Andrew Kang: Why I Think TOM Lee's Bullish Thesis on Ethereum Doesn't Hold Up

TechFlow Selected TechFlow Selected

Andrew Kang: Why I Think TOM Lee's Bullish Thesis on Ethereum Doesn't Hold Up

ETH can be considered a commodity, but that does not imply bullishness.

Author: Andrew Kang, Partner at Mechanism Capital

Translation: Azuma, Odaily Star Daily

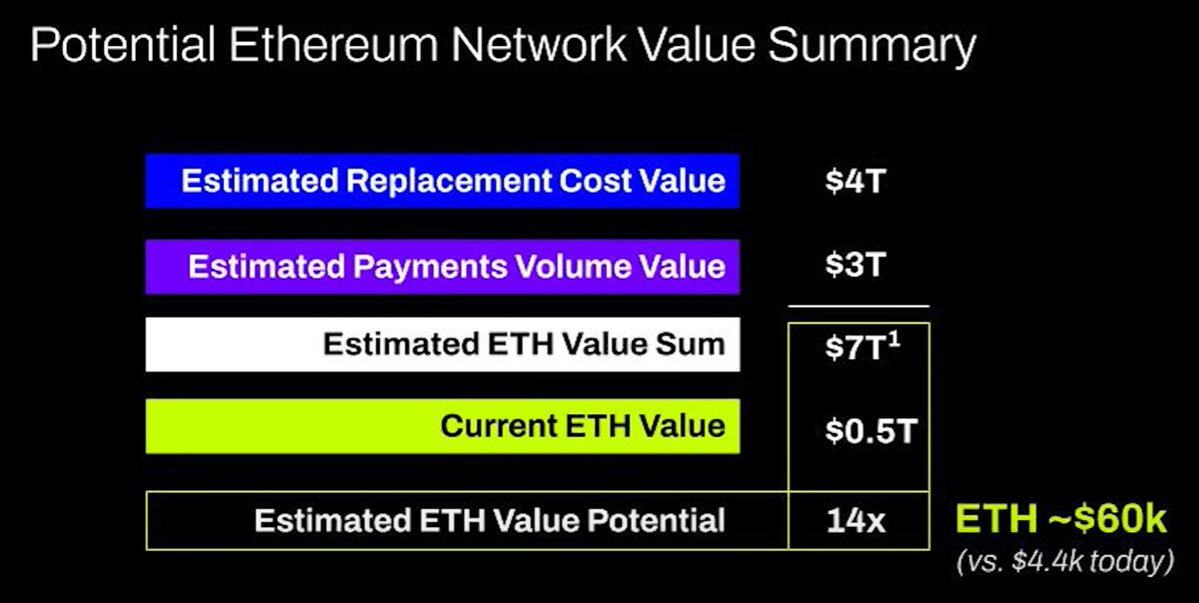

Editor's note: Since Tom Lee became chairman of BitMine and pushed the DAT to continuously buy ETH, he has emerged as the industry's top bull on ETH. In various recent public appearances, Tom Lee has repeatedly emphasized expectations for ETH growth using various arguments, even boldly claiming that ETH's fair value should be $60,000.

