$19.1 billion liquidated in a day, Trump's tariffs open Pandora's box—has winter arrived for the crypto market?

TechFlow Selected TechFlow Selected

$19.1 billion liquidated in a day, Trump's tariffs open Pandora's box—has winter arrived for the crypto market?

If you're a dollar-cost averaging investor or hodler who believes in the long-term value of cryptocurrency, this sharp decline might present an opportunity to "buy high-quality assets at a reasonable price."

Author: Hotcoin Research

Crypto Market Performance

The current total market capitalization of cryptocurrencies is $3.73 trillion, with BTC accounting for 59.9%, or $2.23 trillion. Stablecoin market cap stands at $304.6 billion, up 0.69% over the past seven days with continued growth, of which USDT accounts for 58.88%.

Among the top 200 projects on CoinMarketCap, most declined while a few rose: ZEC gained 67.77% over 7 days, IP dropped 55.79%, MYX fell 55.08%, DEXE declined 50.97%, and KAVA lost 49.35%.

This week, net inflows into U.S. spot Bitcoin ETFs reached $2.7005 billion; net inflows into U.S. spot Ethereum ETFs reached $484.3 million.

Market Outlook (October 13–17):

The current RSI index is 29.37 (oversold zone), Fear & Greed Index is 28 (fear zone), and Altseason Index is 45.

BTC core range: $110,000–115,000

ETH core range: $3,700–4,100

SOL core range: $170–190

On October 11, the market experienced an epic crash. According to Coinglass data, total liquidations across the network surged to $19.1 billion within 24 hours, affecting over 1.62 million traders—both in terms of value and number of individuals, setting a historical record for crypto derivatives trading in the past decade. The crash was initially triggered by news that the Trump administration planned to impose additional tariffs on China, then amplified by market liquidity withdrawal and high leverage exposure. Market sentiment is now highly divided. Regardless, this is not an ideal time to sell holdings at low prices. It may be wiser to wait until the situation stabilizes before acting. After all, the probability of a Fed rate cut on October 30 has already reached 98%. The crypto winter hasn't arrived yet, but market participants should remain cautious.

Short-term Traders:

Monitor closely whether BTC can find support and rebound around $111,050. A breakout above $113,290 could extend the short-term recovery; a drop below $111,050 may lead to further declines toward $109,560 or lower. Volatility will be extremely high, suitable for quick in-and-out trades.

Mid-to-Long Term Investors:

If you believe in the long-term value of cryptocurrencies and follow a dollar-cost averaging or HODL strategy, this sharp correction might offer an opportunity to "buy quality assets at reasonable prices." Consider adopting a phased dollar-cost averaging approach, prioritizing core assets with solid fundamentals such as BTC and ETH.

Understanding the Present

Recap of the Week's Major Events

1. On October 6, the ongoing shutdown of the U.S. federal government entered a new week, delaying key economic data releases and halting approval activities at regulatory bodies like the SEC, increasing market uncertainty;

2. On October 8, the Federal Reserve released the minutes from its September FOMC meeting. Markets scrutinized the document for any signals regarding inflation control and future rate-cut paths to gauge monetary policy direction;

3. On October 8, the SEC postponed its decision on a combined Bitcoin and Ethereum ETF, delaying approval for the first spot ETF combining BTC and ETH, dampening short-term market sentiment;

4. On October 9, concerns about quantum computing threats emerged. Following the Nobel Prize in Physics being awarded to researchers in quantum computing, multiple analysts warned that the technology could pose a long-term threat to blockchain security, sparking market anxiety;

5. On October 10, the SEC delayed decisions on Solana and Litecoin ETFs. The much-anticipated spot ETFs for altcoins were not approved, putting downward pressure on assets like SOL;

6. On October 10, Trump announced 100% tariffs on China—a major geopolitical event that became a market turning point, directly triggering panic-driven selloffs across global risk assets. The crypto market plunged dramatically. Bitcoin crashed from a daily high near $122,000, followed by steep drops in Ethereum, Solana, and other major coins, with losses reaching over 20%-30%. Record-breaking leveraged liquidations erupted during the crash, with total 24-hour liquidations rapidly climbing to $19.1 billion and approximately 1.6 million traders liquidated;

7. On October 11, stablecoin USDe severely depegged. Due to cascading liquidations and systemic stress, the synthetic USD stablecoin USDe briefly traded at $0.65, causing panic in the DeFi ecosystem.

Macroeconomic Overview

1. On October 10, according to CNBC, after a series of rigorous interviews, U.S. Treasury Secretary Besent narrowed down the list of potential Federal Reserve chair candidates from 11 to 5. The final nominee may be announced in January next year, though they may not necessarily assume the role of Chair;

2. On October 10, Nasdaq dropped 1% after Trump threatened to "significantly increase" tariffs on China.

3. On October 11, according to the Fed funds rate monitor, the probability of a 25-basis-point rate cut in October reached 98.1%.

