Jack Ma chasing Ethereum high? Alibaba founder Jack Ma indirectly invests in Ethereum: asset allocation embraces "digital gold" strategy

TechFlow Selected TechFlow Selected

Jack Ma chasing Ethereum high? Alibaba founder Jack Ma indirectly invests in Ethereum: asset allocation embraces "digital gold" strategy

Ethereum is transitioning from mechanism exploration to becoming a norm in wealth allocation.

On September 2, according to BlockBeats, Alibaba founder Jack Ma indirectly holds around 11.15% of Yunfeng Financial, which has accumulated the purchase of 10,000 ETH in the public market, with a total investment cost of approximately $44 million. The purchased ETH is classified as a "investment asset" of the group.

This isn't the first time a Chinese enterprise has publicly bought cryptocurrency. As early as 2021, Hong Kong-listed tech firm Meitu (Meitu Company) began its initial digital asset allocation through subsidiaries, holding 15,000 ETH (worth about $22.1 million) and 379 BTC (nearly $17.9 million) in its portfolio. It exited between late 2024 and early 2025, successfully doubling its net profit. Now, a heavyweight figure from China's tech industry has once again indirectly added crypto assets into corporate reserves, reflecting a new stance by mainstream capital toward digital currency asset allocation.

Ethereum market performance steadily improving: breakout highs may continue

Meanwhile, Ethereum has delivered strong market performance recently, gradually gaining momentum. According to CoinMarketCap data, by early September 2025, Ethereum had surged 25% from its mid-year low to high, peaking at approximately $4,956. Current trading prices have pulled back to around $4,430, with a market cap reaching $533.2 billion. Multiple institutions expect ETH to continue rising this year, driven by ETF inflows, increased institutional holdings, and favorable regulatory developments.

Moreover, although Bitcoin’s short-term trend appears weak, large capital flows are shifting from BTC to ETH. Ethereum is now entering its own “institutional bull run.” What most people anticipate is that Ethereum’s bull market will eventually trigger a broad rally across altcoins.

Holding Ethereum, earning on HTX:全民狂欢赚币, up to 6% annual ETH subsidies

As a leading global one-stop cryptocurrency trading platform, HTX has consistently worked to build a diversified yield product ecosystem. Its Earning (Zhuangbi) section offers users products combining “flexible deposits and withdrawals” with returns significantly higher than traditional finance, covering stablecoins, mainstream crypto simple-earning products, and advanced financial structured products. HTX frequently runs yield-boosting campaigns for Ethereum and other assets, delivering even higher annualized returns. HTX Earning has become the preferred platform for retail investors seeking crypto savings and value-added services.

