Hotcoin Research|September Rate Cut Confirmed: Altcoin Season Countdown Begins, Will Uptober Ignite Q4 Market?

TechFlow Selected TechFlow Selected

Hotcoin Research|September Rate Cut Confirmed: Altcoin Season Countdown Begins, Will Uptober Ignite Q4 Market?

Given October's historically strong performance known as "Uptober," combined with the usual seasonal patterns in Q4 and additional marginal macroeconomic policy easing, Q4 2025 is widely expected to potentially usher in a full-blown "altseason."

Author: Hotcoin Research

1. Introduction

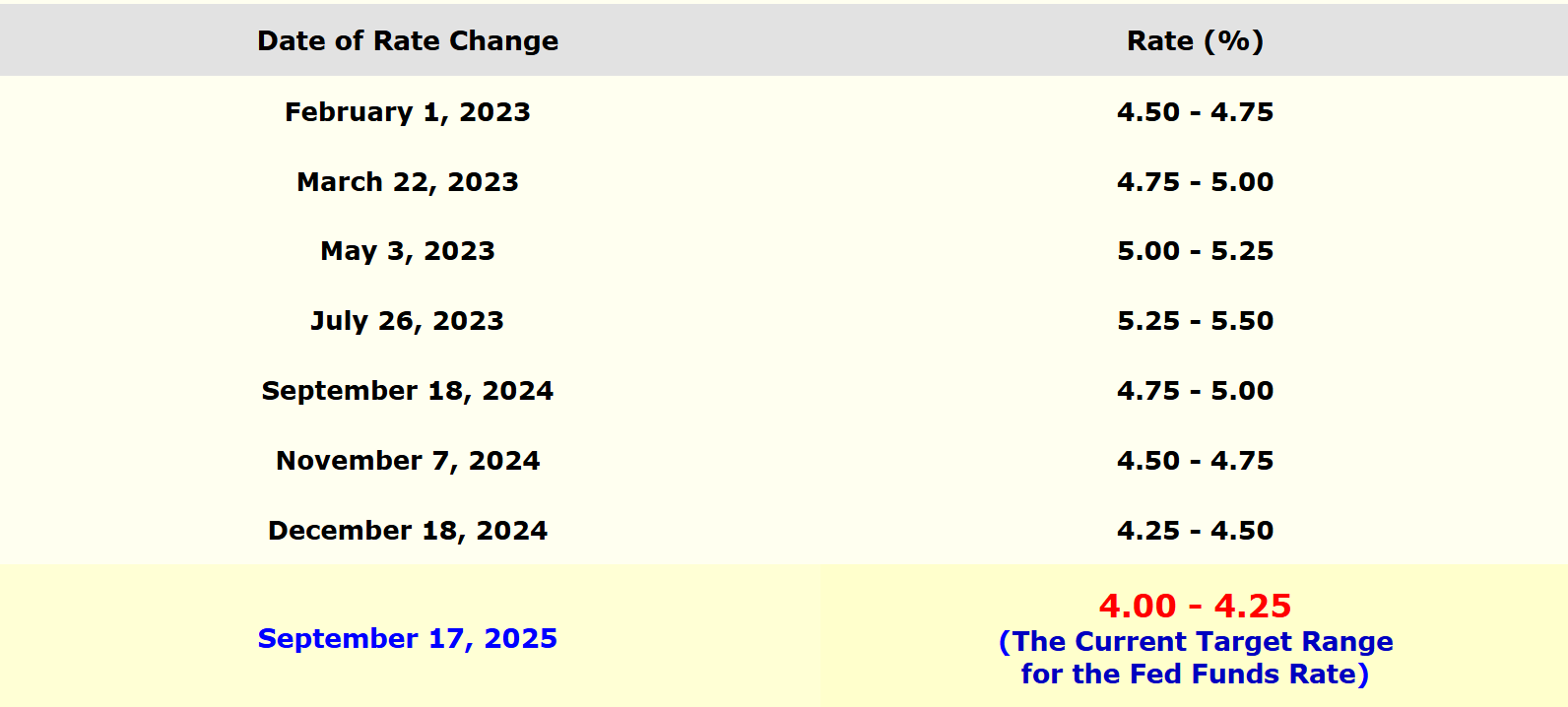

On September 17 local time, the Federal Reserve announced a 25 basis point cut to the target range for the federal funds rate, lowering it to 4.00%–4.25%. This marks the first rate cut since December 2024. Upon the announcement, U.S. stocks initially surged before pulling back, the dollar index dipped briefly, while the crypto market quickly rebounded after short-term volatility—Bitcoin surged past $117,000 and Ethereum broke above $4,600, with altcoins collectively rallying. Market risk appetite is regathering.

This round of rate cuts by the Fed is seen as a continuation of its pause in tightening at the end of last year. However, unlike previous cycles, this easing is not triggered by deep recession or systemic crisis, but rather a proactive "risk management" adjustment. The U.S. economy has not contracted, unemployment remains low, and inflation—though not fully tamed—has eased. The Fed is seeking balance between soft landing and risk prevention. This suggests that the easing pace in 2025 may not be aggressive, but instead a "moderate and sustained" policy probe.

Combined with the historically strong October performance ("Uptober") and typical Q4 seasonality, along with marginal macro loosening, the fourth quarter of 2025 is widely expected to potentially usher in a full-blown "altseason." This article reviews the historical impact of Fed rate cycles and the 2024 rate cuts on markets, analyzes the unique backdrop and characteristics of the September 2025 rate cut, and then examines whether altseason is imminent through indicators such as the Altcoin Season Index, Bitcoin dominance, and institutional capital flows. Finally, we look ahead to Q4 to assess how "Uptober" combined with Fed easing expectations might shape market dynamics. Through this comprehensive analysis, readers will gain clearer insight into the current state of the crypto market and identify potential opportunities and risks in the coming months.

2. Review of Fed Rate Cycles and the 2024 Rate Cut

