The man behind Hyperliquid was an apprentice in the Binance Labs incubator 7 years ago

TechFlow Selected TechFlow Selected

The man behind Hyperliquid was an apprentice in the Binance Labs incubator 7 years ago

7 years to transform from an incubator learner to a challenger of giants.

Author: David, TechFlow

What can 7 years change?

In the world of crypto, 7 years can turn a young man standing in a Binance Labs incubator group photo into a competitor that Binance can no longer ignore.

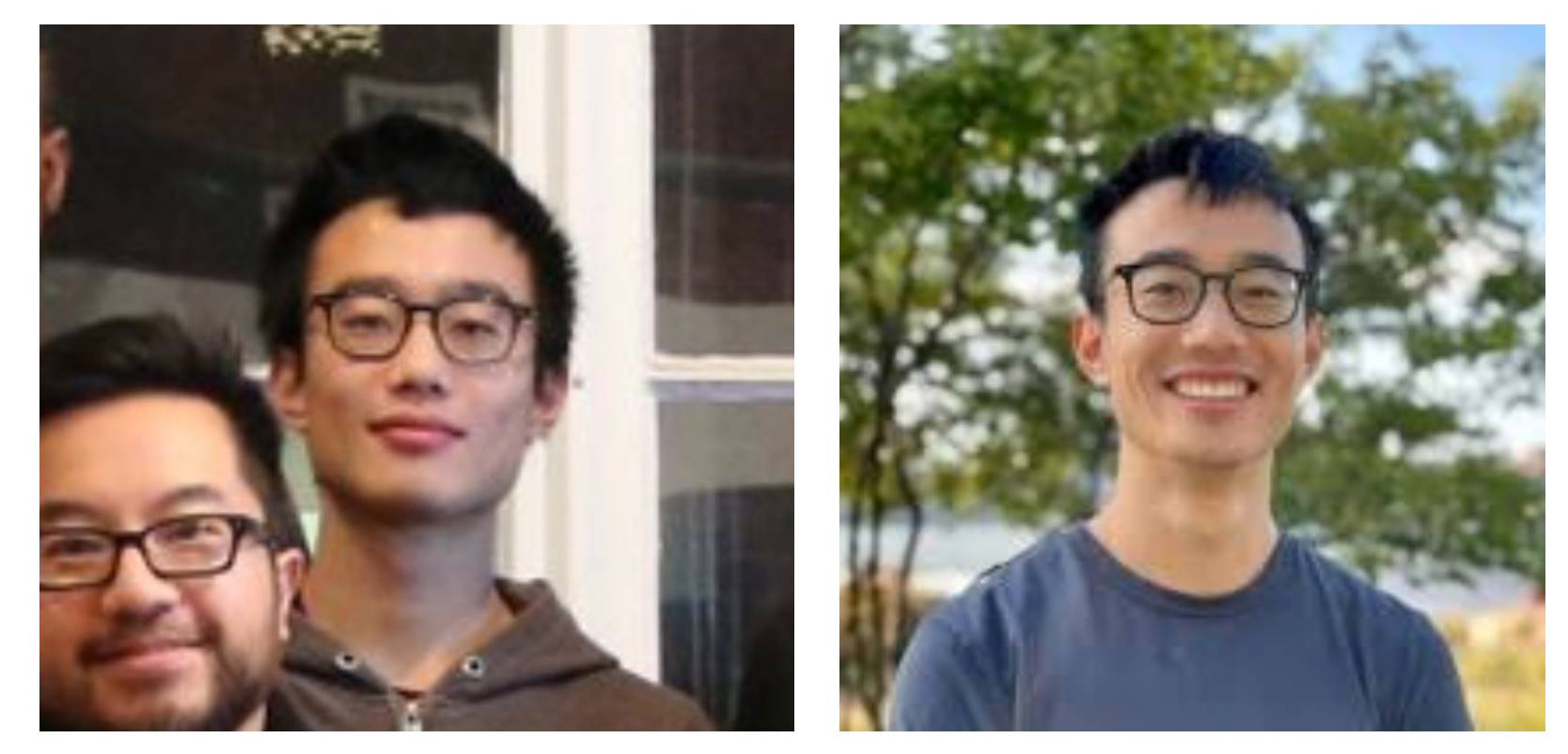

Recently, an old, long-forgotten photo resurfaced online, sparking heated discussions across social media.

