Binance Wallet Booster launches new event, explore Turtle, your one-stop DeFi管家

TechFlow Selected TechFlow Selected

Binance Wallet Booster launches new event, explore Turtle, your one-stop DeFi管家

On one hand, it brings higher returns for users, and on the other hand, it brings higher TVL for projects.

By: Eric, Foresight News

Binance Wallet has released the latest information about its Booster campaign. Users who have reached 61 Alpha points can participate in this Booster event, which offers a total of 15 million TURTLE tokens from Turtle, an on-chain liquidity distribution protocol. Tokens claimed through the Booster event will be subject to vesting periods set by the project team. The event will go live today at 18:00.

Prior to Binance Wallet's announcement, Turtle officially unveiled its tokenomics: the total supply of TURTLE tokens is 1 billion, to be issued on Ethereum, Linea, and BNB Chain. Of these, 31.5% will be allocated to the ecosystem, 13.9% to airdrops, 2% to core contributors, 1.6% to advisors, 5% to communications and marketing, 20% to the team, and 26% to investors.

What is Turtle?

Turtle is a feature-rich, all-in-one DeFi steward. Although not widely known in Chinese communities, it holds considerable influence within English-speaking circles. At the time of writing, Turtle has facilitated over $1.1 billion in liquidity for its partner projects.