Looking back at past Fed rate cycles, the shifts between "loosening → tightening → loosening" have profoundly influenced global asset prices, including crypto assets. Historical data shows that when financial conditions significantly loosen, Bitcoin often experiences substantial appreciation. Conversely, during periods of sharp monetary tightening, the crypto market tends to enter bear territory. For example, from 2016 to 2017, although the Fed gradually raised rates, overall interest rates remained low, enabling Bitcoin to enjoy a cross-year bull run. In 2018, continuous rate hikes and balance sheet reduction by the Fed led to an over 80% drop in Bitcoin's price. Similarly, ultra-low global interest rates and quantitative easing from 2020 to 2021 fueled a crypto boom, whereas the aggressive rate hikes starting in 2022 plunged crypto into winter. After rapidly raising rates to a peak of 5.5% between 2022 and 2023, the Fed entered a rate-cutting phase beginning in September 2024, bringing rates down to 4.25% today. Turning points in the rate cycle often coincide with trend reversals in the crypto market.

2024 was viewed as a pivotal year for crypto’s shift from bear to bull, largely due to the Fed’s policy pivot. Following more than 500 basis points of cumulative rate hikes during 2022–2023, the Fed halted further increases in mid-to-late 2024 and began signaling rate cuts. As inflation steadily declined below 3% and employment growth slowed sharply—even turning negative—the tightening cycle reached its peak. The Fed cut rates three times in the second half of 2024: a 50 bps cut in September, followed by two 25 bps cuts in November and December. By the end of 2024, the federal funds rate target range had dropped from a high of 5.25%–5.50% to 4.25%–4.50%, marking the official reversal of nearly two years of the fastest global rate-hiking cycle.

The policy turning point had an immediate impact on the crypto market. Bitcoin launched a strong upward move in the second half of 2024: the Fed’s initiation of rate cuts in September acted like a fuse, compounded by the supply shock from Bitcoin’s block reward halving in April that year. With these dual catalysts, investor sentiment turned bullish rapidly. Bitcoin surged from around $60,000 in mid-September 2024, reaching a new high above $120,000 by mid-July 2025. The macro liquidity inflection point reversed the long-term market trend, prompting large-scale capital to flow back into crypto: the approval of the first spot Bitcoin ETF in the U.S., narrowing discounts in Grayscale and other institutional trusts, and major tech firms announcing blockchain strategies—all laid the foundation for the crypto recovery from late 2024 into 2025.

