While you're on vacation, your money works for you: achieve "passive profits" during National Day with Bitget GetAgent

TechFlow Selected TechFlow Selected

While you're on vacation, your money works for you: achieve "passive profits" during National Day with Bitget GetAgent

Save this guide—it'll come in handy for your next vacation!

Author: 0x Nameless Crocodile

Bitcoin hit a new high—again! While we were enjoying our National Day holiday, Bitcoin surged to $125,000. The crypto market's frenzy clearly doesn't pause for China's holidays. Market volatility has continued, with over $300 million in daily liquidations across the network on average over the past week, and more than 100,000 users getting liquidated each day. On one side, heavyweights at Token2049 are sending out dense signals; on the other, macro events like the U.S. government shutdown are stirring market turbulence. Even when finally taking a break to enjoy vacation, we can't help but constantly pull out our phones to check headlines, monitor positions, and adjust portfolios.

The market never sleeps, but crypto people need rest. How can we enjoy this rare holiday while ensuring we don’t miss market movements or fail to manage our crypto assets?

Luckily, this time I brought an AI crypto trading strategist with me on my trip to enable passive trading and holiday portfolio management.

On September 29, Bitget offered all users free 7-day access to the Plus membership of its AI trading assistant, GetAgent, before the holiday. Simply logging in automatically unlocks a 7-day Plus trial. The Plus version upgrades the standard edition with features such as 10 daily custom queries, personalized trading strategies, natural language order placement, and in-depth full-market analysis.

Next, I’ll share how I fully leveraged GetAgent to manage my crypto trading during the holiday. Save this guide—you'll definitely use it again next holiday!

With so many AI options, why did I choose Bitget’s GetAgent?

For those unfamiliar with GetAgent, let me briefly introduce it.

GetAgent is Bitget’s globally launched first-ever all-in-one AI crypto trading assistant, embedded directly within the app. It supports natural language interaction and integrates over 50 professional tools (MCP), forming a closed-loop service from market analysis to one-click execution.

Core features include:

-

24/7 real-time monitoring: Continuously tracks price fluctuations, on-chain funds (e.g., whale movements), and social trends without requiring manual platform switching.

-

Personalized strategy generation: Customizes strategies based on user history and risk preferences, such as suggesting accumulation points for blue-chip tokens or predicting trends for Meme coins.

-

Automated execution: Enables natural language orders (e.g., “Buy BTC with 100 USDT”) and allows completing trades directly within chat.

-

Risk management: Automatically diagnoses positions, provides take-profit/stop-loss levels (conservative/aggressive modes), and offers balancing recommendations.

Compared to large models like ChatGPT, an AI assistant embedded within an exchange is clearly more attractive. Beyond the convenience of one-click trading via chat, GetAgent also accesses Bitget’s real-time trading data, offering more comprehensive and actionable insights.

Additionally, GetAgent has strong self-evolution capabilities, continuously learning from user interactions, understanding habits, and adjusting and optimizing its strategies accordingly.

Pre-holiday setup: Enable “unattended mode” in ten minutes

Before the holiday, we need to set up GetAgent through a few simple conversations to be fully prepared. Log into the Bitget App, go to “Frequently Used Features” or the asset page, click on the GetAgent chat interface, and the Plus version will be automatically unlocked. Here’s a small tip: when chatting with GetAgent, try to keep related questions within a single conversation thread, allowing GetAgent to provide better answers and strategies using context.

Step 1: Portfolio health check

Suggested command:

Analyze my current investment portfolio based on my holdings, watchlist, transaction history, and personal data, and provide optimization suggestions.

GetAgent analyzes your holdings, assesses asset allocation and risk concentration, and provides rebalancing recommendations. Additionally, GetAgent infers your investor MBTI personality based on your investment behavior. Just type “Infer my MBTI personality” in the chat, and GetAgent will predict your investor profile and offer corresponding investment advice.

Below is the analysis for one of my accounts:

GetAgent thoroughly listed my holding structure, recent trading records, and watchlist, analyzing my behavioral patterns—even detailing characteristics of every single trade (it’s hard not to blush seeing this level of scrutiny; feels like being completely exposed). Its deep insight and self-proclaimed title of “Chief Strategist” hold up under scrutiny. After detailed analysis, GetAgent provided investment recommendations, advising how to leverage strengths, improve weaknesses, and offering executable, quantifiable action plans.

In every subsequent conversation, GetAgent will base its strategy and allocation suggestions on your MBTI personality traits. You can repeatedly reinforce this by giving commands like “Adjust my ETH position based on my risk preference.”

