Stablecoin L1 L2: Who Is Defining the Next Generation of Global Payments?

TechFlow Selected TechFlow Selected

Stablecoin L1 L2: Who Is Defining the Next Generation of Global Payments?

Stablecoins are rapidly evolving from an in-crypto trading medium into globally accepted payment tools.

Author: Foresight Ventures

In the shift of the crypto industry from "speculation-driven" to "application-driven," stablecoins are accelerating their transformation from in-circle trading mediums into globally universal payment tools. This transition stems not only from traditional finance's urgent need for efficient cross-border clearing but also represents an inevitable outcome of the Web3 ecosystem becoming more inclusive.

Traditional blockchains (e.g., ETH, Tron) suffer from fluctuating fees, slow transaction speeds, and compliance auditing difficulties in stablecoin payment scenarios due to their generic underlying designs. In contrast, stablecoin-dedicated chains focus on optimizing stablecoin circulation, enabling lower costs, higher efficiency, and stronger compliance—thus driving stablecoins into mainstream payments.

The future competition in payments and clearing will center on key capabilities such as zero-fee low-cost transfers, second-level settlement, compliance with auditability, and plug-and-play readiness for merchants and institutions.

This report analyzes five representative stablecoin-dedicated chains—Plasma, Stable, Codex, Noble, and 1Money—across five dimensions: positioning, market strategy, community热度, development progress, and core data, providing a horizontal comparison to reveal their differentiated advantages and potential challenges.

TL;DR

Plasma

Overview

Plasma is a high-performance Layer1 blockchain specifically designed for stablecoins, backed by prominent institutions including Bitfinex, Founders Fund, and Framework.

GTM Strategy

In mid-2025, Plasma opened a pre-TGE subscription window for XPL. Under a "deposit-first, claim-later" process, it attracted approximately $1 billion worth of stablecoins within 30 minutes, issuing proportional refunds for oversubscribed amounts. The project is collaborating with Tether to introduce native USDT and working with liquidity partners such as Bitfinex, Flow Traders, and DRW.

Plasma’s roadmap begins with a permissioned model (trusted validators), progresses through horizontal scaling, and ultimately transitions to an open validator set.

The mainnet Beta is scheduled to launch on September 25, 2025.

Following this, Binance Earn launched a Plasma USDT Locked Product on-chain: the first batch of 250 million USDT was fully subscribed within one hour, later expanded in tranches up to a 1 billion USDT cap, distributing daily USDT rewards and allocating XPL rewards post-TGE.

In September 2025, the team also launched Plasma One—a neobank natively built for stablecoins. Its debit card, issued by Signify Holdings under a Visa license, supports zero-fee USDT transfers, a "spend-as-you-earn" account model, and up to 4% cashback.

Community & Market Hype

Benefiting from strong investor backing, Plasma has drawn significant market attention since its founding in 2024. It has amassed over 130,000 followers on X. After announcing its public sale, widespread community discussion made Plasma a hot topic in the stablecoin chain space.

Development & Testing Progress

Currently in Beta mainnet phase, Plasma has technically achieved integration with Bitcoin sidechains and Ethereum EVM compatibility, connecting node service tools like QuickNode and Tenderly. Its core consensus mechanism is PlasmaBFT (based on Fast HotStuff), with the mainnet progressing through three stages: “trusted validator launch → scale expansion → full openness.” The zero-fee USDT transfer feature remains under development and debugging on the testnet. By mid-2025, Plasma’s test mainnet had already processed around $1 billion in stablecoins (including USDC and USDT) deposited via cross-chain bridges, mapped onto the Plasma chain.

During testing, Plasma integrated with multiple wallets and exchanges, validating its zero-Gas stablecoin transfer capability and network stability. Development activity remains high, with continuous updates to official documentation and code repositories, enabling developers to successfully deploy contracts on its EVM-compatible chain.

