When the claim that Bitcoin will eventually reach $1 million conflicts with the reality of its continuously falling price, who should we believe?

TechFlow Selected TechFlow Selected

When the claim that Bitcoin will eventually reach $1 million conflicts with the reality of its continuously falling price, who should we believe?

People are no longer speaking out for self-hosting or cypherpunk-style Bitcoin discussions, but rather for political heavyweights and financial engineering.

Text: Joakim Book

Translation: AididiaoJP, Foresight News

In today's Bitcoin world, everything seems upside down; the market is filled with bullish voices, Bitcoin recently hit new highs, and treasury companies around the globe are scooping up Bitcoin—yet Bitcoin’s price continues to fall. This dissonance peaked at Bitcoin Asia in Hong Kong, which just concluded.

Suit-wearing professionals have arrived; Bitcoiners have become the new darlings of financial markets.

This has been the story for much of this year, culminating in the astonishing plunge of Bitcoin’s price during Bitcoin Asia 2025. Bitcoin, once the most outspoken assault of distrust against fiat monetary systems, is now diving headfirst back into traditional finance.

Cypherpunks have evolved into “suitcoins,” ultimately finding their final form as “stockcoins.”

The rebellious teenager has repented his sins; the lost investor has returned, shining with dazzling, greedy glory.

We nerds who once wholeheartedly sought to build a brand-new and better world have turned into cheerleaders for regulated, permissioned securities—securities cleverly leveraged and engineered through financialization to maximize Bitcoin per share. Financial logic has been brutally shoved to the forefront, and even the most steadfast cryptographic believers have abandoned much of their principles, because Wall Street is now willing to pay $2, $3, or $5 for every dollar’s worth of Bitcoin.

And at Bitcoin Asia in Hong Kong, everything else was also inverted. People didn’t speak up for self-custody or cypherpunk-style Bitcoin discussions, but rather for political heavyweights and financial engineering.

Alexandre Laizet, CEO of Europe’s largest treasury company, said on stage that balance sheets are turning into income statements. He wasn’t merely suggesting that treasury firms have now become banks, using their balance sheets as profit centers; he meant that for Bitcoin treasury companies, the balance sheet itself is all that matters. When you hold Bitcoin against infinitely printable shares, profits become irrelevant.

“As rational participants in the market, this is exactly what you should do.”

About 200 companies, with Strategy and Metaplanet as the most outspoken leaders of this movement, are scavenging cheap fiat currency from capital markets to buy Bitcoin. Records are being broken everywhere: attendance, viewership, participants, sales. Anyone who has spent time in the Bitcoin world can feel this energy, this construction, this endless factory floor of transport and building. Understanding Bitcoin has never been easier, and we’ve never had more Bitcoin believers.

Yet the price continues its winding downward path—from its high of $125,000 down to $118,204, the entry point where Nakamoto bought $679 million worth, then falling to around $111,000 during the conference, before plunging below $108,000—all perfectly synchronized with the bullish speakers on stage.

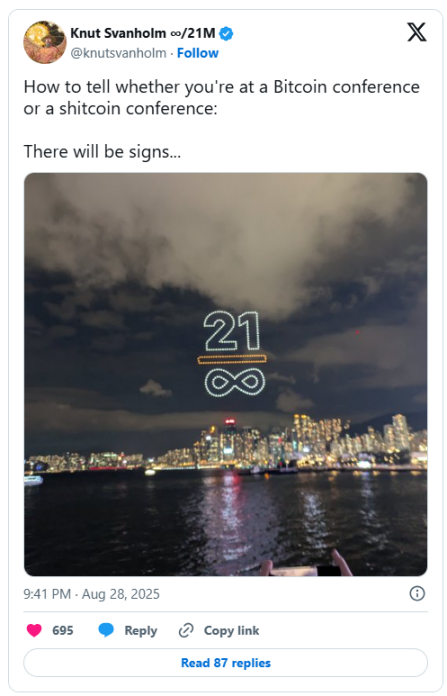

Thursday’s drone show, illuminating Hong Kong’s night sky with stunning Bitcoin graphics, could not have been a more symbolic representation of how utterly inverted everything has become. It displayed a powerful symbol of “21 divided by infinity,” a direct inversion of Knut Svanholm’s famous assertion of “everything divided by 21 million”:

All of us—over 20,000 attendees—having watched for days as bullish declarations on the Nakamoto Stage were contradicted and undermined by the large price chart behind them, desperately needed a rise in Bitcoin’s price to restore confidence.

On the Nakamoto Stage in Hong Kong, David Bailey sat confidently, celebratory, applauding our tremendous efforts and successes as Bitcoiners, while the audience stared at the Bitcoin price sponsored by SALT on the screen behind him, continuously plummeting—each downward tick erasing vast amounts of wealth.

The dissonance between the bullish rhetoric delivered on stage, the impressive and seemingly credible gospel preached by a dozen treasury firms present, and the harsh reality of a continuously falling price, could not have been more stark.

It’s almost as if the more people like David Bailey talk about and promote their stock-based Bitcoin acquisition tools, the worse our market becomes, and the lower the price falls.

Perhaps Mr. Bailey is simply far bolder than I am, but if I had just burned around $60 million of investor funds with nothing to show for it, I would be far more humble, anxious, dejected, and doubtful.

Price is objective, and this is indeed not a delicious cake.

It is equally symbolic that in Hong Kong, we witnessed financialized treasury firms gradually replacing cypherpunks.

We arrived at the latest stop of the Bitcoin festival tour, shocked to see how all things once sacred have been profaned: everything is inverted.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News