78 million buyback + CCMs: How deep is Pump.fun's meme moat?

TechFlow Selected TechFlow Selected

78 million buyback + CCMs: How deep is Pump.fun's meme moat?

Although PUMP tokens won't be unlocked until July 2026, there is still significant growth potential in the future.

Author: Nico

Translation: Saoirse, Foresight News

You've probably noticed that Pump.fun has recently reclaimed its dominant market position. In my previous article, I focused on analyzing competitors and trading terminals; in this one, I'll dive into the bullish case for Pump.fun and explore the vast market opportunities emerging in CCMs (Creator Capital Markets) through native launchpad livestreaming.

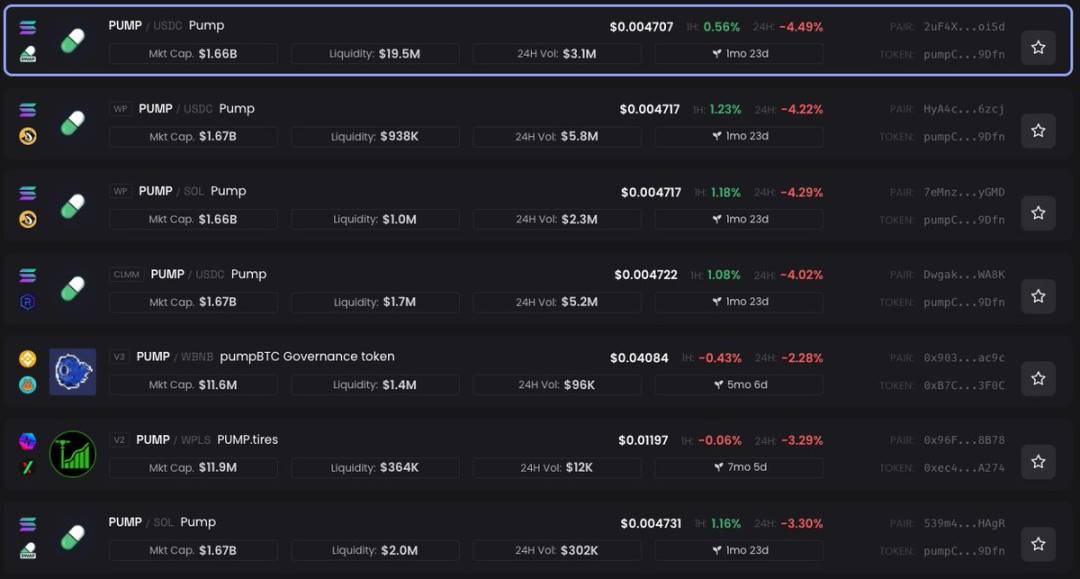

Today, PUMP's token price is firmly above its ICO raise level, and the platform has rolled out multiple updates with a bright outlook ahead. Let's now examine the details closely.

PUMP’s Revenue Flywheel

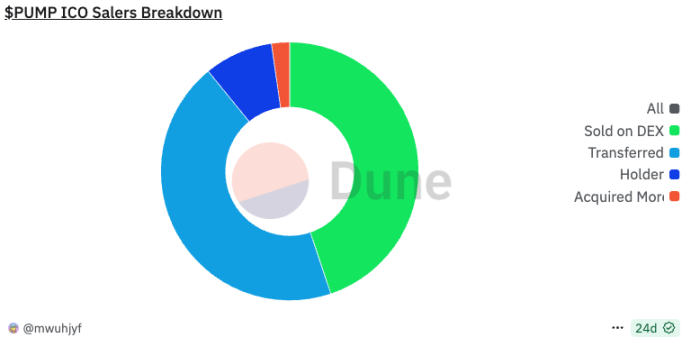

Since the ICO, over half of participants have already sold their tokens, while many others have transferred holdings to different wallets—likely to sell in batches via one or more KYC-verified wallets to various buyers.

