October Decides It All: Altcoin ETFs Awaiting SEC's Final Ruling

TechFlow Selected TechFlow Selected

October Decides It All: Altcoin ETFs Awaiting SEC's Final Ruling

The approval or rejection of Litecoin and SOL, which are the first to face rulings, may determine subsequent market expectations.

Author: 1912212.eth, Foresight News

In October 2025, the U.S. Securities and Exchange Commission (SEC) is set to issue final rulings on at least 16 spot cryptocurrency exchange-traded funds (ETFs), covering various tokens beyond Bitcoin and Ethereum, such as SOL, XRP, LTC, DOGE, ADA, and HBAR. According to recent developments, the SEC has withdrawn multiple delay notices and accelerated the approval process through new universal listing rules, shortening the review period to under 75 days.

According to crypto journalist Eleanor Terrett, the SEC has asked issuers of LTC, XRP, SOL, ADA, and DOGE ETFs to withdraw their 19b-4 filings, as these are no longer required following the approval of universal listing standards.

Since their approval, spot Bitcoin and Ethereum ETFs have attracted significant capital inflows and contributed notably to price increases. So, will these additional ETFs be approved, and will they similarly boost token prices?

Final Decision Deadlines for Multiple Token ETFs Set for October

According to data compiled by Twitter user Jseyff, final deadlines for several altcoin spot ETFs are spread across October. The first pending decision is Canary's LTC ETF, with a deadline of October 2.

This is followed by Grayscale’s Solana and LTC trust conversions on October 10, and finally WisdomTree’s XRP fund on October 24.

According to the upcoming approvals list created by Bloomberg ETF analyst James Seyffart, decisions could be made at any time before the final deadlines.

Applications come from institutions including Grayscale, 21Shares, Bitwise, Canary Capital, WisdomTree, and Franklin Templeton. Notably, BlackRock or Fidelity are not involved in this round, but that does not diminish the potential impact—if approved, these could pave the way for larger-scale products later.

Since the approvals of spot BTC and ETH ETFs, no other cryptocurrencies have received SEC approval, and applications have continued to face delays consistent with the SEC’s past approach. However, the upcoming final rulings will require the SEC to deliver a definitive Yes or No to the market.

The market is watching closely.

The approval or rejection of Litecoin and SOL ETFs, among the earliest to be decided, may shape subsequent market expectations.

Approval Probability

At the end of July, the SEC introduced new listing standards focusing on eligibility requirements and operational mechanisms for crypto ETPs. Physical creation and redemption were formally permitted, meaning authorized participants can now exchange actual crypto assets rather than cash for ETP shares.

The SEC also released spot ETF listing criteria. The new "universal listing standard," expected to take effect in October 2025, aims to streamline the ETF listing process. It requires that crypto assets must have been listed on major exchanges like Coinbase for futures trading for at least six months. This rule is designed to ensure sufficient liquidity and market depth, preventing manipulation.

As a historically established altcoin, Litecoin is well known, and LTC’s maturity and non-security status make it a leading candidate for early approval. Litecoin founder Charlie Lee recently stated in an interview that he expects a spot LTC ETF to launch soon. His view is based on the SEC’s approval of universal crypto ETF listing standards and LTC being included among the ten qualifying assets.

In the interview, Charlie Lee discussed LTC’s prospects within the evolving regulatory framework. He noted that the SEC’s recent approval of universal crypto ETF listing standards was a key driver and emphasized that Litecoin meets the conditions for fast-track approval.

As of now, Polymarket shows the probability of a spot LTC ETF being approved this year rising to 93%.

