The dark side of prediction markets

TechFlow Selected TechFlow Selected

The dark side of prediction markets

In community terms, the oracle is "favoring the whales."

Author: Splin Teron

Translation: Luffy, Foresight News

The pitfalls I'm about to describe— I've personally fallen into every single one, and lost a lot of money because of them.

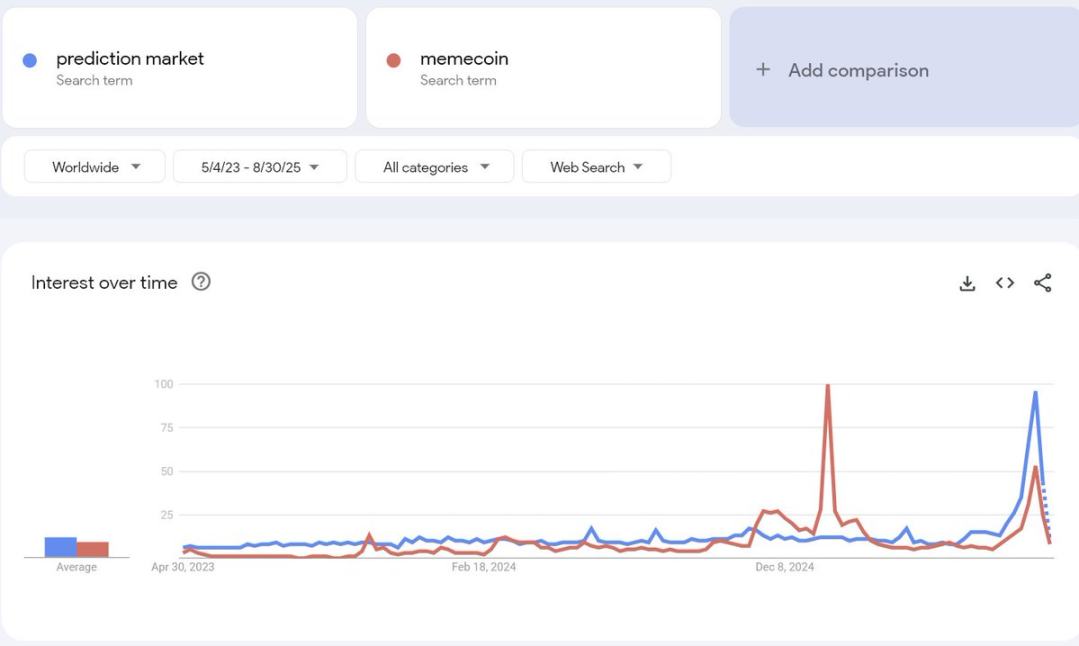

There's no denying the current trend. Google Trends shows that search volume for "prediction markets" now matches the peak search volume for "memecoin" earlier this year.

