From dYdX to Hyperliquid, SunPump: The Breakthrough Path for On-Chain Derivatives

TechFlow Selected TechFlow Selected

From dYdX to Hyperliquid, SunPump: The Breakthrough Path for On-Chain Derivatives

SunPerp's entry signals the beginning of a new cycle driven by collaboration, innovation, and imagination.

The history of decentralized exchanges (DEX) is essentially an evolution of crypto market infrastructure.

The earliest DEXs were mostly limited to rudimentary trading matching, and due to shallow liquidity, complex interactions, and a small user base, they were nearly impossible to compete with centralized exchanges. It wasn't until Uniswap introduced automated market makers (AMM) into the crypto market in 2018 that DEXs truly became an independently viable sector.

The significance of AMMs lies in lowering the barrier to providing liquidity, enabling anyone to become a liquidity provider. However, AMMs also have clear limitations: high slippage, low capital efficiency, and inability to meet professional traders' demand for sophisticated tools. With the maturation of Ethereum Layer2 technologies and the development of cross-chain bridges and on-chain settlement systems, DEX infrastructure gradually entered a usable phase.

At the same time, evolving user demands drove functional expansion of DEXs. The DeFi Summer of 2020 triggered an explosion in crypto users' demand for leverage and derivatives, making perpetual contracts the "strategic battleground" of the DeFi world. This is because on centralized exchanges, perpetual contracts had already become one of the most attractive categories, boasting massive trading volumes and strong user stickiness. As a result, the DEX sector shifted from "liquidity experiments" to "derivatives dominance," truly entering a fiercely competitive fast lane.

dYdX and GMX: Early Exploration of Perp DEX

Early attempts at Perp DEX can be traced back to dYdX in 2021. As one of the earliest on-chain derivatives projects, it adopted a hybrid model of "off-chain matching + on-chain settlement," using the StarkEx Layer2 network to overcome performance bottlenecks. dYdX's success lay in proving for the first time that "on-chain contracts are not impossible." However, its limitations were also evident: matching remained centralized, cross-chain operations were complex, and usability for traders was limited.

Later, in 2022, GMX offered another solution—providing depth through multi-asset AMM pools where users directly take opposite positions against the pool. GMX’s advantages were its "foolproof" user experience and transparency, allowing even ordinary users to easily open contracts, while bringing Perp DEX firmly into the realm of true decentralization. Yet, the AMM model could not offer sufficient professional tools, and faced risks of pool losses during extreme market conditions (exposure of GLP risk), limiting its potential for higher-level development.

During this phase, Perp DEX remained largely experimental. While the market recognized the value of "decentralized contracts," there was still a significant gap compared to CEXs in terms of performance, depth, and professionalism.

High-Performance Blockchains and Full On-Chain Orderbooks: The Rise of Next-Gen DEX

The turning point came in 2023–2024.

