Fearless in Bull and Bear Markets: Crypto Survival Rules

TechFlow Selected TechFlow Selected

Fearless in Bull and Bear Markets: Crypto Survival Rules

The crypto world may often be frustrating, yet it remains worthy of love and dedication to its development.

Author: Pickle Cat

Chapter I: Your “Get-Rich-Quick” Mindset Is the Real Culprit Preventing You from Building Real Wealth

I bought my first Bitcoin in 2013.

As a veteran “long-time noob” who has weathered over a decade of crypto cycles—up to 2026—I’ve witnessed every conceivable way this market can brutalize people.

Over this long stretch, one ironclad rule has become impossible to ignore:

In this space, “winning” is never defined by how much money you make. Everyone who’s ever touched this ecosystem has made money at least once—even absolute beginners with tiny capital can briefly become “geniuses.” So what *is* winning? It’s making money—and still holding onto it years later.

In other words, if you hope to radically transform your life through crypto, you must first realize this isn’t a contest about “who makes the most” or “who multiplies fastest.” It’s a survival contest: “Who lasts the longest?”

Reality is harsh: most “geniuses” become fuel. Only a small minority survive into the next cycle—and among those survivors, even fewer truly compound wealth like a snowball rolling downhill.

After October/November 2025, market sentiment returned once again to that familiar, dull lull.

That day, I lost many friends I’d assumed would ride the crypto wave alongside me for years. Though such “goodbyes” have played out countless times before, each one still triggers an instinctive reflex: I open my scattered, years-long collection of personal reflections.

I think it’s time to organize them. To answer the ultimate question: What exactly—*is there any replicable trait*—that allows someone to survive *all the way through*?

To help answer it, I spoke with several longtime friends still active in crypto—and this article is the result.

This is my exclusive insight—a labor of love. It attempts to explain three things:

- Why do some people survive crypto’s cyclical bloodbaths while others get wiped out?

- How do you stay hopeful when a bear market grinds you down until you’re screaming internally?

- What concrete steps must you take to *become* one of those people?

To fully grasp this principle, we must return to fundamentals—first, forget everything else you’ve heard about this space.

“The only true wisdom is in knowing you know nothing.” — Socrates

The article briefly outlines crypto’s development history and its core essence—elements most newcomers overlook, since learning about them feels far less thrilling (or painful) than jumping straight into trading (and losing).

Yet based on my personal experience, precisely these overlooked elements hold the secret to enduring both bull and bear markets—just as philosopher George Santayana warned: “Those who cannot remember the past are condemned to repeat it.”

In this article, I’ll guide you through:

I. What *actually* reignites crypto bull markets—and how to distinguish between genuine “market ignition” and mere “last gasps.” Includes three case studies and a practical, ready-to-use “baseline checklist.”

II. What actions *actually* increase your odds of catching the “next big wave”?

III. What replicable traits do those who consistently profit across multiple brutal cycles share?

If your wallet has ever been “decentralized” (i.e., emptied), this article is written for you.

I. The Real Catalyst That Lifts Crypto Out of Sideways Drift

Whenever people ask why the crypto market stalls, answers are nearly always identical:

A new narrative hasn’t emerged yet! Institutions haven’t fully entered! A tech revolution hasn’t broken out! It’s all those predatory market makers and KOLs! It’s because Exchange X / Project Y / Company Z messed up!

These factors matter—but solving them has *never* been what ends crypto winters.

If you’ve lived through enough cycles, you’ll see a clear pattern:

Crypto’s resurgence never happens because it becomes *more like traditional finance*. It happens because it reminds people—*viscerally*—how suffocating the old system really is.

Crypto stagnation isn’t due to lack of innovation—or just liquidity issues. At its core, it’s *collaboration failure*: more precisely, stagnation occurs when *all three* of the following simultaneously break down:

- Capital loses interest;

- Emotion is exhausted;

- Current consensus can no longer explain *why anyone should care about this space*.

Under such conditions, weak prices don’t mean crypto is “dead”—they mean *no new element exists to align fresh participants’ efforts*.

This is the root of most confusion.

People assume the next cycle will be triggered by some “better, flashier” product, feature, or narrative. But those are *effects*, not causes. The real inflection point arrives only *after* deeper consensus upgrades complete.

Without seeing this logic clearly, you’ll keep chasing market noise—becoming the easiest prey for manipulative “dog traders” running coordinated pump-and-dump schemes.

That’s why so many endlessly chase “the next hot thing,” trying desperately to be the ultimate diamond-handed hodler—only to find they entered too late, or worse, bought “air coins” within the air coin category.

If you want to cultivate *real* investment intuition—the kind that helps you spot opportunities early, rather than being emotionally crushed weekly after every token launch—you must first learn to distinguish:

Consensus vs. Narrative

The truth is simple: Every single cycle that pulled crypto out of winter was driven by *one thing*: the evolution of consensus.

“Consensus,” in this context, means humanity discovering a *new way* to use cryptocurrency as a medium to financialize some “abstract element” (e.g., belief, judgment, identity)—and then coordinate *at scale* around it.

