2025 Global Deal Guide: 11 Key Transactions Amid Politics and Markets

TechFlow Selected TechFlow Selected

2025 Global Deal Guide: 11 Key Transactions Amid Politics and Markets

Focusing on the most notable bets in 2025.

By Bloomberg

Translated by Saoirse, Foresight News

Another year defined by "high-conviction bets" and "sudden reversals."

From bond desks in Tokyo, credit committees in New York, to foreign exchange traders in Istanbul, markets delivered both windfalls and violent swings. Gold hit record highs, staid mortgage giants saw their shares gyrate like meme stocks, and a textbook arbitrage trade imploded overnight.

Investors piled into positions around political shifts, bloated balance sheets, and fragile market narratives—fueling equity rallies and crowded yield trades—while crypto strategies leaned heavily on leverage and expectations, lacking other solid foundations. After Donald Trump’s return to the White House, global financial markets first plunged, then rebounded; European defense stocks caught fire; speculators ignited wave after wave of market mania. Some positions reaped stunning returns, but others collapsed when momentum reversed, funding dried up, or leverage turned toxic.

As the year closes, Bloomberg spotlights some of the most compelling bets of 2025—the successes, the failures, and the holdings that defined this era. These trades leave investors entering 2026 anxious about a familiar set of concerns: shaky corporations, stretched valuations, and trend-chasing strategies that worked—until they didn’t.

Crypto: The Fleeting Rally Around Trump-Linked Assets

In crypto, “buy everything tied to the Trump brand” appeared an irresistible momentum play. During and after his presidential campaign, Trump went all-in on digital assets (according to Bloomberg Terminal reports), pushing sweeping reforms and installing industry allies across powerful institutions. His family joined in, endorsing tokens and crypto firms—traders treated these as “political rocket fuel.”

A “Trump-linked crypto ecosystem” quickly emerged: hours before inauguration, Trump launched a meme coin promoted on social media; First Lady Melania Trump soon followed with her own token; later in the year, World Liberty Financial—a firm linked to the Trump family—opened trading of its WLFI token to retail investors. A wave of “Trump-themed” investments followed—Eric Trump co-founded American Bitcoin, a publicly traded crypto miner that went public via merger in September.

A cartoon of Donald Trump holding a cryptocurrency token, set against the White House, displayed at a shop in Hong Kong commemorating his inauguration. Photographer: Paul Yeh / Bloomberg

Each launch sparked a rally, but every surge was short-lived. As of December 23, Trump’s meme coin had slumped more than 80% from its January peak; Melania’s meme coin, according to crypto data platform CoinGecko, was down nearly 99%; American Bitcoin’s stock had fallen about 80% from its September high.

Politics provided the spark, but speculation’s laws pulled them back to earth. Even with allies in the White House, these assets couldn’t escape crypto’s core cycle: price rises → leverage floods in → liquidity evaporates. Bitcoin, the sector’s bellwether, is likely to end the year in the red after falling from its October peak. For Trump-linked assets, politics can generate short-term heat—but not long-term protection.

—— Olga Kharif

AI Trade: The Next Big Short?

