Both Lighter's ETH and HL's XPL are spiked, how to avoid being liquidated due to manipulation by large holders?

TechFlow Selected TechFlow Selected

Both Lighter's ETH and HL's XPL are spiked, how to avoid being liquidated due to manipulation by large holders?

Every casino has its own rules.

By: Jaleel Jia Liu

The first episode of the final season of "Black Mirror," titled "Joan Is Awful," tells a story where the female protagonist casually clicks "agree," only to have the platform legally turn her daily life into a real-person drama streamed globally based on that user agreement no one reads.

In reality, every industry has its own user agreements. Perpetual contracts are no different—clearing rules serve as the “user agreement” for this sector.

It's neither flashy nor eye-catching, yet extremely important. The same token, across different trading platforms, features varying depths, differing K-line trends, and distinct clearing mechanisms—resulting in completely different outcomes for positions.

The two perp DEX examples today serve as excellent case studies: at the same time, while Binance’s pre-market contract pricing did not experience similar volatility, XPL prices on Hyperliquid surged close to +200% within about five minutes; similarly, ETH prices on Lighter spiked up to $5,100.

Under extreme market conditions, some celebrate while others suffer.

Within just an hour, several whale accounts on Hyperliquid profited between $38 million and $46.1 million by pushing up prices to liquidate opposing short positions. Among them, address 0xb9c…6801e, which had accumulated long positions since August 24, earned approximately $16 million in profit within one minute after the "order book sweep" at 5:35. HLP netted around $47,000 during this event. Shorts were less fortunate: the XPL short position from 0x64a4 was hit with consecutive liquidations over minutes, losing about $2 million; another short from 0xC2Cb was fully liquidated, suffering losses of approximately $4.59 million.

Rather than calling this “manipulation by bad actors,” it's more accurate to view it as the combined result of clearing systems and market structure—an important lesson for all crypto traders: always pay attention to depth and clearing mechanisms.

How Are Liquidations Triggered?

On any perpetual contract platform, the first thing to understand is Initial Margin (IM) and Maintenance Margin (MM): IM determines the maximum leverage available; MM is the liquidation threshold. When account equity (collateral plus unrealized PnL) falls below MM, the system takes over the position and initiates the liquidation process.

Next comes price determination. The price used to determine liquidation isn’t the last traded price, but rather the Mark Price. This is typically determined jointly by external indices, oracle feeds, and the platform’s own order book, smoothed and resistant to manipulation. The Index Price closely reflects weighted spot references from external markets. The Last Price refers to the most recent trade on the platform and is vulnerable to short-term manipulation via aggressive market orders.

Thus, when “account equity < Maintenance Margin,” liquidation begins. However, the specifics of how liquidation unfolds depend entirely on the platform’s own execution mechanism.