Performance-wise, Plasma claims technical specifications supporting over 1,000 TPS throughput, one-second block times, and second-level finality, with most standard transactions costing less than $0.01 in fees. Notably, it implements a protocol-level paymaster mechanism specifically for USDT, sponsoring gas fees for simple transfers to enable zero-cost transactions (subject to frequency and eligibility restrictions). This significantly enhances user experience for stablecoin payments. Based on official documentation and testnet data, transaction speeds (standard transfers confirmed within 1 second, finalized in seconds; zero-fee USDT slightly slower but still sub-second) meet the needs of most mainstream use cases—ranging from retail daily payments and mainstream DeFi deposit/borrow/trading operations to compliant settlements for small-to-medium merchants—fulfilling core demands for low cost and stability. However, current second-level confirmation speeds and channel design may fall short in ultra-high-frequency quantitative trading or institution-grade sub-second real-time clearing, or during extreme peak concurrency at million-level volumes. Nevertheless, overall performance precisely aligns with mass-market and institutional foundational scenarios for stablecoin payment chains, supporting the vast majority of everyday and mainstream business applications.

Regarding USDC support: Plasma supports bridged and contract-level USDC, not Circle-native issuance. The zero-fee policy explicitly covers USDT but excludes USDC. This means USDC settlement on Plasma is feasible but offers a different cost experience compared to USDT.

Key Data Metrics

The chart below shows the composition of stablecoin deposits on the Plasma network: nearly all deposits consist of AETHUSDC and AETHUSDT, accounting for approximately 60% and 39%, respectively.

Stablecoin Deposit Composition on Plasma (Source: Arkham Intelligence)

Plasma has stated that at mainnet launch, it will aggregate over 15 stablecoins and establish more than 50 project partnerships. These partners span wallets, payment companies, and DeFi protocols, bringing real-world use cases into the Plasma ecosystem. For example, Tether is expected to directly participate, making USDT a native asset on Plasma, while exchanges like Bitfinex may offer deposit/withdrawal interfaces, and market makers such as Flow Traders and DRW will assist with liquidity provisioning.

Stable

Overview

Stable is a dedicated stablecoin public chain incubated by the Tether/Bitfinex team, dubbed the first "Stablechain." Stable emphasizes a unique "USDT-native Gas" model where transaction fees are paid directly in USDT instead of requiring a separate native token. This significantly lowers user entry barriers, making the payment experience closer to fiat transfers.

GTM Strategy

In market promotion, Stable leverages the influence of Tether/Bitfinex: in July 2025, it announced a $28 million seed round led by Bitfinex, Hack VC, Franklin Templeton (a major traditional asset manager), Bybit, KuCoin, and other institutions. Upon announcement, Stable launched global outreach via official blogs, industry media, and coordinated posts on X, greatly increasing visibility.

Additionally, Stable’s roadmap unfolds in three phases: Phase 1 (current) focuses on building network infrastructure and implementing the USDT Gas model; Phase 2 will introduce a stablecoin transaction aggregator and enterprise reserved blockspace services to attract high-volume institutional users; Phase 3 plans further speed optimization and developer tooling to enrich the application ecosystem.

Community & Market Hype

Since emerging in mid-2025, Stable has seen rapid growth in popularity. On X, its official account quickly gained over 160,000 followers (slightly surpassing Plasma). Mainstream sentiment is optimistic, believing it aligns well with regulatory trends and could win institutional favor. However, some community discussions caution that Stable must demonstrate performance and security advantages when competing with rivals like Plasma for liquidity, with users eager to see actual testnet data.

Development & Testing Progress

Stable officially exited stealth mode in late July 2025 and remains in early development. As mentioned, Phase 1 has begun, focusing on sub-second block production and finality, along with the USDT-native Gas mechanism. Public testnet access is expected before year-end 2025, with gradual mainnet rollout (rumored for late 2025 or early 2026). To date, internal testnets are operational, with selected partners invited for trial use.