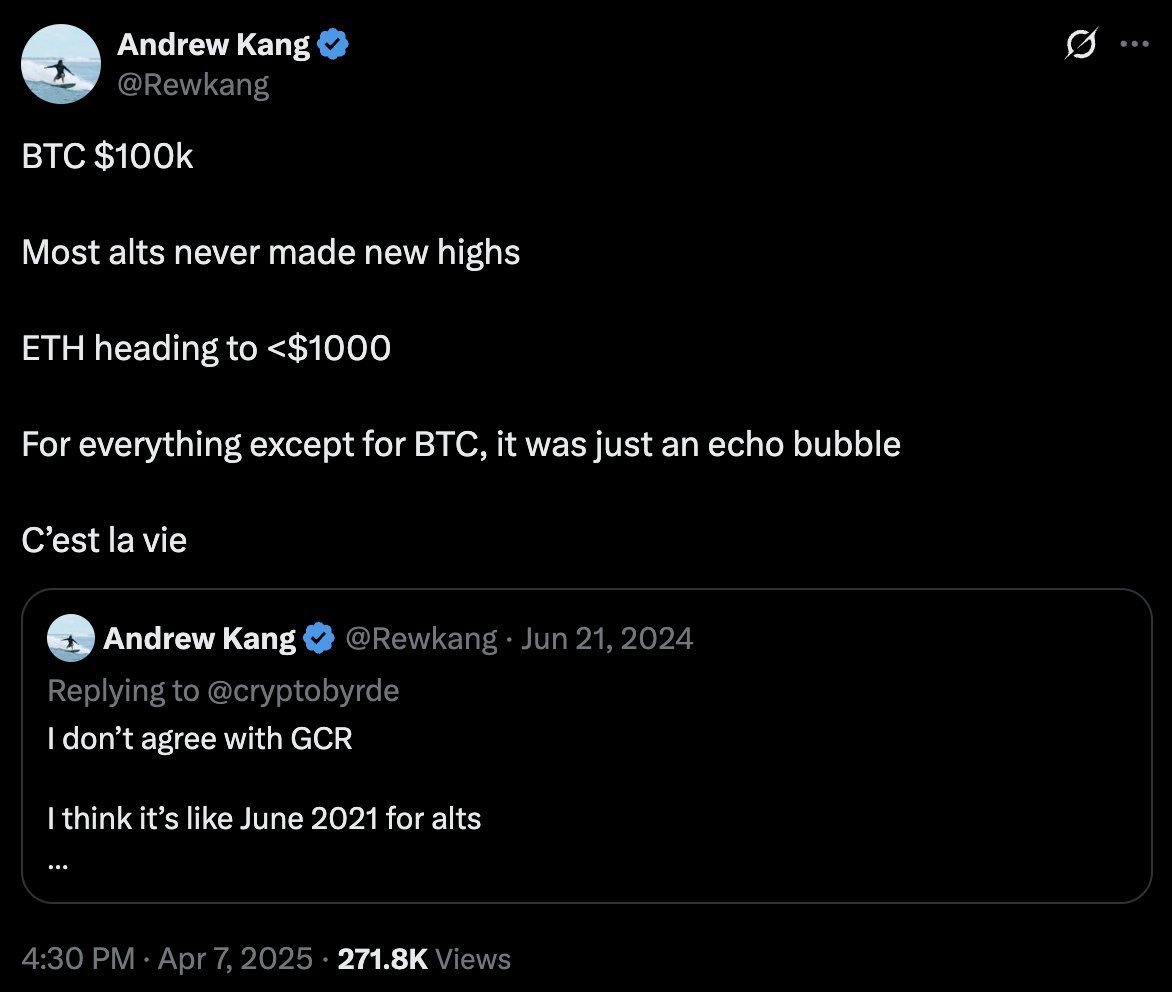

However, not everyone agrees with Tom Lee's logic. Last night, Andrew Kang, partner at Mechanism Capital, published a lengthy post publicly refuting Tom Lee's views and directly mocked him as "sounding like an idiot."

For context, Andrew Kang predicted in April this year—during a broad market pullback—that ETH would fall below $1,000, and has previously expressed bearish views during ETH's upward moves... Position shapes perspective, so his stance may sit at the opposite extreme from Tom Lee’s. Readers are advised to approach this critically.

Below is the original article by Andrew Kang, translated by Odaily Star Daily.