Please note: Consensus is *not* narrative. And this is precisely where most people’s cognitive bias begins.

A narrative is a shared story.

Consensus is shared action.

Narratives are told; consensus is *done*. Stories attract attention; consensus retains people.

- Narrative without action → short-term frenzy;

- Action without narrative → quiet evolution offstage;

- Both together → a true macro-cycle ignites.

To master this, you need long-term vision and a broader, structural lens.

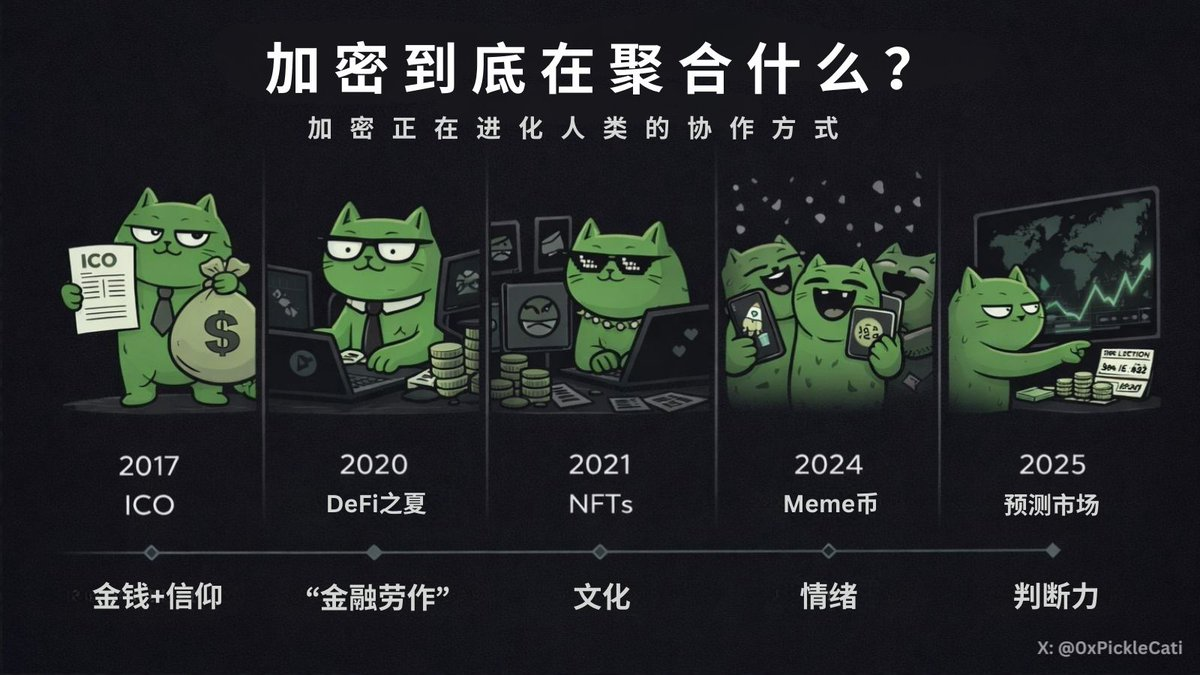

Run through crypto’s brief history, and you’ll see:

All narratives rest on one underlying foundation: *aggregation*—which *is* consensus.

In 2017, ICOs were the era’s ultimate “rallying tool.” Fundamentally, they were coordination mechanisms—gathering people who believed in the same story and pooling their capital and faith into one place.

It was essentially saying: “I’ve got a PDF and a dream—wanna bet?”

Later, IDOs moved this “rallying” to decentralized exchanges, turning fundraising into a permissionless, free-market “ritual.”

Then came DeFi Summer 2020—it aggregated “financial labor.” We became back-office staff for a bank that never sleeps: lending, collateralizing, arbitraging—chasing 3000% APY night after night, praying our positions wouldn’t rug-pull us upon waking.

Next was NFTs in 2021—they aggregated not just capital, but people resonating with shared culture, aesthetics, or ideals. Everyone asked: “Wait—why buy a picture?” “That’s not *just* a picture—that’s *culture*.”

We all searched for our “tribe.” Your tiny JPEG became your passport—a digital “insider” badge granting access to elite group chats and high-end gatherings.

By 2024’s Meme coin era, the trend was undeniable. Tech ceased to matter. What was aggregating now was *emotion*, *identity*, and *in-jokes*.

You weren’t buying whitepapers anymore. You were buying: “You get it—and you know why I’m laughing (or crying). Hehe.” You were buying a *community* that made you feel less alone when the price dropped 80%.

Now, we’ve entered prediction markets. They aggregate not emotion—but *judgment*, and *shared belief about the future*—beliefs that flow freely across borders.

Take the U.S. presidential election: a global focal point. But unless you’re American, you can’t vote. In prediction markets, though you still can’t vote—you *can bet* on your beliefs. That’s the fundamental shift.

Crypto is no longer just moving money—it’s redistributing *who gets to decide*.

Each cycle adds a new dimension to this grand system: money, belief, financial labor, culture, emotion, judgment… ____? What’s next?

