KOLs are flaunting their incomes, while I want to share the hard lessons from three years of VC investing

TechFlow Selected TechFlow Selected

KOLs are flaunting their incomes, while I want to share the hard lessons from three years of VC investing

Patience brings opportunities, luck requires expertise, FOMO = suicide.

Author: BruceLLBlue

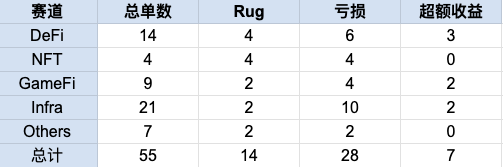

Recently, Twitter has been buzzing with a wave of Chinese-speaking KOLs flaunting their "earnings over the past year": hundreds of millions, even tens of billions, 1024 billion (yes, meme entries included)... After reading all this, all I can say is: impressive! But as a former VC investment lead (GP, General Partner), I just want to vent: in recent years as a crypto VC, I've lost tens of millions of dollars. Not exaggerating—this is real, hard-earned painful experience. Over three years, 55+ direct investments, 27 losing deals (including rugs), 15 completely written off, while also investing in 9 relatively top-tier VCs.

All NFT-related projects failed entirely. GameFi saw 33% rug rates. Infrastructure was hit hardest, with many projects retaining only 10%-20% of their peak valuations. To the income-flaunting KOLs and esteemed crypto traders: congratulations on catching the secondary market wave. But what about ordinary, early-stage-focused VCs? They're constantly groveling to project teams, waiting 3–4 years for token unlocks, only to end up with “invested early, picked right, but couldn’t exit.” Why flip the script and share losses instead? Because this isn’t begging for sympathy—it’s a wake-up call. Being a crypto VC is inherently tough: bear markets kill you slowly; bull markets see you “harvested” by project teams. Yet I believe that in this new cycle, continuing as a traditional VC (or evolving it) might not be ideal. Despite institutional capital flooding in, clearer regulations emerging, and AI + on-chain tools reshaping exit paths, I think there are better ways to realize value. Let me share my hard lessons—hopefully they resonate.

1️⃣ Lesson One: The brutal stats—truth behind 55 deals' "win rate"

From joining crypto VC in August 2022 until leaving in July 2025, I personally executed 55 direct investments and invested in 9 funds.

Rug ratio: 14 out of 55 (25.45%)—NFT projects were the worst-hit, all wiped out. One “star project” backed by a major IP had explosive early NFT sales, but the team lacked Web3 experience, the celebrity founder showed zero interest in launching a token, and key members eventually left, leading to a soft rug. Another “music + Web3” venture led by ex-tech giants veterans spent years doing nothing, then quietly died. Then there was the DEX project born from an “executive startup dream”: the founder made his team work off-the-books while pocketing all revenue—core staff fled. And those “promising” startups spun out of university labs? Most collapsed.

Loss ratio: 28 out of 55 (50.1%). One GameFi project launched at 5x, then fell apart (now worth 20% of cost, down 99% after slow bleed). Another GameFi project, marketed as having a “North American tech giant background,” peaked at 12x, now trades at just 10% of cost. A third GameFi project got crushed by excessive sell pressure from a CEX launchpad, never gained traction, and flatlined. Infrastructure fared worse: no ecosystem breakthroughs, no technical innovation, post-hype valuations often dropped to 10% of cost. Without timely hedging, these positions were utterly destroyed. One socialfi project on the MOVE stack even collapsed right before the 2024 bull run.

What about fund investments (FoF, fund-of-funds)? I invested in 9 top Western funds including @hack_vc @Maven11Capital @FigmentCapital @IOSGVC @BanklessVC, among others. These funds participated in early rounds of some of the most prominent projects this cycle, such as @eigenlayer @babylonlabs_io @MorphoLabs @movementlabsxyz @ionet @alt_layer @MYX_Finance @solayer_labs @ethsign @0G_labs @berachain @initia @stable @monad @ether_fi @brevis_zk @SentientAGI. On paper, returns look decent—2–3x, seemingly respectable—but actual DPI (distributed to paid-in capital) likely only reaches 1–1.5x. Why the gap? Mainly due to slow vesting schedules and poor market liquidity. In a bear market or another FTX-style collapse, your holdings could instantly evaporate.

2️⃣ Lesson Two: How deep the坑, how deeper human nature—the few disasters that truly moved me

The most painful lesson? “Bet on people” backfired. One DEX founder had the aura of a CEX executive, but outsourced core work to contractors while siphoning revenue into personal accounts. The “North American tech giant dream” GameFi project soared 12x at launch, then entered a relentless downtrend—never recovered. An infrastructure project founded by a former @0xPolygon executive? Ecosystem progress stalled indefinitely, now valued at only 15% of initial investment. Several hyped infra projects listed on Korea’s twin exchanges (Upbit and Bithumb), then plummeted—never rebounded. Even a “music NFT” venture led by a Tencent Music executive ended in soft rug after years of inaction.

Chinese-speaking VCs suffer more: language, mindset, and resources put us at inherent disadvantage. Western funds operate differently—they scale for management fees. We often chase quick flips and lack staying power. After raising massive rounds, famous projects outsource roadmap execution globally (from my experience, they just need budget approval), while founders focus solely on community and fundraising. VCs? We’re the weakest link. Some project teams dump tokens via airdrops, trade through USB drives and Korean exchanges (pump to target price at listing, then split profits—this explains why Korean exchanges often show huge opening premiums). Investors have no way to verify anything. Every VC thinks they’re special—go check their IRR and DPI, many wouldn’t beat USDT/USDC staking yields.

3️⃣ Lesson Three: After so many losses, I learned the evolution of “exit supremacy”

Being a VC is genuinely hard. Survive bear markets, gamble on trust, decode human nature, hold illiquid tokens waiting 3–4 years for unlock—without hedging or liquidity management in secondary markets, generating alpha is nearly impossible. From my analysis, the few projects that delivered true outsized returns were mostly invested in between late 2022 and end of 2023, right after the FTX crash. Key reasons: lower valuations, stronger founder conviction, and perfect timing (projects had enough runway to explore and launch TGE early in the bull cycle). Why did other investments underperform or lose money? Simple: either too expensive, too early, or misaligned unlocks.

Looking back, these are invaluable lessons! Now $BTC keeps hitting new highs, traditional giants and Wall Street are rushing in—making it harder than ever for ordinary individuals to get rich quick. Institutional returns are converging toward Web2 VC levels (we’ll never return to the wild pre-2021 era).

The next-gen investor isn't necessarily a VC—it's more likely an individual angel or super-KOL who leverages influence and connections to secure better unlock terms and cheaper allocations. It's not just about investing early or picking right—it's full-stack capture: primary + secondary + options/convertibles + airdrop farming + market making hedging + DeFi arbitrage. There's a severe cognitive gap between East and West—that’s where the real arbitrage goldmine lies.

🔵 Turning from capital to keyboard: reclaiming alpha through content

Losing tens of millions as a crypto VC taught me one thing: endlessly courting project teams, waiting for unlocks, gambling on human nature—only earns you the label “VC dog” and complaints from LPs. Meanwhile, project teams can stealth-dump via airdrops while investors watch helplessly. Enough! I’ve chosen to turn the page and start writing. By typing every day, sharing industry insights and alpha-grade analysis, I no longer wait passively for unlocks. Instead, I proactively identify and capture opportunities ahead of time. Compared to the passive VC model, this path carries more dignity. I create value freely, and my compounding comes from reader trust and shares.

After all these years, I finally understand: patience > opportunity, luck > skill, FOMO = suicide.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News