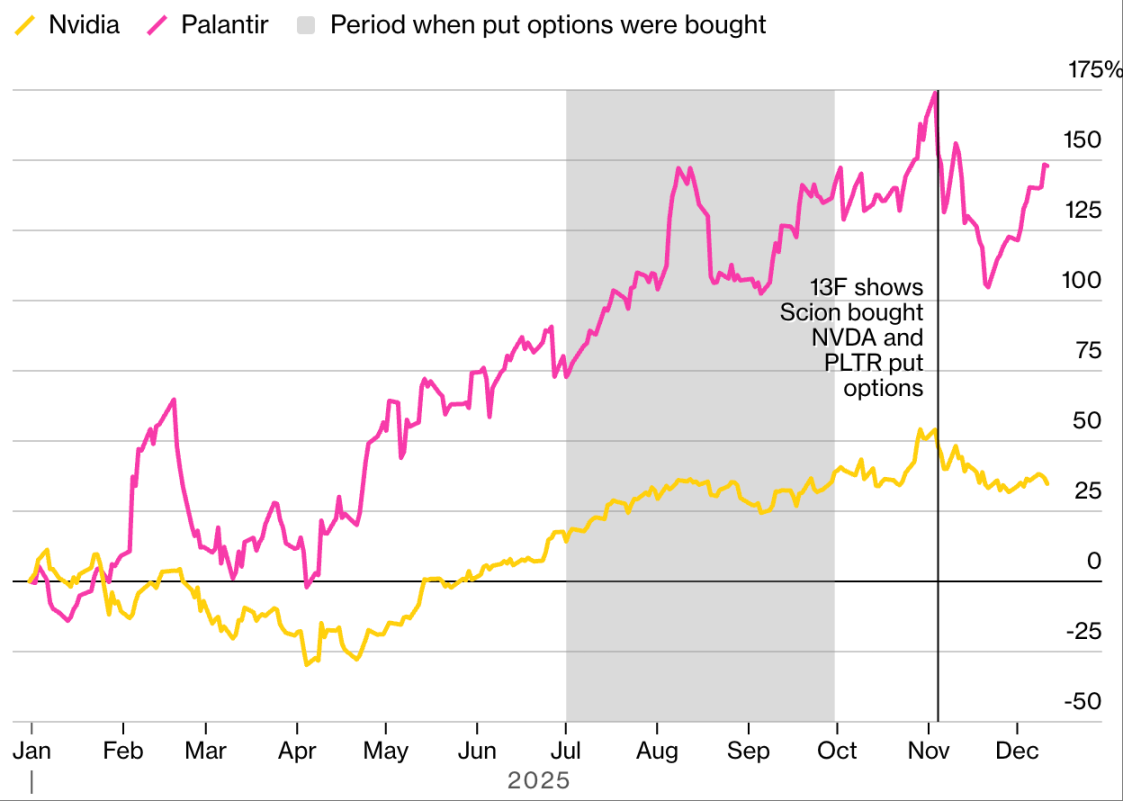

The trade surfaced in a routine filing, but its impact was anything but routine. On November 3, Scion Asset Management disclosed protective put options on Nvidia and Palantir Technologies—two companies that powered the market’s AI-driven rally over the past three years. Though Scion isn’t a giant hedge fund, its manager Michael Burry drew attention: famed for predicting the 2008 subprime crisis in “The Big Short,” he’s seen as a market soothsayer.

The strike prices were staggering: 47% below Nvidia’s closing price at disclosure, and 76% below Palantir’s. Yet mysteries remain: limited disclosure rules mean we can’t know if these puts were part of a more complex strategy; and the filing only reflected Scion’s holdings as of September 30, leaving open the possibility Burry reduced or exited the position afterward.

Still, skepticism about the high valuations and spending of AI giants had already built up like dry tinder. Burry’s filing was the match.

Burry's Bearish Bets on Nvidia and Palantir

The investor made famous by "The Big Short" revealed put option positions in a 13F filing:

Source: Bloomberg, data standardized based on percentage gains as of December 31, 2024

After the news, global market leader Nvidia plunged, Palantir followed, and the Nasdaq dipped slightly—though all later recovered.

No one knows exactly how much Burry profited, but he left a clue on X: buying Palantir puts at $1.84, which surged 101% in under three weeks. This disclosure exposed latent doubts beneath a market dominated by a few AI stocks, passive inflows, and low volatility. Whether this trade proves prescient or premature, it confirms one rule: once market faith cracks, even the strongest narrative can reverse fast.