Of all the financial analyst pieces I’ve read recently, Tom Lee’s thesis on ETH ranks among “the dumbest.” Let’s break down his arguments. Tom Lee’s theory mainly rests on the following points:

-

Adoption of stablecoins and RWA (real-world assets);

-

The “digital oil” analogy;

-

Institutions will buy and stake ETH to secure the network where their tokenized assets reside, and as operating capital;

-

ETH will equate to the total market value of all financial infrastructure companies;

-

Technical analysis;

1. Stablecoin and RWA Adoption

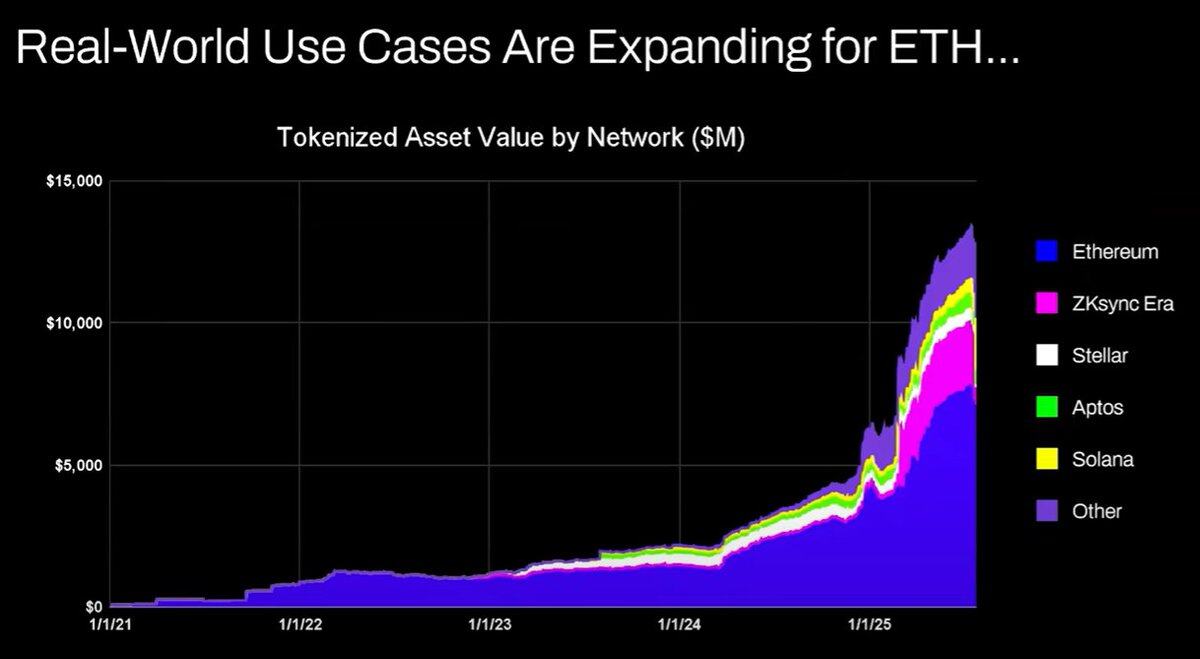

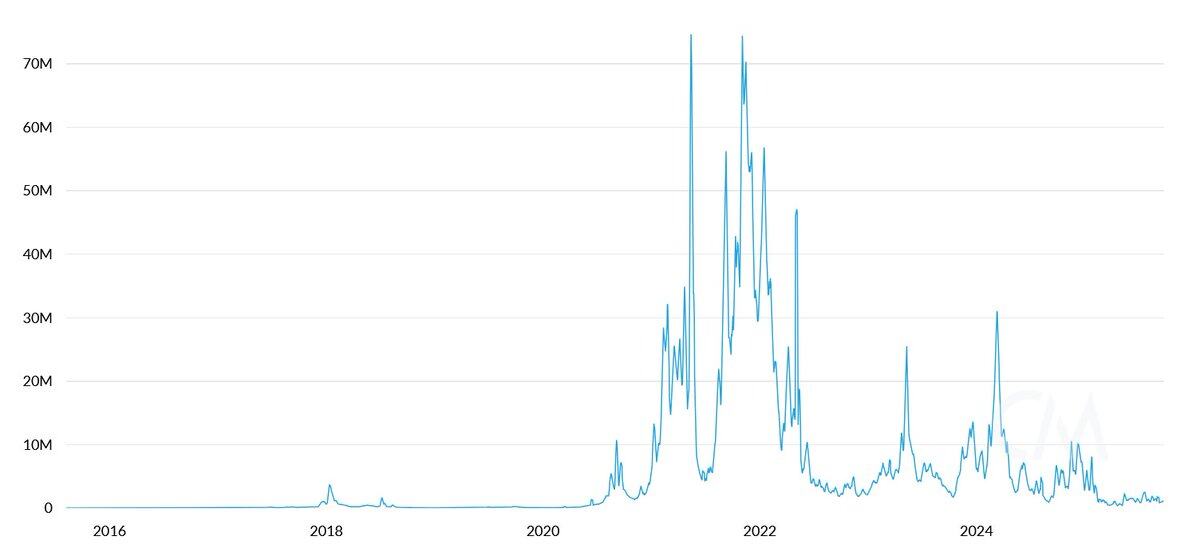

Tom Lee argues that increased activity in stablecoins and asset tokenization will drive up transaction volume, thereby increasing ETH fee revenue. This seems plausible at first glance, but a few minutes of data review reveals otherwise.

Since 2020, the value of tokenized assets and stablecoin transaction volumes have grown 100–1,000x. Yet Tom Lee fundamentally misunderstands Ethereum’s value accrual mechanism—he implies fees should scale proportionally, but in reality, Ethereum’s fee income remains at 2020 levels.

The reasons for this are:

-

Ethereum improves transaction efficiency through upgrades;