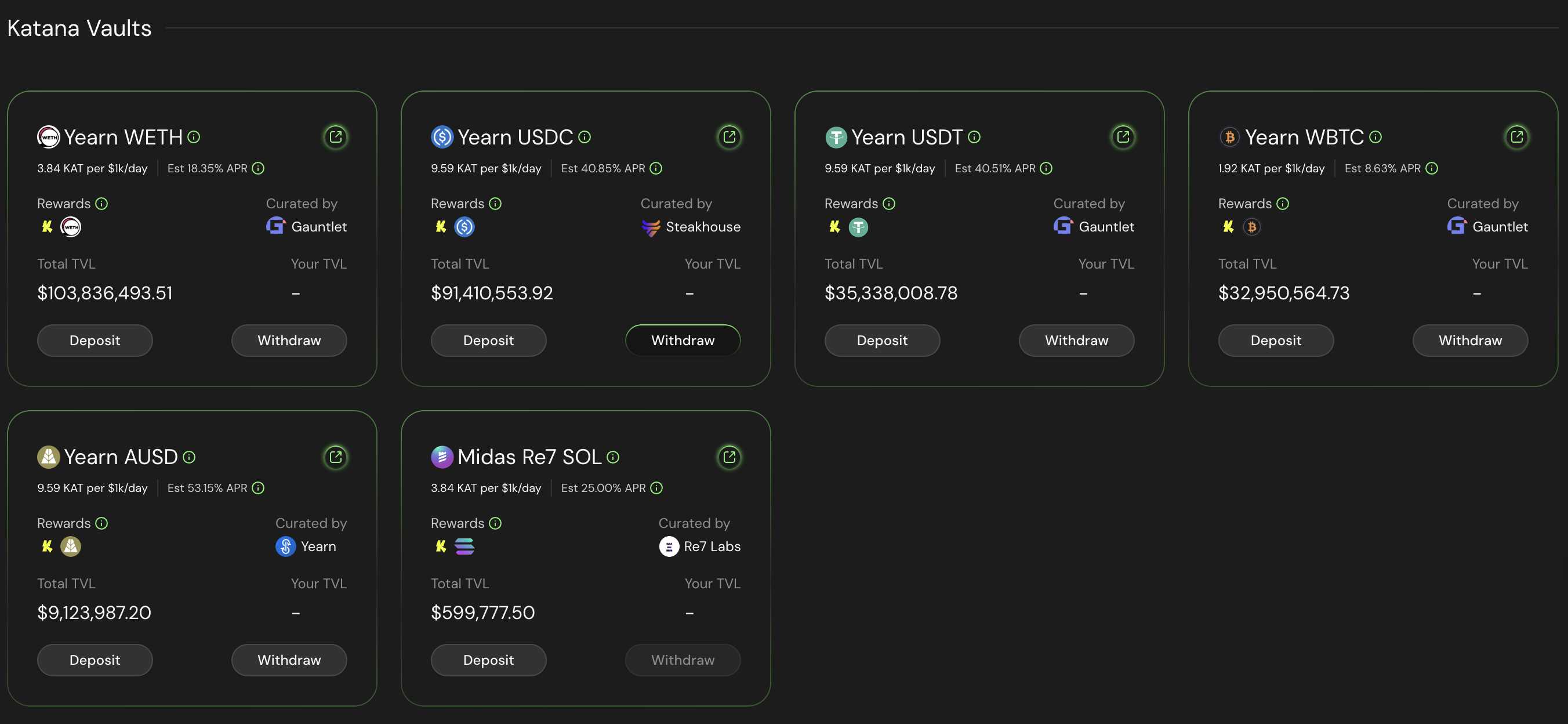

Overall, Turtle offers two main products. The first, called Turtle Campaigns, aims to boost TVL for specific blockchains or ecosystems by summarizing and showcasing optimal yield-generating paths for income-producing assets—such as stablecoins or ETH—within those ecosystems. Users don't need to gather data or calculate yields themselves; they simply choose their preferred strategy.

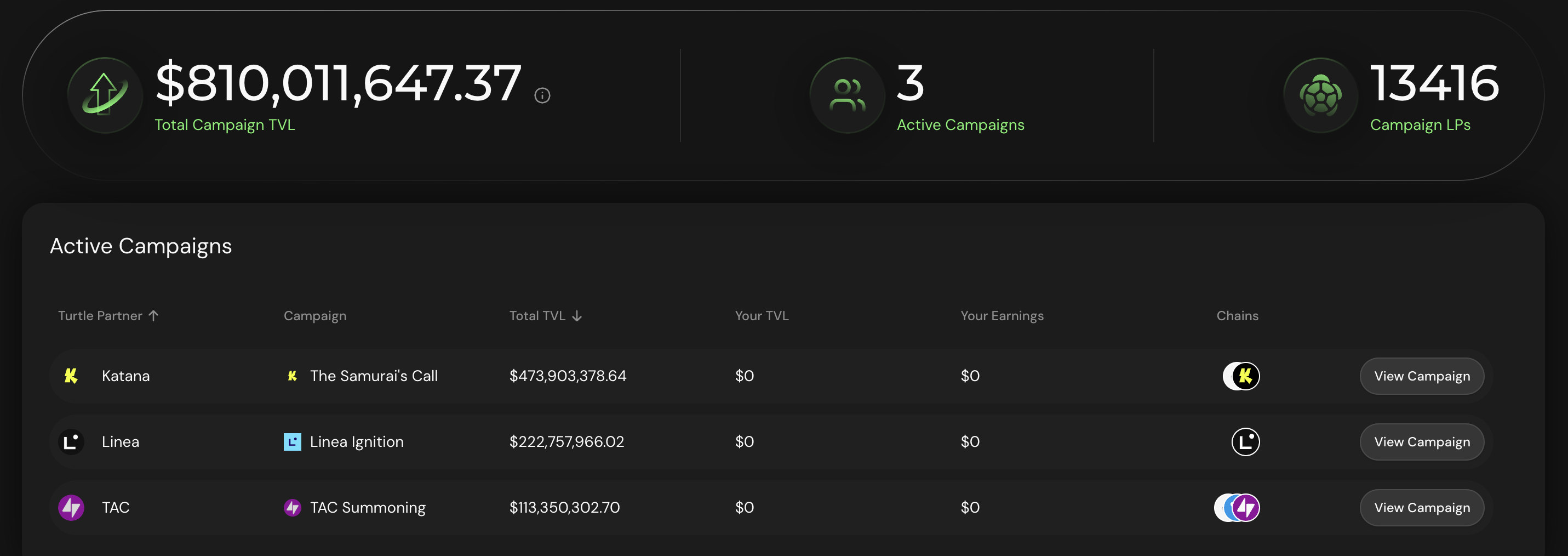

Currently supported projects (ecosystems) under Turtle Campaigns include Katana, a DeFi-focused chain incubated by Polygon Labs and GSR; Linea, Consensys’s Ethereum L2; and TAC, a TON-based EVM blockchain. Together, these campaigns have directed over $800 million in liquidity.

