"March 12" pre-screening? Over $120 million in on-chain liquidations loom as crypto market awaits key catalyst

TechFlow Selected TechFlow Selected

"March 12" pre-screening? Over $120 million in on-chain liquidations loom as crypto market awaits key catalyst

The crypto market is experiencing another broad downturn, with large-scale on-chain liquidations intensifying market panic.

Author: Nancy, PANews

On the fifth anniversary of the "312" incident, the crypto market has once again suffered a broad downturn, with a wave of large-scale on-chain liquidations intensifying market panic.

Facing Over $120 Million in On-Chain Liquidations, Whale Positions Exceeding $100 Million at Heightened Risk

As concerns over a U.S. economic recession and other negative sentiments intensify, the cryptocurrency market is suffering another cyclical blow, severely undermining market confidence. According to CoinGecko data, the total market capitalization of the crypto market has dropped to $2.66 trillion in the past 24 hours. Bitcoin’s price has fallen below $80,000, while Ethereum has dipped below $2,000.

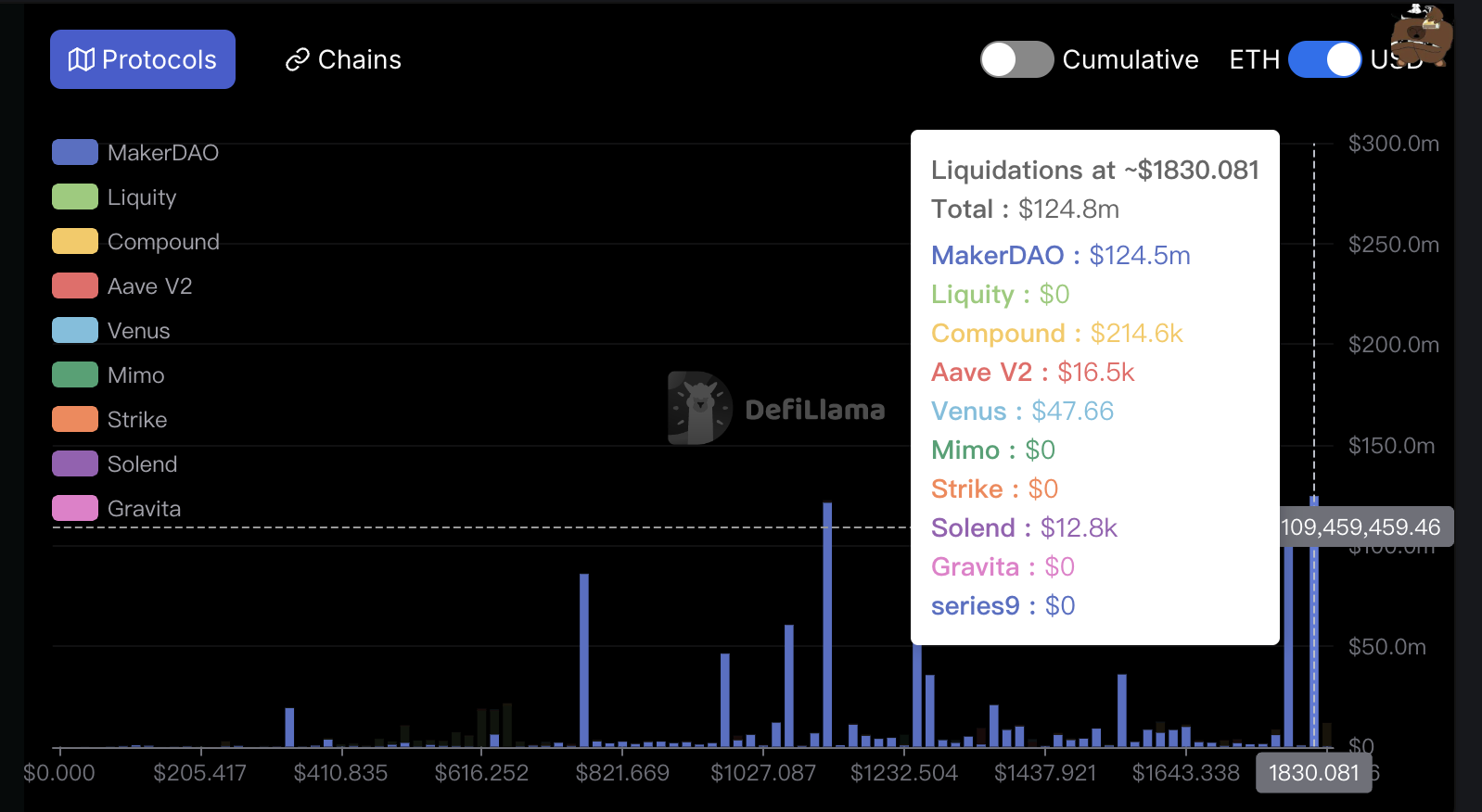

In this market environment, the continued decline in Ethereum's price has significantly amplified both the scale and risk of on-chain liquidations. Data from DeFiLlama shows that nearly $124.8 million in potential on-chain liquidations loom at an ETH price of $1,830.08. This liquidation exposure is primarily concentrated in the MakerDAO protocol, amounting to $124.5 million—99.7% of the total.

To avoid forced liquidation, some whales have been forced to sell at a loss. For example, according to PeckShield monitoring, an address holding a leveraged long position of 6,370 weETH (total debt approximately $10 million) and another holding 1,500 weETH (total debt around 2.27 million DAI) were both liquidated. After ETH fell below $1,800, these two whales had 2,160 rETH (worth about $4.63 million) and 643.78 weETH (worth about $1.23 million) seized, respectively. DeBank data also shows that a major Aave whale, address 0xa33...e12c, sold 25,800 ETH to reduce its loan-to-value ratio and avoid liquidation, suffering leveraged losses of $31.75 million.