-

Stablecoin and asset tokenization activity flows to other blockchains;

-

Tokenizing illiquid assets generates negligible fees—there’s no direct correlation between tokenized value and ETH income. For example, you could tokenize a $100 million bond, but if it trades once every two years, how much fee does it generate for ETH? Maybe $0.10—one single USDT transaction generates far more.

You can tokenize trillions in assets, but if they don’t trade frequently, it might add only $100,000 in value to ETH.

Will blockchain transaction volume and fees grow? Yes.

But most of those fees will be captured by other blockchains with stronger business development teams. As traditional finance migrates to blockchains, other projects have already spotted the opportunity and are actively capturing market share. Solana, Arbitrum, and Tempo have achieved early wins, and even Tether supports two new stablecoin blockchains (Plasma and Stable), aiming to shift USDT trading volume onto their own chains.

2. The “Digital Oil” Analogy

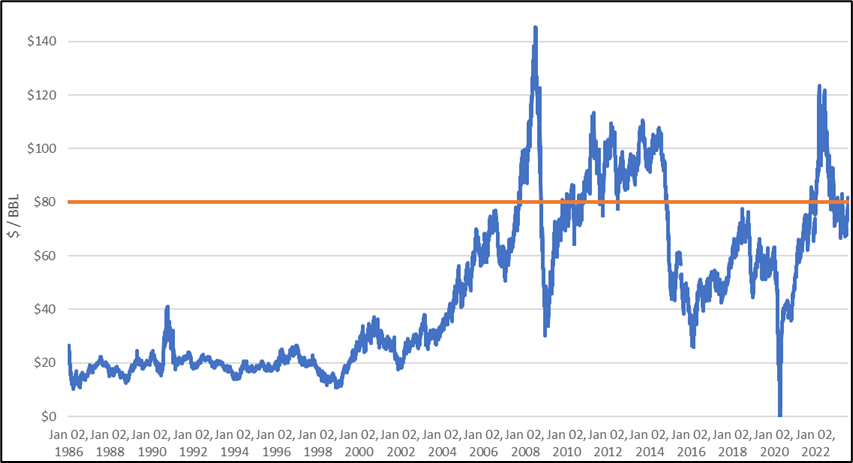

Oil is essentially a commodity. Adjusted for inflation, real oil prices have stayed within the same range for over a century, fluctuating occasionally before reverting.