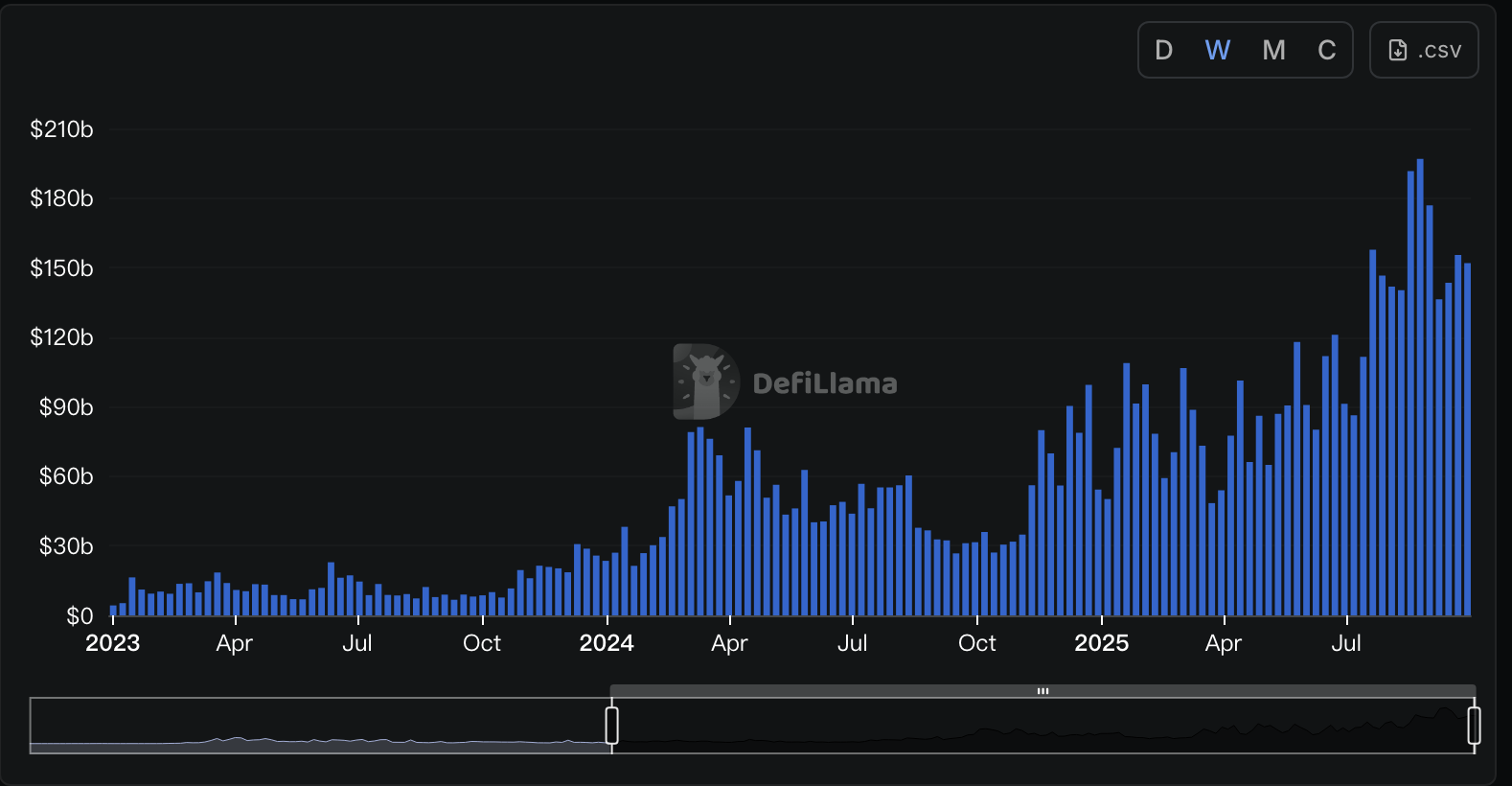

*DefiLlama data shows DEXs TVL has been clearly rising since the second half of 2023

New-generation projects no longer settled for piecing together solutions on Ethereum or Layer2s; instead, they built their own high-performance infrastructures capable of delivering fully on-chain matching experiences approaching centralized exchange performance. Hyperliquid, one of the leading projects, is considered the most representative case.

Hyperliquid is not just a Perp DEX—it built its own high-performance L1 blockchain aiming to serve as the foundational infrastructure for all financial activity and high-performance on-chain trading. Its architecture consists of two parts: HyperCore, which handles on-chain orderbook matching, and HyperEVM, which provides a compatibility layer. Together, they form a fully transparent open financial system where every order, trade, and liquidation is visible and executed with extremely low latency. This is why community users call it the "on-chain Binance."

Beyond technology, Hyperliquid leveraged community and KOL-driven growth to create a flywheel effect. In terms of valuation logic, it also attempted to interpret DeFi protocol value using traditional internet-style user growth and retention models.

