A $USDH Sparked the Stablecoin Competition

TechFlow Selected TechFlow Selected

A $USDH Sparked the Stablecoin Competition

Hyperliquid, knocking on the gates of the established stablecoin fortress.

Author: Yanz, TechFlow

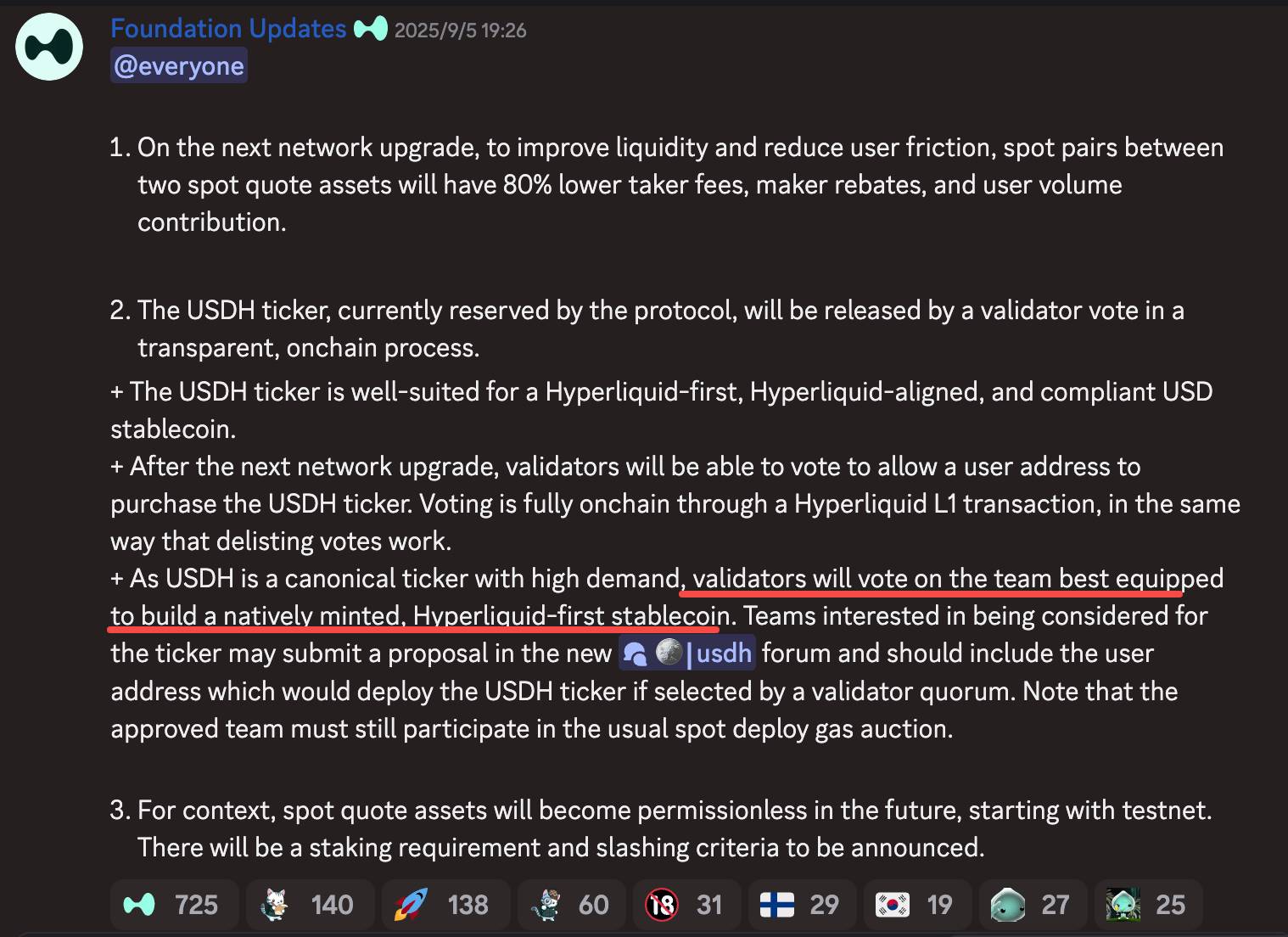

On September 5, 2025, Hyperliquid announced plans to launch its native stablecoin USDH in its next network upgrade, driven by governance.

