CEX Platform Token Buyback and Burn Comparison: Whose Model Is Healthier?

TechFlow Selected TechFlow Selected

CEX Platform Token Buyback and Burn Comparison: Whose Model Is Healthier?

True innovation lies not in destruction itself, but in the continuity and transparency of destruction.

Author: Darshan Gandhi, Polaris Fund

Translation: TechFlow

A deep dive into centralized exchanges (CEX) and their token burns: mechanisms, frequency, and other aspects.

Exchange buybacks and token burns are nothing new.

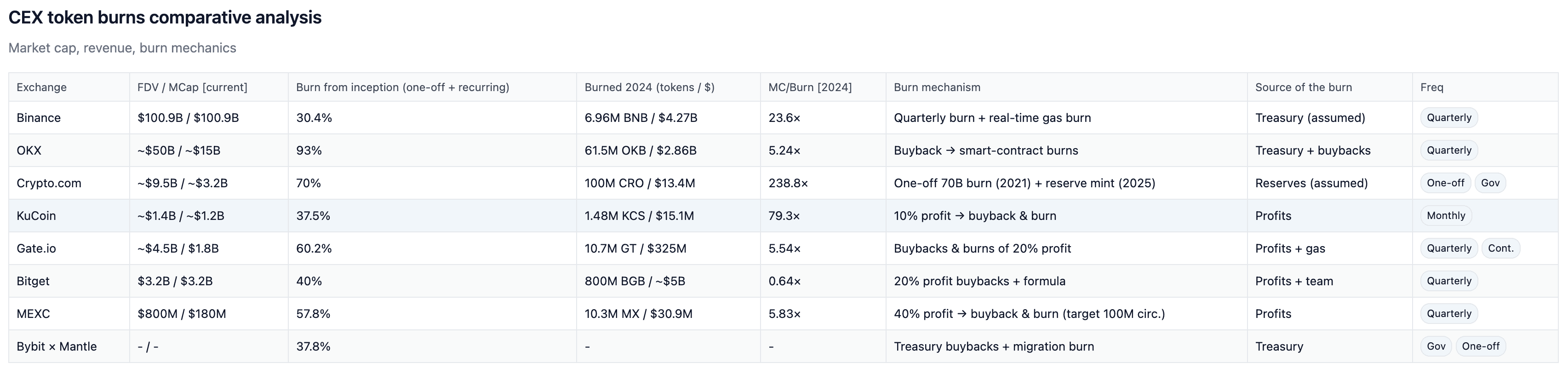

These operations have been quietly ongoing for years, shaping supply and demand dynamics long before attracting mainstream attention. Almost every major centralized exchange (CEX), including Binance ($BNB), OKX ($OKB), Gate ($GT), KuCoin ($KCS), and MEXC ($MX), has implemented some form of burn program for over five years.

Today, the way these token burns are presented has changed.

Hyperliquid ($HYPE) places token buybacks at the core of its token strategy rather than burying them in fine print. It transforms the burn mechanism from a background feature into a prominent one, and more importantly, runs it continuously and transparently as part of treasury management—setting a new benchmark for transparency.

This positioning makes the burn mechanism appear refreshingly new, even though established exchanges like Binance, OKX, Gate, KuCoin, and MEXC have been doing similar things for years. The difference is that legacy exchanges have never marketed burns so aggressively or integrated them so tightly into treasury operations (reasons for which will be analyzed later).

Burn mechanisms are fundamentally a value transfer tool, revealing:

-

How exchanges link token supply to their business model

-

Which levers drive scarcity (profits, formulas, or governance)

-

How credibility is built—or lost—over time

Additionally, burn mechanisms act as inflation control tools, stabilizing supply by offsetting token unlocks or emissions.

The question today isn't whether burns will happen, but whether they are executed consistently enough, and whether the model offers transparency to token holders.

