Figure How to Unlock the Trillion-Dollar Traditional Financial Market: "Everything on Chain" Must Start from Real PMF

TechFlow Selected TechFlow Selected

Figure How to Unlock the Trillion-Dollar Traditional Financial Market: "Everything on Chain" Must Start from Real PMF

First RWA stock?

Author: Lyv

Editors: Bruce Shen, Felix Xu

TL;DR

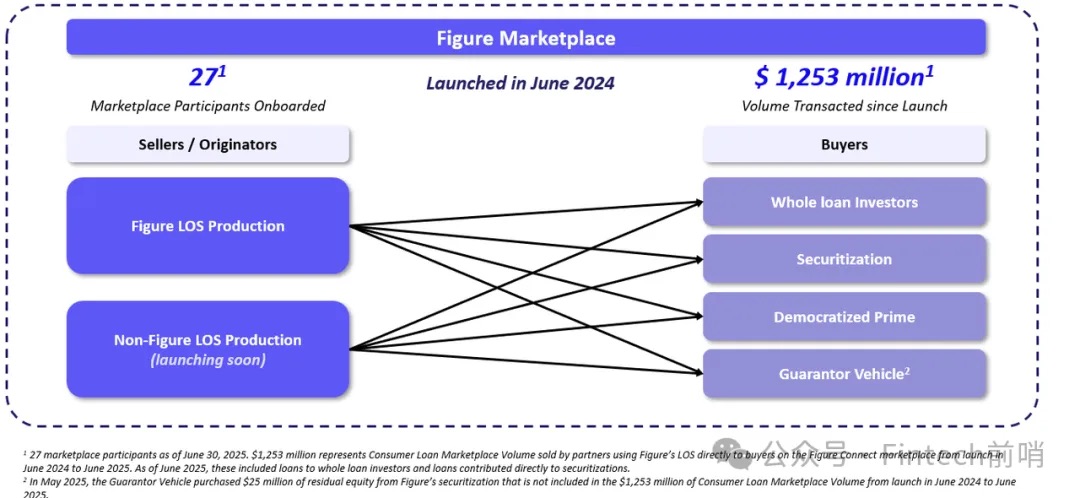

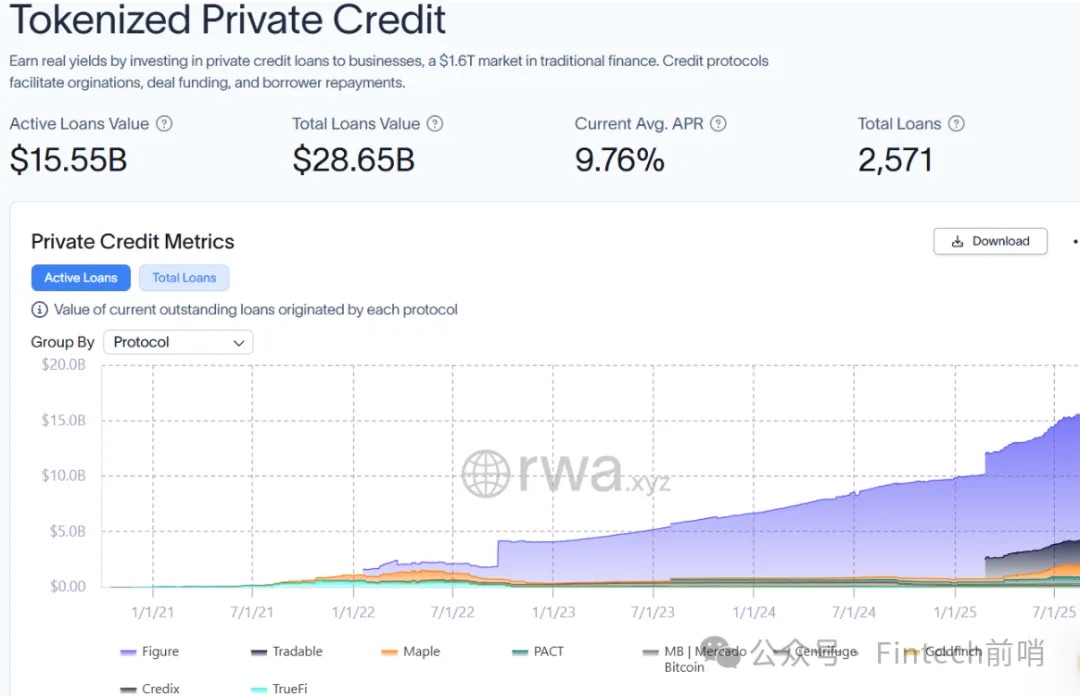

We believe Figure Technology is one of the few blockchain-related startups going public in this cycle that genuinely leverages blockchain technology to empower specific commercial use cases and deliver significant value enhancement. Specifically, Figure’s Loan Origination System (LOS), Provenance blockchain, and on-chain RWA trading platform Figure Connect form a "blockchain + SaaS product" suite targeting the multi-trillion-dollar U.S. private credit market. Since its launch just two quarters ago, Figure Connect has generated over $1.3 billion in transaction volume and contributed more than $45 million in revenue to Figure, rapidly demonstrating strong product-market fit (PMF). We believe that once listed on U.S. markets, Figure—already holding 42% of global RWA assets—will likely be embraced by institutional investors and traders as a leading vertical player in the RWA space, commanding a valuation premium.

