Coinbase can't escape 996 either

TechFlow Selected TechFlow Selected

Coinbase can't escape 996 either

Exchanges are never short of internal competition.

Authors: Lin Wanwan, Jack, EeeVee

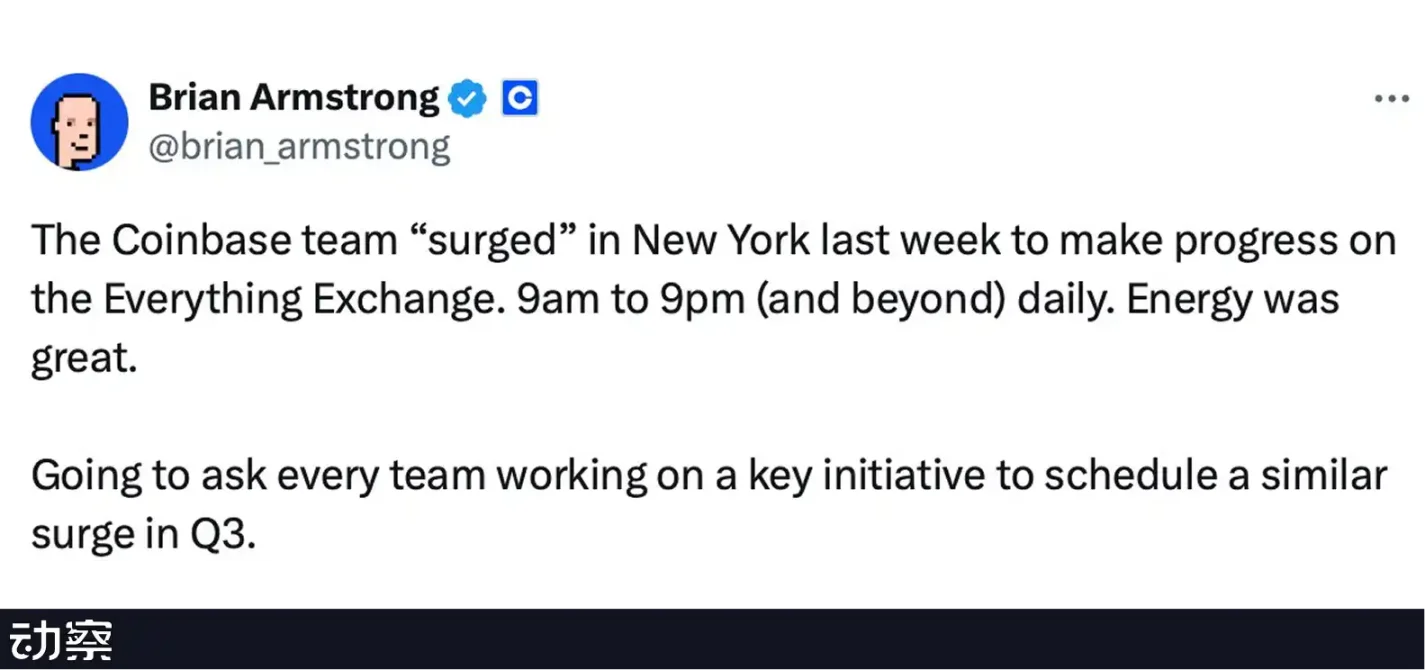

Coinbase has adopted the Chinese-style 996 work culture.

CEO Armstrong boasted on Twitter that the New York team had rallied to work overtime developing Everything Exchange, from 9 a.m. to 9 p.m., or even later.

A seemingly ordinary post sparked fierce division in the comments: Western netizens criticized it as a pathological overwork culture, while Asian users downplayed it: "It's normal in China; nothing to brag about."

Yet 996 is only superficial—the real story behind it is Coinbase’s underlying anxiety.

In Q1 2025, Coinbase's net profit plummeted 94% year-on-year, with transaction revenue declining across the board. In Q2, reported net profit reached $1.4 billion—impressively high at first glance—but this figure stemmed largely from paper gains on its investment in Circle, not organic profitability. Thus, Coinbase’s core spot trading business continues to shrink, squeezed by ETFs, on-chain trading, and Robinhood’s aggressive expansion, leaving the former "compliance king" increasingly on the defensive.

