Messari Research Report: What’s Missing Before Prediction Markets Truly Explode?

TechFlow Selected TechFlow Selected

Messari Research Report: What’s Missing Before Prediction Markets Truly Explode?

From elections to betting on everything, prediction markets are set for explosive growth.

Author: Dylan Bane

Compiled by: TechFlow

Prediction markets have moved beyond elections and demonstrated product-market fit (PMF).

Betting volume is surging, with investors flocking in, and new approaches—from information perps to Telegram bots—are entering the market.

So, which methods will actually work and maximize trading volume growth?

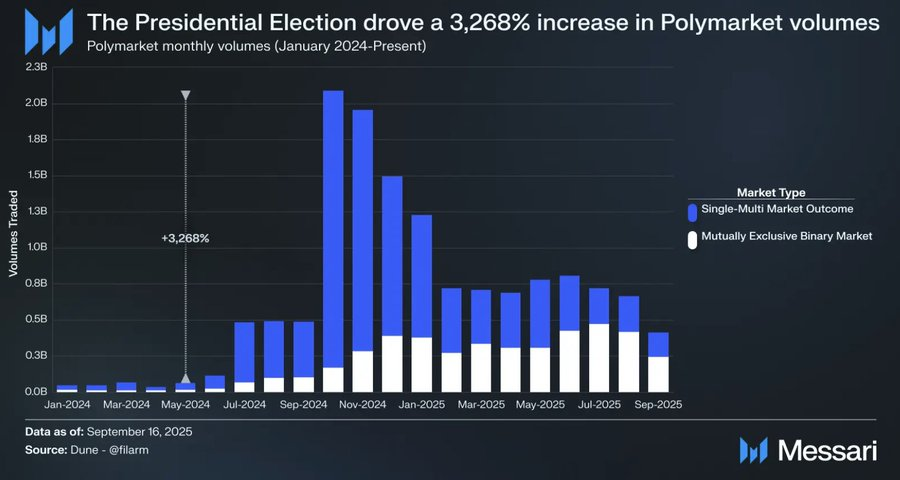

The 2024 election drove Polymarket’s trading volume from $62 million in May to $2.1 billion in October—a 3268% increase.

Mainstream media outlets like CNN and Bloomberg cited Polymarket odds during live broadcasts alongside traditional polling data.

In fact, prediction markets ultimately outperformed polls in forecasting election outcomes.

After the election, prediction market volumes declined but stabilized at over $1 billion per month.

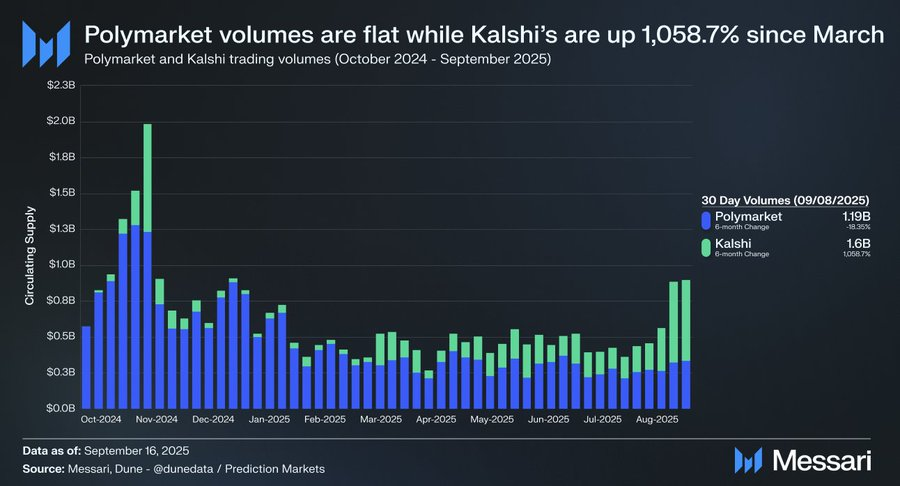

Combined with Kalshi’s recent surge in trading volume, investors believe demand for prediction markets has been validated and further growth is imminent.