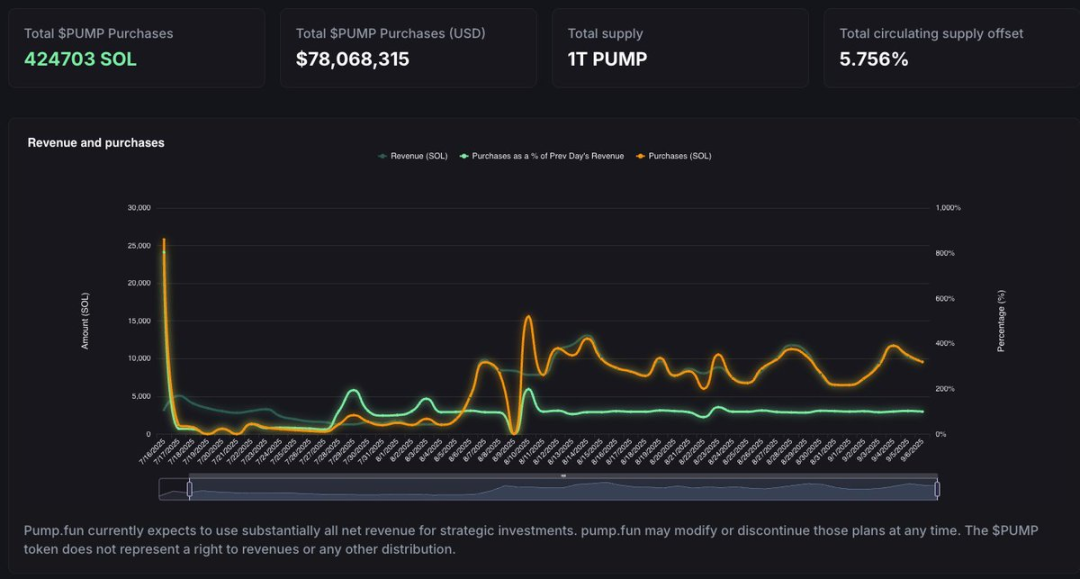

After the token launch, prices dipped temporarily, prompting Pump.fun to activate its "revenue buyback" mechanism, typically repurchasing 90%-95% or more of daily revenue. To date, total buybacks have exceeded $78 million. The official Pump.fun buyback dashboard shows daily buyback amounts and the "supply offset ratio" (currently offsetting 5.75% of circulating supply).

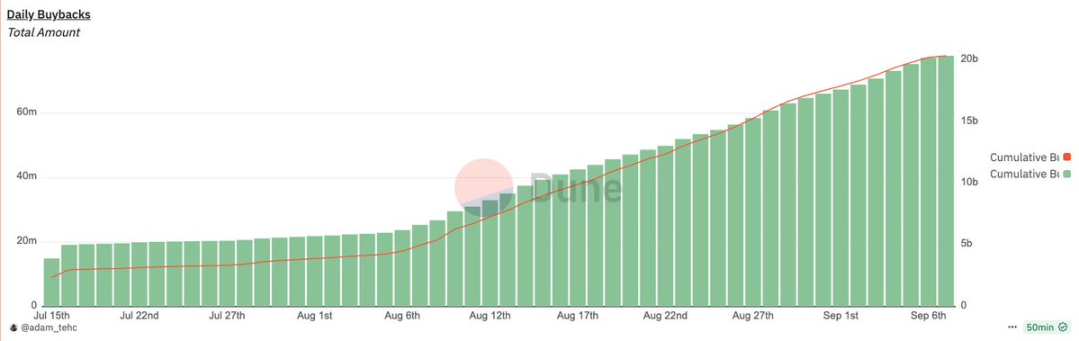

I previously suggested the Pump.fun team add a "cumulative buyback curve" to the dashboard to visually demonstrate the growth trend of buybacks. Until an official update arrives, you can refer to the unofficial dashboard created by @Adam_Tehc.

Data shows that Pump.fun conducts daily buybacks ranging from $1 million to $2.5 million—and the scale is growing rapidly. This creates a complete "revenue flywheel": Pump.fun uses revenue to buy back tokens → attracts more users, boosting trading volume and fees → generates higher revenue, enabling larger buybacks, thus keeping the flywheel spinning.

Currently, the main-chain liquidity pool for PUMP holds around $20–30 million, making the buyback力度 strong enough to counteract selling pressure from existing holders. Additionally, pairing the liquidity pool with USDC enhances resilience against SOL price volatility.

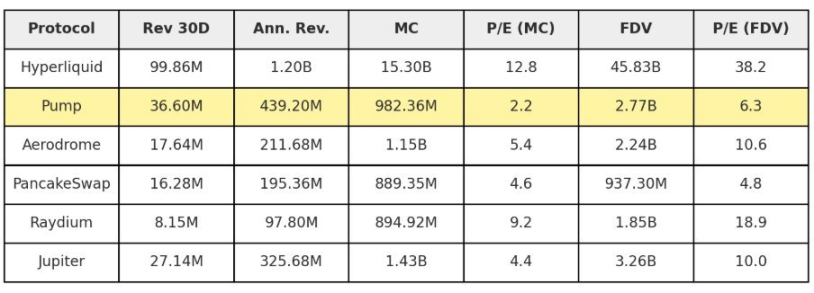

As shown in the P/E ratio comparison compiled by @jermywkh, Pump.fun appears severely undervalued compared to higher-market-cap competitors with lower revenues. If market conditions improve, PUMP could potentially catch up in valuation.