—— Michael P. Regan

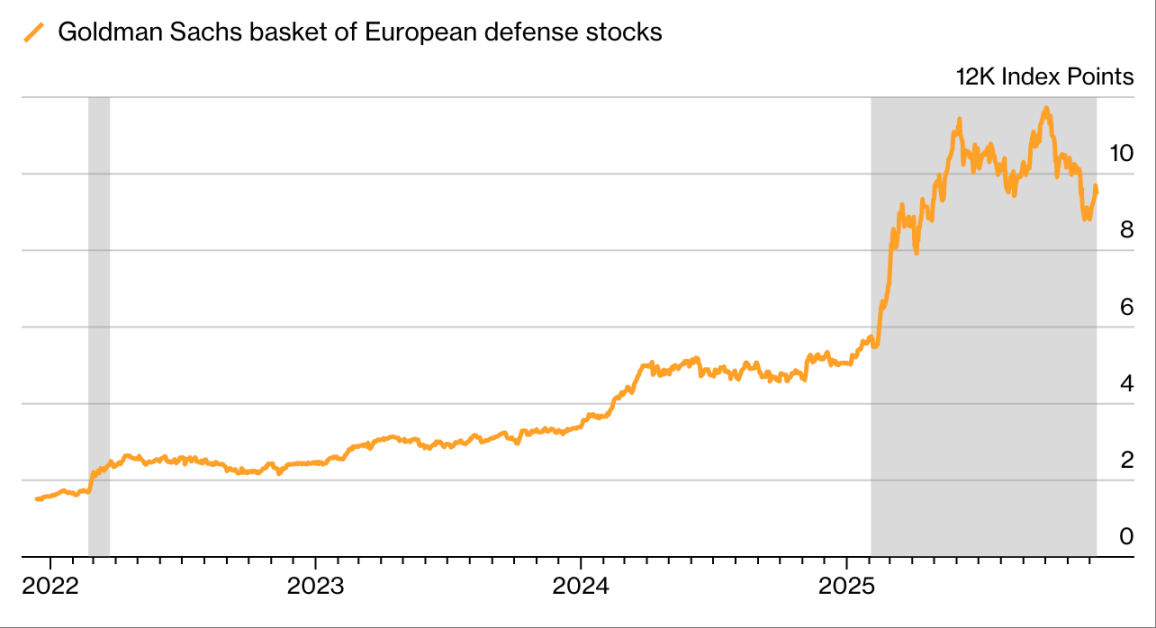

Defense Stocks: Surge Amid a New World Order

Shifting geopolitics transformed European defense stocks—from “toxic assets” shunned by asset managers into breakout performers. With Trump planning to cut military aid to Ukraine, European governments responded with a “defense spending spree,” sending regional defense stocks soaring: as of December 23, Germany’s Rheinmetall AG rose about 150% year-to-date, Italy’s Leonardo SpA gained over 90%.

Once avoided due to ESG (Environmental, Social, and Governance) investing principles, many fund managers have now changed course—some even redefining their investment mandates.

European Defense Stocks Surge in 2025

Defense equities outperformed even the early days of the Russia-Ukraine war:

Source: Bloomberg, Goldman Sachs

"Only earlier this year did we reintroduce defense assets into our ESG funds," said Pierre-Alexis Dumas, CIO at Sycomore Asset Management. "The market paradigm has shifted—and when paradigms shift, we must both act responsibly and defend our values. So now we focus on 'defensive weapons' investments."

From goggle makers to chemical producers, even a printing company—any stock with a defense link was snapped up. As of December 23, the Bloomberg Europe Defense Index was up over 70% year-to-date. The frenzy spilled into credit markets: even firms only loosely tied to defense attracted eager lenders; banks launched “European Defense Bonds”—modeled on green bonds but funding arms manufacturers. This marks a repositioning of defense from reputational liability to public good, proving capital flows faster than ideology when geopolitics shifts.

—— Isolde MacDonogh

The Debasement Trade: Fact or Fiction?

Mounting debt burdens in major economies like the U.S., France, and Japan—and a lack of political will to fix them—led some investors in 2025 to favor “debasement-resistant assets” like gold and crypto, while cooling on government bonds and the dollar. Dubbed the “debasement trade,” this bearish bet draws inspiration from history: Roman emperors like Nero debased currency to manage fiscal strain.

In October, the narrative peaked: fears over U.S. fiscal health, compounded by the longest government shutdown in history, drove investors to seek alternatives to the dollar. That month, gold and bitcoin both hit record highs—a rare moment of synchronicity for two often-competing assets.

Gold Records

The "debasement trade" propelled precious metals to new highs:

Source: Bloomberg

As a story, “debasement” offers a neat explanation for chaotic macro conditions; as a strategy, its real-world performance is far messier. Since then, crypto broadly corrected, bitcoin plunged; the dollar stabilized; and U.S. Treasuries—not collapsing—look set for their best year since 2020. This reminds us: concern over fiscal deterioration can coexist with demand for safe-haven assets, especially during slowing growth and peak policy rates.

Other assets diverged: movements in copper, aluminum, and even silver split between “fear of currency debasement” and forces like Trump’s tariff policies and broader macro trends—blurring the line between inflation hedging and traditional supply shocks. Meanwhile, gold kept climbing, setting new records. Here, the “debasement trade” still holds—but less as a blanket rejection of fiat, more as a precise bet on interest rates, policy, and risk-off demand.

