fragmentation are already in motion. Yet many alternative payment systems face obstacles during expansion: poor user experience, unclear value propositions, governance flaws, and lack of enabling legislation in key markets. In certain cases, legacy systems have proven resilient enough to bypass or outcompete new entrants.

Therefore, the payments landscape is evolving toward one of two outcomes—both more fragmented than today: either a "multi-rail + global access key" ecosystem, or a "hyper-localized + declining global standards" fragmented world.

Scenario A: Multi-Rail Ecosystem with a 'Global Access Key'

In a more optimistic scenario, geopolitical tensions stabilize or ease, and payment standards remain robust, acting like a “global access key” across multiple payment contexts and customer types. The scope of service may vary—from online shopping to a suite of value-added services—while depth ranges from industry-specific cross-border financial solutions to simple remittances for mass-market users.

In this environment, participants must navigate multiple challenges: monitoring and regulating fund flows across multiple rails, managing vastly different economics across use cases and systems, and achieving technical integration between disparate systems. This could give rise to a new class of “integrators” and “aggregators” capable of seamlessly stitching together multiple payment systems. While more fragmented than today, this scenario fosters innovation and specialization, allowing diverse solutions to coexist and meet niche market demands.

Scenario B: Escalating Fragmentation and Erosion of Global Standards

If global trade and commerce continue to face major disruptions and geopolitical tensions intensify, countries may increasingly rely on local and regional alliances, gradually detaching from global flows of goods, services, and people. This scenario emerges when no framework exists to allow coexistence between “global” and “local” systems. Payments would inevitably become more regionalized.

Nations and regions would prioritize resilience and self-sufficiency, leading to more bilateral agreements, intermediary currencies, and alternative payment systems that drift further from global standards. Over time, regional systems and instruments would dominate across use cases, fundamentally reshaping the financial landscape. International connectivity would become more difficult, with profound implications for payment technology stacks—especially for institutions with multinational, global footprints. This could accelerate the adoption of stablecoins and tokenized money.

While Scenario A allows smoother international connectivity, both scenarios imply a further fragmentation and complication of the once-unified global payments map, with solutions becoming increasingly localized. For businesses and financial institutions, adapting to this new reality requires flexibility, innovation, and a deep understanding of the forces shaping money flows.

2.2 Accelerated Adoption of Stablecoins and Tokenized Money

Stablecoins and tokenized money are increasingly becoming integral parts of the financial system, although they have not yet crossed the threshold of widespread adoption. The sector is expanding rapidly—stablecoin issuance has doubled since early 2024—but their share of the trillions of dollars in daily global payments remains limited, with current daily transaction volumes around $30 billion.

Multiple signals suggest stablecoins are approaching a “breakout” moment. First, regulatory clarity is improving: the U.S. (with the recently passed GENIUS Act), EU, UK, Hong Kong, and Japan have all established or refined regulatory frameworks, clarifying licensing, reserve management, anti-money laundering, and customer due diligence requirements. Alignment across regional frameworks will determine whether cross-border stablecoin operations can scale, while regulatory clarity itself lowers barriers to entry—particularly benefiting traditional financial institutions and boosting market confidence.

Technical infrastructure is also rapidly upgrading: moving transaction processing from mainnets to more scalable Layer 2 solutions and adopting more efficient consensus protocols are increasing throughput; user-facing digital wallets and bank-grade custody solutions are becoming more reliable and accessible; advanced on-chain analytics tools enhance security and compliance.

More compelling drivers come from real-world demand. While stablecoins initially gained traction in niche areas like crypto asset settlement, their potential is now recognized across broader use cases: tokenized deposits enable intraday interest accrual and immediate availability; stablecoins offer 7×24 real-time settlement as an alternative to traditional correspondent banking; in countries with volatile local currencies, stablecoins pegged to major global currencies help consumers hedge against inflation. Institutional applications are also emerging, including B2B treasury management, supply chain finance, and repo agreements. Additionally, the “programmability” of stablecoins enables novel use cases such as escrow solutions and restricting government benefits to specific spending categories.