The protocol describes USDH as a "Hyperliquid-preferred and compliant" dollar-pegged asset, aiming to replace external stablecoins like USDC and build a self-sustaining DeFi ecosystem.

Unlike traditional stablecoins (e.g., USDT, USDC) issued by centralized entities that exclusively capture profits, Hyperliquid has adopted an innovative decentralized voting mechanism:

Opening the issuance rights of $USDH to ecosystem teams rather than launching it independently, integrating a community-driven model into stablecoin issuance.

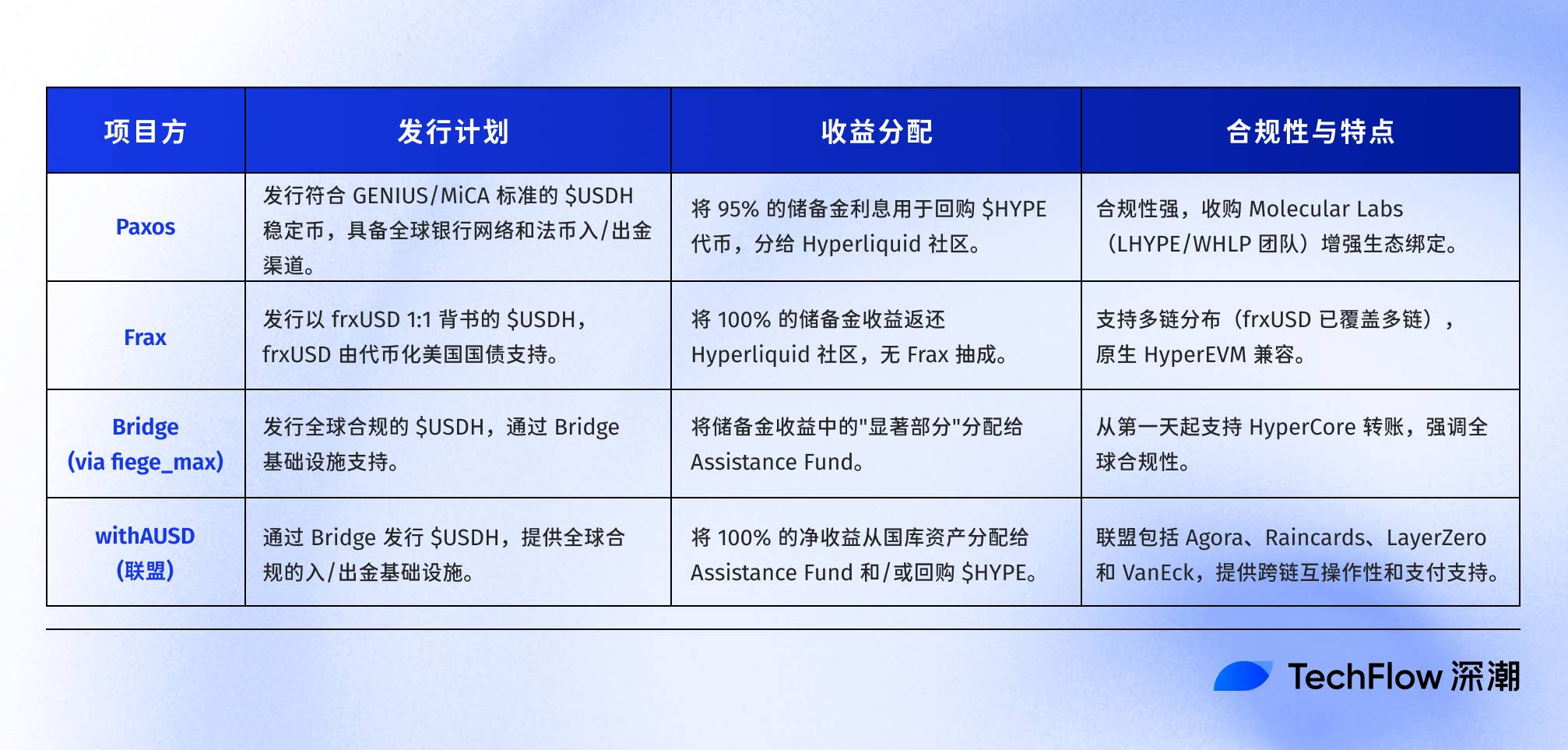

This move immediately triggered intense competition, with Frax and Paxos submitting proposals, and Ethena Labs also seen as a potential contender. The voting, expected to conclude by September 10, may not only reshape the Hyperliquid ecosystem but also signal upheaval in the broader stablecoin landscape.

