Three Steps to Control the Federal Reserve: Unveiling Trump's Clear Roadmap to Reshape the US Central Bank

TechFlow Selected TechFlow Selected

Three Steps to Control the Federal Reserve: Unveiling Trump's Clear Roadmap to Reshape the US Central Bank

U.S. President Trump suddenly announced the removal of Federal Reserve Governor Lisa Cook, triggering market turmoil.

By Luke, Mars Finance

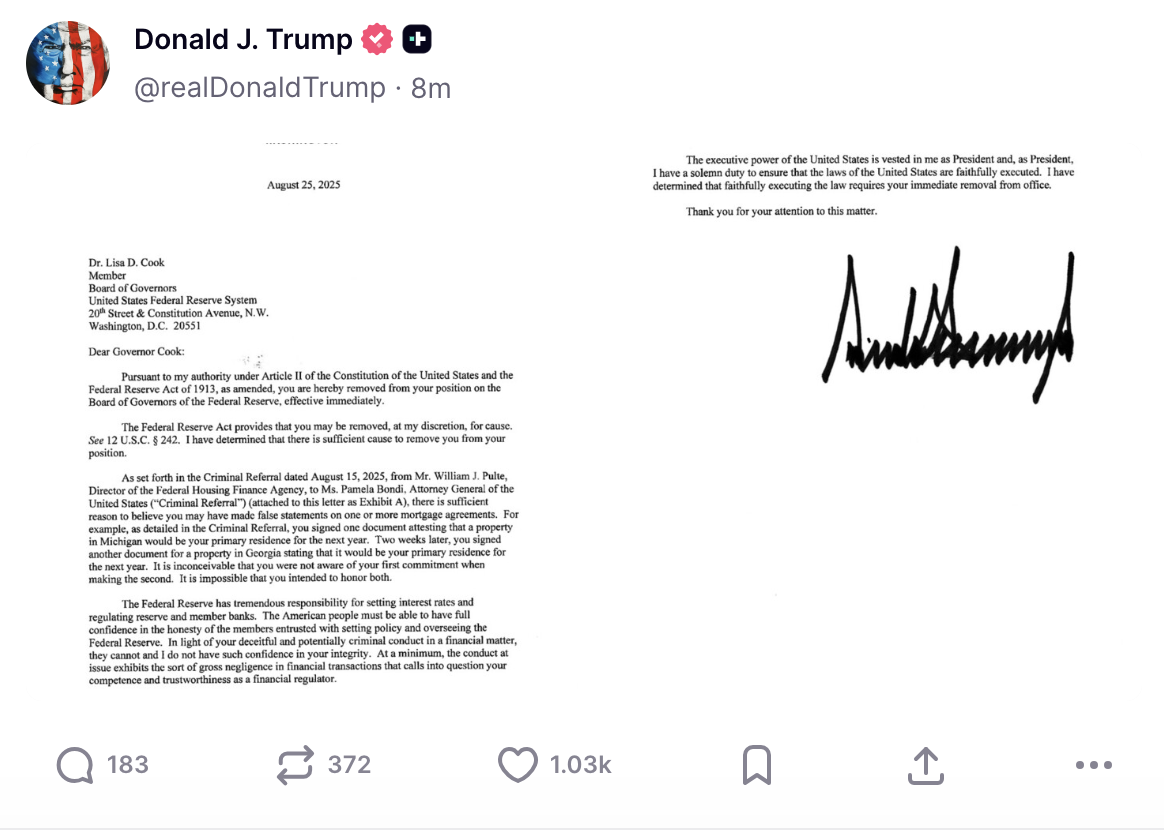

Tuesday evening, a social media post shattered over a century of political consensus in Washington. In his trademark dramatic fashion, U.S. President Donald Trump announced an unprecedented decision: immediately removing Federal Reserve Governor Lisa Cook from office.

The news sent shockwaves through global financial markets. On Wall Street trading screens, U.S. stock futures turned negative while gold, as a safe-haven asset, surged. The market reaction was not merely to a simple personnel change, but stemmed from a deeper fear: this is not a spontaneous political retaliation, but the first step in a systematic plan to fundamentally reshape the U.S. central bank—the formal launch of a clear three-phase roadmap.

The goal of this plan is singular: to completely dismantle the independence of the Federal Reserve and bring the power to set interest rates firmly under White House control.

Step One: Seizing the Board—Starting with Firing Cook

The first and most critical step is gaining stable majority control of the seven-member Federal Reserve Board of Governors.

The Board is the core of the entire Federal Reserve system, and Trump’s strategy has long been underway. During his current term, he has already successfully appointed two governors. Recently, following the early resignation of Adriana Kugler, a governor appointed by former President Biden, Trump swiftly nominated his economic advisor Stephen Miran to fill this third seat.

