Circle: A Comprehensive Analysis of the Leading Compliant Stablecoin

TechFlow Selected TechFlow Selected

Circle: A Comprehensive Analysis of the Leading Compliant Stablecoin

Although Circle's long-term outlook is promising, the current price has fully or even prematurely reflected optimistic expectations, leaving a low valuation safety margin.

Author: Lawrence Lee

1. Research Summary

Key points regarding the valuation and investment in Circle are summarized as follows:

-

Rarity in a high-growth sector: The stablecoin industry where Circle operates is undergoing rapid development. The gradual clarification of U.S. regulatory frameworks further strengthens long-term certainty for the industry, attracting major players to accelerate their entry. While intensifying competition places pressure on Circle, it also confirms market recognition of the stablecoin sector's long-term value. Circle currently ranks second in stablecoin market share and is the only publicly listed entity available for investment, making its scarcity a significant factor in investor decision-making.

-

Valuation already reflects high growth expectations: Multiple valuation metrics indicate that Circle’s current valuation is relatively high, reflecting ample market pricing of its growth prospects—some valuation logic even anticipates its future role as a leading financial infrastructure player. Future stock performance will heavily depend on whether actual results meet or exceed market expectations. If quarterly financials or key operational metrics fall short of optimistic forecasts, a valuation correction may occur.

-

Medium-term financial pressure: Circle’s financial performance hinges on three main drivers. USDC supply is expected to grow continuously with industry expansion and operational improvements, but short-term downward trends in U.S. Treasury yields, combined with persistently high distribution and transaction costs, suggest continued pressure on revenue and profit margins in the near term.

-

Massive share unlock in November–December: Shares held by early investors will be unlocked en masse between November and December, most of which have been held for close to or over ten years, indicating strong exit motivation. This event could exert significant downward pressure on Circle’s stock price.

-

Future catalysts: In the short to medium term, several potential catalysts could influence Circle’s valuation:

-

Bank charter approval – If Circle obtains trust charter approval from the OCC, it would become the first stablecoin bank in the U.S., significantly enhancing its status and credibility, potentially triggering a revaluation.

-

Business diversification progress – Announcements of new revenue streams (e.g., payment fee models) exceeding market expectations could reduce perceptions of interest rate dependency and boost valuation.

-

M&A and partnerships – Deepened collaborations with major banks or tech companies, or potential acquisitions (e.g., by larger financial institutions), would affect market views on Circle’s ultimate value.

-

Conversely, negative catalysts such as sudden Fed rate cuts, new competitor stablecoins, or security incidents could suppress valuation.

-

Investment Recommendation:

Based on the above, our stance on Circle stock is “neutral.” The rationale is that although Circle has promising long-term prospects, the current price fully, if not excessively, reflects optimistic expectations, leaving limited valuation safety margin. Given ongoing macroeconomic and industry uncertainties, near-term volatility risk remains elevated.

PS: This article represents the author’s interim thoughts as of publication, subject to change. Views are highly subjective and may contain factual, data, or logical errors. All opinions expressed herein are not investment advice, and feedback and discussion from peers and readers are welcome.

2. Business & Product Lines

Circle Internet Financial was founded in 2013 by Jeremy Allaire and Sean Neville, with a mission to “enhance global economic prosperity through frictionless value exchange.” Initially focused on crypto payments, Circle faced challenges in its early development. During this period, it explored various business avenues, including launching the crypto market-making platform Circle Trade, acquiring the exchange Poloniex, and purchasing crowdfunding platform SeedInvest.

In 2018, Circle co-founded the Centre Consortium with Coinbase and launched the USD Coin (USDC), positioning it as a compliant and transparent digital dollar. USDC quickly became the world’s second-largest stablecoin, trailing only Tether (USDT). Since then, Circle has gradually divested non-core assets like Poloniex and SeedInvest, focusing its strategy on stablecoins and related businesses.

Today, Circle’s core operations revolve around stablecoins, with additional segments in payment settlement, corporate treasury services, developer platforms, and wallet solutions. These include:

2.1 Stablecoin Issuance & Reserve Management

USDCoin (USDC) Issuance

USDC is Circle’s flagship product, minted and redeemed on-demand by its regulated subsidiaries. As of September 15, 2015, USDC circulation stood at $72.7 billion. Circle commits that each USDC issued is backed by one dollar in reserves held in bank custodial accounts or compliant funds, ensuring a 1:1 peg to the U.S. dollar. The company employs a daily monitoring and T+2 settlement mechanism: when users submit dollar deposits via Circle accounts to mint USDC, Circle issues the corresponding USDC on-chain immediately upon fiat confirmation and sends it to the user’s wallet; redemption works in reverse, with Circle burning USDC and returning equivalent fiat. This “real-time in, real-time out” mechanism ensures stable USDC supply.

Reserve Asset Composition

Circle maintains strict reserve management policies, investing reserves solely in cash and U.S. government bonds with maturities under three months, ensuring “safety, high liquidity, transparency.” According to the latest disclosure dated July 31, 2025, approximately 85% of USDC reserves consist of U.S. dollar money market funds (primarily holding U.S. Treasuries), while 15% are held as deposits in globally systemically important banks (GSIBs). This means the vast majority of reserves are redeemable daily, capable of handling concentrated redemptions.

Circle partnered with BlackRock to establish the “Circle Reserve Fund,” placing Treasury-backed reserves into this SEC-registered fund managed by BlackRock. Fund holdings and net asset values are disclosed regularly. As the sponsor and beneficiary, Circle does not directly interfere with investment decisions, enhancing the professionalism and transparency of reserve operations. Cash reserves are distributed across multiple GSIBs (e.g., BNY Mellon, JPMorgan Chase) to support daily redemption liquidity and payment system integration.

