Circle's interest rate cut dilemma

TechFlow Selected TechFlow Selected

Circle's interest rate cut dilemma

Analyze the impact of monetary policy changes on CRCL's future.

Author: Jack Inabinet, Bankless

Translation: Saoirse, Foresight News

Stablecoin issuer Circle captured significant attention this past summer. On June 5, Circle shares began trading publicly at as high as $69, immediately doubling the capital for early investors who participated in its already expanded initial public offering.

Throughout June, CRCL stock surged continuously. As the share price approached $300, it solidified its reputation as a standout crypto-linked stock. But the good times didn't last—deep into summer, the stock ultimately succumbed to seasonal weakness...

Despite a 7% rally following Powell's dovish remarks last Friday, the stock has trended downward over most of the past month and now trades nearly 60% below its all-time high.

Today, we'll examine the challenges stablecoins face amid looming rate cuts and analyze how monetary policy shifts could impact CRCL’s future.

The sticky issue of "interest"

Circle operates on a bank-like business model: it profits from interest.

Over $60 billion in bank deposits, overnight lending agreements, and short-term U.S. Treasuries back USDC. In Q2 2025, Circle earned $634 million in revenue from interest on these stablecoin reserves.

When interest rates rise, each dollar of USDC reserve generates more interest income; when rates fall, earnings decline. While rates are driven by market forces, the cost of dollars is also influenced by Federal Reserve policy—especially for the short-term instruments Circle uses to manage its reserves.

Last Friday, Federal Reserve Chair Jerome Powell strongly signaled the possibility of rate cuts during his speech at Jackson Hole. We've seen "false dawns" before, but this marks the first time Chair Powell himself has so clearly leaned toward supporting lower rates.

Powell attributed remaining inflation to one-off tariff spikes, emphasized that the labor market is slowing, and defended potential rate cuts. Markets now expect the Fed to announce a rate cut at its September 17 policy meeting.

According to data from CME FedWatch and Polymarket, the probability of a rate cut surged after Powell’s remarks—with a significant shift actually beginning on August 1. That day, employment data revealed only 73,000 jobs added in July, with substantial downward revisions to the previous two months.

Since August 1, both CME FedWatch and Polymarket have consistently predicted a higher likelihood of a 25-basis-point (0.25%) rate cut. If the Fed delivers as expected, Circle’s revenue would drop overnight.

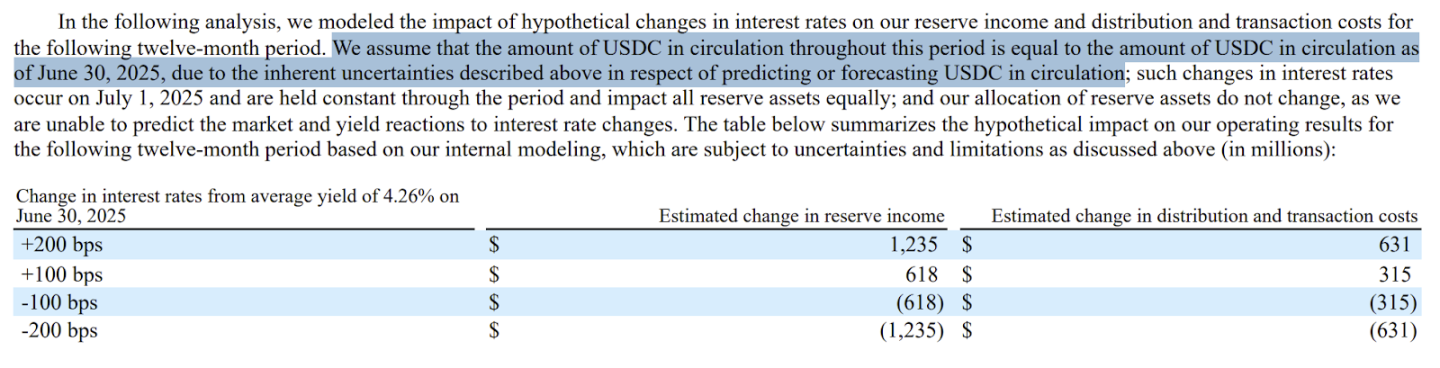

Based on Circle’s own financial projections, every 100-basis-point (1%) decline in the federal funds rate results in a $618 million annual loss in interest income. That means a single "standard-sized" 25-basis-point cut would lead to a $155 million revenue loss.

Luckily, half of this revenue loss would be offset by reduced distribution costs. This aligns with Circle’s agreement with Coinbase, which entitles Coinbase to approximately 50% of USDC reserve interest income. Still, the reality remains: operating becomes increasingly difficult for Circle in a falling interest rate environment.

Modeling analysis of the impact of interest rate changes on reserve income and distribution and transaction costs over the next 12 months

Source: Circle

Although Circle reported a net loss of $482 million in Q2—far below analyst expectations—this discrepancy largely stemmed from a $424 million accounting charge related to employee stock compensation during the IPO.

Nevertheless, Circle’s financials highlight the fragility of a company hovering near break-even. At current USDC supply levels, it cannot withstand a sharp decline in interest rates.

The solution

On the surface, lower interest rates may reduce interest income per dollar of reserves, hurting profitability. But fortunately for CRCL holders, changing just one simple variable could completely reverse the situation...

Powell and many financial commentators believe current rates are already at a "restrictive" level. Fine-tuning the Fed’s policy rate could address both a weakening labor market and inflation control.

If these experts are correct, rate cuts might spark an economic rebound—keeping employment high, lowering credit costs, and boosting the crypto market. In such an optimistic scenario, demand for crypto-native stablecoins could rise, especially if they offer decentralized finance-native yield opportunities above market rates.

To offset the negative impact of a 100-basis-point rate cut—the minimum level considered in Circle’s sensitivity analysis—USDC circulation would need to increase by about 25%, requiring $15.3 billion in new capital inflow into the crypto economy.

Based on 2024 net profit, Circle currently trades at a P/E ratio of 192x, positioning it as a high-growth opportunity. Yet while equity markets remain optimistic about CRCL’s expansion prospects, the stablecoin issuer must achieve growth to survive if the Fed enacts rate cuts in the coming weeks.

Assuming the Fed cuts rates by at least 25 basis points, Circle would need to increase USDC supply by approximately $3.8 billion to maintain current profit levels.

In Circle’s own words: “Any relationship between interest rates and USDC circulation is complex, highly uncertain, and unproven.” No model can yet predict how USDC users will react to lower rates, but history shows that once rate-cut cycles begin, they tend to move quickly.

While Circle might compensate for lost interest income through growth in a booming economy, the data reveals an inherent conflict between the company and a low-rate environment.

The majority of the company’s revenue comes from reserve earnings. Interest rate fluctuations affect reserve yields, which may alter reserve income. However, because circulating USDC is influenced by uncertain factors like user behavior, while the impact of rates on reserve yields can be modeled, the final effect on reserve income cannot be accurately predicted.

Source: Circle

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News