Over the past 18 months, numerous high-profile announcements, partnerships, and acquisitions indicate the industry is actively capturing value from tokenized assets. However, widespread adoption brings risks that must be carefully managed. Despite clearer regulation in major markets, there is still no unified, coherent global regulatory framework, raising uncertainty and potential market disruption. If a major issuer lacks sufficient reserves, a stablecoin could de-peg, triggering a collapse of trust; failure of a dominant stablecoin could ripple through the broader financial system.

Moreover, for stablecoins to achieve true ubiquity, end users must shift from viewing them merely as temporary bridges for fiat conversion to holding them long-term. Once most customers keep funds in stablecoins, traditional banks’ deposit funding sources and revenue models would be disrupted.

The rise of stablecoins aligns with the broader trend of “multi-rail payments”—for example, merchant acquirers now support credit cards, A2A transfers, and stablecoins within unified solutions. Leading players have taken significant steps: PayPal now accepts various digital assets as payment; Coinbase has launched debit cards linked to stablecoins, with credit card products soon to follow. Other providers aiming to meet customer demand for stablecoins must decide whether to build in-house capabilities or partner with aggregators and integrators.

3. Pathways for Payment Participants

As the global payments landscape transforms into a “mosaic” woven from multiple rails, digital assets, and intelligent AI agents, industry participants face a range of strategic choices.

This chapter examines the key decisions facing payment providers, merchants, platform providers, and solution specialists, exploring how each role can position itself, innovate continuously, and capture value in an increasingly “decentralized, programmable, and real-time” environment.

3.1 Payment Providers: Competing on Brand and Trust

As AI agents begin to dominate more consumer journeys, traditional competitive strategies based on “product differentiation + user experience” may become obsolete. Convenience and personalization will become baseline expectations; the real battleground will shift to “brand trust and relationships.” Whoever controls the interaction interface—directly or embedded—will influence consumer decisions in sticky, hard-to-replace ways.

Meanwhile, new rails, stablecoins, and programmable money are rewriting the economic model of consumer payments. Smart agents optimizing “when and how to pay” on behalf of consumers could squeeze interchange fees and interest spreads, pressuring local/regional players and undermining the dominance of global giants. Large institutions and solution experts whose long-term profits rely on “inefficiencies in settlement, credit, and liquidity” must redefine their value proposition to avoid being disintermediated by smaller players or even customers themselves.

The ultimate winners will be those who build intelligent, embedded, secure, and emotionally resonant experiences around “agent-led journeys”—not only anticipating needs and translating complex technology into intuitive interactions but also ensuring explainability and deep alignment with brand trust commitments.

Increased emphasis on “payment sovereignty” and local solutions will benefit regional players while constraining global ones. Local institutions can act as “trust anchors” within domestic ecosystems—such as instant payments, identity layers, and CBDC platforms—driving interoperability, connecting networks, and complying with local policies. Regional players (like Europe’s Wero or Brazil’s Pix) can lead economic blocs by setting rules for cross-border payments, digital identity, and data governance. Global players may need to adopt more flexible, open architectures to accommodate jurisdictional differences and consider partnering with emerging regional firms to overcome brand recognition and trust deficits in certain markets.

3.2 Merchants: Using Payments to Retain Customers

Rising consumer expectations require merchants to deliver seamless, scalable experiences across diverse payment methods, channels, and compliance regimes. As AI agents gain control over demand-side behavior, merchants must acquire customers in new ways and meet higher standards in “payment orchestration, checkout intelligence, and personalized offers.”

Merchant payment service providers must evolve from “supporting acceptance” to “delivering autonomous payment infrastructure,” where smart routing, real-time settlement, automated compliance, and dynamic currency optimization become standard features. The biggest opportunity lies in building an “empowered commerce layer” that helps merchants acquire, convert, and retain customers across channels and regions. This layer includes not only acquiring services but also deeper integration between merchant SaaS and payments. Early movers can turn the complexity of “regional rails + tokenized money” into a competitive advantage through programmable APIs and embedded services.