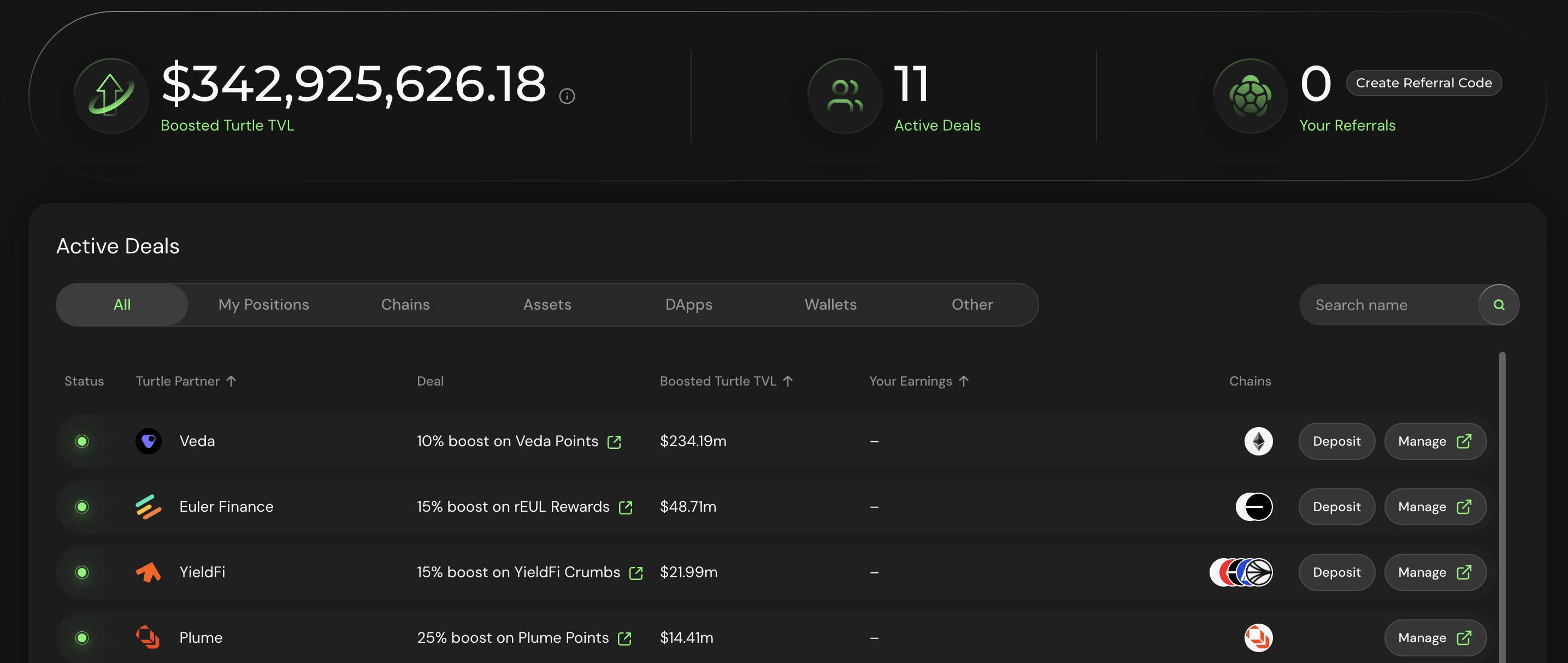

The second product, Boosted Deals, allows partnered projects to offer additional incentives to users who provide liquidity via Turtle, attracting more capital. Additionally, Turtle distributes TURTLE tokens based on users’ actual contributions. This product has currently driven over $340 million in liquidity.

In May this year, Turtle raised over $6 million in funding led by THEIA, with participation from Consensys and Ethereum co-founder Joseph Lubin. Turtle founder Essi Lagevardi previously served as CFO at contract auditing firm Omniscia, whose clients included Euler Finance, Etherfi, Morpho, Fetch.ai, and Maverick. Before that, she was the DeFi lead at blockchain cloud infrastructure company W3BCloud.

Co-founder and CTO Nick Thoma formerly worked as a software engineer at ParaFi Capital, later founding Thoma Technologies and launching Ovrlook, a portfolio management visualization tool. His company also operates distributed validator clusters for Lido and EtherFi.

