Back to "Payments": From Crypto to TradFi, What's the Bigger Narrative for Stablecoins?

TechFlow Selected TechFlow Selected

Back to "Payments": From Crypto to TradFi, What's the Bigger Narrative for Stablecoins?

Stablecoins are becoming the "new US dollar" for cross-border payments among global small and micro traders.

Author: imToken

Yiwu, USDT—these two terms, seemingly unrelated, are now being discussed in the same context.

As the "world's small commodities capital," Yiwu merchants used to rely on层层代理 banks to sell goods to the Middle East, Latin America, and Africa. This process was not only time-consuming and expensive but also frequently exposed them to the risk of frozen funds.

In recent years, however, a quiet transformation has taken place. According to a research report by Huatai Securities, stablecoins have become one of the key tools for cross-border payments in Yiwu. Buyers can now complete transfers via smartphone, with funds arriving within minutes. Chainalysis even estimated that as early as 2023, the volume of stablecoin transactions on-chain in Yiwu exceeded 10 billion U.S. dollars.

Although a follow-up investigation by 21st Century Business Herald pointed out that most Yiwu merchants have never heard of or do not understand stablecoins, with only a few accepting stablecoin payments, this precisely indicates that the trend is still in its early stages yet already showing signs of diffusion.

In other words, stablecoins are becoming the "new dollar" for global micro-trade businesses in cross-border settlements—payments are not just the starting point for stablecoins, but also their most direct gateway into the global financial system.

01 From "Payment" to "Global Payment"

To date, stablecoins have diversified in application: some use them for DeFi mining, others to earn interest, or as collateral assets. Yet behind these uses, payment remains the core function.

Nowhere is this more evident than in "global payments"—cross-border payment scenarios where stablecoins stand in stark contrast to traditional finance.

It is well known that the Society for Worldwide Interbank Financial Telecommunication (SWIFT) has long been the backbone of cross-border transactions. However, under modern financial demands, its inefficiency has become unsustainable—a cross-border remittance often passes through multiple intermediary banks, involves cumbersome procedures, slow settlement, and may take days to complete. During this period, accumulating fees keep transaction costs high.

For cash-flow-dependent businesses or individuals needing to send money home, such delays and costs are nearly unbearable. Simply put, despite SWIFT's global influence, it was not designed for the high-efficiency demands of the digital economy.

Under these circumstances, stablecoins offer a fast, low-cost, borderless alternative. Inherently featuring low cost, borderless reach, and instant settlement, a cross-border transfer via stablecoins takes just minutes without passing through layers of intermediaries. Transaction fees are significantly reduced depending on the network.

For example, transferring mainstream stablecoins like USDT/USDC on major Ethereum L2 networks now costs mere cents per transaction—almost negligible—making stablecoins a viable solution for "global payments." They are increasingly becoming the preferred option for small-value transactions in regions like Southeast Asia and Latin America, where cross-border activity is high but traditional channels are inefficient.

More importantly, for underdeveloped or economically volatile countries, stablecoins are more than just "payment tools"—they also serve short-term value preservation. For users facing local currency depreciation, holding stablecoins means preserving purchasing power.

This dual role of "payment + hedging" is exactly why "global payment stablecoins" deserve special attention.

Source: "Global Payment" (remittance-type) stablecoins from imToken Web (web.token.im)

From imToken’s perspective, stablecoins are no longer a single-narrative tool but a multidimensional "asset portfolio"—different users and needs correspond to different stablecoin choices.

Within this framework, "global payment stablecoins" (such as USDT, USDC, FDUSD, TUSD, EURC) form a distinct category dedicated to cross-border transfers and value circulation. Their role is becoming increasingly clear: they are both high-speed channels for global capital flow and the "new dollar" for users in turbulent markets.

02 Why Can Global Systems Not Bypass Stablecoins?

If "payment" is the original purpose of stablecoins, then "global payment" is their most competitive real-world application. The reason is simple: stablecoins naturally address the three major pain points of cross-border payments—cost, efficiency, and acceptability.

First, for any payment scenario, cost and efficiency are paramount.

As mentioned earlier, traditional cross-border remittances often pass through multiple intermediary banks, taking days and costing tens of dollars. In contrast, the advantages of stablecoins are obvious. On Ethereum L2 networks, transaction fees are typically well under one dollar, making stablecoins common tools for small cross-border payments in Southeast Asia, Latin America, and beyond.