Hyperliquid: Letting the Market Absorb Liquidation Orders

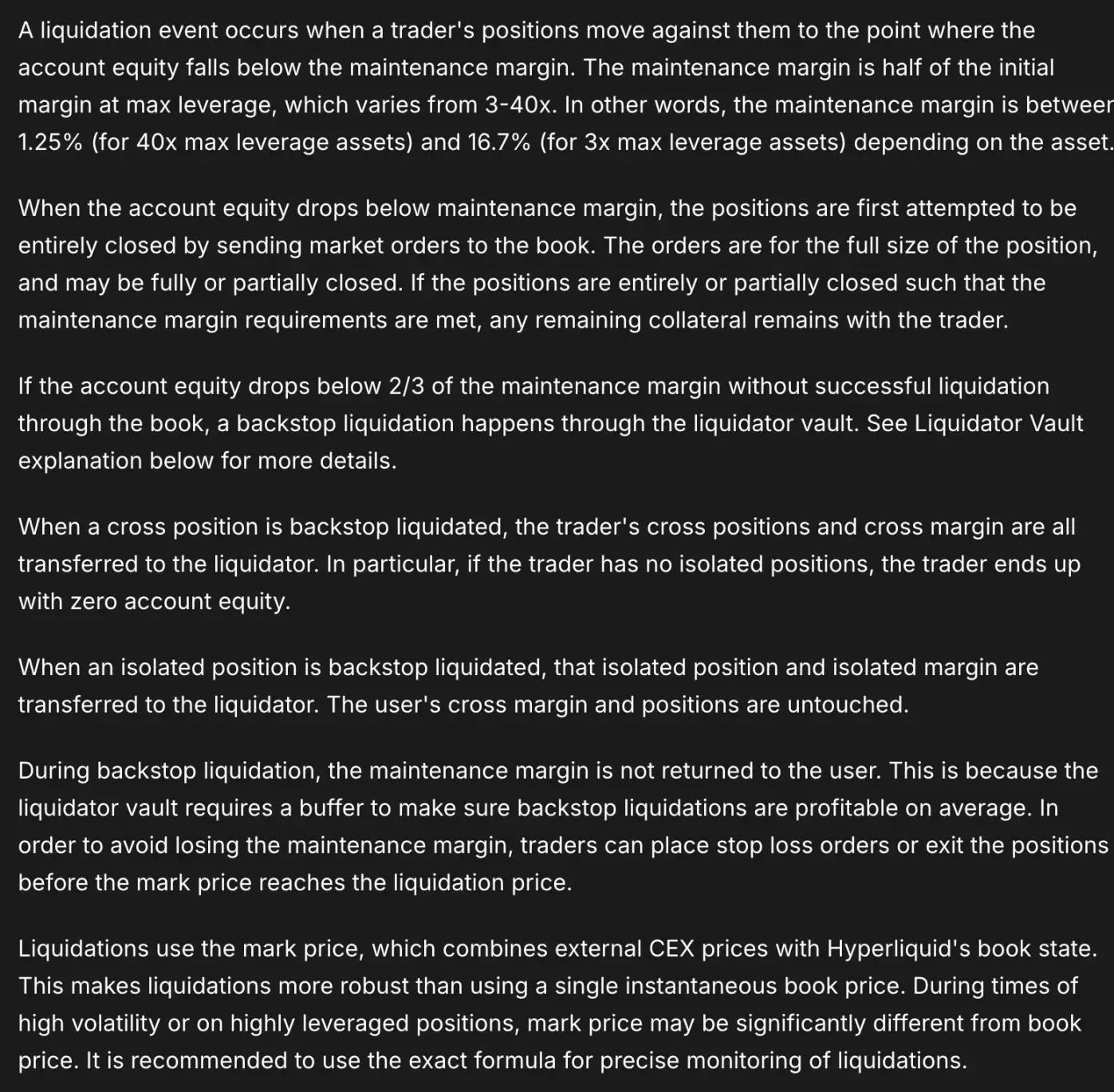

Take Hyperliquid as an example. Hyperliquid’s liquidation mechanism works as follows: once account equity drops below Maintenance Margin (MM), the system prioritizes injecting liquidation orders directly into the order book, allowing the market to absorb the risk organically.

For large positions (e.g., >100k USDC), the system usually clears 20% first, then cools down for about 30 seconds. If triggered again, it may proceed to clear the entire position. If the position remains uncleared and deteriorates further to a deeper threshold (e.g., equity below 2/3×MM), a backup liquidation process activates, where the community-based Liquidator Vault (HLP component) takes over. To ensure sustainability of this “backstop,” in many cases, the maintenance margin is not returned.

The entire process incurs no “liquidation fee.” However, during pre-market periods or times when external anchors are weak and liquidity shallow, the act of liquidating can push prices further in the same direction, creating a short-term spiral effect.

Meanwhile, Hyperliquid’s mark price is determined jointly by external CEX quotes and its internal order book. During volatile moments, if internal trades dominate, the trigger speed accelerates. Additionally, cross-margin and isolated margin differ during the backup phase: with cross-margin, the system may transfer both the entire position and its collateral upon takeover; with isolated margin, only the specific position and its isolated collateral are affected.

Now rewind to early this morning and briefly revisit the XPL incident on Hyperliquid. Starting at 5:35, buyers aggressively swept the order book, rapidly lifting transaction ranges. With mark price driven primarily by internal platform matching, the spike far exceeded normal levels.