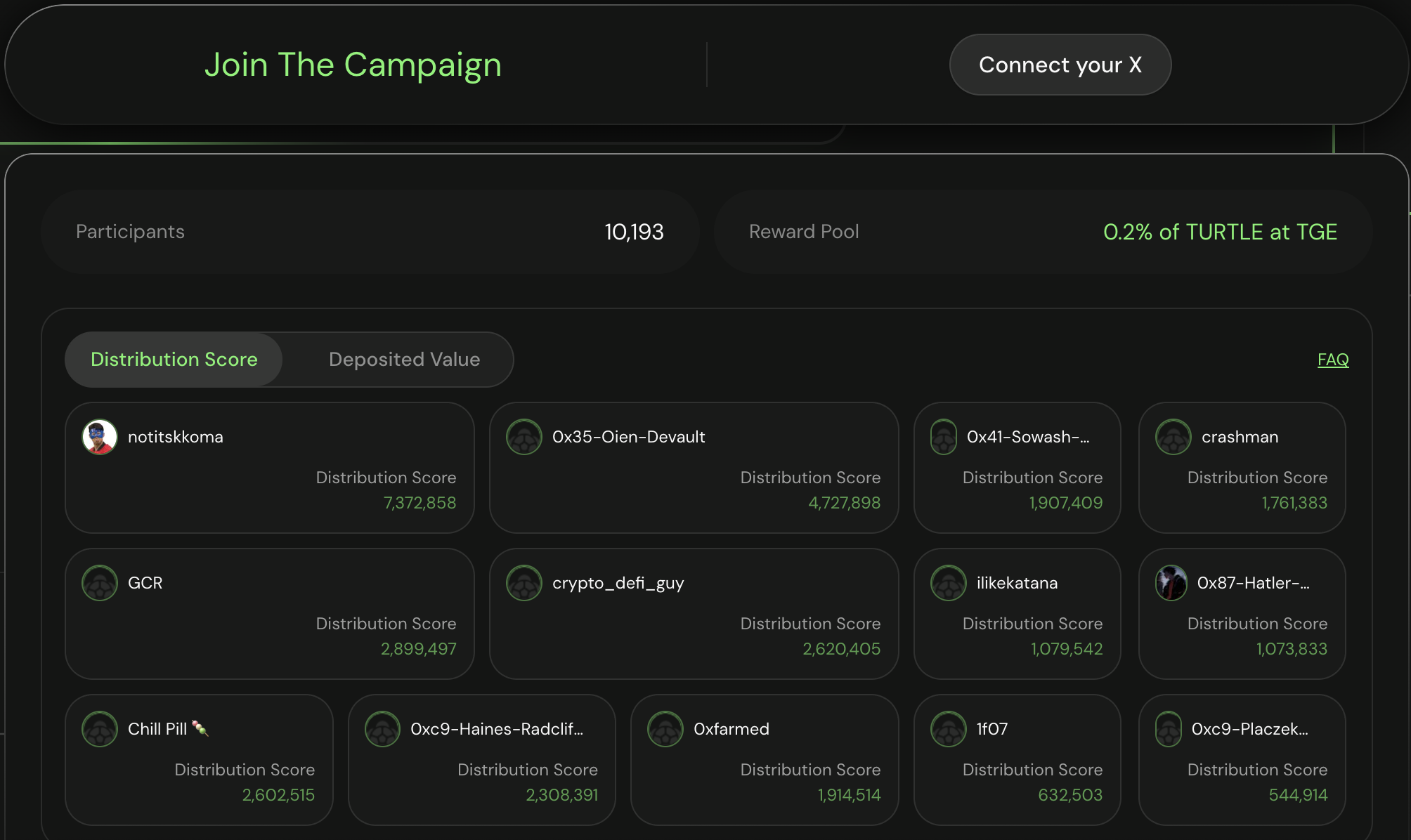

Turtle previously launched a leaderboard campaign where users earned points by depositing assets into the platform and referring others, ultimately receiving token rewards based on their scores. For users already active in DeFi yield farming, Turtle offers a way to reduce complex operational gas costs and research time while earning extra returns.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News