The biggest liquidation day in cryptocurrency history: The October 11 crash revelation

TechFlow Selected TechFlow Selected

The biggest liquidation day in cryptocurrency history: The October 11 crash revelation

Survival is everything.

Author: Min, TechFlow

Following 312 and 519, the crypto market has gained another crash memorial day—October 11.

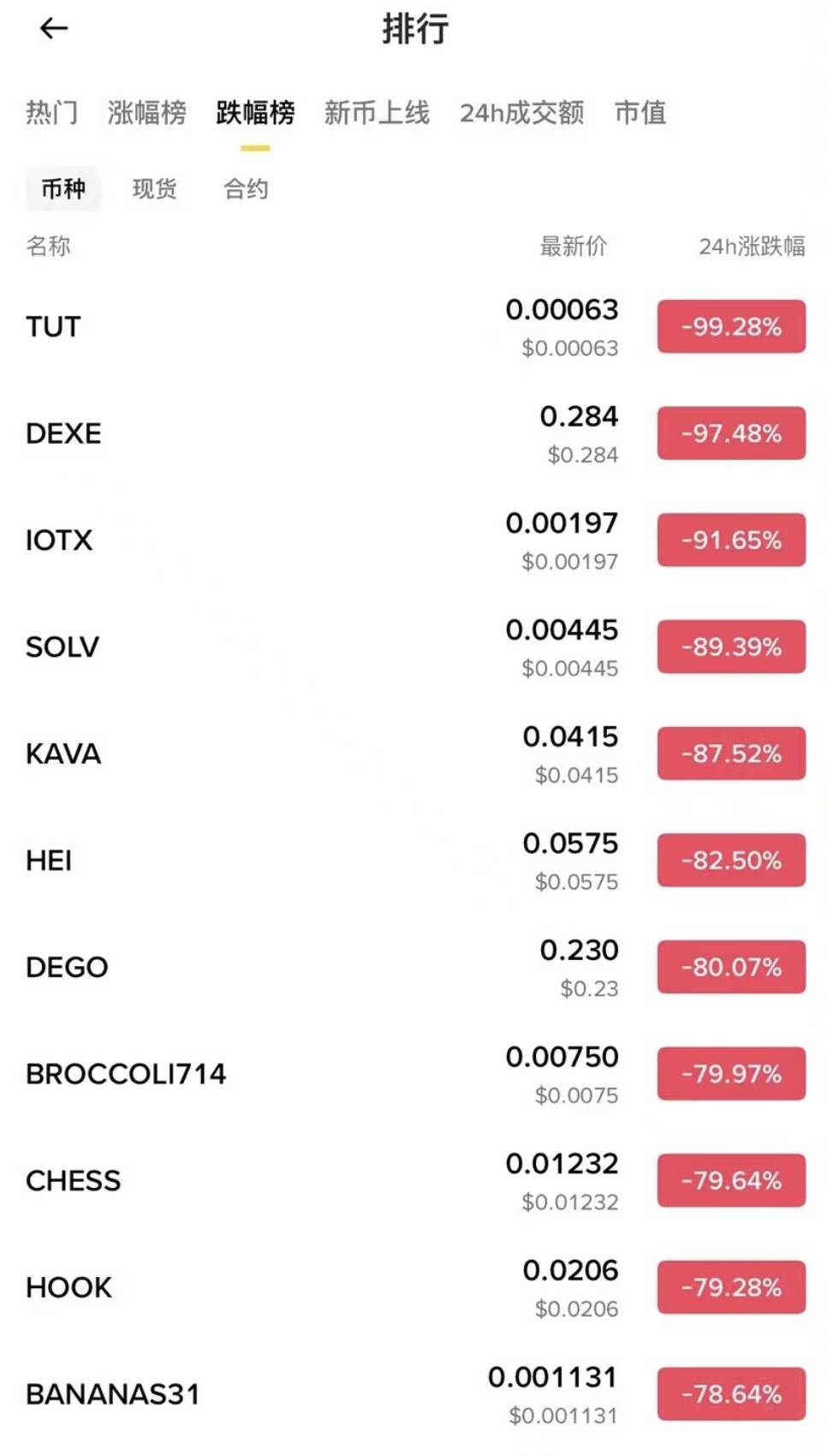

Bitcoin briefly dropped below $110,000, USDE depegged, and altcoins experienced cliff-like collapses, with many project prices plunging to zero within minutes—yes, truly zero.

According to Coinglass data, as of 9 a.m. on the 11th, the 24-hour liquidation volume reached $19.2 billion, affecting 1.64 million individuals, with the largest single liquidation exceeding $200 million.