Competitive Landscape

The key difference between Pump.fun’s “flywheel effect” and recent competitors like Bonk and Heaven Dex lies in its established “native community” and “ecosystem culture” within the Solana meme coin space.

These rivals lack proven track records and sufficient profit reserves. In contrast, the Pump.fun team holds a significant first-mover advantage due to its built-out ecosystem and past achievements.

Now, with the full-featured Pump.fun mobile app launched, livestreaming introduced, and creator fees significantly increased, Pump.fun has further solidified its status as the go-to platform for meme coin issuance and trading—we’ll break down these moves in detail shortly.

In my view, one of Pump.fun’s strengths is that it doesn’t force developers, traders, or regular users into specific operational patterns, instead allowing the community to shape product direction and potential use cases organically. That said, there’s still room for improvement in providing better tools for developers looking to build on top of Pump.fun.

In terms of capital reserves, Pump.fun generated approximately $800 million in revenue pre-buybacks and raised $500 million during the PUMP ICO, leaving the team with roughly $1.3 billion in funding—a figure no competitor can match.

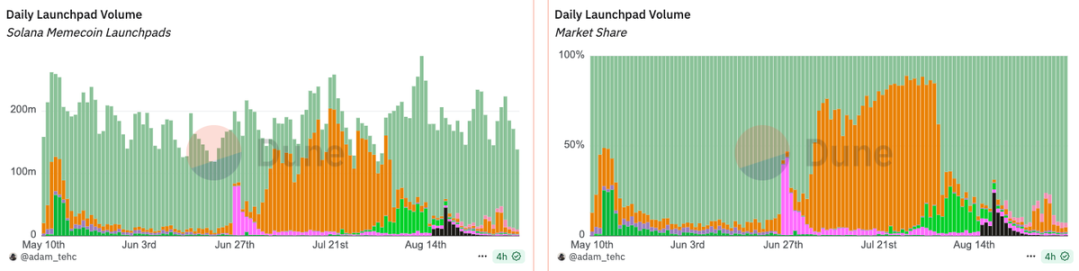

To summarize current market share: Pump.fun has regained over 80%-90% market dominance, Bonk’s lead continues to erode, Heaven Dex briefly rose but quickly faded, and Believe poses almost no competitive threat.

Key Project Breakdown

Ascend: A New Model to Multiply Creator Earnings 10x

The biggest challenge in meme coin launches is sustaining momentum after initial hype fades. Ascend aims to solve this by increasing creator fees tenfold, giving creators ongoing incentives and stable income they can reinvest into long-term token promotion.