Reserve Transparency & Audits

Transparency is viewed by Circle as foundational to USDC’s trust model. Since its 2018 launch, the company has engaged independent auditors monthly to publish reserve attestation reports, disclosing USDC circulation and detailed reserve holdings. Deloitte currently provides attestation services. Audit reports consistently show that USDC reserve assets slightly exceed circulating USDC value, demonstrating 100% backing and risk buffer mechanisms. Circle strictly segregates its own capital from USDC reserves, eliminating misuse risks.

Compared to Tether, which faced regulatory penalties due to opaque reserves, Circle’s self-imposed transparency has earned trust from regulators and institutional clients. In 2023, Circle proactively responded to SEC accounting guidance by detailing USDC reserve fund holdings in its 10-K filing. As the company advances its public listing, it will submit quarterly financial and operational data to the SEC, further strengthening transparency and market confidence.

EURC and Multi-Currency Expansion

Beyond the dollar stablecoin, Circle launched the Euro Coin (EURC) in 2022, pegged 1:1 to the euro. EURC follows the same management model as USDC, with reserves in euro cash and short-term European government bonds. Although EURC’s current market cap is small (around €200 million), it holds significant growth potential as the EU’s Markets in Crypto-Assets (MiCA) regulation takes effect and eurozone attitudes toward digital finance evolve.

Circle has indicated plans to explore issuing other G10 currency stablecoins (e.g., pound, yen) based on market demand and regulatory environments. Recently, Circle received preliminary approval from Abu Dhabi Global Market (ADGM) to offer payment services including stablecoins, suggesting possible Middle East expansion and potentially launching local-currency-pegged stablecoins (e.g., dirham). Through multi-currency expansion, Circle aims to build a comprehensive stablecoin matrix covering major fiat currencies, reinforcing its leadership in the global stablecoin space.

2.2 Payment Settlement & Corporate Treasury Services

Circle Business Accounts

Circle offers comprehensive Circle Account services to enterprise and financial institution clients. Through a single account, customers can conduct bidirectional conversions, transfers, and balance management between fiat and digital currencies like USDC. For example, e-commerce businesses can deposit U.S. dollars into their Circle account and instantly convert them to USDC to pay overseas suppliers; suppliers can then redeem USDC into local fiat anytime. The entire process takes minutes, significantly improving efficiency compared to traditional SWIFT wire transfers.

Circle accounts support multiple fiat on/off-ramp channels, including ACH, SWIFT, wire transfer, and SEPA, achieving broad coverage through integrations with global banks and payment networks. For blockchain payments, the account supports multi-chain USDC receiving addresses, allowing customers to select networks (e.g., Ethereum mainnet or Solana) based on cost and speed requirements. Additionally, Circle accounts provide multi-user permission controls, transaction history exports, and other treasury features to meet corporate financial needs.

Payments API

Circle’s Payments API enables developers to integrate fiat and stablecoin payment functionality into their platforms. By calling the API, merchants can receive customer payments and instantly convert them to USDC. For instance, when a user pays $100 via credit card, the merchant can use Circle’s API to instantly convert the amount into USDC and deposit it into a Circle account, avoiding high cross-border clearing fees and exchange rate risks while maintaining a seamless user experience.

Merchants can also use the “Payouts” feature to convert USDC into local fiat via the API and disburse funds to users through banking networks. Currently, Circle’s payment network covers over 100 countries, effectively connecting unbanked users with digital wallet systems.

Treasury & Exchange Services

Circle provides critical treasury infrastructure to digital asset exchanges and brokers. Traditional banking channels often suffer from slow speeds and complex compliance, whereas integrating with Circle accounts allows exchanges to quickly convert user-deposited U.S. dollars into USDC, enabling near-instant on-chain settlement; withdrawals use USDC for cross-chain transfers and local redemptions, greatly improving efficiency and user experience.

Currently, multiple trading platforms including Coinbase widely use USDC as a dollar alternative. Although USDC’s trading volume share on centralized platforms remains below USDT, it reaches about one-third on top exchanges like Binance. Circle’s OTC minting service supports bulk and efficient USDC issuance and redemption for exchanges and institutions, helping stabilize liquidity during periods of market volatility.

Additionally, Circle’s APIs support large-scale OTC settlements, such as institutions using USDC to settle loans and securities transactions, bypassing delays in bank cross-border clearing. Overall, Circle’s payment and treasury services serve both end-use cases like e-commerce and remittances, and function as underlying financial infrastructure supporting exchanges and institutions. This enterprise-focused model expands USDC’s application ecosystem, enhancing business stickiness and client relationships.

2.3 Developer Platform & Wallet Services

Wallet API & Development Tools

Circle has launched a suite of developer tools to lower the barrier to blockchain integration. The Wallets API enables enterprises to rapidly create and manage digital asset wallets without handling private keys or on-chain interactions themselves. Developers can generate USDC wallet addresses, check balances, and initiate transfers via API calls, with secure key custody and signing handled centrally by Circle’s backend.

This service is particularly useful for traditional businesses seeking to adopt digital assets. For example, a gaming company can use the Wallet API to create USDC wallets for players, distribute in-game rewards, and support withdrawal and redemption, without requiring deep blockchain expertise. Circle also offers blockchain node services and smart contract interfaces compatible with multiple chains like Ethereum and Solana, improving development efficiency.