At first glance, this might seem like just another ordinary group photo released by YZi Labs (formerly Binance Labs) back in 2018—likely showing Garry Tan, the head of renowned startup accelerator Y Combinator, giving guidance to founders participating in the BUIDLers incubation program.

The man in the center wearing black is indeed Garry. But the real focus lies behind him:

The bespectacled young man in a light-colored sweater, with a slightly naive expression, looks strikingly similar to Jeff Yan, founder of Hyperliquid today. If you zoom in further and compare this image with Jeff’s recent public photos, the resemblance is remarkably strong.

Considering Hyperliquid's current standing in the Perp DEX space—routinely achieving daily trading volumes in the billions of dollars—it has effectively become a direct competitor to Binance’s futures business. Thus, this photo means far more than just an archaeological curiosity.

The comment sections quickly exploded.

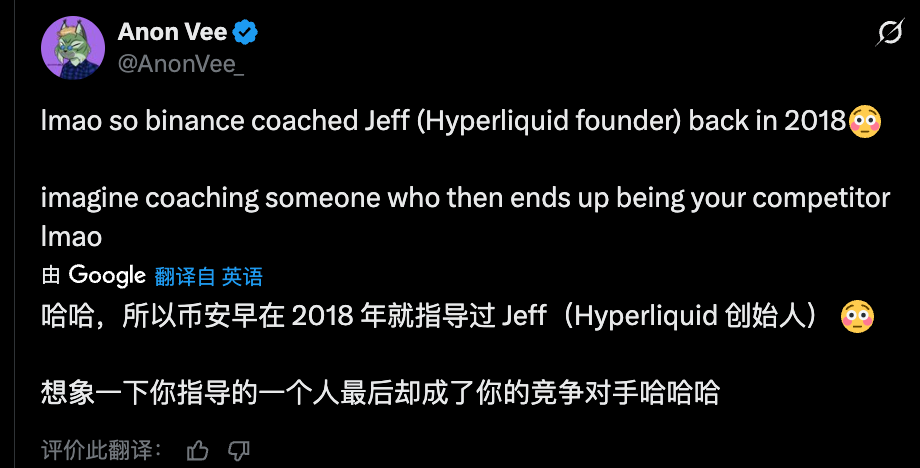

Many tagged Jeff’s account @chameleon_jeff, asking whether it was really him. Others pointed out that Binance may have inadvertently nurtured its own rival.

Regardless, if the photo is authentic, then the transformation of a technical founder—from incubatee to challenger of giants—over seven years becomes a compelling case study worth examining.

Early bets on prediction markets: Jeff was ahead by N versions

The speculation around Jeff in that photo isn't baseless; stronger evidence comes from official Binance Labs records.