Key Data Metrics

As Stable’s mainnet has not yet launched, on-chain metrics such as TVL are currently unavailable.

Codex

Overview

Codex is a blockchain company致力于 building a "universal electronic cash system," with its core product being a stablecoin-dedicated Layer2 network built on Ethereum.

GTM Strategy

Codex’s market strategy focuses on B2B scenarios and enterprise-grade stablecoin settlements. Built using the Optimism tech stack, it aims to provide predictable low fees and stable performance for high-frequency stablecoin transactions.

In market expansion, Codex prioritizes collaboration with stablecoin issuers and financial institutions: it has secured strategic investments from Coinbase, Circle, Foresight, and Cumberland (DRW). Beyond investment, Circle actively supports native USDC integration into the Codex chain. In July 2025, Circle deployed USDC contracts on Codex, making it one of the youngest networks to natively support USDC and enabling direct CCTP v2 cross-chain connectivity. Circle Mint/API integration allows enterprises to mint/redeem USDC directly on Codex, conduct cross-chain settlements, on-chain FX, and fiat on/off-ramps—greatly reducing friction for enterprise adoption. This move grants Codex authoritative recognition within the fiat-backed stablecoin ecosystem and paves the way for integrating other fiat-pegged stablecoins (e.g., Turkey’s BiLira has already joined Codex). Additionally, Codex is partnering with major exchanges and OTC brokers to build off-ramps, allowing users to directly convert on-chain stablecoins into fiat currency.

The GTM strategy includes: ① Anchoring the custody layer by partnering with leading custodians like Fireblocks to build compliant asset custody infrastructure, ensuring secure on-chain storage for institutional funds; ② Connecting the tooling layer by integrating WaaS ("Wallet as a Service") solutions like Dfns, offering institutions convenient on-chain asset management access; ③ Bridging the application layer by targeting payment service providers (PSPs) and cross-border payment firms, initially focusing on high-frequency, mission-critical use cases like corporate settlements and cross-border B2B transactions to validate institutional-grade payment systems.

In summary, Codex’s GTM strategy emphasizes compliance, institutional focus, and multi-asset support: leveraging partnerships with authoritative players like Circle to gain credibility, targeting enterprise use cases in cross-border payments and FX settlement, aiming to establish dominance in this vertical.

Community & Market Hype

Compared to Plasma and Stable’s consumer-oriented marketing, Codex maintains moderate community热度. It has around 7,000 followers on X. Codex communicates cautiously on social media, focusing on product updates and industry insights. After announcing its funding in April, outlets like Cointelegraph and Fortune covered the news, sparking industry-wide discussion on the "dedicated stablecoin chain" model.

Development & Testing Progress

Launched in 2024, Codex accelerated network development after its April funding announcement. Using the Optimism Rollup architecture, it has largely completed mainnet construction and achieved integration with Ethereum mainnet and Circle’s backend. Technically, Codex mainnet went live mid-year: Circle’s official page now lists the Codex USDC contract address, and platforms like Fireblocks and Dfns have begun supporting Codex. This confirms Codex can anchor and circulate USDC on mainnet and connect with top-tier institutional systems.

Codex’s public testnet is now open, allowing developers to bridge assets to Codex and use its API for high-speed stablecoin transfers. Codex also emphasizes compliance features such as on-chain atomic swaps and KYC checks: mechanisms like atomic withdrawal channels and on-chain FX ensure KYC/AML screening occurs during transactions, reducing risks of frozen funds and non-compliance. Additionally, Codex is developing Codex Avenue, a cross-border FX instant settlement platform for second-level clearing across multiple stablecoins.

Codex mainnet gas fees are typically as low as $0.001, paid in ETH. It natively supports USDC minting, eliminating the need for bridges and emphasizing payment-chain functionality focused on asset movement rather than DeFi lockups. Current efforts prioritize applications like instant USDC transfers, maintaining high throughput. In interviews, Codex co-founders mentioned plans to support major stablecoins like USDT and EURC, though no specific timeline for USDT integration has been announced.