However, this figure may only represent the tip of the iceberg. Industry insiders suggest the actual liquidation data far exceeds public reports, "Binance's liquidation volume should be much higher than Hyperliquid and Bybit." According to Coinglass disclosures, Binance’s current reported liquidation volume is merely one-fifth of Hyperliquid’s.

Crypto data analyst MLM (@mlmabc) estimates the real market liquidation volume was around $30–40 billion.

In the past, we comforted ourselves by saying the market has evolved and become more robust, no longer prone to turbulence like 312—but reality has once again brutally disproved that notion.

On the surface, this was an unexpected black swan event, but what truly collapsed the market may have been the long-accumulated leverage-driven boom and structural flaws in the market-making system.

The trigger for this crash was Trump.

That day, he suddenly announced new tariffs on Chinese goods. Sino-U.S. trade tensions escalated sharply, immediately pressuring global risk assets. Risk aversion surged, capital rushed into the U.S. dollar and Treasury bonds, and cryptocurrencies—as representative risk assets—were among the first to be dumped.

This became the first straw that broke the camel’s back.

Yet, a single tariff announcement cannot explain why the entire crypto market instantly avalanched. The real issue lies in the fact that the market's apparent prosperity had long rested on excessive leverage.

Over recent months, Bitcoin and major assets repeatedly hit new highs, but much of the capital behind this surge wasn’t long-term investment—it was leveraged funds built through contracts, borrowing, and liquidity mining. When negative news hit, these highly leveraged long positions were the first to fall. Once support levels were breached, margin calls cascaded, selling pressure snowballed, and the market plunged into a chain reaction of "longs killing longs."

The most telling case might be USDE. Since the official introduction of its 12% subsidy policy, numerous users engaged in circular lending for arbitrage. This mechanism was highly attractive during the bull run, drawing massive inflows quickly and becoming a key engine driving market growth. But on October 11, when tariff fears triggered sell-offs, USDE visibly depegged, briefly falling below $0.66, marking a symbolic moment in this crash.

Even more critical was the complete failure of the market-making mechanism during this plunge.

Bugsbunny, a staff member at Greeks.live, analyzed that currently available active market maker (MM) capital is limited. They concentrate their primary liquidity on Tier0 and Tier1 assets like BTC and ETH, while offering only minimal, incidental support for mid-to-long-tail altcoins.

After Jump’s collapse, market liquidity has relied increasingly on these active MMs, yet they lack robust tail-risk hedging mechanisms. Their capital can cover normal market conditions but is insufficient to stabilize markets during extreme events.

When Trump’s tariff news ignited panic, market makers had to prioritize protecting major assets, pulling liquidity originally allocated to smaller coins. As a result, altcoin markets completely lost counterparty support; sell orders crashed down with no buyers, causing prices to plummet in near free-fall. Tokens like IOTX briefly neared zero—an unmistakable sign of total liquidity collapse.

In fact, with the surge of new projects this year, active MMs have long been overextended. The market lacks sufficient derivatives to hedge tail risks—this event simply ripped away the veil.

Moreover, Bugsbunny pointed out that it was even more fatal that this crash occurred late Friday night (early Saturday morning in Asia), when market makers across both Western and Asian regions operate within defined working hours. Had this happened during a weekday trading session, liquidity might have already recovered.

"But it just so happened to be Friday. Everything was too coincidental."

Danger brings opportunity—some suffer, others profit.

On October 10, before Trump’s announcement, an early Bitcoin investor steadily increased short positions on BTC and ETH via Hyperliquid, amassing over $1.1 billion in exposure. After the crash, they reaped enormous profits. Others seized opportunities amid chaos, profiting from arbitrage on depegged assets like USDE, BNSOL, and WBETH…

Overall, the 10·11 crash wasn't caused by a single factor, but rather a confluence of three forces: macro-level policy shock from a black swan, structural fragility under leverage-fueled growth, and the collapse of market maker liquidity protection.

This morning, seeing waves of despair flooding social media, one cannot help but feel the market’s brutality and indifference.

The crypto market has never been a smooth highway—it’s more like a sea riddled with hidden reefs. Bull market euphoria often carries the illusion of leverage, while black swans lurk silently in the shadows, ready to strike at any moment. For retail investors, the priority isn’t chasing explosive gains, but survival.

As long as you survive, you’ll have a chance to start anew in the next cycle. But if your position gets fully liquidated during extreme volatility, you may never return to the table.

Say it again: survival is everything.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News