In 2022, Circle strengthened institutional-grade security features such as multi-signature wallets and permission management through its acquisition of CYBAVO, helping clients securely manage large digital asset holdings. These efforts aim to position Circle as the “AWS of the blockchain world,” enabling traditional applications to access the stablecoin ecosystem through foundational digital currency services. While API service revenue currently makes up a small portion, its strategic importance lies in expanding USDC adoption and circulation, indirectly driving core business growth.

Cross-Chain Interoperability & CCTP

USDC is currently deployed across more than 10 blockchains, including Ethereum mainnet, multiple Layer 2 networks (e.g., Arbitrum, Optimism), Solana, Avalanche, and Tron. To address fragmented liquidity across chains, Circle developed the Cross-Chain Transfer Protocol (CCTP), allowing users to transfer USDC between chains without relying on centralized exchanges or third-party bridges.

CCTP achieves cross-chain transfers by “burning USDC on the source chain and minting an equivalent amount on the destination chain,” with Circle issuing certificates to ensure security and trustworthiness. The protocol gained widespread attention in 2023 and is seen as a key innovation for mitigating bridge security risks and enabling efficient value transfer. CCTP not only strengthens Circle’s control over USDC cross-chain flows but also enhances consistency of USDC across multiple chains (total supply remains unchanged, only migrating between chains), further solidifying Circle’s central role in the stablecoin ecosystem.

2.4 Future Product Line Expansion

Looking ahead, Circle is actively expanding into new products and services to broaden revenue streams and reinforce its ecosystem advantage:

-

ARC: A Stablecoin-Optimized Blockchain: In August 2025, Circle announced ARC, an open L1 blockchain designed specifically for stablecoins. ARC uses USDC as its native gas token, features a built-in foreign exchange engine enabling 24/7 peer-to-peer on-chain settlement, and is EVM-compatible. The ARC testnet is expected to launch this fall, with the mainnet planned for 2026. ARC will serve as the core platform for Circle’s future operations, hosting multiple new services.

-

Cross-Border FX Exchange: After ARC’s launch, Circle could leverage USDC/EURC to develop cross-border foreign exchange services, enabling fast USD-EUR swaps with better rates and efficiency than traditional FX channels, thus entering the multi-trillion-dollar foreign exchange market.

-

Digital Identity & Compliance: To meet regulatory requirements, Circle may launch on-chain identity verification services, allowing institutions to verify KYC status of counterparty addresses, creating a “permissioned stablecoin” ecosystem that attracts financial institutions sensitive to anonymous transactions.

-

Lending & Yield Products: Although current regulations prohibit stablecoins from paying interest to the public, Circle could still conduct USDC lending services for institutions—accepting collateral and lending USDC for interest income, similar to securities lending. If regulations allow, Circle might relaunch institutional yield products (e.g., “Circle Yield”) under strict risk controls to expand profitability.

-

CBDC Collaboration: As central banks advance CBDC initiatives, Circle could act as a technology provider or distributor. For example, Circle may participate in the UK’s planned digital pound pilot as a private-sector distributor, offering conversion and custody services. The company is also exploring collaborations with other national CBDC teams to maintain its leadership in the digital currency space.

In summary, Circle is evolving from a single stablecoin issuer into a comprehensive digital financial ecosystem encompassing “stablecoins + payments + developers + banking services.” Through horizontal and vertical business expansion, Circle is unlocking new growth opportunities and embedding itself deeper into digital economy infrastructure. As synergies across business lines materialize, Circle aims to build a USDC-centric digital financial network, generating long-term value for shareholders.

3. Management & Governance

3.1 Core Management Team

Co-founder and CEO Jeremy Allaire is a serial internet entrepreneur who previously founded Brightcove, successfully taking it public. He possesses deep insights into open networks and fintech and is widely regarded as a representative figure in the stablecoin industry, frequently participating in U.S. Congressional hearings and policy discussions, advocating for balanced industry regulation.

The other co-founder, Sean Neville, served as president in the company’s early days, establishing its product and technical foundation. He transitioned to a board advisor role in 2019 and still holds company shares.

Circle’s executive team includes CFO Jeremy Fox-Geen, who joined in 2021 after serving as Managing Director at Barclays Investment Bank in the UK, bringing extensive experience in traditional finance and capital markets. He led the company’s SPAC merger and IPO preparation.

COO Elisabeth Carpenter and CLO Flavia Naves both come from traditional financial or tech giants, contributing valuable operational and compliance management expertise. The legal team has played a crucial role in navigating complex regulatory environments and obtaining licenses across jurisdictions.

Overall, Circle’s management team combines technological innovation with rigorous compliance awareness, laying a solid foundation for stable operations amid rapid growth.

3.2 Board & Governance

In 2018, Circle formed the Centre Consortium with Coinbase, equally owned (50%:50%), to manage USDC-related affairs. In 2023, Circle restructured its relationship with Coinbase, taking direct control of USDC operations. Coinbase relinquished its equity stake but retained a 50% revenue share in USDC (see Section 5.2 “Distribution and Transaction Costs” for detailed partnership explanation). Therefore, Coinbase continues to play a significant role in USDC’s development and remains a member of Circle’s board.

Besides Coinbase, Circle’s board includes seasoned industry professionals and strategic investor representatives. Chairman Jeremy Allaire leads the board, with investor representatives from firms like Goldman Sachs, Excel, and Breyer ensuring alignment between company strategy and investor interests. Circle has also appointed several independent directors, including Heath Tarbert, former chair of the FDIC, whose deep regulatory background provides strong support for the company’s IPO process and compliance operations.

3.3 Governance Structure & Shareholder Rights

Circle adopts a dual-class share structure: Class A common stock is offered to public investors, while Class B shares are held by founders and early investors, carrying enhanced voting rights. This mechanism ensures founder Jeremy Allaire retains strategic control post-IPO, shielding long-term planning from short-term market pressures.