Development activity remains strong: the team hails from OP Labs and the Ethereum community, with consistent GitHub updates to network code and TokenFactory modules tailored to issuer needs.

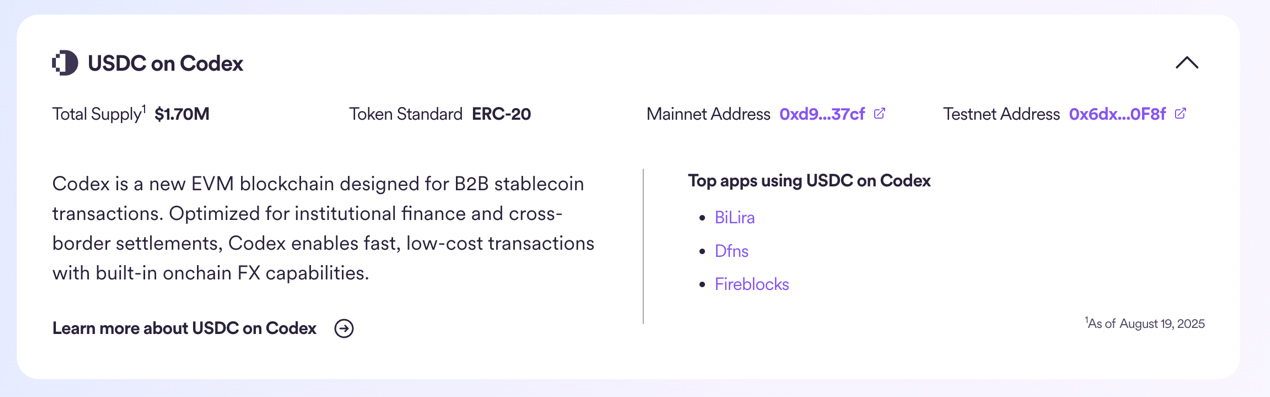

Key Data Metrics

As an emerging network, Codex’s on-chain scale remains modest. Currently, we can only observe via Circle’s multi-chain dashboard that native USDC on Codex is live and supported by CCTP v2, with a circulating supply of about $1.7 million. Aggregators like DefiLlama do not yet list Codex as a standalone chain, so comparable metrics like "DeFi TVL" are unavailable—consistent with Codex’s focus on B2B settlements and compliant pathways rather than broad DeFi liquidity. Below is data on USDC issuance on Codex:

USDC Issuance on Codex (Source:Circle)

Noble

Overview

Noble is the first application-specific chain in the Cosmos ecosystem focused on on-chain asset issuance, particularly stablecoins.

GTM Strategy

Noble’s market strategy leverages the Cosmos multi-chain ecosystem by positioning itself as the "central hub for stablecoin issuance" to deeply integrate with various public chain application demands. Its entry point was partnering with Circle to launch native USDC on Noble in April 2023, solving the prior lack of mainstream stablecoins in Cosmos.

Noble positions itself as the "native issuance chain for stablecoins and RWAs": any stablecoin aiming to serve Cosmos users can choose to issue on Noble, then seamlessly flow across nearly 50 chains in the ecosystem via IBC. This "issue once, flow everywhere" model greatly simplifies access to trusted stablecoin liquidity for applications.

Furthermore, Noble partnered with decentralized stablecoin infrastructure provider M^0 to launch its own yield-bearing stablecoin USDN (Noble Dollar) on Noble in January 2025. Innovatively incorporating U.S. Treasury yields, USDN aims to enhance the appeal of Cosmos-based stablecoins, differentiating itself from traditional USDT/USDC.