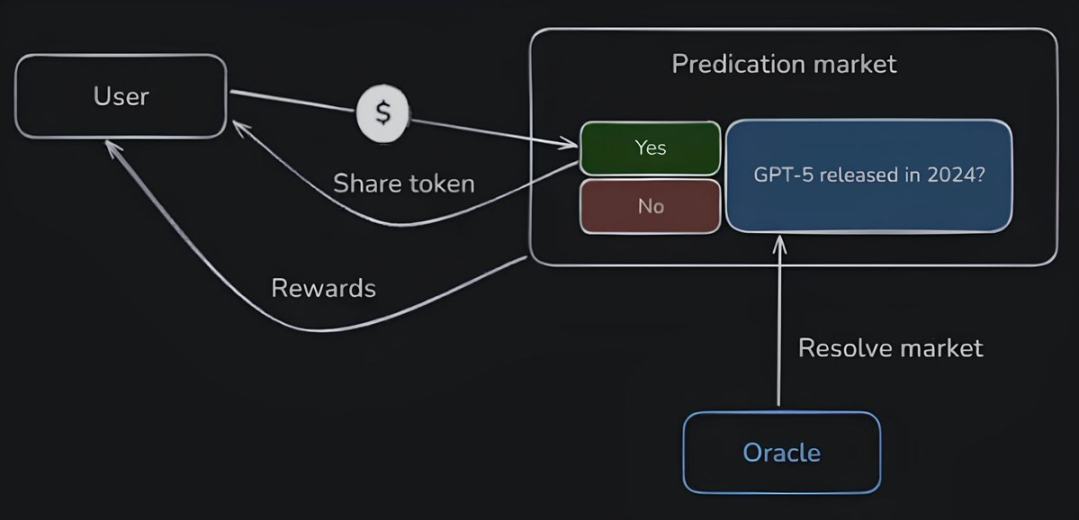

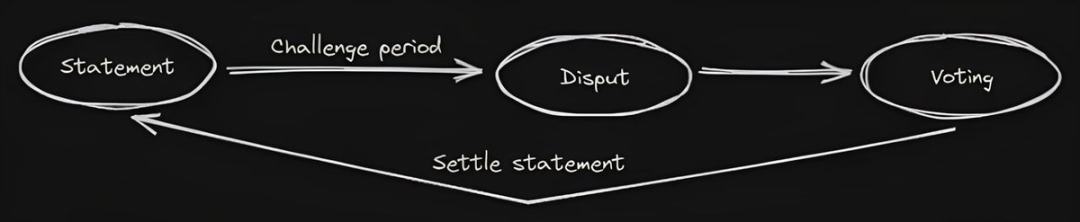

But first, let's quickly go over how prediction markets fundamentally work:

-

Deposit USDC;

-

Purchase an outcome token, either "Yes" or "No";

-

The tokens are locked in a smart contract until the event concludes;

-

Once the event ends, the oracle locks in the result;

-

If you backed the correct outcome, you redeem your tokens and earn profits; if wrong, you lose your principal.

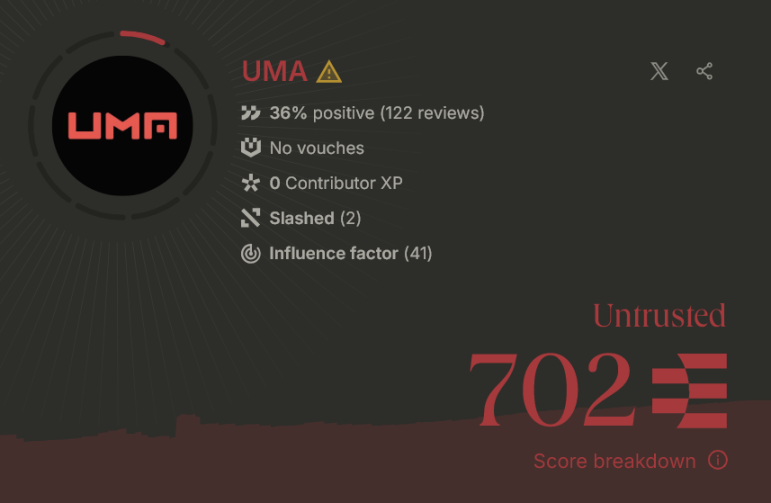

So... the oracle is the external source of truth. On Polymarket, this role is fulfilled by UMA.

After the event, the oracle sends a signal—"Yes" or "No"—to the contract. It's at this point that funds are redistributed among participants.

The entire market's trust hinges on the oracle. If the oracle delivers a "false" outcome, or determines a result in questionable fashion—even when facts are clear—some will profit while others lose.

And here's the problem... such oracle "errors" actually happen quite frequently. Or, as the community puts it, the oracle is "favoring whales"!