Prior to its IPO, Circle completed multiple internal governance enhancements, including establishing audit, compliance, and risk committees led by independent directors to oversee financial reporting and risk management. According to its prospectus, Circle has established comprehensive internal control systems for anti-money laundering (AML) and sanctions compliance, staffed with dedicated compliance officers and subject to annual external audits.

Circle has also defined clear reserve management policies and emergency response plans. For example, during the March 2023 Silicon Valley Bank crisis, Circle temporarily had $3.3 billion in cash reserves inaccessible, causing USDC to briefly de-peg. The management team swiftly issued a transparent announcement, committing to cover any shortfall with its own funds. Ultimately, with Federal Reserve intervention, the reserves were preserved and USDC restored its peg. This incident highlighted the management team’s crisis response and risk communication capabilities, with timely actions preventing widespread user panic.

3.4 Compliance & Regulatory Relations

Since inception, Circle has prioritized compliance, earning a reputation as a “regulation-embracing pioneer.” In 2015, Circle became the first holder of New York State’s BitLicense, considered one of the most stringent state-level regulatory licenses in the digital currency industry, reflecting its high level of cooperation with regulators.

Subsequently, Circle obtained money transmitter licenses in 46 U.S. states, electronic money institution authorization from the UK’s Financial Conduct Authority (FCA), and exempt licensing in Singapore. The company invests heavily annually to meet anti-money laundering (AML) and know-your-customer (KYC) requirements, with its internal compliance team conducting real-time monitoring of large and suspicious transactions and promptly reporting anomalies.

This compliance-first image strengthens Circle’s credibility in regulatory communications. CEO Jeremy Allaire has testified multiple times before U.S. Congress, supporting federal-level stablecoin legislation and expressing willingness to act as a “test case” for stricter oversight in exchange for the industry’s long-term healthy development.

In June 2025, following the U.S. Senate’s passage of the stablecoin bill, Circle swiftly initiated the application process for a federal trust bank charter, aiming to become one of the first compliant stablecoin issuers. Circle’s relationship with regulators is largely collaborative, with management clearly recognizing that proactive regulatory engagement is essential to gaining mainstream market acceptance. This governance philosophy will help Circle maintain a leading position in future compliance competition and sustain a positive public and governmental image.

4. Industry Analysis

4.1 Global Stablecoin Market Overview

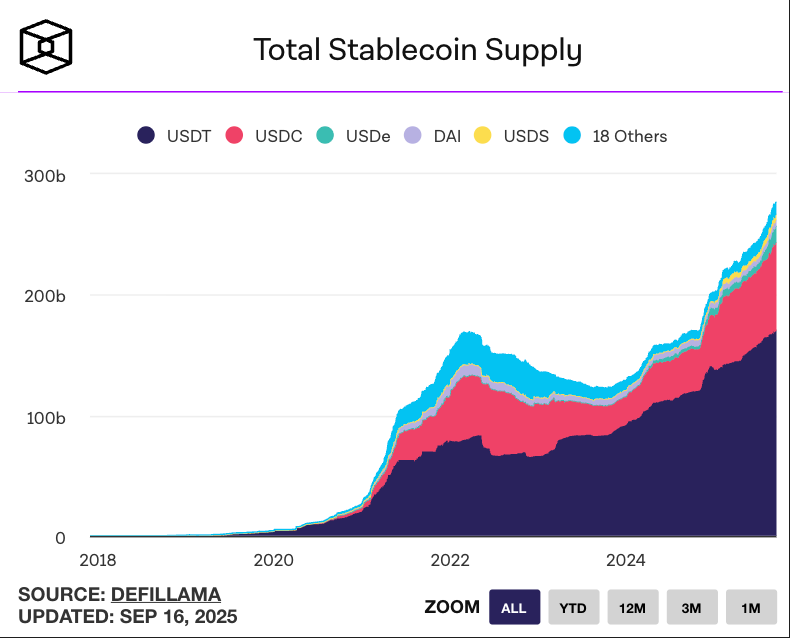

Stablecoins are cryptocurrency assets pegged to fiat currencies or other assets, designed to combine the price stability of fiat with the efficiency of blockchain technology. They have become a vital bridge linking the crypto ecosystem with traditional financial systems. Since 2020, the stablecoin market has experienced explosive growth, with total market capitalization rising from under $10 billion to nearly $200 billion by 2022. Despite a temporary dip during the broader crypto market correction, the market has rebounded strongly with renewed crypto market momentum, and total stablecoin market cap now exceeds $270 billion. As of July 2025, stablecoin supply accounts for over 1.2% of U.S. M2 money supply ($22.12 trillion), representing a significant scale.

The current stablecoin market is dominated by U.S. dollar-denominated products, accounting for over 95%, while other currencies such as euro and pound stablecoins remain in early development stages. Among dollar stablecoins, USDT and USDC together capture about 85% of the market, forming a duopoly.

Stablecoin Circulation Source: theblock

Stablecoin demand primarily stems from the following areas:

1. Crypto Trading Demand

Stablecoins continue to serve as the primary unit of account and safe-haven instrument in digital asset markets, enabling traders to quickly switch between cryptocurrencies and lock in value during market volatility. The medium of exchange in crypto markets shifted entirely from BTC to stablecoins during the 2019–2021 cycle, and currently over 95% of spot trading volume comes from cryptocurrency-stablecoin pairs. In recent years, stablecoin-denominated perpetual contracts have grown rapidly, with trading volumes multiple times higher than spot, and depth comparable to spot markets. The proliferation of perpetual contracts has further increased stablecoin penetration among traders.