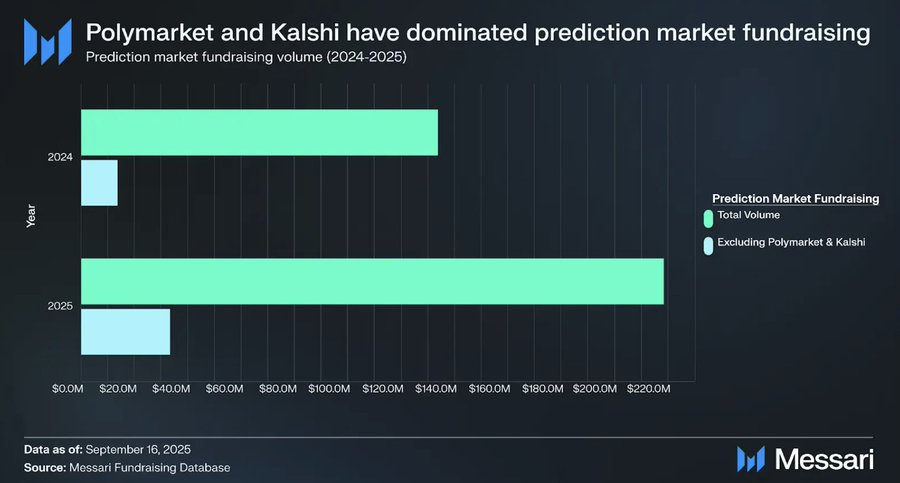

About 90% of capital is concentrated on Polymarket and Kalshi, with valuations approaching double-digit billions (i.e., tens of billions of dollars).

These industry leaders have established liquidity and are now focused on increasing trading volume and strengthening market defenses, as major exchanges like Hyperliquid and Coinbase eye this space.

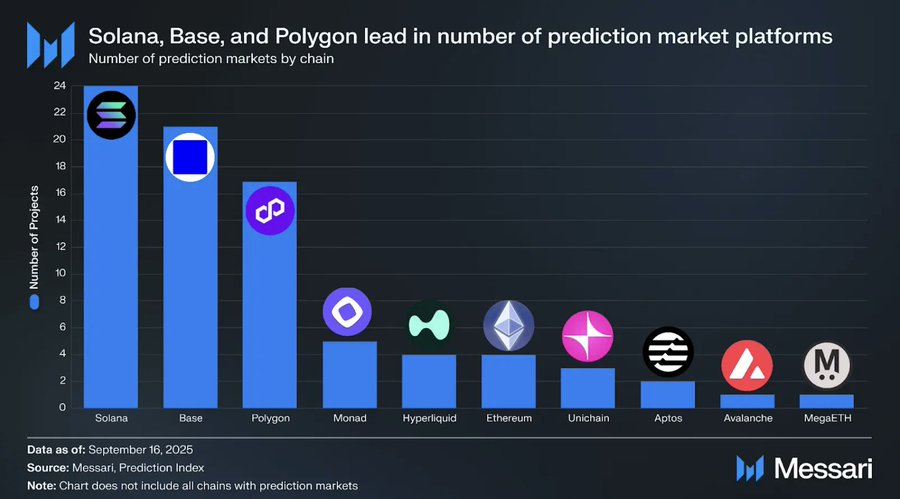

Yet, there are over 100 prediction market projects—and growing—offering abundant opportunities.

The challenge is how investors can identify the best opportunities amid this increasingly complex and noisy landscape.

We believe the best way to solve liquidity issues and boost trading volume is by attracting retail speculators.

Prediction markets can appeal to this segment by focusing on accessibility, fun, user experience, and high potential financial returns.

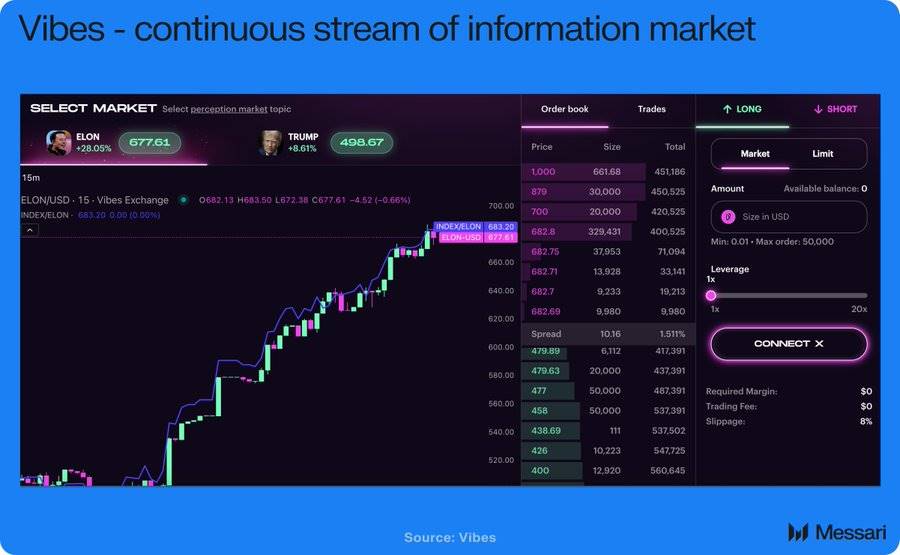

Sustained Flow of Information Perps

Because perps constantly fluctuate, they overcome the slow settlement speeds that deter speculators in binary outcome markets.