For shorts heavily concentrated on one side, this sudden jump sharply reduced the ratio of account equity to Maintenance Margin. Once equity fell below MM, the system took control according to protocol. Then, the system began buying on the order book to close short positions (larger ones possibly partially cleared first, entering a cooldown). These buybacks themselves further pushed up both price and mark price, triggering more shorts to fall below MM. Within seconds to tens of seconds, a positive feedback loop formed—“order book sweep → liquidation trigger → liquidation-driven sweep”—explaining how the price nearly reached +200% within minutes.

If positions still cannot be cleared through the order book and equity continues falling below deeper thresholds (e.g., 2/3×MM), the backup mechanism kicks in, continuing to place backstop bids to ensure risks are absorbed internally.

Once order book depth recovers and the liquidation queue clears, the addresses that initiated the long positions begin taking profits, causing prices to rapidly drop like a rollercoaster—from peak highs back down. This completes the full cycle of “Hyperliquid XPL +200% surge → chain reaction of short liquidations → rapid collapse.”

This outcome is essentially inevitable when pre-market liquidity depth, crowded positioning, and clearing mechanisms interact and compound.

Does Lighter Trigger Earlier Liquidations?

Now consider Lighter. This morning, ETH prices on Lighter spiked to $5,100, drawing significant attention. As a favorite among Western CT circles and currently the second-largest perp DEX by volume after Hyperliquid, Lighter has previously sparked discussions due to frequent price spikes.

Lighter sets three thresholds: IM (Initial Margin) > MM (Maintenance Margin) > CO (Shutdown Margin). Falling below IM triggers “pre-liquidation,” allowing only reductions, no additions. Dropping below MM enters “partial liquidation,” where the system issues IOC limit orders at a pre-calculated “zero price” to reduce your position incrementally. The zero-price design ensures that even if filled at zero price, the account’s health won’t worsen further. If filled at a better price, the system collects up to 1% liquidation fee into LLP (insurance fund). If equity falls below CO, “full liquidation” activates, wiping out the entire position and transferring remaining collateral to LLP. Should LLP lack sufficient funds, ADL (Auto-Deleveraging) activates, matching high-leverage/high-profit counterparties at their respective zero prices to deleverage without harming innocent parties. Overall, Lighter sacrifices some “liquidation speed” to maintain control over account health and order book impact.

So does this mean Lighter’s liquidation price is significantly higher than other DEXs, leading to earlier liquidations?

A more precise answer: yes and no.

In simpler terms, Lighter’s “earlier liquidation” is a staged “firefighting” approach: it uses IOC limit orders at “zero price” to gradually reduce exposure, aiming to stabilize account health—not necessarily blow you out entirely. Full liquidation only occurs upon hitting CO.

Therefore, it’s inaccurate to simply say “Lighter liquidates more easily.” Instead, it performs gentler, incremental liquidations, spreading out risk and reducing the price shock from bulk order sweeps. The trade-off? If filled at prices better than “zero price,” up to 1% liquidation fee goes into the insurance fund (LLP).

