Ethereum revenue plunge sparks heated debate in community, is the alarm bell for recession ringing?

TechFlow Selected TechFlow Selected

Ethereum revenue plunge sparks heated debate in community, is the alarm bell for recession ringing?

Ethereum carries a more complex and grander vision.

Author: David, TechFlow

Recently, the hottest debate in the English-speaking crypto Twitter community has been about Ethereum's revenue.

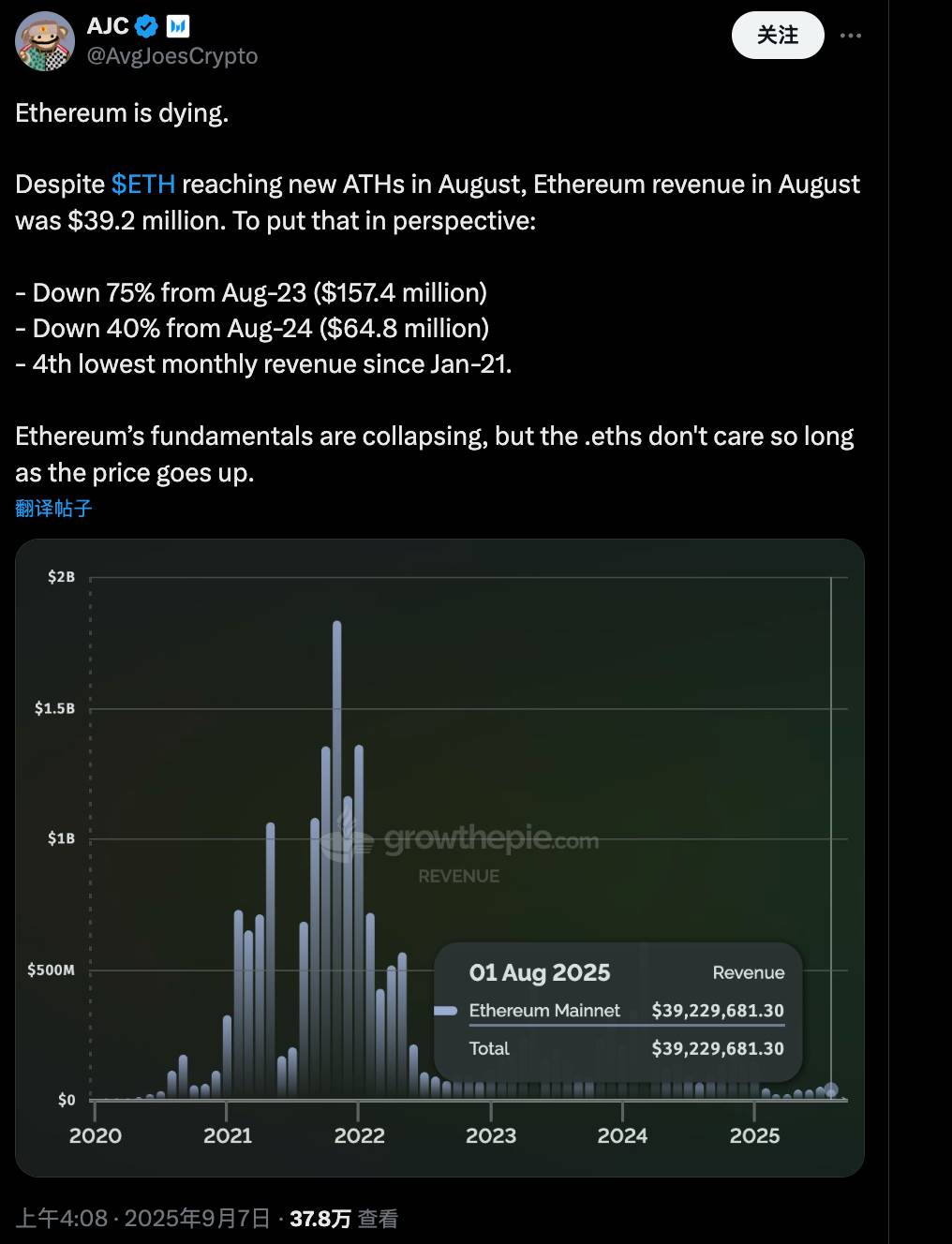

On September 7, AJC, Messari's corporate research manager, posted a thread claiming that the Ethereum network is entering a state of "death." He pointed out that despite ETH reaching a new high in August, Ethereum's monthly revenue for that month was only $39.2 million.

