Polymarket may launch token, filing reveals clues

TechFlow Selected TechFlow Selected

Polymarket may launch token, filing reveals clues

Prediction market unicorn will finally enter the token issuance process as users expect.

Author: jk, Odaily Planet Daily

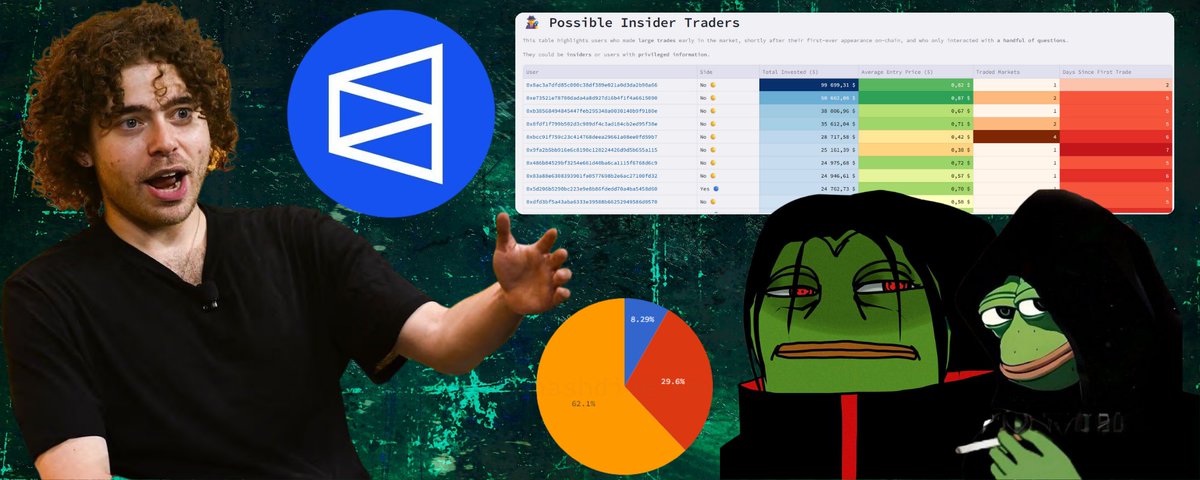

Recent media reports suggest that documents submitted by prediction market platform Polymarket to the U.S. Securities and Exchange Commission (SEC) hint at a potential token issuance. Reviewing the SEC's public database confirms there is indeed basis for this speculation.

The SEC’s EDGAR public database verifies that Blockratize Inc., the operating entity behind Polymarket, did file a Form D financing disclosure around this time. Although the timing differs slightly—the actual filing date was August 1—the media's inference is not unfounded. Moreover, the document contains clauses commonly interpreted in the crypto industry as signals of future token issuance.

For this billion-dollar-valued prediction market giant, which has transitioned from regulatory gray zones to full compliance, rumors of launching a token are hardly surprising. They may signal Polymarket preparing to enter a new chapter in its development.

The "Code" in the Form D

According to the SEC EDGAR database, Blockratize Inc., Polymarket’s operating entity, filed a Form D on August 1, 2025, disclosing details of its latest funding round. Of particular interest is the mention of "other warrants" or "other rights to acquire another security."

In the cryptocurrency industry, such language is often seen as an indicator of future token issuance. Due to the unclear legal status of tokens in the U.S., companies typically cannot explicitly reference token plans in SEC filings. Instead, they use terms like "warrants" to reserve rights for investors to receive tokens in the future—a common practice in traditional equity fundraising within the crypto sector.

The filing indicates a total fundraising target of $257.5 million, with $135.4 million already sold and approximately $122 million remaining, involving 23 investors.

From Exile to Return: How Polymarket Secured Its Place as the Leading Regulated Prediction Market

From Regulatory Vacuum to Crackdown

To understand Polymarket’s current position, one must revisit its turbulent history. Founded in 2020 by Shayne Coplan, it began as a blockchain-based decentralized prediction market. Users could wager in stablecoin USDC on real-world events ranging from political elections to sports outcomes.

The platform’s technical architecture was clever. Built on Ethereum smart contracts, it later migrated to the Polygon network for scalability. Users needed only connect a Web3 wallet to trade—no identity verification required—making the entire process fully decentralized. This design allowed Polymarket to initially sidestep traditional financial regulations, as it involved no fiat transactions or centralized custody of funds.

In October 2020, Polymarket raised a $4 million seed round led by Polychain Capital. As its influence grew, it completed a $25 million Series A led by General Catalyst, followed by a $45 million Series B in 2024 led by Peter Thiel’s Founders Fund, with Vitalik Buterin also participating. By mid-2025, Polymarket had reached a valuation of approximately $1 billion.