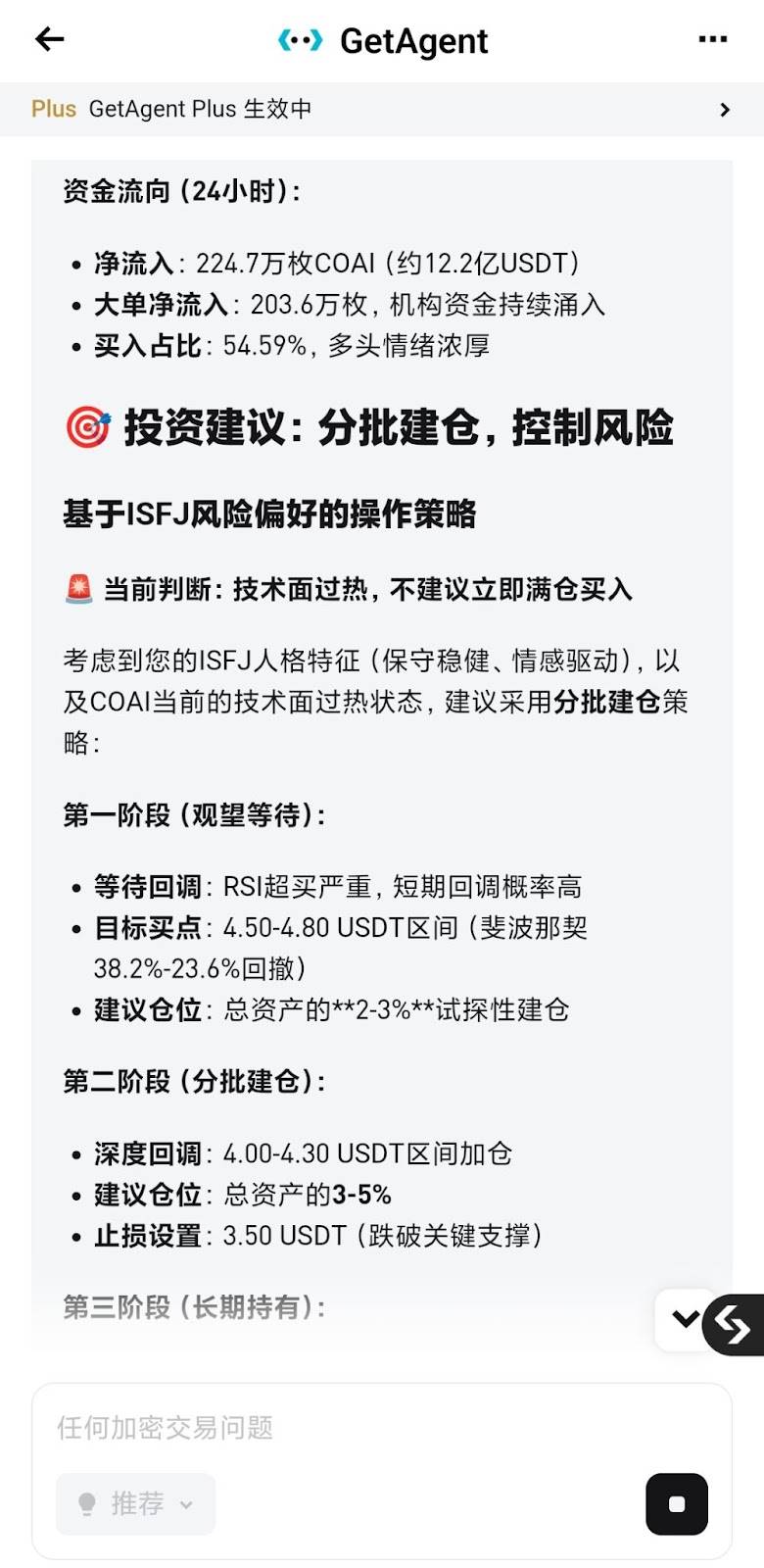

For example, in the image below, when I asked GetAgent to analyze a token’s fundamentals, it tailored its investment strategy recommendation according to my ISFJ personality type:

Step 2: Customize personalized financial or trading strategies

Suggested command: Based on my risk preference, create a spot cost-averaging plan for me during the National Day holiday, or recommend a short-term trading strategy suitable for the current market.

GetAgent provides detailed strategies based on current market conditions and your holdings, going as far as specifying total investment amount, asset allocation ratios, daily execution plans, risk control settings, and even forecasting key support levels and expected allocations—it considers every aspect thoroughly.