I partly agree with Tom Lee that ETH can be seen as a commodity—but that doesn’t imply bullishness. Honestly, I’m not sure what point Tom Lee is trying to make here.

3. Institutions Will Buy and Stake ETH for Security and Operating Capital

Have major banks and financial institutions added ETH to their balance sheets? No.

Have they announced plans to buy ETH? No.

Do banks hoard barrels of gasoline because they pay ongoing energy costs? No—the cost isn’t significant enough; they only pay when needed.

Do banks buy stock in the custodians they use? No.

4. ETH Will Equal the Total Value of All Financial Infrastructure Companies

I’m speechless. This is a fundamental misunderstanding of value accrual—pure fantasy. Not even worth criticizing.

5. Technical Analysis

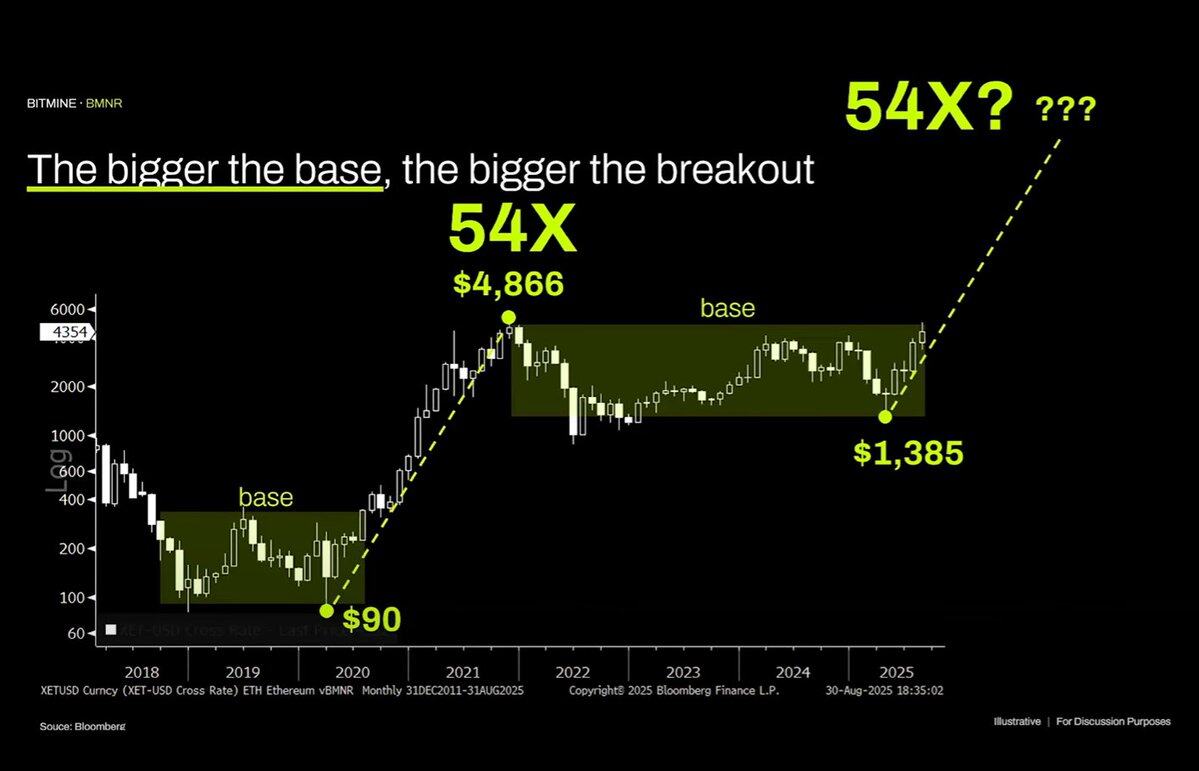

I personally enjoy technical analysis and believe it can offer valuable insights when applied objectively. Unfortunately, Tom Lee appears to be drawing random lines under the guise of technical analysis to support his bias.