Issuance Bidding

The fierce competition for $USDH issuance stems from its strategic value and potential economic returns within the Hyperliquid ecosystem.

Hyperliquid currently holds approximately $5.72 billion in stablecoins, 95% of which is USDC, highlighting its vulnerability to reliance on external stablecoins—especially the risk of USDC being frozen.

Since September 5, 2025, the issuance rights for $USDH have been opened via a decentralized voting mechanism—an attempt by Hyperliquid to create a self-sufficient DeFi ecosystem.

Based on a 4% to 5% reserve yield, the projected annual revenue from successfully replacing USDC is highly attractive, reaching $150–220 million. This income, returned to the community through $HYPE buybacks or dividends, could significantly boost $HYPE's value and ecosystem appeal, drawing major players such as Paxos and Frax into competitive bidding.

In the $USDH issuance race, the winning team will control Hyperliquid’s $570 million liquidity pool, securing long-term revenue and industry influence.

Competition is now intensifying, with the proposal deadline of September 10 approaching, prompting bidders to increase their commitments and propose various issuance plans and revenue-sharing models.

(See table details at:Hyperliquid Stablecoin Bidding War Begins: Who Will Issue USDH?)

Additionally, Ethena Labs, Circle, and PayPal are highly anticipated by the community, with potential proposals that could emerge as dark horses.

However, given the diversity of proposals, skepticism remains within the community. This bidding war is not merely a technical contest, but a battle for the future direction of DeFi.

Stablecoin Wars

The competition extends beyond just $USDH issuance—broader changes are underway.

Omar Kanji, partner at Dragonfly, stated that this move could significantly impact Circle’s USDC. USDC is currently the primary settlement currency for derivatives trading on Hyperliquid, with $5.5 billion in USDC deposits on the platform.

Assuming a 4% yield, migrating these funds would generate an additional $220 million in annualized income for $HYPE holders while posing an equivalent revenue loss risk to Circle, potentially reducing USDC circulation by 7%.

For both Circle and Tether, $USDH undoubtedly challenges their dominant positions, pushing them to accelerate innovation (such as Circle’s CCTP V2) in response to shifting stablecoin dynamics. The stablecoin market may evolve from a duopoly (USDT, USDC) toward multipolarity.