You’ll notice: Every crypto breakout is fundamentally about gathering people *in a new way*. Each phase brings not just more users—but a *new reason to stay*. That’s the key.

The token itself was never the point. Tokens are just the topic everyone gathers around—to play together. What truly flows inside this system is whatever can carry increasingly large-scale native consensus.

Put plainly: What flows through the pipes isn’t “money.” It’s *us*—learning, collectively and without bosses, how to reach bigger, more complex agreements.

To understand this more deeply, consider this simple “Three-Fuel Model”:

- Liquidity (macro risk appetite, USD liquidity, leverage capacity, etc.) acts like oxygen injected into the market—it determines *how fast* prices can move.

- Narrative (why people care, how it’s explained, shared language) attracts attention—it determines *how many people look here*.

- Consensus infrastructure (shared behavior, repeated actions, decentralized collaboration methods) affects longevity—it determines *who stays when price stops rewarding them*.

Liquidity may temporarily lift prices; narrative may briefly ignite attention—but only *new consensus infrastructure* gives people a win-win way to act *beyond* simple buying and selling.

This is why many so-called “mini-bulls” fail to become real bull markets: They have liquidity and compelling stories—but people’s actual consensus remains unchanged.

So, how do you tell “last gasps” from genuine “consensus upgrades”?

Don’t look at price first—look at *behavior*. True consensus upgrades reveal similar signals across time—they change *how we gather to “play” together*.

It always starts with behavior—not price.

To learn this skill yourself, reading theory isn’t enough. You must study crypto history, extract patterns, and synthesize lessons—so you recognize the signal when the next upgrade arrives.

Below are four sections: three expanded case studies I compiled, followed by a baseline checklist to identify whether the next consensus upgrade is underway—and whether narrative-driven behavior will stick.

Expanded Case Study 1: 2017 ICO Boom vs. Early Experiments

BTC & ETH prices during the ICO boom (mid-2017 to mid-2018)

This was crypto’s first moment grasping how to coordinate people and capital globally at scale. Billions flowed on-chain—not to mature products, but to ideas.

Before this, early experiments existed—like Mastercoin in 2013, or Ethereum’s own 2014 crowdsale. Fascinating, yes—but niche. They hadn’t yet created a *global, shared behavioral pattern* capable of pulling everyone onto the same track.

In crypto’s early days, gameplay was simple: mine, trade, hold, spend (e.g., on dark web markets).

Yes, there were “get-rich-quick” Ponzi schemes—but no standardized way yet for strangers to jointly stake on a shared dream *on-chain*.

The DAO in 2016 was crypto’s true “aha!” moment. It proved strangers could pool funds using code alone. But honestly… tools were primitive, tech fragile—and it got hacked. A behavioral pattern emerged—but wasn’t sustainable.

Then 2017 arrived—and everything became “mass-producible.”

Ethereum and the (now mature) ERC-20 standard turned token issuance into a production line. Suddenly, the *foundational logic* of participating in crypto underwent revolution:

- Fundraising went fully on-chain—becoming the new normal.

- Whitepapers became “investment assets.”

- We swapped “minimum viable products” for “minimum viable PDFs.”

- Telegram became financial infrastructure.

This new “trendy” behavior drew millions—and powered an epic bull run. More importantly, it permanently rewired crypto’s DNA.

Even after the bubble burst, we never reverted to the “old model.” Anyone, anywhere, could crowdfund a protocol—that idea was now embedded.

Yes, most 2017 ICOs were outright scams or Ponzis. Such garbage existed before 2017—and persists today in 2026. But *how people coordinated and allocated capital* had changed forever. That’s “consensus upgrade.”

Expanded Case Study 2: DeFi Summer 2020 vs. False Bulls

BTC & ETH prices during DeFi Summer (June–September 2020)

This era marked a *true* “consensus upgrade”: Even without explosive price growth, people began treating crypto assets as *financial tools*. This contrasted sharply with the ICO era—where price surges and user behavior fed each other symbiotically.

Before 2020—outside the ICO frenzy—crypto experience boiled down to “buy, hold, trade, pray.”

(Well, unless you mined… or did something shady 👀)

But now, people developed *on-chain muscle memory*, permanently reshaping the industry. We learned:

- Lending: Deposit crypto into protocols to earn “rent.”

- Collateralized borrowing: Get purchasing power without selling—like mortgaging your house.

- Yield farming: Shift funds weekly to the highest-yielding pools—capital dancing left and right.

- Liquidity provision: Put tokens on the table for others to trade—and earn fees.

- Recursive collateralization: Collateralize, borrow, re-collateralize, re-borrow—layering leverage and yield.

- Governance: Vote on protocol rules—not just speculate on token price.

During DeFi Summer, even as ETH and BTC traded sideways, the entire ecosystem felt *alive*—activity didn’t depend on linear price rallies.

It shattered the “pure casino” mindset—because crypto finally felt like a *productive financial system*, not just a speculative toy.