Crypto market settlement demand remains the primary driver of stablecoin usage.

2. Cross-Border Payments & Financial Inclusion

Leveraging advantages such as fast cross-border transfers, low fees, and 24/7 availability, stablecoins demonstrate significant potential in international remittances and trade settlements. Traditional remittance systems rely on multiple intermediaries, taking days and incurring high costs, whereas using stablecoins like USDC enables near-instant peer-to-peer settlement. Numerous payment providers and remittance firms are piloting stablecoin network integrations, and traditional payment giants like Visa and Mastercard are closely monitoring technological convergence in this space.

3. DeFi & Digital Financial Applications

In decentralized finance (DeFi) ecosystems, stablecoins serve as foundational collateral and units of account for lending, market-making, and derivatives protocols. Users can deposit stablecoins into DeFi platforms to earn interest or participate in liquidity mining, giving them deposit-like functionality. During the 2021 DeFi boom, demand for USDC-based lending surged, prompting Circle to launch “Circle Yield,” offering fixed-income returns to institutions. However, following the 2022 industry turmoil (e.g., the collapse of Terra’s algorithmic stablecoin), such yield offerings have become more cautious.

4. Macroeconomic Influences

Geopolitical dynamics and global financial trends are also accelerating stablecoin adoption. Despite growing “de-dollarization” rhetoric, stablecoins objectively expand the reach of the U.S. dollar: due to their high convenience, many offshore markets prefer holding USDC or USDT over local currencies, thereby reinforcing the dollar’s practical influence. According to ARK Invest analysis, the total U.S. Treasuries held via stablecoins now exceed holdings by countries like Germany and South Korea. Stablecoins are becoming a significant new buyer of U.S. Treasuries and a new vehicle for dollar internationalization, reinforcing the dollar’s reserve currency status. In emerging markets, high inflation and capital controls drive residents to treat stablecoins as dollar alternatives for everyday payments and value storage. For example, in Argentina and Nigeria, USDT and USDC are widely used, forming “parallel currency networks” that compensate for weaknesses in local financial systems.

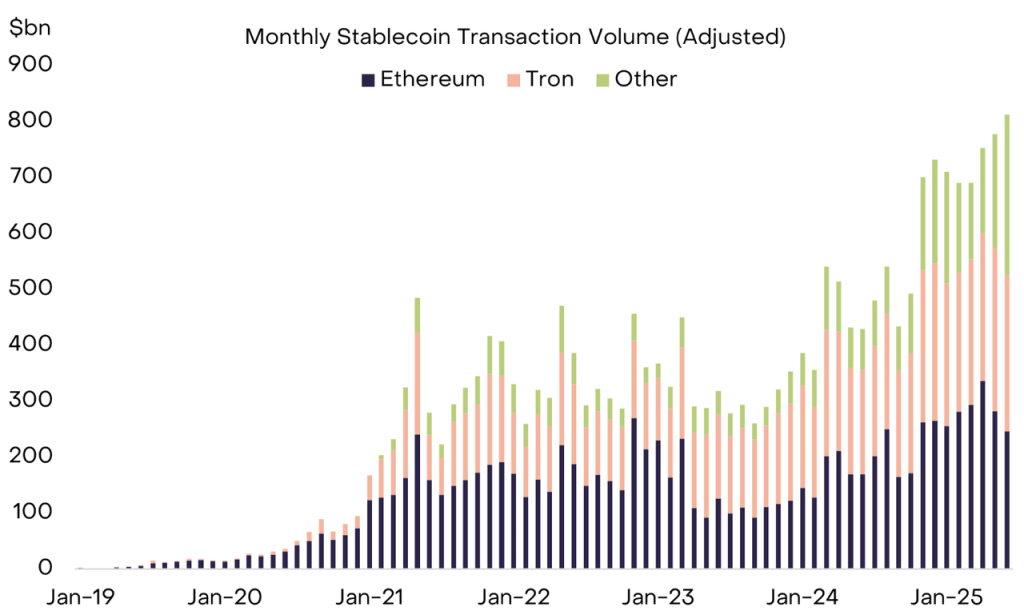

Monthly Stablecoin Transaction Volume Source: Grayscale

It’s worth noting that Google and Coinbase jointly launched Agentic Payments Protocol 2 (AP2) on September 17, designed to securely initiate and process AI-agent-led payments across platforms. AP2 introduces stablecoins as a primary payment method and could promote accelerated stablecoin circulation in the short term. Moreover, stablecoins’ inherent characteristic of being tied to blockchains rather than biometric data makes them naturally more suitable than other payment systems for economic activities between AI agents. Future inter-AI agent economic activity may further expand the stablecoin market.

4.2 Competitive Landscape

The stablecoin market exhibits a “two dominant players, multiple challengers” landscape: Tether (USDT) and Circle (USDC) rank first and second, respectively. Based on current issuance scale, USDT holds about 58% market share, while USDC accounts for approximately 25%. USDT, issued by offshore entity Tether, maintains dominance through first-mover advantage and deep integration with multiple exchanges. However, its operational transparency and compliance have long been questioned, with insufficient reserve disclosures and audits drawing scrutiny from European and U.S. regulators.

In contrast, Circle’s USDC is renowned for compliance and transparency, holding money transmitter licenses in multiple U.S. states and New York’s BitLicense. Circle conducts monthly audits, with reserves composed entirely of cash and short-term U.S. Treasuries, mostly held in U.S.-regulated funds. This prudent strategy significantly enhances institutional trust in USDC. As global regulation tightens, USDC is expected to further expand its share in compliance-sensitive markets (e.g., U.S., EU), while USDT may face constraints in certain jurisdictions (e.g., under EU MiCA regulations).