These perps can also track interesting, easy-to-understand topics that currently lack existing markets.

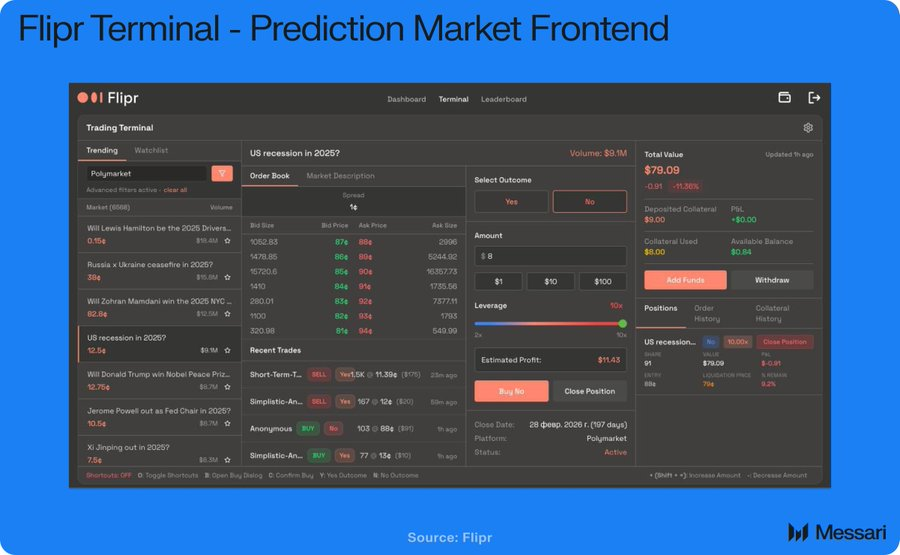

Frontend Platforms

Rather than building native liquidity, startups can source supply from existing industry leaders and deliver a higher-quality trading experience to users.

For example, Flipr offers a trading terminal, trading bots on X, and up to 10x leverage using existing liquidity.

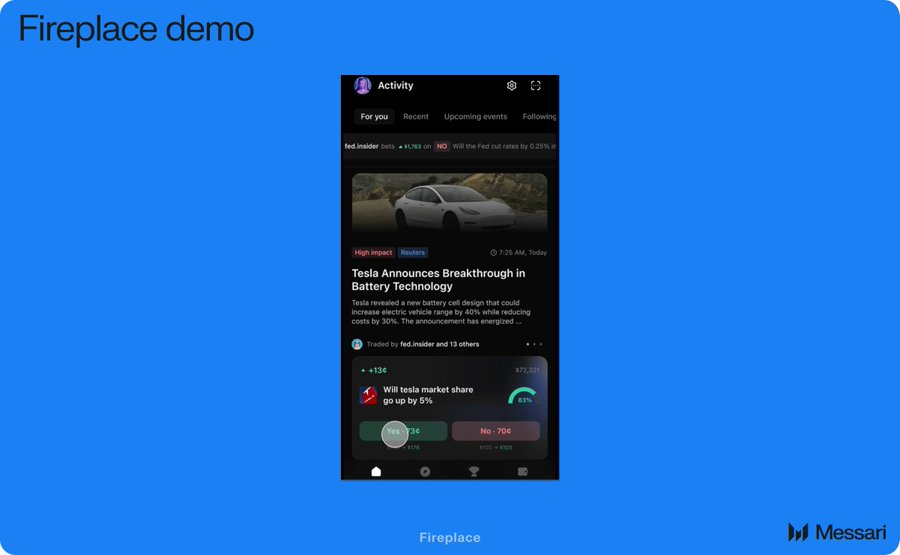

Social Applications

Gameified apps or social experiences can make prediction more engaging.

Just as sports betting is inherently a social experience, prediction markets can foster similar interactive dynamics.

In the early stages of prediction market adoption, the design space remains wide open.

Basket trading, managed indices, celebrity copy trading, parlays, and many other innovations are worth exploring.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News