—— Richard Henderson

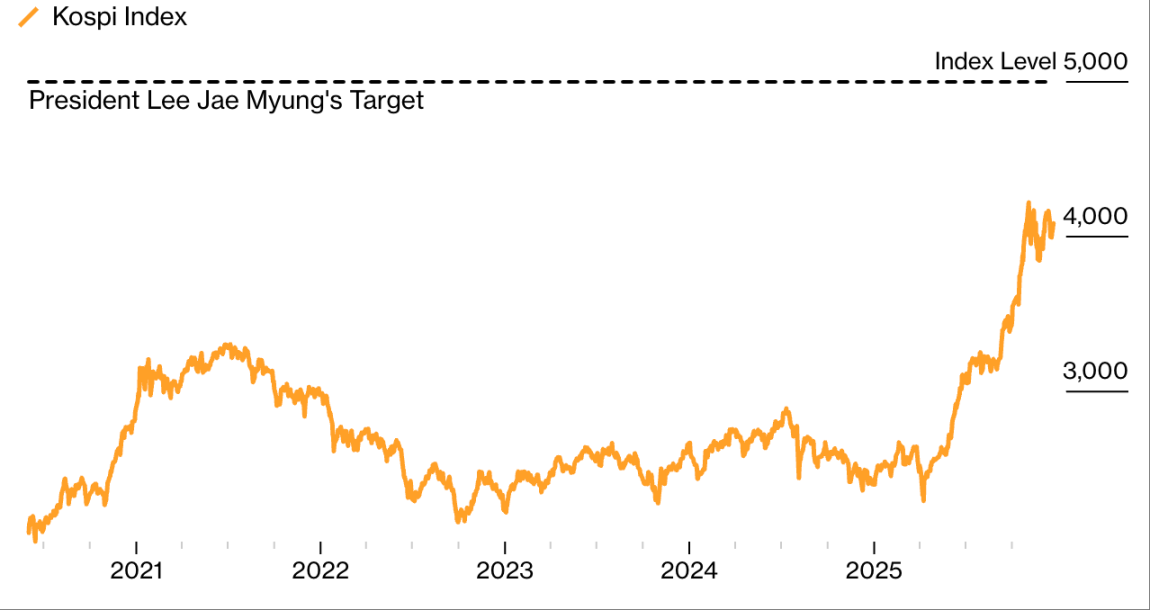

Korean Equities: A K-Pop-Style Boom

For plot twists and thrills, South Korea’s stock market in 2025 could make even K-dramas look tame. Fueled by President Lee Jae-myung’s push to “revive capital markets,” the benchmark Kospi index rose over 70% by December 22, marching toward Lee’s “5,000-point target” and easily topping global equity performance rankings.

It’s rare for political leaders to openly target specific index levels. When Lee first proposed the “Kospi 5,000” plan, it drew little attention. Now, Wall Street banks including JPMorgan and Citigroup increasingly believe the goal could be reached in 2026—partly thanks to the global AI boom, which elevated Korean equities as top picks among Asian AI plays.

Korean Market Rebound

South Korea's benchmark index surges:

Source: Bloomberg

Yet amid this globally leading rally, one group is notably absent: domestic retail investors. Despite Lee frequently reminding voters he was once a retail trader himself, his reform agenda hasn’t convinced local investors that equities are worth holding long-term. Even as foreign money floods in, local retail continues to net sell—pouring a record $33 billion into U.S. stocks and chasing higher-risk plays like crypto and leveraged overseas ETFs.

This creates a side effect: pressure on the won. Capital outflows weaken the currency, underscoring a reality—that even a spectacular market rebound may mask deep-seated domestic investor skepticism.