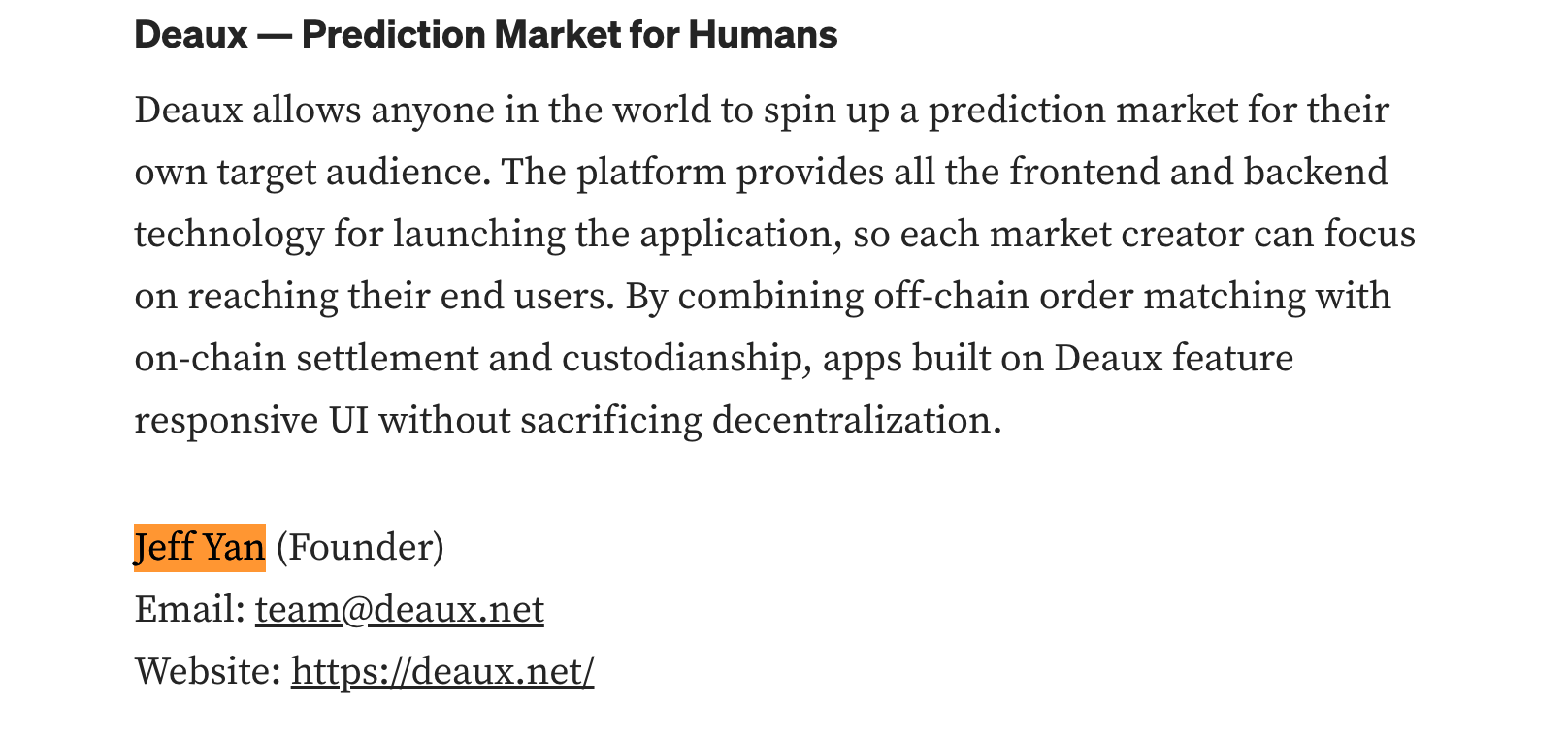

In their Medium post, a project named Deaux appears on the list of Season 1 incubated projects in 2019, founded by none other than Jeff Yan.

What was Deaux? Simply put, it was a decentralized prediction market platform.

Based on the original description, Deaux aimed to allow anyone to create prediction events on-chain, where users could bet on outcomes, with prices determined by market supply and demand. It adopted a hybrid architecture—order matching executed off-chain, while final settlement occurred on-chain.

This design was already quite advanced for 2018—balancing performance with decentralization, aiming to provide crypto-native infrastructure for prediction markets.

Yes, this is exactly what platforms like Polymarket are doing today. From this perspective, Jeff was clearly ahead by several iterations.

This isn’t hindsight bias either. From surviving public information, Deaux emphasized a hybrid on-chain/off-chain model, high-performance order matching, and decentralized settlement—features that bear notable similarity to Hyperliquid today.

Jeff identified the right direction and designed a sound framework—but Deaux never took off. Its website is now defunct, and its social media accounts haven’t been updated since 2019.

The price of being ten steps ahead may simply be poor timing.