DeFi projects like Compound ($COMP), Uniswap ($UNI), Yearn Finance ($YFI), Aave ($AAVE), Curve ($CRV), Synthetix ($SNX), and MakerDAO ($MKR/$DAI) became “banks of the internet.”

Even wild experiments like SushiSwap mattered. Its “vampire attack” siphoned liquidity directly from Uniswap—proving incentives *could* command capital like generals leading armies.

Then… came false revivals, false bulls—“last gasps.”

Think food-named copycat farms—Pasta, Spaghetti, Kimchi. They brought no new coordination behaviors; most vanished as quickly as they appeared.

By 2021, DeFi remained vibrant (dYdX, PancakeSwap grew fast)—but the wild-west phase ended. Crowds had already pivoted to the next shiny narrative: NFTs.

Looking back from 2026, you’ll see 2020 was *when on-chain economics truly birthed*. Nearly everything we do today—from airdrop points to TVL-chasing to Layer 2 incentive campaigns—follows 2020’s playbook.

Post-DeFi Summer, if a new product couldn’t give users a *substantive reason to stay on-chain*, it struggled to gain traction.

Incentives boost short-term activity—but if rewards don’t forge *enduring community habits* (a new paradigm), the project turns ghost town the moment subsidies end.

Expanded Case Study 3: NFTs Flip Social Scripts

BTC & ETH prices during the NFT mania (early 2021–mid-2022). 2021 was a “perfect storm”: Global monetary easing, macro liquidity, institutional entry, NFT explosion, DeFi growth, chain wars—all resonated simultaneously, pushing markets to peak. This case study focuses on NFTs—the period’s most influential catalyst.

If DeFi Summer was the era of geeks buried in liquidity curves, 2021 was when crypto finally gained *personality*. We stopped grinding for yield—and chased vibe, identity, and belonging.

Digital items were no longer copy-pasteable “things.” They had verifiable provenance. You weren’t “buying a picture”—you were getting a digital receipt declaring *you’re the original owner*, with the entire blockchain as your witness.

This rewrote social scripts. People stopped trying to out-compute each other—and started showing off identity.

Avatars became passports. Owning a CryptoPunk or Bored Ape became *digital proof of tribal membership*. Your avatar wasn’t your cat—it was your ticket into the “global elite club.”

Barriers emerged. Your wallet became your membership card. No corresponding asset? No entry to private Discord channels, no invites to insider parties, no exclusive airdrops.

IP ownership, too. BAYC granted commercial rights to holders—successfully launching the “ownership revolution” into mainstream awareness. Suddenly, strangers coordinated around their “apes,” building derivative merch, music, streetwear.

Most crucially, it attracted massive “outsiders.” Artists, gamers, creators—who cared nothing about APY or liquidation mechanics—suddenly found *reason to own a wallet*.

Crypto was no longer just finance. It became the internet’s native cultural layer.

From the consensus-habit perspective:

- Collections replaced liquidity pools.

- Floor price and social capital replaced TVL.

- Belonging replaced yield.

Of course, “last gasps” followed…

First came the “imitator” wave.

Once BAYC’s model proved successful, imitators flooded in. They had stories—but no soul. Countless visually similar collections launched—“BAYC, but with hamsters”—promising fairy-tale roadmaps. Most became air—or “priced air.”

Then came “wash-trading” mania.

Platforms like LooksRare and X2Y2 tried force-fitting DeFi’s “mining” logic onto NFTs—launching “trading mining.” Result? A horde of “scientists” self-traded, moving assets left-to-right. On-paper volume soared—*seeming* like recovery—but behind the scenes, bots were front-running and sniping. Real players had long left.

Finally, the “celebrity cash-grab” wave.

Almost every Tier-1 or -2 celebrity launched a series—because their agents called it a “new ATM.” With no real consensus or community, these projects vanished faster than TikTok trends.

So—what’s the lesson?

Like ICOs and DeFi Summer, the NFT bubble burst. But its behavioral residue is permanent—it lasted long enough to reshape the industry forever.

Crypto wasn’t just a digital bank anymore—it was the internet’s native cultural layer. We stopped asking, “Why own a JPEG?”—and started understanding what this behavior *means*.

For example:

- Brands shifted toward “digital passports” and “community-as-a-service” (CaaS).

- In this AI-saturated age, provenance became the gold standard for digital authenticity.

- Community-first launches are now every new consumer startup’s go-to playbook.

Collaboration habits stuck—and we learned to belong to digital culture. There’s no going back to being just a “user.”

Want to Sharpen Your Investment Instinct? Here’s How.

You’re now one-third through this article. Above, I presented three detailed cases illustrating how to distinguish false consensus upgrades (“last gasps”) from real ones.

Frankly, I could write hundreds more pages dissecting Meme coins and prediction markets—but giving you fish is less valuable than teaching you to fish. So I leave that analysis for *you* to reverse-engineer and internalize.