The personalized financial product recommendation is a recently launched feature ideal for users with limited time who want passive income during holidays.

Exchanges offer diverse and comprehensive financial products, but for beginners, simply understanding them poses a barrier, let alone selecting the right ones. In this regard, GetAgent’s functionality is extremely practical. Just describe your needs to GetAgent, such as “I want to use a trading bot—any recommendations?” or “Recommend a suitable bot based on today’s market,” and GetAgent will customize financial products for you, clearly explaining complex concepts like how to set grid numbers or what a Martingale bot is.

Moreover, GetAgent provides links to create cost-averaging strategies directly within chat, enabling one-click access to trading.

Step 3: Set up market alerts

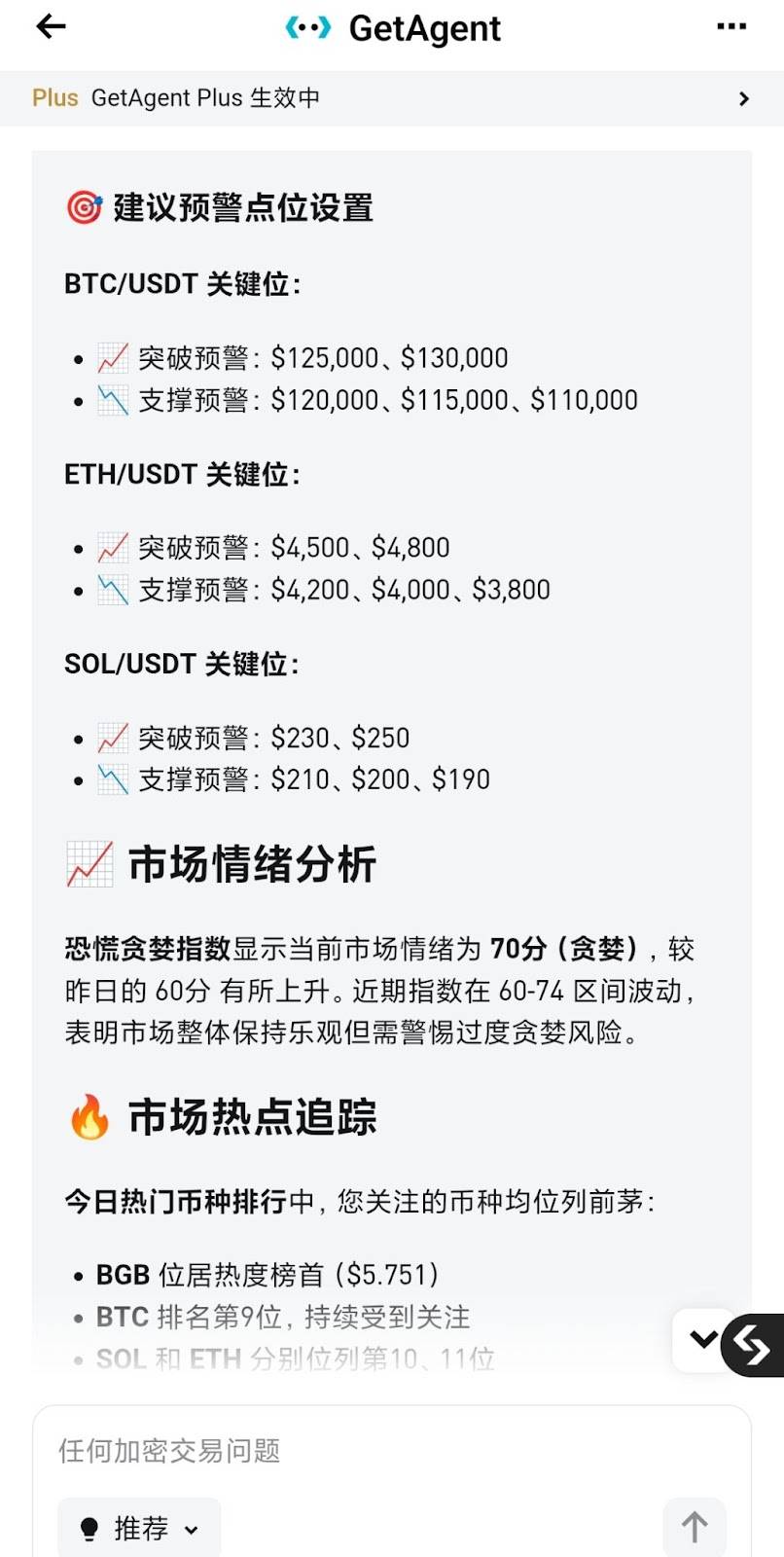

Suggested command: I’m particularly interested in BTC, ETH, and SOL. How can I monitor these effectively during the holiday?