The crypto market in 2018 had just crashed from its bull run peak. Users cared about when prices would rebound—not how to profit from on-chain prediction markets. More importantly, the ecosystem’s infrastructure—blockchain performance, wallet experience, user education—was still immature.

A product requiring frequent trades and low latency couldn’t deliver a smooth experience under those technical constraints.

But failure to launch doesn’t mean failure in vision. Around 2020, Jeff founded Chameleon Trading, the precursor to Hyperliquid. Whether prediction markets or derivatives trading, both fundamentally revolve around “order matching + risk management.”

This time, he set his sights on perpetual contracts—a more mature market with stronger demand and clearer user needs.

The timing was perfect. FTX collapsed in 2022, shattering trust in centralized exchanges and igniting massive demand for decentralized alternatives.

Yet Jeff didn’t follow the path of copying Uniswap or dYdX. Instead, he chose a harder but more radical route: building his own L1 chain.

Moreover, rather than relying on external liquidity providers, he introduced the HLP (Hyperliquid Liquidity Provider) mechanism, enabling users to directly participate in market making. Even more aggressively, he adopted a zero-fee model, sustaining operations through tokenomics and ecosystem growth.

From Deaux to Hyperliquid, you can see the consistency in Jeff’s approach: hybrid on-chain/off-chain architecture, high-performance order books, decentralized settlement.

This time, however, he picked the right market—and caught the right wave.

The invisible founder

Interestingly, despite growing buzz on X about the photo, Jeff himself has never commented.

Browsing Hyperliquid’s Twitter account, you’ll find almost no personal photos or lifestyle content—only product updates, technical docs, and the occasional meme.

Even on Jeff’s personal account, there’s little effort to build a personal brand. His posts mostly focus on product improvements and market insights. His last tweet was on September 23.

This relatively low-key style stands in contrast to the typical crypto playbook, where strong marketing and attention-grabbing tactics dominate. Most founders actively engage in AMAs, podcasts, and conferences, turning their personal identity into part of the project.

But Jeff seems to follow a different path—staying behind code and products, letting trading volume and user growth speak for themselves. Perhaps this is partly why he’s made it from the Binance Labs incubator to where he is today: undistracted by noise, focused on building coherent, consistent products.

From apprentice to competitor

From an incubator apprentice in 2018 to a top player in perpetual DEXs by 2025, the reason Jeff’s old photo sparks discussion is simple: people are struck by his persistence, and by the irony that a project once nurtured by Binance Labs may now be competing against it.

From a bystander’s view, does this feel like Binance raising a tiger that will one day turn on it?

The crypto industry has always championed disruption from the edges and open innovation. In its earlier days, Binance Labs functioned more like an open, inclusive incubator—favoring openness over control.

Think of an incubator as a martial arts school:

A master teaches you kung fu, but can’t demand lifelong loyalty. You’re free to open your own school—even challenge your master. It’s hard to call this betrayal; it’s more like passing down the tradition.

If Binance Labs only funded non-competitive projects, or feared nurturing founders who might grow too big, could it still be called an incubator?

Incubators cannot demand loyalty.

Conversely, Binance Labs may have backed the right person—a founder with potential—even if that founder later built something competitive with its parent company.

In the long run, Binance’s value as an industry giant isn’t just measured by its own profits, but also by how much it fosters the broader crypto ecosystem. If Binance stopped incubating projects merely because they *might* become competitors, that would truly be short-sighted.

More importantly, competition benefits the entire industry and its users.

Hyperliquid’s rise forces other exchanges to continuously improve in product experience, fee structures, transparency, and even wealth distribution.

Users gain more choices—and the power to vote with their feet.

In a way, what Jeff is doing mirrors Binance’s own early challenge to traditional exchanges:

Using better products to redefine what an exchange *should* look like. This time, however, the targets aren’t Coinbase or Bitfinex—they’re Binance itself.

So what can we learn from this internet drama?

Perhaps the real lesson isn’t the surface-level drama of “Binance created a competitor,” but something deeper:

Knowledge should spread, talent should flow, competition should happen—and everyone should benefit from the growth of the crypto ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News