Also worth studying: failed narratives and failed “consensus upgrades”—like Metaverse 1.0 (2021–2022) or SocialFi 1.0 (2023–2024). Though they left only “flash-in-the-pan” wreckage—and didn’t instantly reshape behavior—that doesn’t mean they’re dead. True “consensus upgrades” rarely happen overnight. Just as Mastercoin (2013) pioneered ICOs but lay dormant for years before exploding in 2017 and transforming industry behavior, early failures are stepping stones to cognition.

Don’t ignore “cold” projects. The next “consensus upgrade” might be entirely new—or it might be a “failed old thing” reborn in *some new form*. When that happens, this awareness will be your golden opportunity.

The best way to hone “investment instinct” is hands-on research, analysis, and verification.

Ask yourself constantly: Do I truly understand what the crowd is *doing*? If you can’t observe behavioral shifts, you’ll miss the tide change.

Before Part I concludes, here’s a baseline checklist to spot whether the next consensus upgrade is emerging. I call it the “Noob Self-Protection 5-Question Framework”:

1. Are “outsiders” entering?

A cohort enters whose primary goal *isn’t* profit. You see creators, builders, or identity-seekers—not just traders. If the room holds only traders, the room is fundamentally empty.

(If you’re a trader reading this—yes, I’m one too. You know as well as I do: For this game to work, PvP alone isn’t enough.)

2. Does it pass the “incentive decay” test?

Observe what happens when rewards dry up or prices stall. If people stay, a habit has formed. If they vanish the moment “free lunch” ends, you’re holding priced air.

3. Are they choosing “daily habits” over “holdings”?

Newbies watch candlesticks; masters watch *what people do daily*. If they build routines around this system, it’s a permanent upgrade.

4. Does “behavior > experience” exist?

Real transformation happens when tools are still primitive, fragmented, inefficient. If people endure clunky UIs to participate, the behavior is *real*. By the time apps feel slick and polished—you’re already late.

5. (Most critical!!) Does “love-powered contribution” exist?

This is pivotal. When people defend a system *because it’s part of their identity*—not just because they’ll lose money—the transformation is complete.

So if you fixate solely on price—and fantasize endlessly about “bottoming out” at some magic level—you’re likely setting yourself up to “sell the top,” “panic-sell,” “lose composure,” or “lose sleep over positions.” Massive green candles appear *because behavioral shifts happened months earlier*.

Price is the *result* of that shift—price is merely the lagging indicator that finally acknowledges the world has moved forward.

II. Practice Makes Perfect: If Wealth Won’t 1000x, At Least Make Your Cognition 10x

I know what you’re thinking right now.

“Okay, I get the underlying logic—behavioral shifts, upgraded collaboration, etc. Theoretically, I know *what* to watch for. But when the next consensus upgrade *actually* hits, chaos and opportunity coexist… So—*what exactly* will 1000x? More importantly—how do I spot it *early*, so I can buy aggressively?”

Honestly, this is real life—not tomato-flavored wish fulfillment. Just asking this question is priceless.

If someone confidently stares you in the eye and hands you a “5-step wealth cheat code” they “found somewhere,” they’re either trying to recruit you as a bagholder—or charging you thousands for their “secret mini-course.”

Why? Because every new cycle is a *brand-new coordination game*.

You can’t apply DeFi Summer 2020’s playbook to pick 2024/2025’s breakout Meme coins. Even if you’re today’s top Meme hunter, that skillset won’t guarantee dominance in 2026’s prediction markets.

“Path dependency” has ruined countless people.

(Though exceptions exist—if your last name is Trump, then… yes, you’re absolutely right. After all, you’re a K-line artist in two domains. Congratulations on your unparalleled mastery 😅)

No one predicts the future—but we *can* build solid foundations and a foundational framework to help you dissect and absorb real opportunities *10x faster* than others when they arrive.

Having a framework won’t guarantee higher returns than last cycle—but it *will* give you massive first-mover advantage over gambling newcomers.

The framework has three parts: Crypto Cycle Fundamentals + Crypto Knowledge Architecture + Value Anchoring System.

Part I is done. Now, Part II: “What *exactly* should I learn—and how?”

But a thousand people hold a thousand Hamlets—there’s no “absolute truth.”

So below are two personal suggestions.

Suggestion 1: Become an On-Chain Sherlock Holmes

Here’s a must-master skill list—all 100% free online, no paid courses or “guru” guidance needed. All you pay is your resolve and time:

First: Increase your odds of spotting “organized sniper events”—or you’ll forever remain the bagholder. Learn to read wallet histories, holdings distribution, bundled transactions, fund sources/destinations—and sniff out suspicious on-chain anomalies.

Second: Understand market mechanics—identify potential supply shocks and avoid violent liquidation spikes. Know where and how to check: order book depth, bid-ask spread, exchange net inflows/outflows, token unlock schedules, Mcap/TVL ratios, open interest, funding rates, macro fund flows, etc.

Third: If you don’t want to get devoured raw in the “dark forest,” at minimum, understand how MEV works—or you won’t even know when you’ve been “sandwiched” (my hard-won tears 😢).

If you want to go deeper and outrun peers, learn to detect fake trades/wash trading, arbitrage score-farming, “low-liquidity/high-FDV” traps. If you’re farming airdrops, understand anti-Sybil mechanisms.