Its GTM roadmap is equally clear: ① Direct upstream connection to Circle Mint/API, enabling institutions and fiat capital to mint USDC@Noble directly, avoiding multi-version conflicts and reducing reconciliation overhead; ② Mid-tier low-latency distribution of USDC across Cosmos ecosystem app-chains, prioritizing essential use cases like trading and clearing; ③ Asset-layer extension with the yield-bearing USDN, creating a pathway to convert "non-interest-bearing USDC into interest-bearing USDN" for deployment in margin accounts, settlement, and DeFi across app-chains.

These initiatives reflect a dual-pronged GTM strategy: on one hand, providing a bridge for mainstream stablecoins into Cosmos to meet DeFi demand; on the other, launching innovative local stablecoin products to improve user retention and value capture. Simultaneously, Noble emphasizes user experience and compliance: partnering with Circle to use its Cross-Chain Transfer Protocol (CCTP) ensures smooth, secure conversion of USDC from Ethereum to Cosmos; design features like blacklists and address freezing meet issuers’ compliance requirements.

For users, swapping between USDC and USDN is possible. Two vaults are available to maximize USDN yield:

Points Vault: Forgo yield to earn points. Lock USDN here—the longer the lock-up, the faster points accumulate, with a multiplier bonus after 30 days.

Boosted Yield Vault: Earn base U.S. Treasury yield (currently 4.07%) plus additional yield from Points Vault users who forfeit theirs.

Mechanism formula: Boosted APR ≈ r_tbill × (1 + Points Pool Balance / Boosted Pool Balance). When both pools are similarly sized, annualized yield is roughly double the base rate (~8%+). Early observations showed APR tiers reaching ~16% (inclusive of base yield).

Starting August 6, the Boosted Yield Vault has been disabled, leaving only the Points Vault active. As of August 2025, USDN’s Treasury yield stands at approximately 4.08% annually.

The underlying yield comes from short-duration U.S. Treasuries, distributed to participants. Average on-chain transfer fee is ~$0.01, paid in USDC. Converting between USDC and USDN incurs a 0.1% transaction fee.

Community & Market Hype

As a key infrastructure player in the Cosmos ecosystem, Noble enjoys moderate industry recognition. On X, it has around 30,000 followers. Compared to Tether-affiliated projects, Noble’s community is mid-sized but highly engaged—its audience consists largely of Cosmos ecosystem participants and cross-chain developers.

Market sentiment toward Noble is generally positive: first, its successful introduction of USDC is seen as a milestone in Cosmos maturation, widely acknowledged by the community; second, feedback on the USDN model is mostly favorable, viewed as a valuable innovation for bringing compliant U.S. Treasury yields on-chain. Some skepticism exists, however—concerns that USDN relies on centralized custodied assets for yield generation may imply over-reliance on traditional finance. But the Noble team (led by former Polychain executive Jelena, among others) actively engages the community, explaining security measures and decentralization roadmaps, maintaining trust. Overall, Noble has established OG status in Cosmos and cross-chain circles, often called the "OG chain for interchain stablecoin issuance," with steadily rising market recognition and reputation.

Development & Testing Progress

Noble launched its mainnet in Q2 2023 as an asset-issuance-focused chain built on the Cosmos SDK. Technically, Noble fully supports the IBC protocol, enabling assets issued on Noble to be instantly used across major chains like Osmosis, Cosmos Hub, and Kujira. After jointly completing the first cross-chain USDC issuance with Circle in April 2023, Noble has conducted multiple upgrades to support new asset types: Ondo’s OUSD (USDY) and Monerium’s euro (EURe) were added in 2024; USDN was successfully launched in January 2025.

Built on the modular Cosmos SDK architecture, Noble introduced the TokenFactory module, empowering issuers to independently mint/burn tokens and enforce blacklists. Over the past two years, Noble has significantly enhanced Ethereum interoperability: by integrating Circle’s CCTP at the end of 2023, it enabled direct, fast conversion of USDC from Ethereum to Noble, followed by IBC distribution—greatly improving user experience.