If you prefer active trading and catching opportunities rather than passive execution, start with market alerts. Inform GetAgent upfront about the tokens you care about, and it will guide you step-by-step on setting price alerts within the Bitget App, including specific recommended alert levels:

During setup, GetAgent reminded me—based on my trading personality—to avoid excessive screen-checking and stick to my predetermined DCA plan instead of changing strategies due to short-term price swings (truly thoughtful!).

Holiday practice: Ten efficient daily questions to ask GetAgent

After consulting with GetAgent, my overall holiday strategy focused on steady asset growth primarily through regular DCA into major blue-chip assets. If you're more skilled in trading Memecoins or other niches, simply inform GetAgent of your areas and interests.

Below are some common questions and commands I used during the holiday, ensuring GetAgent regularly checked and adjusted my portfolio. Since each response from GetAgent is highly efficient and comprehensive, the Plus plan’s daily limit of ten queries essentially covered all my holiday needs. For more advanced or frequent traders, subscribing to GetAgent Ultra is recommended, allowing up to 50 custom queries per day.

1. Market scanning and opportunity discovery

Suggested commands:

Are there any important news updates today for my main holdings?

How is the crypto market performing today? Any new opportunities?

Ask GetAgent to provide real-time market trend analysis and hot token recommendations. It will filter 2–3 new trading opportunities for you, helping you quickly grasp market momentum.

2. Position management and risk control

Suggested commands:

Generate my personalized daily position report and provide specific rebalancing suggestions based on current market conditions.

Analyze my current asset portfolio and provide insights and recommendations.

Use the personalized daily position report to let GetAgent analyze your token distribution, profit/loss status, and position adjustments. It will provide real-time market data for your watched tokens, overall performance metrics for major assets (price, 24h change, 24h volume, technical signals, etc.), and highlight tokens on your watchlist—even those you don’t currently hold.

GetAgent provides dynamic rebalancing suggestions and risk warnings based on the latest market data, broken down into stages with priority levels—such as which actions should be taken immediately, completed within the week, or started next week—making them highly actionable. If the overall portfolio suggestions feel too broad, you can drill down into specific tokens and ask GetAgent for deeper insights.

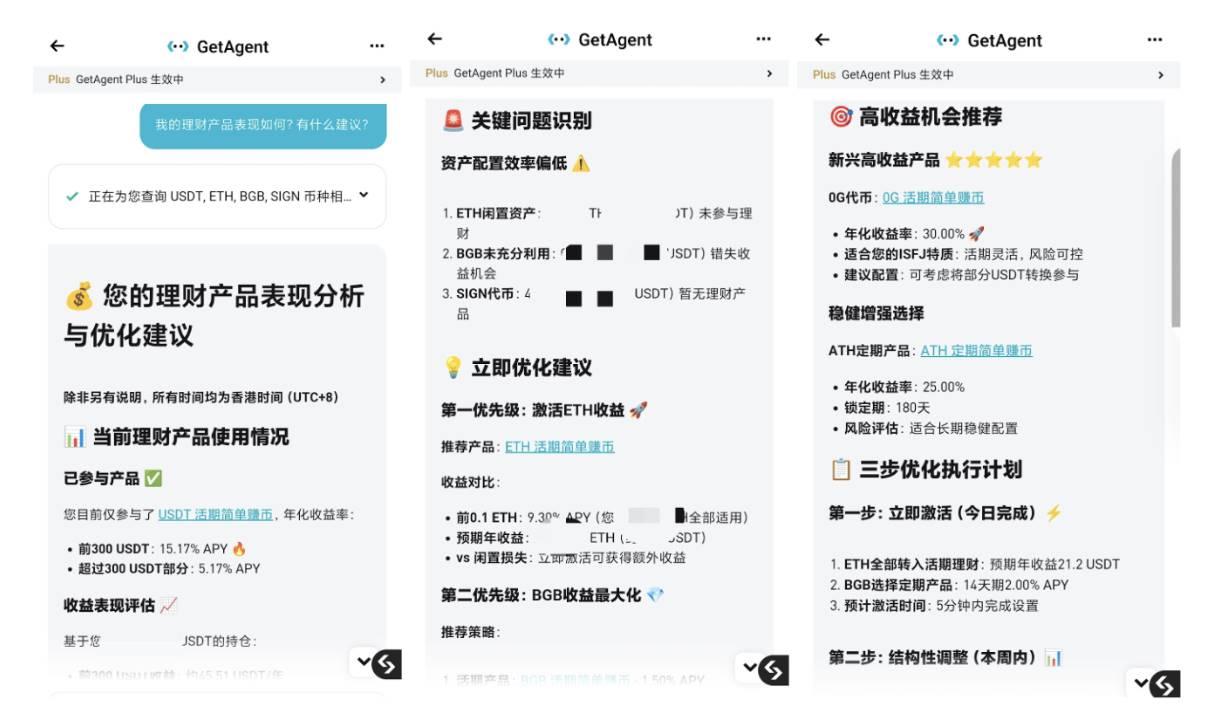

3. Financial product review

Suggested command:

How are my financial products performing? Any recommendations?

After analyzing your overall portfolio, you can further use GetAgent to evaluate your financial products. After assessing returns, GetAgent checks for additional earning opportunities within your holdings, ranks them by priority, and estimates potential gains. It also recommends high-yield opportunities with actionable two-week implementation plans.

If you’re interested in a financial product suggested by GetAgent, you can follow up with comparison queries to obtain estimated returns.

4. In-depth technical analysis and one-click execution

Suggested commands:

You recommended token XX—help me conduct a comprehensive analysis of its fundamentals, news, and technicals. Is now a good time to buy?

What’s the latest news and price trend for ETH? Is it a good time to open a futures position?

After grasping the overall market and key trends, we can ask GetAgent to zoom in on one or two tokens of interest. GetAgent integrates technical indicators (like RSI, MACD) to provide clear support/resistance levels and specific buy/sell recommendations. If you have more time, you can give more detailed instructions—for example: “Provide a comprehensive research report on token XX, including: fundamentals (project positioning, team, ecosystem, tokenomics), recent major news, and technical analysis (key support/resistance, volume, indicator trends). Finally, based on this analysis, give a holistic valuation assessment and specific operational advice (buy, sell, or hold) with reasoning.”

Most importantly, you can execute trades directly within the same chat interface—e.g., “Buy with 20 USDT”—completing transactions in one click, greatly improving efficiency. Notably, GetAgent will undergo a full upgrade for futures integration on October 11. Previously limited to spot trading within chat, it will soon support futures—mentioning a specific position will bring up a position card, enabling one-click navigation to the futures trading page.

5. Strategy review

Suggested commands:

Review and recap the holiday trading strategies you previously provided, based on recent market dynamics.

Which hot tokens did I miss over the past week? What early-positioning suggestions do you have?

In fact, even without explicit review commands, GetAgent frequently references past predictions during daily Q&A. With strong learning abilities, multiple rounds of dialogue push GetAgent to utilize more tools and data, delivering deeper, cross-validated conclusions. Maintaining consistent, high-frequency interaction also enables GetAgent to serve you more personally.

When reviewing the strategies provided during the holiday, you’ll find that GetAgent not only evolves itself but also directly identifies flaws in your execution—such as lack of systematic investing or being overly conservative during key market recovery phases—hitting the core issues in your investment process.

One point bears emphasis: AI is not a prediction oracle. Market direction is shaped by numerous complex factors. If you don’t want to miss trading opportunities on trending tokens, consider testing AI strategies with small, repeated bets before the holiday when you have more energy. But if, like me, your focus is limited during holidays, cautiously adjust positions and use GetAgent to monitor liquidity risks promptly—especially avoiding low-liquidity Meme coins.

Final thoughts

In previous years, returning from long holidays like Spring Festival or National Day left me anxious and overwhelmed by FOMO, frantically scrolling through missed news and hot projects discussed by KOLs.

But during this recent holiday, thanks to GetAgent’s wealth management strategies and daily rebalancing alerts, I secured steady returns (though, out of caution, I followed a relatively conservative approach overall as advised by GetAgent). GetAgent delivered not just profits, but peace of mind. Throughout my trip, I only interacted briefly before bedtime, truly enjoying a relaxed vacation.

A recent quote from Bitget CEO Gracy on AI deeply resonated with me:

“We live in a real world. We are flesh-and-blood beings, not silicon-based lifeforms. AI can never place orders for me—it can only offer suggestions. At least in my personal life, I hope AI exists this way. I cherish moments like lying on the grass with my son, phone aside. These are the very real, human experiences that make life meaningful.”

I believe this philosophy shapes GetAgent’s product vision—AI does not replace humans, but liberates traders from repetitive, time-consuming analysis, achieving a form of “tool democratization.” It allows us to remain calm amid relentless market volatility, reclaiming time and energy for real life and those precious, distinctly human moments.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News