Source: https://www.fedprimerate.com/fedfundsrate/

Historically, the timing of the Fed’s first rate cut typically coincides with slowing economic growth and a bottoming-out labor market before unemployment begins to rise. This "policy pivot" is often interpreted by markets as a turning point for risk assets. The impact of rate cuts varies under different macro conditions: if driven by crisis or recession fears (e.g., 2008, 2020), markets may initially fall due to panic; however, if the cuts are "preventive" or "mid-cycle," made while the economy remains stable solely for risk management, they tend to boost market confidence more clearly. This recent cut was described by Powell as a "risk management cut"—not prompted by drastic changes in fundamentals, but rather a balancing act between employment and inflation risks—indicating that the current easing cycle is likely to be gradual and mild.

3. Analysis of the Background and Features of the September 2025 Rate Cut

The September 2025 rate cut is a "proactive defensive" risk management move, reflecting the Fed’s delicate balance between securing a soft landing and ensuring inflation continues to decline. This cut differs from prior ones in several key aspects:

-

From a macro perspective, the U.S. economy is not in recession. The rate cut is more preventive than reactive. The FOMC statement noted that recent growth has slowed, job gains have cooled, and unemployment has slightly increased but remains low, while inflation has moderated to a state of “elevated but trending lower.” This indicates the primary motivation is to guard against downside labor market risks and achieve a soft landing, rather than respond to runaway risks.

-

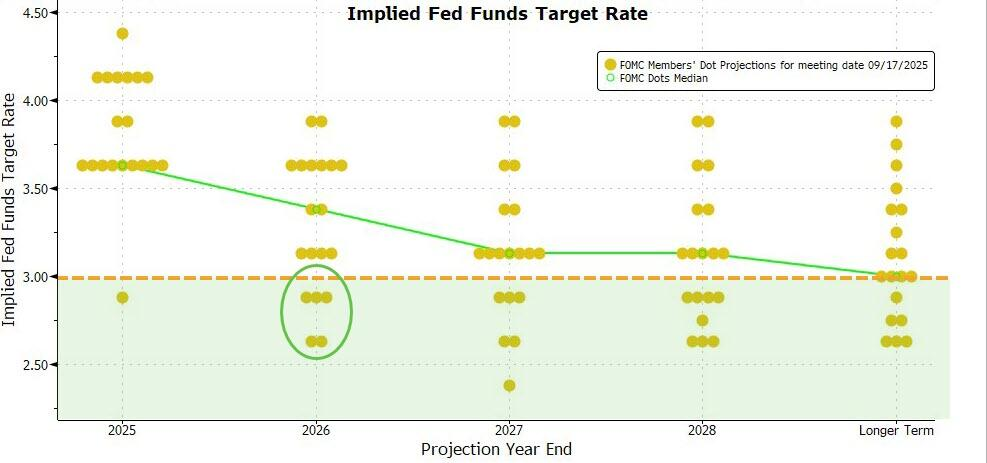

In terms of policy continuity, this is the first cut of 2025 and the resumption of easing after a nine-month pause. The dot plot from the September meeting suggests two more 25 bps cuts this year, with one each in the following two years, indicating a gradual downward path. This reflects the Fed’s continued confidence in economic resilience and desire to preserve policy space, avoiding excessive loosening that could reignite inflation.

Source: https://wallstreetcn.com/articles/3755793

-

The language used during the press conference was also telling. Powell deliberately emphasized, “This is not the start of a series of ongoing cuts.” In other words, the Fed does not want to fuel excessive market expectations for continuous easing, which could lead to overly loose financial conditions. For the crypto market, lower rates in the short term enhance the appeal of risk assets. But in the long run, if the economic fundamentals do not deteriorate significantly, the Fed may not cut indefinitely to zero; policy could stabilize around neutral levels. Thus, while easing expectations boost confidence, short-term volatility and uncertainty remain.