For developers, Noble provides data services like Range API to track USDC flows across chains. Currently, Noble is testing support for Frax’s decentralized stablecoin and Japan’s Progmat stablecoin. Clearly, Noble’s development is steady and goal-oriented: continuously adding new assets while maintaining chain stability. With more RWAs like Treasury yield notes joining, Noble is poised to remain a leader in Cosmos stablecoin innovation.

Key Data Metrics

Stablecoin issuance on Noble has grown rapidly over the past year, with USDC leading: as the primary dollar-pegged stablecoin in Cosmos, USDC on Noble once circulated over $500 million. As of now, according to DeFiLlama, total stablecoin market cap on Noble is approximately $408 million, with USDC accounting for 82% and USDN for 16%. The chart below shows the detailed stablecoin supply on Noble:

Stablecoin Composition on Noble (Source:DeFiLlama)

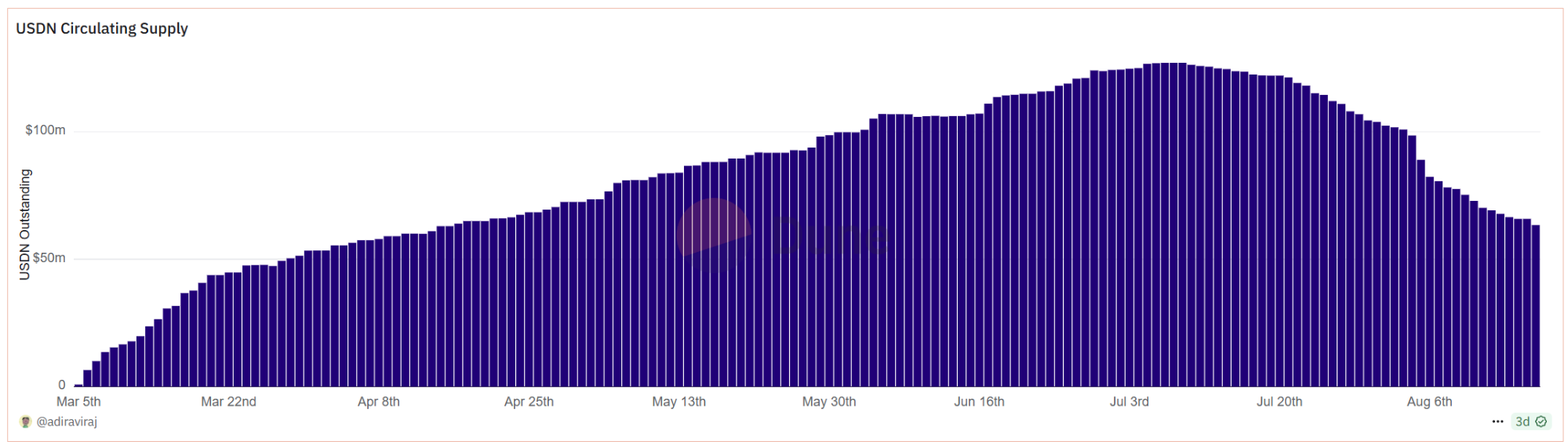

Notably, USDN reached a circulation of about 64 million in just six months—an extremely rapid pace. In ecosystem partnerships, Noble has established IBC connections with over 50 Cosmos chains, enabling free usage and trading of its stablecoins across them. Multiple top-tier Cosmos DeFi protocols (such as Osmosis DEX and Kujira lending market) have integrated Noble-issued USDC into primary trading pairs and stablecoin pools, significantly deepening liquidity across the Cosmos ecosystem.

Transaction volume: Noble processed over $5 billion in USDC transactions in its first year, demonstrating high throughput. Fees are paid in USDC: official docs state USDC is used for transaction fees, with internal transfers averaging ~$0.01. For USDT needs, users must first convert USDT to USDC on the source chain, then distribute via Noble/IBC into Cosmos.

Daily USDN volume on Noble ranges from $50 million to $100 million (Source: Dune)

Overall, Noble has dramatically improved dollar liquidity in the Cosmos ecosystem. Its growth trajectory closely follows that of Cosmos DeFi, showing strong momentum in both strategy and data.