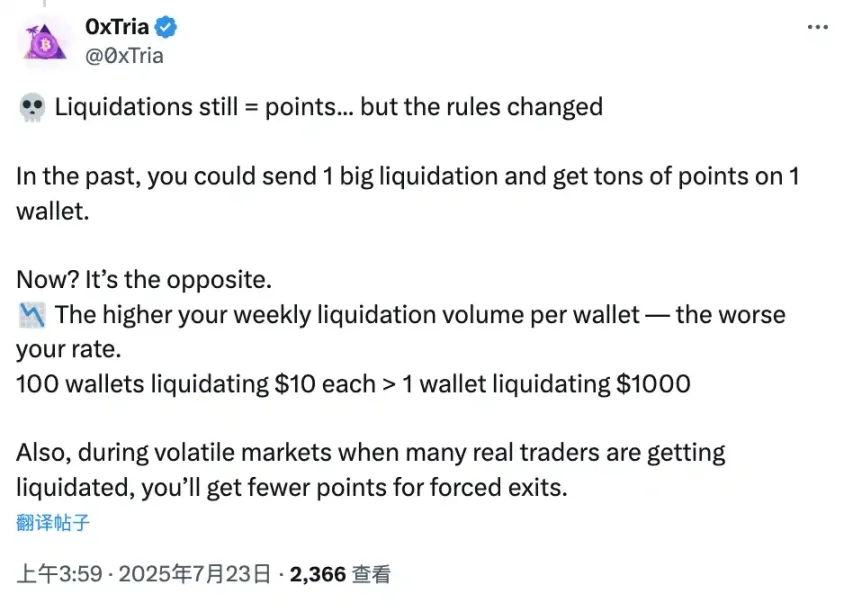

Interestingly, in early versions, Lighter’s points system heavily weighted liquidation amounts. According to analysis by community member 0xTria, initial liquidations yielded roughly “1 point per $1 liquidated,” while community valuation of points ranged from $15–$30. This directly incentivized users to exploit subaccounts and new accounts to “farm points via self-liquidation.” However, weeks later, this weighting was significantly reduced.

How to Avoid Being Manipulated

Crypto is a dog-eat-dog world. For ordinary participants, the focus shouldn’t be on how many multiples you can gain, but on minimizing chances of being liquidated or exploited by whales. So how can we reduce these risks?