Executive Summary

If the last decade was the testing ground for cryptocurrency, then this decade will see real-world asset (RWA) tokenization become the true "main battlefield." Figure—the fintech company co-founded by SoFi founder Mike Cagney in his second major venture—is gradually moving trillions of dollars in private credit onto the blockchain, much like the mythological "Yu Gong Moving Mountains." As the fourth-largest HELOC (Home Equity Line of Credit) lender in the United States, Figure is the self-proclaimed "King of On-Chain HELOC" and the first RWA platform poised to face scrutiny from traditional financial investors in the public markets. The success or failure of Figure may well set the tone for the RWA narrative over the next five years.

Core Thesis: Figure Technology Solutions (hereinafter "Figure") represents an innovative, vertically integrated financial ecosystem focused on the HELOC niche. Built upon blockchain infrastructure, this system aims to progressively yet disruptively restructure the multi-trillion-dollar private credit market.

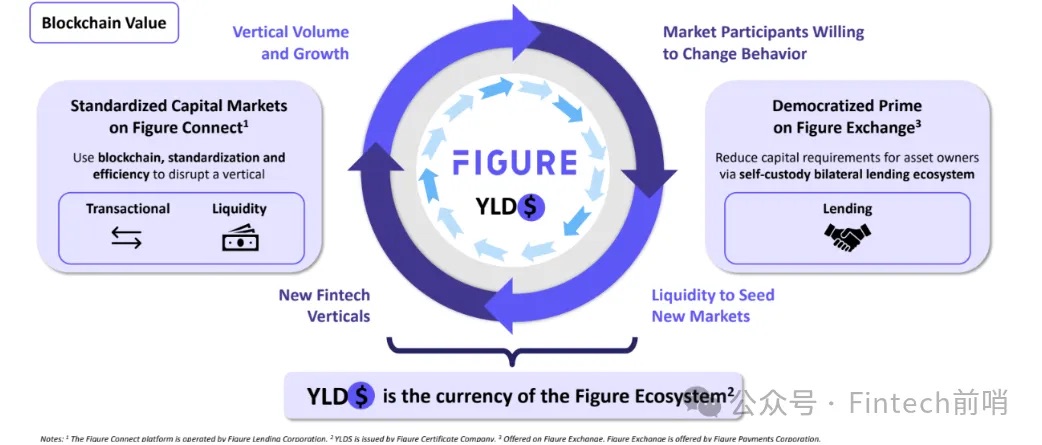

Business Model: Figure’s operational model goes beyond that of a traditional lender—it is fundamentally a fintech company powered by a "SaaS + blockchain" technology stack. Through its proprietary lending arm (Figure Branded) and an extensive network of partners (Partner Branded), Figure originates high-demand financial assets—primarily HELOCs—which are then tokenized on its proprietary Provenance blockchain and facilitated for sale and financing via its capital markets platform, Figure Connect. This process creates a powerful, self-reinforcing "flywheel effect," encompassing asset origination, liquidity creation, and fee generation.

Financial Highlights (First Half of 2025): The company has shown a clear financial inflection point; in H1 2025, it achieved $191 million in revenue, a 22.4% year-over-year increase, and turned profitable with a net profit of $29.1 million. This turnaround was primarily driven by explosive growth in the Figure Connect platform, which generated $45 million in net revenue (including $20 million in "ecosystem service fees"), validating its platform-centric strategy and demonstrating significant operating leverage.

Core Advantages and Opportunities:

-

First-mover advantage and market leadership: Figure dominates the on-chain private credit RWA market, holding over 40% market share by active loan volume, with its on-chain HELOC secondary market having processed over $13 billion in transactions.

-

Proprietary end-to-end tech stack: Possesses a suite of proprietary technologies including the Provenance blockchain, DART (Digital Asset Registry Technology), and Figure Connect, giving it a technological head start.

-

Scalable asset origination capability: As the fourth-largest HELOC lender in the U.S., Figure has proven its ability to originate assets at scale, having issued over $16 billion in HELOC loans and built a partner network of more than 160 institutions.

-

Visionary founder: Founder Mike Cagney has a proven track record of identifying and exploiting structural inefficiencies in large financial markets, with SoFi's business model still widely recognized today.

Key Risks and Challenges:

-

Market and execution risk: The business is highly dependent on the U.S. real estate and HELOC markets, which are sensitive to interest rate fluctuations and macroeconomic conditions. Successfully expanding the business model into new asset classes (commercial loans, consumer loans, credit card loans, etc.) remains a critical execution challenge.

-

Regulatory uncertainty: The company operates at the intersection of evolving regulations around digital assets, blockchain technology, and consumer credit, facing significant compliance and reputational risks across different jurisdictions.

-

Founder and corporate governance risk: A dual-class share structure grants founder Mike Cagney approximately 90% of voting power, resulting in extreme concentration of control that may misalign with public shareholders’ interests. His controversial departure from SoFi also introduces reputational risk.

Valuation and IPO Background: In its final private funding round in 2021, the company reached a valuation of $3.2 billion. As the highly anticipated "first RWA stock," its IPO valuation will be closely watched. Figure officially filed for IPO on August 19, 2025, planning to list on Nasdaq under the ticker "FIGR," potentially setting a new benchmark for future digital asset company IPOs.

01 Founder Narrative / Entrepreneurial Background

We believe founder Mike Cagney’s career has profoundly shaped Figure’s DNA. He is a complex yet uniquely visionary entrepreneur whose past successes provide a compelling foundation for Figure’s future story.

Mike Cagney embodies the rare combination of a Wall Street "veteran" and a Silicon Valley disruptor. His background as a trader and hedge fund manager at Wells Fargo honed his sharp, almost "predatory" instinct for identifying regulatory and market "financial fault lines" and crafting compelling narratives to attract capital.