—— Youkyung Lee

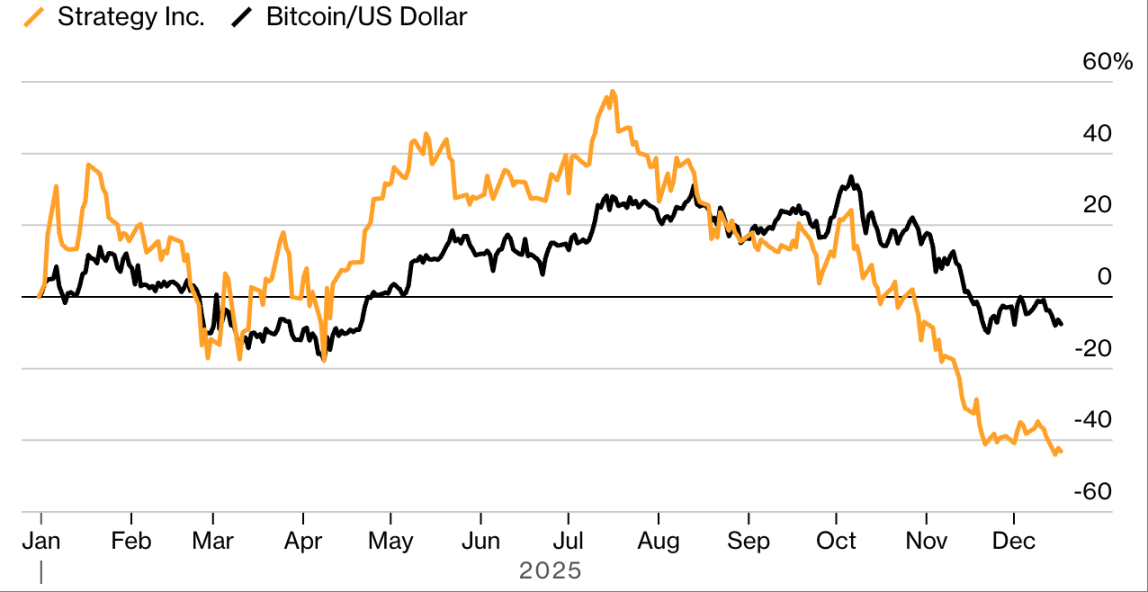

Bitcoin Showdown: Chanos vs. Saylor

Every story has two sides, and the arbitrage battle between short-seller Jim Chanos and Michael Saylor—CEO of Strategy, a self-styled “bitcoin accumulator”—has become a referendum on capitalism in the crypto age.

Early in 2025, as bitcoin soared, Strategy’s stock surged even more. Chanos saw an opportunity: the stock traded at a huge premium to its bitcoin holdings. The legendary short-bet investor deemed this gap unsustainable. He took a “short Strategy, long bitcoin” position, publicly revealing the trade in May while the premium remained high.

Chanos and Saylor then engaged in a public feud. In June, Saylor told Bloomberg Television: “I don’t think Chanos understands our business model at all.” Chanos fired back on X, calling Saylor’s explanations “complete financial gibberish.”

In July, Strategy hit a record high, up 57% year-to-date. But as the number of “digital treasury” firms grew and token prices fell from peaks, Strategy and its copycats began sliding—eroding the premium to bitcoin. Chanos’s bet started paying off.

Strategy Underperforms Bitcoin This Year

As the premium vanishes, Chanos’s short trade pays:

Source: Bloomberg, data standardized based on percentage gains as of December 31, 2024

From Chanos’s public short to his announcement on November 7 that he’d exited, Strategy’s stock dropped 42%. Beyond profit and loss, this episode reveals crypto’s cyclical boom-and-bust nature: balance sheets expand on “confidence,” which itself depends on rising prices and financial engineering. This works—until belief falters. Then, the “premium” becomes a liability, not a strength.