-

The Fed continues its quantitative tightening (QT) alongside rate cuts. Its balance sheet has shrunk from nearly $9 trillion in May 2022 to about $6.6 trillion today. This means liquidity improvement is gradual, and long-term rates remain constrained by supply pressures.

For the crypto industry, this rate cut sends a clear positive signal for liquidity. However, investors should continue monitoring upcoming FOMC meetings in October and December, as well as evolving economic data, to assess the certainty and magnitude of future easing.

4. How Far Is Altseason: Data and Signals Overview

Source: https://coinmarketcap.com/charts/altcoin-season-index/

-

"Altcoin Season Index" surges: A key indicator of altcoin strength is the Altcoin Season Index, which measures how many of the top 100 cryptocurrencies have outperformed Bitcoin over the past 90 days. A reading above 75% signals the onset of altseason. On September 18, the index reached 71%, just 3 percentage points shy of confirming altseason. For most of the first half of the year, this metric stayed below 50%, indicating Bitcoin significantly outperformed the broader market. The recent sharp climb suggests capital is gradually rotating from Bitcoin into higher-risk altcoins. Historically, similar patterns occur after strong Bitcoin rallies enter consolidation phases, creating space for alts to shine. Now, with Bitcoin oscillating around $110,000 and many quality altcoins still far below their all-time highs, capital is naturally sensing rotation opportunities.

-

Bitcoin dominance weakening: Correspondingly, Bitcoin’s market cap share is beginning to retreat from its peak. In Q2, Bitcoin dominance briefly surpassed 50%, a two-year high, reflecting concentrated investor bets on Bitcoin. In Q3, signs of weakening emerged. By mid-September, Bitcoin dominance had dropped roughly 3–5 percentage points from its peak, indicating altcoins’ total market cap is growing faster than Bitcoin’s. The classic rotation model follows: Bitcoin surges → enters stagnation → capital flows into major alts → spreads to small-cap alts. We are now in the middle stage of this model. As long as Bitcoin avoids a deep correction, altcoins could take the lead, further reducing Bitcoin dominance. During the full altseason of 2021, Bitcoin dominance plunged from over 60% to below 40%, fueling double- and triple-digit gains across numerous altcoins.

-

Institutional investors increasing exposure to altcoins: Not only retail investors are talking about altcoins—many institutional players are also targeting quality alt assets. On one hand, Digital Asset Treasury (DAT) strategies are increasingly diversified. Data shows that by mid-2025, total digital asset holdings by public companies exceeded $100 billion, with Bitcoin accounting for over $93 billion. Ethereum-focused treasuries have grown rapidly to over $4 billion, with more firms adding ETH to reserves. Some are investing in high-performance L1 tokens like SOL and BNB, while others form deep partnerships with specific blockchains, acquiring assets such as SUI and XRP. These trends indicate growing institutional recognition of quality altcoins. Major crypto funds are also making large bets on alt sectors, positioning themselves ahead of altseason—focusing on blue-chip and high-potential tokens. Their moves are worth watching.

Looking back at past crypto cycles, once altseason takes hold, capital inflows often spread broadly across various sectors. Yet certain patterns emerge: fundamentally sound new narratives and concepts usually lead the charge, followed by catch-up rallies in older coins. Beyond traditional L1s and DeFi, RWA, AI, and cross-chain protocols are seen as potential drivers this cycle. Many analysts expect real-world asset tokenization to be a major theme in the next cycle, representing the convergence of on-chain liquidity and traditional finance. AI-powered decentralized applications could spark renewed interest in compute and data tokens. Cross-chain infrastructure (e.g., LayerZero, Chainlink CCIP) has already demonstrated value and may become institutional favorites.