Proven Business Model and SoFi’s Success: Cagney’s business model is clear: identify large, inefficient, and regulated financial markets and disrupt them with technology. Co-founding student loan giant SoFi stands as the pinnacle of this approach. Not only did SoFi grow into a unicorn valued at tens of billions, but more importantly, it survived multiple market cycles, proving itself a mature and resilient fintech company.

Controversial Personal History and Risk: Despite immense commercial success, Cagney’s personal history is complicated. His stellar tenure at SoFi ended abruptly due to a cultural scandal involving allegations of sexual harassment. This episode makes him a highly controversial figure, introducing significant "key person risk" for Figure and potentially becoming a reputational liability post-IPO.

Figure’s “Second Act”: Founding Figure is seen as Cagney’s "second act." This time, he is no longer content with optimizing within the existing system—he aims to take the "disruptive mindset" validated at SoFi and give it a "blockchain upgrade":

-

He applies the same strategy, enhanced with blockchain technology, to Figure’s HELOC business, using the on-chain HELOC secondary market Figure Connect as an innovation tool to solve long-standing pain points in the HELOC market—inefficiency, opaque ownership, and unclear transaction records.

-

Cagney’s more radical ideas are being tested and further invested in through experimental products such as Democratized Prime (on-chain securitization + P2P trading) and Figure Exchange (yield-bearing stablecoins, regulated crypto over-collateralized lending).

Besides Mike Cagney, another key member of Figure’s leadership is his wife June Ou, forming a "power couple" at the helm. If Cagney is the external strategist and spokesperson for Figure, June Ou is the internal cornerstone of technology and operations. With over 20 years of experience in technology, she served as COO at SoFi, leading the platform’s expansion from a single student loan product into a diversified financial services platform. At Figure, she advanced from COO to President, continuing to oversee core operations, technology development, and product execution.

02 Overview of the U.S. HELOC Market: Gradual Recovery Post-Subprime Crisis

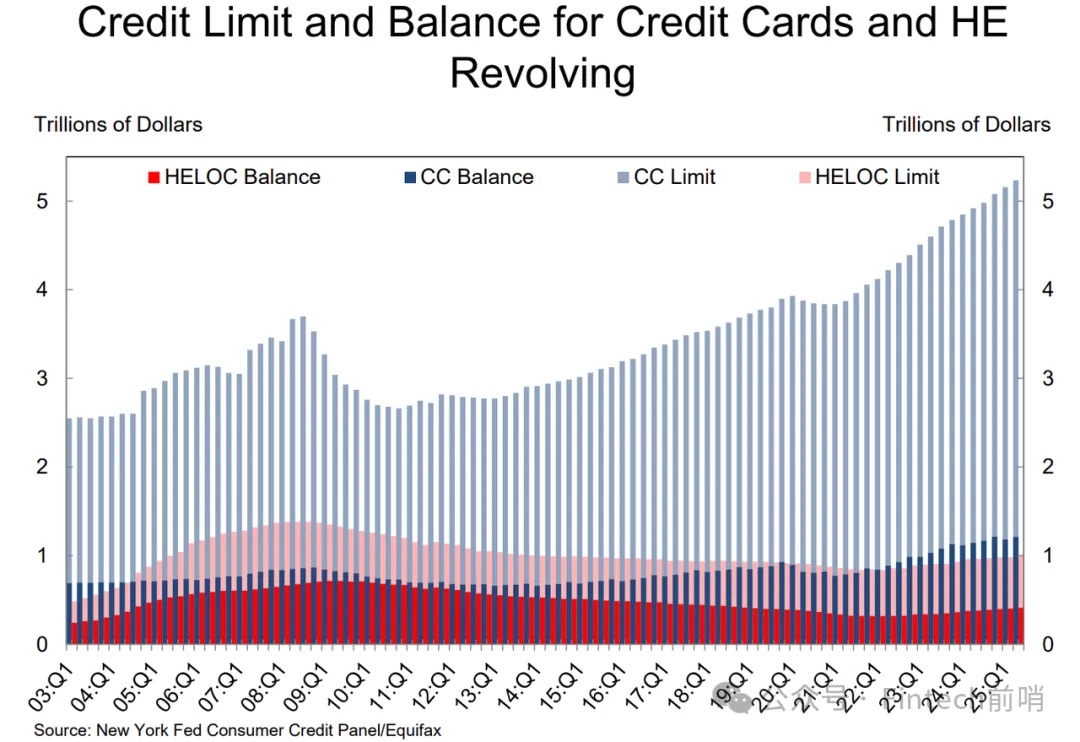

After the financial crisis, HELOC balances underwent a prolonged contraction: New York Fed research shows HELOC balances peaked in 2009 and continued declining until at least the end of 2018 (Q4 2018 at ~$412 billion, a 14-year low).

Since then, rising home prices and disposable home equity, combined with tax changes and the "lock-in effect" (which suppresses refinancing of first mortgages and boosts demand for second liens), have driven steady growth in the HELOC market: The New York Fed’s Q2 2025 report noted HELOC balances rose by another $9 billion that quarter to $411 billion, marking 13 consecutive quarters of growth (suggesting the bottom occurred around early 2022).

Capital Markets React Quickly

Post-subprime crisis, major U.S. banks adopted a cautious stance toward the HELOC market, emphasizing risk management and liquidity control, while still actively participating to capture growth opportunities.