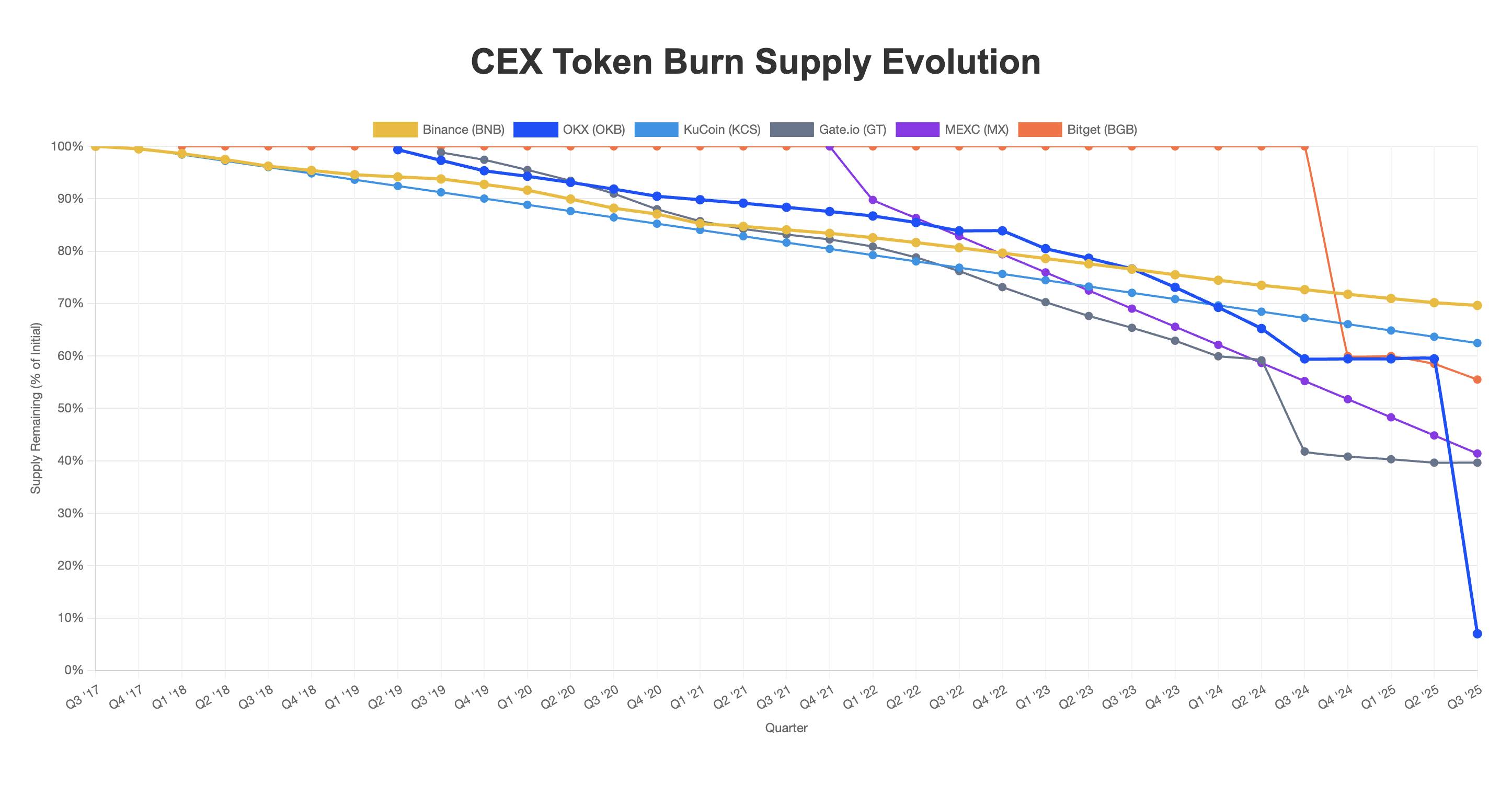

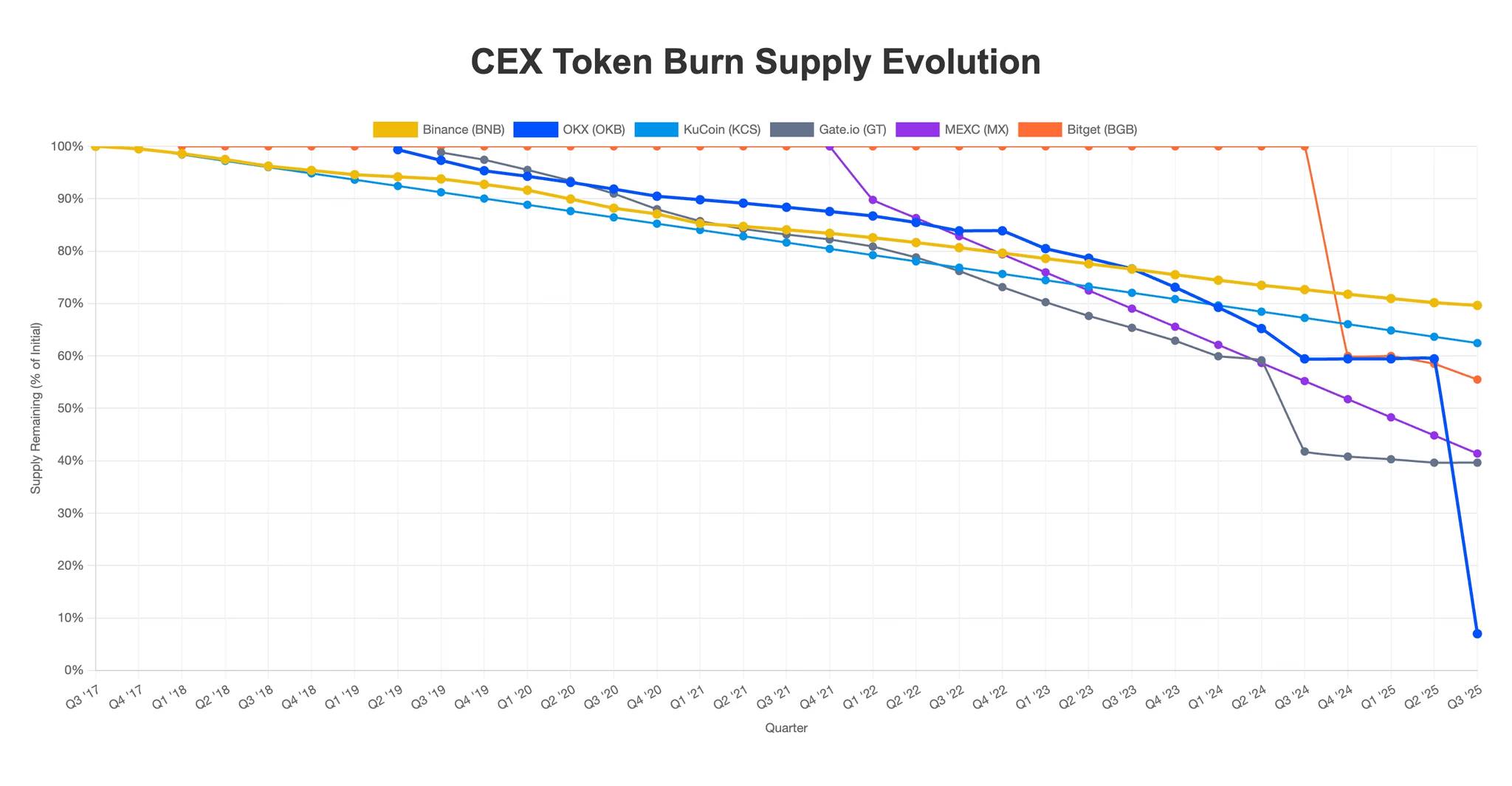

To clearly see this shift, below is a breakdown of how exchange token supply dynamics are changing.

Key takeaway: When analyzing exchange tokens, the burn model is critical. Designs based on profits, formula-driven rules, or governance control have vastly different impacts on scarcity, predictability, and trust.

Burn Models: How Exchanges Operate

Exchange burn programs primarily fall into three categories:

-

Tied to profits or revenue (Gate, KuCoin, MEXC): A fixed percentage of earnings is used to buy back and burn tokens. Cadence is predictable and auditable.

-

Formula- or fund-driven (Binance, OKX, Bitget): Supply reduction is determined by a formula or fund allocation. Larger in scale, but less tied to business health.

-

Governance-driven (Bybit, HTX): Burn pace is decided via token holder voting. This decentralizes control but introduces political and execution risks.