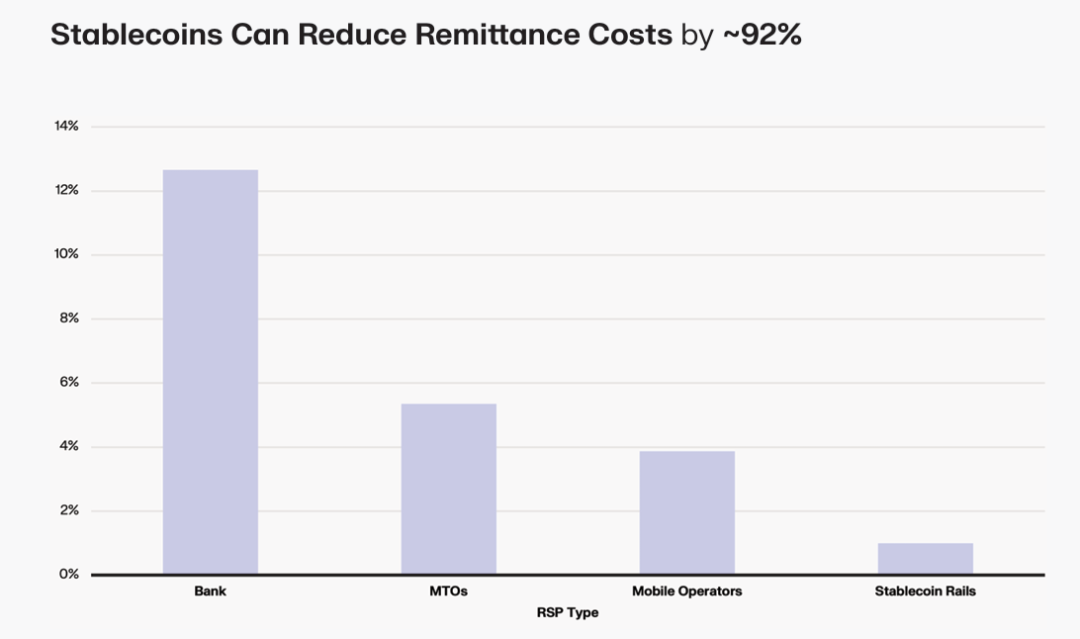

According to a Keyrock report, the cost of sending $200 via traditional banks is about 12.66%, via MTOs (money transfer operators) around 5.35%, and via mobile operators about 3.87%. Stablecoin platforms, however, can reduce such transaction costs to below 1%, greatly improving capital turnover. A stablecoin transfer on Ethereum mainnet usually confirms in seconds, while on certain L2s or emerging public chains, settlement can be even faster—an experience entirely different from SWIFT’s T+N model.

Second, beyond efficiency and cost, widespread adoption depends on whether recipients are willing to accept the payment.

This is thanks to the mutual reinforcement between the crypto market and stablecoins over the years—USDT, the world’s largest stablecoin, has maintained a market cap consistently in the tens of billions of dollars and is the most widely accepted payment medium. USDC, valued for compliance and transparency, is favored by institutions and deeply integrated into Western financial systems.

With continued penetration, in countries like Turkey, Argentina, and Nigeria suffering severe local currency devaluation, USDT has almost become a de facto "savings currency." USDC attracts institutional users with transparent reserves and regulatory compliance, achieving high penetration in Europe and North America. EURC, though smaller in scale, plays an irreplaceable role in cross-border settlements within Europe.

Finally, while speed and cost matter, "is the money truly safe?" remains critical.

With the implementation of the U.S. GENIUS Act, Hong Kong’s Stablecoin Ordinance, and pilot programs launching in Japan, South Korea, and elsewhere, regulatory compliance is gradually becoming the "passport" for stablecoins.

In the future, stablecoins entering the global payment system will likely all be "whitelisted players" on compliant paths.

In summary, stablecoins are becoming infrastructure for "global payments" not by accident, but because they offer comprehensive advantages over traditional cross-border payments in efficiency, cost, acceptance, and transparency.

03 Payment Is the Starting Point—and an Even Bigger Future

Therefore, for stablecoins that have gradually expanded their "global payment" attributes, the demand they face extends far beyond native crypto users:

-

Individuals and enterprises with cross-border remittance or payment needs;

-

Crypto traders who need to quickly move funds across exchanges;

-

Users facing local currency depreciation seeking stable assets like the U.S. dollar or euro for hedging;

From this perspective, "global payment" is not only the original mission of stablecoins but also their most realistic and urgent use case—they are not aiming to dismantle the traditional banking system, but to provide a more efficient, lower-cost, and inclusive alternative. Transactions that once required multiple intermediary banks and took days to settle can now be completed in "minutes and cents."

The future trend is increasingly clear: with the U.S. GENIUS Act, Hong Kong’s Stablecoin Ordinance, and pilot programs rolling out in Japan, South Korea, and other markets, global payment stablecoins will become an indispensable part of the financial system—whether for cross-border payments, corporate treasury management, or personal hedging.

When we look back at Yiwu merchants’ experimental acceptance of USDT, we may realize this is not just a story of one city, but a global microcosm—stablecoins are moving from the margins to the mainstream, from blockchain to reality, ultimately becoming new infrastructure for global value flow.

From this angle, payment is the starting point for stablecoins—and the beginning of their greater future as global financial infrastructure.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News