In contrast, Aster capitalized on Binance's strong resource advantage, winning decisively during its TGE phase and charting a breakout path more reliant on "platform backing."

Through a combination of "airdrops, price pumps, and wealth creation effects," Aster rapidly accumulated users and visibility, successfully siphoning substantial liquidity away from competitors like Hyperliquid. Product-wise, Aster adopted a multi-chain entry strategy, offering both professional mode (orderbook) and simplified mode (AMM-like). It also introduced features like "hidden orders" to enhance execution security for large trades. In one swift move, it vividly illustrated the harshest truth of the crypto market: when facing traffic and capital, technical superiority takes a back seat.

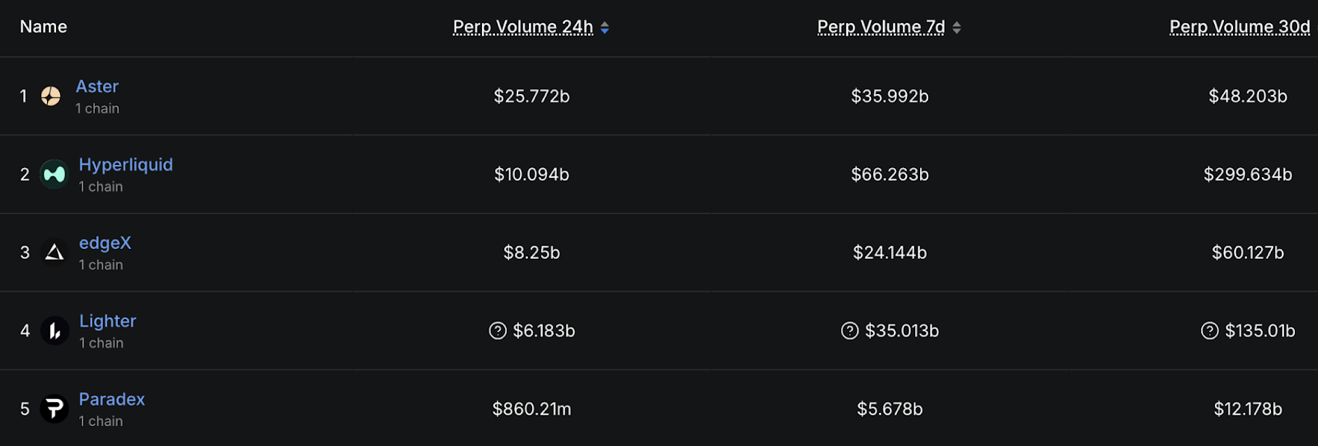

*DefiLlama data shows that as of 24:00 on September 24, Aster's 24-hour perpetual contract trading volume reached $25.772 billion, surpassing Hyperliquid's $10.094 billion, over 2.5 times larger in scale.

If Aster demonstrated the leverage effect of capital and traffic, Lighter represents another type of exploratory path. It seeks differentiation at the trading mechanism level by allowing LLP (liquidity pool, similar to Hyperliquid’s HLP) positions to be used as margin, and emphasizes zero-knowledge proofs to enhance transparency and fairness while maintaining high performance.

In market performance, edgeX stands out with even greater impact. In September 2025, it set a new revenue record for Perp DEX with $49.47 million in total income, earning $20.46 million over the past 30 days, a 147% year-on-year increase. In mobile experience, edgeX is particularly distinctive. Its v2.9 mobile app integrates Privy MPC wallets with CEX-level UX, significantly lowering the barrier to DeFi and gaining strong favor in Asian markets.

Clearly, the hallmark of this stage is the convergence toward CEX-like user experience.

Traders are finding that on-chain contract trading is becoming smoother—even approaching professional quant-grade levels. As performance bottlenecks ease, liquidity begins to concentrate. The narrative around Perp DEX is gradually shedding its "experimental" label and emerging as a real contender capable of capturing market share from CEXs.