Burn programs are also evolving. For example: Binance shifted from a profit-linked burn mechanism to one based on price and block counts, later adding the BEP-95 gas fee burn. Binance once abruptly changed its burn rate as proof that BNB was not a security. From a regulatory standpoint, delinking burns from profits reduces securities classification risk, but shifting mechanisms create market uncertainty.

Other CEXs have also updated their dynamics, such as:

KuCoin adjusted its burn schedule to monthly for greater transparency.

Gate has maintained a stable 20% profit distribution since 2019.

Destruction is rare when a token has a fixed maximum supply. When burns do occur, they are valuable because they reduce circulating supply and accelerate full supply compression.

Key takeaway: Burn models determine durability. Profit-linked = stable and auditable. Formula-driven = scalable but opaque. Governance-driven = decentralized but harder to trust. Sudden model shifts (e.g., Binance) create structural risk, while increased transparency (e.g., KuCoin) builds trust.

Regulatory Perspective

Burn models are not just about economics—they're also about regulatory positioning.

In traditional stock markets, corporate buybacks are controversial, with the U.S. Securities and Exchange Commission (SEC) raising concerns about:

-

Market manipulation

-

Insider interests

-

Weaker disclosure standards

Token burns are equivalent to buybacks in crypto, but without legal protections. This gap changes how models are designed.

-

Profit-linked burns resemble buybacks most closely. Because they directly tie token value to profits, they attract closer regulatory scrutiny.

-

Formula-driven burns (e.g., Binance’s automatic burns, OKX’s supply cap) are easier to defend. They can be described as mechanical, income-independent, and less likely to trigger securities classification.

-

Governance-driven burns add political elements. Regulators may view community votes as insufficient safeguards against manipulation.

Key takeaway: Burn design is both part of tokenomics and legal defense. Delinking burns from profits reduces regulatory risk but also reduces transparency for token holders.

Trends in Exchange Models

Three trend patterns stand out:

1.Scale and Opacity

-

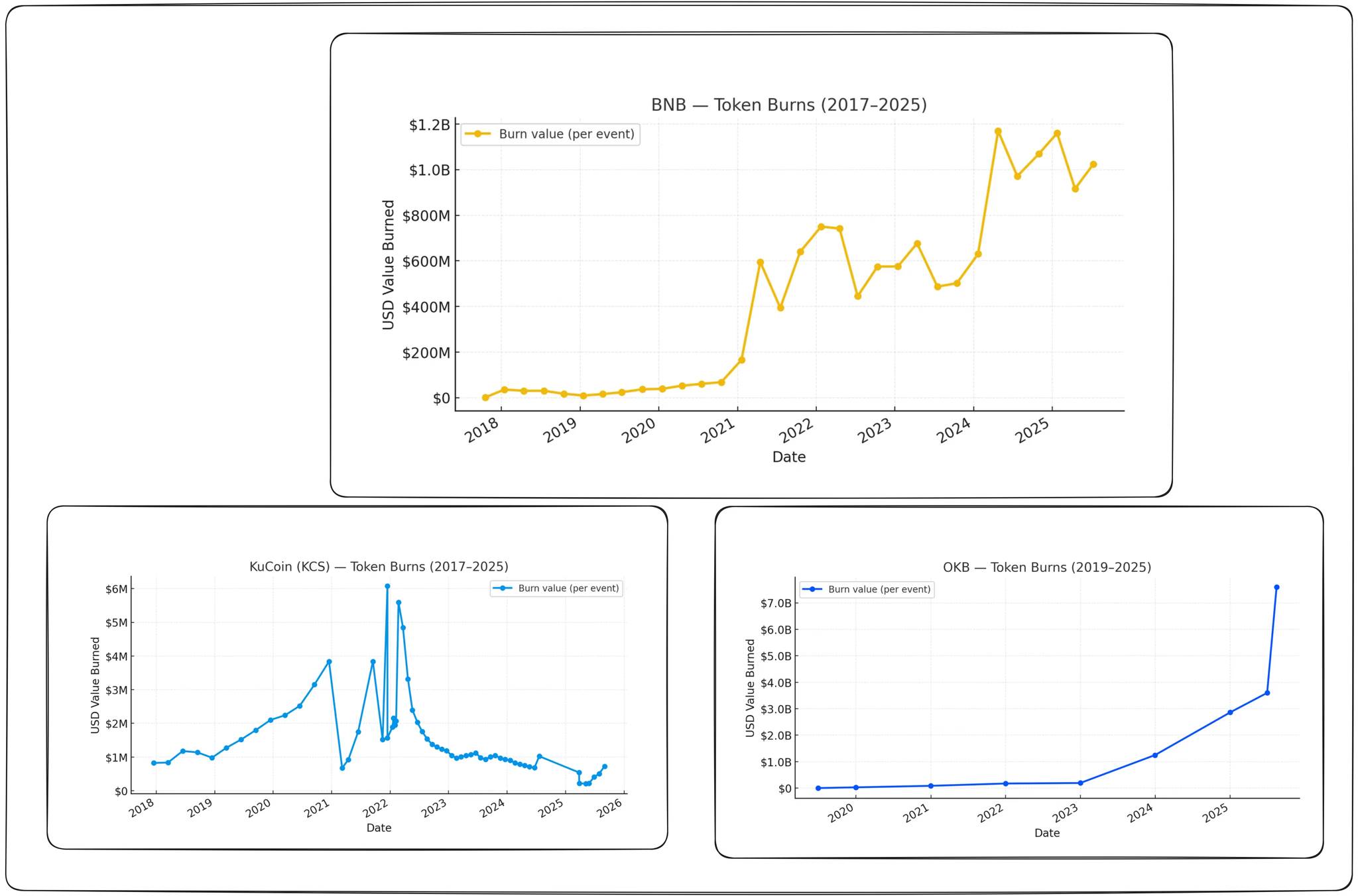

Binance has the largest burn scale (~$1 billion per quarter), but its rules keep changing.

-

OKX eventually set a hard supply cap of 21 million after years of variable pacing.

Key point: Scale attracts attention, but rule changes and delayed caps undermine transparency.

2. Stable Profit-Linked Cadence

-

Gate: Fixed 20% profit distribution since 2019, burned ~60% of supply.

-

MEXC: 40% profit distribution, burned ~57%.

-

KuCoin: Switched to monthly burns in 2022, but burn size shrinks as profitability increases (10% of profits)

Key takeaway: Profit-linked models are easiest to predict. Less burn spending may signal weaker business health.

3.New Entrants and Governance Risk

-

Bitget: Burned $5 billion in December 2024, currently burning ~30 million tokens per quarter, targeting 95% total burn.

-

Mantle: Burned 98.6% of BIT during migration; now relies on DAO.

Key takeaway: Marketing helps, but only proven cadence enhances durability.