Other notable competitors include:

-

Payment Giants: PayPal launched its dollar stablecoin PYUSD in 2023, leveraging its vast user and merchant network to promote stablecoin payments. Currently, PYUSD has a circulation of 1.17 billion, far smaller than USDC, but PayPal’s brand strength and channel capabilities make its potential noteworthy. Recently, Stripe announced its stablecoin L1 Tempo, while Visa and Mastercard are engaging through partnerships and investments in stablecoin payment spaces.

-

Financial Institutions: JPMorgan Chase issues JPM Coin for interbank clearing; Société Générale launched a euro stablecoin. With the stablecoin bill now passed, more banks are expected to enter the space using their credit backing, though applications may focus on B2B scenarios like corporate payments and on-chain clearing, resulting in limited direct competition with USDC in retail markets.

-

Decentralized Stablecoins: Examples include Ethena’s USDE, MakerDAO’s DAI, and USDS. In terms of issuance scale, USDE and USDS+DAI are currently the third- and fourth-largest stablecoins (with 13 billion and 9.5 billion issued, respectively). USDE incorporates perpetual futures funding rate arbitrage into its stablecoin system, yielding returns significantly higher than short-term Treasuries, showing innovation and product-market fit. However, in absolute scale and application scope, these stablecoins remain relatively small and are perceived mainly as yield tools, posing no significant threat to USDC in the short term.

-

Other Compliant Issuers: Includes Paxos’ USDP and BUSD, formerly issued by Binance but discontinued in 2023 due to regulatory pressure. While entities like Paxos hold U.S. trust licenses and high compliance standards, they lag behind Circle in market outreach and ecosystem development. Since 2025, compliant stablecoin projects have emerged rapidly, such as USD1 (circulating over $2.5 billion) launched by the Trump family’s WLFI, Plasma’s governance token XPL reaching a pre-market valuation exceeding $7 billion, and Ethena’s fiat-backed stablecoin USDTB (circulating over $1.6 billion), with more mid- and small-sized projects continuously entering the market.

In summary, Circle has established a first-mover advantage through long-term accumulation in USDC compliance and ecosystem collaboration. However, as the stablecoin regulatory framework becomes clearer, increasing competition is making the market environment increasingly intense.

4.3 Regulatory Environment & Policy

The shift of stablecoins from “unregulated growth” to “regulated inclusion” is an inevitable trend. The 2022 collapse of Terra’s stablecoin triggered global regulatory alarm, prompting countries to explore regulatory frameworks.

In July 2025, the U.S. Congress passed the GENIUS Act (Guiding Establishing National Innovation in United States Stablecoin Act), establishing a federal regulatory framework for payment stablecoins. Key provisions include:

-

Requiring stablecoins to maintain 1:1 full-reserve backing, limited to highly liquid assets (e.g., cash, short-term U.S. Treasuries);

-

Mandating issuers to publish monthly reserve composition reports and undergo independent audits or reviews, with reserves prohibited from unauthorized reuse or re-pledging;

-

Requiring issuers to maintain adequate capital and liquidity buffers and robust risk management commensurate with business scale and risk profile;

-

Prohibiting direct interest or yield payments to holders to avoid classification as deposits or securities;

-

Explicitly excluding securities and commodities regulators (SEC, CFTC) from direct oversight of payment stablecoins, assigning regulatory authority to banking regulators (Federal Reserve, OCC, FDIC) and state financial authorities.

Overall, the GENIUS Act establishes a federal compliance baseline for U.S. stablecoins, clearly defining issuer qualifications, reserve transparency, and redemption obligations. The law will be fully implemented 18 months after enactment (by end-2026), after which unapproved entities will be barred from issuing payment stablecoins in the U.S.

The GENIUS Act is expected to eliminate weaker issuers, promoting industry consolidation. For Circle, which already adheres to high compliance standards (holding money transmitter licenses in 46 U.S. states, New York’s BitLicense, and licenses in Bermuda and the UK), the new federal licensing threshold will further highlight its compliance advantage, potentially squeezing out non-compliant competitors.

Beyond the U.S., the EU passed MiCA in 2023, bringing stablecoins (termed e-money tokens) under unified regulation, requiring licensing and meeting reserve and capital requirements. In 2024, Circle became the first global stablecoin issuer compliant with MiCA, paving the way for European market expansion. In Asia, financial hubs like Singapore and Hong Kong are developing stablecoin licensing regimes. The Hong Kong Monetary Authority proposed regulating stablecoin issuance in late 2023, mandating 1:1 reserves for Hong Kong dollar stablecoins. Japan now permits stablecoin issuance under trust company supervision. Overall, major jurisdictions are racing to introduce stablecoin regulations, aiming to ensure financial stability while attracting related business. This regulatory competition benefits compliant market leaders. Leveraging its multi-jurisdictional licensing (e.g., FCA e-money license in the UK, DABA digital asset license in Bermuda), Circle is well-positioned to enter compliant markets swiftly and gain first-mover advantages internationally.