SunPerp's "Late-Mover Advantage"

Amid the热潮 sparked by Hyperliquid and Aster, the Perp DEX sector is entering a fiercely competitive phase. From underlying technology to user experience, asset coverage to ecosystem integration, each protocol is seeking differentiated breakthrough paths.

Yet in this battle, being a "latecomer" does not imply passivity—in fact, it reflects a well-considered strategic choice. SunPerp launched precisely at a critical juncture where technology, ecosystem maturity, and market demand converge, leveraging a holistic perspective to quickly amplify its strategic advantages.

Ecosystem closure—the power of integrated resources—ensures SunPerp is not an isolated tool but a hub within the crypto ecosystem. The TRON blockchain provides underlying performance and cross-chain capabilities, while JustLend DAO and Sun.io handle liquidity and settlement functions. Multi-dimensional resource synergy enables SunPerp to achieve a complete闭环 from product experience to ecosystem governance, forming a self-sustaining growth mechanism.

*Data shows that on the 10th day of public testing, SunPerp surpassed 7,000 users with cumulative trading volume exceeding 19.5 million USDT, demonstrating strong market appeal and growth potential.

Extreme cost advantages and innovative incentives: the lowest trading fees across the network, "deposit-to-earn cash rewards," and full gas fee rebates—this suite directly targets the core pain points of high-frequency traders, elevating both capital efficiency and return experience to industry-leading levels. Additionally, SunPerp plans to tightly bind growth and user retention through innovative incentive mechanisms such as trading mining, staking mining, points systems, and leaderboards.