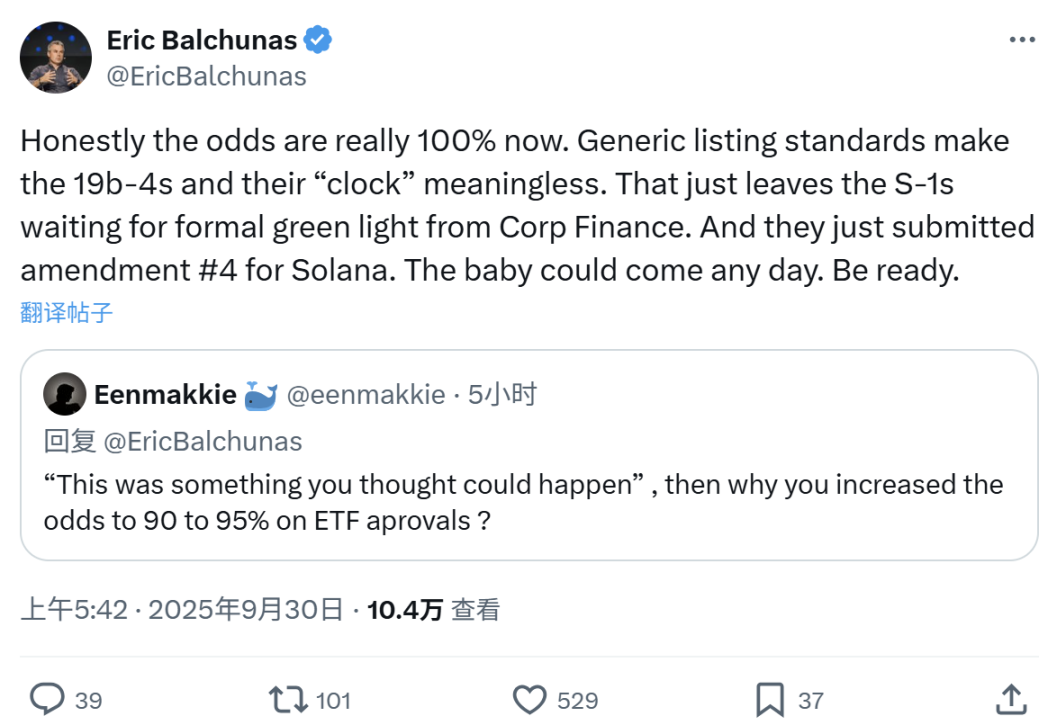

Regarding the SOL spot ETF, Bloomberg ETF analyst Eric Balchunas said, "Honestly, the approval success rate for a SOL spot ETF is now close to 100%. The universal listing standard has rendered 19b-4 filings and their timelines meaningless. Now it's just about S-1 forms. The baby could arrive any minute—get ready."

Notably, ADA is the last coin awaiting a decision at the end of October, with Polymarket showing a 93% probability of its ETF approval.

The SEC’s decisions in early October will clearly serve as a bellwether.

Previously, the SEC approved the Hashdex Crypto Index ETF. Recently, the Hashdex Nasdaq Crypto Index US ETF (NCIQ) added support for XRP, SOL, and XLM, enabling U.S. investors to gain exposure to five crypto assets—BTC, ETH, XRP, SOL, and XLM—through a single investment vehicle.

Earlier, the SEC also approved the conversion of the Bitwise 10 Crypto Index Fund into an ETF, covering assets including BTC, ETH, XRP, SOL, ADA, SUI, LINK, AVAX, LTC, and DOT.

Will Approval Boost Token Prices?

Bitfinex analysts previously predicted that crypto ETF approvals could trigger a new altcoin season or rally, as these approvals would offer traditional investors greater exposure to crypto investments.

However, some analysts disagree with this view.

Bloomberg ETF analyst James Seyffart stated that the current altcoin market movement is driven by digital asset financial companies (DATCOs), not by price increases in individual tokens. Seyffart pointed out that institutional investors prefer multi-crypto portfolio products over single altcoin ETFs. He emphasized that institutional capital favors gaining crypto exposure through regulated products rather than holding tokens directly, a structural shift that could permanently alter the pattern of altcoin price rallies.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News