4.4 Industry Trend Outlook

Several key trends are expected to shape the stablecoin industry in the coming years:

-

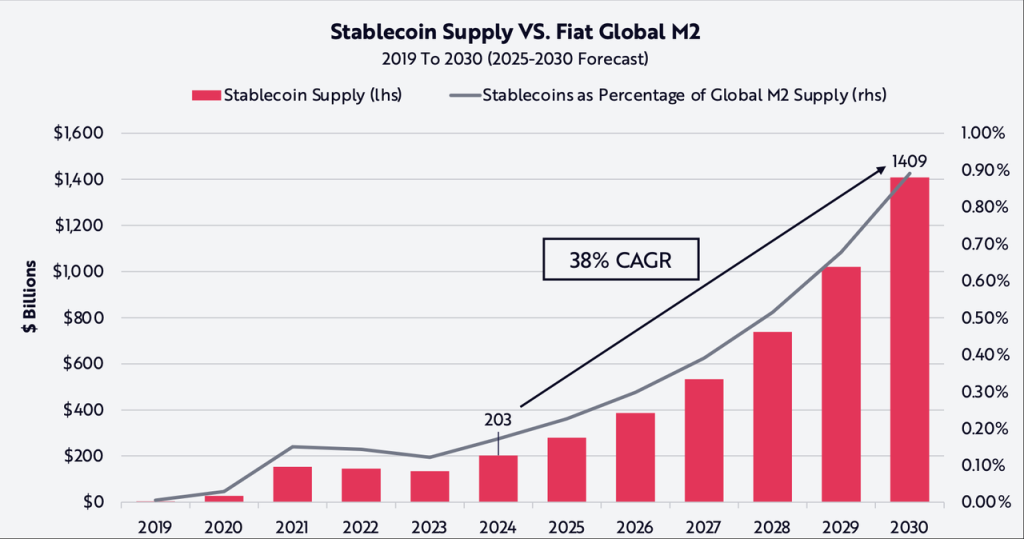

High-speed market growth: Ark Invest predicts that by 2030, stablecoins could account for 0.9% of global M2, exceeding $1.4 trillion.

While JPMorgan holds a conservative view on “stablecoin market cap reaching $1 trillion by 2028,” forecasting only $500 billion, most institutions are more optimistic, believing stablecoins are still in early adoption stages and could achieve 5–10x growth over the next five years. Especially as regulatory frameworks become clearer, traditional financial institutions and markets may widely adopt stablecoins for settlement and liquidity management—for example, piloting securities settlement or replacing legacy systems in Treasury markets. Standard Chartered even forecasts the stablecoin market could reach $2 trillion by 2028.

-

Shift from trading to payments and commerce: Currently, about 94% of stablecoin demand comes from crypto trading and DeFi, with only about 6% used in real-world payments and settlements. As payment companies like PayPal join and networks like Visa integrate, along with legislation affirming stablecoins’ status as payment tools, the share used in payments is expected to rise. Grayscale’s report dubbed 2025 the “Summer of Stablecoins,” noting that major U.S. corporations (Amazon, Walmart, etc.) are exploring stablecoin applications. In the future, stablecoins may be embedded into e-commerce payments, supply chain finance, gaming, and entertainment, enabling large-scale commercial payment use.

-

Deep integration with traditional finance: Stablecoins are gaining increasing recognition from traditional financial institutions: giants like JPMorgan and Bank of America are investing or piloting projects; DTCC, a financial infrastructure provider, is exploring stablecoins to improve settlement efficiency; and even U.S. mortgage lenders are considering including digital assets in borrower net worth calculations. Stablecoins may become tools for bank liquidity and cash management in the future, with some banks possibly holding USDC directly as reserves. U.S. Treasury officials have noted stablecoins’ role in buying Treasuries, suggesting policymakers may gradually accept and support stablecoins as a “private-sector supplement” to the U.S. financial system. It is foreseeable that stablecoin issuers may eventually be integrated into payment systems (e.g., accessing the FedNow real-time payment network), enabling seamless connections between traditional banks and on-chain digital dollars.

-

Technological evolution & multi-chain deployment: Stablecoins will expand to more high-performance public chains and Layer 2 networks to meet diverse use-case demands. USDC is already issued on over 10 blockchains (including Ethereum, Solana, Tron, Algorand, Arbitrum). In 2025, with rapid advancements in new Ethereum Layer 2s and cross-chain protocols, Circle launched the Cross-Chain Transfer Protocol (CCTP) to facilitate USDC movement across chains. Looking ahead, Circle may issue stablecoins in more currencies (e.g., Asian-Pacific currencies) or support integration of central bank-issued CBDCs into its network, further solidifying its role as a global digital currency circulation hub.

In conclusion, the stablecoin industry is transitioning from wild growth to a new phase of regulated competition. Leveraging its leading market share and compliance edge, Circle is well-positioned in this evolution. However, the industry is moving rapidly, requiring continuous innovation and disciplined operations to sustain growth amid concurrent opportunities and challenges.

5. Operations & Financial Performance

5.1 Historical Performance Review

User & Usage Growth

Since its 2018 launch, USDC has maintained steady growth, experiencing surges in supply during the 2020 DeFi wave and 2021 bull run. At the end of 2020, USDC circulation was about $4 billion, rising to over $42 billion by the end of 2021. Despite entering a bear market in 2022, USDC circulation continued to grow to nearly $50 billion.

However, in March 2023, following the bankruptcies of crypto-friendly banks Silvergate and Signature, USDC faced a liquidity crisis, leading to a sharp spike in redemptions and a brief de-peg. Although Circle managed redemptions promptly and fully, the event caused USDC circulation to drop rapidly from 43 billion to 30 billion within a month.

From 2024 to 2025, driven by favorable regulatory developments and accelerating institutional adoption, USDC circulation gradually recovered. In March 2025, it reached a record high of $600 billion. Subsequently, the passage of the Stablecoin Bill (GENIUS ACT) propelled USDC circulation to new highs, exceeding $720 billion as of now.