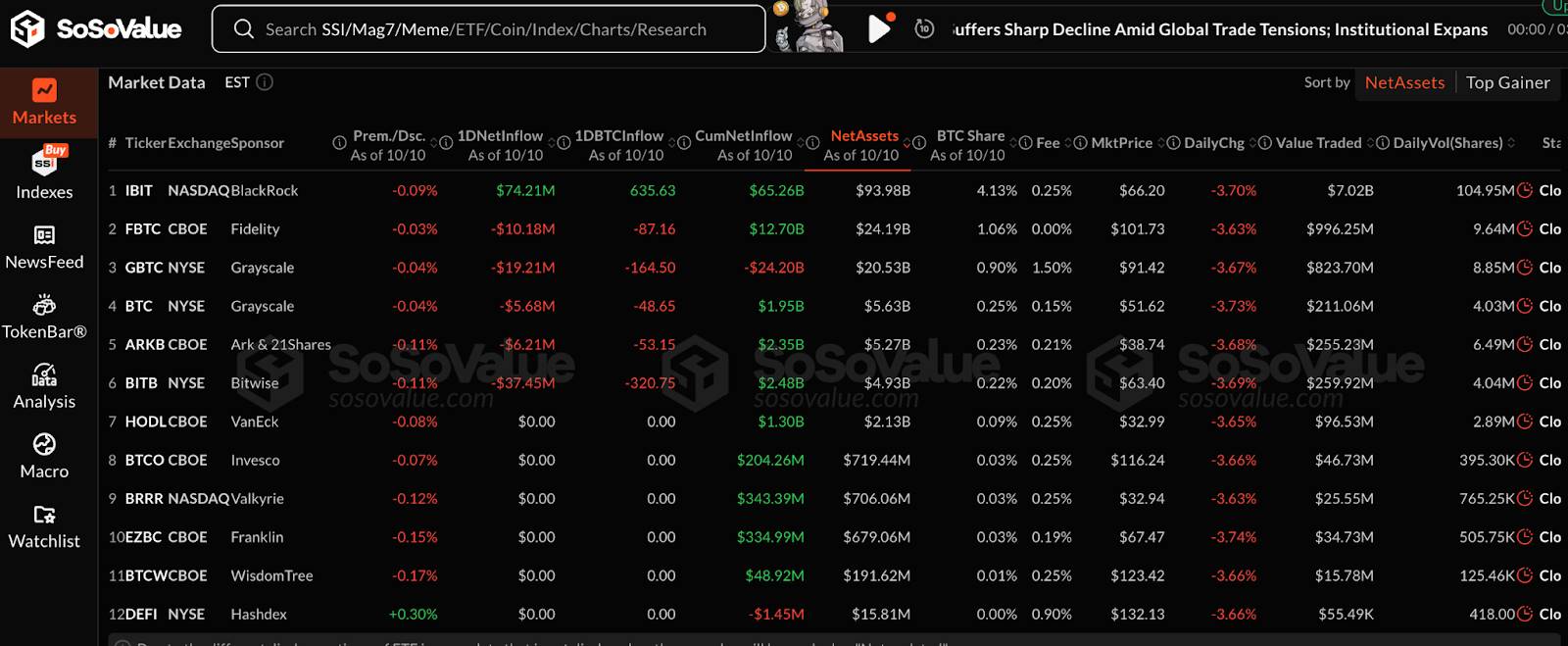

ETFs

Data shows that between October 6 and October 10, net inflows into U.S. spot Bitcoin ETFs amounted to $2.7005 billion. As of October 10, GBTC (Grayscale) had seen cumulative outflows of $24.154 billion, currently holding $20.538 billion, while IBIT (BlackRock) holds $93.567 billion. The total market cap of U.S. spot Bitcoin ETFs stands at $158.938 billion.

Net inflows into U.S. spot Ethereum ETFs: $484.3 million.

Looking Ahead

Event Calendar

1. The Aptos Experience summit will take place in New York on October 15–16;

2. Blockchain Life 2025 will be held in Dubai, UAE, on October 28–29, 2025;

3. Bitcoin MENA will take place at ADNEC, Abu Dhabi, on December 8–9;

4. Solana Breakpoint 2025 will be held in Abu Dhabi from December 11–13.

Project Updates

1. Fleek (FLK) will conduct its TGE on October 14;

2. Intuition (TRUST) will conduct its TGE on October 15;

3. Novastro (XNL) will conduct its TGE on October 15.

Key Events

1. On October 14 at 23:30, Federal Reserve Chair Powell will deliver a speech at an event hosted by the National Association for Business Economics;

2. On October 16 at 20:30, the U.S. will release its September retail sales month-on-month data.

Token Unlocks

1. Aethir (ATH) will unlock 1.26 billion tokens on October 12, worth approximately $57.86 million, representing 16.08% of circulating supply;

2. Starknet (STRK) will unlock 127 million tokens on October 15, worth approximately $16.19 million, representing 5.64% of circulating supply;

3. Sei (SEI) will unlock 55.56 million tokens on October 15, worth approximately $12.6 million, representing 1.15% of circulating supply;

4. Arbitrum (ARB) will unlock 92.65 million tokens on October 16, worth approximately $29.98 million, representing 1.99% of circulating supply;

5. ZKsync (ZK) will unlock 172 million tokens on October 17, worth approximately $7.42 million, representing 3.49% of circulating supply;

6. Fasttoken (FTN) will unlock 20 million tokens on October 18, worth approximately $39.6 million, representing 2.04% of circulating supply.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into practical tools for investors. Through our weekly reports “Weekly Insights” and “In-depth Reports,” we dissect market trends. With our exclusive column “Top Picks” (powered by AI and expert screening), we help you identify promising assets and reduce trial-and-error costs. Every week, our analysts engage with you live via livestreams to interpret hot topics and forecast trends. We believe that warm, human-centered support combined with professional guidance can empower more investors to navigate market cycles and seize value opportunities in Web3.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News