1Money

Overview

1Money is a new blockchain project founded by Brian Shroder, former CEO of Binance.US, aiming to build the world’s first Layer1 network optimized specifically for stablecoin payments.

GTM Strategy

1Money’s market strategy targets mainstream payment users, emphasizing simplicity, compliance, and speed. Unlike traditional blockchains, 1Money explicitly states it “does not require complex tokenomics”—no native Gas token, no staking, no governance voting—making the blockchain feel invisible to users. This design caters to enterprises and ordinary users who value simplicity. For instance, when transferring USDC on 1Money, fees are paid directly in USDC at a fixed, low rate, with no need to hold an additional token.

Its main approach includes: ① Making gas-free stable payments the default experience, planning to offer gas-free paths via ecosystem partners; transaction fees are paid directly in the transferred stablecoin, eliminating the need for a second Gas token. ② Messaging externally as “a dedicated payment network for stablecoins,” suitable for切入电商 payments, small cross-border transfers, and P2P; its website and media repeatedly emphasize “no smart contracts, no congestion, no fee spikes,” enabling predictable service standards for merchants. ③ Running the 1Money Global brand in parallel, offering stablecoin-powered debit cards and USD account infrastructure, potentially funneling traffic from card networks and banks into on-chain settlements.

In market promotion, 1Money highlights its compliance strengths: its board recently welcomed Ken Blanco, former FinCEN director, and Michael Mosier, former acting head of OFAC, both seasoned figures in U.S. regulation, endorsing the network’s compliance framework.

On funding, 1Money announced a seed round exceeding $20 million in January 2025, backed by renowned firms including F-Prime (Fidelity Investments), Galaxy, Kraken, KuCoin, and BitGo. Spanning both traditional finance and crypto, these investors bring not just capital but also connections to future banking and exchange integrations. 1Money emphasizes its role as a bridge between TradFi and Web3, advocating the vision that “stablecoins will form the foundation of the modern financial system.”

Overall, 1Money’s GTM strategy combines technological innovation (ultra-high TPS, minimalist UX) to attract everyday users for stablecoin payments, while leveraging compliance credentials and industry relationships to get banks and payment firms to adopt its network as infrastructure. This dual-track approach aims to push stablecoins from crypto circles into mainstream payments.

Community & Market Hype

As a newly launched project this year, 1Money’s community remains relatively small. On X, its official account has around 7,000 followers, primarily crypto professionals and investors bullish on the payments sector. At launch, 1Money did not conduct large-scale retail airdrops or marketing campaigns, resulting in lower buzz among general crypto users compared to projects like Plasma.

Development & Testing Progress

1Money’s technical roadmap centers on “extreme speed + security + simplicity.” Since inception, it has secretly developed an innovative consensus protocol called BCB (Byzantine Consistent Broadcast). On August 6, 2025, 1Money officially opened its public testnet and launched a developer portal. According to its blog, the testnet demonstrated “unprecedented speed” and validated network functionality without a native token.

Currently, 1Money is refining BCB protocol stability based on testnet feedback, ensuring consistent and efficient operation under diverse network conditions. The mainnet is planned for earliest launch in Q4 2025 (slightly delayed from original Q2 target), preceded by at least one round of security audits and stress testing.

1Money is also actively expanding its developer ecosystem. Though the network does not support smart contracts, it will provide easy-to-use APIs for wallet and payment app integration. Developer documentation and SDKs are already live on the portal, with several wallet providers beginning integration tests.

Key Data Metrics

As 1Money has not yet launched its mainnet, on-chain metrics are primarily performance test data.