This isn't a problem unique to Coinbase—exchanges everywhere are resorting to longer hours and deeper transformations.

The question now confronting Coinbase and its peers is growing sharper: How much longer can the golden age of crypto exchanges last?

From Wall Street to Washington

Years ago, Coinbase realized one truth: to go further, an exchange must embrace four words—legal compliance.

One afternoon in 2019, Brian Armstrong walked into Capitol Hill for the first time. Carrying his presentation slides, he prepared to explain cryptocurrency to lawmakers just like pitching to investors.

But the questions he faced were absurd: "Oh, so you're the CEO of Bitcoin?"

Others asked: "Is this an online game?"

In that moment, he realized: this wasn’t a debate—it was “cross-species communication.”

In fact, Armstrong had long been forced to confront such “misunderstandings.” Before Coinbase went public, he often recalled moments of isolation as a founder—back when crypto existed in a gray zone, nearly no banks would cooperate with Coinbase, making basic tasks like payroll and corporate accounts extremely difficult.

He admitted that every negotiation then felt like begging the traditional financial system for a lifeline.

In the early days, Armstrong naively believed that staying within the law would allow him to focus solely on product. But as Coinbase grew, he realized regulatory ambiguity itself could be weaponized. SEC Chair Gensler used “unclear regulations” as justification to attack the entire industry; Senator Elizabeth Warren even attempted to portray crypto as “financial drugs.”

These experiences made him recognize earlier and more deeply than most the importance of compliance. Unlike many peers chasing traffic, Coinbase chose a seemingly slower path from day one: proactively applying for licenses, enforcing KYC/AML, and consistently engaging regulators.

Armstrong thus understood: if you don’t shape the rules yourself, someone else will define them for you.

So he changed tactics. Beyond flying repeatedly to Washington as an educator, he built a policy team, funded StandWithCrypto.org, created a “pro-crypto index” for every lawmaker, and even invested in the super PAC Fairshake.

In 2024, the U.S. election brought “crypto voters” into the spotlight for the first time: anti-crypto lawmakers were voted out, while pro-crypto candidates won seats. Washington finally realized: 50 million Americans had used crypto wallets. This wasn’t a fringe issue—it was a vote-driving machine.

On Wall Street, Armstrong played a different card: compliance.

Just before its 2021 IPO, Armstrong told media that Coinbase’s entry into Nasdaq was due not just to business performance but to its leadership in compliance. To him, the IPO’s true significance was not fundraising, but legitimacy—a milestone moving crypto from the margins to the mainstream.

In 2025, he pushed for the passage of the Genius Act, requiring stablecoins to be backed 1:1 by cash or U.S. Treasuries. This wasn’t just a legislative win—it became Coinbase’s moat. As a shareholder in Circle, Coinbase shares in USDC’s interest income. In 2024 alone, Circle earned approximately $1.68 billion in reserve interest, about $910 million of which flowed to Coinbase.

Stablecoins became a narrative accepted by both Wall Street and Congress: to governments, they extend dollar dominance; to capital, they offer stable cash flow.

Thus, Coinbase completed a transformation: in Washington, it became a lobbying machine shaping rules; on Wall Street, a compliant gateway connecting capital.

Armstrong once said: "Once you’re big enough, even if you ignore government, government won’t ignore you."

This statement serves as a footnote: Coinbase’s new battleground extends far beyond the exchange itself.

The “CEX Crisis” in the Earnings Report

Compliance alone isn’t enough for exchanges.

Despite remaining one of the world’s largest crypto trading platforms, Coinbase’s 2025 H1 earnings reports were filled with anxiety.

Q1 revenue hit $2 billion, a 24.2% YoY increase—seemingly decent. But against a 94% YoY plunge in net profit, the number lost meaning. A mere $66 million in net profit, far below expectations, made investors realize for the first time: the old centralized exchange model is collapsing.

The decline in spot trading revenue was especially stark.

Institutional trading dropped 30% YoY, retail trading down 19%. Market cooling certainly contributed—since 2025, Bitcoin and Ethereum volatility has sharply decreased, turning the market from a “rollercoaster” to “flat terrain,” reducing trading incentives for both institutions and retail.