Capital Market Channels Are Being Rebuilt

In the past two years, HELOC/second-lien securitization has revived: KBRA launched new HELOC/CES credit indices in 2024–2025, noting these assets account for about 4.5% of the private-label RMBS it tracks, and expects issuance to rise in 2025; Goldman Sachs issued GSMBS 2024-HE1 (99.6% second-lien HELOC); Fitch has reviewed and rated multiple HELOC-inclusive transactions in 2024–2025, highlighting the sector’s resurgence. These developments indicate that capital market channels for second liens are being rebuilt, providing non-depository institutions and some large banks with infrastructure for asset turnover and risk transfer.

JPMorgan Chase Reenters the HELOC Market in 2025

On August 25, 2025, Chase Home Lending announced the relaunch of its HELOC product. This signifies that leading banks, after retreating from risk, rebuilding capital market access, and seeing renewed demand, are reconfiguring this product line. Wells Fargo has not yet reopened to new customers.

Other Major / Regional Banks and Credit Unions Remain Active

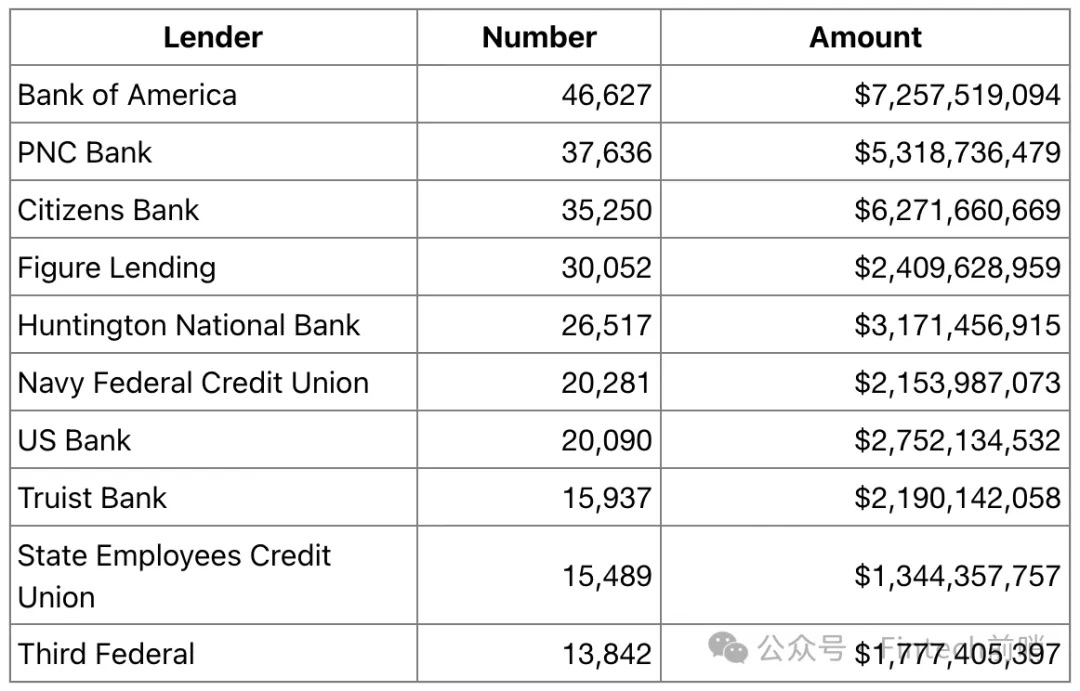

Major and regional banks such as Bank of America (BofA), PNC, U.S. Bank, Truist, Huntington continue offering HELOC to new customers; Citibank also offers HELOC; credit unions (e.g., State Employees' Credit Union, Navy Federal) rank among top issuers. According to 2024 HMDA rankings, BofA led with about 46,000 originations, followed by PNC, Citizens, and Figure Lending—making Figure Lending one of the few non-depository institutions in the top ten.

Top 10 HELOC Lenders in 2024:

HELOC Mortgage Lender Market: Highly Concentrated, Room for Figure to Expand

Institution Count: Numerous but Not Fragmented

Based on CFPB’s report on HMDA 2023 data, 1,221 institutions reported HELOC activity in 2023, but the market is not fragmented: the top 25 institutions originated 461,000 loans, accounting for 44.4% of market share; all but three were depository institutions, with none being small banks.

In 2023 among all 1,221 institutions: 388 institutions originated fewer than 100 loans each, totaling only 6,000 loans; 356 institutions originated 100–499 loans each, totaling 68,000 loans; 477 institutions originated ≥500 loans each, totaling 966,000 loans. In other words, about 39% of institutions (≥500 loans) completed about 93% of total originations, indicating extremely high market concentration.

Figure Lending’s Relative Position

The CFPB reports non-depository institutions accounted for only 4.9% of total originations—roughly equivalent to the size of a top-tier bank (e.g., BofA and PNC ranked #1 and #2 with shares of ~6.2% and 5.1%). As a representative of non-bank platforms, Figure has successfully entered the upper ranks. Industry rankings show Figure Lending was #6 in 2023 and rose to #4 in 2024; however, the Top 25 remain dominated by banks and credit unions.

Figure Lending currently partners with just over 100 institutions. By comparison, to scale up HELOC transaction volume, Figure must rely on partnerships with larger banks/credit unions for distribution and capital market transfers (securitization/trusts)—such as its recent Figure Connect on-chain secondary market initiative. We believe Figure’s relative scale in the HELOC vertical is sufficient to gradually attract more large partners through its technological edge and transaction efficiency, thereby expanding Figure Connect’s trading volume.

03 Figure’s Products and Its Served Ecosystem

Figure has built an integrated, full-process technology stack within the traditional finance HELOC vertical; its judicious use of blockchain technology stands out as a prominent example of Web3 genuinely empowering Web2 commercial applications.