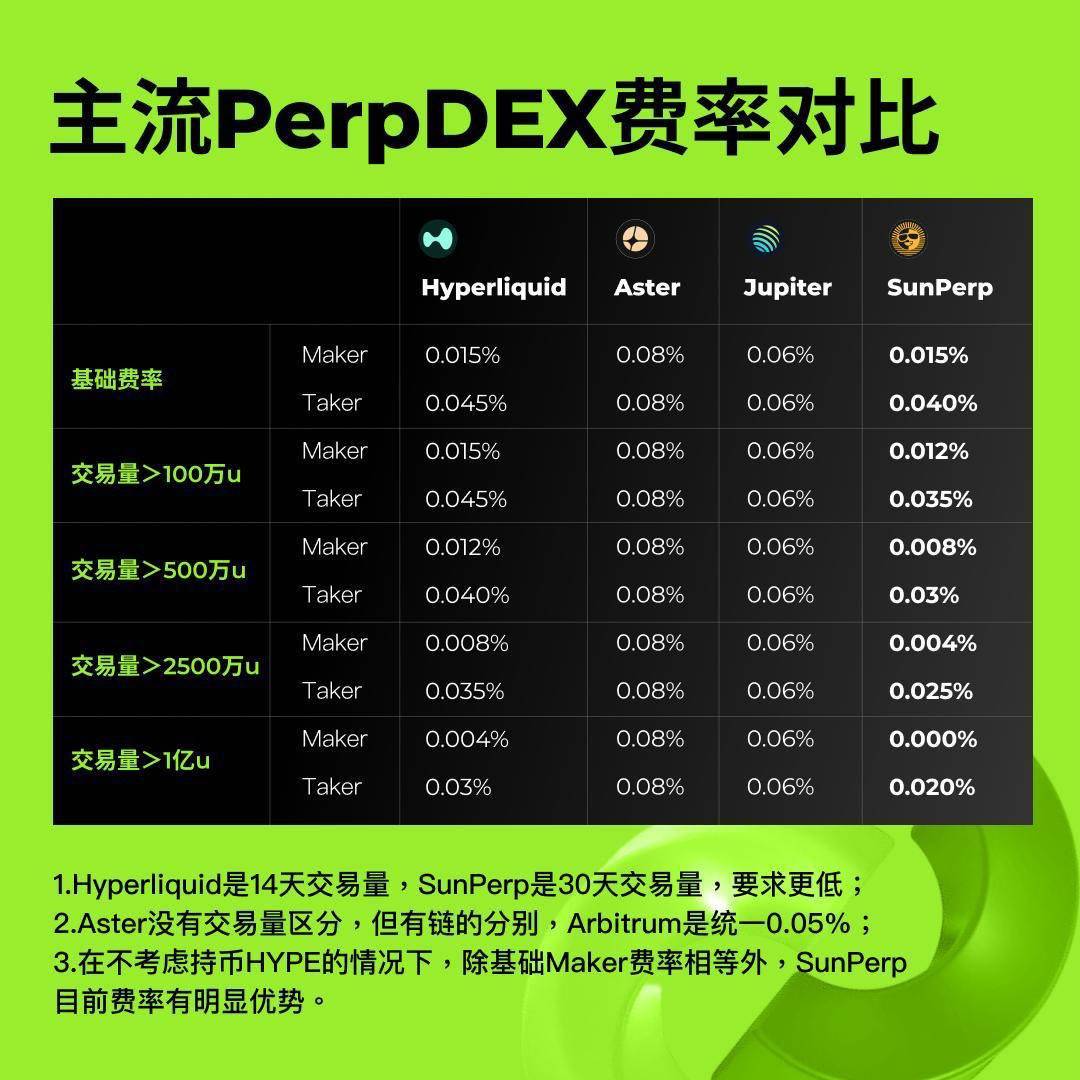

*Beyond basic maker fees, SunPerp's current fee structure is significantly lower than other mainstream Perp DEXs such as Hyperliquid and Aster.

Thus, in the crowded Perp DEX space, SunPerp appears more like a contestant equipped with "resource cheats," giving it a starting speed and growth potential far exceeding its rivals.

More importantly, it strikes a balance between CeFi and DeFi, integrating on-chain transparency, asset efficiency, and mature risk control to form a sustainable, closed-loop trading ecosystem. This combination of ecosystem integration, refined core experience, and strategic foresight makes SunPerp not just another newly launched DEX, but also a key financial engine within the TRON ecosystem poised for long-term growth and market disruption.

The Second Half of Perp DEX: Ecosystem, Users, and Long-Term Growth

At this stage, technological flashiness or low fees alone are no longer the sole winning formulas. Emphasis now shifts to ecosystem integration, user experience optimization, and improved capital efficiency.

SunPerp's entry undoubtedly brings fresh perspectives to the second half of Perp DEX. Its success lies in resource integration combined with innovation. Going forward, SunPerp has the potential to achieve long-term growth and market breakthroughs through the following dimensions:

- Ecosystem Expansion: Further integrate TRON and external on-chain resources to enable deep collaboration in cross-chain liquidity and application scenarios, upgrading from a single trading tool to an ecosystem hub.

- User Deepening: Beyond high-frequency traders, expand to institutional and retail users by offering multi-tiered products, smart strategies, and data tools to boost user stickiness.

- Innovation Drive: Continuously optimize cost structures and reward mechanisms, exploring new innovations such as composite derivatives, on-chain leverage, and hedging tools to enhance capital efficiency and platform competitiveness.

- Governance and Sustainability: Leverage DAO governance and community co-construction to ensure transparent decision-making and user engagement, building a long-term sustainable ecosystem.

Whether SunPerp can truly evolve into TRON's "financial engine" or even become a cross-chain, global infrastructure will require time to prove. But one thing is certain: the second half of Perp DEX is no longer just about trading functionality—it's a competition for ecosystem positioning. Whoever can craft a compelling long-term narrative, integrate upstream and downstream resources, and shape user perception will gain the upper hand in the next phase. SunPerp's arrival doesn't merely add another player—it may signal the beginning of a new era driven by collaboration, innovation, and imagination.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News