This figure represents a 75% drop compared to $157.4 million in August 2023 and a 40% decline from $64.8 million in August 2024. It also marks the fourth-lowest monthly revenue level in Ethereum’s history since January 2021.

AJC lamented that Ethereum's fundamentals are collapsing, yet everyone seems focused solely on ETH price appreciation, ignoring whether the network itself remains healthy. Two days after the post, it had already garnered nearly 380,000 views and close to 300 replies.

Why is discussion around Ethereum's fundamentals gaining so much attention now?

The timing is indeed subtle. ETH is currently at the peak of a bull market, with prices hitting new highs, but underlying network activity and Ethereum's own positioning are quietly shifting.

After the 2024 Dencun upgrade, L2s like Base and Arbitrum gained widespread adoption, drastically reducing mainnet transaction fees and shifting revenue to these scaling layers. With the rise of memecoin speculation this year, SBET and BMNR have rushed to accumulate ETH, while mainstream finance and Wall Street have started treating ETH as a leveraged financial instrument.

Now, Ethereum itself appears more like a selfless, altruistic banner—waving in response to market trends and guiding others forward, yet full of holes?

Revenue decline is an undeniable fact, but whether this signals deterioration within the Ethereum network itself remains a matter of divergent opinions in the community.

Proponents: Revenue Is Lifeblood, the Alarm Has Sounded

The core argument of AJC and other supporters is actually simple: Revenue is the correct metric for evaluating a Layer 1 blockchain.

Specifically, a blockchain’s revenue primarily comes from transaction fees and block space usage, which reflect real user demand for the chain.

As the largest platform in the crypto world, Ethereum's key competitive advantage lies in “block space demand”: its ability to efficiently process smart contracts and decentralized applications, giving it an edge over Bitcoin’s simple value storage narrative—an important differentiator.

But now, with revenue trending toward zero, demand for the mainnet is shrinking. Even though L2s are flourishing, AJC believes the entire ecosystem lacks sufficient new users to sustain their usage levels.

You might ask, why link revenue directly to Ethereum's fundamentals?

The original poster and supporters argue that revenue is collected and burned in ETH, directly fueling ETH's deflationary mechanism. If revenue collapses, fewer tokens are burned, increasing supply pressure and undermining long-term value.

More importantly, during the last bull cycle, the Ethereum community proudly highlighted high on-chain revenue as proof of "block space premium," demonstrating strong network demand. Now the situation has reversed—not by coincidence, but due to the actual collapse of demand drivers.

While somewhat pessimistic, some neutral voices suggest that the network *is* the asset. Prices can be temporarily inflated through speculation, but without solid fundamentals, reality will eventually catch up—a pattern repeatedly proven across other crypto infrastructure projects.

From an observer’s perspective, AJC’s revenue logic does make sense and at least exposes hidden risks beneath the ETH bull market bubble. However, if one ignores other ecosystem metrics such as on-chain activity, this view may appear biased.

Opposition Fires Back: Is Declining Revenue Actually Good?

Once AJC’s argument emerged, the comment section instantly turned into a battlefield, with opponents fiercely rejecting the idea of decline.

Unlike typical Ethereum defenders, these critics approach Ethereum through a broader narrative, centering their rebuttal on this point:

Treating Ethereum as a tech company aiming to maximize revenue is a fundamental category error. Today, Ethereum resembles more of a cryptocurrency, a fixed-supply commodity, or even an emerging economy.

From this perspective, declining revenue isn’t a problem—it’s a positive signal of design success, as it promotes wider user adoption and ecosystem growth.