3.3 Platform Providers: Empowering the Ecosystem

Large multi-product platforms spanning the value chain and multiple payment rails have a natural advantage in leveraging AI and programmable money to help traditional clients like banks accelerate innovation. Their breadth allows them to orchestrate full end-to-end customer journeys and serve as the “control layer” for AI agents and programmable finance. Rich data resources fuel large-scale decision-making and personalization.

However, many platforms are broad but shallow, lagging behind specialists in specific functionalities. Blindly adding comprehensive new features may widen the gap with expert players, prompting customers to seek best-in-class external solutions.

Therefore, platforms must clarify strategic priorities, allocate resources wisely, and effectively deploy new technologies across different customer segments—banks, merchants, enterprises, individuals. With strong R&D and developer ecosystems, large platforms can maintain sustained innovation leadership in targeted service areas.

3.4 Solution Specialists: Unlocking Niche Value

Specialist players—such as cross-border payment experts, single-rail acquirers, and accounts payable/receivable automation vendors—face both opportunities and risks. Fragmentation creates numerous edge cases and niche markets ideal for “point solutions.” However, the rise of agent-driven workflows and programmable money may commoditize functions lacking unique intelligence, depth, or leverage.

Thus, specialists’ winning strategy lies in targeting complex, high-intellectual-value use cases and deeply embedding their capabilities into platform and agent ecosystems—while maintaining both adaptability to regional differences and the ability to orchestrate broader workflows across rails and stages.

Example pathways:

Transform cross-border payment systems into “embedded engines” that allow platforms or agents to dynamically route based on real-time fees, FX fluctuations, and settlement speed, integrating deeply with programmable wallets to optimize cash movement across currencies and rails.

Upgrade KYC/KYB rule engines into “programmable trust layers,” where agent systems adjust onboarding processes in real time based on transaction type, jurisdiction, and customer profile, enabling intelligent and differentiated customer onboarding.

4. Six Strategies to Thrive in the Next Payments Era

Facing the new era of “smart, programmable, connected” payments, participants can adopt six core strategies to capture emerging value.

Design for Intelligent Simplicity

As consumers and businesses rely more on agents and automation, trust and adoption hinge on “keeping complexity internal and simplicity external.” Products must embed simplicity, transparency, and personalization at their core, allowing users to maintain full control over their funds without conscious effort.

Treat Interoperability as Infrastructure

Cross-border, multi-rail transactions will be the norm in any foreseeable future. The ability to bridge different asset types, jurisdictions, and compliance regimes in real time is no longer a differentiator—it’s the entry ticket. Participants must build elastic infrastructures natively designed to meet these demands.

Push Intelligence to the Edge

Decisions must be made instantly—at the point of transaction, within the agent, inside programmable contracts. Routing logic, fraud detection, and liquidity management should be embedded directly into software agents, APIs, and workflows—not reliant on centralized batch processing or manual approval.

Make Compliance Programmable

In an increasingly fragmented regulatory landscape, only those who can encode “local compliance” into software will scale efficiently. Modular policy engines and regionalized logic will replace manual processes and hardcoded rulebooks, enabling “one-click adaptation” to global compliance requirements.

Integrate Into the Ecosystem, Don’t Fight It

In a modular, programmable world, winners are the layers that “become the foundation for others”: whether in intelligence, trust, liquidity, or connectivity. Standalone moats will erode; only those embedded within larger ecosystems will endure.

Build Trust Upstream

When AI and automation initiate transactions, companies must design transparency, explainability, and error traceability into their systems so both users and regulators can always know “what happened and why.” Trust must be earned before the transaction occurs.

5. Conclusion

The payments industry is not just adapting to new technologies or market changes—it is fundamentally reengineering its architecture in response to geopolitical forces, emerging digital paradigms, and the accelerating pace of artificial intelligence. In this fragmented yet interconnected future, success hinges on committing to seamless interoperability across diverse payment rails and proactively embracing complexity.

In the coming years, players who can turn challenges into opportunities and forge new paths in a world where agility, innovation, and trust are the most valuable assets will reap substantial rewards.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News