In its early days, although Polymarket’s terms of service prohibited access by U.S. residents, enforcement was lax. Many of its most popular markets centered on U.S. topics such as presidential elections and Federal Reserve policy, and a significant portion of users were believed to be from the United States. The platform launched over 900 markets within 18 months, demonstrating strong growth momentum.

CFTC’s Heavy Blow

In mid-2021, Polymarket’s high-profile activity and U.S.-focused markets began drawing regulatory attention. On January 3, 2022, the Commodity Futures Trading Commission (CFTC) initiated an enforcement action against Polymarket, accusing it of offering unregistered binary options contracts to U.S. customers without proper authorization.

The CFTC argued that each of Polymarket’s “yes/no” event markets constituted binary option swaps, which under the Commodity Exchange Act can only be offered on registered exchanges or swap execution facilities. Polymarket held neither a Designated Contract Market license nor Swap Execution Facility registration.

The parties eventually settled, with Polymarket agreeing to pay a $1.4 million civil penalty and committing to block U.S. users from accessing the platform and cease offering non-compliant event contracts. Vincent McGonagle, Acting Director of the CFTC’s Enforcement Division, stated: “Regardless of the technology used, including so-called decentralized finance, all derivatives markets must operate within the bounds of the law.”

Survival Abroad and Ongoing Pressure

Following the settlement, Polymarket implemented geolocation blocking—prohibiting access by U.S. users. However, it continued serving users globally and achieved significant growth in 2023 and 2024. To improve user experience, Polymarket introduced instant fiat-to-crypto conversion via MoonPay and Stripe.

During the 2024 U.S. presidential election, trading volume surged dramatically. Although U.S. participation was officially banned, reports indicated many Americans still accessed the site via tools like VPNs—an open secret within the community. To strengthen compliance, Polymarket began implementing identity verification for large traders in late 2024 to prevent circumvention of geographic restrictions.

Nonetheless, regulatory pressure persisted. In May 2024, the CFTC proposed new rules that would outright ban event contracts tied to U.S. election results, reflecting ongoing concerns about political prediction markets. More severely, shortly after the November 2024 U.S. election, the FBI raided CEO Shayne Coplan’s home, seizing electronic devices as part of a joint CFTC and Department of Justice investigation into potential violations of the 2022 settlement agreement.

2025: A Dramatic Turnaround

2025 became a turning point for Polymarket. After months of behind-the-scenes negotiations, both the CFTC and Department of Justice dropped their investigations in mid-July without further charges. This outcome coincided with a change in U.S. administration and shifts in regulatory leadership.

Shortly afterward, Polymarket announced a major acquisition: the purchase of QCX LLC and its affiliated clearinghouse, QC Clearing LLC, for $112 million. QCX was a relatively obscure entity that had applied for Designated Contract Market status back in 2022 and received CFTC approval in July 2025. By acquiring QCX—now renamed “Polymarket US”—Polymarket effectively secured full CFTC exchange and clearing licenses.

“Now, through the acquisition of QCEX, we’re laying the foundation to bring Polymarket back home—to re-enter the U.S. market as a fully regulated and compliant platform where Americans can trade their views,” Coplan announced in the acquisition press release.

This move paved the way for Polymarket to relaunch in the U.S. under CFTC oversight. In early September, the CFTC granted no-action relief to Polymarket’s newly acquired exchange division, exempting certain swap reporting and recordkeeping requirements normally applicable to event contracts. This no-action letter effectively gave Polymarket the green light to legally offer prediction markets in the U.S., provided it operates within defined parameters.

Combined with the Designated Contract Market and Designated Clearing Organization licenses obtained through QCX, Polymarket can now list event-based binary options on a regulated venue. The platform is expected to implement full KYC/AML compliance for U.S. users and adhere to CFTC rules on product oversight and reporting.

Notably, U.S. regulators appear more open to such markets in 2025 than in previous years. The CFTC’s acting chair even commented that the agency had been stuck in a “quagmire of legal uncertainty” when pursuing prediction market cases, suggesting a more lenient stance.

The Real Basis Behind Token Speculation

Against this backdrop, rumors of Polymarket issuing a token now have solid grounding. The reference to "other warrants" in the Form D, combined with the company’s current stage of development and improved regulatory environment, makes a token launch highly plausible.

Of course, this remains speculative, based on industry norms and indirect evidence rather than official confirmation. Yet given that Polymarket has evolved from a DeFi project operating on the edge of regulation into a fully regulated U.S. derivatives exchange, launching a native token aligns with its on-chain heritage and could further solidify its leadership in the prediction market space.

From wild growth in a regulatory vacuum in 2020, to a harsh crackdown by the CFTC in 2022, and finally achieving compliance through acquisition in 2025, Polymarket’s journey mirrors the broader narrative of compliance evolution in the cryptocurrency industry. Today, with a clearer regulatory landscape and a maturing internal compliance framework, this prediction market leader may be poised to begin a new chapter in its development.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News