But deeper pressure comes from shifting market dynamics.

The launch of ETFs has rewritten investor behavior. After Bitcoin, Ethereum, Solana, and XRP all filed for ETFs—once Coinbase’s core trading assets. Compared to CEX trading fees of up to 0.5%, ETF management fees of 0.1%–0.5% annually appear far cheaper, drawing capital toward Wall Street.

Meanwhile, on-chain wealth creation keeps users on-chain.

The meme and DeFi booms have cultivated new habits among native investors: CEXs are no longer primary trading venues, but merely “on/off ramps” and “temporary stablecoin wallets.” The rise of decentralized derivatives accelerates capital outflows. Platforms like Hyperliquid, with flexible listing mechanisms, higher leverage, and superior user experience, quickly attract traders from heavily regulated regions like the U.S. To these users, Coinbase’s “by-the-book” approach feels like a constraint.

Even more threatening competition emerges from the heart of traditional finance.

Robinhood announced a full-scale push into crypto, targeting Coinbase’s most valuable demographic—young retail investors. For them, Robinhood offers a more familiar interface, lower fees, and seamless integration between stocks and crypto. For larger investors, Robinhood’s “brokerage brand” may even be more appealing than Coinbase.

This multi-front pressure was brutally exposed in Q2 2025 earnings. Coinbase reported total revenue of ~$1.5 billion, down 26% quarter-on-quarter. GAAP net profit soared to $1.4 billion—appearing strong, but mostly driven by paper gains from Circle investments and crypto holdings. Strip away these one-time items, and adjusted net profit falls to just $33 million. More critically, core spot trading revenue dropped 39% YoY to $764 million.

Numbers look good on paper, reality is bleak. Coinbase’s profits no longer come from trading, but from stablecoin revenue sharing—barely keeping it alive. This harsh report may signal the end of a golden era.

When Trading Platforms No Longer Rely on Trading

Facing these challenges, Coinbase unveiled a new vision.

In a recent interview, Coinbase CEO Brian Armstrong laid out his plan: all assets will eventually move on-chain, so Coinbase must become Everything Exchange.

To him, crypto isn’t a siloed industry, but a technology capable of upgrading the entire financial system.

Armstrong highlighted the current state of U.S. equities: today, an Argentine wanting to open a U.S. brokerage account faces prohibitively high wealth requirements. For most global investors, U.S. securities remain an exclusive “rich people’s market.”

But tokenizing stocks and moving them on-chain could break these barriers, enabling anyone worldwide to trade U.S. assets anytime.

On-chain also unlocks new possibilities: 24/7 trading, fractional share purchases, and even novel governance models—such as allowing voting rights only to shareholders who’ve held stock for over a year—to incentivize long-term investment.

In his vision, Coinbase would evolve beyond a trading platform into an Everything Exchange—an open, inclusive, always-on financial operating system.

To align with this vision, Coinbase has taken a series of actions: within six months, it acquired Spindl, Iron Fish, Liquifi, and Deribit.

The first three support Base chain: Spindl provides an on-chain advertising stack, helping developers acquire users directly; Iron Fish brings a zero-knowledge proofs team to build privacy features on Base; Liquifi offers token management and compliance tools, set to integrate with Coinbase Prime to serve institutions and RWA projects. Together, they reduce developer friction on Base, creating a full toolset.

The most significant acquisition was Deribit. Derivatives trading is more stable and profitable than spot, but Coinbase has long been absent due to U.S. regulatory constraints. By acquiring Deribit for $2.9 billion, Coinbase instantly gained leading options market share and a large institutional client base. Within a month of closing, Coinbase launched perpetual contracts under CFTC oversight—effectively inheriting Deribit’s capabilities seamlessly.

If acquisitions represent Coinbase’s forceful breakout from trading revenue ceilings, its ongoing business expansion signals a deeper identity transformation.

It’s now focusing on heavy-lifting areas: stablecoins, wallets, public chains, and institutional services. These foundational pieces are shaping a new Coinbase—not just an exchange, but a Web3 version of Apple + Visa + AWS.

The first step is stablecoins.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News