In terms of users, cumulative on-chain addresses surpassed 8.5 million in 2022, with monthly active addresses exceeding 1.1 million. By 2025, daily active addresses averaged about 280,000, with annual transaction counts growing 118%. On-chain transaction volume has also expanded significantly: as of mid-2025, USDC’s 12-month on-chain transaction volume reached approximately $17.5 trillion, primarily from large exchange transfers and DeFi protocols. These figures confirm USDC as one of the most widely used stablecoins in the blockchain ecosystem, with solid user and ecological foundations.

Balance Sheet & Cash Flow

Circle’s balance sheet structure is relatively simple. Its largest asset category corresponds to USDC reserve investments, matched by equivalent USDC liabilities, and excluded from shareholder equity.

Excluding reserve assets, the company’s own assets primarily consist of raised capital and accumulated retained earnings. After raising $1.05 billion in its 2025 IPO, according to Q2 reports, the company now holds over $1.1 billion in cash. Additionally, on August 15, Circle raised another $455 million by issuing 3.5 million new shares at $130 per share. The company currently has ample cash reserves. Circle has long maintained no interest-bearing debt, as its business model requires almost no leverage financing (reserve assets belong to users and are not counted as company borrowings).

Operating cash flow is very healthy, primarily driven by interest income due to the nature of USDC operations. In 2024, operating cash inflow exceeded $1 billion, far surpassing capital expenditures and dividends (Circle has not paid dividends, retaining all profits). Thus, the company’s financial structure is sound, with sufficient internal funds to weather market volatility or support new business investments.

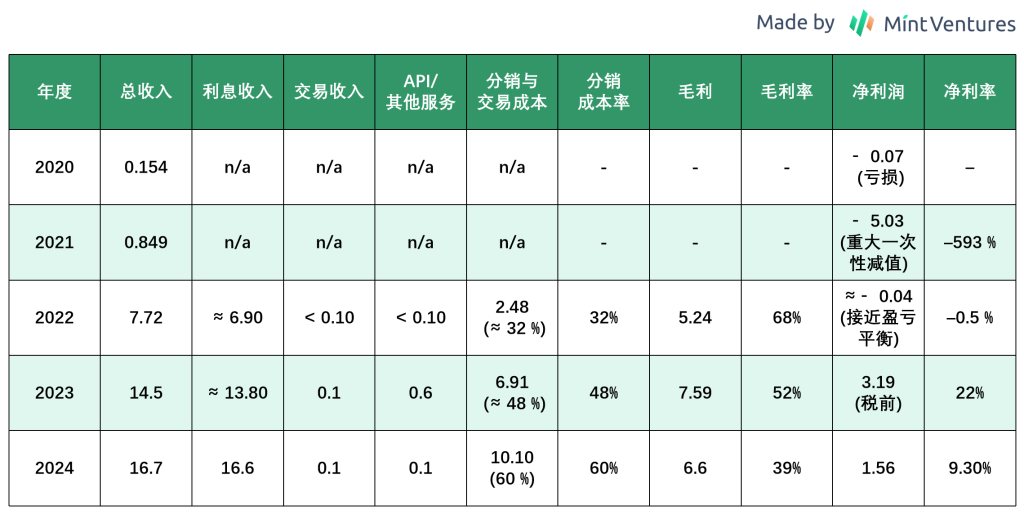

Revenue & Profit Trends

Circle’s revenue consists of interest income and non-interest income, with interest income (i.e., returns on USDC reserves) dominating.

Circle’s business model essentially earns the spread between “user deposit cost” and “reserve investment returns,” similar to a bank, making interest rate fluctuations highly impactful on revenue.

During the Fed’s zero-interest-rate policy in 2020, Circle’s total revenue was only $15.4 million, mostly from incidental fees. Starting in late 2021, as USDC supply expanded and rates rose, reserve interest became the core revenue source, lifting annual revenue to $84.9 million. In 2022, with rapidly rising rates (ending at 4.5% federal funds rate) and USDC average circulation doubling, annual revenue surged to $772 million.

In 2023, with the Fed hiking rates above 5% and maintaining them, Circle’s annual revenue doubled again, reaching about $1.43 billion. Full-year 2024 revenue was $1.676 billion, up 15.6% year-on-year, with growth slowing. In Q1 2025, the company achieved $579 million in revenue, a record high. Annualizing this pace suggests 2025 full-year revenue could exceed $2.3 billion, demonstrating strong profitability in a high-rate environment.

Non-interest income (including API fees, transaction fees) remains minimal, less than 1% of total revenue. This is because Circle intentionally keeps USDC issuance and redemption free to encourage ecosystem usage, not charging minting fees. While sacrificing some direct revenue, this strategy has powerfully driven rapid expansion of the stablecoin ecosystem. Long-term, as payment and API businesses grow, non-interest income share may increase, but it remains low in the near term.

The table below summarizes Circle’s key financial metrics from 2020 to 2024 (all in $ billions).

We now analyze the key drivers of Circle’s financial metrics:

5.2 Key Drivers

Key drivers of Circle’s financial metrics include USDC supply, short-term U.S. Treasury yields, and the proportion of distribution and transaction costs.

5.2.1 USDC Supply

USDC supply directly determines the size of Circle’s reserve holdings, thereby influencing the asset base generating interest income. Circle’s revenue shows a strong positive correlation with USDC circulation. Changes in USDC supply depend on two main factors:

(1) Overall stablecoin market conditions:

The stablecoin market is booming, so as the second-largest stablecoin, USDC naturally benefits. Currently, the main driver remains crypto bull/bear cycles: during bull markets, active trading and DeFi activity increase stablecoin demand, expanding USDC supply; bear markets have the opposite effect.

(2) USDC’s own competitiveness:

If USDC gains a distinct advantage over other

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News