Also critical: Automate parts of your information workflow—data anomaly alerts, news filtering, narrative screening, noise reduction. With vibe coding now, the barrier is low—anyone can learn.

In 2026, nearly everyone I know—including those with zero CS background—is building custom tools to filter noise and hunt opportunities. If you’re still manually hunting info, that’s likely why you’re always one step behind.

If you don’t invest resolve, time, and effort to build this foundation, you’re choosing “hard mode.” Small consequence: you’re always slower—or miss opportunities. Big consequence: you get scammed, rug-pulled, drained—until you finally crack and start learning (or surrender and quit).

I know—because I walked this path. I stepped on every landmine: scammed by strangers and “friends,” trapped in Ponzi schemes, soaked by insider pumps, burned by backdoored contracts, robbed via hot wallets, defrauded in OTC deals—even fell for social engineering. Oh—and that’s *not* counting my 3 liquidations.

Beyond these “tech-leaning” skills, I’ve compiled practical “Social Sherlock” anti-scam tips you can use immediately.

Start simple: Has the project’s official account renamed itself 10+ times? Were past aliases linked to scam projects? Tools exist to check rename history—use them. Before investing, verify the team exists—do founders/core members have X, LinkedIn, GitHub accounts?

If they claim work at top firms or degrees from elite schools, verify. Fake Stanford/Berkeley diplomas—and fabricated ex-Meta/Google/Morgan Stanley resumes—are far more common than people imagine.

Same for claims like “backed by VC X,” “incubated by Y,” or “partnered with Z.” Some “well-known investors” never actually funded them. Some “partners” are merely indirect advisors who let projects use their logos. This happens far more often than expected—I’ve been a victim myself.

In today’s AI-saturated world, fake engagement grows more frequent—and harder to spot. Can you tell if follower count vs. engagement ratio looks off? Can you identify bot replies or AI-generated chatter on Discord, Telegram, or X?

If you couldn’t do these before—you now know exactly where to start training.

Suggestion 2: Immerse Yourself and Cultivate Genuine Connections

Plainly: You need more human connections. Like finance, tech, or any industry—your network *is* your net worth.

I *could* write “50 Things to Check Before Investing in a Project”—but that’s ultimately worthless noise. Why?

Because true “core intel” or alpha—while it still holds first-mover advantage—is *never* publicly shared.

By the time a project is loudly hyped by reputable voices in your feed, you might still profit—but that’s *not* the “life-changing 1000x” you came to crypto for. That “optimal entry window”? Welded shut.

This is why most eager newcomers become liquidity—and quit. Their info is filtered through layer after layer of private circles—stale, delayed, and diluted.

So if you lack reliable “insider lines” (plural preferred), position sizing is your sole safety net—keep most crypto assets in long-term holdings.

Long-term holdings demand less information asymmetry and zero frantic time pressure. They give breathing room to analyze public data—no need to be first to spot patterns. Just one project surviving 1.5+ cycles guarantees multiple profit waves, regardless of entry timing.

Meanwhile, your long-term goal is to stop being a spectator—and become a participant. To do that, you need skin in the game. Beyond family, the world forms alliances by interest. Those you admire won’t swap first-hand intel with someone offering zero equivalent value.

You must become “someone valuable” or possess “something valuable”—be it expertise, field research, capital, or connections. No one knows everything—so seize this opening.

Best method: Dive deep, authentically, into one ecosystem. First, get a job at a project in your target domain—developer, operations, BD—“entry-level = easy conversation.” Work is the fastest way to build reputation and meet your target network.

Of course, just landing an entry-level Web3 job won’t hand you everything overnight—but it’s an excellent start.

“But what if I lack experience and can’t land a solid crypto job?”

Good news: As of 2026, crypto remains far less of a “career desert” than traditional finance or tech giants. You don’t need elite degrees and stacked internships to clear seven rounds of interviews.

Here, your on-chain history *is* your resume. If you’ve spent serious time experimenting, “going all-in,” and doing real work—you already have more relevant experience than most corporate refugees.

Don’t want a job? Two alternatives remain (both demanding immense effort):

- If you’re exceptionally sharp and lucky enough to post impressive on-chain results—and aren’t ready to retire—link your wallet address to your X account. You won’t need to network actively; “kindred spirits” will find you.

- Build a personal brand on X—but the grind is real. Not universally recommended.

There’s no free lunch—and no reliable shortcuts. 100% effort doesn’t guarantee 100% success—but 100% inaction *guarantees* 100% failure (unless your name is Barron Trump).

III. How to Make “Persistence = Victory”

Based on personal experience, those who survive brutal cycles without “swimming naked” share two traits:

- They hold convictions independent of price;

- They’ve built multidimensional value anchoring systems.

First, clarify: Conviction ≠ blind stubbornness or faith born solely from “some guru said so.”

It’s *not* “I’ll never sell, no matter what.”

True conviction is *structural*—and structure inherently includes flexibility. You can hold massive conviction *while* taking partial profits or adjusting position sizes.