At the same time, several large MakerDAO participants are also under liquidation pressure, but the protocol’s OSM mechanism has demonstrated resilience under current conditions. Due to Maker’s use of the Oracle Security Module (OSM), system price updates are delayed by approximately one hour (the Medianizer contract calculates a median price as a reference to prevent short-term volatility from being exploited). This delay provides investors time to add collateral to avoid liquidation, and some whales have already taken action. Currently, Maker’s oracle price remains at $1,806.31, and ETH prices have slightly rebounded. The latest oracle price is now above their individual liquidation thresholds, temporarily shielding these whales from forced liquidation.

For instance, Summer.fi data shows that a whale holding 67,000 ETH (worth approximately $124 million, address 0xab...2313) sold 2,882 ETH (about 5.21 million DAI) before the oracle update at 10 AM to repay debt, lowering its liquidation price from $1,798 to $1,781. Another address (0x22...1246), suspected to belong to the Ethereum Foundation, deposited 30,098 ETH (approximately $56.08 million) into Maker five hours ago, increasing its total Maker position to 100,394 ETH (around $185 million), bringing its liquidation price down to $1,127.06. A third Maker whale holding 60,810 ETH (about $109 million, address 0x6b...30b3) has a liquidation price of $1,798.72.

As on-chain liquidation activity and associated risks escalate, both whale self-rescue efforts and systemic mechanisms are being tested, challenging the resilience of the crypto market. If market conditions deteriorate further, whales’ ability to maneuver financially will become increasingly constrained, exposing leveraged players to even greater challenges. Widespread liquidation events could amplify downward pressure, triggering a vicious cycle.

Crypto Market Resilience Under Stress, Still Awaiting Key Catalysts

Amid global macroeconomic pressures and a wave of de-leveraging through on-chain liquidations, the resilience of the crypto market is undergoing a severe test. Market analysts widely agree that heightened global macroeconomic uncertainty, coupled with expectations of tighter Federal Reserve monetary policy, is the primary driver behind the sharp correction in crypto assets.

According to Bloomberg, escalating tensions over tariff wars and diminishing hopes for further Fed rate cuts have offset the positive impact of President Trump’s recent series of pro-crypto statements. Since the Fed signaled a pause in rate cuts in mid-December last year, risk assets like cryptocurrencies have remained under pressure. Last Friday’s employment data showed the U.S. unemployment rate rising from 4% to 4.1%, further fueling market uncertainty. Augustine Fan, partner at crypto derivatives provider SignalPlus, said, “The ‘underemployment’ rate surged to a five-year high, intensifying recession fears and pushing yields lower as rate cut expectations moved forward to early summer.”

Nexo analysts also noted that the Fed now faces a difficult policy landscape. While weaker employment growth supports the case for rate cuts, persistent inflation concerns—especially those stemming from supply-side constraints and geopolitical uncertainty—may prompt the central bank to proceed cautiously. This uncertain environment could continue weighing on the crypto sector.

Marion Laboure, analyst at Deutsche Bank, stated that in the absence of clear details regarding Trump’s proposed Bitcoin reserve plan, crypto market volatility is likely to remain elevated. Uncertainty surrounds the plan’s timeline, funding, and allocation. Markets remain cautious—positive progress could bring gains, while setbacks may lead to losses.

Matrixport noted in its latest report that the White House crypto summit and confirmation of a U.S. strategic Bitcoin reserve failed to ignite market sentiment. No significant rally emerged, and perpetual contract funding rates remain in single-digit territory. This indicates subdued retail investor enthusiasm, a stark contrast to April and December 2024, when funding rates soared into double digits. Even the momentum from Trump’s official inauguration has been relatively muted, clearly indicating that Bitcoin needs a more impactful catalyst to launch a new upward leg.

“Bitcoin’s price movement is closely tied to U.S. economic indicators. Here’s one possible scenario: if a recession occurs, Bitcoin’s maximum potential downside could be around $50,000; if no recession occurs, its floor price is expected to stay between $70,000 and $75,000. Key market watchers are closely eyeing Wednesday’s Consumer Price Index (CPI) data, which could significantly influence Bitcoin’s price trajectory,” wrote DeFi analyst Adaora Favour Nwankwo.

Bravos Research analysis suggests the crypto market is currently experiencing the largest altcoin liquidation since the LUNA collapse in May 2022. Approximately $10 billion in liquidations have occurred—surpassing the scale seen after the FTX collapse. Data also shows Bitcoin’s dominance continues to rise, signaling no clear “altseason” in the near term.

Arthur Hayes, co-founder of BitMEX, believes Bitcoin represents a true free market, unlike stock markets influenced by policy intervention. Therefore, during fiat liquidity crises, BTC tends to fall before equities—and also rebound ahead of them. He believes Bitcoin may find a bottom around $70,000—a 36% pullback from its $110,000 all-time high—which is a normal correction within a bull market. The next key development to watch is a sharp drop in U.S. equities (SPX, NDX) and potential bankruptcies among traditional financial institutions, after which the Fed, PBOC, ECB, and BoJ may adopt accommodative policies to stimulate the economy. He advises traders to remain patient: those with higher risk tolerance could consider buying the dip, while more conservative investors should wait for central banks to pivot toward easing before re-entering heavily, avoiding the psychological strain of prolonged sideways movement or unrealized losses.

Degen Spartan added that the crypto market has evolved from an early “winner’s game” requiring high technical skill into a “loser’s game.” The core of crypto investing lies in “not dying”—by avoiding unnecessary risks, survival creates opportunities to capture future market upside.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News