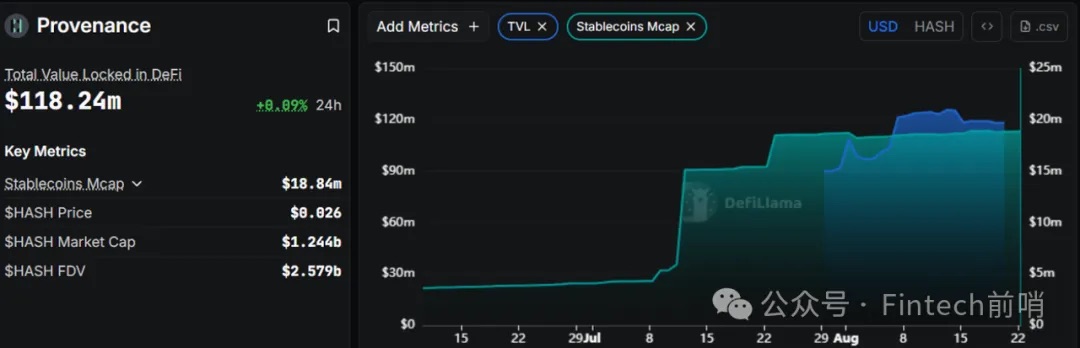

Provenance Blockchain: Figure’s Thoughtfully Designed Ecosystem Foundation

-

Strategic Choice of Cosmos SDK and Architectural Advantage: Provenance is a public blockchain based on Proof-of-Stake (PoS), built using the Cosmos SDK framework. Unlike general-purpose platforms like Ethereum, Cosmos SDK is designed specifically for creating "application-specific blockchains" (AppChains). This allows Figure to build a protocol from scratch, fully customized to meet the stringent requirements of regulated financial services (e.g., identity verification, data confidentiality, transaction finality). By embedding financial-grade features (like identity attributes and data permissions) directly into the protocol layer, Figure achieves the principle of "compliance by design," giving it a fundamental architectural advantage over competitors building similar solutions on general blockchains.

-

Role as an Immutable Record System: As the sole, legally binding ledger for all transacted assets within the ecosystem, Provenance replaces fragmented legacy systems and reconciliation processes in traditional finance. This immutable record of loan contracts, collateral, and ownership history creates a "single source of truth," greatly reducing fraud risk (e.g., double-pledging of collateral) and significantly lowering audit and compliance costs. Figure estimates this technology saves over 100 basis points per loan on average.

Figure Connect: The Core Engine of Modern Capital Markets

Figure Connect is a native on-chain private credit capital markets platform whose workflow, through a series of seamless on-chain steps, completely reshapes the way traditional assets flow.

Reshaping Asset Flow:

-

Asset Origination: Loan originators (whether Figure’s own Figure Lending or partners like The Loan Store) use Figure’s Loan Origination System (LOS) to underwrite a loan.

-

Tokenization on Provenance: Upon disbursement, the loan contract and related data are registered on the Provenance blockchain, becoming a unique, native digital asset (RWA).

-

Marketplace Listing: The originator lists this tokenized loan asset for sale on Figure Connect.

-

Investor Bidding and Price Discovery: Institutional investors (e.g., Bayview Asset Management or Saluda Grade) can view the asset and its verified data on-chain and place bids. Originators can also accept "forward commitments" to lock in pricing for future loan pools.

-

Bilateral Instantaneous Settlement: Once a bid is accepted, settlement occurs directly between the originator’s and investor’s wallets on the Provenance chain. Ownership transfer is immutably recorded, settlement is nearly instantaneous (T+0), eliminating counterparty and settlement risk and compressing traditional months-long settlement cycles to days.

Synergy with Figure’s Lending Business: Figure Lending is the largest single asset originator on the platform, having originated over $16 billion in HELOC loans cumulatively. This vertically integrated model creates a powerful self-reinforcing flywheel, effectively solving the common "cold-start problem" faced by new market platforms. As an "anchor originator," Figure Lending continuously injects large volumes of standardized, high-quality assets into Figure Connect, attracting institutional investors; their participation creates a liquid secondary market, which in turn attracts other third-party originators to tap into this vast capital pool, generating network effects.

Democratized Prime: Expanding Asset Utility via DeFi

Democratized Prime is a decentralized lending protocol built atop Provenance, representing a critical step in bridging traditional finance (TradFi) and decentralized finance (DeFi).

-

Bridging TradFi and DeFi: Democratized Prime allows tokenized assets from Figure Connect (e.g., HELOC asset pools) to be used as collateral. In June 2025, Figure launched a $15 million facility, marking the first time native digital RWAs could be used as collateral in decentralized finance (DeFi) markets.

-

Productive Use of Assets: The platform uses an hourly Dutch auction mechanism to match lenders and borrowers. Any member of Figure Markets can lend against HELOC asset pools and earn yield, with current annualized returns approaching 9%. This demonstrates that tokenized RWAs can not only be traded but also serve as productive, yield-generating assets within the DeFi ecosystem, greatly enhancing capital efficiency.

Core Digital Asset Infrastructure: DART and YLDS

-

DART (Digital Asset Registry Technology): Launched in April 2024, DART is a lien and electronic note (eNote) registry system built on the Provenance blockchain, designed as a more modern and efficient alternative to the existing MERS system in the mortgage industry. It enables lenders and investors like Goldman Sachs and Jefferies to perfect their security interests in digital assets. As of June 30, 2025, 80% of loans originated through Figure’s LOS had been registered on DART.