Analyze Position Structure

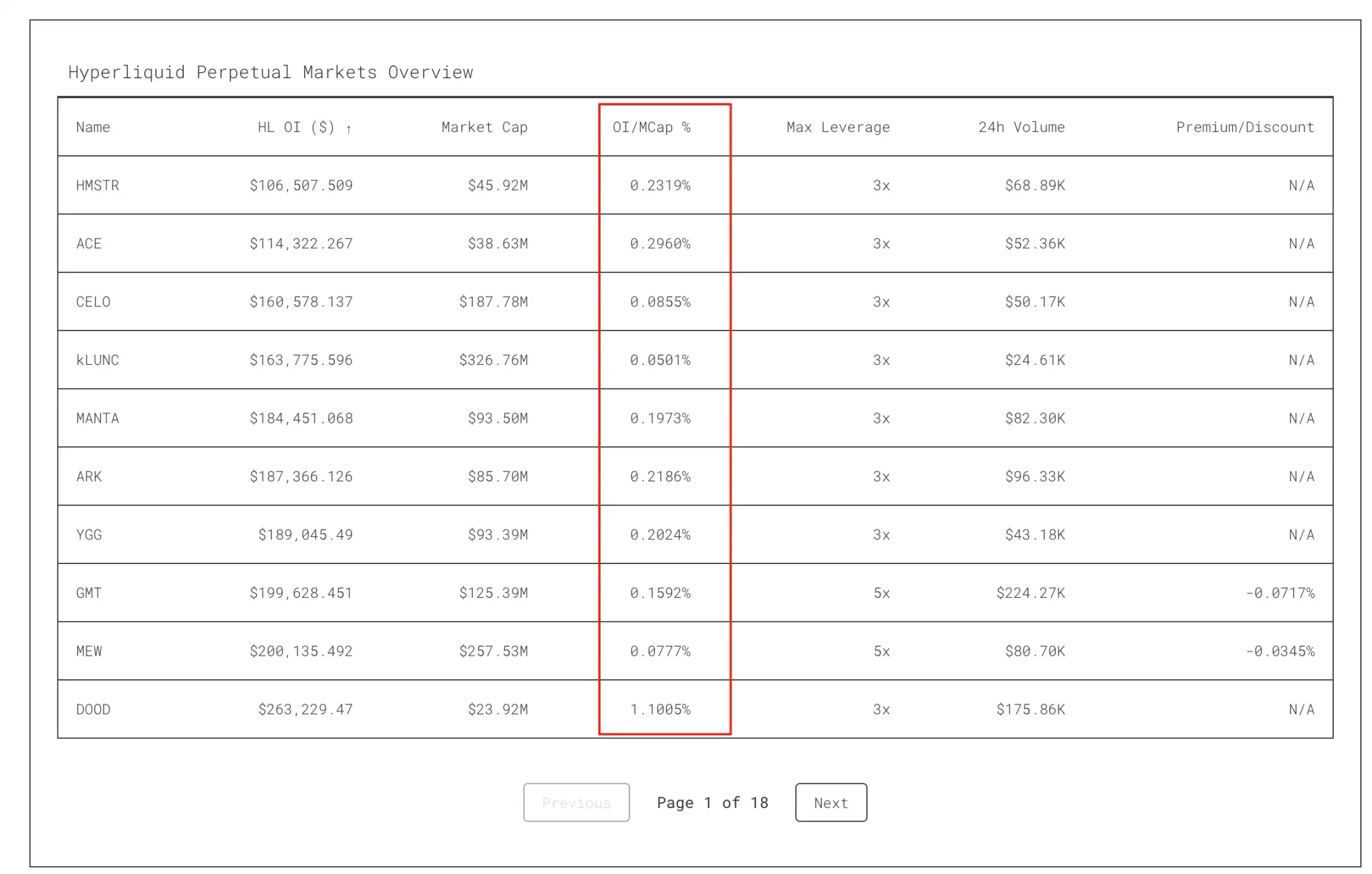

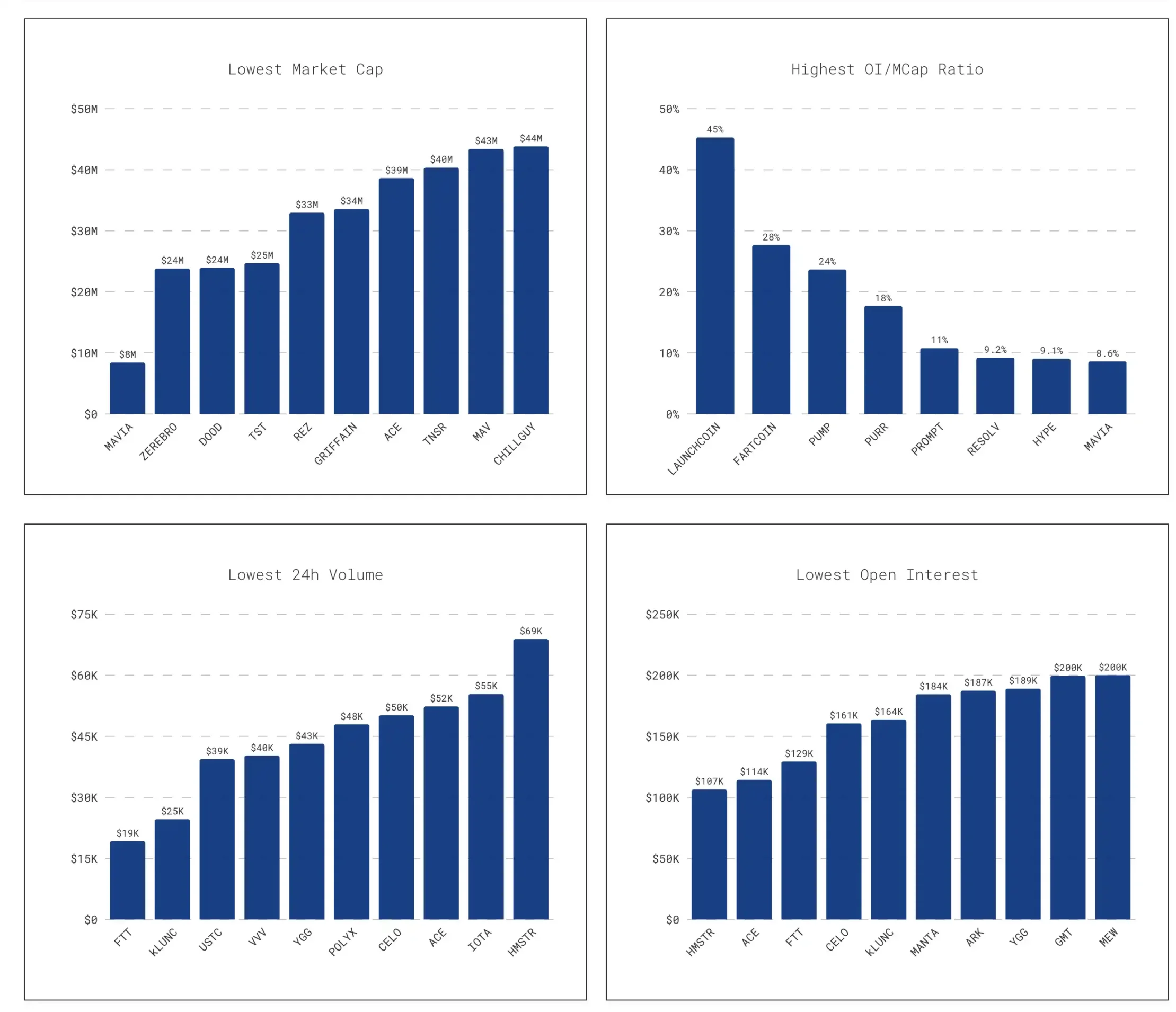

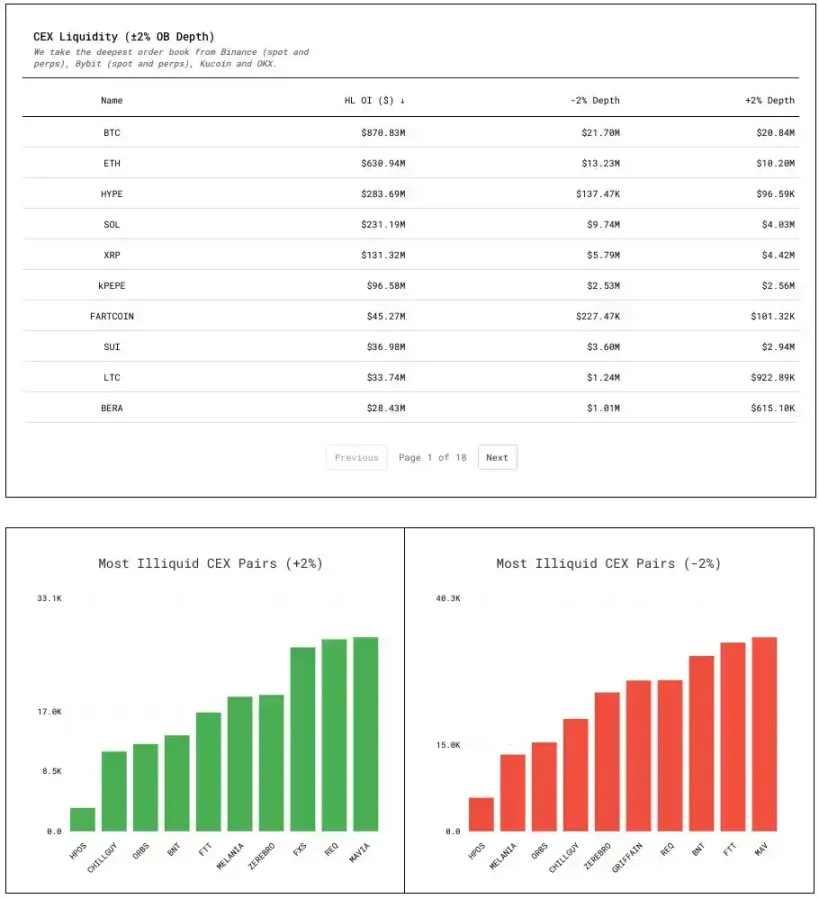

Data platforms like ASXN offer highly instructive insights into Hyperliquid metrics:

Consider the OI/Market Cap ratio—open interest divided by market cap, expressed as a percentage. A higher ratio indicates derivatives positions represent a larger share of the token’s total value, making it easier to manipulate with capital. A classic example was when HLP’s inherited clearing vault positions briefly exceeded 40% of JELLY’s circulating supply, turning the token into a domino ready to fall with the slightest push.

Likewise, DEX liquidity tables allow quick assessment of a token’s on-chain liquidity, manipulation risks, and signs of holder accumulation.

Funding rates and comparisons with major centralized exchanges help identify potentially manipulated assets. When large positions enter thin open interest, funding rates may deviate abnormally compared to other exchanges.