Objectively examining this chart, the most apparent feature is that ETH has been in a multi-year consolidation range—no different from crude oil’s wide-ranging volatility over the past three decades. It’s simply range-bound, and recently failed to break resistance after testing the upper boundary. From a technical standpoint, ETH actually shows bearish signals, and cannot rule out prolonged trading in the $1,000–$4,800 range.

Past parabolic rallies in an asset do not guarantee such trends will continue indefinitely.

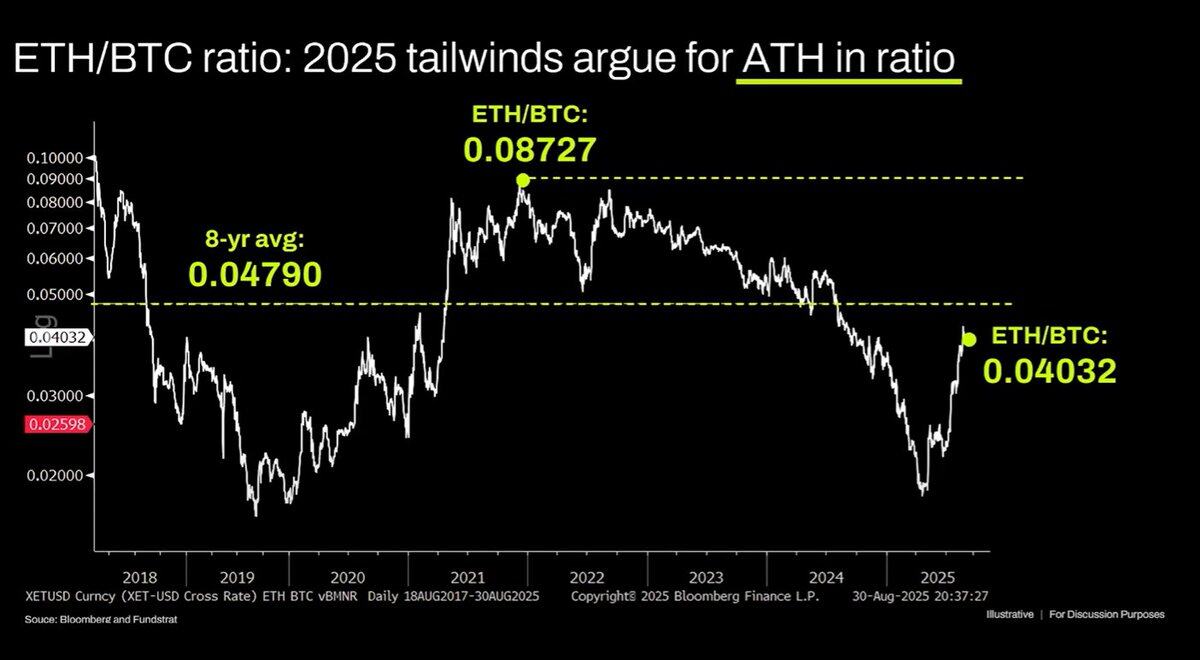

The long-term ETH/BTC chart is similarly misinterpreted. While indeed within a multi-year range, it has been constrained by a downtrend over the past three years. The recent rebound merely reached a long-term support level. This downtrend stems from saturated Ethereum narratives and fundamentals failing to justify valuation growth—factors that remain unchanged to this day.

Ethereum’s valuation is essentially a product of financial misconception. To be fair, such cognitive bias can sustain substantial market cap (see XRP), but its strength is not infinite. Macro liquidity is temporarily propping up ETH’s market cap, but unless a major structural shift occurs, it’s likely to face prolonged underperformance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News