The key distinction is whether you *always*, *consistently*, return to the table.

You won’t leave when the music stops. Your original reason for being here was never red-green candlesticks—you stayed for the foundational *“why.”*

People who withstand cycles never ask: “Gurus, is it up or down today?” They ask: “Even if price deviates from my view for years—does the core logic *still hold*?”

This mental difference creates wildly divergent outcomes.

“Get-rich-quick” thinking doesn’t just drain your wallet. It corrodes conviction—and shatters your belief system.

Rebuilding belief is infinitely harder than rebuilding capital.

So—what *is* their “multidimensional value system”? And how do you build yours?

Layer One: Conceptual Anchoring

Stop dancing to candlesticks. Focus on core principles. Ask: What makes this *worth holding*—even if its price crashes off-screen?

Recall your last 10 token trades. Fast-forward two years. How many will still *exist*? How many will still be *meaningful*?

If you can’t explain why a project warrants long-term capital *without invoking “community” or “moon madness”*—you don’t hold conviction. You hold a position.

Layer Two: Temporal Dimension

Most people’s behavioral logic is chaotic—their decisions easily hijacked by group emotion. Example:

- Today, they FOMO-buy 4 different “definitely mooning” Meme coins in a secret Telegram channel.

- Tomorrow, they bet on Polymarket projects after seeing a “wealth password” tweet from a guru.

- Suddenly, they vanish for weeks.

- Then one day, they DM you asking about a soon-to-list token.

- Somehow, they buy a privacy-sector token—without knowing what the sector even does.

- Days later, they scream “BULLS RETURN!” and “BTC CHARGING—ALL IN!” in groups—just because a headline says “$200K next month.”

Hey—that’s not strategy. That’s handing your money to strangers. Even random cup tosses might beat those odds.

Sure, some pull profits this way—but I’ve never seen them hold those gains two months later. All they retain is past glory—and a +99999% psychological scar.

Their real problem? Noise overwhelms judgment—and they open too many fronts beyond their capability and comprehension.

Short-term speculation, mid-term positioning, and long-term investing demand *entirely different* behavioral modes. Cycle-survivors know *exactly* which time horizon each position belongs to—and never let emotion cross dimensions.

They won’t reject long-term conviction due to short-term price noise—or use long-term narratives to justify impulsive short-term trades.

If you’re shifting from day trading to swing trading, here are common “self-destruct” errors:

- You declare yourself a “long-term investor”—yet 80% of your time chases breaking-news headlines.

- You panic over a trivial 3% dip—well within your risk tolerance.

- Worst: You still allocate capital and assess risk with a “snatch-short-profit” mindset—causing you to *yet again* sell the top.

Temporal anchoring stops this cycle by forcing you to answer one deeply uncomfortable question *before clicking “buy”*: “How long am I willing to admit I’m *wrong*?”

Layer Three: Behavioral Anchoring

You can’t claim “faith” only when things go your way. Real tests come when your portfolio bleeds red—and your mind screams, “DO SOMETHING!”

You need a self-questioning framework—not to predict markets, but to *predict yourself*.

Before every trade, run this checklist—to ensure your future self won’t sabotage your present self:

When price drops x%, do I have a plan?

Do I know whether I’ll hold, reduce, or exit?

Am I letting my position dictate my reasoning?

During drawdowns, am I objectively reassessing the thesis—or subconsciously gathering ammo to justify panic-selling?

Am I constantly changing my target price?

When price rises x%, do I greedily push my take-profit higher “because it feels right”?

Can I explain “holding” *without* using the word “hype”?

Beyond sentiment and hype—can I articulate the *clear, concrete rationale* for holding?

Is this “conviction” or “sunk cost”?

When a position stalls beyond expectations—am I holding because the thesis still holds? Or refusing to admit I’m wrong?

How long does it take me to “own up” after breaking a rule?

When I violate a self-set trading rule—do I catch it and act *immediately*, or wait until my account is wrecked?

Do I engage in “revenge trading”?

After a loss, do I instantly rage-quit and jump into another trade—just to “get back what I lost”?

These questions aren’t about guessing candlestick direction. They map *whether your future self—under extreme psychological stress—will betray your present self.*

“Behavioral anchors” are pre-emptive stress inoculation. You define actions calmly—so you don’t flail desperately in despair.

After all—if you haven’t decided *how* to “play” trading, trading will inevitably start “playing” you.

Layer Four: Belief Anchoring

Notice how the loudest bull-market voices vanish fastest:

“This is your *last chance* to buy XX!” “You’ll *never* see BTC under $100K again!” “Trust me—eat, explode, fly! Not buying XX means fighting the future!”

As prices reverse, these voices evaporate—their “belief” seemingly never existed.

This “get-rich-quick” mindset doesn’t just ruin portfolios via overtrading—it corrodes belief systems. And a shattered belief system is far harder to rebuild than a drained bank account.

“Fast money always breeds pathetic excess. It’s human nature—like African animals feeding on carrion.” — Charlie Munger

Tragically, most people exhaust their capital at the peak of euphoria—so when real opportunity (i.e., the *true* bear market) finally arrives, they’re out of bullets.