-

YLDS Stablecoin: Launched in February 2025, YLDS is the world’s first interest-bearing stablecoin approved by the U.S. Securities and Exchange Commission (SEC) and registered as a security. Backed by cash and cash equivalents, it pays a floating rate tied to the Secured Overnight Financing Rate (SOFR). Strategically, YLDS serves as the native currency and primary settlement asset within the Figure ecosystem, with its regulated status providing the necessary trust foundation for mass adoption. Figure aims to make YLDS the fiat currency of Figure Exchange and the primary on/off-ramp for fiat in the ecosystem.

04 Core Business Lines

Figure’s grand technological vision must ultimately be realized through the scaling of its core businesses. The HELOC business is its solid foundation, while the platform strategy serves as its growth accelerator.

1. Home Equity Line of Credit (HELOC): Foundational Business

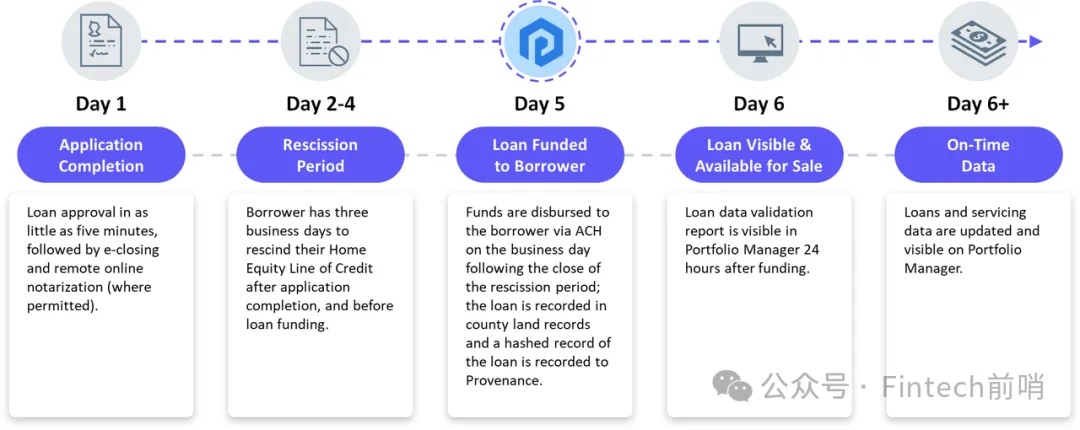

Operational Workflow and On-Chain Mechanism:

-

The entire process begins with a 100% online application, leveraging AI and automated valuation models (AVM), enabling approval in as little as 5 minutes without requiring traditional property appraisals.

-

Funds can be disbursed within just 5 days, a stark contrast to the weeks or even months required by traditional banks.

-

Loans are not "brought on-chain" at a later stage—they are "natively on-chain" from inception. At the moment of disbursement, the eNote and related lien information are registered on DART, creating a tokenized RWA that can be managed by the Figure Connect platform.

-

Since its founding in 2018, Figure has been originating HELOC loans, with its first on-chain asset securitization occurring in March 2020—indicating years of accumulating loan assets on its blockchain, laying the groundwork and transaction history for its current market platform.

Market Size and Growth:

-

Figure and its partners have cumulatively originated over $16 billion in HELOC loans, serving over 201,000 households, making Figure’s ecosystem one of the largest non-bank HELOC providers in the U.S.

-

In 2024, the Figure platform facilitated $5.1 billion in HELOC originations, a 50% year-over-year increase.

Customer Acquisition Strategy:

-

Initial Strategy (2018–Present): Figure’s early strategy was a classic fintech disruption. Founder Cagney敏锐ly identified a market gap: after 2008, major banks largely exited the HELOC market, while rising home prices created record extractable equity for homeowners. Figure successfully captured its first core customers by offering superior speed (5 days vs. 6 weeks) and convenience (100% online).

-

Current Strategy (B2B2C Platform Model): Today, Figure’s strategy has evolved into a powerful B2B2C platform model. The company offers its entire tech stack as a white-label "Lender-as-a-Service" platform to over 160 partners, including banks, credit unions, and independent mortgage lenders.

-

This shift from direct lender to platform provider is key to achieving scalable, capital-light growth. Figure empowers other lenders technologically and earns platform fees from transaction volume flowing through its ecosystem, vastly expanding market reach without bearing corresponding marketing expenses or balance sheet risk.

-

Our prior analysis of the U.S. HELOC market suggests Figure still has at least 3x room to expand its partner network.

List of Confirmed Financial Institution Partners:

Based on S-1 filings, public press releases, and disclosures from the company’s official X account, below are some notable traditional financial institutions that have partnered with Figure:

2. Cryptocurrency-Collateralized Loans: Strategic Adjacent Business

Business Model and Scale: Figure allows customers to borrow cash using Bitcoin (BTC) or Ethereum (ETH) as collateral, without credit checks, with a maximum loan-to-value (LTV) ratio of 75%. However, in 1H25, HELOC accounted for over 99% of Figure’s total loan originations, indicating that crypto-collateralized lending remains a small portion of overall business volume—but holds strategic importance as a bridge connecting consumer credit and digital assets.

Value Proposition and Risk Management:

-

Value proposition: Provides liquidity to cryptocurrency holders without requiring them to sell assets and trigger capital gains taxes, allowing them to retain potential upside.

-

Risk management: All collateral is held in decentralized multi-party computation (MPC) wallets. When collateral value drops and triggers a margin call, if the borrower fails to respond promptly, the collateral is liquidated, and a 2% liquidation fee is charged.

05 Financial Analysis / Peer Benchmarking

(First Half of 2025)

1. Revenue Deep Dive and Sustainability Analysis

Main Revenue Drivers:

-

In the first half of 2025, Figure’s total net revenue reached $190.6 million, a 22.4% increase from $156 million in the same period of 2024.