In closed testing, 1Money achieved a processing capacity of 250,000 TPS—far exceeding Ethereum mainnet and most existing public chains. The team claims this number is linearly scalable, suggesting future capability to handle global-scale payment volumes. Transaction confirmation times remained under 1 second in tests, achieving near-instantaneity comparable to traditional electronic payments. Fees are planned to be set at an extremely low fixed base rate, with partner collaborations (e.g., merchant acquirers) enabling zero-fee experiences for end users.

Compliance is another hallmark of 1Money: it includes built-in network-level sanction address blocking, preventing non-compliant wallets from transacting. Validators undergo KYC, meaning blocks are produced by vetted institutions—offering trust levels close to consortium chains.

In ecosystem data, 1Money has assembled a coalition of over 20 investment and partner organizations, including exchanges (Kraken, KuCoin), payment firms (MoonPay, CoinFlip), custody/security providers (BitGo), and traditional VCs (F-Prime). This will support its stablecoins at launch—mainstream stablecoins like USDC and USDT are expected to integrate immediately, with potential for new stablecoins pegged to multiple fiat currencies from partner institutions.

In sum, 1Money currently emphasizes performance and compliance metrics; its success will ultimately depend on attracting enough active users to generate high transaction volumes.

Conclusion

In summary, Plasma, Stable, Codex, Noble, and 1Money all belong to the category of “stablecoin public chains,” each differing in strategy, progress, and market acceptance:

Market Positioning & Strategy

Plasma and Stable both stem from Tether/Bitfinex roots, focusing on building payment networks around USDT. Comparatively, Plasma emphasizes technological breakthroughs (zero fees, ultra-high speed) and leverages Bitcoin’s security for credibility; Stable, meanwhile, capitalizes on shifting U.S. regulations, emphasizing compliance-friendliness and the usability of “USDT as Gas.” In contrast, Codex and 1Money pursue enterprise/compliance paths: Codex builds on Ethereum L2, offering institutions predictable fees and seamless integration with existing infrastructure (Circle, Coinbase, etc.); 1Money designs compliance from scratch, even sacrificing smart contracts to eliminate complexity, directly targeting real-world deployment in cross-border and retail payments. Noble’s strategy differs—it operates within the Cosmos multi-chain ecosystem, serving both as a partner to stablecoin issuers (helping USDC enter Cosmos) and launching its own innovations (USDN) to meet internal ecosystem needs.

Strategically: Plasma/Stable aim to capture the existing USDT market; Codex/1Money target expansion into institutional payment markets; Noble focuses on strengthening stablecoin supply within the cross-chain ecosystem.

Development Progress & Technical Implementation

In terms of mainnet progress, Noble leads—having run stably for over a year, issuing multiple stablecoins and enabling hundreds of millions in cross-chain volume. Plasma completed a record-breaking test deposit in mid-2025 and is preparing for mainnet launch, with most technical details finalized. Stable remains in internal development, with mainnet expected at year-end or later; many of its concepts (like USDT aggregators, enterprise blockspace) remain unproven. Codex, though funded only in early 2025, leveraged the mature OP Stack solution to launch native USDC quickly, suggesting core development is complete and entering optimization. 1Money, building an innovative consensus from scratch, lags slightly but launched its public testnet in Q3 2025.

Use Cases

These five projects reflect the diversified exploration in the stablecoin chain space: some embrace the largest existing stablecoin USDT for rapid scale; others focus on enhancing technology and compliance to win traditional finance approval; still others solve internal stablecoin liquidity issues within blockchain ecosystems. Going forward, these projects may serve distinct niches or even complement each other. For example, Plasma and Stable might dominate consumer-facing micro-payments; Codex and 1Money could handle enterprise-scale clearing and remittances; Noble will continue advancing cross-chain asset issuance and yield products.

Looking ahead, as regulations clarify and market education deepens, stablecoin chains are poised for rapid growth. Success will hinge not only on technical performance but also on ecosystem development and compliance trust. Among these projects, whoever achieves critical real-world adoption and earns user trust will emerge victorious in the race for “on-chain stablecoin infrastructure,” pushing stablecoins into mainstream payments.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News