With this move, Trump is now just one step away from controlling the Board. Removing Lisa Cook is precisely intended to open up this crucial fourth seat. Once successful, Trump would be able to appoint four loyalists, securing a majority on the seven-member Board and thereby theoretically controlling all major decisions at the Fed.

Of course, this step carries significant legal risks. Trump's stated justification for dismissal—that Cook allegedly committed fraud on a mortgage application before joining the Fed—is widely seen as a political pretext. Cook has quickly filed a lawsuit, and a legal battle over the ambiguous "for cause" removal clause in the Federal Reserve Act is inevitable. This case could very well reach the Supreme Court, whose ruling will define the boundaries of presidential power going forward. Yet in Trump’s playbook, initiating this legal fight is itself a necessary path toward achieving the first objective.

Step Two: Conquering the FOMC—Power Extension by Undermining Foundations

Once the first step—control of the Board—is complete, Trump’s plan rapidly advances to the second phase: indirectly controlling the Federal Open Market Committee (FOMC), the body that actually sets interest rate policy, through the Board.

The FOMC is the world’s most watched financial decision-making body, composed of 7 Federal Reserve governors and 5 regional Fed presidents, totaling 12 voting members. At first glance, even full control of all 7 governors wouldn’t grant total dominance over the FOMC. But Nick Timiraos, known as the “New Fed Whisperer” and a reporter for The Wall Street Journal, has revealed a deeper layer of Trump’s strategy.

Under current law, the 12 regional Fed presidents are appointed by their respective regional boards, but final approval rests with the Washington-based Federal Reserve Board. Timiraos points out that if Trump succeeds in taking control of the Board by March next year, his “majority” could refuse to reappoint regional Fed presidents whose terms are expiring and who oppose White House policy.

This is a foundational undermining of power. By blocking reappointments of regional Fed presidents, a Trump-controlled Board could gradually purge independent voices from the FOMC, ensuring that White House priorities face no resistance during interest rate deliberations. This would completely break down the key firewall protecting the Fed’s independence since its founding in 1913.

Step Three: Executing the New Policy—Building a 'Pro-Cut Majority'

After completing the power consolidation in the first two steps, the plan’s ultimate goal becomes inevitable: aligning the Fed’s monetary policy entirely with political agendas, creating a solid “pro-cut majority.”

Trump’s policy preferences have never been hidden. He has openly declared in cabinet meetings: “The interest people are paying right now is too high. That’s our only problem.” He desires a Federal Reserve willing to slash rates aggressively—to stimulate economic growth, boost the real estate market, and create a prosperous economic backdrop for his political agenda.

A fully controlled Federal Reserve would become the president’s most powerful tool for advancing economic policy. At that point, interest rate decisions would no longer be driven primarily by economic data such as inflation and employment, but increasingly by the White House’s short-term political needs.

Historical Warnings and Echoes in the Crypto World

The reason Trump’s tightly woven plan triggers widespread alarm is because it strikes at a fundamental principle of modern economics: central bank independence. History has repeatedly sounded the alarm—from Nixon’s pressure on the Fed in the 1970s leading to America’s great inflation, to the currency crises in Turkey and Argentina caused by the loss of central bank autonomy—each a painful lesson.

And this 2025 power struggle is now generating profound echoes in the crypto world. Since its inception, Bitcoin’s core narrative has included serving as a hedge against distrust in centralized financial systems. When Satoshi Nakamoto embedded a newspaper headline about banks nearing collapse into the genesis block, the tone was set: resistance against fragile centralized institutions.

Today, as the independence of the Federal Reserve—the “guardian” of the world’s reserve currency—is openly challenged, Bitcoin’s value proposition stands out more than ever. Supporters of the crypto world argue that when monetary policy can be changed at any moment to suit a president’s political goals, the appeal of an asset governed by code, with a fixed issuance schedule and beyond anyone’s control, grows exponentially.

More notably, Trump’s reshaping of financial regulators is not an isolated case. As the Cook controversy unfolds, the Commodity Futures Trading Commission (CFTC) is experiencing a wave of senior departures, while Trump has consistently pushed to bring pro-crypto Republican leaders into his administration. Regardless of intent, these moves objectively create expectations of a more favorable regulatory environment for the crypto industry, while further highlighting the uncertainty within the traditional financial system.

No matter the final outcome, the storm itself has already damaged the credibility of the dollar and the U.S. financial system. In an era of global multipolarity and rapid technological advancement, every blow to the stability of the traditional financial system may objectively push people to explore new alternatives. As The Wall Street Journal warned: this country will ultimately regret it. And for the rising world of digital assets, this might yet again be a moment to prove its value.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News