—— Monique Mulima

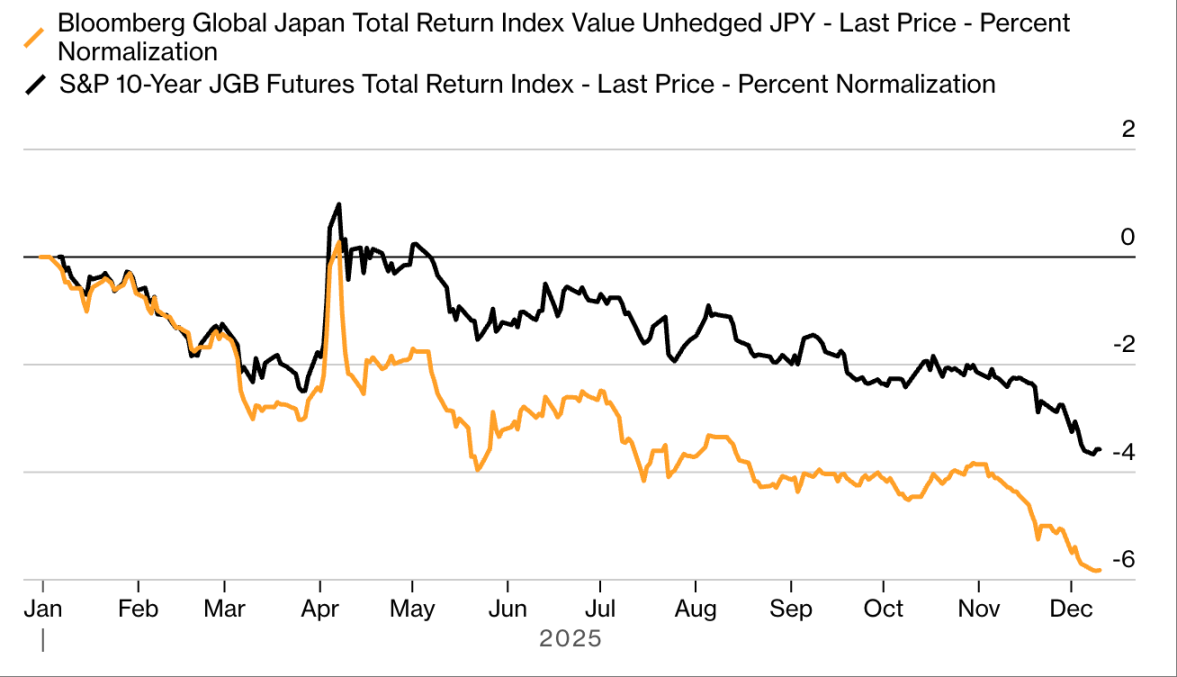

Japanese Government Bonds: From ‘Widowmaker’ to ‘Rainmaker’

For decades, one trade repeatedly burned macro investors: shorting Japanese government bonds, the infamous “widowmaker.” The logic seemed simple: Japan’s massive public debt meant rates would eventually rise to attract buyers. Investors would “borrow and sell” bonds, betting on falling prices. But for years, the Bank of Japan’s loose policy kept borrowing costs low, punishing shorts—until 2025, when the tide finally turned.

This year, the “widowmaker” became the “rainmaker”: yields on Japan’s benchmark government bonds surged, turning the $7.4 trillion JGB market into a short-seller’s paradise. Triggers were multiple: the BOJ hiked rates, and Prime Minister Sanae Takaichi unveiled the largest post-pandemic spending package. The benchmark 10-year JGB yield broke 2%, a multi-decade high; the 30-year yield jumped over 1 percentage point, a record rise. As of December 23, the Bloomberg Japan Treasury Index was down over 6%—the worst-performing major bond market globally.

Japanese Bond Market Plummets This Year

The Bloomberg Japan Treasury Index is the worst-performing major bond index globally:

Source: Bloomberg, data standardized based on percentage gains as of December 31, 2024, and January 6, 2025

Fund managers at Schroders, Jupiter Asset Management, and RBC BlueBay Asset Management all discussed “shorting JGBs in some form” this year. Investors and strategists believe the trade still has room as the policy rate climbs. Moreover, the BOJ is reducing bond purchases, further pushing up yields; and Japan’s debt-to-GDP ratio remains the highest among developed nations—suggesting bearish sentiment on JGBs could persist.

—— Cormac Mullen

Credit “Civil War”: The Payoff of Hardball Tactics

The richest credit returns of 2025 didn’t come from betting on corporate recoveries, but from turning against fellow investors. Known as “creditor vs. creditor warfare,” this strategy brought big wins for firms like Pimco and King Street Capital Management—as they orchestrated a precise play around Envision Healthcare, a medical firm owned by KKR.

Post-pandemic, hospital staffing provider Envision struggled and needed loans from new investors. Issuing new debt required rehypothecating already-pledged assets. Most creditors opposed the plan, but Pimco, King Street, and Partners Group defected in support—allowing a proposal to pass where senior creditors released collateral (equity in Amsurg, Envision’s high-value outpatient surgery business) to secure new debt.

The sale of Amsurg to Ascension delivered strong returns for funds including Pimco. Photographer: Jeff Adkins

These firms then became bondholders secured by Amsurg, eventually converting bonds into equity. This year, Amsurg sold to healthcare giant Ascension Health for $4 billion. Estimates show these “traitor creditors” earned about 90% returns—proving the profit potential of credit infighting.