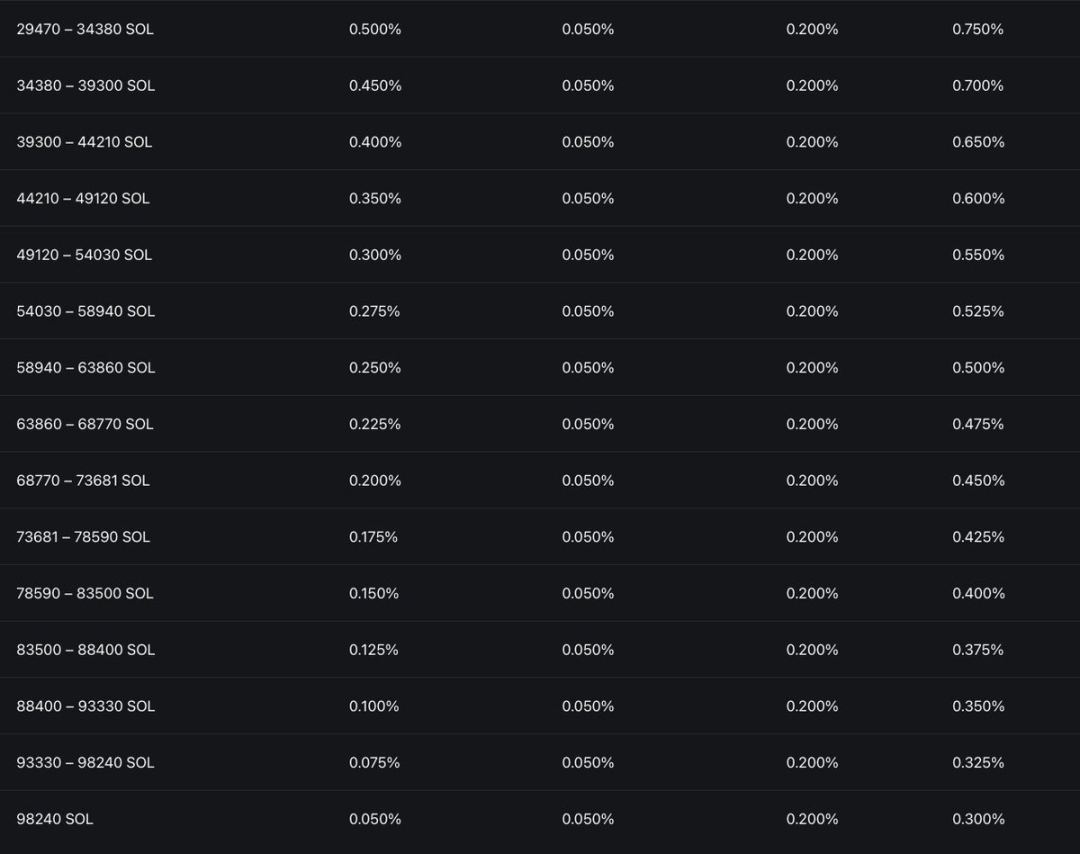

Launching a token on Pump.fun remains completely free. During the “pre-binding phase” (token market cap from $0 to $85,000, assuming SOL at ~$200), creators receive 0.3% of trading volume as fees.

Fee structure: Pump.fun charges 0.93% (nearly 1%) during pre-binding, drops to a fixed 0.05% after binding, plus an additional 0.2% LP swap fee.

Creator fees dynamically adjust as token market cap grows: between $10M–$11M, the range is 0.3%–0.9%; as market cap approaches $20M (SOL still ~$200), fees gradually decrease to 0.05%.

This mechanism brings notable changes: at low market caps (under $10M), fee distribution heavily favors creators, enabling many newly launched tokens to generate high returns. Previously, prolonged low market cap was seen as bearish; now, it may signal bullishness—as creators have stronger incentives to sustain their ecosystems.

Theoretically, once a token reaches higher market caps, large traders won’t be deterred by high fees (allowing larger trades). However, few high-market-cap tokens currently validate this. Notably, tokens launched before Ascend can now also benefit from higher creator fees—an important boost for existing ecosystems.

For reference, the chart below illustrates recent popular tokens’ creator fee changes before and after Ascend.

Glass-Full Foundation

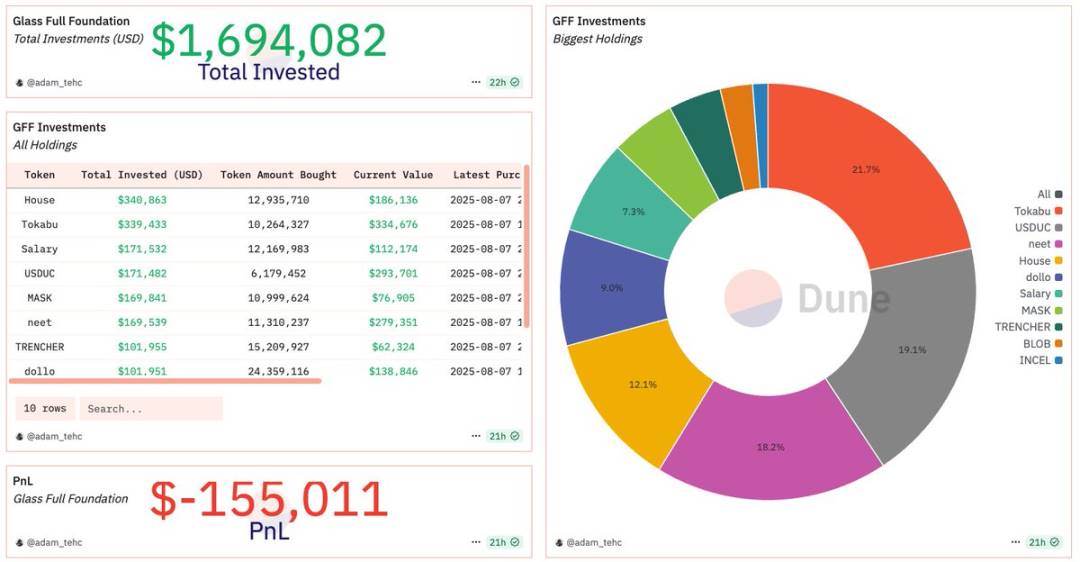

Earlier, the Pump.fun team launched the Glass-Full Foundation, aiming to use part of its revenue to buy back popular tokens on the platform and hold them on its balance sheet.