Burn Pace, Scale, and Quality

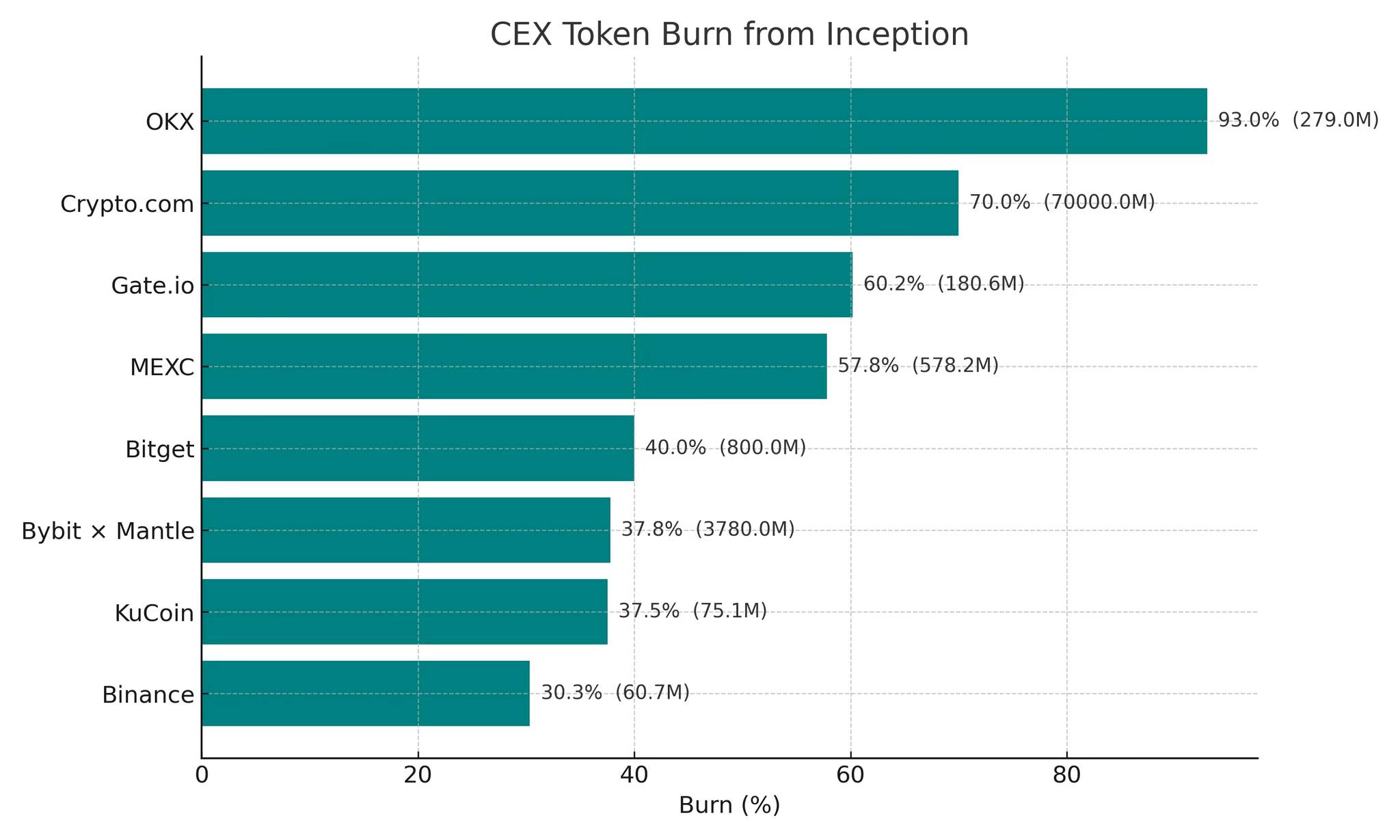

Supply reductions range from ~30% at Binance to ~93% at OKX. But the market prices not just percentages, but also the consistency of burn scale and predictability of rhythm.

-

Gate, KuCoin, MEXC: Stable profit-linked burns → build trust

-

Binance: Largest scale → blurred by constant formula adjustments

-

OKX: Massive $7.6 billion burn boosts confidence → backed by years of consistency

-

Bitget: $5 billion burn → initial event unproven, future follow-through remains to be seen

-

Crypto.com: Reversed 2021 burn in 2025 → led to reduced trust

Note: OKB's large burn in August 2025 coincided with a significant price surge, suggesting one-time supply events can sometimes drive near-term price action.

Key takeaway: Don’t just track burn amounts—ask: Is the scale repeatable? Is the pace tied to profits? Is governance stable? Focus on quarterly/annual dollar volume burned. Large burns = credibility signal, not a guarantee.

Our Overall View

-

Consistency matters more than scale: Markets reward repeatability over headline-grabbing stunts.

-

Profit-linked models are best: They tie token value to exchange health and are easy to evaluate (transparent).

-

Large burns are just markers: Without follow-up, they become mere optics.

For now, buybacks remain an important marketing cost.

Interestingly, centralized exchanges are choosing to reinvest profits back into their own tokens instead of retaining earnings in cash or USDC. This concentrates treasury value into the token itself, amplifying both gains and risks.

Finally, as we’ve tried to illustrate throughout this report, the real innovation isn’t in burning itself, but in the consistency and transparency of burns. Hyperliquid has undoubtedly redefined burning as a visible, cyclical treasury management function. This has effectively reshaped industry expectations: today, mere scarcity is not enough. Regular, clear, and economically aligned scarcity is the true north for all exchanges. This shift could pose significant challenges for slower-moving CEXs.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News