Measure Depth

How do you measure depth? Test how much money it takes to move the price up or down by 2%: how much buying volume is needed to raise the price 2%, and how much selling volume to lower it 2%.

This reveals the actual bid/ask thickness on the best outer sides—the true cost for whales to attack. Assets with poor depth can be easily distorted at low cost, lowering manipulation barriers and increasing risk.

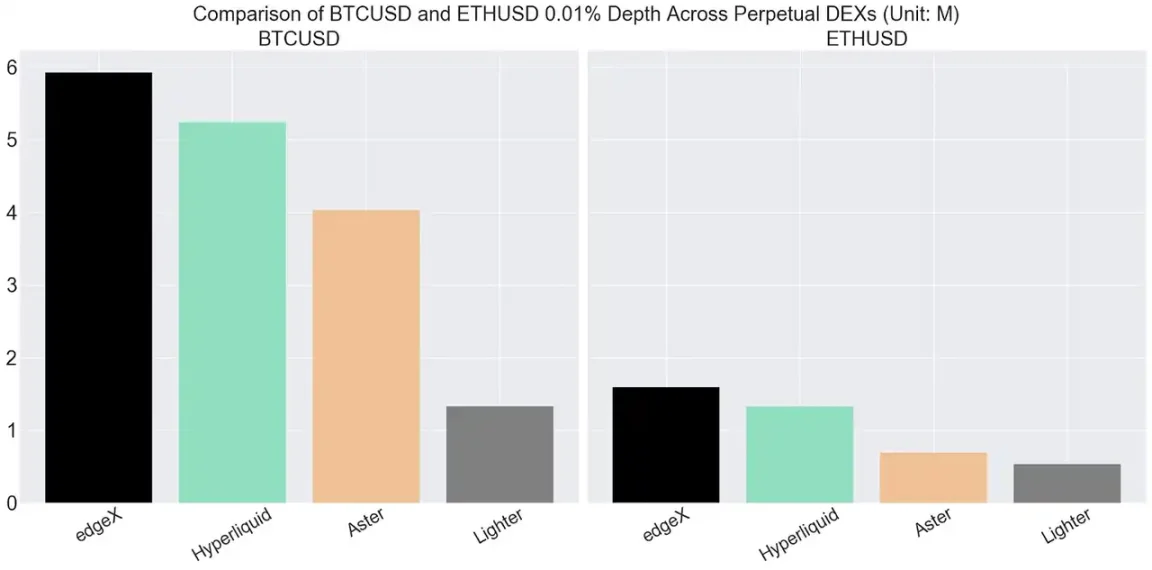

This means we should trade the most liquid tokens on the most liquid platforms.

Take BTC/USDT—the most core pair—as an example. Within a 0.01% price spread, current mainstream perp DEX depths are: edgeX $6M, hyperliquid $5M, Aster $4M, Lighter $1M.

This implies that liquidity for other altcoins will be far below these levels, greatly increasing manipulation risks—especially for pre-market tokens like XPL.

Always Read the Clearing Protocol

Those who clearly understand the rules usually also better grasp the risks they can bear.

Before starting formal trading, thoroughly read all clearing rules: How is mark price calculated? Does the platform rely primarily on external index prices, or does its own order book carry heavy weight? Especially for pre-market or obscure assets, beware whether mark price can easily be swayed by internal trades. Monitor Mark/Index/Last values during normal and volatile periods to detect serious deviations.

Are there tiered margin requirements? If so, larger positions face higher maintenance margins, meaning earlier liquidation points. Is the liquidation path market-order sweeping or batch reduction? What’s the liquidation ratio? What triggers backup liquidation? Are there liquidation fees? Where do fees go—team revenue, treasury vault, or foundation buybacks?

Additionally, even hedging across two trading platforms carries significant risk if depth and clearing mechanisms are ignored. Cross-platform hedging ≠ intra-platform margin protection—treat them separately. Always set stop-losses when possible, prefer isolated margin: isolated affects only that position and its dedicated margin; with cross-margin, only allocate liquidity you can afford to lose.

Finally, note that contract mechanism risks are greater than most people imagine.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News