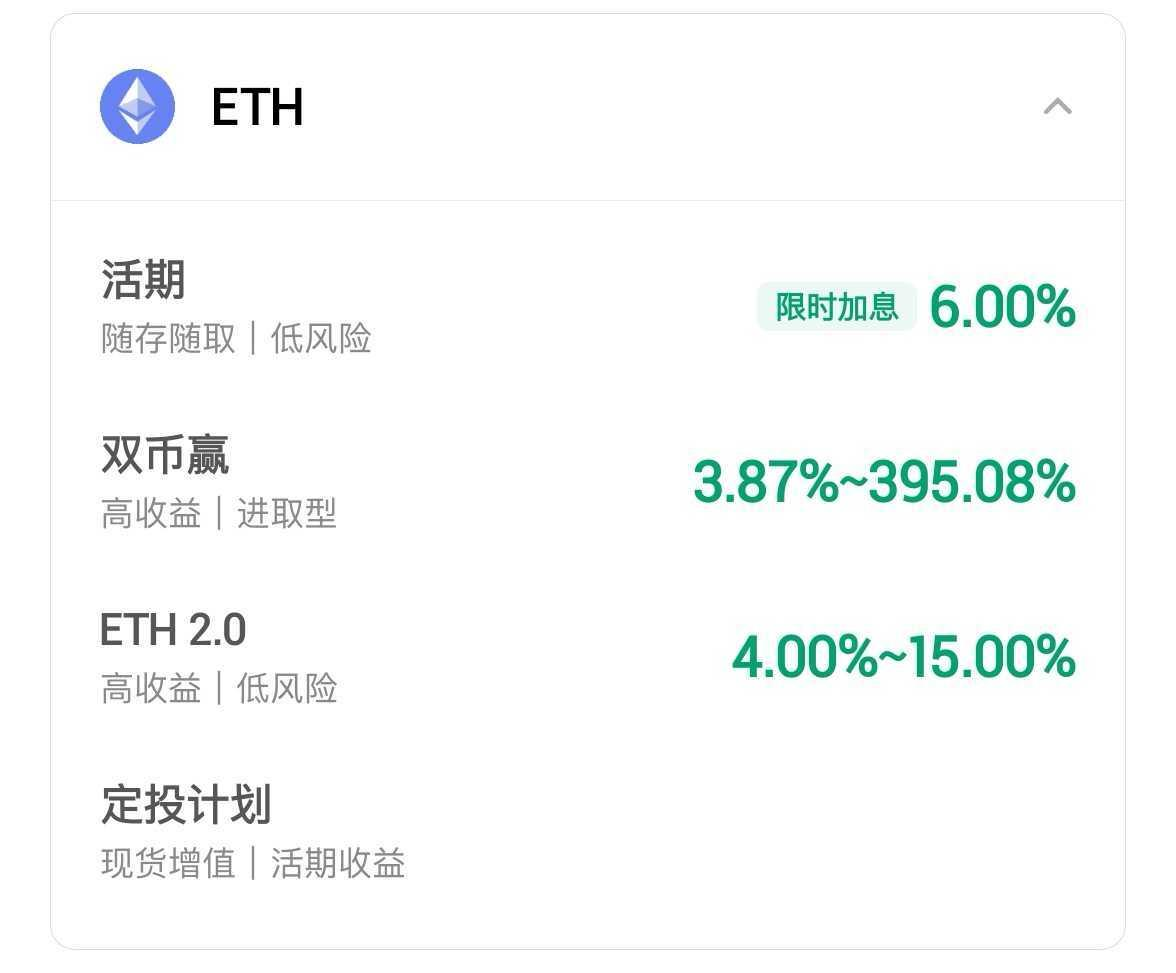

Currently, HTX’s 12th Anniversary “Everyone’s Earning Festival” campaign is live. All users who subscribe to designated major cryptocurrencies will receive boosted interest vouchers via airdrop, with a maximum bonus of 12%. For ETH, annualized subsidy rates can reach up to 6%. In addition, HTX provides Ethereum holders with stable yield opportunities through Simple Earning, structured products, or ETH staking (e.g., ETH2.0), supporting low entry barriers and flexible redemption, enabling ETH holders to participate in staking and earn annualized returns. This suits both long-term ETH holders and short-term participants, balancing yield and liquidity.

HTX Earning has also recently increased subsidies for multiple stablecoin current-account products, offering yields as high as 10–20%, far exceeding traditional bank savings or U.S. Treasury returns. USDT, USDC, USD1, and USDD are all included, with new users receiving limited-time benefits of up to 100% APY.

With the approach of its 12th anniversary, rapidly growing HTX is committed to rewarding global users with more competitive products. The interest subsidies offered by HTX Earning stem from strategic platform investments and group resource support, aiming to continuously enhance user experience and trading activity. HTX has now published Merkle Tree Proof of Reserves (PoR) data for 35 consecutive months, consistently disclosing its reserve holdings and maintaining industry-leading transparency. Backed by stable profitability and robust security, HTX is fully capable and confident in sustaining these subsidies.

Buy, buy, buy: Is Jack Ma chasing highs or strategically bottom-feeding?

This time, from the news of Jack Ma purchasing ETH through Yunfeng Financial to Ethereum’s strong market performance, several key trends emerge:

● Shifting institutional sentiment: Key figures and enterprises allocating part of their assets to Ethereum highlight its strategic role within diversified portfolios;

● Favorable price momentum: Ethereum’s recent rapid rise is expected by many institutions to continue with further upside potential.

From Jack Ma to everyday users, Ethereum is transitioning from experimental mechanisms to a standard wealth allocation tool. HTX Earning offers users diversified crypto investment options with low thresholds, flexible participation, and high-yield rewards, enabling small and medium investors to join in crypto asset appreciation. Users are encouraged to stay updated on HTX platform developments and invest in crypto assets rationally.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News