5. “Uptober” Approaches: Q4 Market Outlook

Source: https://www.coinglass.com/today

With the September rate cut settled, market attention turns to the upcoming October FOMC meeting. The CME FedWatch tool shows rising odds for another rate cut in October. If economic data doesn’t unexpectedly improve, a 25 bps cut at the end of October is highly probable. Goldman Sachs forecasts one cut each in September, October, and December 2025, followed by two more in 2026, bringing the terminal rate to 3.0%–3.25%. This trajectory aligns closely with the dot plot. Therefore, Q4 2025 could see cumulative easing of 75 bps, injecting additional liquidity into markets. Easing expectations are building, and bullish conditions are maturing.

Bolstered by macro tailwinds, seasonal patterns in Q4 are also promising. The crypto community embraces the idea of "Uptober": since 2013, Bitcoin’s average October monthly return has been +22.9%. This stems from both seasonal capital flows—such as year-end risk-on rebalancing and reduced selling pressure—and psychological factors, as investors grow optimistic about year-end rallies after a quiet Q3. When macro and seasonality align, markets often fulfill a "self-fulfilling prophecy."

That said, uncertainties remain. Divergent views among Fed officials in the September meeting suggest disagreement on the future path. Should economic data surprise to the upside, the pace of easing could slow or even pause temporarily. Additionally, after significant gains this year, Bitcoin may experience sideways volatility or pullbacks at current highs to digest profits and rebuild momentum.

Overall, Q4 2025 possesses many ingredients for a repeat of the crypto euphoria seen in 2017 and 2020: macro easing is underway, institutional capital keeps flowing in, market sentiment is shifting from cautious to FOMO, and innovative narratives—RWA tokenization, ETH spot ETFs, public companies entering blockchain—are emerging rapidly. Absent any black swan events, the crypto market in Q4 deserves optimistic anticipation. Especially as Bitcoin hits new highs and consolidates, we may well witness a broad rotation into high-quality altcoins, ushering in a long-awaited "altseason."

6. Conclusion: Seizing Opportunities Between Hype and Calm

The crypto market now stands at an exciting juncture: macro interest rate trends have turned downward, institutional and retail sentiment is warming in sync, Bitcoin is setting new highs and gathering momentum, and altcoins are rising in waves. The fourth quarter of 2025 is highly likely to witness a spectacular "altseason." We maintain a cautiously optimistic view for the coming months: moderate Fed easing will continue to nourish the market, the "Uptober" seasonal effect is likely to reappear, and widespread outperformance of altcoins over Bitcoin may unfold. A dynamic and challenging crypto Q4 awaits us all.

Yet history repeatedly warns: the more exuberant the market becomes, the more critical it is to stay rational. While altseason is enticing, it’s also a time of mixed fortunes. On one hand, it can generate extraordinary wealth—investors who positioned early in quality alts could see multi- or even tens-of-fold paper gains. On the other hand, altseason often breeds speculative bubbles, with mediocre or even absurd projects being wildly hyped, leaving someone to bear the losses at the end.

Every altseason is an adventure filled with both opportunity and traps. Currently, institutional treasuries and whale accounts holding millions are aggressively accumulating altcoins, signaling that even "smart money" sees promise in this cycle. Still, investing remains a personal journey. Maintaining independent thinking, overcoming greed and fear, and striking the right balance between rationality and frenzy are essential skills for any investor aiming to survive and thrive beyond the bull market’s peak.

About Us

Hotcoin Research, the core investment research arm of Hotcoin Exchange, is dedicated to transforming professional analysis into practical tools for your trading success. Through our “Weekly Insights” and “In-depth Reports,” we help you understand market trends. Our exclusive column “Top Altcoin Picks” (powered by AI and expert screening) identifies high-potential assets and reduces trial-and-error costs. Each week, our analysts engage with you live, explaining hot topics and forecasting trends. We believe that warm, human support combined with expert guidance empowers more investors to navigate market cycles and capture Web3’s value opportunities.

Risk Warning

The cryptocurrency market is highly volatile, and investing inherently involves risk. We strongly advise investors to fully understand these risks and operate within a strict risk management framework to ensure capital safety.

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail:labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News