Take Bankless co-founder David Hoffman, who compares Ethereum to early Singapore or Shenzhen—an oasis favoring business freedom. In such an environment, the focus shouldn't be on how much tax revenue the city collects, but rather on whether it drives infrastructure and economic development.

Vivek Raman, former Wall Street trader and founder of Etherealize, argues that Bitcoin generates almost no revenue either, yet no one calls it a failure—so why judge Ethereum solely by revenue?

Their logic traces back to Ethereum founder Vitalik Buterin’s original vision: Ethereum is a fixed-supply commodity valued through supply-demand dynamics, not quarterly earnings reports. High revenue could even create anti-network effects, deterring users with excessive gas fees.

In fact, these opposing views originate from Vitalik’s early vision.

In the whitepaper, Vitalik described ETH as the network’s “cryptographic fuel,” often likened by the community to digital oil—its value driven by supply-demand dynamics rather than corporate-style quarterly financials.

High fees (the source of income) have been proven to hinder user adoption, creating a negative feedback loop that the community sees as an anti-network effect.

Therefore, for them, Ethereum mainnet revenue decline is, in some ways, a good thing.

After the 2024 Dencun upgrade, L2s absorbed mainnet load, causing revenue contraction. But lower fees mean reduced barriers, attracting retail users into DeFi, NFTs, and even institutional-grade applications.

In the comments, Tom Dunleavy, Head of Risk at Varys Capital, bluntly stated that L1 revenue is a bottleneck to ecosystem growth;

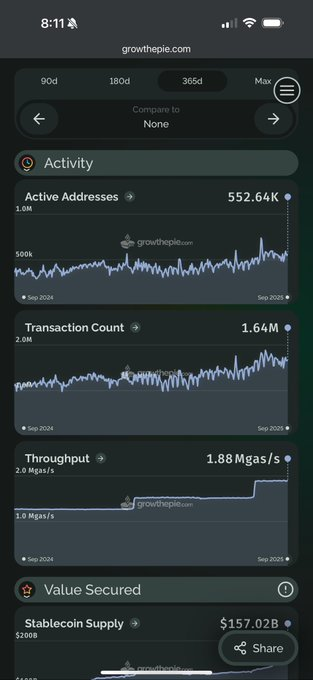

Ryan Berckmans, an Ethereum market cycle trader, countered with data: when 60% of stablecoin market cap resides on Ethereum, when it's being acknowledged by the U.S. Treasury Secretary, and when all major on-chain activity indicators are improving—how can this be called decline?

Ethereum at Its Next Crossroads

Beyond the noise, this debate touches on a fundamental question: How should we value Ethereum?

Judging from the comments, most opponents believe Ethereum is transitioning from a busy execution layer to a stable global settlement layer. Applying tech stock logic—using revenue for valuation—is overly rigid.

Under the tech stock framework, revenue clearly matters most. If revenue collapse truly reflects weakening demand, then the risk of a short-term bull market burst is significant.

Yet the various counterarguments represent a multi-metric narrative, emphasizing Ethereum’s ecosystem health and long-term transformation, where revenue itself is less important. Valuation stems instead from broad recognition and the crypto ecosystem’s dependence on Ethereum.

The debate may end here, but Ethereum’s story is far from over.

Moving from a crypto tech platform to a global economy inevitably involves growing pains—revenue decline, L2s eating into market share, etc.

But this transition may be precisely the path Ethereum must take to mature.

Just as the internet evolved from paid dial-up in its early days to widespread free broadband, where individual user revenue for providers dropped—but the overall digital economy grew exponentially.

Today’s Ethereum stands at a similar inflection point: declining mainnet revenue may be exactly what creates space for broader ecosystem prosperity. The rise of L2s isn’t “stealing” value from Ethereum—it’s amplifying Ethereum’s strategic value as a settlement layer.

More importantly, the very existence of this debate underscores Ethereum’s unique status in the crypto world—no one debates Bitcoin’s “declining revenue,” because its role as digital gold is already widely accepted.

The reason Ethereum sparks such intense discussion is precisely because it carries a more complex and ambitious vision.

If Ethereum stays healthy, we all benefit. Who knows—could the next bull market shift begin right here?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News