This case reveals today’s credit market rules: loose covenants, fragmented creditors—cooperation isn’t required. Being right isn’t enough; the bigger risk is being outmaneuvered by peers.

—— Eliza Ronalds-Hannon

Fannie Mae and Freddie Mac: The Revenge of the Toxic Twins

Since the financial crisis, mortgage giants Fannie Mae and Freddie Mac have operated under U.S. government conservatorship. “When and how they exit” has long been a market speculation focal point. Hedge fund managers like Bill Ackman held long positions, hoping privatization would bring windfalls—but with no progress, shares languished for years on the pink sheets (OTC markets).

Trump’s re-election changed that: optimism surged that a new administration would move the firms out of conservatorship. Their stocks were suddenly engulfed in meme-stock-style enthusiasm. In 2025, the rally intensified: from start-of-year to September highs, both stocks surged 367% (intraday peak 388%), making them among the year’s biggest winners.

Fannie and Freddie Shares Soar on Privatization Hopes

Belief grows that these firms may finally break free from government control.

Source: Bloomberg, data standardized based on percentage gains as of December 31, 2024.

In August, news that the government was considering IPOs for both firms pushed excitement to a peak—market estimates suggested valuations above $500 billion, with plans to sell 5%-15% to raise about $30 billion. While skepticism over timing and execution caused share volatility after the September peak, most investors still hold hope.

In November, Ackman revealed a proposal submitted to the White House: relist Fannie and Freddie on the NYSE, write down preferred shares held by the U.S. Treasury, and exercise government warrants to acquire nearly 80% of common equity. Even Michael Burry joined: in early December, he announced bullish positions and wrote a 6,000-word blog post arguing these firms—once bailed out to avoid collapse—might “no longer be the toxic twins.”

—— Felice Maranz

Turkey Carry Trade: Total Collapse

After a strong 2024, the Turkish carry trade became consensus among emerging market investors. With local bond yields above 40% and the central bank pledging a stable dollar peg, traders piled in—borrowing cheaply abroad to buy high-yielding Turkish assets. Deutsche Bank, Millennium Partners, Gramercy Capital, and others funneled billions into the trade; some staff were even on the ground in Turkey on March 19—when the trade imploded within minutes.

The trigger came that morning: Turkish police raided and detained Ekrem İmamoğlu, the popular opposition mayor of Istanbul. Protests erupted, the lira was dumped, and the central bank failed to stem the plunge. Kit Juckes, FX strategist at Société Générale in Paris, said: “Everyone was blindsided. No one will want to touch this market anytime soon.”

Students hold Turkish flags and banners during protests after Istanbul Mayor Ekrem Imamoglu was detained. Photo: Kerem Ozyer / Bloomberg

By market close, outflows from lira-denominated assets were estimated at around $10 billion, and the market never truly recovered. As of December 23, the lira had depreciated about 17% against the dollar—among the worst-performing currencies globally. The event served as a wake-up call: high yields may reward risk-takers, but they offer no shield against sudden political shocks.

—— Kerim Karakaya

Bond Markets: The Cockroach Alarm Sounds

Credit markets in 2025 weren’t shaken by one catastrophic blow-up, but by a series of smaller crises—exposing unsettling vulnerabilities. Once-routine borrowers found themselves in distress, leaving lenders nursing heavy losses.

Saks Global defaulted after just one interest payment, restructuring $2.2 billion in bonds now trading below 60% of face value; New Fortress Energy’s exchange bonds lost over half their value within a year; Tricolor and First Brands went bankrupt weeks apart, wiping out billions in creditor value. In some cases, complex fraud fueled the collapses; in others, optimistic projections simply never materialized. But regardless, investors face a key question: why did they extend massive credit to firms showing almost no proof of repayment capacity?

JPMorgan gets burned by a credit "cockroach," as Jamie Dimon warns more may be lurking. Photo: Eva Marie Uzcategui / Bloomberg

Years of low defaults and loose monetary policy have eroded credit standards—everything from lender protections to basic underwriting. Lenders to First Brands and Tricolor failed to detect red flags like asset double-pledging and commingling of collateral across multiple loans.

JPMorgan was among those lenders. CEO Jamie Dimon issued a stark warning in October, using a vivid metaphor: “When you see one cockroach, there are usually more hiding.” This “roach risk” may well become one of 2026’s defining themes.

—— Eliza Ronalds-Hannon

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News