It’s bitterly ironic: The very mindset that draws people into crypto—the hunger for overnight riches—is precisely what kills their wealth-building potential.

Most don’t even realize what they’ve lost—until years later, when Bitcoin doubles again, and they slap their thighs: “Why couldn’t I just hold through that dip?!”

That’s why belief is the most vital layer: It’s a creed forged over years.

How to Test If Your Belief Is Strong Enough

Try this: If someone fiercely challenges your stance right now—can you calmly defend it? Can you face sharp questions head-on—not dodge them?

Your belief must be intensely subjective and unique.

For some, it’s Cypherpunk spirit: total rebellion against control and centralization. For them, crypto isn’t investment—it’s the first light escaping a broken system.

For others, it’s monetary history’s next iteration: They see fiat debasement and financial predation repeating cyclically—and recognize crypto as the only hedge against traditional systems collapsing identically every century.

For some believers, it’s sovereignty, neutrality, or survival rights.

You must find *your* “why”—not rent someone else’s. I can’t tell you what your belief *should* be—but I’ll share mine.

Last year, with only 2,000 followers—and nobody caring what I said—I wrote a post answering a simple question:

Why, after *all* these crashes and zeros, do I still buy Bitcoin?

I titled it: “The Fourth Covenant Between God and Humanity.”

Humanity’s first three covenants shared one fatal flaw: They were *never for everyone.*

The first was the Old Testament

Bonded by bloodline—eligibility determined at birth. If you weren’t born into the chosen lineage, you were never qualified.

The second was the New Testament

It preached love and salvation for *all*—but history reveals the truth words tried to hide: If you were a poor Asian farmer in the 17th century, you’d never set foot in a cathedral. Empires barred you at the door—race, power, and hierarchy decided who deserved salvation.

The third was the Declaration of Independence

The birth of the modern world—promising freedom, equality, opportunity—but *only if* you were born on the right soil, held the right passport, lived inside the right system.

Yes, “freedom of movement” technically exists—but for most, it’s prohibitively expensive and statistically improbable. These rules were never written *for ordinary people.*

Most never even reach the starting line—they spend lifetimes proving they’re “worthy,” paying with money, education, obedience, or luck—begging the system to let them “belong.”

Now, the fourth covenant has arrived: Bitcoin.

This is humanity’s first system that asks no questions about who you are.

It doesn’t care about your race. Your nationality. Your language. Your birthplace.

No priests. No governments. No borders. No permission—just you and a private key.

You don’t need to be chosen. You don’t need connections. You don’t need approval. You don’t need to prove yourself to Bitcoin. You either understand it—or you don’t.

This system promises no comfort, safety, or guaranteed success. It offers only one thing humanity has *never truly possessed*: identical rules and equal access for everyone, simultaneously.

For me, this isn’t an investment thesis. Not a trade. Not a gamble. This belief is the *only reason* I can sit silently through market turbulence—endure years of silence, doubt, ridicule, and despair—and still hold.

If You’ve Patiently Read This Far…

Congratulations—you now hold the “survivor’s blueprint.”

You’ve learned how to spot “consensus upgrades,” how to use that “investigator toolkit” to boost early-entry odds, and what elements build belief and discipline.

But I must be honest with you: The Dao follows nature. No matter how advanced your tools—if you can’t control the person wielding them—you’ll always be overpowered.

Everything I’ve shared stems from 13 years of market turbulence—countless errors, lessons, and searing scars. These fragmented reflections arose from late-night talks with friends who, like me, survived the battlefield.

Flipping through my messy notes, I realized I have enough material to write a full book—with each chapter exploring crypto from a distinct angle.

Yet these lessons won’t make you a master overnight—just as “get-rich-quick” thinking won’t make you rich.

I’ve watched “geniuses” fall in every cycle… Not because they lacked intelligence or misread the board—but because they carried a “get-rich-quick brain” and wore arrogant, “shatter-on-contact” pride. Meanwhile, those profiting in 2026—and preserving gains while exiting cleanly—share one insight: The token was never the point.

The point is the sovereign system we’re building—and the personal discipline required to belong to it.

Crypto is the planet’s most ruthless, most honest teacher: It forces your inner demons into the light—and exposes your weakest traits—greed, impatience, laziness—then charges you a massive “tuition fee.” Mine, I think, is fully paid. Ha. My only hope is this article spares you paying as much.

If you truly read all this (not letting AI summarize it for you), I genuinely believe you have the potential to join our ranks—the survivors who’ve conquered multiple cycles. You’re exactly the kind of person who can master the skill list I outlined in Part II.

I sincerely hope you become one of my new “old friends”—a comrade who grows with me through the next cycle, the one after, and countless cycles to come—witnessing Bitcoin’s full-world disruption together.

And to my long-time readers: Thank you. Your kindness and support inspired me to revisit my past and share these experiences.

Crypto may often frustrate—but it remains worthy of love, and worthy of building.

So—I’ll go first. See you at the next “consensus upgrade.”

— Pickle Cat

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News