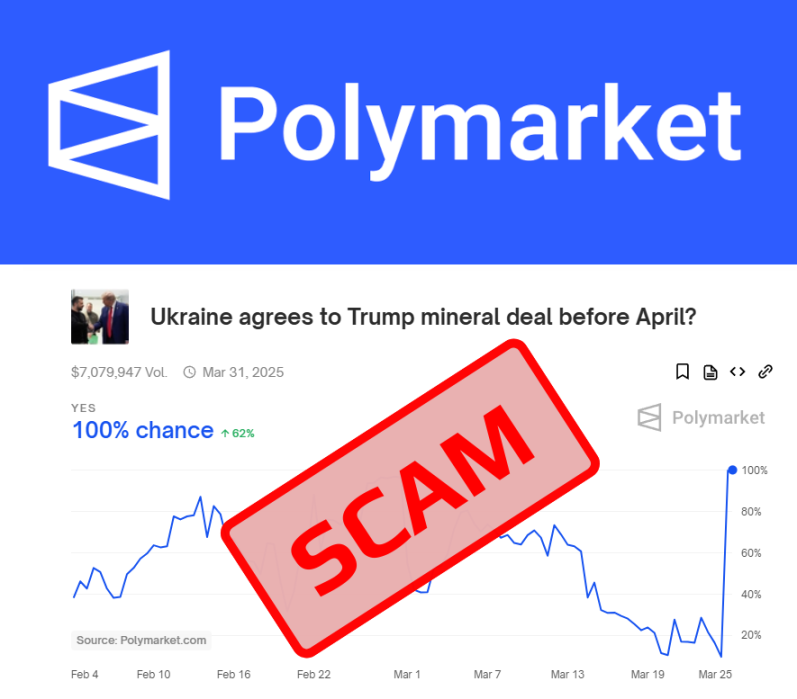

Case 1: Ukraine-Trump Minerals Deal

March 2025: The Polymarket prediction market on whether "Ukraine and Trump reached a minerals deal" was settled as Yes, despite no such deal ever being made. This outcome was pushed through by UMA whales. Users lost millions of dollars, yet Polymarket announced no refunds would be issued.

Case 2: Will TikTok Be Banned Before May 2025?

January 2025: The Polymarket market asking "Will TikTok be banned before May 2025?" was settled as Yes. Although the U.S. Supreme Court approved the relevant legislation, TikTok was never actually banned and continued operating normally. The UMA oracle locked in this result directly, bypassing standard dispute resolution processes. The market involved around $120 million in funds. Users widely accused the platform of manipulation, but no refunds were offered.

Case 3: Will Zelenskyy Appear in Traditional Suit?

July 2025: The Polymarket market on whether "Zelenskyy will appear in a traditional suit" attracted over $210 million in wagers. Despite multiple media outlets—and even the suit’s tailor—confirming that Zelenskyy wore a suit, the UMA oracle ruled the outcome as No. They defended this with a vague explanation that the "market’s core intent was 'a suit with a tie'", a justification clearly designed to protect whale positions.

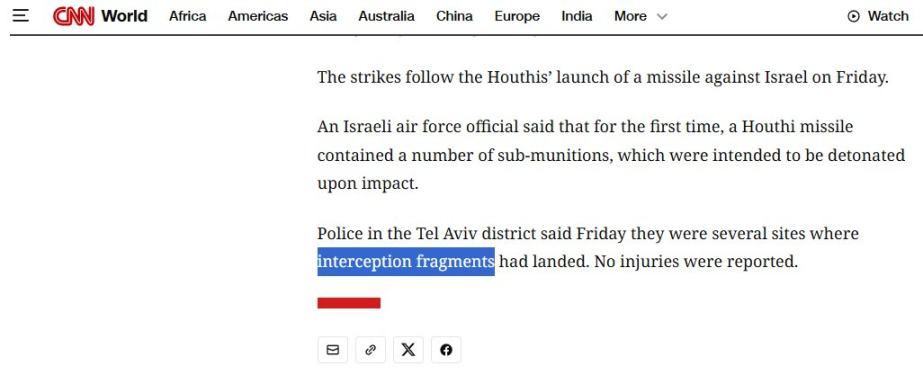

Case 4: Will Houthi Attack Israel Before August 31?

August 2025: The Polymarket market on whether "the Houthis will attack Israel before August 31" had $13 million in trading volume and was settled as Yes. In reality, official reports confirmed that missiles were intercepted mid-air. According to rules, the outcome should have been No.

I don't want to list every case just to pad the word count... if you'd like more, you can search Reddit or use Grok, ChatGPT to find out.

Why do markets with seemingly obvious outcomes end up settled contrary to facts? Who exactly holds the voting power?

I don't know the answer, but one thing is clear: this is happening, and people are losing money because of it!

What screening methods can help you avoid risks before trading?

-

Practice proper capital management: risk no more than 1%-3% of your deposit on a single market;

-

Choose events with clear information sources, such as court rulings, official statements, or on-chain data;

-

Check market liquidity and the list of top holders;

-

Take profits early—exit when gains reach around 95%, rather than waiting for final settlement.

And hopefully you realize: prediction markets lean more toward gambling than investing. If you can't control the urge to bet, it's best to stay away...

But if you decide to dive deeper, I’ve included a diagram showing the distribution across different protocols to help you navigate the world of prediction markets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News