While well-intentioned, this move was essentially a minor ecosystem support measure—more of a short-term response to Bonk’s similar initiative at the time. The fact that no new buybacks have occurred in the past month supports this interpretation. Still, community sentiment toward the foundation remains positive.

To date, the foundation has bought back $1.6 million worth of popular Pump.fun tokens, with only a 10% overall loss. These tokens are unlikely to be sold, effectively amounting to indirect “burning” (reducing circulating supply).

Tokens repurchased include: TOKABU, USDUC, NEET, DOLLO, INCEL.

Livestreaming and CCMs (Creator Capital Markets)

Recently, Pump.fun released growth metrics for its livestreaming service. New livestream platforms often struggle to gain traction quickly, but Pump.fun’s numbers stand out—data clearly demonstrates its appeal.

Optimized creator fees not only strongly incentivize “event-based streaming,” but also attract non-crypto streamers to test this novel monetization model: on traditional platforms, streamers face fierce competition and must meet thresholds like minimum follower count or viewer numbers to monetize—without guaranteed high returns even after qualifying.

On Pump.fun, streamers can rise faster—they gain attention rapidly through “token-related interactions,” achieve viral traffic spikes during trending events, and earn substantial returns via creator fees and initial token allocations (if choosing to sell).

I believe we’re only at the beginning of micro-influencers entering Pump.fun livestreaming: launching tokens is entirely free, and starting a stream is just a tap away via the mobile app. This low-barrier model will continue driving demand for this use case.

I personally plan to start livestreaming on Pump.fun soon. Based on our research, we hope Pump.fun can offer streamers more support—such as better developer tools (to build platform extensions), detailed analytics, and enhanced livestream features.

Mobile-First Strategy: Targeting Top Traders and Developers

Pump.fun has consistently emphasized its mobile-first approach, integrating rich social features into its native app: KOL / top trader leaderboards, token-specific chat rooms (app-only), real-time livestream chats, and even private messaging between users.

As user penetration grows, these social features will likely keep improving, reinforcing Pump.fun’s position as the premier platform for meme coin trading and issuance.

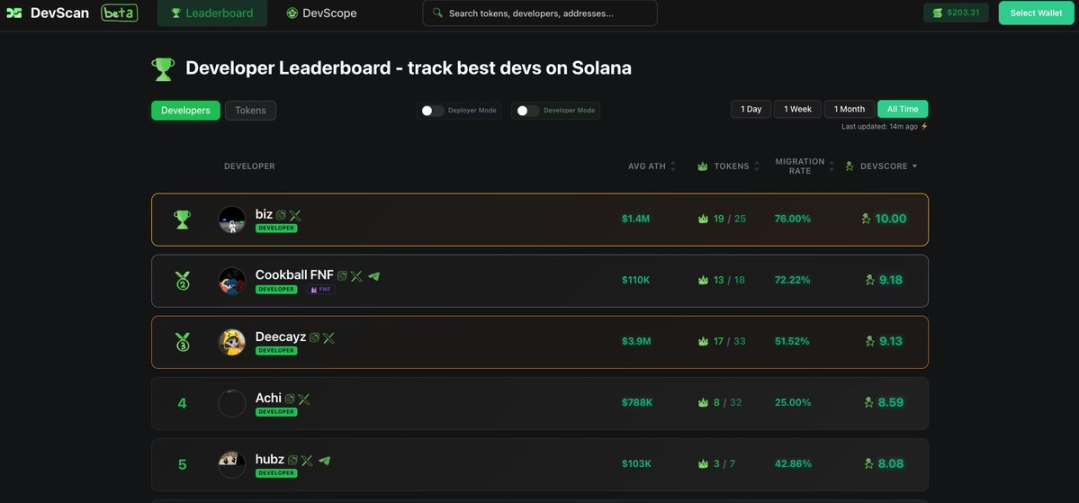

It’s important to note that developers are central to the meme coin ecosystem—no developers, no new tokens. Going forward, Pump.fun may increase support for developers—for instance, spotlighting high-quality creators or offering dedicated showcase platforms akin to “KOLSCAN.”

Currently, sites like https://devscan.wtf and https://www.devscan.tech have made early attempts, displaying data on “top frequent issuers” and related metrics.

Summary and Outlook

Pump.fun’s future looks bright: community engagement is strong, and its tokenomics are logically sound. Through protocol designs aligned with ecosystem needs and transparent communication, Pump.fun has clearly regained community trust.

Although PUMP token unlocks won’t begin until July 2026, there remains substantial room for growth ahead.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News