Facing Losses: The Trader's Path to Self-Redemption

TechFlow Selected TechFlow Selected

Facing Losses: The Trader's Path to Self-Redemption

There is no guarantee of阶段性胜利 in trading; one bad decision could ruin an entire career.

Author: thiccy

Translation: Chopper, Foresight News

2025 has been another year of extreme volatility, and many have suffered losses in trading.

This article is not for those who have been consistently losing money, but for traders who were previously profitable and skilled, yet gave back a significant portion of their gains this quarter.

One of the most painful experiences in life is watching months or even years of hard work vanish in an instant.

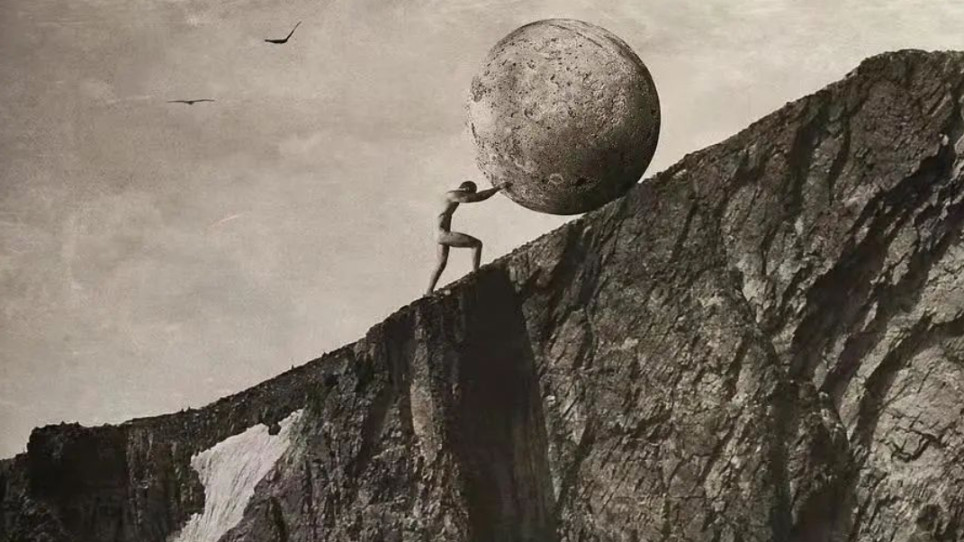

In Greek mythology, Sisyphus offended the gods and was sentenced to eternal punishment: he must push a massive boulder up a mountain, only for it to roll back down each time he reaches the summit, forcing him to start over. The cruelty of this punishment is unique—it strikes at the core of human experience.

Trading is much the same. Unlike most professions, there are no guaranteed milestones of success—just one bad decision can destroy an entire career. This trait has driven many into despair.

When the "boulder" rolls down, people typically react in two ways.

One group increases their bets, attempting to quickly recover losses. They trade more aggressively, unknowingly falling into the trap of the Martingale strategy: doubling down after a loss, hoping one winning trade will cover all previous losses. This approach sometimes works—and that’s precisely why it’s so dangerously deceptive: it reinforces a habit that inevitably leads to ruin.

The other group becomes exhausted and exits the market entirely. These individuals often come from comfortable financial backgrounds where risk no longer offers asymmetric rewards. They console themselves by claiming the market no longer provides opportunities or that they’re simply unsuited for trading. They choose permanent withdrawal—effectively ending their trading careers with their own hands.

Both reactions are understandable, yet overly extreme and fail to address the root issue. The real problem is this: your risk management system has flaws. Most people vastly overestimate their ability to manage risk.

Risk management isn't an unsolvable puzzle—the underlying math is well understood. The true challenge isn’t knowing what to do, but doing it consistently despite emotions, ego, stress, and fatigue. Maintaining alignment between intention and action is one of the hardest things humans face. And the market always ruthlessly exposes any misalignment.

So, what should you do after a loss?

First, accept this truth: you didn’t just have bad luck or suffer injustice. This loss stemmed from a flaw in your trading process, and was therefore inevitable. If you don’t precisely identify and fix this issue, history will repeat itself.

Second, fully accept your current net worth—do not anchor yourself to past highs. The urge to “make the money back” is one of the most dangerous obsessions in trading. Step away from the screen temporarily and appreciate what you’ve already achieved. You’re still alive, still in the game—that’s enough. Your goal now isn’t recovery, but simply generating new profits.

Treat this loss as tuition paid to the market—an expensive lesson that revealed a fatal flaw. You would have had to learn it eventually; be grateful you learned it before your bets grew even larger. If handled correctly, you’ll look back on this moment with gratitude. Character is forged in hardship.

Identify the specific cause of failure. For most, losses stem from reasons like “over-leveraging,” “failing to set stop-losses,” or “ignoring triggered stop-losses.” Establishing strict rules around position sizing and stop-loss execution prevents most catastrophic drawdowns.

Remind yourself constantly: the only way to prevent the boulder from rolling again is to adhere strictly to these rules. They are the sole barrier between you and the pain, self-loathing, and chaos you currently feel. Without rules, you have nothing.

Give yourself time to grieve. Shout, vent, even break something if needed—release the emotion instead of letting it fester inside.

Most importantly, transform pain into action. Trauma must be converted into structured rules and processes—or else it will repeat.

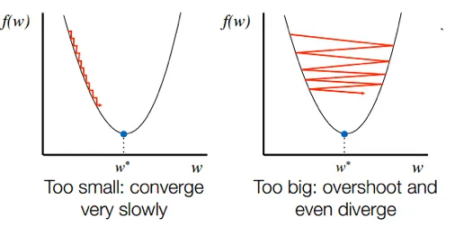

This mindset toward adversity applies not only to trading losses, but to every form of loss in life. The two common reactions mentioned earlier are too extreme because solving one problem often creates several others. If you cannot recover from a loss with precision and nuance, you’ll forever oscillate around the optimal solution—like a gradient descent algorithm with oversized steps, never converging to the correct answer.

After Napoleon's defeat, he immediately began rebuilding infrastructure for the next battle. A defeat is only fatal if it destroys your capacity to fight again. The first priority after loss is securing the weak point and restoring yourself to peak condition as quickly as possible.

You don’t need redemption or revenge; avoid self-pity and blind rage. You must act like a precision machine: patch the漏洞, rebuild the system, and ensure this error never happens again. Every failure you survive becomes a moat in your trading framework—a moat others can only acquire through personal suffering.

It is such failures that shape a person. Be grateful when they arrive—they exist to teach you essential lessons, never without purpose. Allow yourself to feel the pain, but use that agony as fuel to ensure it never repeats.

The reason this is so difficult is that once you find the right path, wealth compounding becomes inevitable. Finally, good luck.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News