-

The company’s revenue primarily comes from origination fees, loan sale proceeds, servicing fees, and interest income generated by assets originated through its Loan Origination System (LOS). In H1 2025, this segment accounted for approximately 76% of total net revenue.

-

Figure Connect Platform Revenue: This is the core of the company’s growth story. Net revenue from the platform reached $45 million in H1 2025—a phenomenal increase compared to just $200,000 for the entire year of 2024.

Growth Engine Analysis:

-

The explosive growth in Figure Connect revenue was the fundamental catalyst behind the company’s overall revenue acceleration and profitability, strongly validating its platform strategy.

-

Prior to H1 2025, Figure’s revenue relied almost entirely on its own lending activities (origination, sales, servicing)—a capital-intensive, traditional lending model. The $45 million in revenue from Figure Connect in H1 2025, however, represents high-margin, capital-light platform fees derived from third-party transaction volume.

-

This indicates that Figure’s B2B2C strategy is not only effective but rapidly scaling. This growth model is sustainable and may even accelerate further. As network effects emerge and more asset classes are introduced to Figure Connect, its value proposition strengthens, driving a virtuous cycle of growth. Compared to pure lending, this is a more scalable and higher-margin business model.

2. Profitability and Cost Structure Analysis

Profitability Trajectory: Figure achieved a dramatic financial turnaround, reporting a net profit of $29.4 million in H1 2025, compared to a net loss of $13.4 million in the same period of 2024.

Cost Efficiency Driving Margin Expansion:

-

Figure’s profitability stems not only from revenue growth but also from the inherent cost efficiencies of its blockchain-based business model. Traditional loan origination, servicing, and securitization involve numerous intermediaries and repetitive manual processes, resulting in high operating costs.

-

By using the Provenance blockchain as a single, immutable ledger, Figure automates many of these functions. DART replaces MERS, smart contracts replace manual verification, and on-chain transparency reduces audit and compliance overhead.

-

Figure claims these efficiency gains save over 100 basis points per loan on average. As loan volume increases, these savings scale accordingly, leading to margin expansion. Unlike traditional lenders whose costs typically grow linearly with volume, Figure’s tech platform generates significant operating leverage. Revenue from Figure Connect, in particular, carries extremely high margins, directly contributing to net profit and explaining the company’s rapid path to profitability.

3. Key Financial Metrics and Peer Comparison

Cash Flow and Return on Equity (ROE):

As of June 30, 2025, the company’s total shareholder equity stood at $404.5 million. Annualizing the H1 2025 net profit ($29.4 million) yields a preliminary estimate of an annualized ROE of approximately 14.5%. For a growth-stage company, this is a strong indicator.

Balance Sheet and Capital Structure:

As of June 30, 2025, Figure had $1.27 billion in total assets, $869 million in total liabilities, and $404.5 million in total shareholder equity. The company carried $291.7 million in accumulated deficit on its books, reflecting sustained investment in growth prior to achieving profitability.

Peer Benchmarking:

To comprehensively assess Figure’s performance, comparison with key public companies is essential. SoFi is a relevant fintech lender, Rocket a mortgage tech giant, Block a diversified fintech with crypto exposure, and Circle a benchmark issuer of regulated digital assets. This comparison table provides investors with a quantitative basis to quickly evaluate Figure’s financial position in terms of growth, profitability, and efficiency, highlighting its unique combination of strong growth and emerging profitability.

06 Core Management Team / Shareholder Structure / Key Risks

Figure Core Management Team

Based on the prospectus and public LinkedIn data, Figure has assembled an executive team with deep experience in finance, technology, and law:

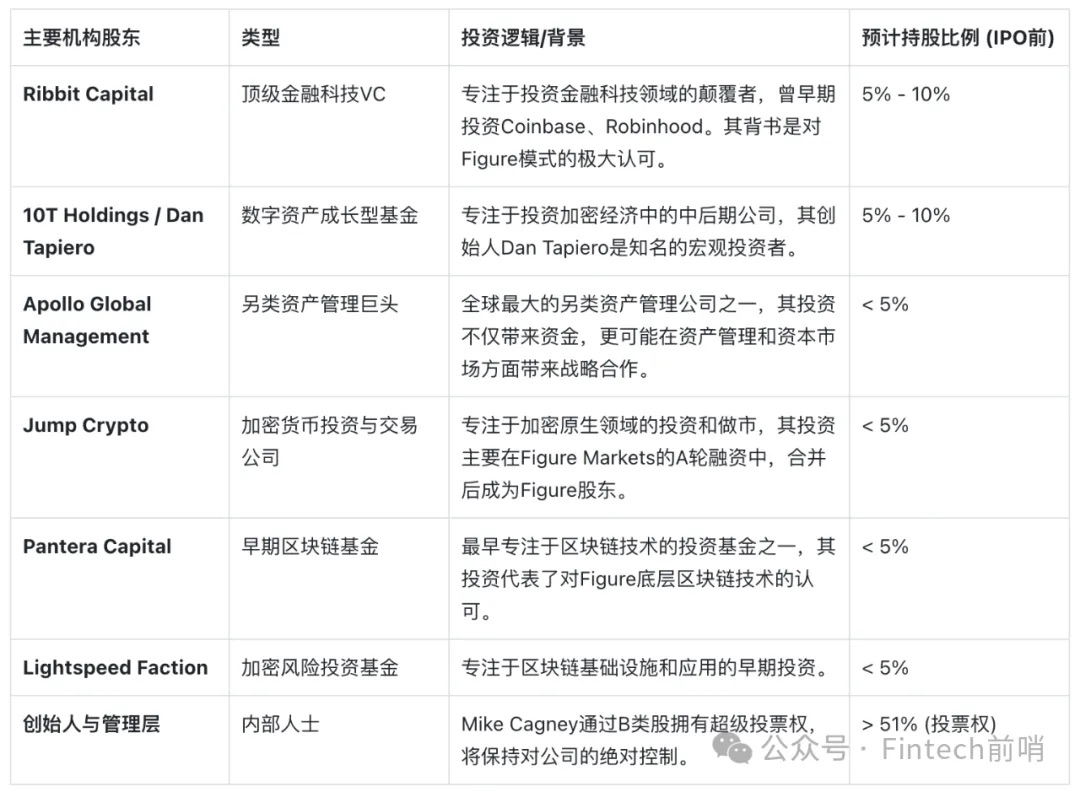

Governance and Shareholder Structure: A "Controlled Company"

-

Post-IPO, Figure will adopt a dual-class share structure, where Class B shares carry ten votes per share. Founder Mike Cagney and his permitted transferees will hold all Class B shares, collectively owning about 90% of voting power.

-

This means, under Nasdaq rules, Figure will be classified as a "controlled company." Public shareholders will have virtually no say in strategic decisions, board composition, or executive compensation—the company’s fate will be entirely tied to Cagney’s vision and execution. This lack of shareholder control will be a major concern for governance-focused investors and may impact valuation.

Key Investment Risks

Based on the prospectus and our analysis, we believe investors should pay attention to the following core risks:

-

Competition risk: Figure faces intense competition from two fronts: traditional financial institutions re-entering the HELOC market, and other emerging fintech competitors. Additionally, competition from unregulated or lightly regulated crypto-native firms cannot be ignored, as they may move faster.

-

Blockchain and digital asset risk: Blockchain applications in capital markets are still in early stages. The company faces inherent risks of the technology, including potential security vulnerabilities, ongoing regulatory uncertainty around digital assets, and the impact of crypto market volatility on its business.

-

Macroeconomic sensitivity: The core HELOC business is highly dependent on the health of the U.S. real estate market and the interest rate cycle. A sharp decline in home prices or prolonged high interest rates could dampen demand for its core products.

07 Conclusion and Key Takeaways

Figure’s IPO is not merely another fintech listing—it is the most significant public market validation to date for the entire real-world asset (RWA) tokenization thesis. Figure is not a theoretical project, but a real, profitable, and scaled enterprise that has already tokenized and traded billions of dollars in real financial assets on-chain.

1. Public Market Test for the RWA Theme

-

Bull case: The bullish argument rests on the strength of Figure’s vertically integrated ecosystem. If Figure Connect can successfully expand from HELOC to broader private credit asset classes (e.g., auto loans, consumer loans, SME loans) and become the dominant blockchain marketplace in this space, the company could evolve from a lender into essential financial market infrastructure. In this scenario, its addressable market would expand from the HELOC market to the multi-trillion-dollar global private credit market, justifying a higher valuation multiple based on platform economics.

-

Bear case: The bearish view focuses on the highly concentrated risk in its founder and corporate governance structure, along with significant regulatory and macroeconomic headwinds. Investors must essentially bet entirely on Mike Cagney’s long-term vision and execution, with little recourse if his strategy falters or his leadership sparks new controversies.

-

Some analysts argue that beyond the $400 billion HELOC market, other private credit segments are even more concentrated, with most existing business held by large national banks, limiting the incremental commercial value Figure’s blockchain technology can deliver and making it difficult to drive transformation in these legacy sectors.

-

Final assessment: Figure’s IPO presents a compelling yet high-risk investment opportunity. The company holds clear technological and first-mover advantages in a high-potential market. Its recent financial performance proves the viability of its business model and operating leverage. However, investors must weigh these strengths against profound governance risks and uncertainties in the external regulatory and economic environment. As a publicly traded stock, FIGR’s success or failure could have significant ripple effects, potentially influencing the pace of institutional capital inflows into the broader RWA space for years to come.

2. Potential Stock Price Catalysts Post-IPO

Rate Cuts and Demand Recovery:

-

Moderate rate cuts will lower HELOC borrowing costs, stimulating more homeowners to apply for credit-worthy home equity lines. Given that high rates over the past year suppressed mortgage borrowing demand, even a cumulative 50 bps cut could significantly improve monthly payment burdens for HELOCs.

-

Data shows HELOC rates fell by about 2.5 percentage points from early 2024 to early 2025, with the average second-lien HELOC rate dropping below 7.5% in March 2025, reducing monthly payments for a $50,000 loan from $412 to $311. With another expected 50 bps cut in H2 2025, borrowing costs will fall further.

-

In Q1 2025, U.S. home equity second-lien drawdowns reached $25 billion, up 22% year-on-year—the highest for the period in 17 years. This shows that lower rates are already shifting borrower behavior, increasing willingness to "tap home equity."

-

Additionally, lower rates will encourage more new home construction and renovations, stimulating broader real estate demand.

Direct Impact on Figure:

-

For Figure, its agile online platform and fast approval process position it well to capture this surge in demand, leading to increased loan originations and expanded Figure Connect transaction volume.

-

Since Figure’s main revenue comes from platform fees rather than lending spreads, its direct financial sensitivity to interest rates is low. However, its transaction volume is highly dependent on rate-driven loan demand. Overall, rate cuts have complex implications for interest-income-driven firms but indirectly benefit fee-based companies like Figure primarily through higher transaction volumes.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News