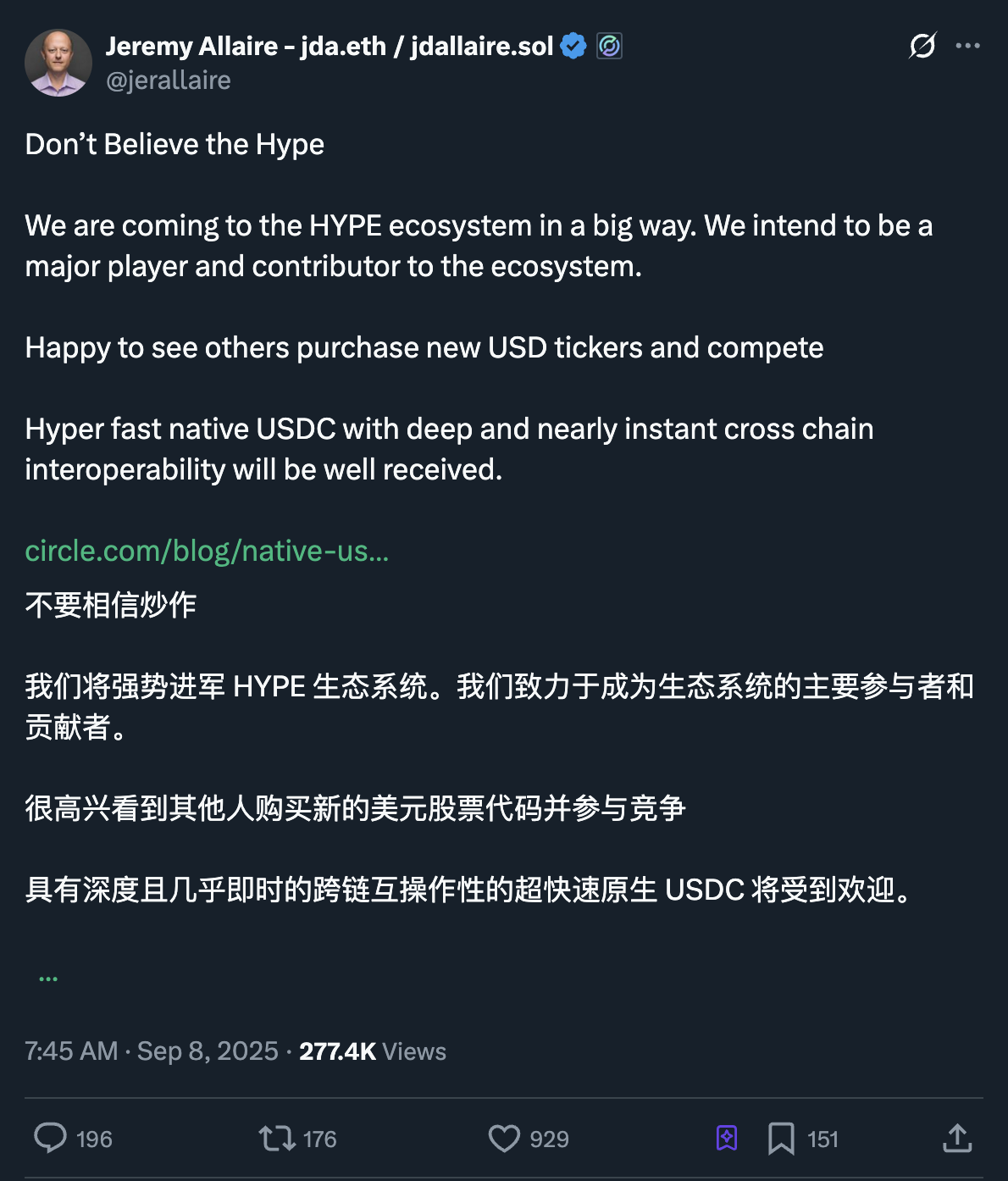

Notably, Circle’s CEO has already reacted, announcing on September 8 a strong push into the HYPE ecosystem, proposing deployment of native USDC on HyperEVM and CCTP V2 as key strategies.

(Original postsource)

Yet this claim lacks credibility. That tweet was posted on July 31, when Circle first announced its imminent entry, but there has been no clear progress since. Many users have expressed doubt, with one top-voted comment stating: "You should do better, move faster."

Overall, recent data shows the global stablecoin market has surpassed $286 billion, with $USDT (59%) and $USDC (25.2%) collectively holding nearly 85% of the market share.

As of September 8, Tether’s USDT leads with a circulating market cap of $168.8 billion, attracting traders and retail users through wide availability on centralized exchanges (CEX) and low transaction costs. Circle’s USDC follows with a $72.5 billion market cap, favored by institutional users.

Beyond disrupting the current duopoly in the stablecoin sector, Hyperliquid’s initiative is setting a precedent for other DEXs, motivating platforms like Arbitrum and Optimism to explore similar paths, accelerating the shift toward a multipolar stablecoin landscape.

This challenge to the established order recalls a classic metaphor from financial history—"the barbarians at the gate."

In the 1989 book *Barbarians at the Gate: The Fall of RJR Nabisco*, "the barbarians" symbolize emerging forces challenging traditional power structures.

Today, this metaphor aptly applies to the stablecoin industry, where Hyperliquid, as the "barbarian," is knocking at the gates of incumbent powers with its innovative $USDH.

$USDH has sparked short-term price volatility, driving a 12.27% increase in $HYPE over seven days. While setting new standards and forcing legacy players to adapt, concerns about fairness have emerged due to the Hyperliquid Foundation and CEO Jeff currently holding the majority of voting power, raising debates over centralization.

Amid this wave of transformation, regardless of who ultimately secures $USDH, community benefit remains the central focus.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News